Key Insights

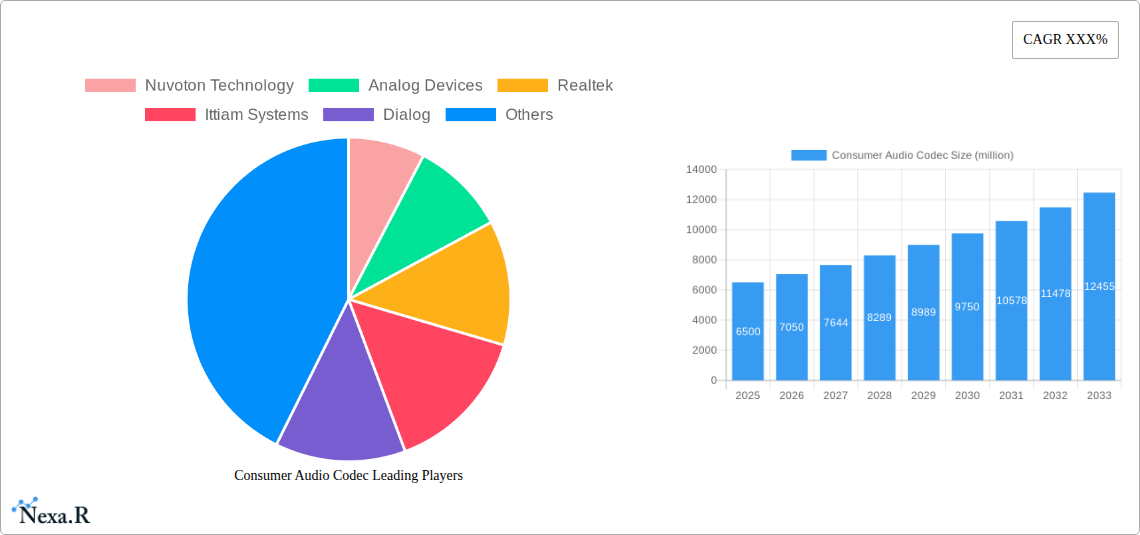

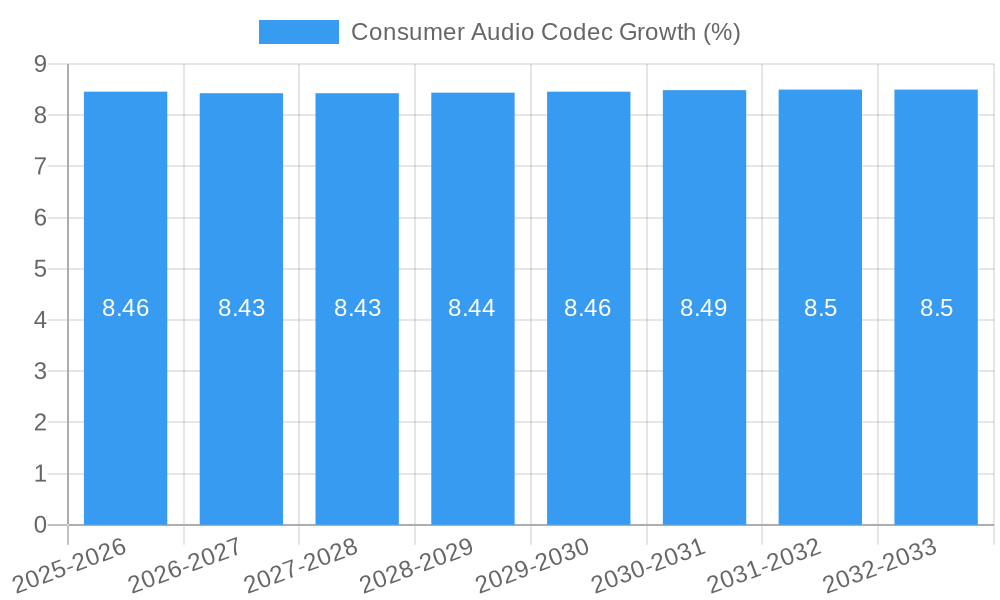

The global Consumer Audio Codec market is poised for significant expansion, projected to reach a substantial market size of approximately $6,500 million by 2025. This growth is propelled by a Compound Annual Growth Rate (CAGR) of roughly 8.5% anticipated over the forecast period of 2025-2033. The increasing demand for high-fidelity audio experiences in consumer electronics, coupled with the burgeoning adoption of smart home devices and wearable technology, are key drivers behind this upward trajectory. Advancements in digital audio codecs are enabling more efficient compression and superior sound quality, directly fueling market penetration. The residential use segment, in particular, is experiencing robust demand driven by the proliferation of soundbars, smart speakers, and home theater systems.

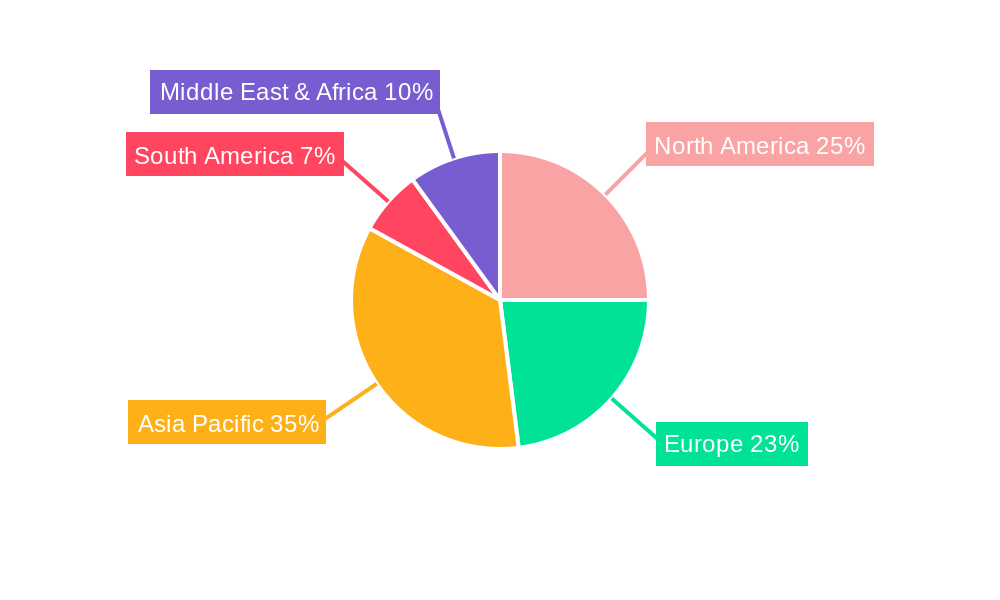

Despite the positive outlook, certain restraints may temper the market's pace. The high cost associated with developing and integrating cutting-edge codec technologies, alongside potential fragmentation in industry standards, could present challenges. However, ongoing innovation in areas like AI-powered audio processing and the integration of audio codecs into increasingly complex System-on-Chips (SoCs) are expected to offset these restraints. The market is characterized by a dynamic competitive landscape, with key players like Texas Instruments, Analog Devices, and Realtek actively investing in research and development to capture market share. Asia Pacific, led by China and India, is expected to emerge as a dominant region due to its vast consumer base and rapid technological adoption, while North America and Europe will continue to be significant contributors to market growth.

Here's the SEO-optimized report description for the Consumer Audio Codec market, incorporating all your requirements:

Consumer Audio Codec Market: Global Outlook and Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the global Consumer Audio Codec market, offering critical insights into its dynamics, growth trends, competitive landscape, and future outlook. Designed for industry professionals, investors, and strategists, this report leverages extensive data and expert analysis to deliver actionable intelligence. We explore the intricate parent and child market structures, revealing growth pockets and strategic imperatives for stakeholders. The study covers the period from 2019 to 2033, with a base year of 2025 and a detailed forecast for 2025-2033. Quantified with values in million units, this report ensures precise understanding of market scale and evolution.

Consumer Audio Codec Market Dynamics & Structure

The Consumer Audio Codec market exhibits a moderately concentrated structure, with a few key players dominating innovation and market share. Technological advancements, particularly in digital audio processing and integration capabilities, are the primary drivers of market expansion. Evolving regulatory frameworks around digital signal processing and audio quality standards also play a significant role in shaping product development and market entry. Competitive product substitutes include integrated solutions within System-on-Chips (SoCs) and increasing sophistication of software-based audio processing, though dedicated hardware codecs retain a strong presence due to performance and efficiency. End-user demographics are shifting towards younger, tech-savvy consumers demanding immersive audio experiences in smartphones, wearables, and smart home devices. Mergers and acquisitions (M&A) are a notable trend, with larger semiconductor companies acquiring specialized codec providers to enhance their product portfolios and expand market reach.

- Market Concentration: Moderately concentrated, with leading players focusing on R&D and strategic partnerships.

- Technological Innovation Drivers: Miniaturization, power efficiency, advanced noise cancellation, high-resolution audio support, and AI integration for audio enhancement.

- Regulatory Frameworks: Evolving standards for digital audio transmission, interoperability, and environmental compliance influencing product design.

- Competitive Product Substitutes: Software codecs, integrated SoC audio blocks, and emerging audio rendering technologies.

- End-User Demographics: Growing demand from millennials and Gen Z for premium audio in mobile devices, gaming consoles, and smart entertainment systems.

- M&A Trends: Strategic acquisitions to gain intellectual property, expand product offerings, and consolidate market position. Estimated M&A deal volumes in the last five years are in the range of 15-25 deals annually.

Consumer Audio Codec Growth Trends & Insights

The Consumer Audio Codec market is poised for robust growth, driven by a confluence of escalating consumer demand for superior audio experiences and relentless technological innovation. The market size is projected to expand significantly, with an estimated market value of xx million units in the base year 2025, reaching xx million units by the end of the forecast period in 2033. This expansion is fueled by a consistent Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period. The increasing penetration of high-definition audio content, coupled with the proliferation of smart audio devices such as wireless earbuds, soundbars, smart speakers, and in-car entertainment systems, are key adoption rate accelerators. Consumers are increasingly willing to invest in devices that offer enhanced audio fidelity, noise cancellation, and spatial audio capabilities, directly impacting the demand for advanced audio codecs. Technological disruptions, including the advent of AI-powered audio processing for personalized sound profiles, real-time audio enhancement, and improved voice recognition, are creating new product categories and driving upgrade cycles. Furthermore, the growing popularity of immersive gaming and virtual reality experiences necessitates sophisticated audio codecs that can deliver realistic and engaging soundscapes. Consumer behavior shifts are evident in the preference for seamless connectivity, multi-room audio synchronization, and voice-activated control, all of which rely on efficient and high-performance audio codec solutions. The trend towards miniaturization and power efficiency in portable devices also pushes the development of compact yet powerful audio codecs. The historical period (2019-2024) witnessed a steady increase in market adoption, driven by the initial surge in TWS earbuds and smart speakers, laying a strong foundation for future expansion. The estimated market size in 2024 was xx million units. As technology matures and consumer expectations evolve, the Consumer Audio Codec market is set to become an increasingly critical component of the consumer electronics ecosystem.

Dominant Regions, Countries, or Segments in Consumer Audio Codec

The Digital Consumer Audio Codecs segment is the dominant force driving the global Consumer Audio Codec market. This dominance stems from the pervasive integration of digital audio technologies across a vast spectrum of consumer electronics. The Residential Use application segment, encompassing smart home devices, home theater systems, and portable audio players, represents a significant growth engine within this digital framework. Regionally, Asia Pacific emerges as the leading market, propelled by its massive consumer base, robust manufacturing capabilities, and rapid adoption of cutting-edge consumer electronics.

- Dominant Segment: Digital Consumer Audio Codecs, accounting for an estimated 85% of the total market share in 2025. This segment's dominance is attributed to the transition from analog to digital signal processing for superior audio quality, advanced features, and reduced form factors.

- Key Application Driver: Residential Use, contributing approximately 60% to the overall application market in 2025. The proliferation of smart speakers, soundbars, wireless audio systems, and smart TVs in homes fuels demand for high-performance digital audio codecs.

- Leading Region: Asia Pacific, projected to capture around 45% of the global market share by 2025. This region's leadership is driven by factors such as a burgeoning middle class, increased disposable income, rapid urbanization, and its status as a global hub for consumer electronics manufacturing and innovation. Countries like China, South Korea, and Japan are at the forefront of this growth.

- Growth Potential in Asia Pacific: The region benefits from strong government support for technology development, a highly competitive market that fosters innovation, and a large, receptive consumer base eager to adopt new audio technologies.

- Emerging Growth in Commercial Use: While Residential Use leads, the Commercial Use segment, including audio solutions for retail spaces, public address systems, and professional audio equipment, is also experiencing steady growth, driven by an increasing demand for high-quality audio in public and business environments. This segment is expected to grow at a CAGR of 7.2% from 2025-2033.

- Country-Specific Dominance within Asia Pacific: China, with its immense market size and manufacturing prowess, is a key influencer. South Korea and Japan contribute significantly through their leading consumer electronics brands known for audio innovation.

Consumer Audio Codec Product Landscape

The Consumer Audio Codec product landscape is characterized by continuous innovation focused on enhancing audio fidelity, reducing power consumption, and enabling advanced features. Leading products offer multi-channel support, high-resolution audio decoding (e.g., Hi-Res Audio, DSD), and sophisticated digital signal processing (DSP) capabilities for noise cancellation, equalization, and spatial audio rendering. Unique selling propositions include ultra-low power consumption for battery-powered devices, seamless integration with wireless protocols like Bluetooth 5.3 and Wi-Fi 6, and advanced AI acceleration for intelligent audio processing. Technological advancements are driving the development of smaller form factors, improved thermal management, and enhanced interoperability with various audio ecosystems.

Key Drivers, Barriers & Challenges in Consumer Audio Codec

Key Drivers:

- Rising Demand for Immersive Audio: Consumers increasingly seek richer, more engaging audio experiences in entertainment, gaming, and communication.

- Proliferation of Smart Devices: The widespread adoption of smartphones, smart speakers, wearables, and IoT devices creates a continuous need for integrated audio solutions.

- Technological Advancements: Innovations in digital signal processing, AI, and miniaturization enable higher performance and new functionalities.

- Growth in High-Resolution Audio Content: The availability of lossless and high-resolution audio formats encourages the use of advanced codecs.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors and component shortages can impact production timelines and costs, with an estimated 5-10% impact on production capacity in certain periods.

- Increasing Component Costs: Rising raw material and manufacturing expenses can pressure profit margins.

- Intense Competition: The market is competitive, leading to price pressures and a need for continuous differentiation.

- Regulatory Compliance: Meeting evolving global standards for audio quality, power efficiency, and environmental impact requires significant R&D investment.

- Integration Complexity: Integrating advanced codecs into complex system-on-chips (SoCs) requires specialized expertise and can extend development cycles.

Emerging Opportunities in Consumer Audio Codec

Emerging opportunities lie in the burgeoning market for AI-driven audio personalization, enabling codecs to adapt sound profiles to individual user preferences and environmental acoustics. The expansion of the metaverse and advanced gaming environments presents a significant opportunity for codecs supporting highly realistic spatial audio and immersive soundscapes. Furthermore, the demand for robust and secure audio solutions in the automotive sector, particularly for in-cabin entertainment and advanced driver-assistance systems (ADAS), offers a substantial growth avenue. Untapped markets include developing economies where premium audio is becoming increasingly aspirational, and niche applications like professional audio streaming and advanced hearing aids.

Growth Accelerators in the Consumer Audio Codec Industry

Long-term growth in the Consumer Audio Codec industry is being accelerated by breakthroughs in low-power, high-performance processing architectures, enabling more sophisticated audio features in battery-constrained devices. Strategic partnerships between semiconductor manufacturers and audio software specialists are fostering the development of integrated, end-to-end audio solutions. Market expansion strategies targeting emerging economies, where the adoption of consumer electronics is rapidly increasing, also act as significant growth accelerators. The continuous evolution of wireless audio technologies, such as LE Audio, promises enhanced quality and efficiency, further driving demand for compatible codecs.

Key Players Shaping the Consumer Audio Codec Market

- Nuvoton Technology

- Analog Devices

- Realtek

- Ittiam Systems

- Dialog

- STMicroelectronics

- Texas Instruments

Notable Milestones in Consumer Audio Codec Sector

- 2021: Introduction of Bluetooth LE Audio standard, enabling new possibilities for efficient, high-quality wireless audio.

- 2022: Launch of advanced AI-enabled audio codecs for smart home devices, offering personalized sound experiences.

- 2023: Significant advancements in spatial audio codecs for virtual and augmented reality applications, enhancing immersion.

- 2024: Increased integration of audio codecs within System-on-Chips (SoCs) for mobile devices, driving miniaturization and power efficiency.

- 2024: Major semiconductor companies announce strategic acquisitions of specialized audio codec IP providers to bolster their portfolios.

In-Depth Consumer Audio Codec Market Outlook

The Consumer Audio Codec market is set for sustained and accelerated growth, fueled by ongoing technological innovation and evolving consumer demands for premium audio experiences. Key growth accelerators include the widespread adoption of AI for audio processing, the expansion of immersive audio technologies in gaming and XR, and the increasing integration of sophisticated audio solutions within the automotive sector. Strategic partnerships and aggressive R&D investments by leading players are further solidifying the market's trajectory. Future market potential is immense, with opportunities in emerging economies and niche applications presenting attractive avenues for expansion and revenue generation. Stakeholders who can effectively navigate supply chain complexities and capitalize on the demand for high-fidelity, feature-rich audio solutions will be well-positioned for success.

Consumer Audio Codec Segmentation

-

1. Application

- 1.1. Residential Use

- 1.2. Commercial Use

-

2. Type

- 2.1. Analog Consumer Audio Codecs

- 2.2. Digital Consumer Audio Codecs

Consumer Audio Codec Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Consumer Audio Codec REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Audio Codec Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Use

- 5.1.2. Commercial Use

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Analog Consumer Audio Codecs

- 5.2.2. Digital Consumer Audio Codecs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Consumer Audio Codec Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Use

- 6.1.2. Commercial Use

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Analog Consumer Audio Codecs

- 6.2.2. Digital Consumer Audio Codecs

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Consumer Audio Codec Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Use

- 7.1.2. Commercial Use

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Analog Consumer Audio Codecs

- 7.2.2. Digital Consumer Audio Codecs

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Consumer Audio Codec Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Use

- 8.1.2. Commercial Use

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Analog Consumer Audio Codecs

- 8.2.2. Digital Consumer Audio Codecs

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Consumer Audio Codec Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Use

- 9.1.2. Commercial Use

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Analog Consumer Audio Codecs

- 9.2.2. Digital Consumer Audio Codecs

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Consumer Audio Codec Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Use

- 10.1.2. Commercial Use

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Analog Consumer Audio Codecs

- 10.2.2. Digital Consumer Audio Codecs

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nuvoton Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Analog Devices

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Realtek

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ittiam Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dialog

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STMicroelectronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Texas Instruments

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Nuvoton Technology

List of Figures

- Figure 1: Global Consumer Audio Codec Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Consumer Audio Codec Revenue (million), by Application 2024 & 2032

- Figure 3: North America Consumer Audio Codec Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Consumer Audio Codec Revenue (million), by Type 2024 & 2032

- Figure 5: North America Consumer Audio Codec Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Consumer Audio Codec Revenue (million), by Country 2024 & 2032

- Figure 7: North America Consumer Audio Codec Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Consumer Audio Codec Revenue (million), by Application 2024 & 2032

- Figure 9: South America Consumer Audio Codec Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Consumer Audio Codec Revenue (million), by Type 2024 & 2032

- Figure 11: South America Consumer Audio Codec Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Consumer Audio Codec Revenue (million), by Country 2024 & 2032

- Figure 13: South America Consumer Audio Codec Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Consumer Audio Codec Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Consumer Audio Codec Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Consumer Audio Codec Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Consumer Audio Codec Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Consumer Audio Codec Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Consumer Audio Codec Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Consumer Audio Codec Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Consumer Audio Codec Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Consumer Audio Codec Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Consumer Audio Codec Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Consumer Audio Codec Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Consumer Audio Codec Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Consumer Audio Codec Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Consumer Audio Codec Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Consumer Audio Codec Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Consumer Audio Codec Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Consumer Audio Codec Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Consumer Audio Codec Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Consumer Audio Codec Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Consumer Audio Codec Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Consumer Audio Codec Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Consumer Audio Codec Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Consumer Audio Codec Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Consumer Audio Codec Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Consumer Audio Codec Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Consumer Audio Codec Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Consumer Audio Codec Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Consumer Audio Codec Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Consumer Audio Codec Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Consumer Audio Codec Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Consumer Audio Codec Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Consumer Audio Codec Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Consumer Audio Codec Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Consumer Audio Codec Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Consumer Audio Codec Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Consumer Audio Codec Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Consumer Audio Codec Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Consumer Audio Codec Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Audio Codec?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Consumer Audio Codec?

Key companies in the market include Nuvoton Technology, Analog Devices, Realtek, Ittiam Systems, Dialog, STMicroelectronics, Texas Instruments.

3. What are the main segments of the Consumer Audio Codec?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Audio Codec," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Audio Codec report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Audio Codec?

To stay informed about further developments, trends, and reports in the Consumer Audio Codec, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence