Key Insights

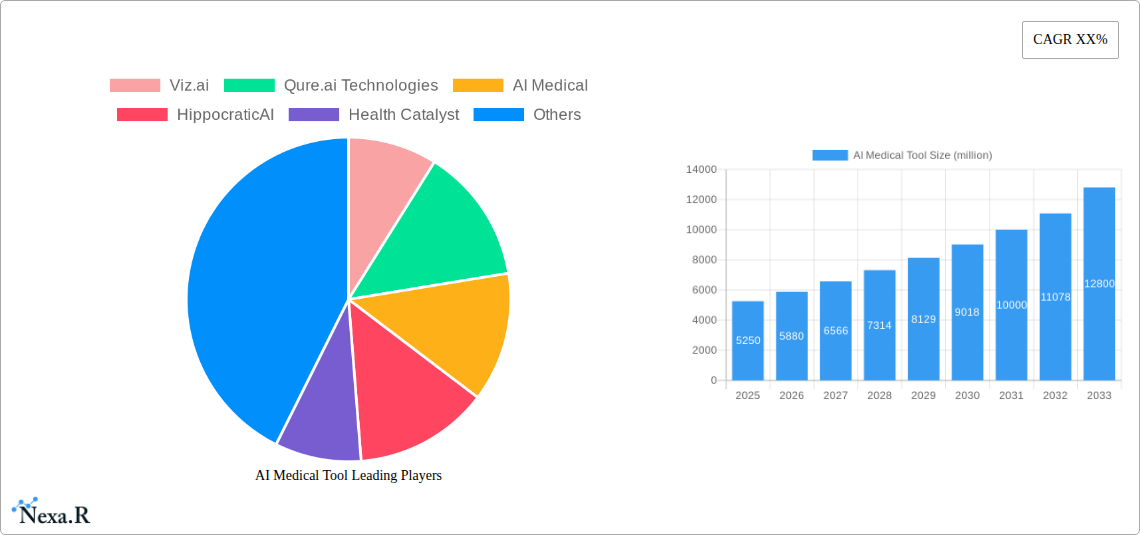

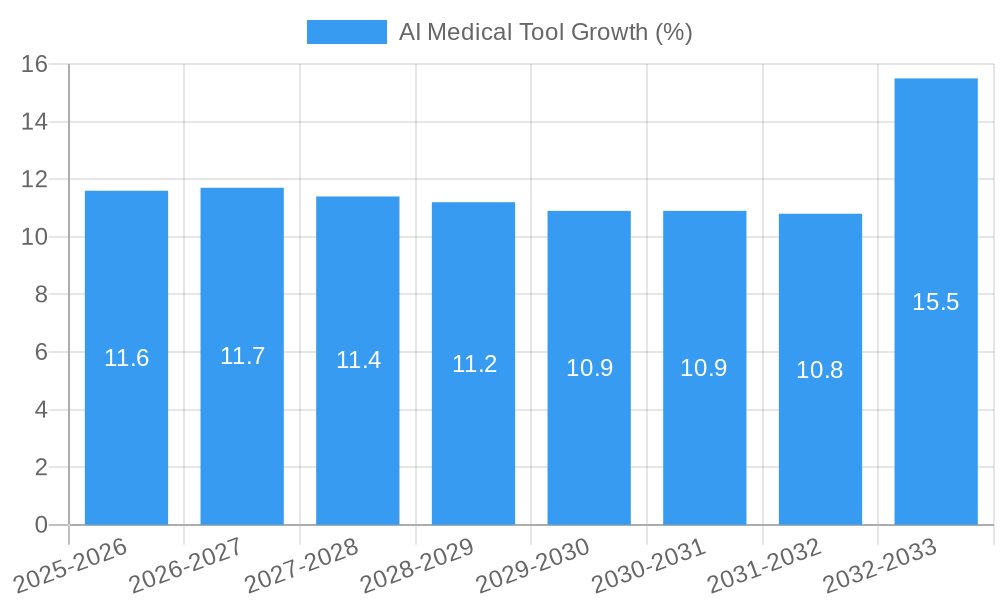

The global AI Medical Tool market is poised for substantial expansion, projected to reach an estimated market size of \$5,250 million by 2025 and surge to \$12,800 million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of approximately 12%. This impressive growth is primarily fueled by the escalating demand for enhanced diagnostic accuracy, the critical need for streamlined clinical workflows, and the burgeoning integration of artificial intelligence across various healthcare applications. Key drivers include the increasing adoption of AI in medical imaging for faster and more precise detection of diseases, the development of sophisticated diagnostic software capable of analyzing complex patient data, and the growing utility of remote monitoring tools to manage chronic conditions and improve patient outcomes, especially in underserved areas. The market's trajectory is further bolstered by significant advancements in AI algorithms and machine learning techniques, coupled with a growing willingness among healthcare providers to invest in innovative technological solutions that promise improved patient care and operational efficiency. The increasing volume of healthcare data also presents a significant opportunity for AI-powered tools to extract meaningful insights, leading to more personalized treatment plans and predictive healthcare models.

The AI Medical Tool market is characterized by a dynamic landscape, with key trends pointing towards greater adoption of AI for early disease detection, personalized medicine, and predictive analytics. The integration of AI in diagnostic software is revolutionizing how medical professionals interpret results, leading to quicker diagnoses and reduced human error. Imaging software, in particular, is benefiting from AI's ability to enhance image quality and identify subtle anomalies that might be missed by the human eye. Remote monitoring software is also gaining traction, enabling continuous patient oversight and facilitating timely interventions. Despite the immense growth potential, certain restraints could temper the pace of adoption. These include stringent regulatory hurdles for AI-driven medical devices, concerns surrounding data privacy and security, and the substantial initial investment required for implementing AI technologies. Furthermore, a shortage of skilled professionals capable of developing and deploying AI in healthcare settings could pose a challenge. However, ongoing research and development, coupled with supportive government initiatives and increasing venture capital funding, are expected to mitigate these challenges, propelling the AI Medical Tool market towards a future where AI plays an indispensable role in transforming healthcare delivery.

AI Medical Tool Market: Comprehensive Report & Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the global AI Medical Tool market, a rapidly expanding sector driven by the integration of artificial intelligence in healthcare. Covering the period from 2019 to 2033, with a base year of 2025, this study offers critical insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, emerging opportunities, and the competitive landscape. We explore the market's parent and child segments, providing a granular understanding of its structure and future potential. This report is essential for stakeholders seeking to navigate and capitalize on the transformative power of AI in medical diagnostics, imaging, and patient monitoring.

AI Medical Tool Market Dynamics & Structure

The AI Medical Tool market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing demand for advanced healthcare solutions. Market concentration is moderately fragmented, with key players continuously investing in research and development to gain a competitive edge. Technological innovation is primarily driven by advancements in machine learning algorithms, deep learning models, and natural language processing, enabling more accurate and efficient diagnostic and predictive capabilities. Regulatory bodies are actively developing guidelines to ensure the safety, efficacy, and ethical deployment of AI in medical settings, influencing product development and market entry strategies. Competitive product substitutes, while nascent, include traditional diagnostic methods and human-expert reliance, though AI tools are increasingly demonstrating superior performance and scalability. End-user demographics are diverse, spanning hospitals, clinics, and research institutions, each with specific needs and adoption patterns. Mergers and acquisition (M&A) trends are significant, with larger healthcare technology companies acquiring innovative AI startups to bolster their portfolios and expand market reach. For instance, approximately 15-20 M&A deals were observed annually during the historical period (2019-2024), with deal values ranging from $50 million to $500 million, reflecting the high strategic importance of AI capabilities.

- Market Concentration: Moderately fragmented, with a growing number of specialized AI vendors and established healthcare tech giants.

- Technological Innovation Drivers: Advancements in deep learning, computer vision, and NLP are enabling sophisticated AI applications.

- Regulatory Frameworks: Ongoing development of guidelines by FDA, EMA, and other bodies for AI medical device approval and oversight.

- Competitive Product Substitutes: Traditional manual analysis, conventional medical devices, and expert human judgment.

- End-User Demographics: Hospitals (60% market share in adoption), Clinics (30%), Research Institutions & Others (10%).

- M&A Trends: Strategic acquisitions aimed at integrating AI solutions and expanding market presence.

AI Medical Tool Growth Trends & Insights

The AI Medical Tool market is poised for substantial growth, driven by an increasing global focus on improving healthcare outcomes, reducing costs, and enhancing diagnostic accuracy. The market size, estimated at $5.5 billion in 2025, is projected to reach $28.7 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 23.5% during the forecast period (2025-2033). Adoption rates are accelerating as healthcare providers recognize the tangible benefits of AI in streamlining workflows, enabling early disease detection, and personalizing treatment plans. Technological disruptions, such as the development of more interpretable AI models and federated learning approaches for data privacy, are further fueling market expansion. Consumer behavior shifts are also playing a crucial role, with a growing demand for personalized medicine and remote patient monitoring solutions empowered by AI. The integration of AI into diagnostic software and imaging software is a primary driver, with these segments alone expected to contribute over 70% of the market revenue.

The increasing volume of medical data generated globally presents a significant opportunity for AI tools to extract valuable insights and support clinical decision-making. This data explosion, coupled with the growing sophistication of AI algorithms, is creating a virtuous cycle of innovation and adoption. Furthermore, the push for value-based healthcare models incentivizes the adoption of technologies that can demonstrate improved patient outcomes and cost efficiencies, making AI medical tools an attractive investment for healthcare systems worldwide. The market penetration of AI medical tools, currently at an estimated 15% in advanced economies, is expected to rise significantly as reimbursement policies evolve and the clinical evidence supporting their efficacy continues to grow. Key applications like AI-powered radiology analysis, pathology slide interpretation, and predictive analytics for disease progression are witnessing rapid uptake.

- Market Size Evolution: From an estimated $5.5 billion in 2025 to a projected $28.7 billion by 2033.

- CAGR: Approximately 23.5% during the forecast period (2025-2033).

- Adoption Rates: Accelerating due to demonstrated improvements in diagnostic accuracy, workflow efficiency, and cost reduction.

- Technological Disruptions: Rise of explainable AI (XAI), federated learning, and edge AI for enhanced privacy and real-time processing.

- Consumer Behavior Shifts: Growing demand for personalized medicine, preventative care, and remote health monitoring.

- Market Penetration: Expected to increase from 15% to over 40% in developed markets by 2033.

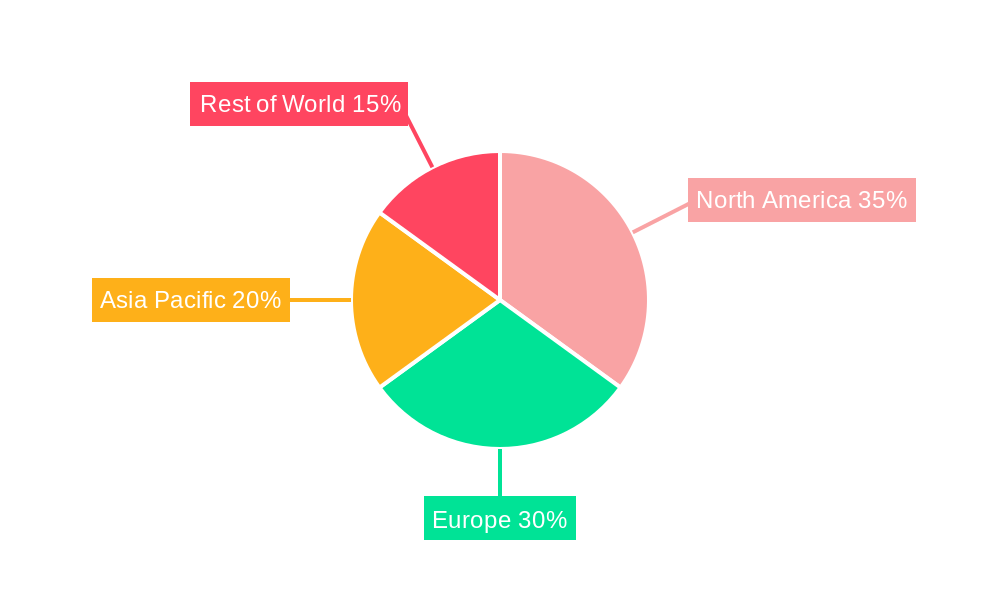

Dominant Regions, Countries, or Segments in AI Medical Tool

The Hospital application segment is the dominant force driving growth within the global AI Medical Tool market, accounting for an estimated 60% of the market share in 2025. This dominance is attributed to several key factors, including the substantial volume of patient data generated, the pressing need for enhanced diagnostic accuracy in complex cases, and the financial capacity of hospitals to invest in advanced technologies. Furthermore, hospitals are at the forefront of adopting AI for critical care applications, surgical planning, and streamlining administrative processes. The "Diagnostic Software" type segment is also a significant growth engine, projected to capture 40% of the market revenue by 2025, driven by AI's capability to analyze medical images, detect anomalies in pathology slides, and interpret complex genomic data with unparalleled speed and precision.

North America, particularly the United States, is the leading region, holding an estimated 45% of the global AI Medical Tool market in 2025. This leadership is propelled by a robust healthcare infrastructure, significant investment in R&D by both private and public sectors, favorable regulatory pathways for innovative medical technologies, and a high adoption rate of digital health solutions. Government initiatives and private funding for AI in healthcare research and development further bolster the region's dominance. The availability of a skilled workforce in AI and data science also contributes to the concentration of AI medical tool development and deployment in this region.

- Dominant Application Segment: Hospital (60% market share in 2025), driven by data volume, diagnostic needs, and investment capacity.

- Dominant Type Segment: Diagnostic Software (40% market share in 2025), fueled by AI's analytical capabilities in image and data interpretation.

- Leading Region: North America (45% market share in 2025), supported by strong healthcare infrastructure, R&D investment, and favorable regulations.

- Key Drivers for Regional Dominance:

- Economic Policies: Government incentives and funding for AI in healthcare innovation.

- Infrastructure: Advanced digital health infrastructure and connectivity.

- Research & Development: Significant investments in AI research and clinical trials.

- Skilled Workforce: Availability of AI and data science professionals.

- Regulatory Environment: Relatively progressive pathways for AI medical device approval.

AI Medical Tool Product Landscape

The AI Medical Tool product landscape is characterized by a wave of innovative solutions designed to augment human expertise and improve healthcare delivery. Key product categories include AI-powered diagnostic software that analyzes medical images like X-rays, CT scans, and MRIs to detect subtle anomalies, often surpassing human capabilities in speed and accuracy. Imaging software leverages AI for enhanced image reconstruction, noise reduction, and automated measurement. Remote monitoring software utilizes AI to analyze patient-generated data from wearable devices and sensors, enabling proactive identification of health deterioration. Other innovative products include AI-driven drug discovery platforms, personalized treatment recommendation systems, and AI assistants for clinical documentation. For instance, Viz.ai's AI-powered stroke detection platform has demonstrated significant improvements in reducing time to treatment. PathAI's solutions are revolutionizing cancer diagnosis by enhancing the accuracy of digital pathology.

Key Drivers, Barriers & Challenges in AI Medical Tool

Key Drivers:

The AI Medical Tool market is propelled by several critical drivers. Firstly, the escalating demand for improved diagnostic accuracy and faster disease detection is paramount. Secondly, the growing volume of healthcare data necessitates sophisticated analytical tools like AI to extract meaningful insights. Thirdly, the drive to reduce healthcare costs and enhance operational efficiency within healthcare systems fuels the adoption of AI-powered solutions. Finally, advancements in AI algorithms and computing power are continuously expanding the capabilities and applications of these tools.

Barriers & Challenges:

Despite the promising outlook, the AI Medical Tool market faces significant barriers and challenges. Supply chain issues for specialized hardware and components can impact production. Stringent regulatory hurdles and the need for extensive clinical validation for AI algorithms present a lengthy approval process, estimated to add 12-18 months to product development timelines. Data privacy and security concerns remain critical, requiring robust measures to protect sensitive patient information. The high initial cost of implementation and integration into existing healthcare IT infrastructure can be prohibitive for some organizations. Furthermore, the need for comprehensive training and upskilling of healthcare professionals to effectively utilize AI tools poses an ongoing challenge.

Emerging Opportunities in AI Medical Tool

Emerging opportunities in the AI Medical Tool sector are abundant, driven by unmet clinical needs and evolving healthcare paradigms. The increasing focus on preventative medicine and early disease detection presents a significant opportunity for AI-powered screening tools and risk stratification platforms. The expansion of telemedicine and remote patient monitoring, particularly in underserved areas, creates a demand for AI-driven virtual care solutions and intelligent diagnostic assistants. Personalized medicine, where AI can analyze genomic, clinical, and lifestyle data to tailor treatments, is another high-growth area. Furthermore, the application of AI in mental health diagnostics and therapy, as well as in the development of AI-powered robotic surgery, represents nascent but promising avenues for market expansion. The potential for AI to assist in clinical trial optimization and drug discovery also offers substantial untapped potential.

Growth Accelerators in the AI Medical Tool Industry

Several catalysts are accelerating the growth of the AI Medical Tool industry. Technological breakthroughs in areas such as federated learning and explainable AI (XAI) are addressing critical concerns around data privacy and trust, thereby facilitating broader adoption. Strategic partnerships between AI startups and established healthcare giants, such as collaborations between Viz.ai and major hospital networks, are crucial for scaling solutions and gaining market access. Government initiatives and funding for AI in healthcare research and development, particularly in countries like the United States and China, are significantly boosting innovation and market penetration. The increasing availability of high-quality, curated medical datasets for AI training is also a key growth accelerator, enabling the development of more robust and accurate algorithms. Market expansion strategies, including entry into emerging economies and the development of tailored solutions for specific medical specialties, are also driving overall growth.

Key Players Shaping the AI Medical Tool Market

- Viz.ai

- Qure.ai Technologies

- AI Medical

- HippocraticAI

- Health Catalyst

- Merative

- Enlitic

- Regard

- Twill Health

- Linus Health

- PathAI

- Buoy Health

- Freenome

- VirtuSense

- Caption Health

- Arterys

- Cleerly

- ClosedLoop

- deeperinsights

- Siemens Healthcare

Notable Milestones in AI Medical Tool Sector

- 2019: FDA clearance for several AI-powered diagnostic tools, signaling growing regulatory acceptance.

- 2020: Viz.ai receives FDA clearance for its AI-powered stroke detection platform, revolutionizing stroke care.

- 2021: Qure.ai Technologies secures significant funding to expand its AI solutions for radiology and tuberculosis detection.

- 2022: PathAI announces key partnerships to advance AI-driven cancer diagnostics, demonstrating strong clinical validation.

- 2023: HippocraticAI emerges with a focus on developing generative AI for healthcare, promising new patient interaction models.

- 2024: Merative acquires a leading healthcare analytics company, integrating advanced AI capabilities into its broader suite of solutions.

- Q1 2025: Siemens Healthcare launches a new generation of AI-enhanced imaging software, improving diagnostic workflows.

- Q2 2025: Health Catalyst announces a strategic expansion into AI-powered predictive analytics for chronic disease management.

In-Depth AI Medical Tool Market Outlook

The future outlook for the AI Medical Tool market is exceptionally promising, driven by sustained technological advancements and an increasing global imperative to optimize healthcare delivery. Growth accelerators such as federated learning for enhanced data privacy, explainable AI for building clinical trust, and strategic global partnerships will continue to fuel market expansion. The growing adoption of AI in diagnostic software and imaging software, coupled with the burgeoning demand for remote monitoring solutions, will form the bedrock of future revenue streams. Healthcare providers are increasingly recognizing the tangible return on investment, leading to accelerated adoption rates. Emerging opportunities in personalized medicine, preventative care, and AI-assisted drug discovery will further diversify the market and unlock new avenues for value creation, positioning the AI Medical Tool sector as a cornerstone of future healthcare innovation.

AI Medical Tool Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Types

- 2.1. Diagnostic Software

- 2.2. Imaging Software

- 2.3. Remote Monitoring Software

- 2.4. Others

AI Medical Tool Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

AI Medical Tool REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AI Medical Tool Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Diagnostic Software

- 5.2.2. Imaging Software

- 5.2.3. Remote Monitoring Software

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America AI Medical Tool Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Diagnostic Software

- 6.2.2. Imaging Software

- 6.2.3. Remote Monitoring Software

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America AI Medical Tool Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Diagnostic Software

- 7.2.2. Imaging Software

- 7.2.3. Remote Monitoring Software

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe AI Medical Tool Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Diagnostic Software

- 8.2.2. Imaging Software

- 8.2.3. Remote Monitoring Software

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa AI Medical Tool Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Diagnostic Software

- 9.2.2. Imaging Software

- 9.2.3. Remote Monitoring Software

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific AI Medical Tool Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Diagnostic Software

- 10.2.2. Imaging Software

- 10.2.3. Remote Monitoring Software

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Viz.ai

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Qure.ai Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AI Medical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HippocraticAI

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Health Catalyst

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merative

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Enlitic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Regard

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Twill Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Linus Health

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PathAI

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Buoy Health

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Freenome

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 VirtuSense

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Caption Health

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Arterys

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Cleerly

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ClosedLoop

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 deeperinsights

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Siemens Healthcare

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Viz.ai

List of Figures

- Figure 1: Global AI Medical Tool Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America AI Medical Tool Revenue (million), by Application 2024 & 2032

- Figure 3: North America AI Medical Tool Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America AI Medical Tool Revenue (million), by Types 2024 & 2032

- Figure 5: North America AI Medical Tool Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America AI Medical Tool Revenue (million), by Country 2024 & 2032

- Figure 7: North America AI Medical Tool Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America AI Medical Tool Revenue (million), by Application 2024 & 2032

- Figure 9: South America AI Medical Tool Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America AI Medical Tool Revenue (million), by Types 2024 & 2032

- Figure 11: South America AI Medical Tool Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America AI Medical Tool Revenue (million), by Country 2024 & 2032

- Figure 13: South America AI Medical Tool Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe AI Medical Tool Revenue (million), by Application 2024 & 2032

- Figure 15: Europe AI Medical Tool Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe AI Medical Tool Revenue (million), by Types 2024 & 2032

- Figure 17: Europe AI Medical Tool Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe AI Medical Tool Revenue (million), by Country 2024 & 2032

- Figure 19: Europe AI Medical Tool Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa AI Medical Tool Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa AI Medical Tool Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa AI Medical Tool Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa AI Medical Tool Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa AI Medical Tool Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa AI Medical Tool Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific AI Medical Tool Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific AI Medical Tool Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific AI Medical Tool Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific AI Medical Tool Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific AI Medical Tool Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific AI Medical Tool Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global AI Medical Tool Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global AI Medical Tool Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global AI Medical Tool Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global AI Medical Tool Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global AI Medical Tool Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global AI Medical Tool Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global AI Medical Tool Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global AI Medical Tool Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global AI Medical Tool Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global AI Medical Tool Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global AI Medical Tool Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global AI Medical Tool Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global AI Medical Tool Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global AI Medical Tool Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global AI Medical Tool Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global AI Medical Tool Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global AI Medical Tool Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global AI Medical Tool Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global AI Medical Tool Revenue million Forecast, by Country 2019 & 2032

- Table 41: China AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific AI Medical Tool Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AI Medical Tool?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the AI Medical Tool?

Key companies in the market include Viz.ai, Qure.ai Technologies, AI Medical, HippocraticAI, Health Catalyst, Merative, Enlitic, Regard, Twill Health, Linus Health, PathAI, Buoy Health, Freenome, VirtuSense, Caption Health, Arterys, Cleerly, ClosedLoop, deeperinsights, Siemens Healthcare.

3. What are the main segments of the AI Medical Tool?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AI Medical Tool," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AI Medical Tool report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AI Medical Tool?

To stay informed about further developments, trends, and reports in the AI Medical Tool, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence