Key Insights

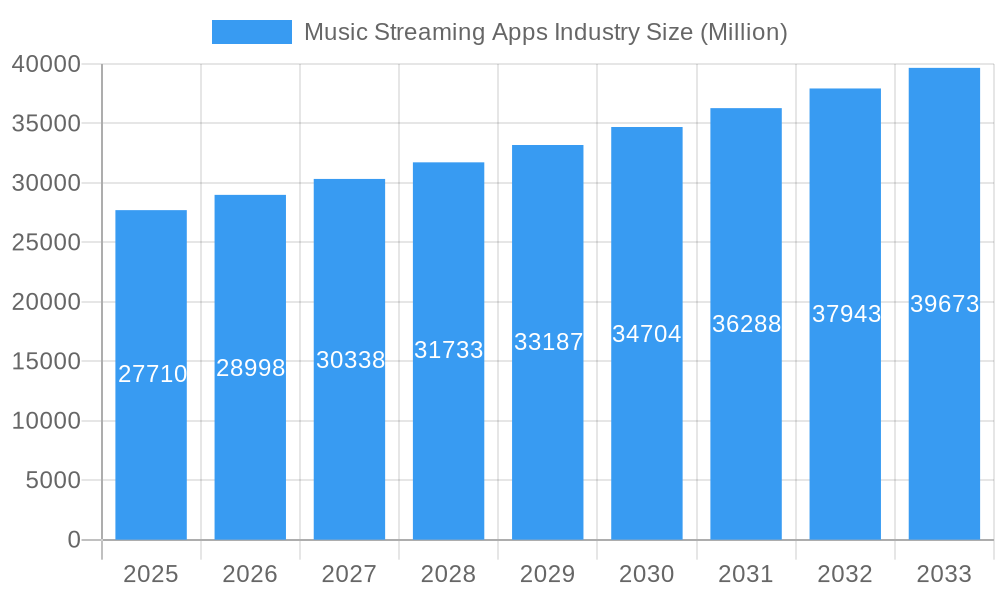

The global music streaming apps market, valued at $27.71 billion in 2025, is projected to experience robust growth, driven by the increasing adoption of smartphones, affordable data plans, and the rising preference for on-demand music consumption. The market's Compound Annual Growth Rate (CAGR) of 4.63% from 2025 to 2033 indicates a steady expansion, fueled by continuous innovation in features like personalized playlists, high-fidelity audio, and social integration within apps. Key players like Spotify, Apple Music, and Amazon Music are constantly vying for market share through strategic partnerships, exclusive content deals, and aggressive marketing campaigns. The segmentation by platform (Android and iPhone) and type (in-app purchases, advertisements, and other revenue models) highlights diverse monetization strategies and user preferences. The North American market currently holds a significant share, but the Asia-Pacific region is expected to witness substantial growth driven by increasing internet penetration and a burgeoning young population eager to embrace digital music services. Competition remains fierce, with established players facing challenges from emerging regional services and the ongoing evolution of user habits and technological advancements, particularly in areas like AI-powered music discovery and immersive audio experiences.

Music Streaming Apps Industry Market Size (In Billion)

The market’s growth trajectory will be significantly influenced by factors such as pricing strategies, the expanding reach of 5G networks improving streaming quality and accessibility, and the ongoing evolution of copyright regulations impacting music licensing. The "other types" revenue segment, which may include subscriptions bundled with other services or hardware, warrants close monitoring for future growth potential. While in-app purchases and advertisements form established revenue streams, diversification of income sources remains crucial for sustainable growth and resilience against market fluctuations. Furthermore, geographic expansion into underserved markets, particularly in Africa and Latin America, presents significant opportunities for established and emerging players alike, necessitating targeted marketing strategies and localized content offerings. Ultimately, the continued success in the music streaming app market hinges on delivering innovative features, personalized user experiences, and adapting to the ever-changing technological landscape.

Music Streaming Apps Industry Company Market Share

Music Streaming Apps Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Music Streaming Apps industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and anyone seeking a deep understanding of this rapidly evolving sector. The parent market is the digital music market, and the child market is music streaming applications.

Music Streaming Apps Industry Market Dynamics & Structure

The music streaming apps market is characterized by intense competition, rapid technological innovation, and evolving regulatory landscapes. Market concentration is high, with a few dominant players controlling a significant portion of the market share. The industry is driven by advancements in mobile technology, high-speed internet penetration, and growing consumer preference for on-demand music access. However, factors such as piracy, royalty disputes, and data privacy concerns pose significant challenges. Mergers and acquisitions (M&A) activity has been significant, with larger players consolidating their market positions. The estimated market size in 2025 is XX Million units.

- Market Concentration: High, with top 5 players holding approximately 70% market share (2025 estimate).

- Technological Innovation Drivers: AI-powered recommendations, high-fidelity audio streaming, personalized playlists.

- Regulatory Frameworks: Varying copyright laws and data privacy regulations across different regions.

- Competitive Product Substitutes: Physical music, radio broadcasting, other digital music platforms.

- End-User Demographics: Predominantly young adults (18-35 years) with high disposable incomes and smartphone ownership.

- M&A Trends: Increasing consolidation through acquisitions of smaller players and technology companies. Estimated M&A deal volume in 2024: XX deals.

Music Streaming Apps Industry Growth Trends & Insights

The music streaming apps market has witnessed phenomenal growth over the past decade, driven by increasing smartphone penetration, affordable data plans, and the convenience of on-demand music streaming. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately XX%, and is projected to remain strong at XX% during the forecast period (2025-2033). Market penetration continues to increase, particularly in emerging markets. Technological disruptions, such as the introduction of lossless audio and immersive audio formats, are driving premium subscription growth. Consumer behavior is shifting towards personalized experiences and curated content. The evolution of social features within music streaming apps is another major factor influencing user engagement and growth. The overall market size is projected to reach XX Million units by 2033.

Dominant Regions, Countries, or Segments in Music Streaming Apps Industry

North America and Europe currently hold the largest market shares in the music streaming apps industry due to higher internet penetration, strong digital music consumption habits, and a high concentration of major players. However, Asia-Pacific is expected to show the fastest growth rate due to increasing smartphone adoption and a growing middle class.

By Type:

- In-app Purchases: This segment is expected to maintain strong growth due to the increasing popularity of premium features and exclusive content.

- Advertisement: While a significant revenue stream for many platforms, this segment faces increasing competition from subscription-based models.

- Other Types: This includes revenue from partnerships, merchandise, and other ancillary services and may see modest growth.

By Platform:

- Android: This platform commands a larger market share due to its wider global reach and affordability.

- iPhone: While having a smaller global market share compared to Android, the iPhone segment demonstrates higher average revenue per user (ARPU).

Key Drivers:

- Strong digital music consumption trends.

- Increasing smartphone and internet penetration.

- Favorable economic policies promoting digital economy growth.

- Robust telecommunications infrastructure.

Music Streaming Apps Industry Product Landscape

The music streaming apps market showcases a diverse range of products, characterized by varying features, pricing models, and user interfaces. Key innovations include personalized playlists, high-fidelity audio streaming, social features, and integration with other services (smart speakers, smart cars). The competitive landscape encourages constant product innovation and improvement in user experience, driving platform differentiation. Performance metrics such as user engagement, churn rate, and ARPU are critical in assessing platform success.

Key Drivers, Barriers & Challenges in Music Streaming Apps Industry

Key Drivers:

- Growing smartphone penetration and internet access globally.

- Increasing demand for convenient and on-demand music access.

- Technological advancements like AI-powered recommendations and lossless audio.

Key Challenges and Restraints:

- Intense competition among established players.

- Copyright infringement and royalty disputes.

- Data privacy concerns and regulatory scrutiny.

- Dependence on mobile data infrastructure in certain markets. This can impact accessibility in developing regions.

Emerging Opportunities in Music Streaming Apps Industry

Emerging opportunities include expanding into untapped markets (Africa, Latin America), exploring new applications of music streaming (e.g., interactive live music experiences, personalized fitness soundtracks), and catering to niche genres and communities. The metaverse presents a significant opportunity for innovative music experiences and immersive virtual concerts. The growing popularity of podcasts and audiobooks also opens doors for diversification of content.

Growth Accelerators in the Music Streaming Apps Industry

Long-term growth will be driven by further technological breakthroughs, strategic partnerships between streaming services and artists, and expansion into new markets. The integration of artificial intelligence to enhance personalization and discoverability will be crucial. Aggressive marketing strategies and collaborations with other entertainment platforms are also expected to fuel growth.

Key Players Shaping the Music Streaming Apps Industry Market

- Tidal

- NetEase Inc

- Google LLC

- Tencent Music Entertainment Group

- Deezer

- Spotify AB

- SoundCloud

- Wynk Music

- Pandora

- Apple Inc

Notable Milestones in Music Streaming Apps Industry Sector

- December 2022: YouTube Music announced the development of its Custom Radio Playlist feature.

- May 2022: JioSaavn and Warner Music India launched "Spotted," an artist discovery initiative.

In-Depth Music Streaming Apps Industry Market Outlook

The future of the music streaming apps market looks bright, driven by technological advancements, strategic partnerships, and the ever-growing appetite for digital music. The market is poised for continued growth, with significant opportunities for innovation and expansion. Strategic acquisitions and the emergence of new technologies will continue to shape the competitive landscape. The industry's focus on user experience and personalized content will remain paramount.

Music Streaming Apps Industry Segmentation

-

1. Type

- 1.1. In-app Purchases

- 1.2. Advertisement

- 1.3. Other Types

-

2. Platform

- 2.1. Android

- 2.2. Iphone

Music Streaming Apps Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Music Streaming Apps Industry Regional Market Share

Geographic Coverage of Music Streaming Apps Industry

Music Streaming Apps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage

- 3.3. Market Restrains

- 3.3.1. Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers

- 3.4. Market Trends

- 3.4.1. Rising Demand for In-App Purchases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-app Purchases

- 5.1.2. Advertisement

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Android

- 5.2.2. Iphone

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. In-app Purchases

- 6.1.2. Advertisement

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Android

- 6.2.2. Iphone

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. In-app Purchases

- 7.1.2. Advertisement

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Android

- 7.2.2. Iphone

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. In-app Purchases

- 8.1.2. Advertisement

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Android

- 8.2.2. Iphone

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. In-app Purchases

- 9.1.2. Advertisement

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Android

- 9.2.2. Iphone

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. In-app Purchases

- 10.1.2. Advertisement

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Android

- 10.2.2. Iphone

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tidal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NetEase Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tencent Music Entertainment Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deezer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Spotify AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SoundCloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wynk Music*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pandora

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tidal

List of Figures

- Figure 1: Global Music Streaming Apps Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 17: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 18: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 23: Latin America Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Latin America Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 29: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Music Streaming Apps Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 15: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 18: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Streaming Apps Industry?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Music Streaming Apps Industry?

Key companies in the market include Tidal, NetEase Inc, Google LLC, Tencent Music Entertainment Group, Deezer, Spotify AB, SoundCloud, Wynk Music*List Not Exhaustive, Pandora, Apple Inc.

3. What are the main segments of the Music Streaming Apps Industry?

The market segments include Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage.

6. What are the notable trends driving market growth?

Rising Demand for In-App Purchases.

7. Are there any restraints impacting market growth?

Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers.

8. Can you provide examples of recent developments in the market?

In December 2022, YouTube was on the verge of introducing the Custom Radio Playlist feature. Soon, customers of the Google-owned music streaming service would have the option to design their own station. The YouTube Music App would give consumers various options for musicians so they may discover their favorites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Music Streaming Apps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Music Streaming Apps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Music Streaming Apps Industry?

To stay informed about further developments, trends, and reports in the Music Streaming Apps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence