Key Insights

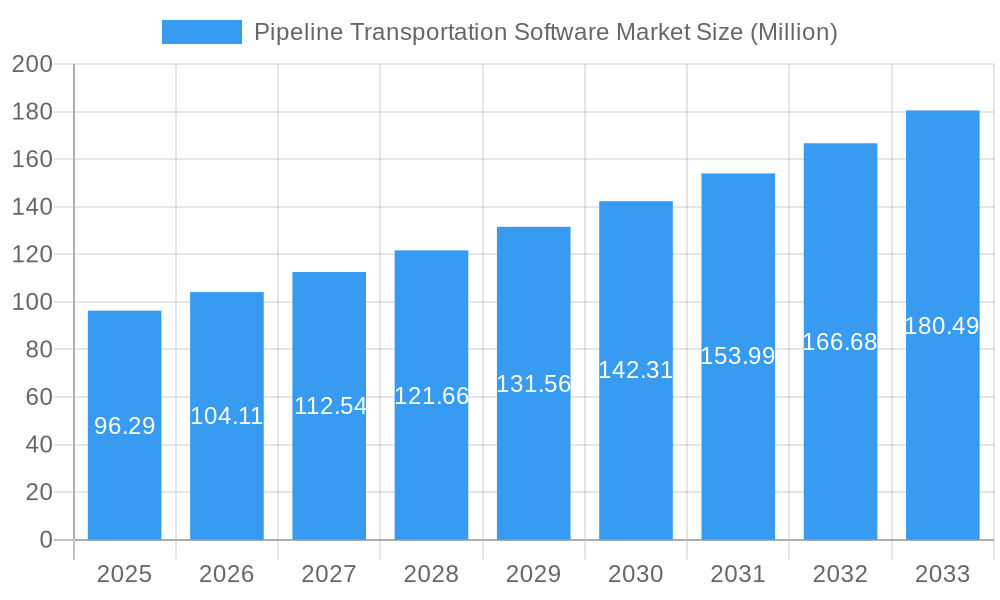

The global Pipeline Transportation Software Market is poised for significant expansion, projected to reach an estimated USD 96.29 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.13% anticipated throughout the forecast period of 2025-2033. This substantial growth is fueled by the increasing complexity of managing vast and intricate pipeline networks across various critical industries. The need for enhanced operational efficiency, real-time monitoring, predictive maintenance, and stringent safety compliance are primary drivers propelling the adoption of specialized pipeline transportation software. As regulatory frameworks become more demanding and the risk of operational failures carries immense financial and environmental consequences, organizations are increasingly investing in sophisticated software solutions to streamline their operations, mitigate risks, and ensure the secure and reliable flow of resources. The trend towards digitalization and the integration of advanced technologies like IoT, AI, and big data analytics within these software platforms are further bolstering market momentum, offering unprecedented capabilities for data-driven decision-making and proactive management.

Pipeline Transportation Software Market Market Size (In Million)

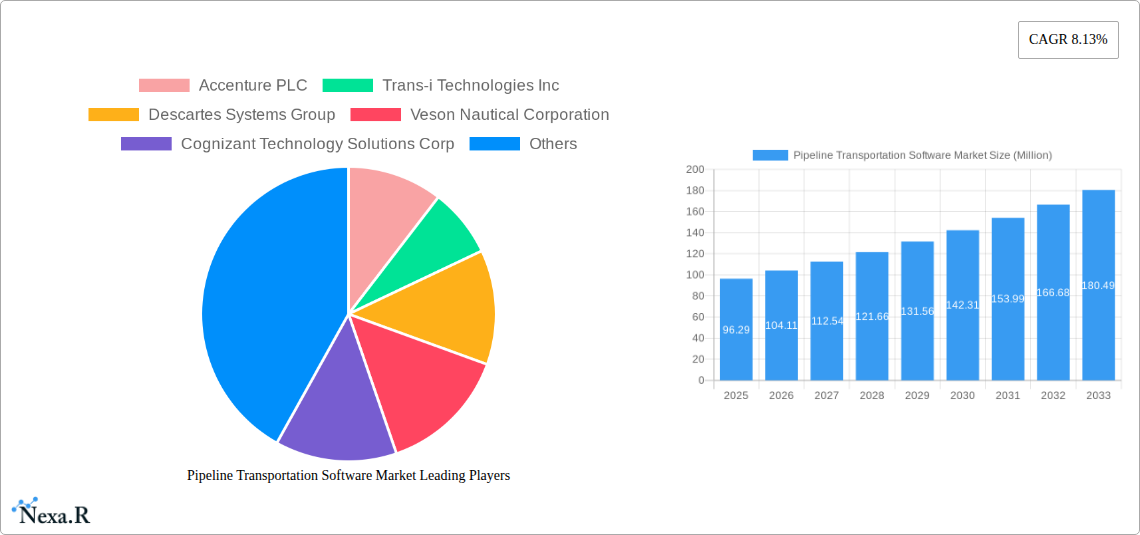

The market's expansion is further supported by the diverse range of end-user verticals that rely heavily on efficient pipeline transportation, including Oil and Gas, Manufacturing and Industrial, Chemicals, and Aerospace and Defense. Each of these sectors presents unique operational challenges and safety imperatives that pipeline transportation software is designed to address. While the adoption of cloud and hybrid deployment models is gaining traction due to their scalability and cost-effectiveness, on-premise solutions continue to hold a significant share, particularly in sectors with stringent data security requirements. Key industry players like Accenture PLC, SAP SE, and Descartes Systems Group are actively innovating and expanding their offerings to cater to the evolving needs of this dynamic market. Regions like North America and Europe are expected to lead in market share, driven by established infrastructure and advanced technological adoption, while the Asia Pacific region is anticipated to witness the fastest growth due to rapid industrialization and increasing investments in energy infrastructure.

Pipeline Transportation Software Market Company Market Share

Unlock critical insights into the burgeoning pipeline transportation software market. This in-depth report provides a data-driven analysis of market dynamics, growth trends, regional dominance, and future opportunities. Gain a strategic advantage by understanding the technologies, key players, and industry developments shaping the logistics software, supply chain management, and transportation management systems landscape. This report leverages extensive research to deliver actionable intelligence for stakeholders in the oil and gas logistics, chemical transportation, and industrial logistics software sectors.

Pipeline Transportation Software Market Market Dynamics & Structure

The pipeline transportation software market is characterized by a moderately consolidated structure, with key players actively investing in technological advancements to gain a competitive edge. Major drivers include the increasing demand for enhanced operational efficiency, real-time tracking capabilities, and stringent regulatory compliance within the oil and gas software and chemical logistics industries. Competitive product substitutes, while present in broader logistics software categories, are increasingly being tailored to the specific needs of pipeline operations, focusing on safety, integrity management, and flow assurance. End-user demographics are predominantly centered around large enterprises in the oil and gas, chemical, and manufacturing and industrial sectors, with a growing interest from the retail and food and beverage industries for specialized pipeline solutions. Mergers and acquisitions (M&A) trends are moderate, driven by the strategic acquisition of innovative technologies and the expansion of market reach. For instance, the acquisition of smaller niche providers by larger ERP or supply chain management software giants aims to integrate specialized pipeline functionalities into their broader offerings. Barriers to innovation include the high cost of R&D for specialized functionalities, the need for deep domain expertise in pipeline operations, and the lengthy adoption cycles within established industrial sectors.

- Market Concentration: Moderately consolidated with a few dominant players.

- Technological Innovation Drivers: Real-time monitoring, predictive maintenance, enhanced safety features, integration with IoT devices.

- Regulatory Frameworks: Compliance with environmental regulations, safety standards, and international trade laws.

- Competitive Product Substitutes: General-purpose logistics software, manual tracking systems, but with increasing specialization.

- End-user Demographics: Predominantly large enterprises in oil & gas, chemical, and manufacturing.

- M&A Trends: Strategic acquisitions for technology and market expansion.

- Innovation Barriers: High R&D costs, domain expertise requirements, slow adoption rates.

Pipeline Transportation Software Market Growth Trends & Insights

The pipeline transportation software market is poised for robust growth, driven by a confluence of technological advancements and escalating demand for streamlined logistics solutions. The market size evolution is projected to witness a significant upward trajectory, fueled by the increasing adoption rates of cloud-based transportation management systems (TMS) and sophisticated supply chain visibility tools. These platforms are instrumental in optimizing the complex operations associated with the movement of bulk commodities and specialized materials via pipelines, thereby enhancing efficiency and reducing operational costs. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and route optimization, are reshaping the industry's landscape. AI-powered analytics can forecast potential pipeline failures, minimize downtime, and ensure the continuous flow of critical resources. Furthermore, shifts in consumer behavior, particularly the growing emphasis on sustainability and responsible resource management, are indirectly influencing the market. Companies are seeking software solutions that can provide granular data on emissions, energy consumption, and environmental impact, thereby enabling them to meet corporate social responsibility goals. The market penetration of advanced pipeline management software is expected to deepen as more organizations recognize its value in enhancing safety, security, and regulatory compliance. The estimated market size for 2025 stands at approximately USD 7,800 million, with a projected Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. This growth is underpinned by a rising awareness of the benefits of digitalization in the transportation sector. The adoption of asset tracking software and fleet management software within the pipeline context is becoming a standard practice, contributing to the overall expansion of the market. The historical period from 2019 to 2024 saw steady growth, laying the foundation for the accelerated expansion anticipated in the forecast period.

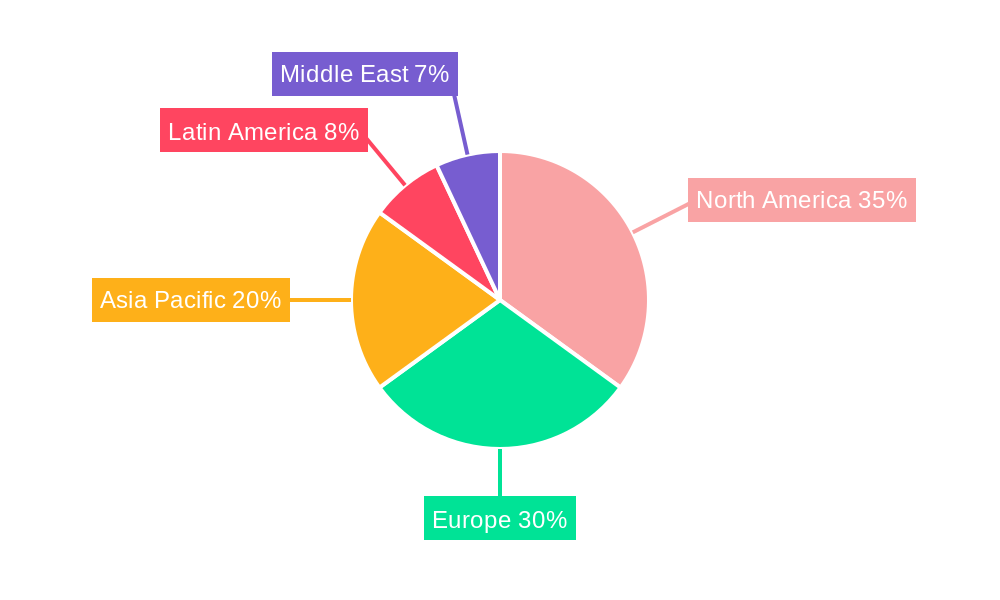

Dominant Regions, Countries, or Segments in Pipeline Transportation Software Market

The pipeline transportation software market exhibits pronounced dominance across specific regions and end-user verticals, reflecting the concentration of pipeline infrastructure and the demand for sophisticated management solutions. North America, particularly the United States, stands out as a leading region, driven by its extensive oil and gas infrastructure, robust manufacturing sector, and a proactive approach towards adopting advanced logistics technology. The region's mature market for oil and gas software and chemical logistics management solutions, coupled with supportive government initiatives for infrastructure development and digital transformation, fuels its leading position.

Within the Deployment segment, Cloud deployment is rapidly gaining traction, outpacing traditional On-premise solutions. The scalability, flexibility, and cost-effectiveness of cloud-based transportation management systems are particularly attractive to businesses seeking agile and efficient operations. While Hybrid deployment models also hold significance, offering a blend of on-premise control and cloud benefits, the momentum is clearly shifting towards fully cloud-native solutions.

The End-user Vertical analysis reveals that the Oil and Gas sector is the primary growth engine for the pipeline transportation software market. This is due to the inherent complexities of transporting crude oil, natural gas, and refined products, necessitating highly specialized software for monitoring, safety, integrity management, and regulatory compliance. The Chemical industry also represents a significant market, with the need for precise control over the transportation of hazardous materials, emphasizing safety and environmental protection. The Manufacturing and Industrial sector, encompassing various raw material and finished product pipelines, contributes substantially to market growth, driven by the pursuit of operational efficiency and supply chain optimization. Emerging opportunities are also seen in sectors like Food and Beverage for liquid ingredient transportation, and Construction for bulk material movement, albeit at a nascent stage.

Dominant Region: North America, led by the United States.

- Key Drivers: Extensive oil & gas infrastructure, strong manufacturing base, government support for digital transformation.

- Market Share: Estimated at over 40% of the global market.

- Growth Potential: Continued investment in pipeline upgrades and digital solutions.

Dominant Deployment: Cloud.

- Key Drivers: Scalability, cost-effectiveness, remote accessibility, faster deployment times.

- Market Penetration: Expected to reach over 60% by 2033.

- Growth Potential: Continued migration from on-premise solutions.

Dominant End-user Vertical: Oil and Gas.

- Key Drivers: Critical need for safety, integrity management, regulatory compliance, and real-time monitoring.

- Market Share: Accounts for approximately 45% of the total market.

- Growth Potential: Driven by exploration, production, and transportation of hydrocarbons.

Pipeline Transportation Software Market Product Landscape

The pipeline transportation software market is characterized by continuous product innovation focused on enhancing operational efficiency, safety, and compliance. Key advancements include sophisticated SCADA (Supervisory Control and Data Acquisition) integration for real-time pipeline monitoring, AI-powered predictive maintenance algorithms to anticipate equipment failures, and advanced simulation tools for flow assurance and integrity management. Applications span across leak detection, pressure monitoring, cathodic protection management, and emergency response planning. Performance metrics are increasingly emphasizing reduced downtime, improved throughput, minimized environmental impact, and enhanced worker safety. Unique selling propositions often revolve around the software's ability to provide end-to-end visibility of pipeline assets, seamless integration with existing enterprise systems, and robust reporting capabilities for regulatory bodies. Technological advancements are pushing towards the development of digital twins for pipelines, offering virtual representations for comprehensive analysis and scenario planning.

Key Drivers, Barriers & Challenges in Pipeline Transportation Software Market

The pipeline transportation software market is propelled by several key drivers, including the escalating need for enhanced operational efficiency and safety in the transportation of critical resources like oil, gas, and chemicals. Technological advancements, such as the proliferation of IoT sensors and the integration of AI and machine learning for predictive analytics, are enabling more proactive and intelligent pipeline management. Furthermore, stringent regulatory frameworks and the increasing global focus on environmental protection are compelling organizations to adopt sophisticated software solutions for compliance and risk mitigation.

However, the market also faces significant barriers and challenges. The high initial investment required for implementing advanced pipeline management systems can be a deterrent, particularly for smaller enterprises. The complex nature of existing pipeline infrastructure and the need for seamless integration with legacy systems pose technical hurdles. Additionally, the scarcity of skilled personnel capable of operating and maintaining these sophisticated software solutions presents a considerable challenge. Regulatory compliance, while a driver, can also be a barrier due to the constant evolution of standards and the cost associated with adhering to them across different jurisdictions.

Emerging Opportunities in Pipeline Transportation Software Market

Emerging opportunities within the pipeline transportation software market are diverse and promising. The increasing global demand for energy and raw materials is driving the need for expanded and modernized pipeline networks, thereby creating new markets for advanced software solutions. The growing focus on sustainability and environmental responsibility presents a significant opportunity for software that can monitor and reduce emissions, detect leaks efficiently, and optimize energy consumption within pipeline operations. Furthermore, the adoption of digital twin technology for pipelines offers a revolutionary approach to asset management, predictive maintenance, and operational simulation, unlocking new avenues for innovation and revenue generation. The integration of blockchain technology for enhanced supply chain transparency and security in the transportation of sensitive materials is another emerging area with substantial growth potential.

Growth Accelerators in the Pipeline Transportation Software Market Industry

Several catalysts are accelerating the growth of the pipeline transportation software market. Technological breakthroughs, particularly in areas like AI, IoT, and advanced analytics, are enabling more intelligent and automated pipeline management. The increasing investment by governments and private entities in upgrading and expanding energy and raw material transportation infrastructure provides a fertile ground for the adoption of these software solutions. Strategic partnerships between software providers and pipeline operators are crucial for tailoring solutions to specific industry needs and ensuring seamless integration. Market expansion strategies, including the penetration into emerging economies and the development of specialized software modules for niche applications within the chemical and food and beverage sectors, are also contributing to sustained growth.

Key Players Shaping the Pipeline Transportation Software Market Market

- Accenture PLC

- Trans-i Technologies Inc

- Descartes Systems Group

- Veson Nautical Corporation

- Cognizant Technology Solutions Corp

- HighJump Software Inc

- Bass Software Ltd

- SAP SE

- DNV GL (GL Maritime Software GmbH)

- Aljex Software Inc

Notable Milestones in Pipeline Transportation Software Market Sector

- April 2023: Serbia's government announced to invest EUR 28 million (USD 30.6 million) in the overall development of river transport infrastructure all over the country as a crucial part of the Sail Through Serbia government initiative. The Sail Through Serbia initiative envisages the construction of new piers, marinas, and the increasing volume of river traffic throughout the country, thereby facilitating the market's growth opportunities.

- January 2023: The Nhava Sheva Freeport Terminal Private Limited (NSFTPL) and Asian Development Bank (ADB) signed a USD 131 million loan mainly to upgrade the Jawaharlal Nehru Port Container Terminal situated in Navi Mumbai Maharashtra, India, to augment the international trade in India through transparent, efficient, and state-of-the-art logistics infrastructure. This would make the market witness ample opportunities to grow and expand throughout the forecast period.

In-Depth Pipeline Transportation Software Market Market Outlook

The pipeline transportation software market is set for a period of significant expansion and innovation. Growth accelerators such as the increasing global demand for energy and raw materials, coupled with a heightened emphasis on operational efficiency and safety, will continue to drive market adoption. The ongoing digital transformation across industries, particularly in the oil and gas and chemical sectors, will foster the integration of advanced technologies like AI, IoT, and blockchain, leading to more intelligent and autonomous pipeline operations. Strategic investments in infrastructure development and a growing awareness of the benefits of cloud-based solutions will further propel market growth. The outlook suggests a market where predictive maintenance, real-time monitoring, and comprehensive regulatory compliance become standard, creating a more resilient and sustainable pipeline transportation ecosystem.

Pipeline Transportation Software Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

- 1.3. Hybrid

-

2. End-user Vertical

- 2.1. Retail

- 2.2. Oil and Gas

- 2.3. Manufacturing and Industrial

- 2.4. Aerospace and Defense

- 2.5. Chemical

- 2.6. Construction

- 2.7. Healthcare

- 2.8. Food and Beverage

- 2.9. Other End-user Verticals

Pipeline Transportation Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Pipeline Transportation Software Market Regional Market Share

Geographic Coverage of Pipeline Transportation Software Market

Pipeline Transportation Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volume of Cargo; Establishment of New Ports in Developing Countries

- 3.3. Market Restrains

- 3.3.1. Stringent Emission Laws and Policies

- 3.4. Market Trends

- 3.4.1. Establishment of New Ports in Developing Countries is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Retail

- 5.2.2. Oil and Gas

- 5.2.3. Manufacturing and Industrial

- 5.2.4. Aerospace and Defense

- 5.2.5. Chemical

- 5.2.6. Construction

- 5.2.7. Healthcare

- 5.2.8. Food and Beverage

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Retail

- 6.2.2. Oil and Gas

- 6.2.3. Manufacturing and Industrial

- 6.2.4. Aerospace and Defense

- 6.2.5. Chemical

- 6.2.6. Construction

- 6.2.7. Healthcare

- 6.2.8. Food and Beverage

- 6.2.9. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Retail

- 7.2.2. Oil and Gas

- 7.2.3. Manufacturing and Industrial

- 7.2.4. Aerospace and Defense

- 7.2.5. Chemical

- 7.2.6. Construction

- 7.2.7. Healthcare

- 7.2.8. Food and Beverage

- 7.2.9. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Retail

- 8.2.2. Oil and Gas

- 8.2.3. Manufacturing and Industrial

- 8.2.4. Aerospace and Defense

- 8.2.5. Chemical

- 8.2.6. Construction

- 8.2.7. Healthcare

- 8.2.8. Food and Beverage

- 8.2.9. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Retail

- 9.2.2. Oil and Gas

- 9.2.3. Manufacturing and Industrial

- 9.2.4. Aerospace and Defense

- 9.2.5. Chemical

- 9.2.6. Construction

- 9.2.7. Healthcare

- 9.2.8. Food and Beverage

- 9.2.9. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East Pipeline Transportation Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Retail

- 10.2.2. Oil and Gas

- 10.2.3. Manufacturing and Industrial

- 10.2.4. Aerospace and Defense

- 10.2.5. Chemical

- 10.2.6. Construction

- 10.2.7. Healthcare

- 10.2.8. Food and Beverage

- 10.2.9. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trans-i Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Descartes Systems Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veson Nautical Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cognizant Technology Solutions Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HighJump Software Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bass Software Ltd *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SAP SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DNV GL (GL Maritime Software GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aljex Software Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global Pipeline Transportation Software Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 9: Europe Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Asia Pacific Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 21: Latin America Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Latin America Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Latin America Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Latin America Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Pipeline Transportation Software Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Middle East Pipeline Transportation Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East Pipeline Transportation Software Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Middle East Pipeline Transportation Software Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Middle East Pipeline Transportation Software Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Pipeline Transportation Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Pipeline Transportation Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 5: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 11: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Pipeline Transportation Software Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 17: Global Pipeline Transportation Software Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Pipeline Transportation Software Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pipeline Transportation Software Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the Pipeline Transportation Software Market?

Key companies in the market include Accenture PLC, Trans-i Technologies Inc, Descartes Systems Group, Veson Nautical Corporation, Cognizant Technology Solutions Corp, HighJump Software Inc, Bass Software Ltd *List Not Exhaustive, SAP SE, DNV GL (GL Maritime Software GmbH, Aljex Software Inc.

3. What are the main segments of the Pipeline Transportation Software Market?

The market segments include Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Cargo; Establishment of New Ports in Developing Countries.

6. What are the notable trends driving market growth?

Establishment of New Ports in Developing Countries is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Stringent Emission Laws and Policies.

8. Can you provide examples of recent developments in the market?

April 2023: Serbia's government announced to invest EUR 28 million (USD 30.6 million) in the overall development of river transport infrastructure all over the country as a crucial part of the Sail Through Serbia government initiative. The Sail Through Serbia initiative envisages the construction of new piers, marinas, and the increasing volume of river traffic throughout the country, thereby facilitating the market's growth opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pipeline Transportation Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pipeline Transportation Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pipeline Transportation Software Market?

To stay informed about further developments, trends, and reports in the Pipeline Transportation Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence