Key Insights

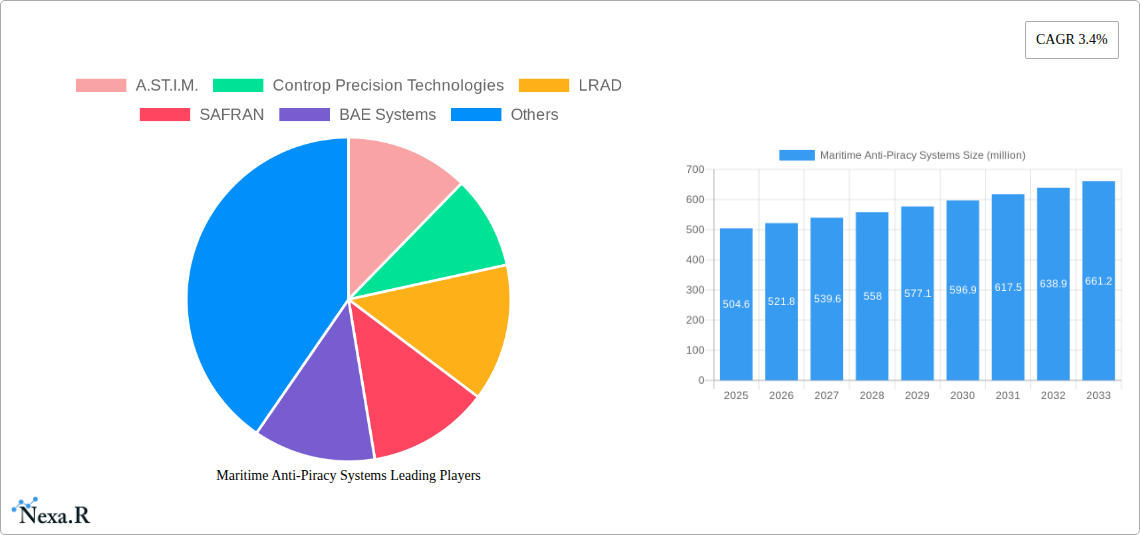

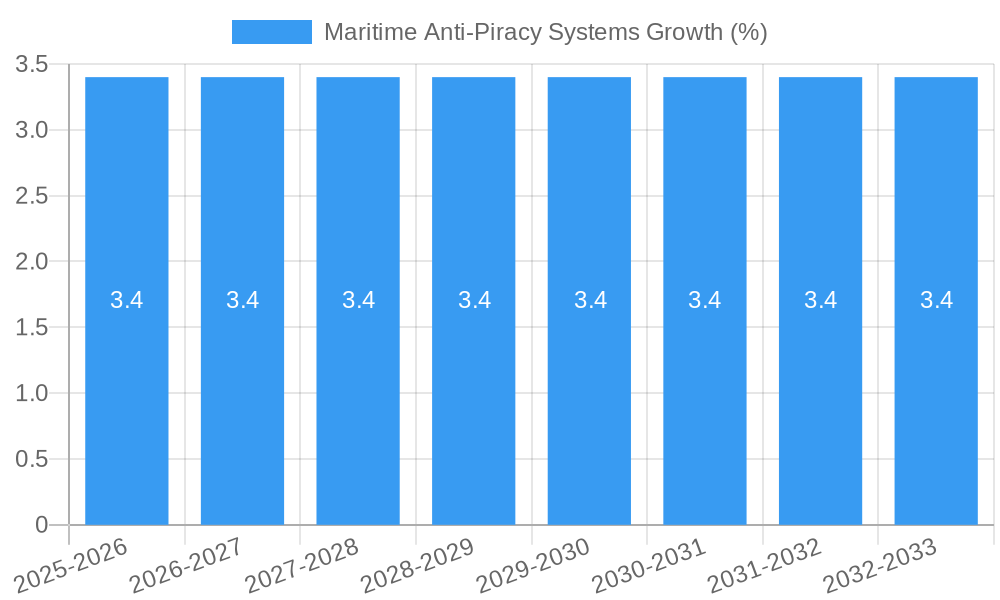

The global Maritime Anti-Piracy Systems market is poised for steady growth, with a current market size estimated at USD 504.6 million in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 3.4% through 2033. This expansion is primarily fueled by the persistent threat of piracy in key maritime trade routes, necessitating enhanced security measures for commercial vessels. The increasing sophistication of piracy tactics demands continuous innovation in anti-piracy solutions, driving investments in both lethal and non-lethal technologies. Sectors such as Passenger Ships and Ferries, Dry Cargo Vessels, and Tankers are expected to be significant contributors to market revenue, reflecting their exposure to pirate activities and the critical need for secure transit. Furthermore, the growing emphasis on maritime safety regulations and international cooperation in combating piracy are creating a favorable environment for market expansion.

The market's trajectory is further shaped by emerging trends, including the integration of advanced surveillance technologies like AI-powered anomaly detection and drone-based monitoring, alongside the deployment of non-lethal deterrents such as acoustic devices and directed energy systems. These advancements aim to provide comprehensive protection while minimizing collateral damage and adhering to evolving international maritime law. While the market exhibits robust growth potential, certain factors, such as the high cost of implementing advanced anti-piracy systems and the potential for regulatory challenges in certain regions, may pose moderate restraints. Nevertheless, the unwavering commitment of shipping companies and governments to ensure the safety of maritime trade and personnel will continue to propel the adoption of innovative maritime anti-piracy solutions across the globe.

Here is a compelling, SEO-optimized report description for Maritime Anti-Piracy Systems, integrating high-traffic keywords and market structure details.

Maritime Anti-Piracy Systems Market Dynamics & Structure

The global maritime anti-piracy systems market is characterized by a moderate concentration, with key players like BAE Systems, SAFRAN, and Guardian Maritime leading in technological innovation and market penetration. The demand is primarily driven by the persistent threat of piracy in critical shipping lanes, compelling maritime authorities and private operators to invest in advanced security solutions. Technological innovation, particularly in areas such as long-range acoustic devices (LRADs), sophisticated surveillance systems, and automated threat detection, is a significant driver. Regulatory frameworks, including IMO guidelines and national security directives, also play a crucial role in shaping market requirements. Competitive product substitutes, ranging from basic security personnel to integrated electronic warfare systems, present a dynamic competitive landscape. End-user demographics are diverse, encompassing large shipping corporations, naval forces, and individual vessel owners. Mergers and acquisitions (M&A) trends are evident as established companies seek to expand their product portfolios and geographical reach, with an estimated XX M&A deals recorded in the historical period. Innovation barriers include the high cost of advanced technologies and the need for continuous adaptation to evolving piracy tactics.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation Drivers: Advanced surveillance, non-lethal deterrence, AI-powered threat detection.

- Regulatory Frameworks: IMO guidelines, national security mandates.

- Competitive Product Substitutes: Security personnel, passive defense measures, integrated electronic systems.

- End-User Demographics: Shipping companies, naval forces, private security firms.

- M&A Trends: Strategic acquisitions for portfolio expansion and market consolidation.

- Innovation Barriers: High R&D costs, rapid technological obsolescence.

Maritime Anti-Piracy Systems Growth Trends & Insights

The maritime anti-piracy systems market is poised for significant growth, projected to expand from an estimated market size of $XXX million in 2025 to $XXX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is fueled by a confluence of factors, including the unabated threat of piracy in vulnerable maritime regions, increasing global trade volumes, and a growing emphasis on crew and asset safety. Adoption rates for advanced anti-piracy technologies are steadily rising, moving beyond traditional armed guards to encompass sophisticated electronic countermeasures and surveillance solutions. Technological disruptions are a constant, with advancements in drone technology for maritime surveillance, AI-driven anomaly detection, and enhanced acoustic deterrence systems reshaping the market. Consumer behavior shifts are notable, with a greater willingness among vessel operators and charterers to invest in proactive security measures rather than reactive responses. The market penetration of non-lethal systems, in particular, is expected to surge as operational effectiveness and ethical considerations gain prominence. The underlying market value is estimated at $XXX million in the base year of 2025.

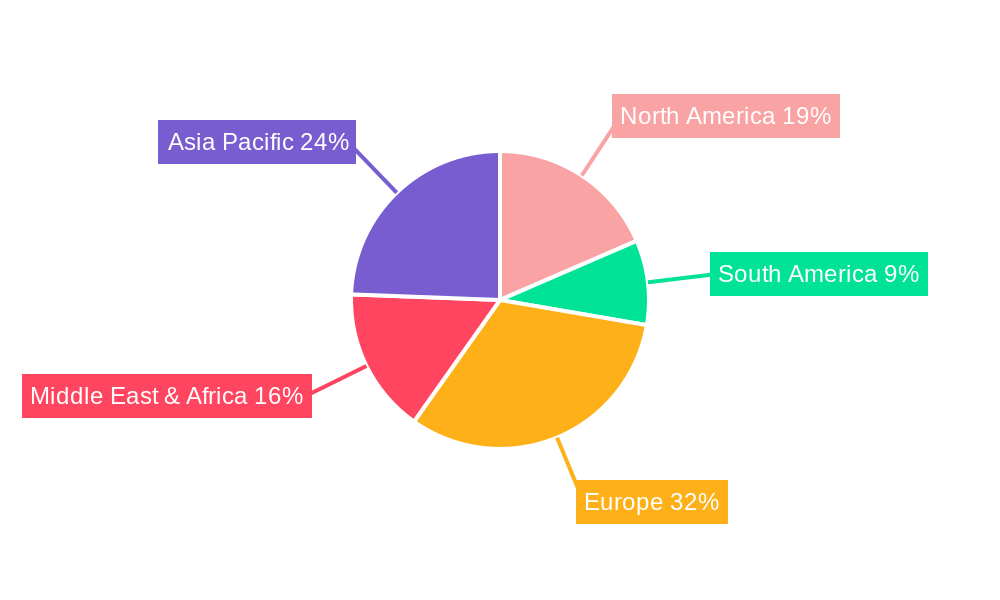

Dominant Regions, Countries, or Segments in Maritime Anti-Piracy Systems

The Tankers segment, driven by the high value of cargo and the critical importance of uninterrupted oil and gas supply chains, is emerging as a dominant force in the maritime anti-piracy systems market. Regions such as the Middle East, Southeast Asia, and the Horn of Africa, which have historically been hotspots for pirate activity, continue to witness substantial investment in anti-piracy technologies. The Dry Bulk Carriers segment also represents a significant growth area, accounting for a substantial portion of global shipping and facing persistent security challenges.

- Dominant Application Segment: Tankers, characterized by high cargo value and critical trade routes.

- Market Share: Estimated at XX% of the total application segment in 2025.

- Growth Potential: Driven by increasing global energy demands and the need for secure transport.

- Key Regional Hotspots:

- Horn of Africa: Continued vigilance and investment in robust security systems.

- Southeast Asia (Strait of Malacca, South China Sea): Intensified piracy and armed robbery incidents necessitate advanced countermeasures.

- Gulf of Guinea: Persistent threats to oil tankers and cargo vessels.

- Dominant Type Segment: Non-Lethal Anti-Piracy Weapons, reflecting a shift towards de-escalation and crew safety.

- Market Share: Projected to reach XX% of the total type segment by 2033.

- Growth Drivers: Enhanced operational efficiency, reduced collateral damage, and international regulations.

- Supporting Factors:

- Economic Policies: Government initiatives and international cooperation to combat piracy.

- Infrastructure: Development of port security and naval patrol capabilities.

- Technological Adoption: Increasing integration of sophisticated surveillance and deterrence systems.

Maritime Anti-Piracy Systems Product Landscape

The maritime anti-piracy systems product landscape is characterized by continuous innovation in both lethal and non-lethal technologies. Solutions range from advanced acoustic deterrents (LRADs) capable of disorienting attackers at significant distances to sophisticated electro-optical surveillance systems offering real-time threat identification. Non-lethal options are gaining traction, including non-toxic sonic barriers, high-intensity lights, and visual deterrents, focusing on disabling pirate approach without causing casualties. Lethal systems, while still a part of the security matrix, are increasingly being supplemented or replaced by these advanced non-lethal alternatives. Performance metrics emphasize range, effectiveness, reliability in harsh maritime environments, and ease of integration with existing vessel security systems. Unique selling propositions lie in the miniaturization of devices, improved power efficiency, and enhanced AI-driven threat analysis for reduced false alarms.

Key Drivers, Barriers & Challenges in Maritime Anti-Piracy Systems

The primary forces propelling the maritime anti-piracy systems market include the relentless threat of piracy in key maritime routes, leading to a heightened demand for robust security solutions. Technological advancements in surveillance, AI-powered threat detection, and non-lethal deterrence are significant drivers. Evolving regulatory landscapes and international cooperation efforts also encourage investment. Increased global trade necessitates secure shipping lanes, further boosting demand.

- Technological Drivers: AI in surveillance, advanced acoustic deterrents, drone integration.

- Economic Drivers: Rising global trade volumes, high value of maritime cargo.

- Policy Drivers: International maritime security initiatives, IMO regulations.

Key challenges and restraints include the high cost of sophisticated anti-piracy systems, making them less accessible for smaller operators. Supply chain disruptions can impact the availability of components. Regulatory hurdles, though often driving adoption, can also be complex and vary by jurisdiction. Competitive pressures from traditional security measures and the ever-evolving tactics of pirates require continuous adaptation and innovation, posing a significant challenge.

- Cost: High initial investment and maintenance expenses for advanced systems.

- Regulatory Hurdles: Complex and evolving international and national regulations.

- Pirate Tactics: Continuous adaptation of piracy methods requires system upgrades.

- Supply Chain Issues: Potential disruptions impacting the availability of critical components.

Emerging Opportunities in Maritime Anti-Piracy Systems

Emerging opportunities lie in the development and deployment of integrated, multi-layered security solutions that combine active deterrence with passive defenses and advanced surveillance. The growing use of autonomous vessels presents new challenges and opportunities for remote monitoring and control of anti-piracy systems. Untapped markets in developing nations with increasing maritime trade activity are also promising. Innovative applications, such as AI-powered predictive threat analysis and drone-based early warning systems, are expected to gain significant traction, offering enhanced proactive security measures. Evolving consumer preferences are leaning towards cost-effective, sustainable, and non-lethal solutions that minimize collateral damage and risk.

Growth Accelerators in the Maritime Anti-Piracy Systems Industry

Catalysts driving long-term growth in the maritime anti-piracy systems industry include significant technological breakthroughs, such as the integration of AI and machine learning for predictive threat assessment and enhanced situational awareness. Strategic partnerships between technology providers and maritime security firms are crucial for developing comprehensive and tailored solutions. Market expansion strategies, including the penetration of emerging economies and the development of specialized systems for niche vessel types, will also accelerate growth. The increasing emphasis on maritime security as a critical component of global trade stability will continue to foster investment and innovation.

Key Players Shaping the Maritime Anti-Piracy Systems Market

- A.ST.I.M.

- Controp Precision Technologies

- LRAD

- SAFRAN

- BAE Systems

- Guardian Maritime

- Monitor Systems

- SentientVision

- ST Electronics

Notable Milestones in Maritime Anti-Piracy Systems Sector

- 2019: Increased deployment of acoustic deterrence systems in response to heightened piracy off the coast of West Africa.

- 2020: Advancements in drone technology for maritime surveillance begin to be integrated into security protocols.

- 2021: Growing adoption of AI-powered threat detection algorithms for real-time analysis of vessel approaches.

- 2022: Launch of new non-toxic sonic barrier technologies as alternatives to acoustic deterrents.

- 2023: Several key mergers and acquisitions aimed at consolidating market share and expanding product portfolios.

- 2024: Increased regulatory focus on cyber security for maritime defense systems.

In-Depth Maritime Anti-Piracy Systems Market Outlook

The future of maritime anti-piracy systems is exceptionally promising, driven by a clear and present need for enhanced maritime security. Growth accelerators are firmly rooted in ongoing technological innovation, particularly in the domains of artificial intelligence for predictive analysis and advanced sensor fusion. Strategic partnerships between established defense contractors and specialized maritime technology firms will lead to more comprehensive and integrated security offerings. Market expansion will be further fueled by increased adoption in regions previously less affected by piracy but experiencing rising maritime trade. The emphasis on crew safety, asset protection, and the uninterrupted flow of global commerce will ensure sustained demand for effective anti-piracy solutions.

Maritime Anti-Piracy Systems Segmentation

-

1. Application

- 1.1. Passenger Ships and Ferries

- 1.2. Dry Cargo Vessels

- 1.3. Tankers

- 1.4. Dry Bulk Carriers

- 1.5. Special Purpose Vessels

- 1.6. Service Vessels

- 1.7. Fishing Vessels

- 1.8. Others

-

2. Types

- 2.1. Lethal Anti-Piracy Weapons

- 2.2. Non-Lethal Anti-Piracy Weapons

Maritime Anti-Piracy Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Maritime Anti-Piracy Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Anti-Piracy Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Ships and Ferries

- 5.1.2. Dry Cargo Vessels

- 5.1.3. Tankers

- 5.1.4. Dry Bulk Carriers

- 5.1.5. Special Purpose Vessels

- 5.1.6. Service Vessels

- 5.1.7. Fishing Vessels

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Lethal Anti-Piracy Weapons

- 5.2.2. Non-Lethal Anti-Piracy Weapons

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Maritime Anti-Piracy Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Ships and Ferries

- 6.1.2. Dry Cargo Vessels

- 6.1.3. Tankers

- 6.1.4. Dry Bulk Carriers

- 6.1.5. Special Purpose Vessels

- 6.1.6. Service Vessels

- 6.1.7. Fishing Vessels

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Lethal Anti-Piracy Weapons

- 6.2.2. Non-Lethal Anti-Piracy Weapons

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Maritime Anti-Piracy Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Ships and Ferries

- 7.1.2. Dry Cargo Vessels

- 7.1.3. Tankers

- 7.1.4. Dry Bulk Carriers

- 7.1.5. Special Purpose Vessels

- 7.1.6. Service Vessels

- 7.1.7. Fishing Vessels

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Lethal Anti-Piracy Weapons

- 7.2.2. Non-Lethal Anti-Piracy Weapons

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Maritime Anti-Piracy Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Ships and Ferries

- 8.1.2. Dry Cargo Vessels

- 8.1.3. Tankers

- 8.1.4. Dry Bulk Carriers

- 8.1.5. Special Purpose Vessels

- 8.1.6. Service Vessels

- 8.1.7. Fishing Vessels

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Lethal Anti-Piracy Weapons

- 8.2.2. Non-Lethal Anti-Piracy Weapons

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Maritime Anti-Piracy Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Ships and Ferries

- 9.1.2. Dry Cargo Vessels

- 9.1.3. Tankers

- 9.1.4. Dry Bulk Carriers

- 9.1.5. Special Purpose Vessels

- 9.1.6. Service Vessels

- 9.1.7. Fishing Vessels

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Lethal Anti-Piracy Weapons

- 9.2.2. Non-Lethal Anti-Piracy Weapons

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Maritime Anti-Piracy Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Ships and Ferries

- 10.1.2. Dry Cargo Vessels

- 10.1.3. Tankers

- 10.1.4. Dry Bulk Carriers

- 10.1.5. Special Purpose Vessels

- 10.1.6. Service Vessels

- 10.1.7. Fishing Vessels

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Lethal Anti-Piracy Weapons

- 10.2.2. Non-Lethal Anti-Piracy Weapons

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 A.ST.I.M.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Controp Precision Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LRAD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SAFRAN

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE Systems

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Guardian Maritime

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Monitor Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SentientVision

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ST Electronics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 A.ST.I.M.

List of Figures

- Figure 1: Global Maritime Anti-Piracy Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Maritime Anti-Piracy Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America Maritime Anti-Piracy Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Maritime Anti-Piracy Systems Revenue (million), by Types 2024 & 2032

- Figure 5: North America Maritime Anti-Piracy Systems Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Maritime Anti-Piracy Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Maritime Anti-Piracy Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Maritime Anti-Piracy Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America Maritime Anti-Piracy Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Maritime Anti-Piracy Systems Revenue (million), by Types 2024 & 2032

- Figure 11: South America Maritime Anti-Piracy Systems Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Maritime Anti-Piracy Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Maritime Anti-Piracy Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Maritime Anti-Piracy Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Maritime Anti-Piracy Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Maritime Anti-Piracy Systems Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Maritime Anti-Piracy Systems Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Maritime Anti-Piracy Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Maritime Anti-Piracy Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Maritime Anti-Piracy Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Maritime Anti-Piracy Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Maritime Anti-Piracy Systems Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Maritime Anti-Piracy Systems Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Maritime Anti-Piracy Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Maritime Anti-Piracy Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Maritime Anti-Piracy Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Maritime Anti-Piracy Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Maritime Anti-Piracy Systems Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Maritime Anti-Piracy Systems Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Maritime Anti-Piracy Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Maritime Anti-Piracy Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Maritime Anti-Piracy Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Maritime Anti-Piracy Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Anti-Piracy Systems?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Maritime Anti-Piracy Systems?

Key companies in the market include A.ST.I.M., Controp Precision Technologies, LRAD, SAFRAN, BAE Systems, Guardian Maritime, Monitor Systems, SentientVision, ST Electronics.

3. What are the main segments of the Maritime Anti-Piracy Systems?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 504.6 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Anti-Piracy Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Anti-Piracy Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Anti-Piracy Systems?

To stay informed about further developments, trends, and reports in the Maritime Anti-Piracy Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence