Key Insights

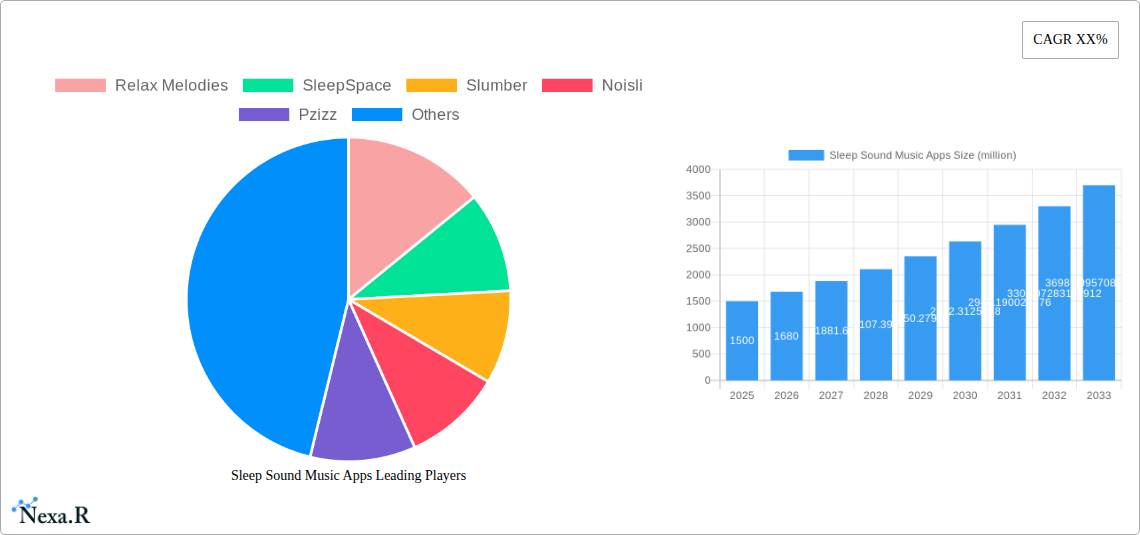

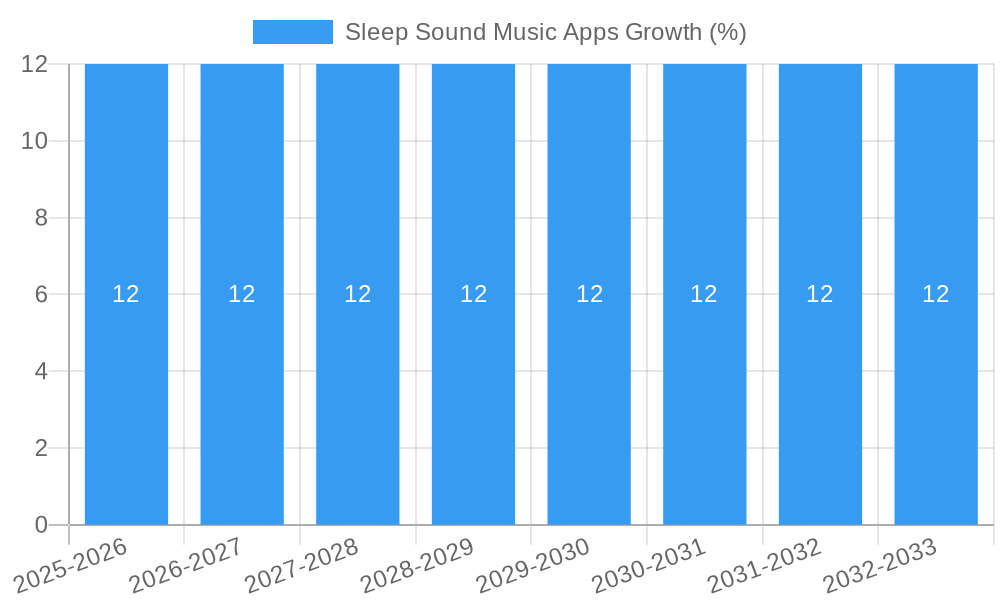

The global Sleep Sound Music Apps market is poised for significant expansion, projected to reach an estimated USD 1,500 million in 2025 and grow at a compound annual growth rate (CAGR) of approximately 12% through 2033. This robust growth is fueled by a confluence of factors, chief among them the increasing global awareness of mental well-being and the profound impact of quality sleep on overall health. As more individuals recognize sleep as a critical pillar of a healthy lifestyle, the demand for accessible and effective sleep-aid solutions is escalating. The proliferation of smartphones and a growing comfort with digital health applications further democratize access to these tools. The market caters to a broad demographic, with distinct applications for both children, benefiting from calming lullabies and soothing narratives, and adults seeking relief from stress, anxiety, and insomnia. This dual focus ensures sustained demand across age groups. Leading companies like Calm, Headspace, and Relax Melodies are at the forefront, continuously innovating with diverse soundscapes, guided meditations, and personalized sleep programs to meet evolving user needs and preferences.

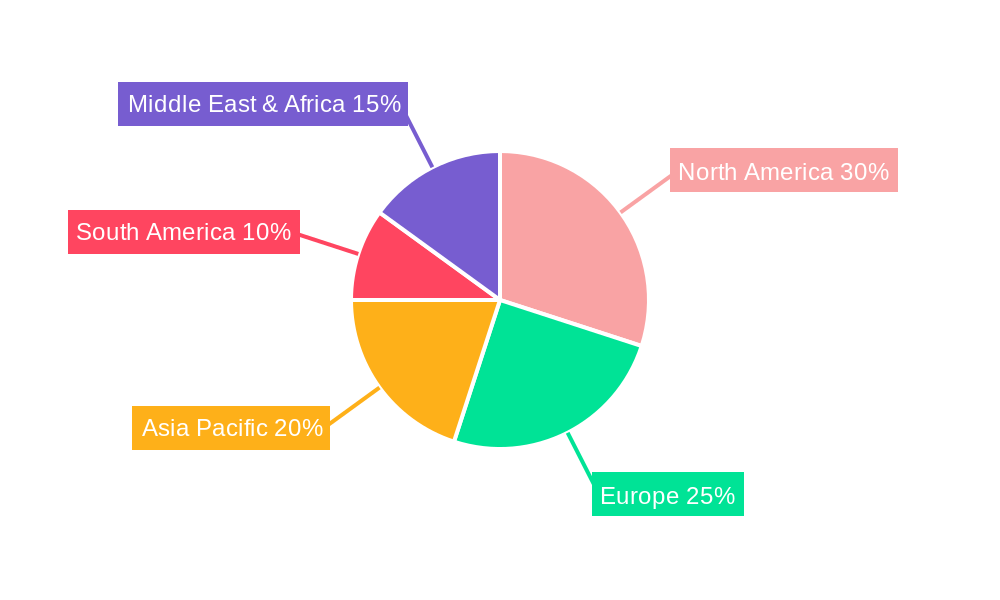

The market's trajectory is shaped by key trends, including the integration of AI for personalized sleep recommendations, the growing popularity of nature sounds and white noise variations, and the demand for features that track sleep patterns and offer insights. The shift towards subscription-based models provides a stable revenue stream for app developers, while partnerships with wearable device manufacturers offer integrated sleep monitoring solutions. However, challenges such as intense market competition, the need for continuous content updates to retain user engagement, and concerns around data privacy present potential restraints. Despite these hurdles, the pervasive stress of modern life, coupled with a continuous pursuit of improved sleep quality, solidifies the Sleep Sound Music Apps market's position as a dynamic and promising sector within the digital health and wellness landscape. The Asia Pacific region, with its rapidly expanding middle class and increasing digital penetration, is expected to emerge as a significant growth engine in the coming years.

This in-depth report provides a strategic overview of the global Sleep Sound Music Apps market, encompassing historical analysis, current trends, and robust future projections. Leveraging high-traffic keywords and segmenting the market into parent (Applications) and child (Types) categories, this analysis is designed to offer unparalleled insights for industry professionals. The study period spans from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033.

Sleep Sound Music Apps Market Dynamics & Structure

The global Sleep Sound Music Apps market exhibits a moderately concentrated structure, with key players like Calm, Headspace, and Relax Melodies holding significant market share. Technological innovation remains a primary driver, with advancements in AI-powered soundscapes and personalized sleep programs continually reshaping user experience. Regulatory frameworks are largely non-restrictive, focusing on data privacy and content standards, though evolving digital health guidelines may influence future development. Competitive product substitutes include traditional methods like meditation, physical therapy, and over-the-counter sleep aids, but the convenience and accessibility of apps provide a distinct advantage. End-user demographics are broad, encompassing individuals of all ages seeking to improve sleep quality, with a growing segment of the Parent Market: For Adults and a rapidly expanding niche within the Parent Market: For Children. Mergers and acquisitions (M&A) trends are on the rise as established companies seek to expand their feature sets and user base, with an estimated M&A deal volume of 15-20 annually in the historical period.

- Market Concentration: Moderate, with leading players dominating.

- Technological Innovation Drivers: AI-driven personalization, biofeedback integration, enhanced sound quality.

- Regulatory Frameworks: Primarily data privacy and content standards.

- Competitive Product Substitutes: Meditation, sleep aids, relaxation techniques.

- End-User Demographics: Broad appeal, with significant adoption by adults and increasing interest in the children's segment.

- M&A Trends: Increasing activity driven by market consolidation and feature expansion.

Sleep Sound Music Apps Growth Trends & Insights

The global Sleep Sound Music Apps market is poised for substantial growth, driven by increasing awareness of sleep hygiene and mental well-being. The market size is projected to expand from approximately $1,500 million in 2019 to an estimated $5,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 25% projected for the forecast period (2025–2033). Adoption rates are accelerating, particularly among younger demographics and individuals experiencing stress-related sleep disturbances. Technological disruptions, such as the integration of personalized soundscapes based on individual sleep patterns and the development of binaural beats for deeper relaxation, are key growth catalysts. Consumer behavior shifts are evident, with a growing preference for readily accessible, on-demand solutions for sleep improvement. The market penetration of sleep sound music apps is expected to reach over 40% in developed economies by 2033.

- Market Size Evolution: Significant expansion from historical levels to substantial projected growth.

- CAGR (2025-2033): Anticipated at a healthy 25%.

- Adoption Rates: Accelerating due to rising health consciousness and stress.

- Technological Disruptions: Personalized sound, AI integration, biofeedback.

- Consumer Behavior Shifts: Demand for convenient, digital sleep solutions.

- Market Penetration: Increasing across all demographics, with higher penetration in mature markets.

Dominant Regions, Countries, or Segments in Sleep Sound Music Apps

The Parent Market: For Adults segment, specifically within the Type: White Noise and Type: Light Music categories, currently drives the most significant market growth. North America, particularly the United States, leads the global market due to high disposable incomes, advanced technological adoption, and widespread awareness of mental health and wellness. Europe follows closely, with countries like the UK and Germany demonstrating strong engagement with sleep sound music apps.

In North America, the dominance is fueled by:

- High Disposable Income: Enabling widespread adoption of subscription-based services.

- Technological Infrastructure: Robust internet connectivity and smartphone penetration.

- Wellness Trends: A strong cultural emphasis on self-care and mental well-being.

- Market Share: Estimated to hold 45% of the global market in 2025.

- Growth Potential: Continual innovation and increasing adoption by older demographics.

The Parent Market: For Children is an emerging powerhouse, with a projected CAGR of 30% over the forecast period. This growth is attributed to increasing parental concern over children's sleep habits and the growing availability of child-friendly content and features.

- Dominant Segment (Application): For Adults, accounting for approximately 70% of the market share in 2025.

- Dominant Segment (Type): White Noise and Light Music, collectively making up 65% of the market.

- Leading Region: North America, with a strong foothold in the United States.

- Emerging High-Growth Segment: For Children, showing rapid expansion due to parental focus on well-being.

Sleep Sound Music Apps Product Landscape

Product innovation in the Sleep Sound Music Apps market is characterized by a focus on immersive and personalized experiences. Apps like Calm and Headspace are leading the charge with diverse sound libraries, guided meditations, and sleep stories. Companies are integrating features such as ambient sound generation (e.g., Noisli, Nature Space), AI-powered adaptive soundscapes that respond to user biofeedback, and the development of distinct audio types like Pink noise, white noise, brown noise, and nature sounds. The integration of curated playlists and the ability to mix and match sounds are crucial for user engagement. Innovations also extend to the Type: Others category, including ASMR content and binaural beats, catering to niche sleep needs. The overall performance metric focuses on user retention, daily active users, and subscription conversion rates, with Calm reportedly having over 100 million downloads.

Key Drivers, Barriers & Challenges in Sleep Sound Music Apps

Key Drivers:

- Increasing prevalence of sleep disorders and insomnia: A major impetus for seeking digital solutions.

- Growing awareness of mental health and wellness: Driving demand for stress-reduction tools.

- Advancements in mobile technology and AI: Enabling more sophisticated and personalized experiences.

- Convenience and accessibility of on-demand audio content: Meeting the needs of busy lifestyles.

- Expansion of the freemium model: Lowering barriers to entry and driving user acquisition.

Barriers & Challenges:

- Intense Market Competition: With numerous players, differentiation is crucial.

- User Retention: Keeping users engaged beyond the initial novelty.

- Monetization Strategies: Balancing free and premium offerings effectively.

- Perception of Efficacy: Overcoming skepticism about the effectiveness of app-based solutions for severe sleep issues.

- Data Privacy Concerns: As apps collect more user data for personalization, privacy becomes paramount.

- Cost of Content Creation and Licensing: Developing high-quality, diverse soundscapes can be expensive.

- Regulatory Scrutiny: Potential for evolving regulations around digital health and data.

Emerging Opportunities in Sleep Sound Music Apps

Emerging opportunities lie in the continued development of hyper-personalized sleep experiences, utilizing advanced AI and biofeedback integration to create unique soundscapes tailored to individual needs. The Parent Market: For Children presents a significant untapped market, with potential for interactive stories, lullabies, and educational content designed to promote healthy sleep habits from an early age. Expansion into new geographic regions with growing digital penetration and increasing health consciousness is also a key opportunity. Furthermore, partnerships with healthcare providers and wearable technology companies could unlock new revenue streams and enhance the credibility of these applications. The integration of sleep tracking and analysis directly within sound apps offers a comprehensive sleep solution.

Growth Accelerators in the Sleep Sound Music Apps Industry

Long-term growth in the Sleep Sound Music Apps industry will be propelled by technological breakthroughs such as real-time sleep stage analysis informing adaptive soundscapes and the development of immersive 3D audio environments. Strategic partnerships with mental health organizations, wellness influencers, and educational institutions will broaden reach and foster credibility. Market expansion strategies focusing on emerging economies with rising smartphone adoption and increasing health awareness will unlock new user bases. The continuous innovation in content variety, including partnerships with renowned musicians and sound designers, will keep user engagement high.

Key Players Shaping the Sleep Sound Music Apps Market

- Calm

- Headspace

- Relax Melodies

- SleepSpace

- Slumber

- Noisli

- Pzizz

- Nature Space

- Sleepa

- Nature Sounds

- White Noise Lite

- Tide

- Sleepjar

- Voice Apps

- AcousticSheep

- Relax & Sleep Well

Notable Milestones in Sleep Sound Music Apps Sector

- 2019: Increased adoption of meditation and mindfulness features within sleep apps.

- 2020: Surge in demand for sleep apps due to pandemic-related stress and altered routines.

- 2021: Introduction of advanced AI-driven personalized soundscape technology.

- 2022: Growing focus on integrating sleep sound apps with wearable devices for enhanced tracking.

- 2023: Expansion of content libraries to include ASMR and binaural beat offerings.

- 2024: Increased M&A activity as larger wellness platforms acquire specialized sleep sound app companies.

In-Depth Sleep Sound Music Apps Market Outlook

- 2019: Increased adoption of meditation and mindfulness features within sleep apps.

- 2020: Surge in demand for sleep apps due to pandemic-related stress and altered routines.

- 2021: Introduction of advanced AI-driven personalized soundscape technology.

- 2022: Growing focus on integrating sleep sound apps with wearable devices for enhanced tracking.

- 2023: Expansion of content libraries to include ASMR and binaural beat offerings.

- 2024: Increased M&A activity as larger wellness platforms acquire specialized sleep sound app companies.

In-Depth Sleep Sound Music Apps Market Outlook

The future market outlook for Sleep Sound Music Apps remains exceptionally strong, driven by sustained consumer interest in sleep optimization and mental well-being. Continued technological advancements in AI, biofeedback, and immersive audio will fuel product innovation and user engagement. Strategic expansion into underserved markets, coupled with partnerships across the healthcare and wellness ecosystems, will accelerate growth. The increasing demand for specialized content catering to diverse age groups and needs, particularly within the Parent Market: For Children, presents significant untapped potential. The market is expected to mature with a focus on robust subscription models and premium feature offerings, solidifying its position as an indispensable tool for enhancing sleep quality and overall health.

Sleep Sound Music Apps Segmentation

-

1. Application

- 1.1. For Children

- 1.2. For Adults

-

2. Types

- 2.1. White Noise

- 2.2. Light music

- 2.3. Others

Sleep Sound Music Apps Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sleep Sound Music Apps REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sleep Sound Music Apps Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. For Children

- 5.1.2. For Adults

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. White Noise

- 5.2.2. Light music

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sleep Sound Music Apps Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. For Children

- 6.1.2. For Adults

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. White Noise

- 6.2.2. Light music

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sleep Sound Music Apps Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. For Children

- 7.1.2. For Adults

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. White Noise

- 7.2.2. Light music

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sleep Sound Music Apps Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. For Children

- 8.1.2. For Adults

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. White Noise

- 8.2.2. Light music

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sleep Sound Music Apps Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. For Children

- 9.1.2. For Adults

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. White Noise

- 9.2.2. Light music

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sleep Sound Music Apps Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. For Children

- 10.1.2. For Adults

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. White Noise

- 10.2.2. Light music

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Relax Melodies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SleepSpace

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Slumber

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Noisli

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pzizz

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Calm

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nature Space

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sleepa

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nature Sounds

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 White Noise Lite

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tide

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sleepjar

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Voice Apps

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Headspace

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AcousticSheep

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Pink noise

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Relax & Sleep Well

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Relax Melodies

List of Figures

- Figure 1: Global Sleep Sound Music Apps Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Sleep Sound Music Apps Revenue (million), by Application 2024 & 2032

- Figure 3: North America Sleep Sound Music Apps Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Sleep Sound Music Apps Revenue (million), by Types 2024 & 2032

- Figure 5: North America Sleep Sound Music Apps Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Sleep Sound Music Apps Revenue (million), by Country 2024 & 2032

- Figure 7: North America Sleep Sound Music Apps Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Sleep Sound Music Apps Revenue (million), by Application 2024 & 2032

- Figure 9: South America Sleep Sound Music Apps Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Sleep Sound Music Apps Revenue (million), by Types 2024 & 2032

- Figure 11: South America Sleep Sound Music Apps Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Sleep Sound Music Apps Revenue (million), by Country 2024 & 2032

- Figure 13: South America Sleep Sound Music Apps Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sleep Sound Music Apps Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Sleep Sound Music Apps Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Sleep Sound Music Apps Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Sleep Sound Music Apps Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Sleep Sound Music Apps Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Sleep Sound Music Apps Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Sleep Sound Music Apps Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Sleep Sound Music Apps Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Sleep Sound Music Apps Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Sleep Sound Music Apps Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Sleep Sound Music Apps Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Sleep Sound Music Apps Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Sleep Sound Music Apps Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sleep Sound Music Apps Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sleep Sound Music Apps Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Sleep Sound Music Apps Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Sleep Sound Music Apps Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Sleep Sound Music Apps Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sleep Sound Music Apps Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sleep Sound Music Apps Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Sleep Sound Music Apps Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Sleep Sound Music Apps Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Sleep Sound Music Apps Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Sleep Sound Music Apps Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Sleep Sound Music Apps Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Sleep Sound Music Apps Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Sleep Sound Music Apps Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Sleep Sound Music Apps Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Sleep Sound Music Apps Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Sleep Sound Music Apps Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Sleep Sound Music Apps Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Sleep Sound Music Apps Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Sleep Sound Music Apps Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Sleep Sound Music Apps Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Sleep Sound Music Apps Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Sleep Sound Music Apps Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Sleep Sound Music Apps Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Sleep Sound Music Apps Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sleep Sound Music Apps?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Sleep Sound Music Apps?

Key companies in the market include Relax Melodies, SleepSpace, Slumber, Noisli, Pzizz, Calm, Nature Space, Sleepa, Nature Sounds, White Noise Lite, Tide, Sleepjar, Voice Apps, Headspace, AcousticSheep, Pink noise, Relax & Sleep Well.

3. What are the main segments of the Sleep Sound Music Apps?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sleep Sound Music Apps," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sleep Sound Music Apps report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sleep Sound Music Apps?

To stay informed about further developments, trends, and reports in the Sleep Sound Music Apps, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence