Key Insights

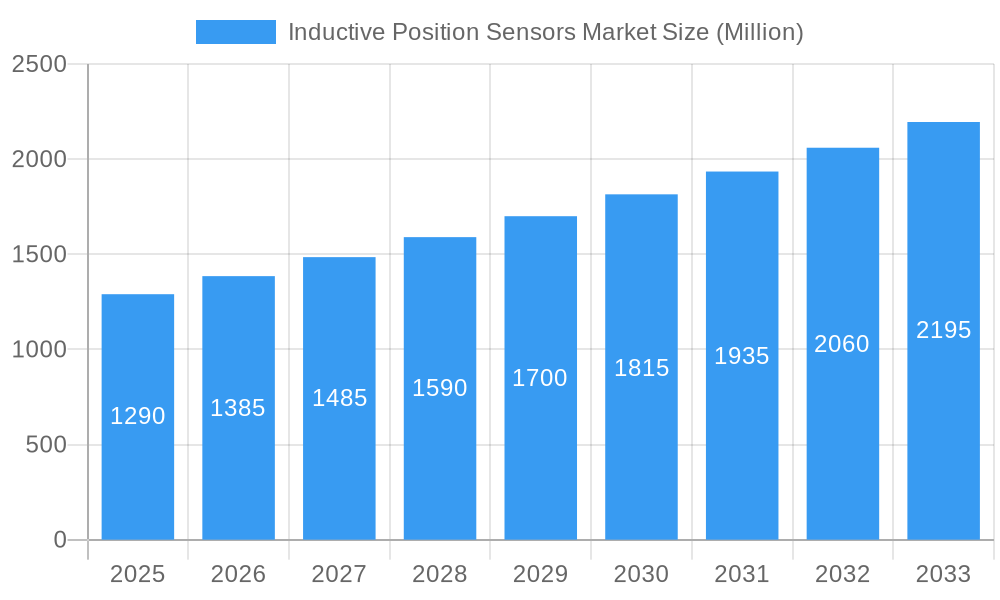

The global Inductive Position Sensors Market is poised for significant expansion, projected to reach a valuation of USD 1.29 billion with a robust Compound Annual Growth Rate (CAGR) of 7.13% during the forecast period of 2025-2033. This growth is primarily fueled by the increasing demand for automation across various industrial sectors. As industries embrace Industry 4.0 principles, the need for precise and reliable position sensing solutions becomes paramount for optimizing manufacturing processes, enhancing product quality, and improving operational efficiency. The automotive sector, driven by advancements in autonomous driving technologies and sophisticated vehicle control systems, represents a substantial contributor to this market expansion. Furthermore, the aerospace and defense industries' stringent requirements for high-performance and durable sensing components will continue to drive innovation and adoption of inductive position sensors. The packaging industry is also witnessing a surge in automated machinery, further bolstering the demand for these sensors.

Inductive Position Sensors Market Market Size (In Billion)

Key drivers shaping the Inductive Position Sensors Market include the escalating adoption of smart manufacturing technologies and the growing complexity of automated systems across diverse applications. These sensors are crucial for enabling real-time monitoring and control of machinery, leading to reduced downtime and increased productivity. Emerging trends such as miniaturization of sensor technology, integration of IoT capabilities for remote monitoring, and the development of sensors with enhanced environmental resistance are further propelling market growth. While the market presents a promising outlook, certain restraints such as the initial investment cost for advanced sensor systems and the availability of alternative sensing technologies, though less prevalent in specific high-precision applications, may present challenges. However, the inherent advantages of inductive sensors, including their non-contact operation, durability, and reliability in harsh environments, ensure their continued dominance in critical industrial applications. The market is characterized by the presence of prominent global players dedicated to research and development, aiming to introduce innovative solutions that cater to evolving industry needs and maintain a competitive edge.

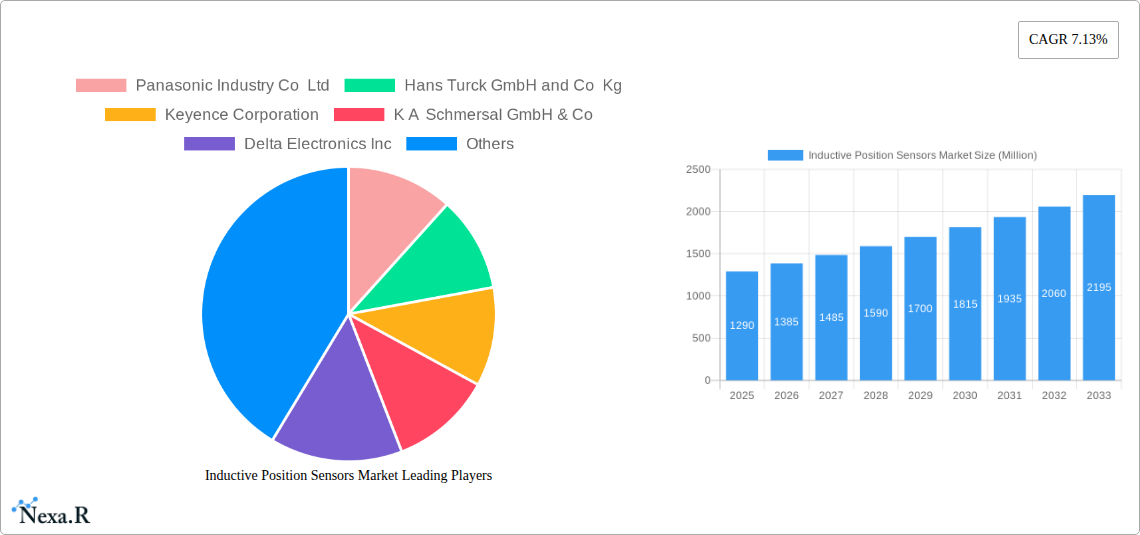

Inductive Position Sensors Market Company Market Share

Inductive Position Sensors Market Report Description

Unlock the future of industrial automation and sensing with the definitive "Inductive Position Sensors Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2025–2033" report. This comprehensive market analysis delves deep into the intricate dynamics of the inductive position sensors sector, offering unparalleled insights for stakeholders seeking to navigate this rapidly evolving landscape. From crucial market drivers and barriers to regional dominance and cutting-edge product innovations, this report provides a 360-degree view of the global inductive proximity sensor market, smart sensor market, and industrial sensor market.

This report is meticulously crafted to empower industry professionals, including R&D managers, business development executives, and market strategists, with the data-driven intelligence necessary for informed decision-making. We analyze the impact of technological advancements, changing end-user application needs, and the competitive strategies of leading manufacturers. With a focus on actionable insights and quantifiable data, this report serves as your indispensable guide to capitalizing on the significant growth opportunities within the inductive position sensors industry.

Report Scope:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Values Presented: In Million Units

- Key End-user Applications: Industrial, Automotive, Aerospace and Defense, Packaging, Other End-user Applications

- Key Companies: Panasonic Industry Co Ltd, Hans Turck GmbH and Co Kg, Keyence Corporation, K A Schmersal GmbH & Co, Delta Electronics Inc, Fargo Controls Inc, Baumer Holding AG, Omron Corporation, Eaton Corporation PLC, Autonics Corporation, Honeywell International, Sick AG, Riko Opto-electronics Technology Co Ltd, Balluff GmbH, Rockwell Automation Inc, Pepperl+Fuchs, EUCHNER USA Inc, Datalogic SpA

Inductive Position Sensors Market Market Dynamics & Structure

The inductive position sensors market is characterized by a moderately consolidated structure, with a few key players holding significant market share, alongside a substantial number of regional and niche manufacturers. This dynamic is driven by continuous technological innovation, particularly in areas like miniaturization, enhanced environmental resistance, and integration with Industry 4.0 technologies such as IoT and AI. Regulatory frameworks, while generally supportive of industrial safety and efficiency, can influence product development and adoption, especially in critical sectors like automotive and aerospace. Competitive product substitutes, such as photoelectric or ultrasonic sensors, present an ongoing challenge, forcing inductive sensor manufacturers to emphasize their distinct advantages in robust performance and immunity to environmental factors. End-user demographics are shifting towards increased automation across all industries, leading to higher demand for reliable and precise sensing solutions. Mergers and acquisitions (M&A) are strategic tools employed by larger companies to expand their product portfolios, gain access to new markets, and consolidate their competitive positions. The market is projected to see a significant increase in M&A activities as companies seek to strengthen their capabilities in smart sensor technology.

- Market Concentration: Moderately consolidated with dominant global players and a competitive long-tail of smaller manufacturers.

- Technological Innovation Drivers: Miniaturization, improved accuracy, enhanced durability for harsh environments, smart connectivity (IoT, AI integration).

- Regulatory Frameworks: Focus on industrial safety, environmental standards, and data security for connected devices.

- Competitive Product Substitutes: Photoelectric sensors, ultrasonic sensors, proximity switches.

- End-user Demographics: Growing demand from manufacturing, automotive (EVs), aerospace, and packaging sectors due to automation trends.

- M&A Trends: Strategic acquisitions to enhance product offerings, expand geographical reach, and acquire technological expertise in smart sensing.

Inductive Position Sensors Market Growth Trends & Insights

The global inductive position sensors market is poised for robust growth, driven by the relentless pursuit of automation and efficiency across various industrial sectors. The market size evolution is intrinsically linked to the adoption of Industry 4.0 principles, where smart sensors are foundational for data acquisition and intelligent decision-making. We project the inductive position sensors market to reach approximately $8,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 5.8% during the forecast period (2025–2033). Adoption rates are accelerating, particularly in developing economies embracing advanced manufacturing techniques. Technological disruptions, such as the development of non-contact sensing technologies and integration with wireless communication protocols, are further fueling demand. Consumer behavior shifts are also playing a crucial role; end-users are increasingly prioritizing sensor solutions that offer predictive maintenance capabilities, reduced downtime, and enhanced operational safety. This is leading to a surge in demand for inductive proximity sensors with integrated diagnostics and self-monitoring features. The automotive industry's electrification and the increasing complexity of vehicle systems are significant growth engines, requiring highly reliable and precise position sensing for critical components. Similarly, the aerospace and defense sector's stringent requirements for fault tolerance and extreme environment performance are creating substantial market opportunities. The packaging industry's demand for high-speed, accurate detection for quality control and sorting also contributes significantly to market expansion. The ongoing industrial automation initiatives globally, coupled with a strong emphasis on smart manufacturing, are creating a favorable environment for the sustained growth of the inductive position sensors market. The increasing sophistication of automation systems, from robotic arms to automated guided vehicles (AGVs), necessitates precise and dependable position feedback, a forte of inductive sensors. Furthermore, the growing need for condition monitoring and predictive maintenance in industrial settings is driving the adoption of inductive sensors equipped with advanced diagnostic capabilities. This proactive approach to machinery health not only minimizes unexpected downtime but also optimizes operational efficiency, directly impacting the bottom line of businesses. The shift towards sustainable manufacturing practices also indirectly benefits the inductive position sensors market, as optimized processes and reduced waste often stem from improved automation and control, powered by reliable sensing technologies.

Dominant Regions, Countries, or Segments in Inductive Position Sensors Market

The Industrial segment, encompassing a vast array of manufacturing processes, robotics, and material handling systems, is the undisputed leader in driving the global inductive position sensors market. This dominance stems from the sheer scale of industrial operations worldwide and the fundamental need for precise, reliable, and robust sensing solutions in these demanding environments. Within the industrial segment, key drivers include the pervasive adoption of automation in factories to enhance productivity, reduce labor costs, and improve product quality. Economic policies globally that encourage industrial modernization and investment in advanced manufacturing technologies directly fuel demand for inductive position sensors. Infrastructure development, particularly in emerging economies undergoing rapid industrialization, also plays a critical role by expanding the footprint of manufacturing facilities that require extensive sensor networks. The market share within the industrial segment is substantial, estimated to be over 45% of the total market value, with significant growth potential projected.

- Industrial Segment Dominance:

- Key Drivers: Widespread automation in manufacturing, robotics, material handling, and process control.

- Economic Policies: Government initiatives promoting Industry 4.0, smart factories, and advanced manufacturing.

- Infrastructure Development: Expansion of industrial zones and manufacturing facilities globally.

- Growth Potential: Continual evolution of industrial processes and increasing demand for precision automation.

Other significant segments contributing to market growth include:

- Automotive: Driven by electrification, advanced driver-assistance systems (ADAS), and sophisticated vehicle manufacturing processes. Estimated to capture around 25% of the market share.

- Packaging: Essential for high-speed sorting, filling, and quality control in automated packaging lines. Expected to hold approximately 15% of the market.

- Aerospace and Defense: Demands extremely high reliability, accuracy, and environmental resistance for critical applications. Though a smaller segment by volume, it commands high-value applications, accounting for about 10% of the market.

- Other End-user Applications: Including medical devices, building automation, and renewable energy systems, offering niche growth opportunities.

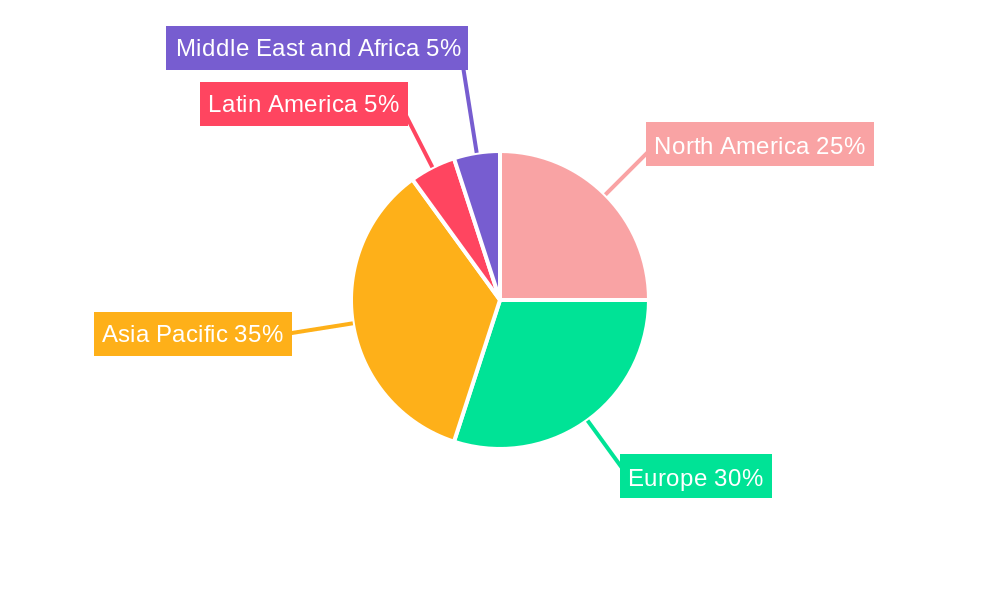

The Asia Pacific region, particularly China, is a major hub for manufacturing and technological innovation, making it the largest regional market for inductive position sensors. North America and Europe also represent significant markets due to advanced industrial infrastructure and strong R&D investments.

Inductive Position Sensors Market Product Landscape

The inductive position sensors market is defined by continuous innovation aimed at enhancing performance, miniaturization, and integration capabilities. Manufacturers are actively developing sensors with extended sensing ranges, higher accuracy for detecting minute positional changes, and improved resistance to extreme temperatures, vibration, and corrosive environments. Unique selling propositions include non-contact operation, making them ideal for applications where wear and tear from physical contact would be detrimental. Technological advancements are also focused on integrating these sensors into smart systems, enabling data connectivity for IoT applications, predictive maintenance, and remote monitoring. This includes the development of sensors with built-in diagnostics and self-monitoring capabilities, offering enhanced reliability and reduced downtime.

Key Drivers, Barriers & Challenges in Inductive Position Sensors Market

Key Drivers:

- Industrial Automation Expansion: The global push for automated manufacturing processes, robotics, and smart factories is the primary growth engine.

- Technological Advancements: Miniaturization, increased precision, enhanced durability for harsh environments, and integration with IoT/AI technologies.

- Automotive Sector Growth: Increasing demand for sensors in electric vehicles (EVs) and advanced driver-assistance systems (ADAS).

- Demand for Reliability and Durability: Inductive sensors' inherent robustness in challenging conditions.

- Government Initiatives: Support for Industry 4.0 and smart manufacturing globally.

Barriers & Challenges:

- Competition from Substitutes: Photoelectric, ultrasonic, and vision sensors offering alternative solutions for specific applications.

- Cost Sensitivity: In some price-sensitive applications, the initial cost of inductive sensors can be a barrier.

- Supply Chain Disruptions: Global supply chain volatility can impact raw material availability and production costs.

- Skilled Workforce Shortage: Lack of trained personnel to install, maintain, and integrate advanced sensor systems.

- Cybersecurity Concerns: As sensors become more connected, ensuring the security of data transmission and control systems is a growing challenge.

- Regulatory Compliance: Adhering to diverse and evolving international standards can add complexity and cost.

Emerging Opportunities in Inductive Position Sensors Market

Emerging opportunities in the inductive position sensors market lie in the burgeoning fields of robotics, collaborative robots (cobots), and autonomous systems. The growing demand for precise positional feedback in these advanced applications presents significant potential. Furthermore, the expansion of smart grid technologies and renewable energy infrastructure requires robust and reliable sensors for monitoring and control, opening new avenues for inductive sensor deployment. The increasing trend towards predictive maintenance across all industries is driving the development of inductive sensors with embedded diagnostic capabilities and self-monitoring features, creating opportunities for higher-value product offerings. The niche but growing market for medical devices also presents opportunities for highly accurate and sterile inductive sensors.

Growth Accelerators in the Inductive Position Sensors Market Industry

Long-term growth in the inductive position sensors market will be significantly accelerated by breakthroughs in materials science, enabling even greater durability and performance in extreme conditions. Strategic partnerships between sensor manufacturers and automation solution providers will foster the development of integrated systems that offer enhanced functionality and ease of implementation for end-users. The relentless drive towards miniaturization will unlock new applications in compact machinery and portable devices. Furthermore, market expansion strategies focusing on emerging economies undergoing rapid industrialization and automation will be crucial growth catalysts. The increasing adoption of AI and machine learning within sensor technology, enabling intelligent data analysis and autonomous decision-making, will also be a key accelerator, transforming inductive sensors from simple detection devices into integral components of smart, self-optimizing systems.

Key Players Shaping the Inductive Position Sensors Market Market

- Panasonic Industry Co Ltd

- Hans Turck GmbH and Co Kg

- Keyence Corporation

- K A Schmersal GmbH & Co

- Delta Electronics Inc

- Fargo Controls Inc

- Baumer Holding AG

- Omron Corporation

- Eaton Corporation PLC

- Autonics Corporation

- Honeywell International

- Sick AG

- Riko Opto-electronics Technology Co Ltd

- Balluff GmbH

- Rockwell Automation Inc

- Pepperl+Fuchs

- EUCHNER USA Inc

- Datalogic SpA

Notable Milestones in Inductive Position Sensors Market Sector

- September 2022: Carlo Gavazzi introduced IRC40 Inductive Proximity Sensors specifically designed for daily indoor and outdoor applications. Moreover, it ensures accurate detection of actuating parts, such as skid conveyor positioning, material positioning on conveyor systems, and step detection on escalators.

- August 2022: Pepperl+Fuchs launched a remarkably tight and corrosion-free housing for extreme outdoor applications. The F31K2 dual inductive sensor is ideal for valve position feedback under extreme conditions. The optimized inductive proximity sensor series from Pepperl+Fuchs now includes a non-intrinsically safe variant with IECEx approval for global use in Zone 2/22 hazardous areas, demonstrating high robustness and durability against heat, cold, salt water, and UV radiation.

In-Depth Inductive Position Sensors Market Market Outlook

The future outlook for the inductive position sensors market is exceptionally bright, propelled by the pervasive trend of industrial automation and the increasing demand for smart, connected solutions. Growth accelerators such as advancements in sensor miniaturization and integration with AI will drive the development of more sophisticated and versatile applications. Strategic alliances and market expansion into high-growth regions will further solidify the market's trajectory. The report forecasts continued robust growth, fueled by the need for reliable and precise sensing in evolving sectors like electric mobility and advanced manufacturing, positioning the inductive position sensors market as a critical enabler of future technological progress.

Inductive Position Sensors Market Segmentation

-

1. End-user Application

- 1.1. Industrial

- 1.2. Automotive

- 1.3. Aerospace and Defense

- 1.4. Packaging

- 1.5. Other End-user Applications

Inductive Position Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Inductive Position Sensors Market Regional Market Share

Geographic Coverage of Inductive Position Sensors Market

Inductive Position Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Industrial Automation; Increase in the Demand for Non-contact Sensing Technology

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Energy-efficient Pumps; Fluctuations in the Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Industrial Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inductive Position Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Application

- 5.1.1. Industrial

- 5.1.2. Automotive

- 5.1.3. Aerospace and Defense

- 5.1.4. Packaging

- 5.1.5. Other End-user Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Application

- 6. North America Inductive Position Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Application

- 6.1.1. Industrial

- 6.1.2. Automotive

- 6.1.3. Aerospace and Defense

- 6.1.4. Packaging

- 6.1.5. Other End-user Applications

- 6.1. Market Analysis, Insights and Forecast - by End-user Application

- 7. Europe Inductive Position Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Application

- 7.1.1. Industrial

- 7.1.2. Automotive

- 7.1.3. Aerospace and Defense

- 7.1.4. Packaging

- 7.1.5. Other End-user Applications

- 7.1. Market Analysis, Insights and Forecast - by End-user Application

- 8. Asia Pacific Inductive Position Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Application

- 8.1.1. Industrial

- 8.1.2. Automotive

- 8.1.3. Aerospace and Defense

- 8.1.4. Packaging

- 8.1.5. Other End-user Applications

- 8.1. Market Analysis, Insights and Forecast - by End-user Application

- 9. Latin America Inductive Position Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Application

- 9.1.1. Industrial

- 9.1.2. Automotive

- 9.1.3. Aerospace and Defense

- 9.1.4. Packaging

- 9.1.5. Other End-user Applications

- 9.1. Market Analysis, Insights and Forecast - by End-user Application

- 10. Middle East and Africa Inductive Position Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Application

- 10.1.1. Industrial

- 10.1.2. Automotive

- 10.1.3. Aerospace and Defense

- 10.1.4. Packaging

- 10.1.5. Other End-user Applications

- 10.1. Market Analysis, Insights and Forecast - by End-user Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic Industry Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hans Turck GmbH and Co Kg

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Keyence Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 K A Schmersal GmbH & Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Delta Electronics Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fargo Controls Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baumer Holding AG*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Omron Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eaton Corporation PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Autonics Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Honeywell International

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sick AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Riko Opto-electronics Technology Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Balluff GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Rockwell Automation Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Pepperl+Fuchs

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 EUCHNER USA Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Datalogic SpA

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Panasonic Industry Co Ltd

List of Figures

- Figure 1: Global Inductive Position Sensors Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Inductive Position Sensors Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 3: North America Inductive Position Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 4: North America Inductive Position Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Inductive Position Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Inductive Position Sensors Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 7: Europe Inductive Position Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 8: Europe Inductive Position Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Inductive Position Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Inductive Position Sensors Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 11: Asia Pacific Inductive Position Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 12: Asia Pacific Inductive Position Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Inductive Position Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Inductive Position Sensors Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 15: Latin America Inductive Position Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 16: Latin America Inductive Position Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Inductive Position Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Inductive Position Sensors Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 19: Middle East and Africa Inductive Position Sensors Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 20: Middle East and Africa Inductive Position Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Inductive Position Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inductive Position Sensors Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 2: Global Inductive Position Sensors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Inductive Position Sensors Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 4: Global Inductive Position Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Inductive Position Sensors Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 8: Global Inductive Position Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Inductive Position Sensors Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 14: Global Inductive Position Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific Inductive Position Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Inductive Position Sensors Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 20: Global Inductive Position Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Inductive Position Sensors Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 22: Global Inductive Position Sensors Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inductive Position Sensors Market?

The projected CAGR is approximately 7.13%.

2. Which companies are prominent players in the Inductive Position Sensors Market?

Key companies in the market include Panasonic Industry Co Ltd, Hans Turck GmbH and Co Kg, Keyence Corporation, K A Schmersal GmbH & Co, Delta Electronics Inc, Fargo Controls Inc, Baumer Holding AG*List Not Exhaustive, Omron Corporation, Eaton Corporation PLC, Autonics Corporation, Honeywell International, Sick AG, Riko Opto-electronics Technology Co Ltd, Balluff GmbH, Rockwell Automation Inc, Pepperl+Fuchs, EUCHNER USA Inc, Datalogic SpA.

3. What are the main segments of the Inductive Position Sensors Market?

The market segments include End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Industrial Automation; Increase in the Demand for Non-contact Sensing Technology.

6. What are the notable trends driving market growth?

Industrial Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; High Cost of Energy-efficient Pumps; Fluctuations in the Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

September 2022: Carlo Gavazzi introduced IRC40 Inductive Proximity Sensors specifically designed for daily indoor and outdoor applications. Moreover, it ensures accurate detection of actuating parts, such as skid conveyor positioning, material positioning on conveyor systems, and step detection on escalators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inductive Position Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inductive Position Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inductive Position Sensors Market?

To stay informed about further developments, trends, and reports in the Inductive Position Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence