Key Insights

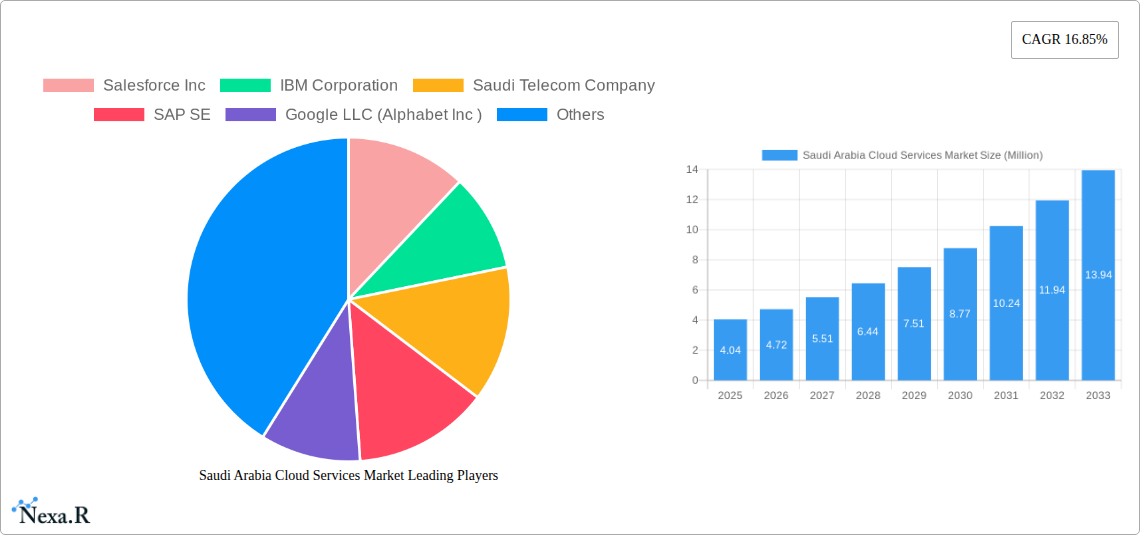

The Saudi Arabia Cloud Services Market is poised for significant expansion, with an estimated market size of USD 4.04 million in 2025, projected to grow at an impressive Compound Annual Growth Rate (CAGR) of 16.85% through to 2033. This robust growth is primarily fueled by several key drivers, including the nation's ambitious Vision 2030 initiative, which mandates digital transformation across all sectors. The increasing adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) across industries like Oil, Gas, and Utilities, Government and Defense, and Healthcare are significantly propelling cloud service demand. Furthermore, government investment in digital infrastructure and the growing need for scalable and secure data management solutions are creating a fertile ground for cloud service providers. The market is witnessing a strong preference for Public Cloud services, with Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS) models leading the adoption due to their cost-effectiveness and flexibility.

Saudi Arabia Cloud Services Market Market Size (In Million)

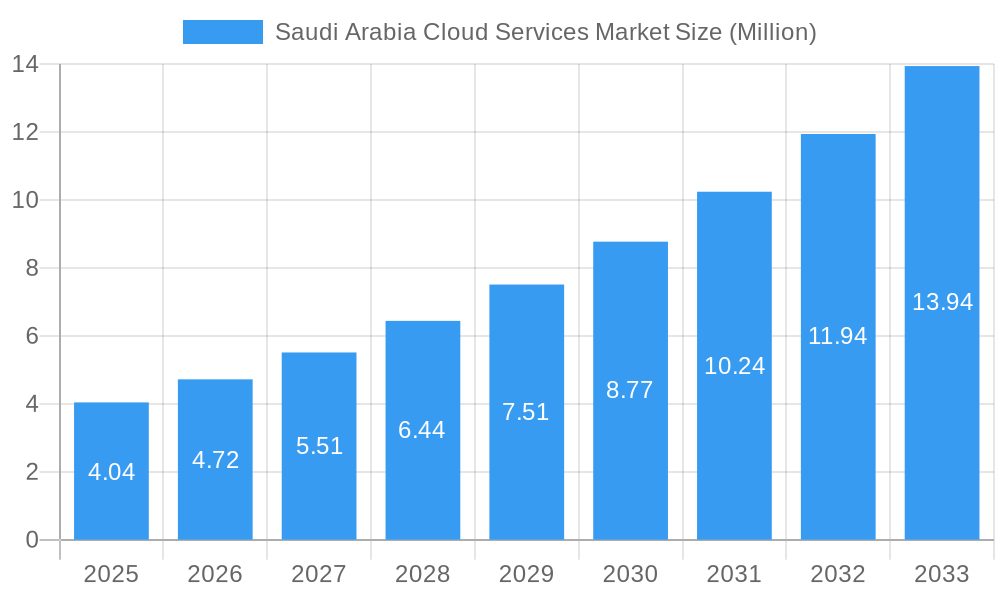

The Saudi Arabian cloud landscape is characterized by intense competition among global technology giants and emerging local players. Major companies like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM, Oracle, and SAP are heavily investing in expanding their cloud infrastructure and offerings within the Kingdom. The emphasis on data localization and the growing demand for hybrid and multi-cloud solutions are also shaping market trends. While the market benefits from strong governmental support and a rapidly digitizing economy, potential restraints could include cybersecurity concerns, the need for skilled IT professionals, and the ongoing complexities of cloud migration for legacy systems. Nevertheless, the overwhelming surge in digital initiatives, coupled with the inherent benefits of cloud computing such as enhanced agility, cost optimization, and improved business continuity, ensures a dynamic and promising future for the Saudi Arabia Cloud Services Market.

Saudi Arabia Cloud Services Market Company Market Share

This in-depth report provides a definitive analysis of the Saudi Arabia Cloud Services Market, encompassing a detailed examination of market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the strategic positioning of leading players. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is an essential resource for understanding the evolution and future trajectory of cloud adoption in the Kingdom. We integrate high-traffic keywords such as "Saudi Arabia cloud market," "cloud computing Saudi Arabia," "IaaS Saudi Arabia," "PaaS Saudi Arabia," and "private cloud Saudi Arabia" to ensure maximum visibility for industry professionals seeking actionable insights.

Saudi Arabia Cloud Services Market Market Dynamics & Structure

The Saudi Arabia cloud services market is characterized by a dynamic and evolving structure, driven by significant digital transformation initiatives and a strong government push for economic diversification. Market concentration is moderate, with a few hyperscale providers dominating the Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) segments, while a more fragmented landscape exists for specialized Software-as-a-Service (SaaS) solutions. Technological innovation is a primary driver, fueled by investments in AI, big data analytics, and edge computing, all of which rely heavily on robust cloud infrastructure. Regulatory frameworks are progressively becoming more supportive of cloud adoption, with data localization policies and cybersecurity mandates shaping the deployment strategies for both public and private clouds. Competitive product substitutes are emerging, particularly in niche SaaS areas, but the core IaaS and PaaS markets remain dominated by established global players and strong local telecommunication companies. End-user demographics are increasingly tech-savvy, with a growing demand for scalable, cost-effective, and secure cloud solutions across all sectors. Mergers and acquisitions (M&A) trends, though less frequent in the core infrastructure space, are observed in the value-added services and niche application sectors, signaling consolidation and strategic expansion.

- Market Concentration: Moderate, with hyperscalers holding significant share in IaaS/PaaS.

- Innovation Drivers: AI, big data, edge computing, digital transformation initiatives.

- Regulatory Landscape: Evolving support for cloud adoption, data localization, cybersecurity focus.

- Competitive Substitutes: Growing in specialized SaaS segments.

- End-User Demographics: Tech-savvy, demanding scalable and secure solutions.

- M&A Trends: Observed in value-added services and niche application sectors.

Saudi Arabia Cloud Services Market Growth Trends & Insights

The Saudi Arabia cloud services market is poised for substantial growth, propelled by the nation's ambitious Vision 2030. The market size is projected to expand significantly, driven by increasing adoption rates across both public and private sectors. Technological disruptions, including the widespread integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), are acting as powerful catalysts, necessitating robust and scalable cloud infrastructure. Consumer behavior shifts are evident, with businesses moving away from on-premises solutions towards the agility, flexibility, and cost-efficiency offered by cloud services. This transition is further accelerated by the growing demand for advanced analytics, data storage, and disaster recovery capabilities. The market is experiencing a surge in the adoption of hybrid and multi-cloud strategies, allowing organizations to leverage the benefits of different cloud models while maintaining control over sensitive data. The development of local cloud regions by major international providers is also a significant trend, ensuring compliance with data residency requirements and improving latency for local users. The overall market penetration of cloud services is expected to reach new heights as more enterprises recognize its strategic importance in enhancing operational efficiency and fostering innovation. The projected Compound Annual Growth Rate (CAGR) for the Saudi Arabia cloud services market underscores a period of sustained and accelerated expansion.

Dominant Regions, Countries, or Segments in Saudi Arabia Cloud Services Market

The Public Cloud segment, particularly Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS), is the dominant force driving the Saudi Arabia cloud services market. This dominance is fueled by several key factors, including government initiatives aimed at digitalizing public services and fostering a robust digital economy, as well as the inherent scalability and cost-effectiveness that IaaS and PaaS offer to enterprises of all sizes. The Oil, Gas, and Utilities sector, being a cornerstone of the Saudi economy, is a significant early adopter, leveraging cloud for data analytics, operational efficiency, and digital twin technologies. Similarly, the Government and Defense sector is heavily investing in cloud solutions for enhanced national security, citizen services, and digital transformation projects, making it a substantial contributor to the overall market growth. The Financial Services industry is also a major player, driven by the need for secure, compliant, and scalable platforms for banking, fintech, and insurance operations. The increasing adoption of smart city initiatives and the development of mega-projects like NEOM are further bolstering the demand for cloud infrastructure.

- Dominant Segment: Public Cloud (IaaS & PaaS)

- Key End-User Industries Driving Growth:

- Oil, Gas, and Utilities: Data analytics, operational efficiency, digital twins.

- Government and Defense: Digital services, national security, digital transformation.

- Financial Services: Secure and scalable platforms for banking, fintech, insurance.

- Supporting Factors:

- Government digital transformation initiatives.

- Scalability and cost-effectiveness of IaaS/PaaS.

- Smart city development and mega-projects.

- Increasing demand for advanced computing capabilities.

- Growth Potential: High, with continued investment in infrastructure and digital services.

Saudi Arabia Cloud Services Market Product Landscape

The Saudi Arabia cloud services market is witnessing a rapid evolution in its product landscape, characterized by a surge in hybrid and multi-cloud offerings, advanced AI/ML integration, and specialized industry-specific solutions. Providers are increasingly focusing on delivering robust security features, enhanced data analytics capabilities, and seamless integration with existing on-premises systems. The emphasis is on providing end-to-end solutions that cater to the diverse needs of sectors like healthcare, finance, and government. Key technological advancements include the development of sovereign cloud solutions, serverless computing, and containerization technologies, offering greater agility and efficiency. Unique selling propositions revolve around compliance with local regulations, localized support, and a commitment to driving digital innovation within the Kingdom.

Key Drivers, Barriers & Challenges in Saudi Arabia Cloud Services Market

Key Drivers: The Saudi Arabia cloud services market is propelled by a confluence of strategic governmental vision, technological advancements, and evolving business needs. Vision 2030's mandate for economic diversification and digital transformation is a primary catalyst, encouraging widespread cloud adoption. The growing demand for advanced analytics, AI, and IoT solutions, which necessitate scalable and flexible cloud infrastructure, further fuels market growth. Furthermore, the increasing focus on cybersecurity and data sovereignty is driving organizations to adopt cloud solutions that meet stringent regulatory requirements.

Barriers & Challenges: Despite the robust growth drivers, the market faces several challenges. Concerns regarding data security and privacy, though diminishing, remain a significant consideration for some enterprises. A shortage of skilled cloud professionals can hinder rapid adoption and implementation. Moreover, the initial cost of migration and the complexity of integrating cloud services with legacy systems can pose barriers for smaller businesses. Intense competition among global and local providers also presents challenges in market penetration and pricing strategies.

Emerging Opportunities in Saudi Arabia Cloud Services Market

Emerging opportunities in the Saudi Arabia cloud services market are abundant, particularly in the realms of edge computing, specialized industry clouds, and the burgeoning metaverse and Web3.0 applications. The rapid expansion of 5G networks creates a fertile ground for edge computing solutions, enabling real-time data processing for industries like manufacturing and logistics. Furthermore, the development of tailored cloud solutions for sectors such as smart agriculture and personalized healthcare presents significant untapped potential. The government's commitment to fostering a digital economy also opens avenues for cloud-based solutions supporting startups and SMEs.

Growth Accelerators in the Saudi Arabia Cloud Services Market Industry

The Saudi Arabia cloud services market is experiencing significant growth acceleration driven by several key catalysts. The unwavering commitment of the Saudi government to digital transformation, as outlined in Vision 2030, provides a strong strategic impetus. The continuous influx of foreign direct investment into technology sectors further bolsters this growth. Technological breakthroughs in areas like AI, machine learning, and serverless computing are enabling more sophisticated and efficient cloud solutions. Strategic partnerships between global cloud providers and local enterprises are crucial for knowledge transfer and market penetration, accelerating the adoption of advanced cloud technologies.

Key Players Shaping the Saudi Arabia Cloud Services Market Market

- Salesforce Inc

- IBM Corporation

- Saudi Telecom Company

- SAP SE

- Google LLC (Alphabet Inc )

- CloudSigma

- Microsoft Corporation

- Alibaba Cloud (Alibaba Group Holding Limited)

- Amazon Web Services Inc (AMAZON COM Inc )

- Oracle Corporation

- VMware Inc

Notable Milestones in Saudi Arabia Cloud Services Market Sector

- February 2023: Oracle announced plans to establish a third Public Cloud Region in Saudi Arabia, investing USD 1.5 billion to upgrade cloud infrastructure. This new region in Riyadh, alongside the existing Jeddah Region and the planned NEOM Region, signals a significant expansion of Oracle's cloud capabilities in the Kingdom.

- February 2023: At LEAP23, Google Cloud partnered with Lean Business Services to offer Digital Health solutions. Lean utilized Google Cloud's Apigee for a Digital Platform enabling secure healthcare services, including telemedicine, by developing APIs and authenticating health institutions and individuals.

In-Depth Saudi Arabia Cloud Services Market Market Outlook

The future outlook for the Saudi Arabia cloud services market is exceptionally promising, driven by sustained government investment, technological innovation, and increasing enterprise adoption. The ongoing expansion of hyper-scale data centers and the proliferation of specialized cloud services will cater to the evolving needs of diverse industries. Emerging trends like sovereign cloud, hybrid multi-cloud architectures, and the integration of AI/ML into core cloud offerings will further accelerate market growth. Strategic partnerships and a focus on developing local talent will be critical in capitalizing on the vast opportunities within the Kingdom's digital transformation journey. The market is well-positioned for continued robust expansion throughout the forecast period.

Saudi Arabia Cloud Services Market Segmentation

-

1. Deployment

-

1.1. Public Cloud

- 1.1.1. Platform-as-a-Service (PaaS)

- 1.1.2. Infrastructure-as-a-Service (IaaS)

- 1.2. Private Cloud

-

1.1. Public Cloud

-

2. End-User Industry

- 2.1. Oil, Gas, and Utilities

- 2.2. Government and Defense

- 2.3. Healthcare

- 2.4. Financial Services

- 2.5. Manufacturing and Construction

- 2.6. Other End-User Industries

Saudi Arabia Cloud Services Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Cloud Services Market Regional Market Share

Geographic Coverage of Saudi Arabia Cloud Services Market

Saudi Arabia Cloud Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government policies and initiatives; Economic Benefits Leading to Cloud Adoption; Increasing Penetration of Technology Giants

- 3.3. Market Restrains

- 3.3.1 High Dependence on External Sources to Balance the Skill Deficit; Vendor Lock In; Compliance Issues

- 3.3.2 Migration Complexity

- 3.3.3 And Security Risks

- 3.4. Market Trends

- 3.4.1. Economic Benefits Leading to Cloud Adoption is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Cloud Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Public Cloud

- 5.1.1.1. Platform-as-a-Service (PaaS)

- 5.1.1.2. Infrastructure-as-a-Service (IaaS)

- 5.1.2. Private Cloud

- 5.1.1. Public Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil, Gas, and Utilities

- 5.2.2. Government and Defense

- 5.2.3. Healthcare

- 5.2.4. Financial Services

- 5.2.5. Manufacturing and Construction

- 5.2.6. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Salesforce Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saudi Telecom Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAP SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google LLC (Alphabet Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CloudSigma

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alibaba Cloud (Alibaba Group Holding Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amazon Web Services Inc (AMAZON COM Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VMware Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Salesforce Inc

List of Figures

- Figure 1: Saudi Arabia Cloud Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Cloud Services Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Cloud Services Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Saudi Arabia Cloud Services Market Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 3: Saudi Arabia Cloud Services Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Saudi Arabia Cloud Services Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: Saudi Arabia Cloud Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Cloud Services Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Cloud Services Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Saudi Arabia Cloud Services Market Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 9: Saudi Arabia Cloud Services Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Saudi Arabia Cloud Services Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: Saudi Arabia Cloud Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Cloud Services Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Cloud Services Market?

The projected CAGR is approximately 16.85%.

2. Which companies are prominent players in the Saudi Arabia Cloud Services Market?

Key companies in the market include Salesforce Inc, IBM Corporation, Saudi Telecom Company, SAP SE, Google LLC (Alphabet Inc ), CloudSigma, Microsoft Corporation, Alibaba Cloud (Alibaba Group Holding Limited), Amazon Web Services Inc (AMAZON COM Inc ), Oracle Corporation, VMware Inc.

3. What are the main segments of the Saudi Arabia Cloud Services Market?

The market segments include Deployment, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Government policies and initiatives; Economic Benefits Leading to Cloud Adoption; Increasing Penetration of Technology Giants.

6. What are the notable trends driving market growth?

Economic Benefits Leading to Cloud Adoption is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Dependence on External Sources to Balance the Skill Deficit; Vendor Lock In; Compliance Issues. Migration Complexity. And Security Risks.

8. Can you provide examples of recent developments in the market?

February 2023: In order to meet growing demand for its cloud services, Oracle plans to set up a 3rd Public Cloud Region in Saudi Arabia. Oracle's planned investment of USD 1.5 billion in the Kingdom to upgrade cloud infrastructure capabilities is part of this new cloud region, which will be set up in Riyadh. The Oracle Cloud Riyadh Region will likely be added to the current Oracle Cloud Jeddah Region and the proposed Oracle Cloud Region in the future metropolis of NEOM.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Cloud Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Cloud Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Cloud Services Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Cloud Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence