Key Insights

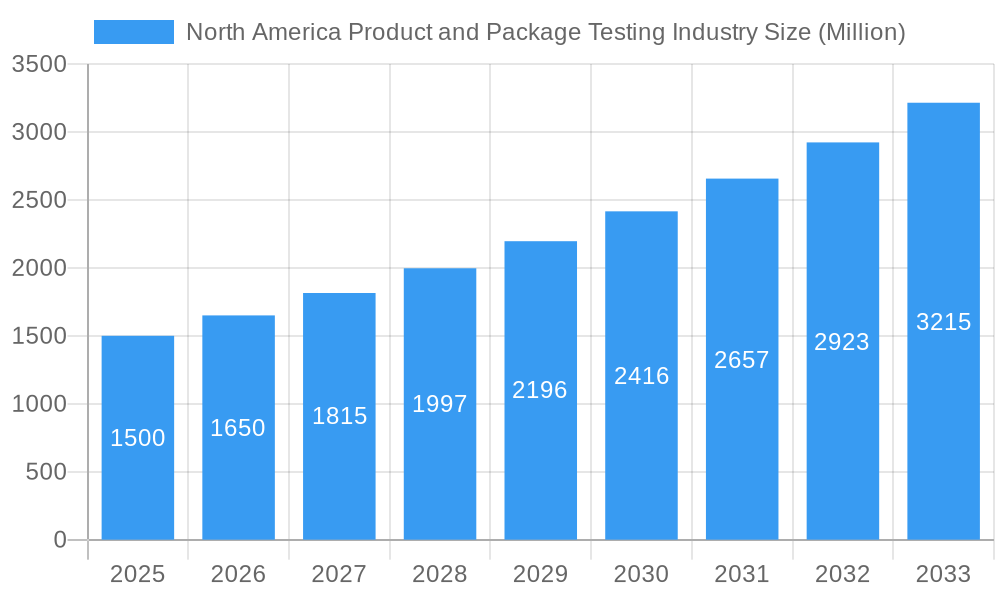

The North American product and package testing market is poised for significant expansion, driven by escalating consumer expectations for product safety and quality, stringent regulatory mandates, and the burgeoning e-commerce sector. The market, valued at $2.5 billion in 2025, is projected to achieve a compound annual growth rate (CAGR) of 10% between 2025 and 2033. Key growth drivers include the robust demand from the food & beverage, healthcare, and industrial sectors, necessitating rigorous testing for product safety and shelf-life integrity. The rapid growth of e-commerce further fuels demand for advanced packaging testing to ensure durability during transit. Market segmentation by testing type reveals strong contributions from physical performance, chemical, and environmental testing. The global shift towards sustainable packaging materials is creating novel opportunities for specialized testing services. Within North America, the United States leads market share due to its extensive manufacturing base and established regulatory landscape, with Canada also exhibiting substantial growth influenced by its strong manufacturing and healthcare industries.

North America Product and Package Testing Industry Market Size (In Billion)

The competitive environment features a dynamic interplay between large global testing corporations and specialized niche firms. Leading entities such as Intertek, SGS, and National Technical Systems offer comprehensive testing solutions across diverse industries. Future market trends suggest potential consolidation, with larger organizations likely to acquire smaller players to broaden service portfolios and market reach. Technological advancements in testing methodologies, coupled with the increasing integration of automation and digital technologies, are set to enhance operational efficiency and accuracy. While potential challenges like fluctuating raw material costs and the demand for skilled labor exist, the overarching outlook for the North American product and package testing market remains highly positive, underscored by its critical role in upholding product quality, safety, and regulatory compliance.

North America Product and Package Testing Industry Company Market Share

North America Product and Package Testing Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America product and package testing industry, covering market size, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by country (United States, Canada), primary material (glass, paper, plastic, metal), type of testing (physical performance, chemical, environmental), and end-user industry (food and beverage, healthcare, industrial, personal and household products, other).

North America Product and Package Testing Industry Market Dynamics & Structure

The North American product and package testing market is characterized by a moderately concentrated landscape, with a few large multinational players and numerous smaller, specialized firms. Market concentration is estimated at xx% in 2025, with the top five players holding xx% market share. Technological innovation, particularly in automation and AI-driven testing, is a key growth driver. Stringent regulatory frameworks regarding product safety and environmental sustainability significantly influence testing requirements. The market witnesses continuous innovation with the emergence of new testing methodologies, materials, and technologies. Competitive pressures stem from both established players and emerging firms offering specialized services. The increasing demand for sustainable and eco-friendly packaging solutions creates opportunities for specialized testing services. Mergers and acquisitions (M&A) activity is moderate, with an estimated xx M&A deals in the historical period (2019-2024), reflecting consolidation and expansion efforts.

- Market Concentration: xx% in 2025 (estimated)

- Top 5 Players Market Share: xx% (estimated)

- M&A Deals (2019-2024): xx

- Key Innovation Drivers: Automation, AI, Sustainable Packaging Testing

- Regulatory Influences: Safety & Environmental Standards

North America Product and Package Testing Industry Growth Trends & Insights

The North American product and package testing market experienced robust growth during the historical period (2019-2024), driven by increasing consumer demand for high-quality products, stringent regulatory compliance requirements, and the growing adoption of e-commerce. The market size reached xx million units in 2024, and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements, such as the integration of automation and AI in testing processes, improving efficiency and accuracy. Consumer preferences for sustainable and eco-friendly packaging materials have also driven demand for specialized testing services. Shifting consumer behavior towards online shopping has increased the volume of products requiring thorough testing.

Dominant Regions, Countries, or Segments in North America Product and Package Testing Industry

The United States represents the dominant market within North America, accounting for xx% of the total market share in 2025, driven by its robust manufacturing sector, large consumer base, and stringent regulatory landscape. The plastic packaging segment shows the highest growth potential due to its widespread use across various end-user industries. Within testing types, physical performance testing dominates due to its critical role in ensuring product safety and durability, holding approximately xx% market share. The food and beverage industry is the largest end-user segment, primarily driven by stringent quality and safety regulations and the focus on consumer trust.

- Dominant Country: United States (xx% market share in 2025)

- Fastest-Growing Segment (Primary Material): Plastic

- Largest Segment (Testing Type): Physical Performance Testing

- Largest End-User Industry: Food and Beverage

North America Product and Package Testing Industry Product Landscape

The product landscape is characterized by a wide range of testing services, including physical performance, chemical, and environmental testing tailored to diverse product categories and packaging materials. Advanced testing techniques leveraging automation, AI, and sophisticated analytical tools are becoming increasingly prevalent. Unique selling propositions frequently involve specialization in specific industries or packaging types, rapid turnaround times, and the use of cutting-edge testing technologies. Companies continuously innovate to meet evolving customer requirements, including faster testing cycles, more comprehensive data analysis, and environmentally friendly testing methods.

Key Drivers, Barriers & Challenges in North America Product and Package Testing Industry

Key Drivers: Increasing consumer demand for high-quality products, stringent regulatory compliance, growing e-commerce, and the shift towards sustainable packaging.

Key Challenges: Intense competition, fluctuating raw material prices, supply chain disruptions impacting testing equipment and reagents availability, and the need for continuous investments in advanced testing technologies. These factors can cause project delays and impact profitability. The estimated impact of supply chain disruptions on industry revenue in 2024 was approximately xx million units.

Emerging Opportunities in North America Product and Package Testing Industry

Emerging opportunities include the rising demand for specialized testing services catering to sustainable packaging, the integration of AI and automation into testing procedures, the growth of the e-commerce sector demanding more robust packaging solutions, and the expansion into emerging markets. Untapped markets exist in specialized packaging segments like pharmaceuticals and advanced medical devices. Also, advancements in material science present novel testing requirements.

Growth Accelerators in the North America Product and Package Testing Industry

Long-term growth will be driven by the continued adoption of advanced testing technologies, strategic partnerships between testing labs and manufacturers, and expansion into new product categories and markets. Government initiatives promoting sustainable packaging and stricter regulations will further stimulate demand. Technological breakthroughs in material science are expected to generate new testing needs and drive market expansion.

Key Players Shaping the North America Product and Package Testing Industry Market

- Turner Packaging

- CRYOPAK

- National Technical Systems

- Intertek

- DDL Inc

- SGS

- Nefab

- Advance Packaging

- Caskadetek

- CSZ Testing Services Laboratories

Notable Milestones in North America Product and Package Testing Industry Sector

- April 2021: SGS introduced a new comprehensive footwear packaging testing technique.

- July 2021: Cryopak launched its PUR-Forma Long Range Duration line of polyurethane shipping solutions.

In-Depth North America Product and Package Testing Industry Market Outlook

The North American product and package testing market is poised for continued growth over the forecast period, driven by technological advancements, increasing regulatory scrutiny, and the growing importance of sustainable packaging. Strategic opportunities lie in developing specialized testing services for emerging industries, leveraging AI and automation to enhance efficiency, and expanding into underserved markets. The market's future potential is significant, offering attractive prospects for both established players and new entrants.

North America Product and Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

North America Product and Package Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Product and Package Testing Industry Regional Market Share

Geographic Coverage of North America Product and Package Testing Industry

North America Product and Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Glass Segment Observing Gradual Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Product and Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turner Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CRYOPAK

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Technical Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intertek

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DDL Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SGS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nefab

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advance Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caskadetek

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CSZ Testing Services Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Turner Packaging

List of Figures

- Figure 1: North America Product and Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Product and Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Product and Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 7: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Product and Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Product and Package Testing Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the North America Product and Package Testing Industry?

Key companies in the market include Turner Packaging, CRYOPAK, National Technical Systems, Intertek, DDL Inc, SGS, Nefab, Advance Packaging, Caskadetek, CSZ Testing Services Laboratories.

3. What are the main segments of the North America Product and Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Glass Segment Observing Gradual Growth.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

In April 2021, SGS introduced a new comprehensive footwear packaging testing technique. The industry-first testing package assists brand owners and retailers, including e-commerce, in creating packaging that performs effectively, meets environmental and sustainability criteria, and ensures consumers receive quality footwear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Product and Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Product and Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Product and Package Testing Industry?

To stay informed about further developments, trends, and reports in the North America Product and Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence