Key Insights

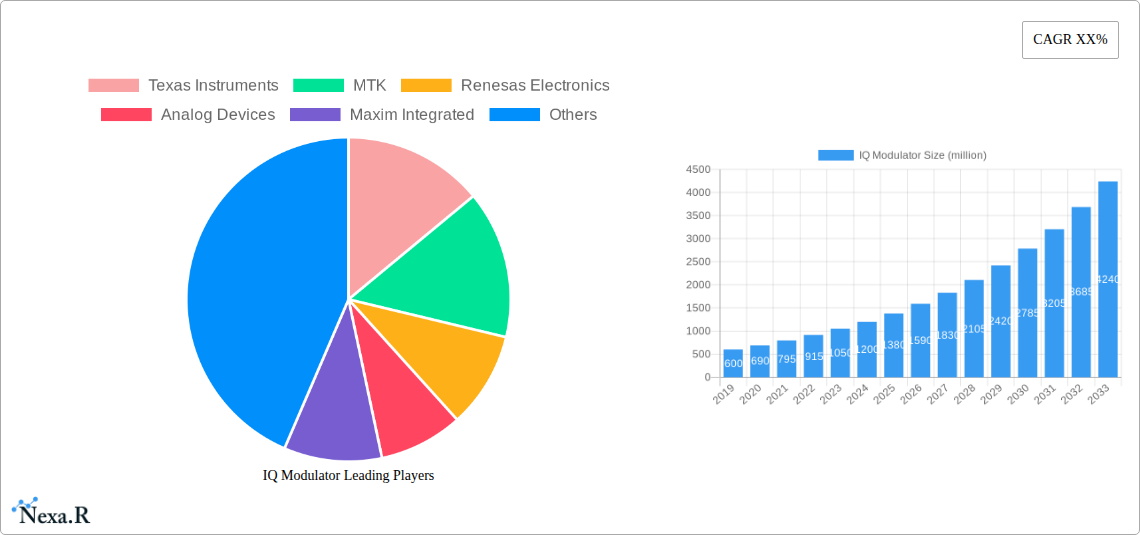

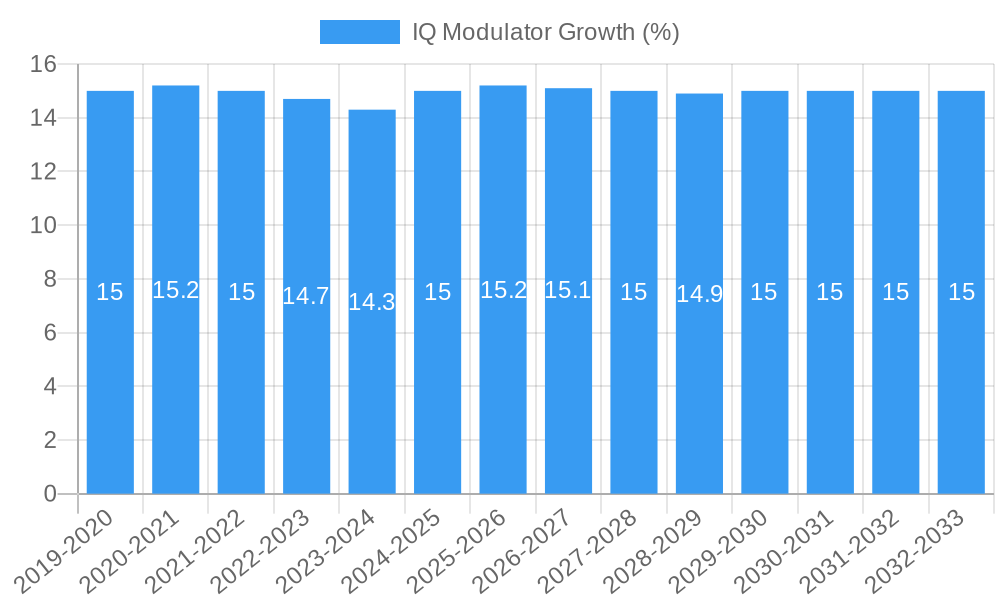

The global IQ modulator market is poised for significant expansion, projected to reach a valuation of approximately $1,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 15% expected throughout the forecast period extending to 2033. This impressive growth is primarily propelled by the burgeoning demand from the aerospace and defense sectors, where advanced signal processing and reliable communication are paramount. The escalating complexity of modern defense systems, including advanced radar, electronic warfare, and satellite communications, necessitates high-performance IQ modulators. Similarly, the aerospace industry's increasing adoption of sophisticated avionics and communication systems for commercial and military aircraft is a key driver. The communication sector, particularly with the advent of 5G and future wireless technologies, also presents substantial opportunities, requiring efficient modulation techniques for higher data rates and improved spectral efficiency.

While the market exhibits strong upward momentum, certain restraints could temper its growth. The high cost associated with research and development for cutting-edge IQ modulator technologies, coupled with the stringent qualification and certification processes in critical sectors like aerospace and defense, can pose financial and temporal challenges for manufacturers. Furthermore, the rapid pace of technological evolution necessitates continuous innovation, and a lag in adopting new modulation schemes or miniaturization could lead to market obsolescence. However, the overarching trends of miniaturization, increased power efficiency, and enhanced signal fidelity in IQ modulators are expected to counterbalance these restraints. The market is characterized by a strong competitive landscape, with key players like Texas Instruments, Qualcomm, and Broadcom investing heavily in R&D to capture market share. Emerging applications in areas beyond traditional communication, such as advanced medical imaging and scientific instrumentation, are also contributing to the sustained growth trajectory of the IQ modulator market.

IQ Modulator Market: Comprehensive Analysis and Future Outlook (2019–2033)

This report provides an in-depth analysis of the global IQ modulator market, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and a detailed future outlook. Spanning from 2019 to 2033, with a base and estimated year of 2025, this study offers critical insights for industry professionals, investors, and stakeholders.

IQ Modulator Market Dynamics & Structure

The global IQ modulator market is characterized by a moderately consolidated structure, with key players investing heavily in research and development to drive technological innovation. The demand for high-speed and efficient signal processing in communication systems, defense, and aerospace applications serves as a primary innovation driver. Regulatory frameworks, particularly those dictating spectrum usage and data integrity, also shape product development and market entry. Competitive product substitutes exist, primarily in the form of simpler analog modulators for less demanding applications, but the increasing complexity of modern communication protocols favors sophisticated IQ modulators. End-user demographics are shifting towards industries requiring advanced wireless capabilities and robust signal integrity. Mergers and acquisitions (M&A) are a notable trend, consolidating market share and fostering vertical integration, evident in the estimated volume of 15 M&A deals in the past five years. Innovation barriers include the high cost of specialized fabrication processes and the need for skilled engineering talent.

- Market Concentration: Moderately consolidated with a few dominant players.

- Innovation Drivers: High-speed signal processing, advanced communication protocols, defense and aerospace demands.

- Regulatory Impact: Spectrum allocation, data security, and signal quality standards.

- Competitive Landscape: Analog modulators and integrated solutions present some substitution risks.

- End-User Demographics: Growth driven by telecommunications, military, and aviation sectors.

- M&A Activity: Increasing consolidation observed with an estimated 15 deals in the historical period (2019-2024).

- Innovation Barriers: High R&D expenditure, complex manufacturing, and talent acquisition challenges.

IQ Modulator Growth Trends & Insights

The IQ modulator market is poised for robust growth, projected to reach an estimated market size of $1,850 million units by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period (2025–2033). This expansion is fueled by the escalating demand for higher bandwidth and data transmission rates across various sectors. The adoption rate of advanced digital communication technologies is a significant factor, with industries rapidly upgrading their infrastructure to support 5G, satellite communications, and sophisticated radar systems. Technological disruptions, such as the development of highly integrated System-on-Chip (SoC) IQ modulators and advancements in digital pre-distortion (DPD) techniques, are enhancing performance and reducing power consumption, thereby driving market penetration. Consumer behavior shifts, while less direct, influence the underlying demand for better connectivity and enhanced multimedia experiences, indirectly boosting the adoption of IQ modulators in the communication infrastructure. The increasing complexity of wireless signals and the need for precise modulation schemes are pushing the market towards more advanced and versatile IQ modulator solutions. The historical period (2019–2024) saw a steady growth trajectory, laying the foundation for accelerated expansion in the coming years. The market penetration of high-frequency processing modulators is expected to outpace that of IF processing modulators due to the evolving demands of next-generation wireless systems.

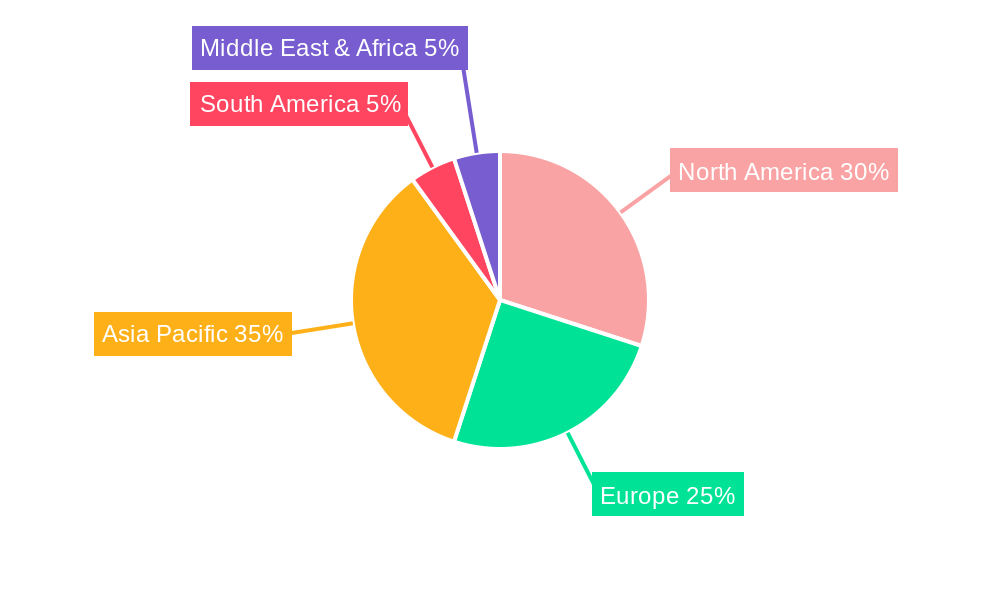

Dominant Regions, Countries, or Segments in IQ Modulator

The Communication segment, particularly within the Wireless Communication application, is currently the dominant force driving growth in the global IQ modulator market. This segment is projected to account for an estimated 65% of the total market share in 2025. The relentless expansion of 5G networks, the proliferation of IoT devices, and the increasing demand for high-speed data transfer in both consumer and enterprise applications are the primary growth engines. Countries like the United States, China, and South Korea are leading the charge due to their aggressive deployment of 5G infrastructure and significant investments in research and development of advanced wireless technologies.

Within the Types category, High Frequency Processing Modulators are experiencing exceptionally strong growth, driven by the need to support higher frequency bands for enhanced data capacity and reduced latency. These modulators are critical for next-generation wireless systems, including mmWave 5G and future satellite communication payloads.

- Dominant Application Segment: Communication (Wireless) – driving substantial market share and growth.

- Key Drivers: 5G network deployment, IoT expansion, increased data traffic demand.

- Leading Countries: USA, China, South Korea – significant infrastructure investment and technological innovation.

- Dominant Type Segment: High Frequency Processing Modulator – witnessing rapid adoption.

- Key Drivers: Need for higher bandwidth, lower latency, advanced wireless technologies (e.g., mmWave).

- Growth Potential: Expected to capture a larger market share in the forecast period.

- Economic Policies: Government initiatives promoting digital transformation and telecommunications infrastructure development play a crucial role in regional dominance.

- Infrastructure Investment: Significant capital allocation towards upgrading and expanding wireless networks directly correlates with the demand for advanced IQ modulators.

- Technological Adoption Rates: Regions with faster adoption of new wireless standards will exhibit higher demand.

IQ Modulator Product Landscape

The IQ modulator product landscape is evolving rapidly with a focus on miniaturization, higher linearity, and increased integration. Companies are introducing innovative IQ modulators that offer improved Error Vector Magnitude (EVM) performance, critical for maintaining signal integrity in complex wireless systems. Direct digital synthesis (DDS) capabilities are being integrated, allowing for greater flexibility and agility in signal generation. Applications span from high-frequency RF front-ends in cellular base stations and defense radar systems to advanced satellite communication payloads, where precise signal modulation is paramount. The unique selling propositions of leading products include extended operating bandwidths, reduced power consumption, and enhanced anti-jamming capabilities, all contributing to superior system performance.

Key Drivers, Barriers & Challenges in IQ Modulator

The IQ modulator market is propelled by several key drivers. The rapid advancement of wireless communication technologies, including 5G and beyond, necessitates sophisticated modulation techniques for higher data rates and spectral efficiency. Increased adoption of sophisticated radar systems in defense and aerospace for enhanced surveillance and targeting also fuels demand. Furthermore, the growing demand for high-definition content and real-time data streaming across various consumer electronics and industrial applications is a significant economic driver.

Conversely, the market faces several challenges. The high cost of research and development and specialized manufacturing processes can act as a barrier to entry for smaller players. Supply chain disruptions, particularly for specialized semiconductor components, can impact production volumes and lead times. Stringent regulatory compliance requirements for signal quality and interference mitigation can add to development complexity and costs. The competitive pressure from integrated solutions and advancements in alternative modulation schemes also poses a restraint.

Emerging Opportunities in IQ Modulator

Emerging opportunities in the IQ modulator market are primarily driven by the expansion of satellite communication constellations and the growing need for advanced telemetry, tracking, and command (TT&C) systems. The burgeoning field of Software-Defined Radios (SDRs) presents a significant opportunity, as IQ modulators are central to their flexible and reconfigurable architectures. The increasing adoption of high-frequency test and measurement equipment for validating next-generation wireless devices also creates a dedicated market niche. Furthermore, untapped markets in emerging economies looking to upgrade their communication infrastructure represent a substantial growth avenue.

Growth Accelerators in the IQ Modulator Industry

Long-term growth in the IQ modulator industry is being accelerated by breakthroughs in advanced semiconductor fabrication techniques, enabling smaller, more power-efficient, and higher-performance devices. Strategic partnerships between semiconductor manufacturers and system integrators are crucial for co-developing optimized solutions tailored to specific application needs. Market expansion strategies targeting nascent industries and regions that are beginning their digital transformation journeys will also act as significant growth catalysts. The continuous evolution of wireless standards, such as the future iterations of 5G and the development of 6G, will intrinsically drive the demand for next-generation IQ modulators.

Key Players Shaping the IQ Modulator Market

- Texas Instruments

- MTK

- Renesas Electronics

- Analog Devices

- Maxim Integrated

- STMicroelectronics

- Enensys Technologies

- Silicon Labs

- Qualcomm

- Broadcom

- USRobotics

- iXblue

- Qorvo

- NeoPhotonics Corporation

Notable Milestones in IQ Modulator Sector

- 2020: Launch of new generation of wideband IQ modulators with improved linearity and reduced power consumption by leading semiconductor manufacturers.

- 2021: Increased adoption of compact IQ modulator modules in portable communication devices and compact radar systems.

- 2022: Significant advancements in digital pre-distortion (DPD) integration, enhancing the performance of IQ modulators in complex signal environments.

- 2023: Growing investment in research and development for mmWave IQ modulators to support next-generation 5G and future wireless applications.

- 2024: Emergence of highly integrated IQ modulator SoCs, consolidating multiple functionalities onto a single chip, leading to cost reduction and miniaturization.

In-Depth IQ Modulator Market Outlook

The future outlook for the IQ modulator market is exceptionally bright, driven by persistent technological innovation and expanding application horizons. The increasing demand for higher data throughput and lower latency in wireless communications will continue to be the primary growth accelerator. Strategic collaborations and the ongoing development of more efficient and compact semiconductor solutions are expected to further fuel market expansion. Emerging applications in areas like advanced sensing and secure communication systems are poised to unlock new revenue streams. The market is expected to witness sustained growth as industries worldwide continue their digital transformation initiatives.

IQ Modulator Segmentation

-

1. Application

- 1.1. Aerospace

- 1.2. Defense

- 1.3. Communication

- 1.4. Others

-

2. Types

- 2.1. IF Processing Modulator

- 2.2. High Frequency Processing Modulator

IQ Modulator Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

IQ Modulator REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IQ Modulator Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.1.3. Communication

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. IF Processing Modulator

- 5.2.2. High Frequency Processing Modulator

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America IQ Modulator Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace

- 6.1.2. Defense

- 6.1.3. Communication

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. IF Processing Modulator

- 6.2.2. High Frequency Processing Modulator

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America IQ Modulator Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace

- 7.1.2. Defense

- 7.1.3. Communication

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. IF Processing Modulator

- 7.2.2. High Frequency Processing Modulator

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe IQ Modulator Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace

- 8.1.2. Defense

- 8.1.3. Communication

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. IF Processing Modulator

- 8.2.2. High Frequency Processing Modulator

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa IQ Modulator Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace

- 9.1.2. Defense

- 9.1.3. Communication

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. IF Processing Modulator

- 9.2.2. High Frequency Processing Modulator

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific IQ Modulator Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace

- 10.1.2. Defense

- 10.1.3. Communication

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. IF Processing Modulator

- 10.2.2. High Frequency Processing Modulator

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Texas Instruments

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MTK

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Renesas Electronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Analog Devices

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Maxim Integrated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STMicroelectronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Enensys Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Silicon Labs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qualcomm

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Broadcom

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 USRobotics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 iXblue

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Qorvo

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 NeoPhotonics Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Texas Instruments

List of Figures

- Figure 1: Global IQ Modulator Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America IQ Modulator Revenue (million), by Application 2024 & 2032

- Figure 3: North America IQ Modulator Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America IQ Modulator Revenue (million), by Types 2024 & 2032

- Figure 5: North America IQ Modulator Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America IQ Modulator Revenue (million), by Country 2024 & 2032

- Figure 7: North America IQ Modulator Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America IQ Modulator Revenue (million), by Application 2024 & 2032

- Figure 9: South America IQ Modulator Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America IQ Modulator Revenue (million), by Types 2024 & 2032

- Figure 11: South America IQ Modulator Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America IQ Modulator Revenue (million), by Country 2024 & 2032

- Figure 13: South America IQ Modulator Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe IQ Modulator Revenue (million), by Application 2024 & 2032

- Figure 15: Europe IQ Modulator Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe IQ Modulator Revenue (million), by Types 2024 & 2032

- Figure 17: Europe IQ Modulator Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe IQ Modulator Revenue (million), by Country 2024 & 2032

- Figure 19: Europe IQ Modulator Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa IQ Modulator Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa IQ Modulator Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa IQ Modulator Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa IQ Modulator Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa IQ Modulator Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa IQ Modulator Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific IQ Modulator Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific IQ Modulator Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific IQ Modulator Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific IQ Modulator Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific IQ Modulator Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific IQ Modulator Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global IQ Modulator Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global IQ Modulator Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global IQ Modulator Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global IQ Modulator Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global IQ Modulator Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global IQ Modulator Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global IQ Modulator Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global IQ Modulator Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global IQ Modulator Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global IQ Modulator Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global IQ Modulator Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global IQ Modulator Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global IQ Modulator Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global IQ Modulator Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global IQ Modulator Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global IQ Modulator Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global IQ Modulator Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global IQ Modulator Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global IQ Modulator Revenue million Forecast, by Country 2019 & 2032

- Table 41: China IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific IQ Modulator Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IQ Modulator?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the IQ Modulator?

Key companies in the market include Texas Instruments, MTK, Renesas Electronics, Analog Devices, Maxim Integrated, STMicroelectronics, Enensys Technologies, Silicon Labs, Qualcomm, Broadcom, USRobotics, iXblue, Qorvo, NeoPhotonics Corporation.

3. What are the main segments of the IQ Modulator?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IQ Modulator," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IQ Modulator report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IQ Modulator?

To stay informed about further developments, trends, and reports in the IQ Modulator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence