Key Insights

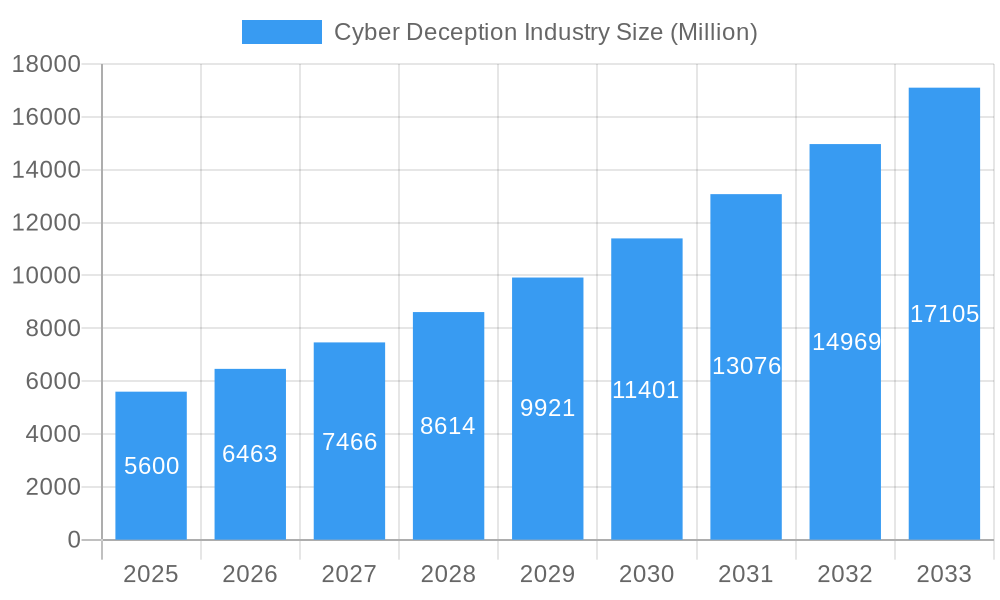

The Cyber Deception market is experiencing substantial growth, driven by the increasing sophistication of cyber threats and the imperative for proactive security strategies. Projected to reach $3.3 billion by 2025, the industry anticipates a robust Compound Annual Growth Rate (CAGR) of 13.8% from 2025 through 2033. This expansion is attributed to the widespread adoption of advanced deception technologies across diverse end-user industries. Key factors fueling this trend include the rising incidence of ransomware, advanced persistent threats (APTs), and insider threats, compelling organizations to invest in deception solutions for early detection, analysis, and mitigation of sophisticated attacks. The limitations of traditional security measures in identifying novel and evasive attack vectors further accelerate this adoption. Businesses increasingly integrate deception technologies into their cybersecurity architecture, creating controlled environments to lure and trap attackers, thereby complementing existing defenses.

Cyber Deception Industry Market Size (In Billion)

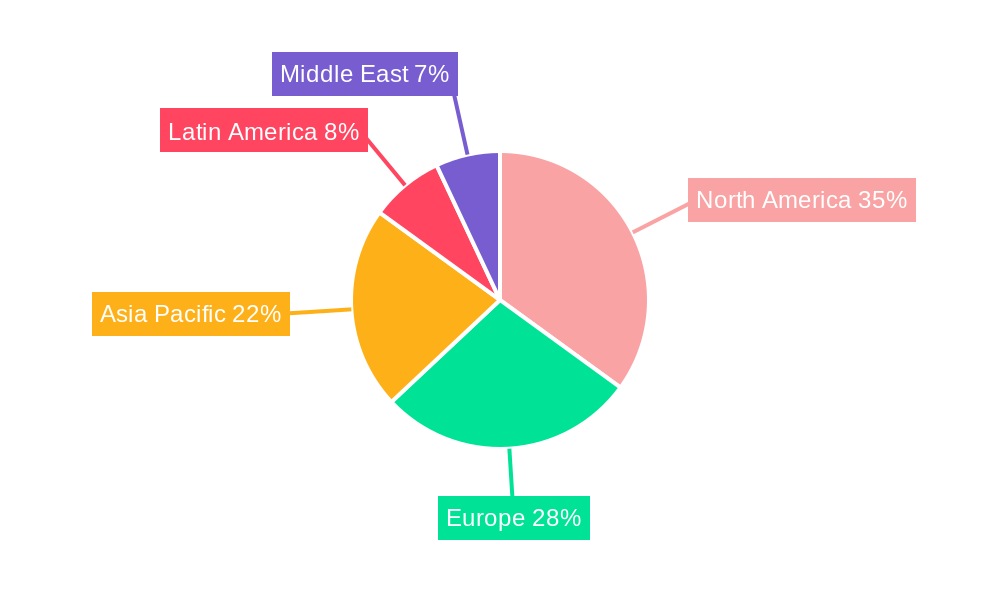

The market is segmented by critical areas, including Application Security, Network Security, and Data Security, which are primary focus areas for deception technology deployment. Service delivery models are evolving, with a pronounced shift towards Professional Services and Managed Services, indicating a rising demand for expert implementation and ongoing support to optimize deception platform effectiveness. End-user verticals such as IT & Telecom, Retail, Energy & Power, BFSI, and Healthcare are leading adoption due to their sensitive data and high-value targets. Geographically, North America and Europe are expected to dominate market adoption and investment, supported by mature cybersecurity infrastructures and stringent regulatory frameworks. However, the Asia Pacific region is poised for the fastest growth, driven by rapid digital transformation and heightened cybersecurity awareness. Restraints, such as initial implementation costs and the need for specialized personnel, are being progressively addressed by the demonstrable return on investment in preventing costly breaches. Emerging trends include the integration of AI and machine learning to enhance decoy realism and adaptiveness, fostering a more dynamic and effective defensive posture.

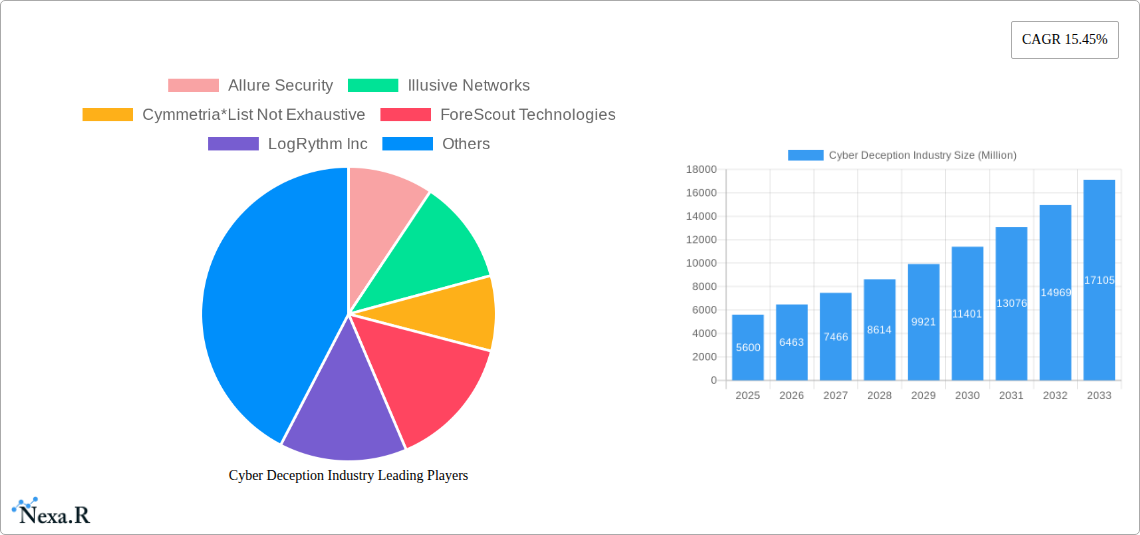

Cyber Deception Industry Company Market Share

Gain critical insights into the Cyber Deception market with our comprehensive analysis. This report offers strategic guidance for stakeholders navigating the evolving landscape of deception technology, leveraging high-impact keywords and detailed market segmentation for optimal search engine visibility and professional engagement.

Cyber Deception Industry Market Dynamics & Structure

The cyber deception industry is characterized by dynamic market concentration, driven by continuous technological innovation and an escalating threat landscape. The need for proactive defense mechanisms beyond traditional security postures fuels the adoption of deception technologies, creating a competitive environment where companies are vying for market share through advanced solutions. Regulatory frameworks, while still maturing, are beginning to influence adoption by mandating more robust data protection and incident response capabilities. The market is seeing a significant shift towards integrated deception platforms that cover multiple layers of security.

- Market Concentration: Highly fragmented in its early stages, now consolidating around key players offering comprehensive deception suites.

- Technological Innovation Drivers: Rise of sophisticated APTs, insider threats, and the need for early threat detection.

- Regulatory Frameworks: GDPR, CCPA, and other data privacy regulations indirectly boost demand for enhanced breach detection.

- Competitive Product Substitutes: Traditional IDS/IPS, SIEM solutions, and advanced EDR are evolving to incorporate deception elements.

- End-User Demographics: Growing adoption across all sectors, with a particular emphasis on those handling sensitive data.

- M&A Trends: An increase in strategic acquisitions as larger cybersecurity firms aim to integrate deception capabilities into their portfolios.

Cyber Deception Industry Growth Trends & Insights

The global cyber deception market is projected to witness robust growth from 2025 to 2033, driven by an increasing awareness of its efficacy in detecting advanced persistent threats (APTs) and zero-day exploits. As cyberattacks become more sophisticated and elusive, traditional security measures are proving insufficient, compelling organizations to adopt proactive deception strategies. The market size evolution is indicative of a significant CAGR, reflecting a growing adoption rate across various end-user verticals. Technological disruptions, such as the integration of AI and machine learning into deception platforms, are enhancing their ability to mimic real assets and adapt to attacker behaviors, thereby increasing their effectiveness.

Consumer behavior is shifting towards prioritizing cybersecurity investments that offer advanced threat intelligence and real-time detection capabilities. This shift is directly fueling the demand for deception technologies, as they provide a unique advantage by luring attackers into controlled environments, enabling defenders to gather valuable intelligence before significant damage occurs. The market penetration of cyber deception solutions is expected to accelerate as organizations recognize its potential to reduce the dwell time of attackers and minimize the impact of breaches. The increasing complexity of IT infrastructures, including cloud environments and IoT devices, further necessitates advanced defense mechanisms like deception, creating new avenues for market expansion.

The forecast period will likely see a surge in managed deception services, catering to organizations that lack the in-house expertise to deploy and manage complex deception environments effectively. This trend, coupled with the continuous innovation in deception techniques, such as AI-driven decoys and adaptive threat landscapes, will solidify cyber deception as a critical component of a modern cybersecurity strategy. The estimated market size for 2025 stands at approximately $3,500 Million, with projections indicating substantial growth to over $10,000 Million by 2033.

Dominant Regions, Countries, or Segments in Cyber Deception Industry

North America currently stands as the dominant region in the cyber deception industry, driven by a confluence of factors including a mature cybersecurity market, high cybersecurity spending, and a proactive approach to threat mitigation. The United States, in particular, accounts for a substantial market share due to the presence of leading cybersecurity vendors, a high concentration of critical infrastructure, and stringent regulatory compliance requirements across sectors like BFSI and Healthcare. The robust adoption of advanced security technologies and the continuous threat of sophisticated cyberattacks in this region propel the demand for comprehensive deception solutions.

- IT & Telecom: This segment is a primary driver of growth, owing to the ever-evolving threat landscape and the critical need for network security and data protection in managing vast amounts of sensitive information.

- BFSI (Banking, Financial Services, and Insurance): Financial institutions are heavily investing in cyber deception to protect sensitive customer data and financial assets from sophisticated fraud and cyberattacks, including ransomware and phishing.

- Network Security: As a core component of deception technology, network security solutions are witnessing high adoption. They are crucial for creating a virtualized and deceptive network environment to detect lateral movement and attacker reconnaissance.

- Professional Service: The increasing complexity of deploying and managing deception environments is driving demand for professional services, including deployment, customization, and ongoing support.

- Managed Service: Organizations are increasingly opting for managed deception services to leverage expert guidance and continuous monitoring, especially those with limited in-house cybersecurity resources.

The dominance of North America is further cemented by government initiatives promoting cybersecurity resilience and a strong ecosystem of research and development in advanced security technologies. The region’s proactive stance on cybersecurity, coupled with its economic strength, enables significant investment in cutting-edge solutions like cyber deception. The estimated market share for North America in 2025 is approximately 35% of the global market, with an anticipated CAGR of xx% during the forecast period.

Cyber Deception Industry Product Landscape

The cyber deception industry is witnessing rapid innovation, with platforms offering sophisticated honeypots, decoy servers, and fake credentials designed to lure and trap attackers. Product advancements focus on creating highly realistic and dynamic decoys that mimic legitimate assets across application security, network security, data security, and endpoint security layers. These solutions are increasingly integrating AI and machine learning to adapt to attacker tactics and provide real-time threat intelligence, offering unique selling propositions through their ability to detect novel and sophisticated threats.

Key Drivers, Barriers & Challenges in Cyber Deception Industry

The cyber deception industry is primarily propelled by the escalating sophistication of cyber threats, the inadequacy of traditional security measures in detecting advanced persistent threats (APTs), and the increasing need for early threat detection and intelligence gathering. Regulatory compliance and the growing awareness of the financial and reputational damage caused by data breaches also act as significant drivers. Technological advancements in AI and machine learning are further enhancing the capabilities and adoption of deception technologies.

- Drivers: Advanced threat landscape, need for proactive defense, regulatory compliance, demand for threat intelligence.

- Barriers & Challenges:

- Perceived Complexity: Many organizations perceive deception technologies as complex to deploy and manage.

- Integration Challenges: Integrating deception solutions seamlessly with existing security infrastructure can be difficult.

- Cost Concerns: Initial investment costs and ongoing operational expenses can be a barrier for some small and medium-sized enterprises.

- False Positives/Negatives: Ensuring the accuracy of deception systems to minimize false positives and negatives is a continuous challenge.

- Skilled Workforce Shortage: A lack of skilled cybersecurity professionals capable of effectively deploying and managing deception platforms.

Emerging Opportunities in Cyber Deception Industry

Emerging opportunities in the cyber deception industry lie in the expansion of deception technologies into cloud-native environments and the Internet of Things (IoT). The increasing adoption of hybrid cloud strategies presents a fertile ground for deception solutions designed to protect distributed infrastructure. Furthermore, the growing prevalence of sophisticated insider threats is opening up new application areas for deception, focusing on detecting anomalous user behavior. Untapped markets in developing economies are also presenting significant growth potential as cybersecurity awareness and investment rise.

Growth Accelerators in the Cyber Deception Industry Industry

Long-term growth in the cyber deception industry is being significantly accelerated by breakthroughs in AI and machine learning, enabling more adaptive and realistic decoy environments. Strategic partnerships between deception technology providers and broader cybersecurity ecosystems, such as SIEM and SOAR platforms, are creating integrated solutions that enhance overall security efficacy. Furthermore, market expansion strategies focusing on educating businesses about the proactive benefits of deception, alongside the increasing adoption of managed deception services, are playing a crucial role in driving sustained growth.

Key Players Shaping the Cyber Deception Industry Market

- Allure Security

- Illusive Networks

- Cymmetria

- ForeScout Technologies

- LogRythm Inc

- Acalvio Technologies

- GuardiCore Limited

- Fidelis Cybersecurity (TopSpin Security)

Notable Milestones in Cyber Deception Industry Sector

- 2019: Increased investment in AI-driven deception platforms.

- 2020: Rise of cloud-based deception solutions.

- 2021: Growing adoption of deception for insider threat detection.

- 2022: Key acquisitions of deception technology startups by larger cybersecurity firms.

- 2023: Enhanced integration of deception with Security Orchestration, Automation, and Response (SOAR) platforms.

In-Depth Cyber Deception Industry Market Outlook

The outlook for the cyber deception industry is exceptionally bright, with continued strong growth projected. The increasing frequency and sophistication of cyberattacks, coupled with the limitations of traditional security approaches, will solidify deception technology as an indispensable component of any robust cybersecurity strategy. Future market potential is immense, driven by the ongoing innovation in AI-powered deception, the expansion of deception solutions into cloud and IoT environments, and the growing demand for managed services. Strategic opportunities lie in developing more user-friendly platforms, fostering tighter integrations with existing security stacks, and educating the market on the proactive value proposition of deception.

Cyber Deception Industry Segmentation

-

1. Layer

- 1.1. Application Security

- 1.2. Network Security

- 1.3. Data Security

- 1.4. Endpoint Security

-

2. Service Type

- 2.1. Professional Service

- 2.2. Managed Service

-

3. End-user Vertical

- 3.1. IT & Telecom

- 3.2. Retail

- 3.3. Energy & Power

- 3.4. BFSI

- 3.5. Healthcare

- 3.6. Other End-user Verticals

Cyber Deception Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cyber Deception Industry Regional Market Share

Geographic Coverage of Cyber Deception Industry

Cyber Deception Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Cyber Attacks to Drive the Market; Omnipresence of Online and Digital Data and Growth in Cloud-Based Technology Accelerates the Growth

- 3.3. Market Restrains

- 3.3.1. ; Increasing Use of Pirated Network Tools; Lack of Cyber Expertise

- 3.4. Market Trends

- 3.4.1. Increasing Cyber Attacks to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyber Deception Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Layer

- 5.1.1. Application Security

- 5.1.2. Network Security

- 5.1.3. Data Security

- 5.1.4. Endpoint Security

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Professional Service

- 5.2.2. Managed Service

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. IT & Telecom

- 5.3.2. Retail

- 5.3.3. Energy & Power

- 5.3.4. BFSI

- 5.3.5. Healthcare

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Layer

- 6. North America Cyber Deception Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Layer

- 6.1.1. Application Security

- 6.1.2. Network Security

- 6.1.3. Data Security

- 6.1.4. Endpoint Security

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Professional Service

- 6.2.2. Managed Service

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. IT & Telecom

- 6.3.2. Retail

- 6.3.3. Energy & Power

- 6.3.4. BFSI

- 6.3.5. Healthcare

- 6.3.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Layer

- 7. Europe Cyber Deception Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Layer

- 7.1.1. Application Security

- 7.1.2. Network Security

- 7.1.3. Data Security

- 7.1.4. Endpoint Security

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Professional Service

- 7.2.2. Managed Service

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. IT & Telecom

- 7.3.2. Retail

- 7.3.3. Energy & Power

- 7.3.4. BFSI

- 7.3.5. Healthcare

- 7.3.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Layer

- 8. Asia Pacific Cyber Deception Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Layer

- 8.1.1. Application Security

- 8.1.2. Network Security

- 8.1.3. Data Security

- 8.1.4. Endpoint Security

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Professional Service

- 8.2.2. Managed Service

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. IT & Telecom

- 8.3.2. Retail

- 8.3.3. Energy & Power

- 8.3.4. BFSI

- 8.3.5. Healthcare

- 8.3.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Layer

- 9. Latin America Cyber Deception Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Layer

- 9.1.1. Application Security

- 9.1.2. Network Security

- 9.1.3. Data Security

- 9.1.4. Endpoint Security

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Professional Service

- 9.2.2. Managed Service

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. IT & Telecom

- 9.3.2. Retail

- 9.3.3. Energy & Power

- 9.3.4. BFSI

- 9.3.5. Healthcare

- 9.3.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Layer

- 10. Middle East Cyber Deception Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Layer

- 10.1.1. Application Security

- 10.1.2. Network Security

- 10.1.3. Data Security

- 10.1.4. Endpoint Security

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Professional Service

- 10.2.2. Managed Service

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. IT & Telecom

- 10.3.2. Retail

- 10.3.3. Energy & Power

- 10.3.4. BFSI

- 10.3.5. Healthcare

- 10.3.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Layer

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allure Security

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Illusive Networks

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cymmetria*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ForeScout Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LogRythm Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Acalvio Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GuardiCore Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fidelis Cybersecurity (TopSpin Security)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Allure Security

List of Figures

- Figure 1: Global Cyber Deception Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cyber Deception Industry Revenue (billion), by Layer 2025 & 2033

- Figure 3: North America Cyber Deception Industry Revenue Share (%), by Layer 2025 & 2033

- Figure 4: North America Cyber Deception Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 5: North America Cyber Deception Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Cyber Deception Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 7: North America Cyber Deception Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Cyber Deception Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Cyber Deception Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cyber Deception Industry Revenue (billion), by Layer 2025 & 2033

- Figure 11: Europe Cyber Deception Industry Revenue Share (%), by Layer 2025 & 2033

- Figure 12: Europe Cyber Deception Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 13: Europe Cyber Deception Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: Europe Cyber Deception Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 15: Europe Cyber Deception Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Cyber Deception Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Cyber Deception Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cyber Deception Industry Revenue (billion), by Layer 2025 & 2033

- Figure 19: Asia Pacific Cyber Deception Industry Revenue Share (%), by Layer 2025 & 2033

- Figure 20: Asia Pacific Cyber Deception Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Asia Pacific Cyber Deception Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Asia Pacific Cyber Deception Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 23: Asia Pacific Cyber Deception Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Pacific Cyber Deception Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Cyber Deception Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Cyber Deception Industry Revenue (billion), by Layer 2025 & 2033

- Figure 27: Latin America Cyber Deception Industry Revenue Share (%), by Layer 2025 & 2033

- Figure 28: Latin America Cyber Deception Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 29: Latin America Cyber Deception Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Latin America Cyber Deception Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Cyber Deception Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Cyber Deception Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Cyber Deception Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Cyber Deception Industry Revenue (billion), by Layer 2025 & 2033

- Figure 35: Middle East Cyber Deception Industry Revenue Share (%), by Layer 2025 & 2033

- Figure 36: Middle East Cyber Deception Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 37: Middle East Cyber Deception Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Middle East Cyber Deception Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 39: Middle East Cyber Deception Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East Cyber Deception Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Cyber Deception Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cyber Deception Industry Revenue billion Forecast, by Layer 2020 & 2033

- Table 2: Global Cyber Deception Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 3: Global Cyber Deception Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Cyber Deception Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cyber Deception Industry Revenue billion Forecast, by Layer 2020 & 2033

- Table 6: Global Cyber Deception Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 7: Global Cyber Deception Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Cyber Deception Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Cyber Deception Industry Revenue billion Forecast, by Layer 2020 & 2033

- Table 10: Global Cyber Deception Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: Global Cyber Deception Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Cyber Deception Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cyber Deception Industry Revenue billion Forecast, by Layer 2020 & 2033

- Table 14: Global Cyber Deception Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 15: Global Cyber Deception Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Cyber Deception Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Cyber Deception Industry Revenue billion Forecast, by Layer 2020 & 2033

- Table 18: Global Cyber Deception Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 19: Global Cyber Deception Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Cyber Deception Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Cyber Deception Industry Revenue billion Forecast, by Layer 2020 & 2033

- Table 22: Global Cyber Deception Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 23: Global Cyber Deception Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global Cyber Deception Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Deception Industry?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the Cyber Deception Industry?

Key companies in the market include Allure Security, Illusive Networks, Cymmetria*List Not Exhaustive, ForeScout Technologies, LogRythm Inc, Acalvio Technologies, GuardiCore Limited, Fidelis Cybersecurity (TopSpin Security).

3. What are the main segments of the Cyber Deception Industry?

The market segments include Layer, Service Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Cyber Attacks to Drive the Market; Omnipresence of Online and Digital Data and Growth in Cloud-Based Technology Accelerates the Growth.

6. What are the notable trends driving market growth?

Increasing Cyber Attacks to Drive the Market.

7. Are there any restraints impacting market growth?

; Increasing Use of Pirated Network Tools; Lack of Cyber Expertise.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyber Deception Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyber Deception Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyber Deception Industry?

To stay informed about further developments, trends, and reports in the Cyber Deception Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence