Key Insights

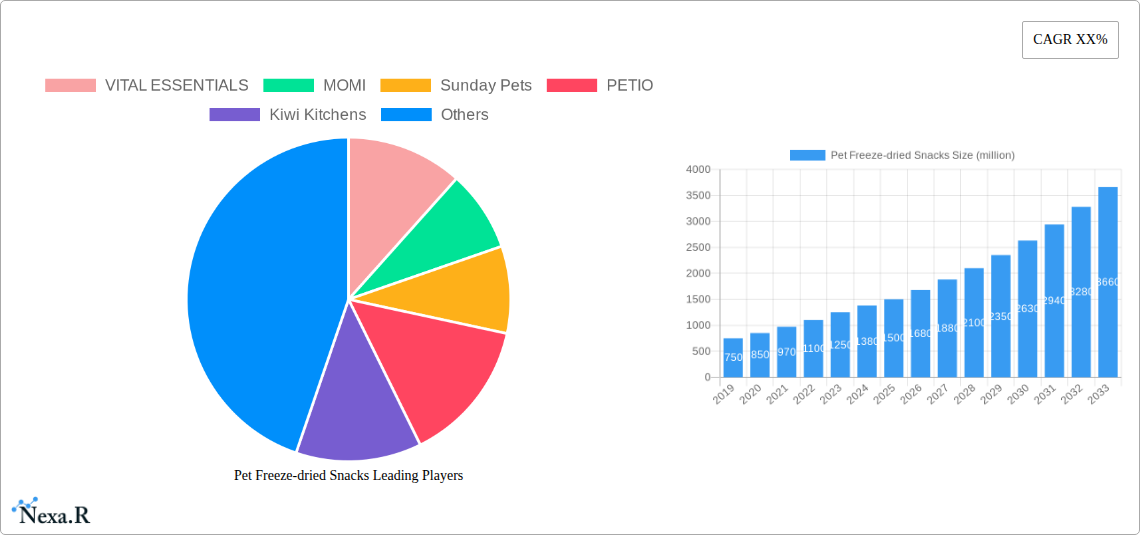

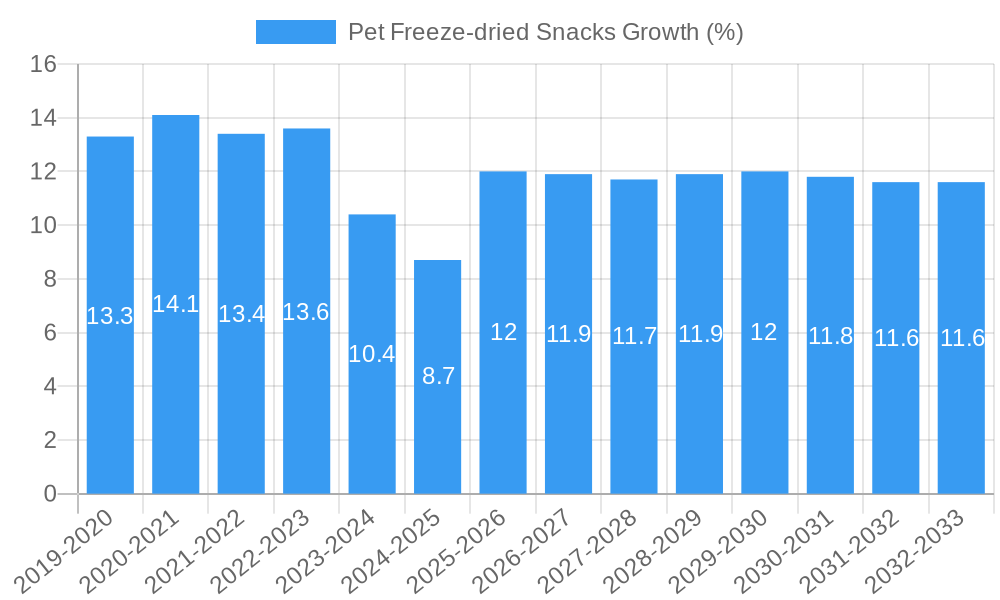

The global Pet Freeze-dried Snacks market is projected to reach a substantial market size of approximately $1,500 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 12% through 2033. This significant expansion is primarily fueled by the escalating humanization of pets, leading owners to invest more in premium and health-conscious food options. The rising disposable incomes globally further enable pet owners to prioritize high-quality treats that offer nutritional benefits and appeal to their pets' palates. Key drivers include the growing awareness of the health advantages of freeze-dried products, such as preserved nutrients, extended shelf life without artificial preservatives, and improved palatability for picky eaters. The convenience of these snacks for both owners and pets, coupled with their suitability as training aids, also contributes significantly to market growth.

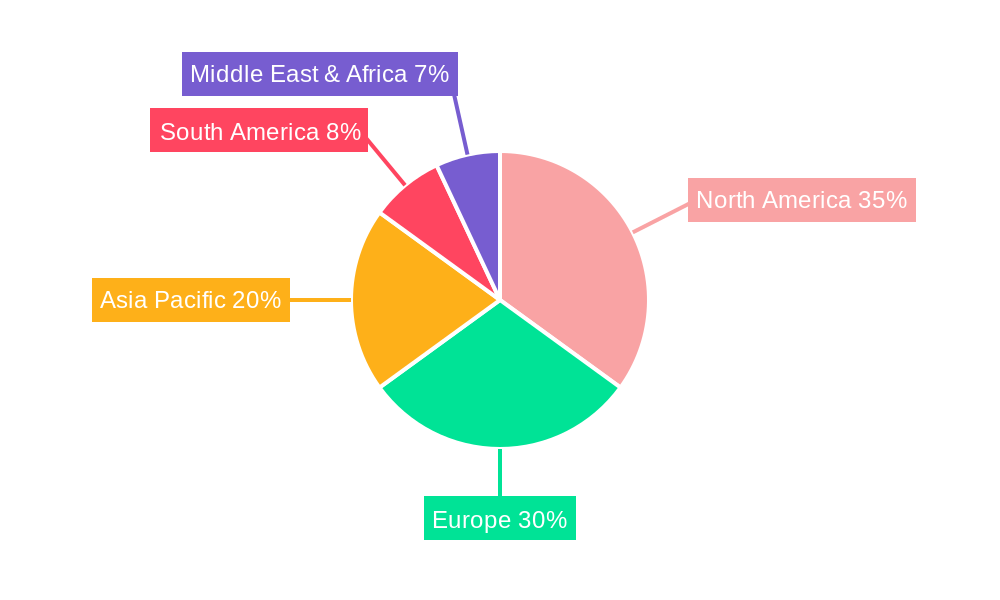

The market is witnessing a dynamic evolution with increasing demand across various distribution channels, notably a surge in online sales, reflecting the broader e-commerce trend in the pet industry. Supermarkets and hypermarkets also maintain a strong presence, offering accessibility to a wide consumer base. Within product types, freeze-dried beef and chicken snacks are leading segments due to their high protein content and widespread acceptance among pets. However, the introduction of innovative “other” protein sources is also gaining traction, catering to pets with specific dietary needs or owner preferences. Geographically, North America and Europe currently dominate the market, driven by mature pet care industries and high pet ownership rates. Asia Pacific, however, is emerging as a high-growth region, spurred by increasing pet adoption and a burgeoning middle class with a greater willingness to spend on premium pet products. Despite the promising outlook, challenges such as the higher cost of freeze-dried production compared to traditional treats and potential supply chain complexities for specialized ingredients could pose some restraints to rapid expansion.

Pet Freeze-dried Snacks Market Dynamics & Structure

The global pet freeze-dried snacks market is characterized by a dynamic interplay of innovation, evolving consumer demands, and a growing emphasis on premium pet nutrition. Market concentration is moderate, with key players like VITAL ESSENTIALS, MOMI, Sunday Pets, PETIO, Kiwi Kitchens, Cat-Man-Doo, Pure Bites, Halo Liv-A-Littles, and ORIJEN actively competing through product differentiation and strategic market penetration. Technological innovation, particularly in freeze-drying processes to preserve nutritional value and enhance palatability, serves as a significant driver. Regulatory frameworks, while generally supportive of pet food safety, can influence ingredient sourcing and labeling standards. Competitive product substitutes include traditional kibble, wet food, and other treats, but freeze-dried options distinguish themselves through their natural ingredients and perceived health benefits. End-user demographics are increasingly skewed towards younger pet owners and those who view their pets as family members, willing to invest in high-quality, specialized nutrition. Mergers and acquisitions (M&A) trends, while not yet dominant, are expected to rise as larger pet food conglomerates seek to acquire innovative startups and expand their presence in this high-growth segment.

- Technological Innovation Drivers: Advanced freeze-drying techniques, shelf-stable packaging solutions, and the development of novel protein sources and functional ingredients.

- Regulatory Frameworks: FDA regulations for pet food safety, labeling requirements for natural and organic claims, and international import/export standards.

- Competitive Product Substitutes: Dehydrated treats, air-dried snacks, baked biscuits, jerky treats, and dental chews.

- End-User Demographics: Millennial and Gen Z pet owners, health-conscious consumers, and owners of pets with specific dietary needs or sensitivities.

- M&A Trends: Acquisitions of smaller, innovative brands by larger pet food companies to gain market share and access new technologies.

Pet Freeze-dried Snacks Growth Trends & Insights

The global pet freeze-dried snacks market is projected for substantial growth, with an estimated market size of $8,500 million units in the base year 2025. This expansion is fueled by a confluence of accelerating consumer adoption rates and significant technological advancements. The increasing humanization of pets, coupled with a greater awareness of the nutritional benefits of freeze-dried foods – such as retained nutrients, enhanced flavor, and natural ingredients – are primary demand drivers. Consumers are actively seeking out premium, healthy, and species-appropriate treats for their companions, moving away from artificial ingredients and preservatives. This shift in consumer behavior directly translates into higher adoption rates for freeze-dried options, particularly among younger pet owners who are more attuned to health and wellness trends for both themselves and their pets. The estimated Compound Annual Growth Rate (CAGR) for the forecast period of 2025–2033 is a robust 12.5%, indicating a sustained and significant upward trajectory.

Technological disruptions continue to play a pivotal role. Innovations in freeze-drying equipment have led to increased efficiency and reduced production costs, making these premium products more accessible. Furthermore, advancements in ingredient sourcing and processing allow for a wider variety of single-ingredient and multi-ingredient freeze-dried snacks, catering to diverse dietary preferences and potential allergen concerns. The online sales channel has emerged as a critical growth accelerator, offering convenience and a broader product selection for consumers. E-commerce platforms have facilitated direct-to-consumer sales for many brands, bypassing traditional retail limitations and fostering brand loyalty. The market penetration of freeze-dried snacks, while already considerable, is expected to deepen as more pet owners experience the tangible benefits of these high-quality treats. From a historical perspective, the market has witnessed a consistent upward trend from 2019–2024, laying a strong foundation for future expansion. The estimated market size in 2019 was approximately $4,200 million units, demonstrating a remarkable doubling of the market within a few years and projecting a healthy trajectory towards $15,000 million units by the end of the forecast period in 2033.

Dominant Regions, Countries, or Segments in Pet Freeze-dried Snacks

The global pet freeze-dried snacks market is experiencing dynamic growth across various regions and segments, with North America currently leading in terms of market share and influence. This dominance is attributed to a mature pet care industry, high disposable incomes, and a strong consumer inclination towards premium pet products. Within North America, the United States stands out as the primary driver, characterized by widespread pet ownership and a well-established infrastructure for pet food distribution, including a strong presence of Supermarkets/Hypermarkets and a rapidly expanding Online Sales channel. The accessibility of these retail formats, coupled with the convenience offered by e-commerce, makes freeze-dried snacks readily available to a vast consumer base.

Online Sales are a particularly potent growth engine, not just in North America but globally. The ease of comparison shopping, access to a wider variety of specialized products, and direct-to-consumer delivery models have significantly boosted the adoption of pet freeze-dried snacks. This segment is projected to witness the highest CAGR over the forecast period. The Types segment of Freeze-dried Chicken and Freeze-dried Beef commands significant market share due to their widespread appeal, high protein content, and perceived digestibility, making them favored choices for a broad spectrum of pets.

Key drivers underpinning the dominance of these segments include:

- Economic Policies: Favorable economic conditions and robust pet spending in North America support the premiumization trend in pet food.

- Infrastructure: Well-developed retail networks and advanced logistics for e-commerce enable widespread product availability.

- Consumer Behavior: A strong emotional connection with pets and a willingness to invest in their health and well-being.

- Technological Adoption: Early and widespread adoption of online shopping and digital marketing strategies.

- Regulatory Environment: A generally stable and supportive regulatory framework for pet food safety.

While North America currently holds the leading position, the Asia-Pacific region, particularly China and Japan, is exhibiting rapid growth. This is driven by increasing pet ownership, rising disposable incomes, and a growing awareness of pet nutrition. The Online Sales channel is also a crucial facilitator in these emerging markets. The Freeze-dried Chicken and Freeze-dried Beef types are expected to continue their strong performance across all regions, with potential for growth in novel protein sources within the "Other" types category as consumer preferences diversify. The strategic importance of Supermarkets/Hypermarkets will persist for broad accessibility, while Independent Retailers specializing in premium pet products will cater to niche demand.

Pet Freeze-dried Snacks Product Landscape

The product landscape of pet freeze-dried snacks is characterized by a commitment to natural ingredients, high nutritional value, and enhanced palatability. Innovations focus on single-ingredient options, such as Freeze-dried Beef and Freeze-dried Chicken, which are highly sought after for their simplicity and allergen-friendliness. Beyond these staples, the market is witnessing a rise in diverse protein sources like fish, turkey, and lamb, catering to specific dietary needs and owner preferences. Manufacturers are also incorporating functional ingredients, including probiotics for gut health and glucosamine for joint support. Packaging innovations are crucial, with many brands opting for resealable pouches that maintain freshness and convenience, a key selling proposition for busy pet owners. Performance metrics emphasize high protein content, minimal processing, and the absence of artificial additives, colorings, or preservatives, aligning with the growing demand for "clean label" pet food.

Key Drivers, Barriers & Challenges in Pet Freeze-dried Snacks

Key Drivers:

- Humanization of Pets: Owners increasingly treat pets as family members, driving demand for premium, healthy food options.

- Health and Wellness Trend: Growing awareness of the nutritional benefits of freeze-dried snacks, such as preserved nutrients and natural ingredients.

- Convenience and Palatability: Freeze-dried snacks offer excellent palatability and a long shelf life, appealing to both pets and owners.

- Technological Advancements: Improved freeze-drying processes enhance efficiency and reduce costs, making products more accessible.

Key Barriers & Challenges:

- Higher Production Costs: The freeze-drying process is energy-intensive, leading to higher retail prices compared to traditional pet food.

- Supply Chain Vulnerabilities: Reliance on specific protein sources and potential disruptions in the availability of raw materials can impact production.

- Consumer Education: Some consumers may still be unfamiliar with the benefits of freeze-dried products, requiring education on their value proposition.

- Competition from Established Brands: Traditional pet food manufacturers have strong brand loyalty and extensive distribution networks, posing a competitive challenge.

- Regulatory Hurdles: Navigating evolving regulations regarding ingredient sourcing, labeling, and international trade can be complex, estimated to add 5-10% to operational costs.

Emerging Opportunities in Pet Freeze-dried Snacks

Emerging opportunities in the pet freeze-dried snacks sector lie in the expansion of product lines to include functional and specialized treats. This includes developing formulations for specific life stages (e.g., puppy, senior), addressing common pet ailments (e.g., dental health, anxiety), and catering to novel protein diets for pets with allergies. The untapped potential in emerging markets across Asia and Latin America presents significant growth prospects, driven by increasing pet ownership and rising disposable incomes. Furthermore, sustainable sourcing and eco-friendly packaging are becoming key differentiators, appealing to environmentally conscious consumers. The integration of smart packaging with QR codes for enhanced traceability and consumer engagement also represents a burgeoning opportunity.

Growth Accelerators in the Pet Freeze-dried Snacks Industry

Several catalysts are accelerating the growth of the pet freeze-dried snacks industry. Technological breakthroughs in freeze-drying efficiency, leading to reduced energy consumption and production costs, are making these premium products more competitive. Strategic partnerships between ingredient suppliers and snack manufacturers are ensuring a consistent supply of high-quality raw materials. Furthermore, market expansion strategies, particularly the aggressive growth of online sales channels and direct-to-consumer models, are reaching a wider customer base. The increasing popularity of subscription box services for pet supplies also acts as a significant growth accelerator, providing recurring revenue streams and customer loyalty.

Key Players Shaping the Pet Freeze-dried Snacks Market

- VITAL ESSENTIALS

- MOMI

- Sunday Pets

- PETIO

- Kiwi Kitchens

- Cat-Man-Doo

- Pure Bites

- Halo Liv-A-Littles

- ORIJEN

Notable Milestones in Pet Freeze-dried Snacks Sector

- 2020: VITAL ESSENTIALS launches its expanded line of single-ingredient freeze-dried dog and cat treats, focusing on raw nutrition and convenience.

- 2021: Pure Bites sees significant growth driven by the increasing demand for natural and limited-ingredient pet treats during the pandemic.

- 2022: Sunday Pets introduces innovative freeze-dried meal toppers and mixers, catering to a growing trend of enhancing pet diets.

- 2023: PETIO expands its presence in the Asian market with new freeze-dried snack formulations tailored to local preferences and pet types.

- 2024: Halo Liv-A-Littles announces a strategic partnership to optimize its supply chain for freeze-dried ingredients, aiming for greater sustainability and cost-efficiency.

In-Depth Pet Freeze-dried Snacks Market Outlook

The outlook for the pet freeze-dried snacks market remains exceptionally bright, propelled by sustained humanization of pets and a relentless pursuit of optimal pet nutrition. Growth accelerators such as technological advancements in production efficiency, strategic market expansion through robust online sales channels, and increasing consumer demand for natural and functional treats will continue to fuel this upward trajectory. The market is poised for significant expansion, driven by both an increase in the number of pet owners and a deepening of market penetration as more consumers recognize the superior quality and health benefits of freeze-dried products. Strategic opportunities lie in product diversification, tapping into emerging markets, and emphasizing sustainability to capture the interest of an increasingly conscious consumer base.

Pet Freeze-dried Snacks Segmentation

-

1. Application

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Independent Retailers

- 1.4. Online Sales

- 1.5. Others

-

2. Types

- 2.1. Freeze-dried Beef

- 2.2. Freeze-dried Chicken

- 2.3. Other

Pet Freeze-dried Snacks Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pet Freeze-dried Snacks REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pet Freeze-dried Snacks Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Independent Retailers

- 5.1.4. Online Sales

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Freeze-dried Beef

- 5.2.2. Freeze-dried Chicken

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pet Freeze-dried Snacks Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Independent Retailers

- 6.1.4. Online Sales

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Freeze-dried Beef

- 6.2.2. Freeze-dried Chicken

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pet Freeze-dried Snacks Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Independent Retailers

- 7.1.4. Online Sales

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Freeze-dried Beef

- 7.2.2. Freeze-dried Chicken

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pet Freeze-dried Snacks Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Independent Retailers

- 8.1.4. Online Sales

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Freeze-dried Beef

- 8.2.2. Freeze-dried Chicken

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pet Freeze-dried Snacks Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Independent Retailers

- 9.1.4. Online Sales

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Freeze-dried Beef

- 9.2.2. Freeze-dried Chicken

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pet Freeze-dried Snacks Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Supermarkets/Hypermarkets

- 10.1.2. Convenience Stores

- 10.1.3. Independent Retailers

- 10.1.4. Online Sales

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Freeze-dried Beef

- 10.2.2. Freeze-dried Chicken

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VITAL ESSENTIALS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MOMI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sunday Pets

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PETIO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kiwi Kitchens

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cat-Man-Doo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pure Bites

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halo Liv-A-Littles

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ORIJEN

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 VITAL ESSENTIALS

List of Figures

- Figure 1: Global Pet Freeze-dried Snacks Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Pet Freeze-dried Snacks Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Pet Freeze-dried Snacks Revenue (million), by Application 2024 & 2032

- Figure 4: North America Pet Freeze-dried Snacks Volume (K), by Application 2024 & 2032

- Figure 5: North America Pet Freeze-dried Snacks Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Pet Freeze-dried Snacks Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Pet Freeze-dried Snacks Revenue (million), by Types 2024 & 2032

- Figure 8: North America Pet Freeze-dried Snacks Volume (K), by Types 2024 & 2032

- Figure 9: North America Pet Freeze-dried Snacks Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Pet Freeze-dried Snacks Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Pet Freeze-dried Snacks Revenue (million), by Country 2024 & 2032

- Figure 12: North America Pet Freeze-dried Snacks Volume (K), by Country 2024 & 2032

- Figure 13: North America Pet Freeze-dried Snacks Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Pet Freeze-dried Snacks Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Pet Freeze-dried Snacks Revenue (million), by Application 2024 & 2032

- Figure 16: South America Pet Freeze-dried Snacks Volume (K), by Application 2024 & 2032

- Figure 17: South America Pet Freeze-dried Snacks Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Pet Freeze-dried Snacks Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Pet Freeze-dried Snacks Revenue (million), by Types 2024 & 2032

- Figure 20: South America Pet Freeze-dried Snacks Volume (K), by Types 2024 & 2032

- Figure 21: South America Pet Freeze-dried Snacks Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Pet Freeze-dried Snacks Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Pet Freeze-dried Snacks Revenue (million), by Country 2024 & 2032

- Figure 24: South America Pet Freeze-dried Snacks Volume (K), by Country 2024 & 2032

- Figure 25: South America Pet Freeze-dried Snacks Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Pet Freeze-dried Snacks Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Pet Freeze-dried Snacks Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Pet Freeze-dried Snacks Volume (K), by Application 2024 & 2032

- Figure 29: Europe Pet Freeze-dried Snacks Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Pet Freeze-dried Snacks Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Pet Freeze-dried Snacks Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Pet Freeze-dried Snacks Volume (K), by Types 2024 & 2032

- Figure 33: Europe Pet Freeze-dried Snacks Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Pet Freeze-dried Snacks Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Pet Freeze-dried Snacks Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Pet Freeze-dried Snacks Volume (K), by Country 2024 & 2032

- Figure 37: Europe Pet Freeze-dried Snacks Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Pet Freeze-dried Snacks Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Pet Freeze-dried Snacks Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Pet Freeze-dried Snacks Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Pet Freeze-dried Snacks Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Pet Freeze-dried Snacks Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Pet Freeze-dried Snacks Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Pet Freeze-dried Snacks Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Pet Freeze-dried Snacks Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Pet Freeze-dried Snacks Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Pet Freeze-dried Snacks Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Pet Freeze-dried Snacks Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Pet Freeze-dried Snacks Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Pet Freeze-dried Snacks Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Pet Freeze-dried Snacks Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Pet Freeze-dried Snacks Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Pet Freeze-dried Snacks Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Pet Freeze-dried Snacks Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Pet Freeze-dried Snacks Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Pet Freeze-dried Snacks Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Pet Freeze-dried Snacks Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Pet Freeze-dried Snacks Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Pet Freeze-dried Snacks Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Pet Freeze-dried Snacks Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Pet Freeze-dried Snacks Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Pet Freeze-dried Snacks Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pet Freeze-dried Snacks Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pet Freeze-dried Snacks Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Pet Freeze-dried Snacks Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Pet Freeze-dried Snacks Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Pet Freeze-dried Snacks Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Pet Freeze-dried Snacks Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Pet Freeze-dried Snacks Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Pet Freeze-dried Snacks Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Pet Freeze-dried Snacks Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Pet Freeze-dried Snacks Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Pet Freeze-dried Snacks Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Pet Freeze-dried Snacks Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Pet Freeze-dried Snacks Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Pet Freeze-dried Snacks Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Pet Freeze-dried Snacks Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Pet Freeze-dried Snacks Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Pet Freeze-dried Snacks Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Pet Freeze-dried Snacks Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Pet Freeze-dried Snacks Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Pet Freeze-dried Snacks Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Pet Freeze-dried Snacks Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Pet Freeze-dried Snacks Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Pet Freeze-dried Snacks Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Pet Freeze-dried Snacks Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Pet Freeze-dried Snacks Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Pet Freeze-dried Snacks Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Pet Freeze-dried Snacks Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Pet Freeze-dried Snacks Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Pet Freeze-dried Snacks Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Pet Freeze-dried Snacks Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Pet Freeze-dried Snacks Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Pet Freeze-dried Snacks Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Pet Freeze-dried Snacks Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Pet Freeze-dried Snacks Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Pet Freeze-dried Snacks Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Pet Freeze-dried Snacks Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Pet Freeze-dried Snacks Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Pet Freeze-dried Snacks Volume K Forecast, by Country 2019 & 2032

- Table 81: China Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Pet Freeze-dried Snacks Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Pet Freeze-dried Snacks Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Freeze-dried Snacks?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Pet Freeze-dried Snacks?

Key companies in the market include VITAL ESSENTIALS, MOMI, Sunday Pets, PETIO, Kiwi Kitchens, Cat-Man-Doo, Pure Bites, Halo Liv-A-Littles, ORIJEN.

3. What are the main segments of the Pet Freeze-dried Snacks?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pet Freeze-dried Snacks," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pet Freeze-dried Snacks report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pet Freeze-dried Snacks?

To stay informed about further developments, trends, and reports in the Pet Freeze-dried Snacks, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence