Key Insights

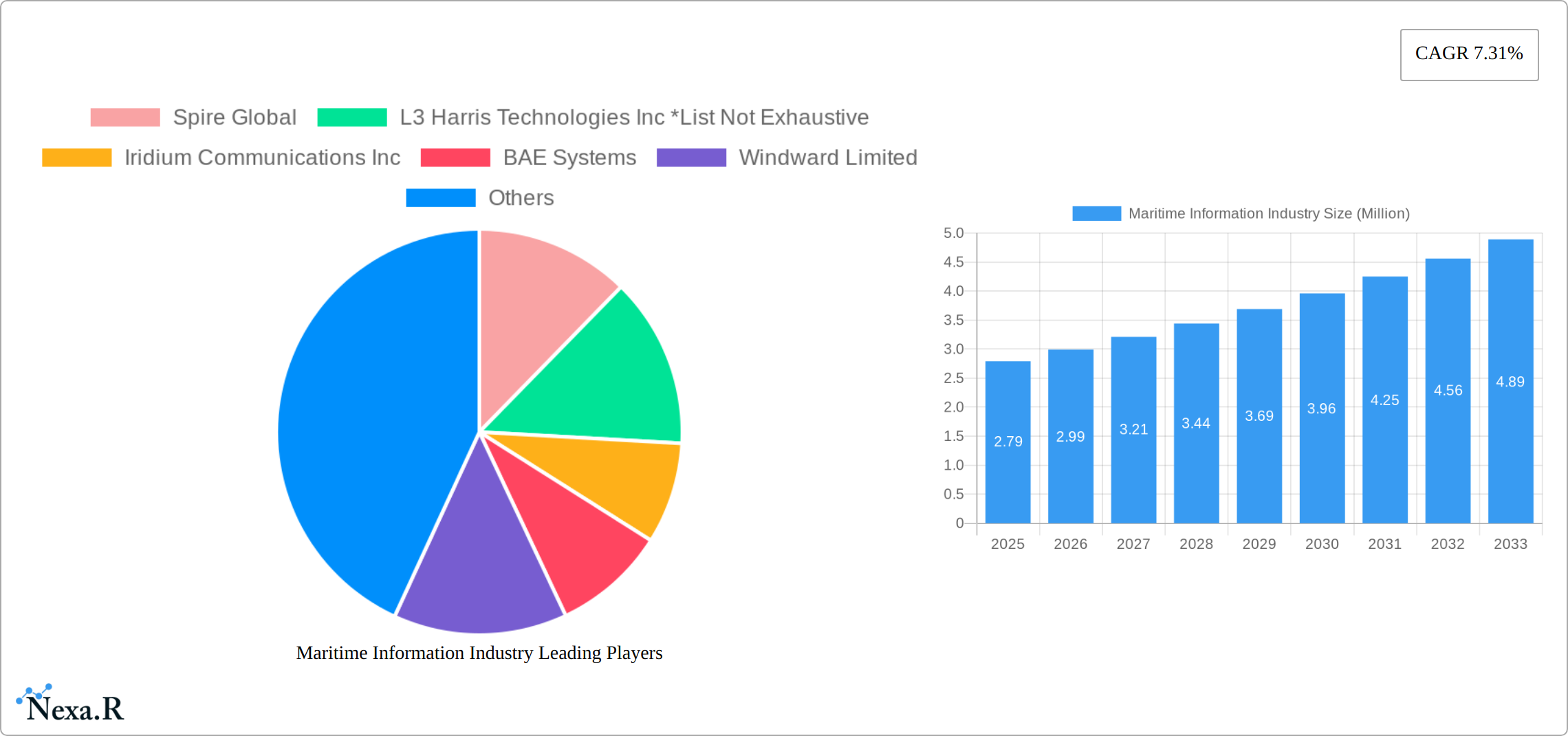

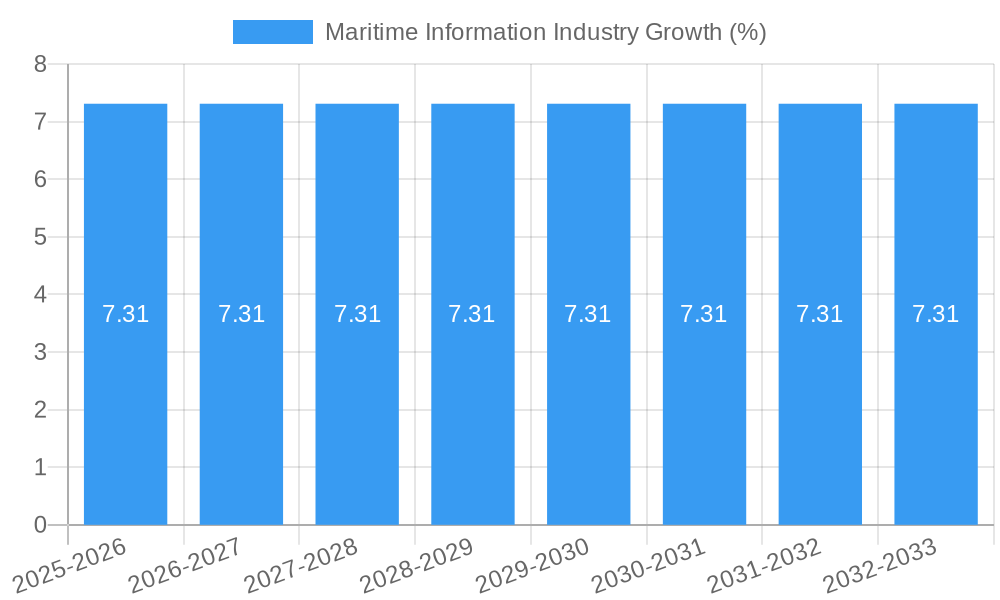

The Maritime Information Industry, valued at $2.79 million in 2025, is poised for significant growth with a projected CAGR of 7.31% through to 2033. This expansion is driven by increasing demands for real-time data and analytics in maritime operations, enhancing safety, efficiency, and compliance across global waters. Key applications such as Automatic Identification Systems (AIS), Synthetic Aperture Radar (SAR), and Vessel Identification and Tracking are at the forefront, with AIS leading due to its critical role in navigation and collision avoidance. The market is segmented by end-users into government and commercial sectors, with the government segment expected to dominate due to its focus on maritime security and surveillance. Major players like Spire Global, L3 Harris Technologies Inc, and Iridium Communications Inc are leveraging advanced technologies to meet these needs, contributing to the industry's robust growth trajectory.

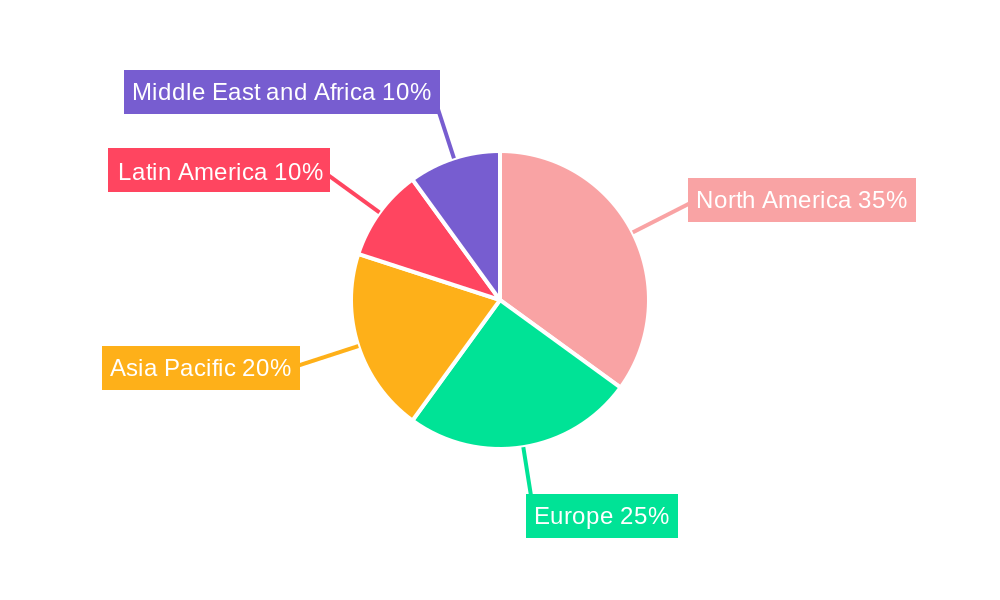

Regionally, North America is anticipated to hold a significant market share, supported by advanced technological infrastructure and high investment in maritime security. Europe and the Asia Pacific follow, with the latter showing rapid growth due to increasing maritime trade and the need for efficient port management. The Middle East and Africa, along with Latin America, are emerging markets with potential for growth, driven by the development of their maritime sectors and increasing focus on safety and efficiency. As the industry evolves, trends such as the integration of AI and machine learning for predictive analytics, and the adoption of satellite imaging for broader coverage, are expected to further propel the market forward, overcoming restraints such as high initial costs and the need for skilled personnel.

Maritime Information Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Maritime Information Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report analyzes parent markets (Maritime Industry) and child markets (e.g., Vessel Tracking, Satellite Imagery) to provide a granular understanding of the market. The market size in 2025 is estimated at XX Million and is projected to reach XX Million by 2033.

Maritime Information Industry Market Dynamics & Structure

The Maritime Information Industry exhibits a moderately concentrated market structure, with several key players commanding significant market share. The market is undergoing dynamic transformation fueled by rapid technological innovation, evolving regulatory landscapes, and a surging demand for enhanced maritime safety, security, and operational efficiency. Mergers and acquisitions (M&A) activity is moderate, reflecting an ongoing industry consolidation trend. Competition is intense, with companies continuously innovating to deliver cutting-edge solutions and gain a competitive edge.

- Market Concentration: The top 5 players held an estimated xx% of the global market share in 2025. This concentration is expected to [increase/decrease/remain stable] in the coming years due to [explain reason, e.g., increased M&A activity, emergence of new players, etc.].

- Technological Innovation: Advancements in satellite technology, Artificial Intelligence (AI), the Internet of Things (IoT), and big data analytics are driving the adoption of sophisticated maritime information solutions. However, high initial investment costs, complex system integration challenges, and the need for skilled personnel to manage and interpret the data pose significant innovation barriers. The industry is also grappling with cybersecurity concerns related to the increasing reliance on interconnected systems.

- Regulatory Frameworks: International Maritime Organization (IMO) regulations are crucial drivers, mandating enhanced safety and security measures, thereby fostering market growth. However, the variability in national regulations across different countries creates complexities for businesses operating globally and necessitates compliance with diverse standards.

- Competitive Product Substitutes: While limited, traditional methods of maritime communication and tracking are being progressively replaced by more efficient, accurate, and cost-effective technologies. This transition is driven by the need for real-time data and improved decision-making capabilities.

- End-User Demographics: The market is segmented into Government and Commercial end-users. While Government currently holds a larger market share, driven by national security and maritime surveillance needs, commercial adoption is experiencing rapid growth, fueled by increasing operational efficiency demands and cost savings opportunities.

- M&A Trends: The industry has witnessed xx M&A deals in the past 5 years, primarily driven by companies seeking to expand their product portfolios, enhance their technological capabilities, and achieve wider geographic reach. This consolidation trend is expected to [continue/slow down/change direction] in the future due to [explain reason].

Maritime Information Industry Growth Trends & Insights

The Maritime Information Industry exhibits robust growth, fueled by increasing global trade, stringent safety regulations, and the burgeoning adoption of advanced technologies. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration for advanced maritime information solutions is increasing, particularly in developing economies with rapidly growing maritime sectors. Technological disruptions, such as the adoption of AI-powered analytics and autonomous vessels, are reshaping the industry landscape. Consumer behavior shifts towards digitally-driven solutions and real-time data accessibility are driving market expansion.

Dominant Regions, Countries, or Segments in Maritime Information Industry

North America and Europe currently dominate the Maritime Information Industry, due to the high concentration of key players, established maritime infrastructure, and robust technological capabilities. However, the Asia-Pacific region is experiencing rapid growth, driven by significant investments in port infrastructure, the expansion of maritime trade, and supportive government policies. Within application segments, Vessel Identification and Tracking, and Satellite Imaging remain the largest segments in terms of market value. [Mention any other significant segments and their growth potential].

- Key Drivers (Asia-Pacific):

- Rapid economic growth and increasing maritime trade volumes.

- Government initiatives promoting technological advancements and digitalization within the maritime sector.

- Significant investments in port infrastructure modernization and expansion.

- Increasing focus on environmental sustainability and compliance with emission regulations.

- Dominant Segments:

- Vessel Identification and Tracking: This segment is driven by stringent regulatory requirements for improved vessel safety, security, and compliance with international regulations.

- Satellite Imaging: Growing demand for high-resolution imagery for maritime surveillance, resource management, environmental monitoring, and disaster response.

- Government End-users: Government agencies remain major drivers due to security, surveillance, and enforcement needs. This segment is also influenced by increasing budgetary allocations for maritime security and defense.

- [Add other significant segments with brief descriptions and growth drivers]

Maritime Information Industry Product Landscape

The Maritime Information Industry offers a diverse range of products and services, including Automatic Identification Systems (AIS), Synthetic Aperture Radar (SAR), advanced vessel tracking solutions, high-resolution satellite imagery, and a growing array of value-added applications. These products are characterized by continuous innovation, incorporating advanced features such as AI-powered analytics, predictive maintenance capabilities, improved data visualization tools, and enhanced cybersecurity measures. The emphasis is on providing enhanced accuracy, real-time data delivery, seamless integration with existing maritime systems, and user-friendly interfaces to deliver unique selling propositions and enhance operational efficiency.

Key Drivers, Barriers & Challenges in Maritime Information Industry

Key Drivers:

- Increasing demand for enhanced maritime safety and security.

- Stringent regulations mandating improved data transparency and tracking.

- Growing adoption of advanced technologies (IoT, AI, Big Data analytics).

- Rise in global trade and maritime activities.

Challenges & Restraints:

- High initial investment costs associated with advanced technologies.

- Cybersecurity concerns and data privacy issues.

- Interoperability challenges across different systems and platforms.

- Dependence on satellite infrastructure and connectivity limitations.

- The impact of supply chain disruptions led to a xx% increase in costs in 2023.

Emerging Opportunities in Maritime Information Industry

- Expanding applications of AI and machine learning for predictive maintenance and risk management.

- Growth in the demand for autonomous vessel solutions and related data management systems.

- Development of integrated maritime platforms incorporating data from multiple sources.

- Opportunities in the untapped markets of developing economies.

Growth Accelerators in the Maritime Information Industry

Technological breakthroughs in areas such as AI, IoT, and satellite technology are pivotal growth catalysts. Strategic partnerships between technology providers and maritime operators are accelerating the adoption of advanced solutions. Expansion into new geographical markets and diversification of service offerings are key strategies for industry players.

Key Players Shaping the Maritime Information Industry Market

- Spire Global

- L3 Harris Technologies Inc

- Iridium Communications Inc

- BAE Systems

- Windward Limited

- Inmarsat Global Limited

- Thales Group

- ORBCOMM Inc

- SAAB group

- Northrop Grumman Corporation

- [Add other relevant key players]

Notable Milestones in Maritime Information Industry Sector

- June 2023: Inmarsat Maritime launched Fleet Reach, a service providing seamless connectivity for ships, even in port, enhancing operational efficiency and communication capabilities.

- October 2023: India launched maritime projects worth INR 23,000 crore (approximately xx Million USD), boosting the blue economy and stimulating growth in the maritime information sector.

- [Add other significant milestones and their impact on the industry]

In-Depth Maritime Information Industry Market Outlook

The Maritime Information Industry is poised for sustained growth, driven by technological advancements, increasing regulatory pressures, and the burgeoning global maritime trade. Strategic investments in R&D, strategic partnerships, and expansion into new markets will be crucial for companies seeking to capitalize on future opportunities. The market's evolution towards greater data integration, enhanced automation, and AI-driven solutions will present significant growth potential.

Maritime Information Industry Segmentation

-

1. Application

- 1.1. Automatic Identification Systems

- 1.2. Synthetic Aperture Radar

- 1.3. Vessel Identification and Tracking

- 1.4. Satellite Imaging

- 1.5. Other Applications

-

2. End-user

- 2.1. Government

- 2.2. Commercial

Maritime Information Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Maritime Information Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advantage of Enhancing On-board Safety and Compliance Conditions on Ships

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Automated Identification Systems to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automatic Identification Systems

- 5.1.2. Synthetic Aperture Radar

- 5.1.3. Vessel Identification and Tracking

- 5.1.4. Satellite Imaging

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Government

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automatic Identification Systems

- 6.1.2. Synthetic Aperture Radar

- 6.1.3. Vessel Identification and Tracking

- 6.1.4. Satellite Imaging

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Government

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automatic Identification Systems

- 7.1.2. Synthetic Aperture Radar

- 7.1.3. Vessel Identification and Tracking

- 7.1.4. Satellite Imaging

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Government

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automatic Identification Systems

- 8.1.2. Synthetic Aperture Radar

- 8.1.3. Vessel Identification and Tracking

- 8.1.4. Satellite Imaging

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Government

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automatic Identification Systems

- 9.1.2. Synthetic Aperture Radar

- 9.1.3. Vessel Identification and Tracking

- 9.1.4. Satellite Imaging

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Government

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automatic Identification Systems

- 10.1.2. Synthetic Aperture Radar

- 10.1.3. Vessel Identification and Tracking

- 10.1.4. Satellite Imaging

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Government

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Maritime Information Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Spire Global

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 L3 Harris Technologies Inc *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Iridium Communications Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 BAE Systems

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Windward Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Inmarsat Global Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Thales Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ORBCOMM Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SAAB group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Northrop Grumman Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Spire Global

List of Figures

- Figure 1: Global Maritime Information Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Maritime Information Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Maritime Information Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Maritime Information Industry Revenue (Million), by End-user 2024 & 2032

- Figure 15: North America Maritime Information Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 16: North America Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Maritime Information Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Maritime Information Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Maritime Information Industry Revenue (Million), by End-user 2024 & 2032

- Figure 21: Europe Maritime Information Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 22: Europe Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Maritime Information Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Maritime Information Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Maritime Information Industry Revenue (Million), by End-user 2024 & 2032

- Figure 27: Asia Pacific Maritime Information Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 28: Asia Pacific Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Maritime Information Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Maritime Information Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Maritime Information Industry Revenue (Million), by End-user 2024 & 2032

- Figure 33: Latin America Maritime Information Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 34: Latin America Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Maritime Information Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East and Africa Maritime Information Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East and Africa Maritime Information Industry Revenue (Million), by End-user 2024 & 2032

- Figure 39: Middle East and Africa Maritime Information Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 40: Middle East and Africa Maritime Information Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Maritime Information Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Maritime Information Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Maritime Information Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Maritime Information Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Global Maritime Information Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Maritime Information Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Maritime Information Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Maritime Information Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Maritime Information Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Maritime Information Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Maritime Information Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Maritime Information Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 17: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Maritime Information Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Maritime Information Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 20: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Maritime Information Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Maritime Information Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 23: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Maritime Information Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Maritime Information Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 26: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Maritime Information Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Maritime Information Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 29: Global Maritime Information Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Information Industry?

The projected CAGR is approximately 7.31%.

2. Which companies are prominent players in the Maritime Information Industry?

Key companies in the market include Spire Global, L3 Harris Technologies Inc *List Not Exhaustive, Iridium Communications Inc, BAE Systems, Windward Limited, Inmarsat Global Limited, Thales Group, ORBCOMM Inc, SAAB group, Northrop Grumman Corporation.

3. What are the main segments of the Maritime Information Industry?

The market segments include Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Advantage of Enhancing On-board Safety and Compliance Conditions on Ships.

6. What are the notable trends driving market growth?

Automated Identification Systems to Dominate the Market.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

June 2023 - Inmarsat Maritime announced the launch of a fleet reach service to bring seamless connectivity to ships from sea to port. The new maritime connectivity service will enable uninterrupted access to high-speed connectivity, even when docked in ports, beating the coastal capacity crunch. The company's Fleet Reach service is optimized by Fleet Xpress, which offers supercharged coastal connectivity and enables faster speeds, increased signal strength, lower latency, and more reliable connectivity when sailing near coasts or docked in-port

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Information Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Information Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Information Industry?

To stay informed about further developments, trends, and reports in the Maritime Information Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence