Key Insights

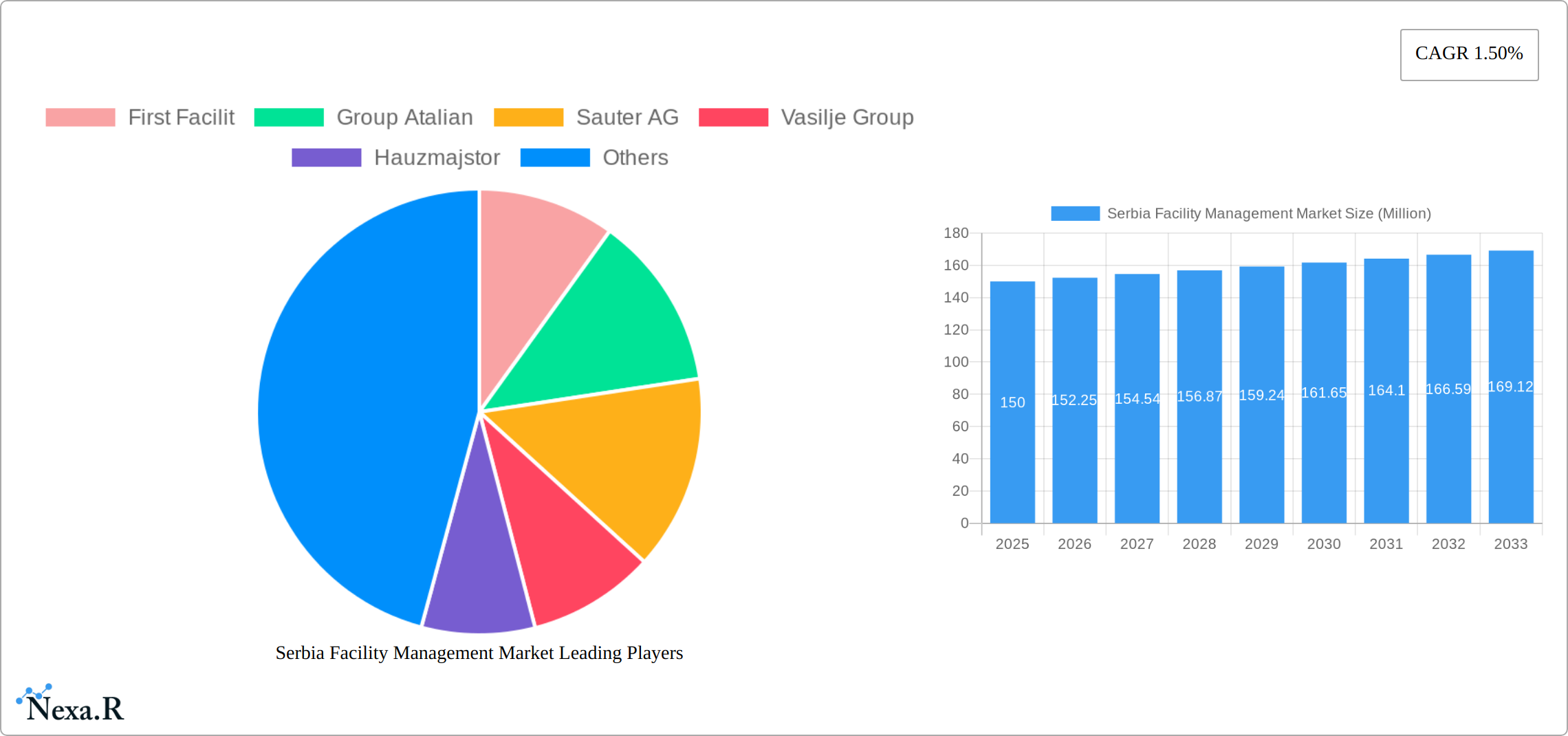

The Serbian Facility Management (FM) market, valued at approximately €150 million in 2025, is projected to experience steady growth, driven by increasing urbanization, a burgeoning commercial sector, and a rising focus on operational efficiency across various industries. The market's Compound Annual Growth Rate (CAGR) of 1.50% from 2025 to 2033 reflects a stable expansion, indicating consistent demand for both hard FM (technical services like HVAC and building maintenance) and soft FM (services like cleaning and security). The dominance of outsourced facility management suggests a growing preference among businesses for specialized expertise and cost optimization. Key growth drivers include the expanding retail and hospitality sectors, the modernization of existing infrastructure, and increasing awareness of sustainability practices within facility management. While the market faces potential restraints like economic fluctuations and a relatively small market size compared to larger European economies, ongoing investments in infrastructure development and the adoption of advanced technologies within the FM sector are expected to offset these challenges. Leading players like First Facilit, Group Atalian, and others are well-positioned to capitalize on these opportunities by leveraging their expertise in integrated FM solutions and adapting to the evolving needs of diverse end-users in commercial, institutional, and public sectors.

The segmentation of the Serbian FM market reveals a balance between in-house and outsourced services, indicating a strategic approach by businesses to optimize their facility management functions. The presence of both hard and soft FM offerings reflects a comprehensive market catering to diverse needs. The relatively even distribution across end-users, including commercial, institutional, public/infrastructure, and industrial sectors highlights the broad applicability of FM services within the Serbian economy. The forecast period (2025-2033) presents significant opportunities for market expansion, particularly within the industrial and public sectors, where improved efficiency and maintenance are crucial factors. Future growth will likely depend on government policies supporting sustainable practices in building management, alongside further adoption of innovative technologies to enhance efficiency and reduce operational costs.

Serbia Facility Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Serbia facility management market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and forecast period 2025-2033. It segments the market by facility management type (in-house, outsourced), offering type (Hard FM, Soft FM), and end-user (commercial, institutional, public/infrastructure, industrial, others). The market size is valued in millions of units.

Serbia Facility Management Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Serbian facility management sector. The market is characterized by a mix of both large multinational corporations and smaller, local providers. Market concentration is moderate, with several key players holding significant market share but not dominating completely. Technological innovation is a key driver, with smart building technologies and integrated workplace management systems (IWMS) gaining traction. Regulatory frameworks influence health and safety standards and sustainable practices. The growing adoption of outsourcing further contributes to market expansion.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of market share in 2024.

- Technological Drivers: Smart building technologies, IWMS, IoT, and AI-powered solutions are driving efficiency and demand.

- Regulatory Framework: Compliance with EU standards and local regulations regarding building safety and sustainability is a key factor.

- Competitive Substitutes: Limited direct substitutes, but internal resource allocation within organizations represents an indirect form of competition.

- End-User Demographics: Growth is driven by increased awareness of cost efficiency and the need for specialized services across commercial, institutional, and industrial sectors.

- M&A Trends: A moderate number of M&A activities have been observed, primarily focusing on technological integration and expansion of service offerings. xx M&A deals were recorded between 2019 and 2024.

Serbia Facility Management Market Growth Trends & Insights

The Serbian facility management market is experiencing robust growth, fueled by a confluence of factors including rapid urbanization, a strengthening economy, and a heightened awareness of operational efficiency improvements. While precise figures for market size in millions of units require specific data for 2019 and 2024, substantial expansion has been observed between these years. This growth trajectory is particularly pronounced within the commercial and institutional sectors, significantly driven by technological advancements and the increasing preference for outsourcing facility management services. This shift allows businesses to focus on core competencies while entrusting specialized firms with facility operations.

The Compound Annual Growth Rate (CAGR) for the period 2019-2024, while needing specific numerical values for accuracy, is projected to continue a strong upward trend. Similarly, the projected CAGR for 2025-2033 requires specific data but is anticipated to reflect the sustained market momentum. This consistent growth is underpinned by organizations prioritizing cost optimization and quality enhancements. The adoption of smart building technologies and Integrated Workplace Management Systems (IWMS) solutions is accelerating this expansion, offering real-time data analysis and predictive capabilities. Furthermore, evolving consumer preferences, especially the growing demand for sustainable and energy-efficient facilities, are shaping future market demand and driving innovation.

Dominant Regions, Countries, or Segments in Serbia Facility Management Market

The Belgrade region dominates the Serbian facility management market, accounting for approximately xx% of total market value in 2024, due to its higher concentration of commercial and institutional facilities.

- By Facility Management Type: Outsourced Facility Management is expected to witness faster growth than in-house facility management due to cost-effectiveness and specialized expertise.

- By Offering Type: Hard FM currently holds a larger market share compared to Soft FM, but Soft FM is anticipated to experience higher growth over the forecast period.

- By End-Users: The Commercial sector dominates the market, driven by the needs of large corporations and expanding businesses, followed by the Institutional sector (government buildings, educational institutions, etc.) and Public/Infrastructure sector.

Key Drivers:

- Strong economic growth in Serbia.

- Increasing focus on operational efficiency in organizations.

- Government initiatives promoting sustainable buildings and infrastructure.

Serbia Facility Management Market Product Landscape

The Serbian facility management market encompasses a comprehensive range of services, encompassing both hard FM (maintenance, repairs, and technical services) and soft FM (security, cleaning, catering, and other support services). The market is witnessing significant innovation, particularly with the integration of smart building technologies. These include advanced energy management systems, automated maintenance platforms, and building information modeling (BIM) tools. These technologies offer compelling value propositions, providing real-time monitoring, predictive maintenance capabilities, and data-driven operational optimizations, ultimately leading to enhanced efficiency and substantial cost savings for clients. The incorporation of sustainability features within these technologies is also becoming increasingly important.

Key Drivers, Barriers & Challenges in Serbia Facility Management Market

Key Drivers:

- Growing adoption of technology and automation, including AI and IoT solutions.

- Increasing demand for sustainable and energy-efficient solutions, driven by environmental concerns and regulatory pressures.

- Rise in outsourcing of facility management services, allowing companies to focus on their core business operations.

- Government initiatives promoting sustainable development and infrastructure investments, creating opportunities for FM providers.

- Expansion of the commercial real estate sector, increasing demand for professional FM services.

Key Challenges:

- Skilled labor shortages in the industry, requiring investment in training and development programs.

- Competition from smaller local players, necessitating differentiation through specialized services or technological expertise.

- Economic fluctuations impacting investment decisions, requiring FM providers to adapt to changing market conditions.

- Maintaining compliance with evolving regulations and standards, demanding continuous updates and adaptation.

- Integration of new technologies and data management within existing systems.

Emerging Opportunities in Serbia Facility Management Market

- Growing demand for green building certifications and sustainable practices.

- Increased focus on workplace wellness and employee experience.

- Expansion into emerging sectors like renewable energy management within facilities.

- Adoption of advanced analytics and AI-driven solutions for predictive maintenance and resource optimization.

Growth Accelerators in the Serbia Facility Management Market Industry

Technological advancements, strategic partnerships, and international investment will be key drivers of growth in the Serbian facility management market. The increasing adoption of smart building technologies, IoT, and AI-powered solutions will significantly enhance efficiency and productivity. Collaboration between domestic and international players will bring in expertise and capital. Investments in infrastructure projects across Serbia will significantly boost the demand for facility management services.

Key Players Shaping the Serbia Facility Management Market Market

- First Facilit

- Group Atalian

- Sauter AG

- Vasilje Group

- Hauzmajstor

- Atrium Property Services

- REIWAG

- International Property Management

- ProBlue

- Diversey Holdings LTD

Notable Milestones in Serbia Facility Management Market Sector

- December 2021: First Facility launched the Smart Building Management mobile application, showcasing the growing adoption of technology in the sector.

- January 2022: CBRE acquired Buildingi, enhancing its capabilities in space utilization and building information modeling (BIM), highlighting consolidation within the market.

- [Add other significant milestones with dates and brief descriptions]

In-Depth Serbia Facility Management Market Market Outlook

The Serbian facility management market is poised for significant growth, driven by increasing adoption of technology, a focus on sustainability, and ongoing investment in infrastructure. Strategic partnerships and expansions into untapped market segments will be crucial for long-term success. The market presents lucrative opportunities for both established players and new entrants seeking to capitalize on technological advancements and evolving client needs. The forecast for the next decade is positive with steady, sustainable growth propelled by both domestic and foreign investment in the sector.

Serbia Facility Management Market Segmentation

-

1. Facility Management Type

- 1.1. In-house Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single Facility Management

- 1.2.2. Bundled Facility Management

- 1.2.3. Integrated Facility Management

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-Users

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

Serbia Facility Management Market Segmentation By Geography

- 1. Serbia

Serbia Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Investments in Real Estate Sector Enabling Smart Building Constructions; Growth of Commercial Buildings

- 3.2.2 Corporate offices

- 3.2.3 Residential & Non-Residential Buildings; Government Initiatives for Smart Infrastructure Construction

- 3.3. Market Restrains

- 3.3.1. Increasing Incidents of Cybercrime

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Outsourcing Facilities Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Serbia Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. In-house Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single Facility Management

- 5.1.2.2. Bundled Facility Management

- 5.1.2.3. Integrated Facility Management

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-Users

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Serbia

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 First Facilit

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Group Atalian

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sauter AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vasilje Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hauzmajstor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Atrium Property Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 REIWAG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Property Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ProBlue

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Diversey Holdings LTD

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 First Facilit

List of Figures

- Figure 1: Serbia Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Serbia Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Serbia Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Serbia Facility Management Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Serbia Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 4: Serbia Facility Management Market Volume K Unit Forecast, by Facility Management Type 2019 & 2032

- Table 5: Serbia Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 6: Serbia Facility Management Market Volume K Unit Forecast, by Offering Type 2019 & 2032

- Table 7: Serbia Facility Management Market Revenue Million Forecast, by End-Users 2019 & 2032

- Table 8: Serbia Facility Management Market Volume K Unit Forecast, by End-Users 2019 & 2032

- Table 9: Serbia Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Serbia Facility Management Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Serbia Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Serbia Facility Management Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Serbia Facility Management Market Revenue Million Forecast, by Facility Management Type 2019 & 2032

- Table 14: Serbia Facility Management Market Volume K Unit Forecast, by Facility Management Type 2019 & 2032

- Table 15: Serbia Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 16: Serbia Facility Management Market Volume K Unit Forecast, by Offering Type 2019 & 2032

- Table 17: Serbia Facility Management Market Revenue Million Forecast, by End-Users 2019 & 2032

- Table 18: Serbia Facility Management Market Volume K Unit Forecast, by End-Users 2019 & 2032

- Table 19: Serbia Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Serbia Facility Management Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Serbia Facility Management Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the Serbia Facility Management Market?

Key companies in the market include First Facilit, Group Atalian, Sauter AG, Vasilje Group, Hauzmajstor, Atrium Property Services, REIWAG, International Property Management, ProBlue, Diversey Holdings LTD.

3. What are the main segments of the Serbia Facility Management Market?

The market segments include Facility Management Type, Offering Type, End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Real Estate Sector Enabling Smart Building Constructions; Growth of Commercial Buildings. Corporate offices. Residential & Non-Residential Buildings; Government Initiatives for Smart Infrastructure Construction.

6. What are the notable trends driving market growth?

Increasing Demand for Outsourcing Facilities Management.

7. Are there any restraints impacting market growth?

Increasing Incidents of Cybercrime.

8. Can you provide examples of recent developments in the market?

January 2022 - CBRE acquired Buildingi, a leading provider of occupancy management and technology services. The acquisition provides space utilization data management and Computer-Aided Design (CAD) services in Building Information Modeling and Integrated Workplace Management Systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Serbia Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Serbia Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Serbia Facility Management Market?

To stay informed about further developments, trends, and reports in the Serbia Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence