Key Insights

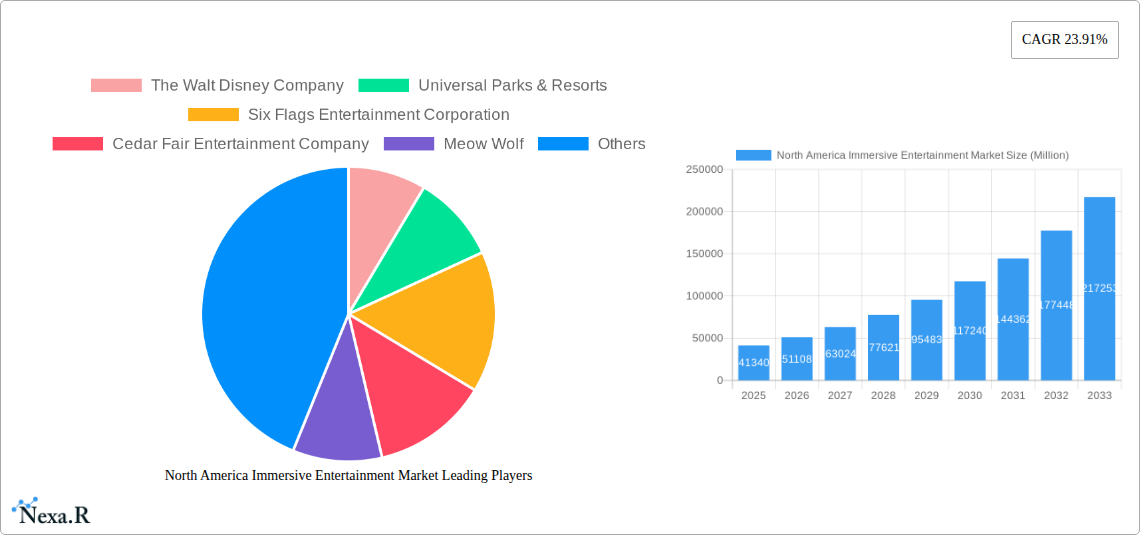

The North America immersive entertainment market, valued at $41.34 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 23.91% from 2025 to 2033. This surge is fueled by several key factors. Firstly, the rising popularity of escape rooms, virtual reality (VR) experiences, and augmented reality (AR) attractions caters to a growing demand for unique and engaging entertainment options. Secondly, technological advancements continuously enhance the quality and sophistication of immersive experiences, leading to increased consumer appeal and willingness to spend. Thirdly, strategic collaborations between entertainment giants like The Walt Disney Company and innovative startups such as Meow Wolf are driving market innovation and expanding the range of available experiences. Finally, a younger generation accustomed to interactive digital experiences fuels this market's expansion.

North America Immersive Entertainment Market Market Size (In Billion)

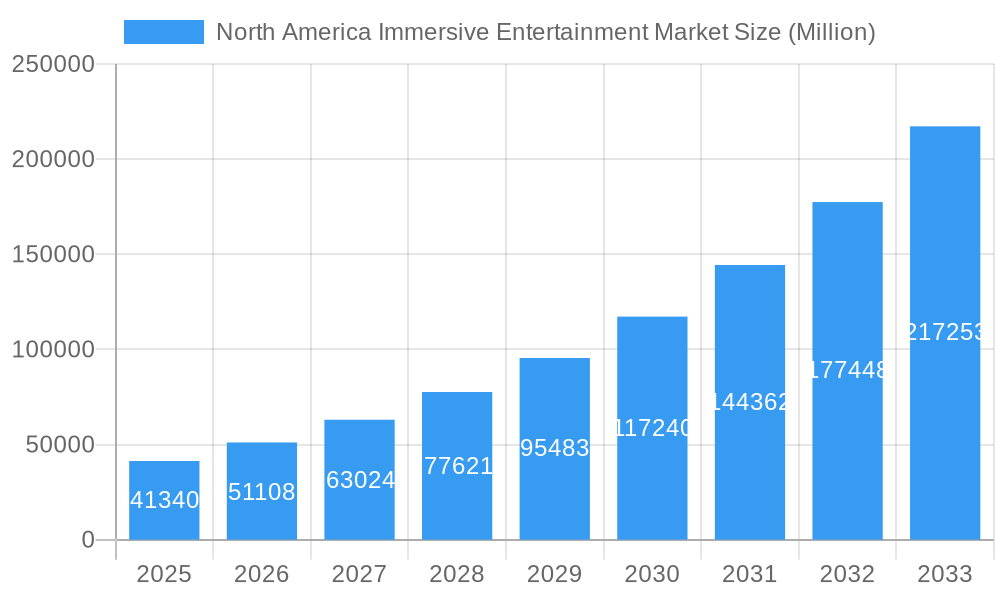

Despite the significant growth, the market faces certain challenges. Competition is intense, with established players like Six Flags and Universal Parks & Resorts alongside emerging companies vying for market share. Maintaining novelty and technological edge is crucial for sustained success. Furthermore, pricing strategies must balance affordability with the high production costs associated with creating and maintaining high-quality immersive experiences. Overcoming these obstacles requires innovative business models, targeted marketing, and a keen understanding of evolving consumer preferences. The market's future success hinges on the continued development of creative, engaging, and accessible immersive entertainment options that cater to a broad range of demographics.

North America Immersive Entertainment Market Company Market Share

This in-depth report provides a comprehensive analysis of the North America Immersive Entertainment Market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market of entertainment and the child market of immersive experiences (VR, AR, XR, etc.), this report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in million units.

North America Immersive Entertainment Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the North American immersive entertainment sector. The market is characterized by a moderate level of concentration, with key players such as The Walt Disney Company, Universal Parks & Resorts, and Six Flags Entertainment Corporation holding significant market share (estimated at xx%). However, the emergence of innovative companies like Meow Wolf and Two Bit Circus signifies a growing diversification.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Technological Innovation: Rapid advancements in VR/AR/MR technologies, enhanced by chipsets like Qualcomm’s Snapdragon XR2+ Gen 2, are driving market expansion.

- Regulatory Framework: Regulations surrounding data privacy and safety standards are evolving and influencing market development.

- Competitive Substitutes: Traditional entertainment options (e.g., cinemas, theme parks) represent indirect competition.

- End-User Demographics: Millennials and Gen Z represent key demographics, driving demand for immersive experiences.

- M&A Trends: The market has witnessed xx M&A deals in the last five years, indicating significant consolidation and expansion strategies. (Note: Specific numbers may not be available publicly and require research beyond this report description.)

North America Immersive Entertainment Market Growth Trends & Insights

The North American immersive entertainment market is experiencing robust growth, driven by technological innovation, increasing consumer demand, and expanding applications across various sectors. The market size reached approximately xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by factors such as the rising adoption of VR/AR/MR technologies in entertainment, gaming, and other sectors, technological advancements in haptics and sensory feedback, improved accessibility of technology, and increasing consumer spending on leisure activities. Consumer behavior is shifting towards seeking more interactive and engaging entertainment experiences.

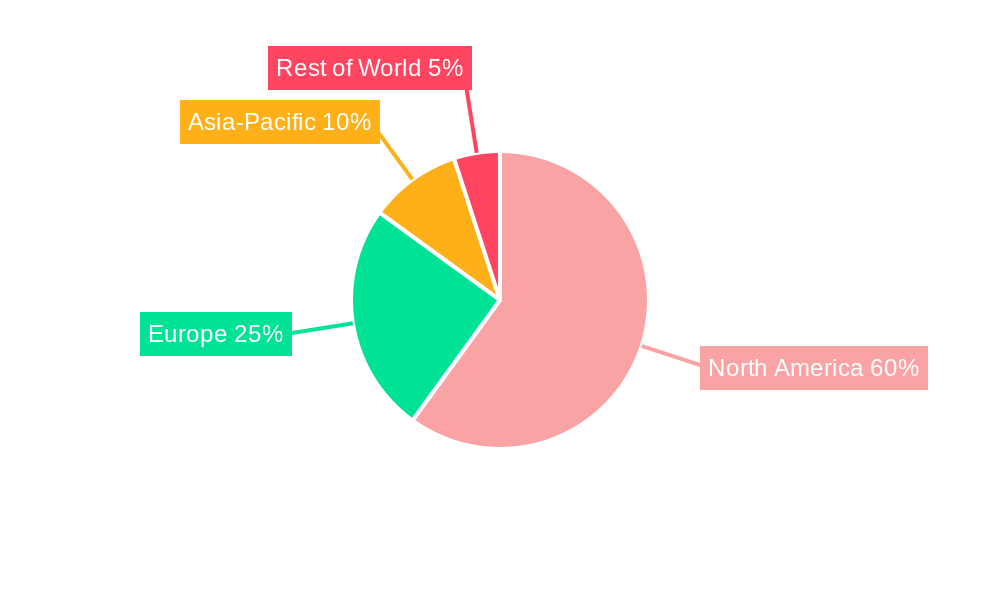

Dominant Regions, Countries, or Segments in North America Immersive Entertainment Market

California and Florida are leading the North American immersive entertainment market due to their strong entertainment industries, high concentrations of technology companies, and favorable regulatory environments. The theme park and location-based entertainment segments dominate, followed by home entertainment and VR/AR gaming.

- Key Drivers in California: Silicon Valley’s technology hub fosters innovation, while Hollywood’s entertainment industry fuels content creation.

- Key Drivers in Florida: A large tourism sector and established theme parks drive significant demand.

- Segment Dominance: Theme Parks and Location-Based Entertainment hold the largest market share due to their established infrastructure and broad appeal.

North America Immersive Entertainment Market Product Landscape

The market encompasses a diverse range of products, including VR headsets, AR glasses, immersive theme park experiences, location-based entertainment venues, and interactive gaming platforms. Recent innovations focus on improving realism, haptic feedback, and user interaction, creating more engaging and immersive experiences. Companies are continuously developing new applications and utilizing unique selling propositions such as personalized storylines, interactive narratives, and realistic sensory simulations to capture market share.

Key Drivers, Barriers & Challenges in North America Immersive Entertainment Market

Key Drivers:

- Technological advancements in VR/AR/MR technologies.

- Rising consumer demand for engaging entertainment experiences.

- Increased investment in immersive technologies from various sectors.

Key Challenges:

- High initial investment costs for VR/AR/MR equipment and infrastructure.

- Concerns surrounding motion sickness and other potential health effects.

- Competition from established entertainment forms.

- Supply chain disruptions impacting the availability of components. (Impact estimated at xx% reduction in production during specific periods.)

Emerging Opportunities in North America Immersive Entertainment Market

Emerging opportunities include the expansion of immersive experiences into education, healthcare, training, and retail sectors. The integration of AI and advanced sensor technology promises to further enhance realism and personalization. Untapped markets include rural areas and underserved communities, offering significant growth potential.

Growth Accelerators in the North America Immersive Entertainment Market Industry

Technological breakthroughs, strategic partnerships between technology companies and entertainment providers, and the expansion of immersive experiences into new sectors are key catalysts for long-term growth. The development of more affordable and accessible VR/AR/MR devices will broaden the market's reach.

Key Players Shaping the North America Immersive Entertainment Market Market

- The Walt Disney Company

- Universal Parks & Resorts

- Six Flags Entertainment Corporation

- Cedar Fair Entertainment Company

- Meow Wolf

- Sleep No More (Punchdrunk)

- Madame Tussauds (Merlin Entertainments)

- The VOID

- Two Bit Circus

- Punch Bowl Social

- List Not Exhaustive

Notable Milestones in North America Immersive Entertainment Market Sector

- January 2024: Goertek and Ultraleap partnered to announce a VR/MR headset reference design based on Qualcomm's XR2+ Gen 2 chipset, improving hand-tracking capabilities. This significantly lowers the barrier to entry for OEMs in the VR/MR market.

- January 2024: Qualcomm Technologies Inc. launched the Snapdragon XR2+ Gen 2 Platform, enhancing visual clarity, user tracking, and overall immersive experiences. This platform represents a substantial leap forward in the capabilities of VR/MR devices.

In-Depth North America Immersive Entertainment Market Market Outlook

The North America immersive entertainment market is poised for continued strong growth, driven by technological advancements, increasing consumer adoption, and the expansion of immersive experiences into new sectors. Strategic partnerships and investments in innovation will be key to capturing market share and driving long-term success. The market's future potential is significant, offering numerous opportunities for established players and new entrants alike.

North America Immersive Entertainment Market Segmentation

-

1. Application

- 1.1. Themed Entertainment

- 1.2. Haunted Attractions and Escape Rroms

- 1.3. Immersive Theatre

- 1.4. Experiential Art Museums

- 1.5. Others (Includes Exhibitions, etc.)

North America Immersive Entertainment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Immersive Entertainment Market Regional Market Share

Geographic Coverage of North America Immersive Entertainment Market

North America Immersive Entertainment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Creative success in the entertainment industry is driving the revenue growth in the sector

- 3.3. Market Restrains

- 3.3.1. Creative success in the entertainment industry is driving the revenue growth in the sector

- 3.4. Market Trends

- 3.4.1. Creative Success in the Entertainment Industry is Driving Revenue Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Immersive Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Themed Entertainment

- 5.1.2. Haunted Attractions and Escape Rroms

- 5.1.3. Immersive Theatre

- 5.1.4. Experiential Art Museums

- 5.1.5. Others (Includes Exhibitions, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Walt Disney Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Universal Parks & Resorts

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Six Flags Entertainment Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cedar Fair Entertainment Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Meow Wolf

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sleep No More (Punchdrunk)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Madame Tussauds (Merlin Entertainments)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The VOID

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Two Bit Circus

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Punch Bowl Social*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Walt Disney Company

List of Figures

- Figure 1: North America Immersive Entertainment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Immersive Entertainment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Immersive Entertainment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Immersive Entertainment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: North America Immersive Entertainment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Immersive Entertainment Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: North America Immersive Entertainment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Immersive Entertainment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: North America Immersive Entertainment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: North America Immersive Entertainment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Immersive Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States North America Immersive Entertainment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada North America Immersive Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Immersive Entertainment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Immersive Entertainment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico North America Immersive Entertainment Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Immersive Entertainment Market?

The projected CAGR is approximately 23.91%.

2. Which companies are prominent players in the North America Immersive Entertainment Market?

Key companies in the market include The Walt Disney Company, Universal Parks & Resorts, Six Flags Entertainment Corporation, Cedar Fair Entertainment Company, Meow Wolf, Sleep No More (Punchdrunk), Madame Tussauds (Merlin Entertainments), The VOID, Two Bit Circus, Punch Bowl Social*List Not Exhaustive.

3. What are the main segments of the North America Immersive Entertainment Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Creative success in the entertainment industry is driving the revenue growth in the sector.

6. What are the notable trends driving market growth?

Creative Success in the Entertainment Industry is Driving Revenue Growth in the Market.

7. Are there any restraints impacting market growth?

Creative success in the entertainment industry is driving the revenue growth in the sector.

8. Can you provide examples of recent developments in the market?

January 2024: VR and MR device vendor Goertek partnered with hand-tracking provider Ultraleap to announce a VR/MR headset reference design that follows from Qualcomm’s XR2+ Gen 2 chipset revealment, where Qualcomm also revealed the new reference design. The design intends to support OEMs in creating MR/VR devices with high-quality hand-tracking features from Ultraleap’s Gemini framework. Ultraleap’s computer vision and machine learning models enable low-cost hand-tracking integration for enterprise end users.January 2024: Qualcomm Technologies Inc. launched the Snapdragon XR2+ Gen 2 Platform, a single-chip architecture that provides 4.3 K spatial computing at 90 frames per second for better visual clarity throughout work and plays. Supporting 12 or more concurrent cameras with powerful on-device AI, Snapdragon XR2+ Gen 2-powered devices can also effortlessly track the user, their movements, and the world around them for effortless navigation and unparalleled experiences that merge physical and digital spaces. Snapdragon XR2+ Gen 2 unlocks 4.3K resolution, taking productivity and entertainment to the next level by bringing spectacularly clear visuals to use cases such as room-scale screens, life-size overlays, and virtual desktops.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Immersive Entertainment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Immersive Entertainment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Immersive Entertainment Market?

To stay informed about further developments, trends, and reports in the North America Immersive Entertainment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence