Key Insights

The Asia-Pacific anti-caking agents market is projected for significant expansion, with an estimated market size of USD 1.3 billion in 2024 and a projected Compound Annual Growth Rate (CAGR) of 5.6%. This growth is primarily attributed to the increasing demand for processed and packaged foods across the region, especially in developing economies like India and China. Evolving consumer preferences for convenience and extended product shelf life in food items are key drivers for anti-caking solutions. The cosmetic and personal care sector's increasing adoption of these agents for enhanced product texture and stability also contributes to market growth. The animal feed industry presents another substantial opportunity, as improved feed quality directly impacts animal health and productivity.

Asia-Pacific Anti Caking Industry Market Size (In Billion)

Market segmentation reveals that Calcium Compounds and Sodium Compounds currently hold substantial shares due to their broad applicability and cost-efficiency. Magnesium Compounds, however, are anticipated to experience robust growth owing to their enhanced performance in specialized applications. Geographically, China is expected to maintain market leadership, supported by its extensive industrial infrastructure and significant food processing capabilities. India is emerging as a high-growth market, propelled by its large population and rising disposable incomes. While the market outlook is predominantly positive, challenges may arise from stringent regulatory frameworks in select nations and raw material price volatility. Leading companies, including Merck KGaA, BASF SE, and Evonik Industries AG, are actively investing in research and development to pioneer innovative and sustainable anti-caking solutions, thereby influencing the market's trajectory.

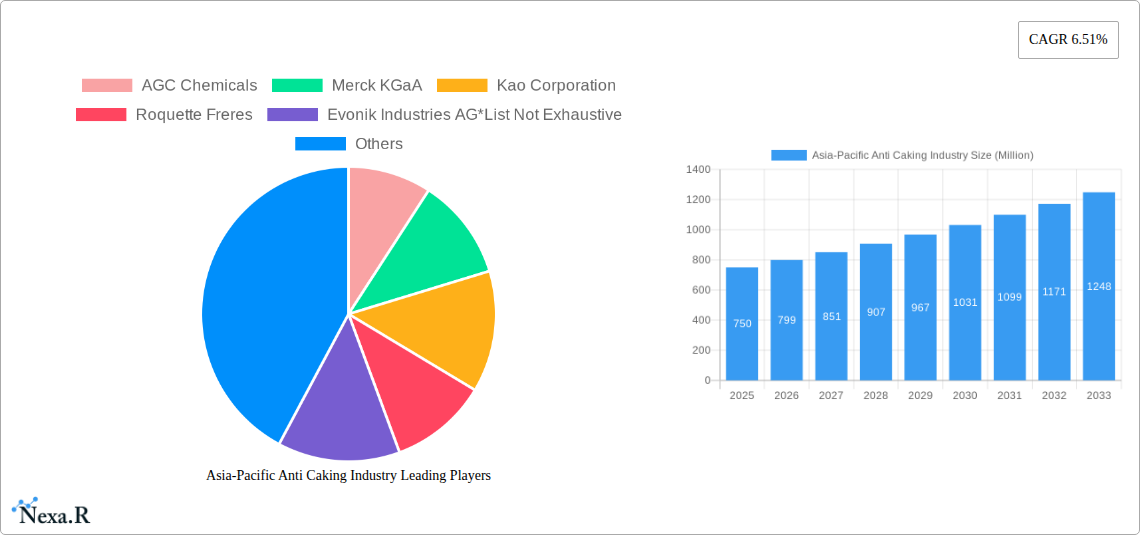

Asia-Pacific Anti Caking Industry Company Market Share

Comprehensive Asia-Pacific Anti-Caking Agents Market Report: Dynamics, Growth, and Future Outlook (2019-2033)

This in-depth report provides an indispensable analysis of the Asia-Pacific Anti-Caking Agents market, offering a granular view of its dynamics, growth trajectories, and competitive landscape. Covering the study period from 2019 to 2033, with a base year of 2025, this report equips industry stakeholders with critical insights into market segmentation, regional dominance, technological advancements, and future opportunities. We delve into the intricacies of this vital sector, analyzing parent and child markets to deliver unparalleled market intelligence for strategic decision-making.

Asia-Pacific Anti Caking Industry Market Dynamics & Structure

The Asia-Pacific anti-caking agents market exhibits a moderately concentrated structure, characterized by the presence of a few dominant global players alongside a growing number of regional manufacturers. Technological innovation is a key driver, particularly in developing advanced anti-caking solutions for specialized food, cosmetic, and feed applications. Regulatory frameworks, primarily focused on food safety and ingredient approval, play a crucial role in market entry and product development. Competitive product substitutes, such as particle engineering and improved processing techniques, pose a constant challenge, pushing manufacturers to differentiate through efficacy and cost-effectiveness. End-user demographics in the Asia-Pacific region are rapidly evolving, with a rising middle class demanding premium and convenient processed foods, driving demand for high-quality anti-caking agents. Mergers and acquisitions (M&A) are also observed, although at a moderate pace, as companies seek to expand their product portfolios and geographical reach. For instance, the estimated M&A deal volume for the past year was approximately 5 M&A deals, valued at an estimated $150 Million. Innovation barriers include high R&D costs and the stringent approval processes in various countries.

- Market Concentration: Moderate, with key global players holding significant market share.

- Technological Innovation: Driven by demand for enhanced performance in specific applications and improved food processing.

- Regulatory Frameworks: Primarily focused on food safety standards, impacting product formulations and market access.

- Competitive Landscape: Includes both established anti-caking agents and alternative solutions.

- End-User Demographics: Shifting towards demand for convenience, quality, and specialized products.

- M&A Trends: Moderate activity aimed at portfolio expansion and market penetration.

- Innovation Barriers: High R&D investment and complex regulatory approvals.

Asia-Pacific Anti Caking Industry Growth Trends & Insights

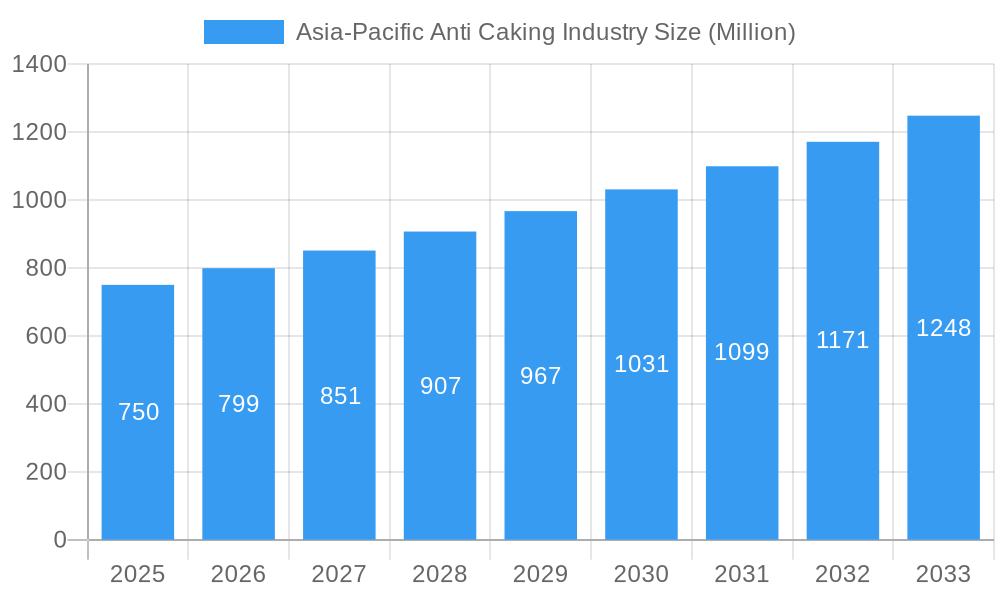

The Asia-Pacific anti-caking agents market is projected for robust growth, fueled by escalating demand from the burgeoning food and beverage industry, driven by population growth, urbanization, and changing dietary habits across the region. The estimated market size for 2025 is valued at $850 Million. This growth is further propelled by the increasing adoption of processed and convenience foods, where anti-caking agents are essential for maintaining product quality, shelf life, and ease of use. Technological disruptions, such as the development of novel, natural, and allergen-free anti-caking agents, are gaining traction, catering to evolving consumer preferences and stricter regulatory demands. Consumer behavior is shifting towards healthier and more functional food products, prompting manufacturers to explore innovative applications for anti-caking agents beyond traditional uses. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at 5.2%. Market penetration is expected to deepen, particularly in emerging economies within the Asia-Pacific region, where awareness of product quality and processing efficiency is on the rise.

The expanding cosmetic and personal care sector is also a significant contributor to market growth, with anti-caking agents playing a vital role in the formulation of powders, makeup, and other dry cosmetic products. The feed industry, driven by the need for efficient animal nutrition and feed handling, presents another substantial avenue for market expansion. Innovations in anti-caking agent production, focusing on sustainability and reduced environmental impact, are becoming increasingly important as global environmental consciousness grows. The estimated market size for 2033 is projected to reach $1,300 Million. Factors such as improved distribution networks and increased investment in food processing infrastructure across the Asia-Pacific region are facilitating market accessibility and further stimulating demand. The increasing preference for food products with extended shelf lives, especially in regions with developing cold chain logistics, directly translates into higher demand for anti-caking agents that preserve product integrity. Furthermore, the rising popularity of bakery products, dairy items, and ready-to-eat meals, all heavily reliant on anti-caking agents for optimal texture and flowability, underscores the market's upward trajectory. The report forecasts that the market penetration of anti-caking agents in the food and beverage segment will reach 85% by 2033.

Dominant Regions, Countries, or Segments in Asia-Pacific Anti Caking Industry

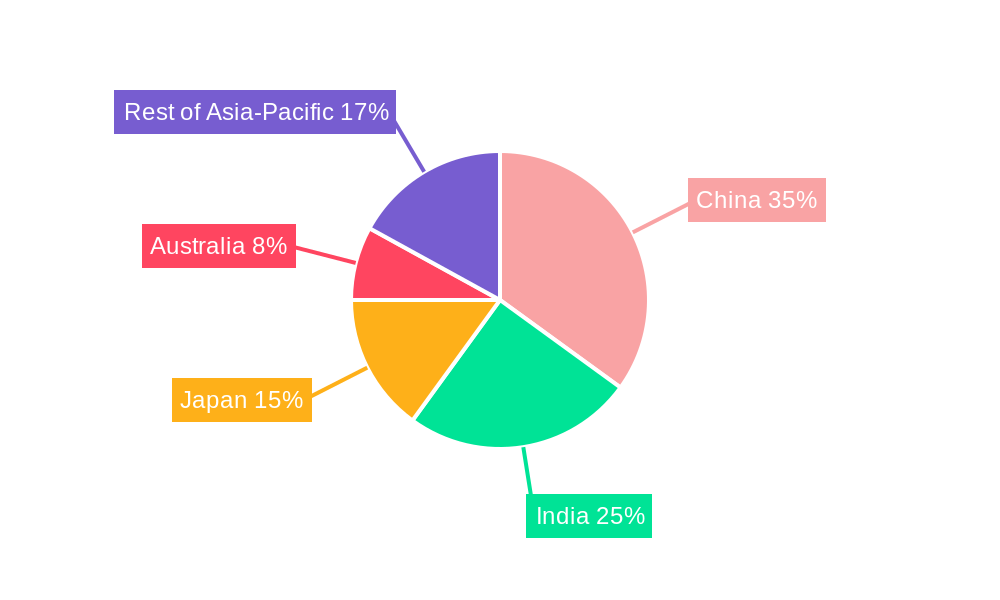

China stands out as the dominant country in the Asia-Pacific anti-caking agents market, driven by its massive population, a rapidly expanding food and beverage processing industry, and significant investments in agricultural and manufacturing sectors. The country’s estimated market share for anti-caking agents in 2025 is 35% of the total Asia-Pacific market. Economic policies supporting domestic manufacturing, coupled with a growing middle class with increasing disposable income, have propelled China to the forefront. The infrastructure development in food processing and logistics further solidifies its position. Following closely is India, which exhibits a substantial growth potential due to its large, young population, evolving consumer preferences for packaged foods, and a government focus on boosting the food processing sector. India’s estimated market share for 2025 is 20%.

Among the segments, Food and Beverage is the clear leader, accounting for an estimated 70% of the total market revenue in 2025. Within this broad application, Bakery Products and Dairy Products represent the largest sub-segments, driven by their widespread consumption and the critical need for anti-caking agents to maintain texture, prevent clumping, and ensure product consistency. The demand for anti-caking agents in Soups & Sauces and Beverages is also on a steady rise due to the increasing popularity of convenience foods and ready-to-drink products.

The Type segment sees Calcium Compounds as the leading category, owing to their cost-effectiveness and widespread use across various food applications. However, Sodium Compounds also hold a significant share due to their high efficacy. The Cosmetic and Personal Care segment is demonstrating strong growth, driven by the increasing demand for makeup powders, talcum powders, and other dry cosmetic formulations. The Feed application is steadily growing, fueled by the expansion of the animal husbandry sector and the need for improved feed quality and handling.

- Dominant Country: China, due to its large market size and robust food processing industry.

- Key Growth Driver Country: India, with its burgeoning population and expanding food sector.

- Leading Application Segment: Food and Beverage, due to widespread use in processed foods.

- Sub-Segments Driving Food & Beverage Growth: Bakery Products and Dairy Products.

- Dominant Type of Anti-Caking Agent: Calcium Compounds, followed by Sodium Compounds.

- Fastest Growing Application Segment: Cosmetic and Personal Care.

- Emerging Growth Segment: Feed, supported by animal husbandry expansion.

Asia-Pacific Anti Caking Industry Product Landscape

The Asia-Pacific anti-caking agents market is characterized by continuous product innovation aimed at enhancing efficacy, addressing specific application needs, and meeting evolving regulatory and consumer demands. Manufacturers are focusing on developing highly porous, amorphous silica-based anti-caking agents that offer superior moisture absorption and particle separation. Innovations also include natural and plant-derived anti-caking solutions, appealing to the growing consumer preference for clean-label products. Performance metrics such as particle size distribution, moisture absorption capacity, and inertness are key differentiators. Advanced processing techniques are enabling the creation of customized anti-caking agents with tailored functionalities for diverse applications, from preventing caking in powdered infant formula to ensuring free-flowing properties in instant coffee. The unique selling proposition often lies in the development of agents that are non-GMO, allergen-free, and compliant with stringent international food safety standards.

Key Drivers, Barriers & Challenges in Asia-Pacific Anti Caking Industry

Key Drivers:

- Growing Food & Beverage Industry: Rapid expansion of processed food consumption and demand for convenience.

- Technological Advancements: Development of more effective and specialized anti-caking solutions.

- Increasing Disposable Incomes: Leading to higher demand for premium and processed food products.

- Demand for Extended Shelf Life: Anti-caking agents contribute to product stability and longevity.

- Growth in Cosmetic & Personal Care: Rising demand for dry cosmetic formulations.

Key Barriers & Challenges:

- Regulatory Hurdles: Stringent and varied approval processes across different Asia-Pacific countries.

- Price Sensitivity: Competition from lower-cost alternatives and a focus on cost-effectiveness.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges impacting raw material availability and distribution.

- Awareness and Adoption: Lower awareness of advanced anti-caking solutions in certain developing markets.

- Substitution Threat: Potential for alternative processing methods to reduce the need for anti-caking agents.

- Environmental Concerns: Increasing scrutiny on the environmental impact of production processes and ingredient sourcing, with an estimated 10% of the market facing pressure due to sustainability concerns.

Emerging Opportunities in Asia-Pacific Anti Caking Industry

Emerging opportunities lie in the development of novel, natural, and biodegradable anti-caking agents that cater to the growing demand for sustainable and clean-label products. The untapped potential in emerging economies within Southeast Asia and the Pacific Islands presents a significant avenue for market expansion, driven by improving living standards and increasing urbanization. Furthermore, exploring innovative applications beyond traditional food and cosmetic uses, such as in the pharmaceutical industry for drug formulation or in industrial applications like powder handling, offers substantial growth prospects. The demand for specialty anti-caking agents for niche applications, like high-moisture powdered ingredients or temperature-sensitive products, is also a burgeoning opportunity.

Growth Accelerators in the Asia-Pacific Anti Caking Industry Industry

Several catalysts are propelling the long-term growth of the Asia-Pacific anti-caking industry. Technological breakthroughs in material science and encapsulation techniques are enabling the creation of superior anti-caking agents with enhanced functionalities and improved performance under various conditions. Strategic partnerships between ingredient manufacturers, food processors, and research institutions are fostering innovation and accelerating product development cycles. Market expansion strategies, including direct market entry, joint ventures, and collaborations with local distributors, are crucial for penetrating diverse regional markets. The increasing focus on food safety and quality standards globally is also acting as a growth accelerator, driving demand for certified and reliable anti-caking solutions.

Key Players Shaping the Asia-Pacific Anti Caking Industry Market

- AGC Chemicals

- Merck KGaA

- Kao Corporation

- Roquette Freres

- Evonik Industries AG

- BASF SE

Notable Milestones in Asia-Pacific Anti Caking Industry Sector

- 2023 January: Launch of a new generation of plant-based anti-caking agents by Kao Corporation, focusing on natural ingredients.

- 2023 March: BASF SE announces significant investment in R&D for sustainable anti-caking solutions in Asia.

- 2023 July: Merck KGaA expands its portfolio of specialty silicas for anti-caking applications in the region.

- 2024 February: Roquette Freres introduces innovative anti-caking agents for gluten-free bakery products.

- 2024 August: Evonik Industries AG enhances its production capacity for high-performance anti-caking agents in Southeast Asia.

- 2025 Q1: AGC Chemicals partners with a leading Asian food manufacturer to co-develop custom anti-caking solutions.

In-Depth Asia-Pacific Anti Caking Industry Market Outlook

The Asia-Pacific anti-caking agents market is poised for sustained and significant growth, driven by a confluence of demographic, economic, and technological factors. The report forecasts a CAGR of 5.2% from 2025 to 2033, with the market value reaching an estimated $1,300 Million by 2033. Strategic opportunities abound in the development and marketing of natural, sustainable, and application-specific anti-caking solutions, particularly for the burgeoning food and beverage sector in China and India. Continuous innovation in product formulation, coupled with strategic market penetration initiatives and potential M&A activities, will shape the competitive landscape. The industry's ability to adapt to evolving regulatory environments and consumer preferences will be paramount to unlocking its full growth potential.

Asia-Pacific Anti Caking Industry Segmentation

-

1. Type

- 1.1. Calcium Compounds

- 1.2. Sodium Compounds

- 1.3. Magnesium Compounds

- 1.4. Others

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Bakery Products

- 2.1.2. Dairy Products

- 2.1.3. Soups & Sauces

- 2.1.4. Beverages

- 2.1.5. Others

- 2.2. Cosmetic and Personal Care

- 2.3. Feed

-

2.1. Food and Beverage

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Anti Caking Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Anti Caking Industry Regional Market Share

Geographic Coverage of Asia-Pacific Anti Caking Industry

Asia-Pacific Anti Caking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Growing Demand in Bakery Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Anti Caking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Calcium Compounds

- 5.1.2. Sodium Compounds

- 5.1.3. Magnesium Compounds

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Bakery Products

- 5.2.1.2. Dairy Products

- 5.2.1.3. Soups & Sauces

- 5.2.1.4. Beverages

- 5.2.1.5. Others

- 5.2.2. Cosmetic and Personal Care

- 5.2.3. Feed

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Anti Caking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Calcium Compounds

- 6.1.2. Sodium Compounds

- 6.1.3. Magnesium Compounds

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.1.1. Bakery Products

- 6.2.1.2. Dairy Products

- 6.2.1.3. Soups & Sauces

- 6.2.1.4. Beverages

- 6.2.1.5. Others

- 6.2.2. Cosmetic and Personal Care

- 6.2.3. Feed

- 6.2.1. Food and Beverage

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan Asia-Pacific Anti Caking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Calcium Compounds

- 7.1.2. Sodium Compounds

- 7.1.3. Magnesium Compounds

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.1.1. Bakery Products

- 7.2.1.2. Dairy Products

- 7.2.1.3. Soups & Sauces

- 7.2.1.4. Beverages

- 7.2.1.5. Others

- 7.2.2. Cosmetic and Personal Care

- 7.2.3. Feed

- 7.2.1. Food and Beverage

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia-Pacific Anti Caking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Calcium Compounds

- 8.1.2. Sodium Compounds

- 8.1.3. Magnesium Compounds

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.1.1. Bakery Products

- 8.2.1.2. Dairy Products

- 8.2.1.3. Soups & Sauces

- 8.2.1.4. Beverages

- 8.2.1.5. Others

- 8.2.2. Cosmetic and Personal Care

- 8.2.3. Feed

- 8.2.1. Food and Beverage

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Anti Caking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Calcium Compounds

- 9.1.2. Sodium Compounds

- 9.1.3. Magnesium Compounds

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.1.1. Bakery Products

- 9.2.1.2. Dairy Products

- 9.2.1.3. Soups & Sauces

- 9.2.1.4. Beverages

- 9.2.1.5. Others

- 9.2.2. Cosmetic and Personal Care

- 9.2.3. Feed

- 9.2.1. Food and Beverage

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Anti Caking Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Calcium Compounds

- 10.1.2. Sodium Compounds

- 10.1.3. Magnesium Compounds

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.1.1. Bakery Products

- 10.2.1.2. Dairy Products

- 10.2.1.3. Soups & Sauces

- 10.2.1.4. Beverages

- 10.2.1.5. Others

- 10.2.2. Cosmetic and Personal Care

- 10.2.3. Feed

- 10.2.1. Food and Beverage

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AGC Chemicals

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kao Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Roquette Freres

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evonik Industries AG*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 AGC Chemicals

List of Figures

- Figure 1: Asia-Pacific Anti Caking Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Anti Caking Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Anti Caking Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Anti Caking Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Asia-Pacific Anti Caking Industry?

Key companies in the market include AGC Chemicals, Merck KGaA, Kao Corporation, Roquette Freres, Evonik Industries AG*List Not Exhaustive, BASF SE.

3. What are the main segments of the Asia-Pacific Anti Caking Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Growing Demand in Bakery Industry.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Anti Caking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Anti Caking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Anti Caking Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Anti Caking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence