Key Insights

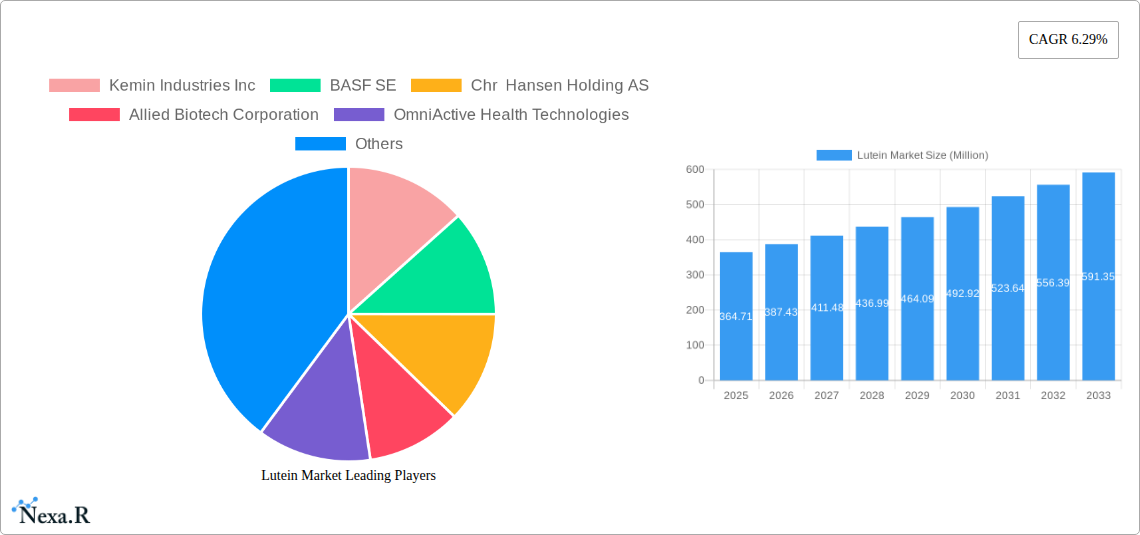

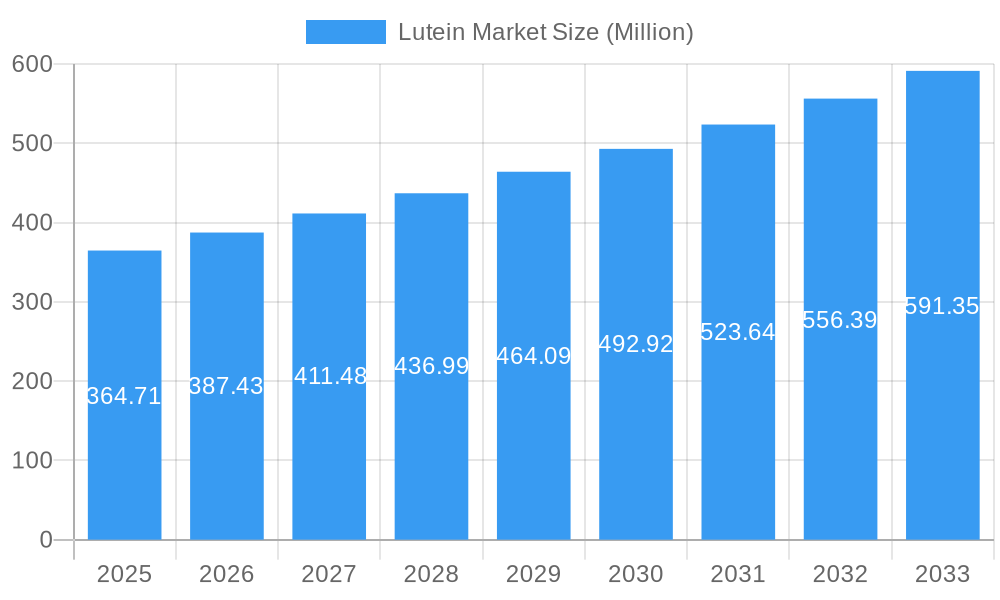

The global Lutein market is poised for robust growth, projected to reach a significant valuation of USD 364.71 million by 2025. This expansion is underpinned by a compound annual growth rate (CAGR) of 6.29% over the forecast period, indicating sustained demand and increasing market penetration. A primary driver for this growth is the escalating consumer awareness regarding the health benefits of lutein, particularly its role in eye health and as a potent antioxidant. The dietary supplements and food & beverage industries are leading this surge, with manufacturers actively incorporating lutein into a wide array of products to cater to health-conscious consumers. Furthermore, advancements in extraction and synthesis technologies are improving product purity and bioavailability, making lutein more accessible and effective, thus fueling its adoption across various applications. The pharmaceutical sector is also showing increased interest in lutein for its therapeutic potential in managing age-related macular degeneration and other chronic conditions.

Lutein Market Market Size (In Million)

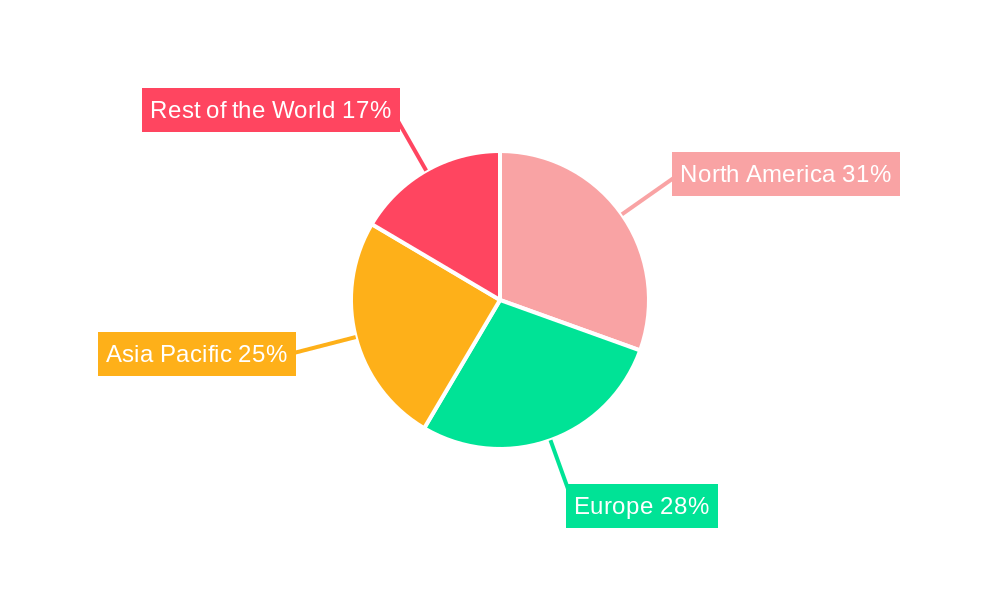

The market dynamics are further shaped by evolving consumer preferences for natural and plant-derived ingredients, which lutein, often sourced from marigold flowers, readily fulfills. This trend is particularly prominent in developed regions like North America and Europe, which currently hold substantial market shares. However, the Asia Pacific region, driven by burgeoning economies and a rapidly growing middle class with increasing disposable income and health awareness, is emerging as a significant growth frontier. While the market demonstrates strong potential, it is not without its challenges. Fluctuations in the prices of raw materials, such as marigold flowers, can impact production costs and subsequently influence market pricing. Additionally, stringent regulatory approvals for new lutein-based products in certain regions can act as a restraint. Nevertheless, ongoing research and development into novel applications of lutein, coupled with strategic collaborations and expansions by key market players like BASF SE, Kemin Industries Inc, and Chr. Hansen Holding AS, are expected to propel the market forward, solidifying lutein's position as a valuable ingredient in health and wellness.

Lutein Market Company Market Share

Lutein Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global Lutein market, encompassing its parent and child market dynamics, growth trajectories, and future potential. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for industry professionals seeking to understand market intricacies and capitalize on emerging opportunities. We present all quantitative values in Million units for clarity and precision.

Lutein Market Dynamics & Structure

The Lutein market exhibits a moderately concentrated structure, with key players investing heavily in research and development to drive technological innovation. The escalating demand for lutein in dietary supplements, food and beverages, and animal feed applications is significantly shaping market dynamics. Regulatory frameworks, particularly concerning ingredient purity and labeling, play a crucial role in market entry and expansion. Competitive product substitutes, such as other carotenoids and synthetic alternatives, present a challenge, but lutein's proven health benefits, especially for eye health, maintain its distinct market position. End-user demographics are shifting towards a more health-conscious population, with increasing awareness of preventative healthcare and the benefits of nutrient-rich diets. Mergers and acquisitions (M&A) trends are observed as companies aim to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Moderate, with a few dominant players and several smaller niche suppliers.

- Technological Innovation Drivers: Focus on enhanced bioavailability, new extraction techniques, and innovative delivery systems for lutein and zeaxanthin.

- Regulatory Frameworks: Stringent regulations in North America and Europe regarding food additives and dietary supplement ingredients.

- Competitive Product Substitutes: Astaxanthin, zeaxanthin, and various vitamins.

- End-User Demographics: Growing elderly population, increasing demand from health-conscious consumers, and rising awareness of age-related macular degeneration (AMD).

- M&A Trends: Strategic acquisitions to gain access to new technologies or expand market share. For instance, the acquisition of ingredient suppliers or companies with strong distribution networks.

Lutein Market Growth Trends & Insights

The Lutein market is poised for robust growth, driven by an escalating global demand for health and wellness products. The market size is projected to witness a significant expansion, fueled by rising consumer awareness regarding the preventative health benefits of lutein, particularly its role in eye health and its antioxidant properties. Adoption rates for lutein-infused products are accelerating across various applications, including dietary supplements, functional foods, and beverages. Technological advancements are playing a pivotal role, with innovations in extraction and purification processes leading to higher purity lutein with improved bioavailability. This enhanced efficacy further drives consumer acceptance and market penetration. Consumer behavior shifts are profoundly impacting the market, with a discernible trend towards natural ingredients and preventative healthcare solutions. Consumers are increasingly seeking supplements and food products that contribute to long-term well-being, making lutein a sought-after ingredient. The aging global population also represents a substantial growth driver, as lutein is widely recognized for its efficacy in combating age-related eye conditions such as macular degeneration and cataracts. The base year 2025 is estimated to have a market value of approximately $XXX Million units, with an estimated Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033, reaching an estimated market value of $XXX Million units by the end of the forecast period. The historical period (2019–2024) has shown a steady upward trend in demand, setting a strong foundation for future expansion. The increasing prevalence of digital devices and prolonged screen time globally has further amplified the need for eye health solutions, directly benefiting the lutein market. Manufacturers are responding by developing innovative product formulations and exploring new application areas to cater to evolving consumer needs and preferences.

Dominant Regions, Countries, or Segments in Lutein Market

The Dietary Supplements segment is currently the dominant force driving growth within the global Lutein market. This dominance is attributed to several intertwined factors, including heightened consumer awareness of lutein's health benefits, particularly for eye health, and the widespread availability of lutein-rich supplements. The aging global population, coupled with an increased focus on preventative healthcare, further fuels the demand for dietary supplements that can mitigate age-related conditions like macular degeneration.

Key drivers within this segment include:

- Rising Health Consciousness: Consumers are actively seeking natural ingredients to support their well-being, making lutein a popular choice.

- Aging Population: The increasing prevalence of age-related eye conditions necessitates effective preventative and management solutions, with lutein and zeaxanthin being prime candidates.

- Product Innovation: Manufacturers are continuously introducing novel supplement formulations, including combination products with other beneficial nutrients, enhancing market appeal.

- Online Retail Channels: The accessibility and convenience of online platforms have significantly expanded the reach of lutein supplements to a broader consumer base.

- Clinical Endorsements: Growing scientific evidence supporting lutein's efficacy in promoting eye health contributes to consumer trust and market growth.

The North America region, particularly the United States, holds a significant market share within the dietary supplements segment. This leadership is underpinned by a well-established healthcare infrastructure, high disposable incomes, and a strong culture of proactive health management. The region benefits from robust regulatory frameworks that support the introduction and marketing of dietary supplements. European countries also represent a substantial market, driven by similar demographic trends and a growing consumer preference for natural health products. The Asia Pacific region is emerging as a high-growth area, fueled by increasing disposable incomes, a burgeoning middle class, and a growing awareness of health and wellness trends. Economic policies promoting health and wellness, coupled with expanding distribution networks, are expected to accelerate market penetration in this region. The continued innovation in product development and targeted marketing campaigns will be crucial in sustaining and expanding the dominance of the dietary supplements segment in the Lutein market.

Lutein Market Product Landscape

The lutein product landscape is characterized by ongoing innovation focused on improving efficacy and expanding applications. Key advancements include the development of highly bioavailable lutein esters and free lutein formulations, often derived from marigold flowers. These products are increasingly being fortified into a wide array of consumer goods, ranging from functional foods and beverages to specialized infant nutrition. Technological innovations in extraction and encapsulation methods are yielding lutein with enhanced stability and absorption rates, making it more effective in addressing concerns like digital eye strain and age-related macular degeneration. The product landscape is also evolving with the introduction of lutein combined with zeaxanthin, creating synergistic formulations for comprehensive eye health support.

Key Drivers, Barriers & Challenges in Lutein Market

Key Drivers:

- Growing Health and Wellness Trends: Increasing consumer demand for natural ingredients and preventative healthcare solutions is a primary growth driver.

- Rising Incidence of Eye Diseases: The aging global population and increased screen time contribute to a higher prevalence of age-related macular degeneration and other eye conditions, boosting demand for lutein.

- Technological Advancements: Innovations in extraction, purification, and bioavailability enhancement are improving product quality and efficacy.

- Expanding Applications: Lutein's use is broadening beyond supplements into food and beverage fortification, animal feed, and cosmetics.

Barriers & Challenges:

- Supply Chain Volatility: Dependence on agricultural sources like marigolds can lead to price fluctuations and supply disruptions due to weather or disease.

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different regions can be complex and costly.

- Competition from Substitutes: While lutein has distinct benefits, other antioxidants and carotenoids can offer similar health claims, posing competitive pressure.

- Price Sensitivity: The cost of high-quality lutein can be a limiting factor for some consumer segments and applications.

- Consumer Awareness Gaps: Despite growing awareness, a segment of the population may still lack complete understanding of lutein's benefits, impacting adoption rates.

Emerging Opportunities in Lutein Market

Emerging opportunities in the Lutein market are largely driven by evolving consumer preferences and scientific discoveries. The increasing demand for natural, plant-based ingredients presents a significant avenue for growth. Innovative applications in the cosmetics industry, leveraging lutein's antioxidant and anti-inflammatory properties for skin health, are gaining traction. Furthermore, the development of targeted delivery systems that optimize lutein absorption and efficacy for specific health outcomes, such as cognitive function and immune support, represents a promising frontier. The growing awareness of lutein's potential benefits beyond eye health is opening new market segments and product development avenues.

Growth Accelerators in the Lutein Market Industry

Several key catalysts are accelerating the growth of the Lutein market. The continuous influx of research highlighting lutein's broad-spectrum health benefits, particularly its role in combating oxidative stress and inflammation, is a major accelerator. Technological breakthroughs in sustainable cultivation and extraction methods are improving cost-effectiveness and environmental impact, making lutein more accessible. Strategic partnerships between ingredient manufacturers and food and beverage companies are expanding its integration into everyday products. Moreover, the increasing global focus on personalized nutrition and preventative healthcare is creating a fertile ground for the growth of lutein-containing dietary supplements and functional foods.

Key Players Shaping the Lutein Market Market

- Kemin Industries Inc

- BASF SE

- Chr Hansen Holding AS

- Allied Biotech Corporation

- OmniActive Health Technologies

- Koninklijke DSM NV

- Industrial Organica SA de CV

- Lycored Corp

- Divi's Laboratories Ltd

- Ashland Global Specialty Chemicals Inc

Notable Milestones in Lutein Market Sector

- November 2021: Ashland launched a soy-free GPM lutein with new eye health ingredients to address eye strain from excessive screen time. They also launched extended-release ingredients N-dur xr caffeine and melatonin for powdered drink products.

- June 2021: OmniActive Health Technologies announced the launch of Integrative Actives, a platform that facilitates the delivery of multiple actives into concentrated smaller doses. Nutritears was the first product created using OmniActive's Integrative Actives platform, featuring lutein and zeaxanthin isomers, curcuminoids, and vitamin D3.

- May 2021: PharmaLinea unveiled a line of preventative eye health supplements in consumer-friendly formats, including Vision Orosticks and Vision Liquid Sticks. The line utilized highly sought-after carotenoids lutein and zeaxanthin to address rising eye health concerns linked to increased screen time.

In-Depth Lutein Market Market Outlook

The future outlook for the Lutein market is exceptionally promising, underpinned by persistent growth drivers and evolving consumer demands. The sustained emphasis on preventative health and the burgeoning global demand for natural, science-backed ingredients will continue to fuel market expansion. Innovations in bioavailability and delivery systems will unlock new therapeutic applications, extending beyond established eye health benefits to areas like cognitive function and skin vitality. The increasing penetration of lutein in functional foods and beverages, driven by consumer desire for convenient health solutions, represents a significant avenue for future growth. Strategic collaborations and ongoing research will further solidify lutein's position as a key ingredient in the health and wellness landscape, ensuring robust market growth throughout the forecast period.

Lutein Market Segmentation

-

1. Application

- 1.1. Food and Beverage

- 1.2. Dietary Supplements

- 1.3. Pharmaceuticals

- 1.4. Animal Feed

- 1.5. Other Applications

Lutein Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Lutein Market Regional Market Share

Geographic Coverage of Lutein Market

Lutein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Consumption of Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lutein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverage

- 5.1.2. Dietary Supplements

- 5.1.3. Pharmaceuticals

- 5.1.4. Animal Feed

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Lutein Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverage

- 6.1.2. Dietary Supplements

- 6.1.3. Pharmaceuticals

- 6.1.4. Animal Feed

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Lutein Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverage

- 7.1.2. Dietary Supplements

- 7.1.3. Pharmaceuticals

- 7.1.4. Animal Feed

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Lutein Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverage

- 8.1.2. Dietary Supplements

- 8.1.3. Pharmaceuticals

- 8.1.4. Animal Feed

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Lutein Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverage

- 9.1.2. Dietary Supplements

- 9.1.3. Pharmaceuticals

- 9.1.4. Animal Feed

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kemin Industries Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BASF SE

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Chr Hansen Holding AS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Allied Biotech Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 OmniActive Health Technologies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Koninklijke DSM NV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Industrial Organica SA de CV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lycored Corp

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Divi's Laboratories Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ashland Global Specialty Chemicals Inc *List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kemin Industries Inc

List of Figures

- Figure 1: Global Lutein Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Lutein Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America Lutein Market Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Lutein Market Volume (Million), by Application 2025 & 2033

- Figure 5: North America Lutein Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Lutein Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Lutein Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Lutein Market Volume (Million), by Country 2025 & 2033

- Figure 9: North America Lutein Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Lutein Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Lutein Market Revenue (Million), by Application 2025 & 2033

- Figure 12: Europe Lutein Market Volume (Million), by Application 2025 & 2033

- Figure 13: Europe Lutein Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Lutein Market Volume Share (%), by Application 2025 & 2033

- Figure 15: Europe Lutein Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Lutein Market Volume (Million), by Country 2025 & 2033

- Figure 17: Europe Lutein Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Lutein Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Lutein Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Asia Pacific Lutein Market Volume (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Lutein Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Lutein Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Asia Pacific Lutein Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Lutein Market Volume (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Lutein Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Lutein Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Lutein Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Rest of the World Lutein Market Volume (Million), by Application 2025 & 2033

- Figure 29: Rest of the World Lutein Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Lutein Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Rest of the World Lutein Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Rest of the World Lutein Market Volume (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Lutein Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Lutein Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lutein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Lutein Market Volume Million Forecast, by Application 2020 & 2033

- Table 3: Global Lutein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Lutein Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Global Lutein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Lutein Market Volume Million Forecast, by Application 2020 & 2033

- Table 7: Global Lutein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Lutein Market Volume Million Forecast, by Country 2020 & 2033

- Table 9: United States Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 11: Canada Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of North America Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Lutein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Lutein Market Volume Million Forecast, by Application 2020 & 2033

- Table 19: Global Lutein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Lutein Market Volume Million Forecast, by Country 2020 & 2033

- Table 21: Spain Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Germany Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: France Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Italy Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Russia Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Lutein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Lutein Market Volume Million Forecast, by Application 2020 & 2033

- Table 37: Global Lutein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Lutein Market Volume Million Forecast, by Country 2020 & 2033

- Table 39: China Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 41: Japan Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: India Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Australia Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Australia Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Lutein Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global Lutein Market Volume Million Forecast, by Application 2020 & 2033

- Table 51: Global Lutein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Lutein Market Volume Million Forecast, by Country 2020 & 2033

- Table 53: South America Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South America Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Middle East and Africa Lutein Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Middle East and Africa Lutein Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lutein Market?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the Lutein Market?

Key companies in the market include Kemin Industries Inc, BASF SE, Chr Hansen Holding AS, Allied Biotech Corporation, OmniActive Health Technologies, Koninklijke DSM NV, Industrial Organica SA de CV, Lycored Corp, Divi's Laboratories Ltd, Ashland Global Specialty Chemicals Inc *List Not Exhaustive.

3. What are the main segments of the Lutein Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 364.71 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increased Consumption of Dietary Supplements.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, Ashland launched a soy-free GPM lutein with new eye health ingredients to address eye strain from excessive screen time. It also launched extended-release ingredients N-dur xr caffeine and melatonin for powdered drink products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lutein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lutein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lutein Market?

To stay informed about further developments, trends, and reports in the Lutein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence