Key Insights

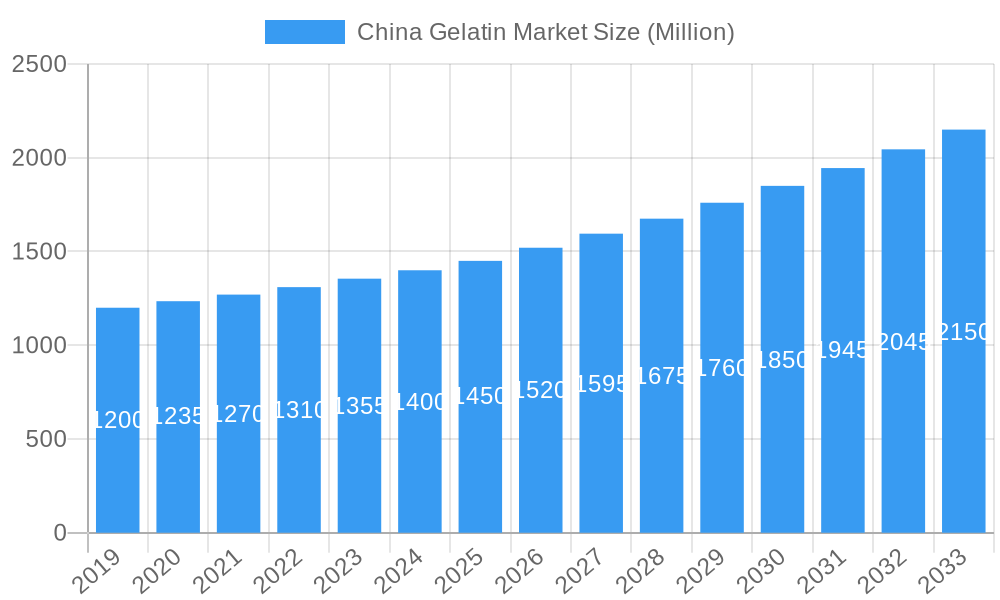

The China Gelatin Market is projected for significant expansion, fueled by escalating demand across various end-user industries. With an anticipated market size of USD 1.32 billion in 2025 and a compound annual growth rate (CAGR) of 5.84%, the market is set for robust growth during the 2025-2033 forecast period. Key growth drivers include the Personal Care and Cosmetics sector, alongside the substantial Food and Beverages industry. Within food applications, gelatin consumption is rising in bakery, confectionery, and dairy products due to its effective gelling, thickening, and emulsifying properties. The pharmaceutical sector's consistent demand for gelatin in capsule manufacturing and other medical uses will remain a stable contributor. Advancements in processing technologies and the development of specialized gelatin formulations are also propelling market growth.

China Gelatin Market Market Size (In Billion)

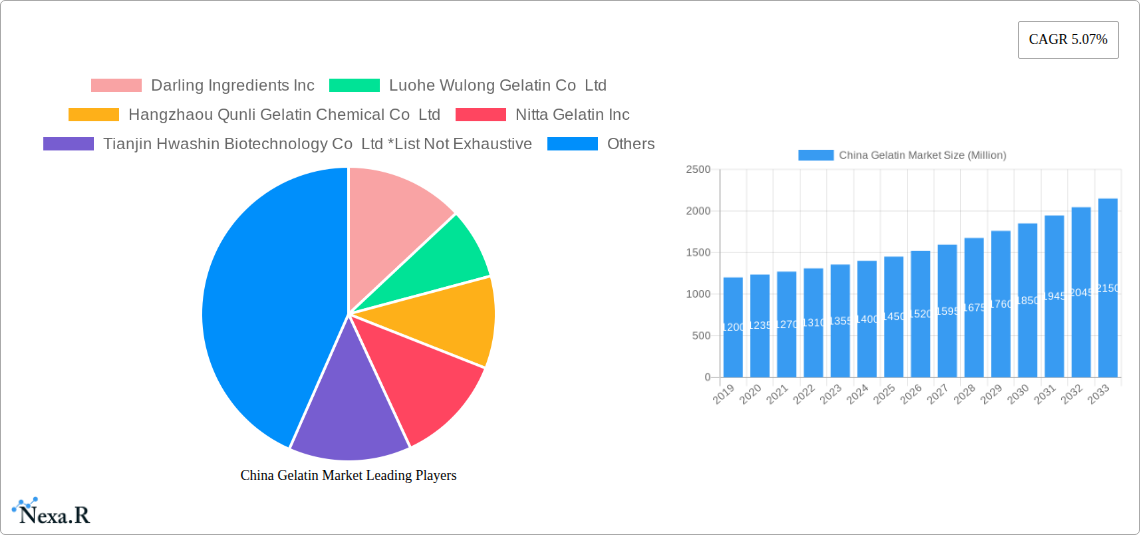

Market dynamics are further influenced by evolving consumer preferences for clean-label ingredients and heightened awareness of collagen's benefits. This trend is stimulating innovation in both animal- and marine-based gelatin production, with an increasing emphasis on sustainable sourcing and product purity. While opportunities abound, potential challenges include raw material price volatility and stringent regulatory compliance. The competitive landscape features major global and domestic players, such as Darling Ingredients Inc. and Nitta Gelatin Inc., alongside prominent Chinese manufacturers, indicating a strong commitment to innovation and market penetration. China's vital role in global gelatin production and consumption is underscored by the market's substantial size and consistent growth trajectory.

China Gelatin Market Company Market Share

Gain critical insights into the dynamic China Gelatin Market, a crucial sector encompassing food and beverages, pharmaceuticals, and personal care. This comprehensive report examines market dynamics, growth trends, regional performance, product offerings, key drivers, emerging opportunities, and the competitive strategies of leading players. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this analysis offers actionable intelligence for stakeholders seeking to leverage opportunities within China's expanding gelatin industry.

China Gelatin Market Dynamics & Structure

The China Gelatin Market is characterized by a moderate to high level of concentration, with a few key players dominating production and innovation. Technological advancements in processing and purification techniques are critical drivers, enabling the development of specialized gelatin grades for diverse applications. Stringent regulatory frameworks, particularly concerning food safety and pharmaceutical standards, influence product development and market entry. The competitive landscape is shaped by the availability of both animal-based and marine-based gelatin, with the former holding a larger market share. End-user demographics, particularly the growing middle class and increasing demand for convenience and health-conscious products, are significantly impacting consumption patterns. Merger and acquisition (M&A) trends reveal a strategic focus on vertical integration, capacity expansion, and the acquisition of specialized technologies to meet escalating market demands.

- Market Concentration: Dominant presence of leading global and domestic manufacturers.

- Technological Drivers: Innovation in extraction, purification, and modification for specialized applications (e.g., halal, pharmaceutical-grade).

- Regulatory Frameworks: Strict adherence to food safety (GB standards) and pharmaceutical (GMP) regulations.

- Competitive Product Substitutes: Limited direct substitutes for core gelatin functionalities, but alternatives like pectin and agar-agar in certain food applications.

- End-User Demographics: Rising disposable incomes, urbanization, and increasing health awareness driving demand in confectionery, dairy, and pharmaceutical sectors.

- M&A Trends: Strategic acquisitions to expand market reach, enhance product portfolios, and secure raw material supply chains.

China Gelatin Market Growth Trends & Insights

The China Gelatin Market is poised for robust growth, propelled by an escalating demand across its diverse end-use segments. The market size is projected to witness significant expansion, driven by increasing adoption rates in the pharmaceutical sector for capsule production and advanced drug delivery systems, alongside sustained demand from the food and beverage industry for its gelling, stabilizing, and emulsifying properties. Technological disruptions, such as advancements in rendering processes and the development of specialized gelatin derivatives, are enhancing product efficacy and broadening application ranges. Consumer behavior shifts, including a growing preference for functional foods and clean-label products, are further fueling the market. The estimated market size for 2025 stands at approximately xx Million units. The CAGR for the forecast period is expected to be around xx%. Market penetration for pharmaceutical-grade gelatin is projected to rise by xx% by 2033.

Dominant Regions, Countries, or Segments in China Gelatin Market

The Food and Beverages segment, particularly Confectionery and Dairy and Dairy Alternative Products, is a dominant force in the China Gelatin Market, contributing significantly to overall market growth. Economic policies supporting the growth of the food processing industry, coupled with substantial investments in infrastructure for cold chain logistics and retail distribution, have fostered widespread availability and consumption of gelatin-containing products. The increasing disposable incomes and evolving dietary habits of Chinese consumers, who are increasingly seeking convenient and palatable food options, have directly translated into higher demand for confectionery items, yogurts, and other dairy-based products that rely on gelatin for texture and stability.

- Dominant Segment: Food and Beverages (Confectionery, Dairy)

- Key Drivers:

- Rising Consumer Demand for Confectionery: A substantial portion of the population enjoys candies, gummies, and chocolates.

- Growth in Dairy Sector: Increased consumption of yogurt, desserts, and ice cream requiring gelling and texturizing agents.

- Urbanization and Convenience: Demand for ready-to-eat (RTE) and ready-to-cook (RTC) food products where gelatin plays a role in texture.

- Economic Policies: Government support for food processing and manufacturing.

- Infrastructure Development: Enhanced logistics and supply chain efficiency.

- Key Drivers:

- Market Share: The Food and Beverages segment is estimated to hold approximately xx% of the total China Gelatin Market share in 2025.

- Growth Potential: Projections indicate a continued growth rate of xx% for this segment through 2033, driven by product innovation and expanding consumer base.

While Food and Beverages lead, the Pharmaceuticals segment is a rapidly growing and high-value segment, driven by the demand for high-purity gelatin in capsule manufacturing, wound dressings, and drug delivery systems. The Personal Care and Cosmetics sector also presents a steady growth trajectory due to gelatin's moisturizing and film-forming properties in skincare and haircare products.

China Gelatin Market Product Landscape

The China Gelatin Market is witnessing continuous product innovation aimed at enhancing functionality and catering to niche applications. Key advancements include the development of specialized pharmaceutical-grade gelatin with exceptionally low endotoxin levels for medical implants and vaccine production, as exemplified by Darling Ingredients' Quali-Pure. Modified gelatin products, such as Darling Ingredients' X-Pure GelDAT, offer unique properties for specific pharmaceutical and cosmetic applications. The focus is on improving biocompatibility, biodegradability, and ensuring consistent quality across batches to meet stringent industry requirements. The market is seeing an increasing variety of animal-based gelatins (bovine, porcine, and avian) with varying bloom strengths and viscosity profiles to suit diverse functional needs.

Key Drivers, Barriers & Challenges in China Gelatin Market

Key Drivers:

- Growing Demand in Food & Beverage: Expanding confectionery, dairy, and convenience food markets.

- Pharmaceutical Applications: Increasing use in capsule shells, wound healing, and drug delivery systems.

- Personal Care Growth: Rising demand in cosmetics for moisturizing and texturizing properties.

- Technological Advancements: Improved processing and purification methods leading to higher quality gelatin.

- Rising Disposable Incomes: Enabling higher consumption of value-added food and healthcare products.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the cost of animal by-products.

- Stringent Regulations: Compliance with evolving food safety and pharmaceutical standards.

- Supply Chain Disruptions: Potential for disruptions due to animal diseases or logistical issues.

- Competition: Intense competition from both domestic and international players.

- Consumer Perceptions: Some consumers may have concerns regarding the source of animal-based gelatin.

Emerging Opportunities in China Gelatin Market

Emerging opportunities in the China Gelatin Market lie in the development and commercialization of specialized gelatin derivatives with enhanced functionalities for advanced pharmaceutical applications, such as targeted drug delivery and tissue engineering. The growing demand for halal-certified and ethically sourced gelatin presents a significant market niche, as evidenced by Gelita AG's strategic acquisition in Turkey. Furthermore, the expanding market for plant-based alternatives, while posing a challenge, also creates an opportunity for innovation in the production of marine-based gelatins with comparable properties. Untapped potential exists in catering to the specific needs of the rapidly aging population with specialized nutritional and pharmaceutical gelatin products.

Growth Accelerators in the China Gelatin Market Industry

Long-term growth in the China Gelatin Market will be significantly accelerated by ongoing technological breakthroughs in extraction and purification processes, enabling the production of higher-value, specialized gelatin grades. Strategic partnerships and collaborations between ingredient suppliers and end-product manufacturers will foster innovation and faster market penetration. Expansion into emerging geographical regions within China, coupled with aggressive marketing strategies highlighting the health and functional benefits of gelatin, will also be crucial growth catalysts. The increasing focus on sustainable sourcing and production methods will further enhance market appeal and drive demand from environmentally conscious consumers and corporations.

Key Players Shaping the China Gelatin Market Market

- Darling Ingredients Inc.

- Luohe Wulong Gelatin Co Ltd

- Hangzhaou Qunli Gelatin Chemical Co Ltd

- Nitta Gelatin Inc.

- Tianjin Hwashin Biotechnology Co Ltd

- Henan Boom Gelatin Co Ltd

- GELITA AG

- Foodchem International Corporation

- Jellice Group

- Xiamen Hyfine Gelatin Co Ltd

Notable Milestones in China Gelatin Market Sector

- October 2022: Darling Ingredients introduced Quali-Pure, an innovative pharmaceutical-grade gelatin for embolization, wound healing, drug delivery, hemostasis, and vaccine production, boasting controlled endotoxin levels and consistent quality.

- December 2021: Gelita AG acquired a 65% stake in SelJel, a Turkish gelatin producer, strengthening its global leadership and halal bovine gelatin production capabilities.

- May 2021: Darling Ingredients expanded its Rousselot brand with new pharmaceutical-grade and modified gelatin products, including the launch of X-Pure GelDAT - Gelatin Desaminotyrosine.

In-Depth China Gelatin Market Market Outlook

The future outlook for the China Gelatin Market is exceptionally promising, driven by a confluence of sustained demand from established sectors and the emergence of new high-growth applications. The pharmaceutical industry's increasing reliance on advanced gelatin-based biomaterials for drug delivery and medical devices, coupled with the expanding nutraceutical market, will act as significant growth accelerators. Furthermore, ongoing investments in R&D for novel gelatin functionalities and sustainable production methods are expected to unlock new market segments and enhance competitive advantage. Strategic market penetration through localized production and tailored product offerings will be key to capitalizing on the vast consumer base and evolving industrial demands in China.

China Gelatin Market Segmentation

-

1. Form

- 1.1. Animal-Based

- 1.2. Marine-Based

-

2. End-User

- 2.1. Personal Care and Cosmetics

-

2.2. Food and Beverages

- 2.2.1. Bakery

- 2.2.2. Condiments/Sauces

- 2.2.3. Confectionery

- 2.2.4. Dairy and Dairy Alternative Products

- 2.2.5. RTE/RTC Food Products

- 2.2.6. Snacks

- 2.3. Pharmaceuticals

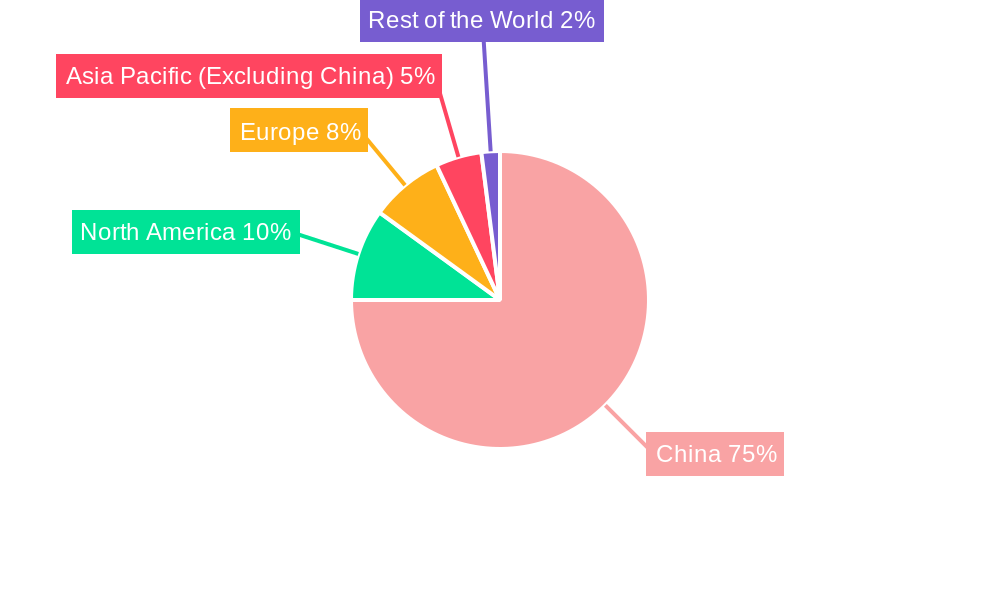

China Gelatin Market Segmentation By Geography

- 1. China

China Gelatin Market Regional Market Share

Geographic Coverage of China Gelatin Market

China Gelatin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Gelatin Consumption; Rising Consumer Demand for Convenient and Functional Foods and Beverages Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source of Gelatin Hamper the Market

- 3.4. Market Trends

- 3.4.1. Rising Consumer Demand for Convenient and Functional Foods and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Gelatin Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Animal-Based

- 5.1.2. Marine-Based

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Personal Care and Cosmetics

- 5.2.2. Food and Beverages

- 5.2.2.1. Bakery

- 5.2.2.2. Condiments/Sauces

- 5.2.2.3. Confectionery

- 5.2.2.4. Dairy and Dairy Alternative Products

- 5.2.2.5. RTE/RTC Food Products

- 5.2.2.6. Snacks

- 5.2.3. Pharmaceuticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luohe Wulong Gelatin Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hangzhaou Qunli Gelatin Chemical Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nitta Gelatin Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tianjin Hwashin Biotechnology Co Ltd *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Henan Boom Gelatin Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GELITA AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Foodchem International Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jellice Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xiamen Hyfine Gelatin Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: China Gelatin Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Gelatin Market Share (%) by Company 2025

List of Tables

- Table 1: China Gelatin Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: China Gelatin Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: China Gelatin Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Gelatin Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: China Gelatin Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: China Gelatin Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Gelatin Market?

The projected CAGR is approximately 5.84%.

2. Which companies are prominent players in the China Gelatin Market?

Key companies in the market include Darling Ingredients Inc, Luohe Wulong Gelatin Co Ltd, Hangzhaou Qunli Gelatin Chemical Co Ltd, Nitta Gelatin Inc, Tianjin Hwashin Biotechnology Co Ltd *List Not Exhaustive, Henan Boom Gelatin Co Ltd, GELITA AG, Foodchem International Corporation, Jellice Group, Xiamen Hyfine Gelatin Co Ltd.

3. What are the main segments of the China Gelatin Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 billion as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Gelatin Consumption; Rising Consumer Demand for Convenient and Functional Foods and Beverages Drives the Market Growth.

6. What are the notable trends driving market growth?

Rising Consumer Demand for Convenient and Functional Foods and Beverages.

7. Are there any restraints impacting market growth?

Concerns over the Source of Gelatin Hamper the Market.

8. Can you provide examples of recent developments in the market?

October of 2022: Darling Ingredients introduced an innovative gelatin product known as Quali-Pure, specifically tailored for pharmaceutical applications, including but not limited to embolization, wound healing, drug delivery, hemostasis, and vaccine production. Quali-Pure boasts exceptional characteristics, including tightly controlled endotoxin levels, consistent quality across batches, biocompatibility, and biodegradability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Gelatin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Gelatin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Gelatin Market?

To stay informed about further developments, trends, and reports in the China Gelatin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence