Key Insights

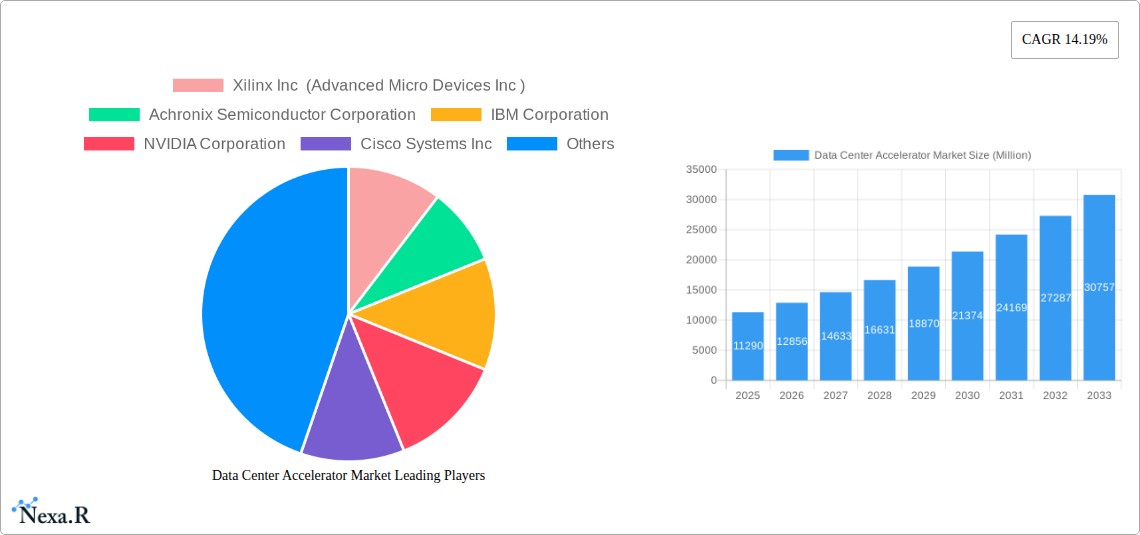

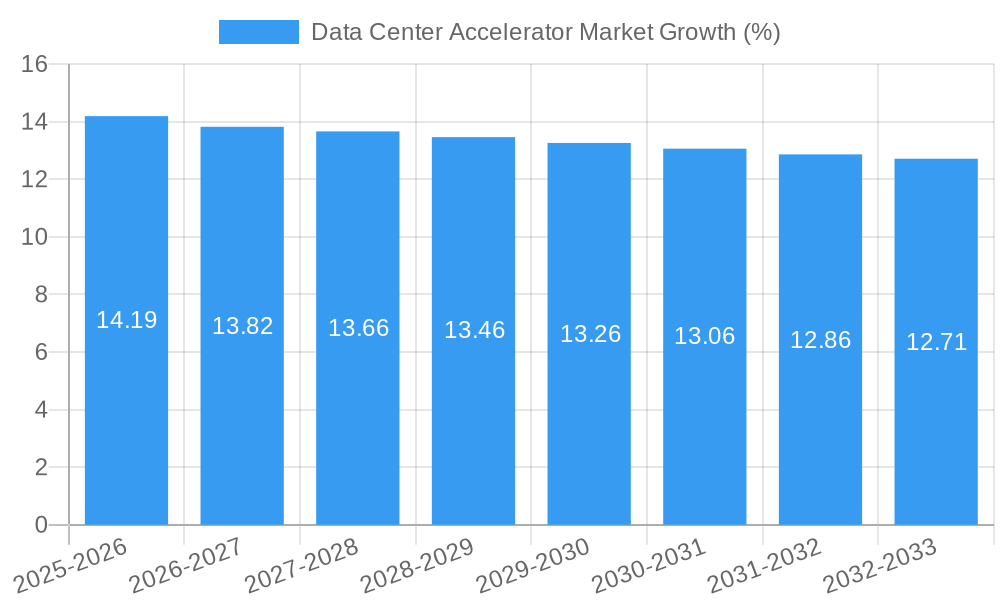

The global Data Center Accelerator Market is poised for remarkable expansion, projected to reach approximately USD 11.29 billion in the base year of 2025. This impressive growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 14.19% from 2019 to 2033, indicating a dynamic and rapidly evolving landscape. The primary drivers fueling this surge are the insatiable demand for enhanced processing power within data centers, driven by the burgeoning adoption of Artificial Intelligence (AI) and High-Performance Computing (HPC). As AI models become increasingly complex and data-intensive, and as scientific research, financial modeling, and big data analytics push the boundaries of traditional computing, the need for specialized accelerators becomes paramount. These accelerators, including CPUs, GPUs, FPGAs, and ASICs, are designed to offload computationally intensive tasks from general-purpose processors, thereby significantly boosting efficiency, reducing latency, and lowering power consumption. The market's expansion is further propelled by the continuous innovation in hardware design and the increasing deployment of hyperscale data centers worldwide.

Key trends shaping the data center accelerator market include the growing integration of AI-specific hardware and the rising popularity of heterogeneous computing architectures, which leverage the strengths of various accelerator types. The shift towards edge computing also presents a significant opportunity, as accelerators are increasingly being deployed closer to data sources to enable real-time processing. However, the market faces certain restraints, such as the high initial investment costs associated with advanced accelerator technologies and the ongoing challenge of managing the complexity of integrated systems. Furthermore, the rapid pace of technological evolution necessitates continuous research and development, which can pose a barrier to entry for smaller players. Despite these challenges, the sustained growth of cloud computing, the proliferation of data, and the continuous pursuit of greater computational efficiency ensure a bright future for the data center accelerator market, with significant opportunities for established players like NVIDIA, Intel, AMD, and emerging innovators.

Data Center Accelerator Market: Unleashing Next-Gen Compute Power for AI & HPC

This comprehensive report delivers an in-depth analysis of the Data Center Accelerator Market, a pivotal sector driving the exponential growth of High-Performance Computing (HPC) and Artificial Intelligence (AI). Explore market dynamics, growth trajectories, dominant regions, and key players shaping the future of data processing. Discover how specialized hardware is revolutionizing data center efficiency and performance. The market encompasses critical segments like CPU (Central Processing Unit), GPU (Graphics Processing Unit), FPGA (Field-Programmable Gate Array), and ASIC (Application-specific Integrated Circuit) processors, powering diverse applications including High-performance Computing, Artificial Intelligence, and Other Applications. This analysis covers the Study Period: 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033.

Data Center Accelerator Market Dynamics & Structure

The Data Center Accelerator Market is characterized by intense technological innovation and a rapidly evolving competitive landscape. Market concentration is influenced by a few dominant players in specific processor segments, particularly in GPUs and ASICs for AI workloads. Key drivers of technological innovation include the insatiable demand for faster processing in AI model training and inference, and the ever-increasing data volumes generated by IoT devices and digital transformation initiatives. Regulatory frameworks, while not directly dictating accelerator hardware, indirectly influence adoption through data privacy regulations and mandates for energy efficiency in data centers. Competitive product substitutes exist, with ongoing advancements in general-purpose CPUs attempting to bridge performance gaps, but specialized accelerators maintain a significant edge for targeted workloads. End-user demographics are shifting towards enterprises heavily invested in AI, machine learning, cloud computing, and big data analytics, spanning sectors like technology, finance, healthcare, and research. Mergers and acquisitions (M&A) are a significant trend, as larger technology companies seek to acquire specialized IP and talent to bolster their accelerator offerings. For instance, the acquisition of Xilinx by AMD signifies a strategic move to integrate advanced FPGA capabilities into their processor portfolio, aiming to capture a broader market share in AI and adaptive computing. The market's structure is a blend of integrated semiconductor manufacturers, fabless design houses, and system integrators, all contributing to the ecosystem. Barriers to innovation include the substantial R&D investments required for cutting-edge chip design, the long design cycles, and the complexity of software and hardware integration. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15.5% from 2025 to 2033, with its valuation reaching an estimated $38,700 Million in 2025 and soaring to approximately $102,500 Million by 2033.

Data Center Accelerator Market Growth Trends & Insights

The Data Center Accelerator Market is experiencing robust growth, driven by the transformative impact of advanced computing technologies on virtually every industry. The market size has seen a significant expansion from an estimated $15,800 Million in 2019 to an estimated $28,500 Million in 2024, demonstrating a healthy historical growth trajectory. This upward trend is fueled by escalating adoption rates of AI and machine learning applications across enterprises seeking to gain competitive advantages through data-driven insights and automation. Technological disruptions are at the forefront, with continuous advancements in chip architectures, interconnect technologies, and memory solutions enabling unprecedented processing speeds and energy efficiency. The shift towards specialized accelerators, such as GPUs for parallel processing and FPGAs for reconfigurable computing, is a testament to the industry's pursuit of optimized performance for specific workloads. Consumer behavior shifts are also playing a crucial role, as businesses increasingly prioritize cloud-native solutions and leverage cloud service providers that offer access to cutting-edge accelerator hardware. This democratizes access to powerful computing resources, accelerating innovation across smaller and medium-sized enterprises as well. The market penetration of accelerators is expanding beyond traditional HPC domains into emerging areas like autonomous driving, advanced scientific research, and real-time analytics. The estimated market size for 2025 stands at an impressive $38,700 Million, with projections indicating a surge to approximately $102,500 Million by 2033, reflecting a compelling CAGR of 15.5% during the forecast period. This sustained growth underscores the indispensable role of data center accelerators in powering the digital economy and enabling next-generation technological advancements.

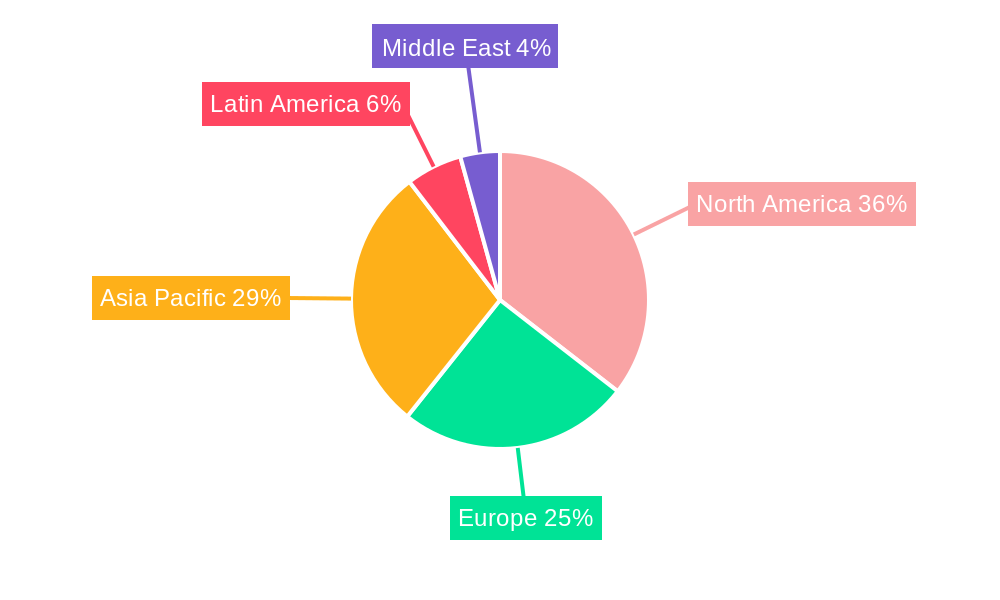

Dominant Regions, Countries, or Segments in Data Center Accelerator Market

The Data Center Accelerator Market is witnessing significant regional dominance, with North America and Asia Pacific emerging as key growth engines. Within North America, the United States leads due to its established presence of major technology companies, robust AI research and development ecosystem, and substantial investments in cloud infrastructure. The region's high concentration of hyperscale data centers and a strong demand for AI-powered solutions in sectors like finance, healthcare, and technology contribute significantly to its market leadership. Countries like China and Japan are driving growth in the Asia Pacific region, fueled by government initiatives supporting AI development, a rapidly expanding digital economy, and a burgeoning semiconductor industry. Investments in smart city projects and the widespread adoption of IoT devices in these countries are creating a massive demand for data processing power, further boosting the accelerator market.

Among the processor types, GPUs (Graphics Processing Units) currently hold a dominant position, primarily due to their exceptional parallel processing capabilities, making them ideal for deep learning training and inference workloads. The surge in AI adoption directly translates to increased demand for GPUs. However, ASICs (Application-specific Integrated Circuits) are rapidly gaining traction, particularly for specific AI workloads where tailored designs offer superior performance and energy efficiency. FPGAs (Field-Programmable Gate Arrays) are carving out a niche in applications requiring reconfigurability and low latency, such as network acceleration and specialized HPC tasks. CPUs (Central Processing Units), while foundational, are increasingly being augmented or replaced by accelerators for intensive computational tasks.

In terms of applications, Artificial Intelligence is the most significant growth driver, accounting for a substantial portion of the market's demand. The continuous development of more complex AI models and the expansion of AI into new domains, from natural language processing to computer vision, are fueling this trend. High-performance Computing (HPC) remains a critical application, powering scientific research, climate modeling, drug discovery, and financial simulations. The ongoing need for ever-increasing computational power in these fields ensures sustained demand for accelerators. Other Applications, encompassing areas like video analytics, cryptography, and genomics, are also contributing to market growth as specialized accelerators find their way into more niche but high-impact use cases.

Data Center Accelerator Market Product Landscape

The Data Center Accelerator Market is characterized by a dynamic product landscape driven by continuous innovation in hardware design and specialization. Leading companies are launching advanced processors tailored for specific computational demands. For instance, NVIDIA's latest GPU architectures offer significantly enhanced performance for AI training and inference, featuring specialized Tensor Cores and high-bandwidth memory. AMD, through its acquisition of Xilinx, is integrating high-performance FPGAs that provide reconfigurable acceleration for diverse workloads, offering flexibility alongside raw power. Intel is focusing on its diverse portfolio, including CPUs with integrated AI capabilities and specialized AI accelerators, aiming for a broad market reach. Achronix and Qualcomm are also contributing with innovative FPGA and custom silicon solutions respectively, catering to specialized market segments and edge computing demands. These products are designed to reduce latency, increase throughput, and improve energy efficiency in data centers, enabling faster time-to-insight and more cost-effective operations for AI, HPC, and other demanding applications.

Key Drivers, Barriers & Challenges in Data Center Accelerator Market

Key Drivers:

- Explosive Growth of AI and Machine Learning: The insatiable demand for processing power for training and deploying AI models is the primary catalyst. This fuels the need for specialized hardware like GPUs and ASICs.

- Increasing Data Volumes: The proliferation of IoT devices, big data analytics, and digital content generation necessitates accelerators to efficiently process and analyze vast datasets.

- Advancements in HPC Applications: Scientific research, climate modeling, drug discovery, and financial simulations require immense computational power, driving the adoption of accelerators.

- Cloud Computing Expansion: Cloud providers are investing heavily in accelerators to offer high-performance computing services, democratizing access for a wider range of users.

- Energy Efficiency Demands: The drive for greener data centers encourages the use of accelerators that can deliver higher performance per watt.

Barriers & Challenges:

- High R&D and Manufacturing Costs: Developing and manufacturing advanced semiconductor accelerators is incredibly expensive, posing a significant barrier to entry.

- Software Ecosystem Complexity: Optimizing software to fully leverage the capabilities of diverse accelerator architectures is a complex and ongoing challenge.

- Talent Shortage: A scarcity of skilled engineers with expertise in hardware design, AI software development, and parallel programming can hinder adoption and innovation.

- Supply Chain Disruptions: The global semiconductor supply chain remains susceptible to disruptions, potentially impacting the availability and cost of accelerators.

- Interoperability and Standardization: Achieving seamless interoperability between different accelerator types and platforms can be challenging, impacting integration efforts.

- Competition from General-Purpose CPUs: While specialized, accelerators face indirect competition from increasingly capable general-purpose CPUs, especially for less compute-intensive tasks.

Emerging Opportunities in Data Center Accelerator Market

Emerging opportunities in the Data Center Accelerator Market are abundant, driven by evolving technological frontiers and expanding application horizons. The growing adoption of edge computing presents a significant avenue, requiring compact and power-efficient accelerators for real-time data processing closer to the source. Furthermore, the increasing demand for specialized AI workloads such as natural language processing (NLP), computer vision for autonomous systems, and complex scientific simulations is creating opportunities for highly optimized ASICs and FPGAs. The burgeoning field of quantum computing integration also hints at future accelerator needs, potentially in hybrid classical-quantum computing architectures. The development of more energy-efficient accelerator designs to meet sustainability goals will be a key differentiator. Finally, the expansion of AI-as-a-Service (AIaaS) and HPC-as-a-Service (HPCaaS) models by cloud providers will continue to democratize access and fuel market growth by lowering the barrier to entry for smaller enterprises.

Growth Accelerators in the Data Center Accelerator Market Industry

Several catalysts are accelerating long-term growth in the Data Center Accelerator Market. Technological breakthroughs in semiconductor manufacturing processes, such as advancements in lithography and chiplet integration, are enabling the creation of more powerful and cost-effective accelerators. Strategic partnerships between semiconductor manufacturers, cloud providers, and software developers are crucial for building robust ecosystems and ensuring widespread adoption of accelerator technologies. These collaborations streamline the development of optimized software stacks and accelerate the integration of accelerators into existing data center infrastructure. Furthermore, market expansion strategies, including the development of solutions for emerging markets and the creation of accelerators tailored for specific industry verticals, are driving sustained growth. The increasing investment in AI R&D by governments and private enterprises globally is a significant tailwind, fostering continuous demand for cutting-edge acceleration hardware.

Key Players Shaping the Data Center Accelerator Market Market

- Xilinx Inc (Advanced Micro Devices Inc)

- Achronix Semiconductor Corporation

- IBM Corporation

- NVIDIA Corporation

- Cisco Systems Inc

- Advanced Micro Devices Inc

- Qualcomm Technologies Inc

- NEC Corporation

- Dell Technologies Inc

- Intel Corporation

Notable Milestones in Data Center Accelerator Market Sector

- December 2022: Atos announced the development of "Atos' AWS Data Lake Accelerator for SAP," a solution in collaboration with AWS, to expedite and monitor company KPIs by providing easy access to SAP and non-SAP data silos, enabling self-service and enterprise-wide reporting for significant insights.

- October 2022: Accenture and Google Cloud expanded their global partnership, with a renewed commitment to growing talent pools, enhancing joint capabilities, developing new data and AI solutions, and providing enhanced support to help clients build a solid digital core and reinvent their enterprises on the cloud.

- June 2022: Sanofi launched its first digital accelerator, aiming to become a premier digital healthcare company by creating products and solutions that leverage digital technologies, data, and artificial intelligence (AI) to transform medicine.

- June 2022: GE Digital launched its new accelerator product line, including software solutions designed to enable customers in asset-intensive energy industries to quickly set up Asset Performance Management (APM) and other services, accelerating time to value and extending APM to a wider variety of assets.

In-Depth Data Center Accelerator Market Market Outlook

The future outlook for the Data Center Accelerator Market is exceptionally strong, characterized by sustained high growth and continuous innovation. The persistent demand for advanced computing power in AI, HPC, and emerging fields like edge computing will continue to be the primary growth accelerant. Strategic opportunities lie in the development of more energy-efficient and cost-effective accelerator solutions, catering to the increasing focus on sustainability in data center operations. Furthermore, the ongoing evolution of semiconductor technologies, including advancements in chiplet integration and novel materials, promises to unlock new levels of performance and functionality. Companies that can effectively build comprehensive software ecosystems around their hardware, ensuring ease of use and broad compatibility, will be well-positioned to capture market share. The expansion of cloud-based acceleration services will continue to democratize access, driving adoption across a wider spectrum of industries and enabling new frontiers of digital transformation. The market is poised to redefine computational capabilities, empowering businesses and researchers to tackle increasingly complex challenges and unlock unprecedented insights.

Data Center Accelerator Market Segmentation

-

1. Processor Type

- 1.1. CPU (Central Processing Unit)

- 1.2. GPU (Graphics Processing Unit)

- 1.3. FPGA (Field-Programmable Gate Array)

- 1.4. ASIC (Application-specific Integrated Circuit)

-

2. Application

- 2.1. High-performance Computing

- 2.2. Artificial Intelligence

- 2.3. Other Applications

Data Center Accelerator Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Data Center Accelerator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Deployment of AI in HPC Data Centers; Increasing Deployment of Data Center Facilities and Cloud-Based Services

- 3.3. Market Restrains

- 3.3.1. Limited AI Hardware Experts Coupled with Infrastructural Concerns

- 3.4. Market Trends

- 3.4.1. FPGA Processor Type Segemnt is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Processor Type

- 5.1.1. CPU (Central Processing Unit)

- 5.1.2. GPU (Graphics Processing Unit)

- 5.1.3. FPGA (Field-Programmable Gate Array)

- 5.1.4. ASIC (Application-specific Integrated Circuit)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. High-performance Computing

- 5.2.2. Artificial Intelligence

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Processor Type

- 6. North America Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Processor Type

- 6.1.1. CPU (Central Processing Unit)

- 6.1.2. GPU (Graphics Processing Unit)

- 6.1.3. FPGA (Field-Programmable Gate Array)

- 6.1.4. ASIC (Application-specific Integrated Circuit)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. High-performance Computing

- 6.2.2. Artificial Intelligence

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Processor Type

- 7. Europe Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Processor Type

- 7.1.1. CPU (Central Processing Unit)

- 7.1.2. GPU (Graphics Processing Unit)

- 7.1.3. FPGA (Field-Programmable Gate Array)

- 7.1.4. ASIC (Application-specific Integrated Circuit)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. High-performance Computing

- 7.2.2. Artificial Intelligence

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Processor Type

- 8. Asia Pacific Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Processor Type

- 8.1.1. CPU (Central Processing Unit)

- 8.1.2. GPU (Graphics Processing Unit)

- 8.1.3. FPGA (Field-Programmable Gate Array)

- 8.1.4. ASIC (Application-specific Integrated Circuit)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. High-performance Computing

- 8.2.2. Artificial Intelligence

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Processor Type

- 9. Latin America Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Processor Type

- 9.1.1. CPU (Central Processing Unit)

- 9.1.2. GPU (Graphics Processing Unit)

- 9.1.3. FPGA (Field-Programmable Gate Array)

- 9.1.4. ASIC (Application-specific Integrated Circuit)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. High-performance Computing

- 9.2.2. Artificial Intelligence

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Processor Type

- 10. Middle East Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Processor Type

- 10.1.1. CPU (Central Processing Unit)

- 10.1.2. GPU (Graphics Processing Unit)

- 10.1.3. FPGA (Field-Programmable Gate Array)

- 10.1.4. ASIC (Application-specific Integrated Circuit)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. High-performance Computing

- 10.2.2. Artificial Intelligence

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Processor Type

- 11. North America Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Data Center Accelerator Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Xilinx Inc (Advanced Micro Devices Inc )

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Achronix Semiconductor Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 IBM Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 NVIDIA Corporation

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Cisco Systems Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Advanced Micro Devices Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Qualcomm Technologies Inc *List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 NEC Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Dell Technologies Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Intel Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Xilinx Inc (Advanced Micro Devices Inc )

List of Figures

- Figure 1: Global Data Center Accelerator Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Data Center Accelerator Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 15: North America Data Center Accelerator Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 16: North America Data Center Accelerator Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Data Center Accelerator Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Data Center Accelerator Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 21: Europe Data Center Accelerator Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 22: Europe Data Center Accelerator Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Data Center Accelerator Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Data Center Accelerator Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 27: Asia Pacific Data Center Accelerator Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 28: Asia Pacific Data Center Accelerator Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Pacific Data Center Accelerator Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Data Center Accelerator Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 33: Latin America Data Center Accelerator Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 34: Latin America Data Center Accelerator Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Latin America Data Center Accelerator Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Latin America Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East Data Center Accelerator Market Revenue (Million), by Processor Type 2024 & 2032

- Figure 39: Middle East Data Center Accelerator Market Revenue Share (%), by Processor Type 2024 & 2032

- Figure 40: Middle East Data Center Accelerator Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Middle East Data Center Accelerator Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East Data Center Accelerator Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East Data Center Accelerator Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center Accelerator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center Accelerator Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 3: Global Data Center Accelerator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Data Center Accelerator Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Data Center Accelerator Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Data Center Accelerator Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 51: Global Data Center Accelerator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Data Center Accelerator Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 54: Global Data Center Accelerator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Data Center Accelerator Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 57: Global Data Center Accelerator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Data Center Accelerator Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 60: Global Data Center Accelerator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Data Center Accelerator Market Revenue Million Forecast, by Processor Type 2019 & 2032

- Table 63: Global Data Center Accelerator Market Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Global Data Center Accelerator Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Accelerator Market?

The projected CAGR is approximately 14.19%.

2. Which companies are prominent players in the Data Center Accelerator Market?

Key companies in the market include Xilinx Inc (Advanced Micro Devices Inc ), Achronix Semiconductor Corporation, IBM Corporation, NVIDIA Corporation, Cisco Systems Inc, Advanced Micro Devices Inc, Qualcomm Technologies Inc *List Not Exhaustive, NEC Corporation, Dell Technologies Inc, Intel Corporation.

3. What are the main segments of the Data Center Accelerator Market?

The market segments include Processor Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Deployment of AI in HPC Data Centers; Increasing Deployment of Data Center Facilities and Cloud-Based Services.

6. What are the notable trends driving market growth?

FPGA Processor Type Segemnt is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Limited AI Hardware Experts Coupled with Infrastructural Concerns.

8. Can you provide examples of recent developments in the market?

December 2022 - Atos has announced the development of a new solution in collaboration with AWS that allows clients to expedite and properly monitor company key performance indicators (KPIs) by offering simple access to SAP and non-SAP data silos. "Atos' AWS Data Lake Accelerator for SAP" is a new solution that delivers self-service and enterprise-wide reporting for significant insights into daily changes that swiftly influence choices to drive the bottom line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Accelerator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Accelerator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Accelerator Market?

To stay informed about further developments, trends, and reports in the Data Center Accelerator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence