Key Insights

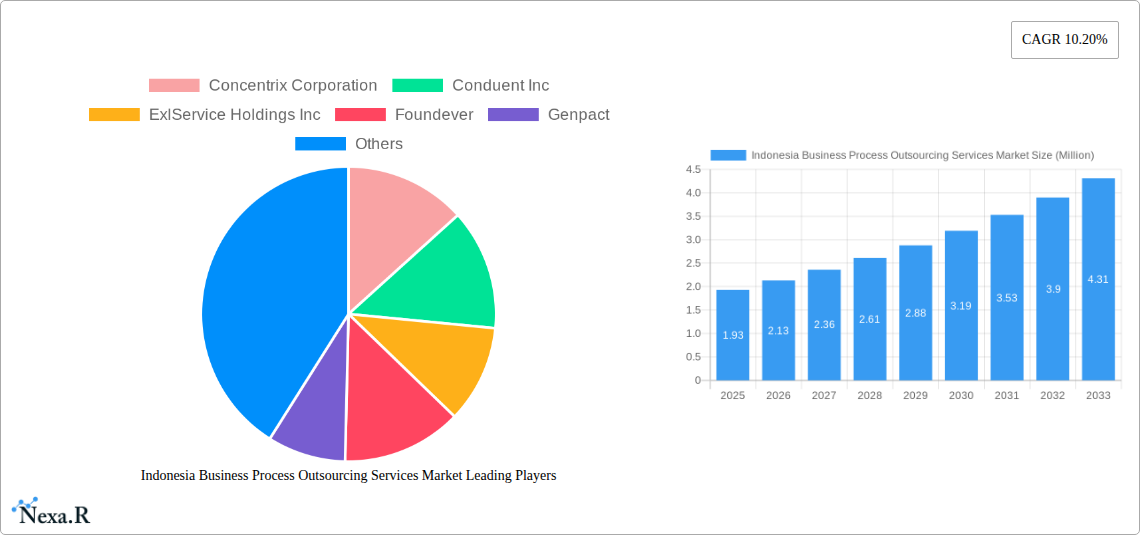

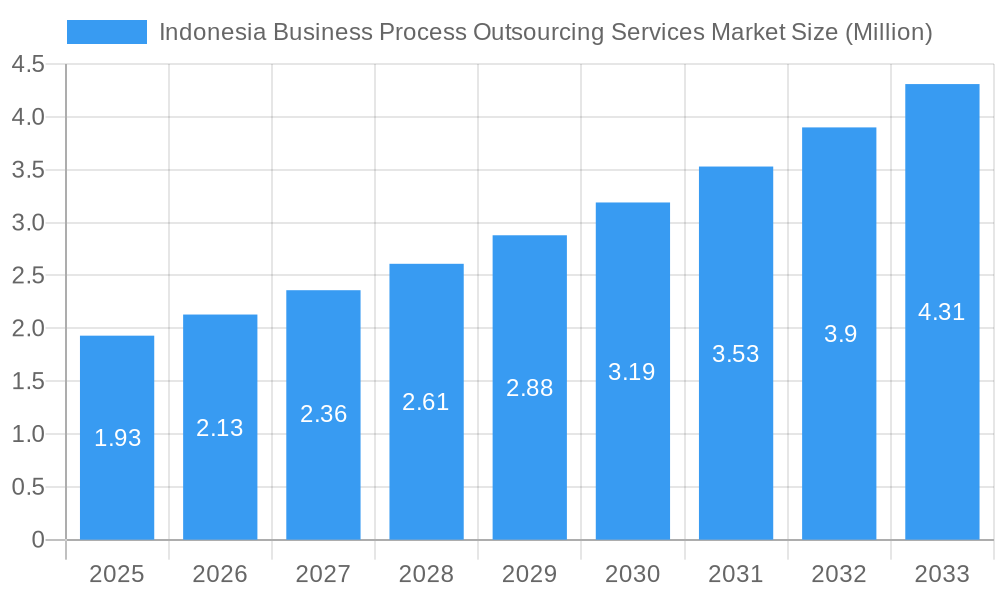

The Indonesia Business Process Outsourcing (BPO) Services Market is poised for significant expansion, projected to reach approximately $1.93 million by 2025 and experience a robust Compound Annual Growth Rate (CAGR) of 10.20% over the forecast period from 2025 to 2033. This remarkable growth trajectory is fueled by a confluence of factors, with key drivers including the increasing demand for cost optimization among Indonesian businesses, the growing need for specialized expertise and advanced technology adoption, and the government's supportive initiatives aimed at fostering the digital economy and attracting foreign investment. The surge in digital transformation across various sectors necessitates specialized BPO services that can manage complex processes efficiently and effectively, further bolstering market growth.

Indonesia Business Process Outsourcing Services Market Market Size (In Million)

The market's expansion will be further propelled by emerging trends such as the increasing adoption of cloud-based BPO solutions, the rise of robotic process automation (RPA) for enhanced efficiency, and a growing preference for customer experience (CX) focused outsourcing. While the market enjoys strong growth potential, certain restraints, such as concerns regarding data security and privacy, a shortage of skilled talent in niche areas, and the inherent complexities in managing outsourced operations, need to be strategically addressed. The BPO landscape in Indonesia is segmented across various processes like HR, Sales and Marketing, and Customer Care, catering to a diverse range of end-users including BFSI, Telecom and IT, Healthcare, and Retail. Leading global and regional players are actively participating in this dynamic market, contributing to its competitive environment and driving innovation.

Indonesia Business Process Outsourcing Services Market Company Market Share

Indonesia Business Process Outsourcing Services Market: Comprehensive Report Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Indonesia Business Process Outsourcing (BPO) Services Market, offering a comprehensive outlook from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study meticulously examines market dynamics, growth trends, dominant segments, and key players shaping this rapidly evolving sector. The report integrates high-traffic keywords such as "Indonesia BPO," "outsourcing services Indonesia," "digital transformation Indonesia," and "customer experience solutions" to ensure maximum search engine visibility for industry professionals and decision-makers. We delve into parent and child market segments to provide granular insights, presenting all values in Million units for clarity and strategic application.

Indonesia Business Process Outsourcing Services Market Market Dynamics & Structure

The Indonesia BPO services market is characterized by a moderately concentrated structure, with several large global players alongside a growing number of domestic providers. Technological innovation is a significant driver, fueled by the increasing adoption of automation, AI, and cloud computing to enhance service delivery efficiency and customer experience. Regulatory frameworks are evolving to support the digital economy and foreign investment, creating a more conducive environment for BPO expansion. Competitive product substitutes, primarily in-house service delivery and emerging regional BPO hubs, are present, necessitating continuous innovation and competitive pricing strategies from Indonesian providers. End-user demographics are shifting towards a greater demand for specialized and data-driven BPO solutions, particularly within the BFSI and Telecom & IT sectors. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to gain market share and expand service portfolios. For instance, recent M&A activities have aimed at integrating AI capabilities and expanding geographical reach within the Southeast Asian region. The market is witnessing a growing emphasis on cloud-based BPO solutions, a trend that is expected to accelerate innovation and adoption. The increasing demand for omnichannel customer support further pushes BPO providers to invest in advanced technologies and skilled workforces. The Indonesian government's focus on digital transformation and skilling initiatives also plays a crucial role in shaping the competitive landscape.

- Market Concentration: Moderate, with a blend of global and local BPO providers.

- Technological Innovation Drivers: AI, automation, cloud computing, and big data analytics.

- Regulatory Frameworks: Evolving to support digital economy growth and attract foreign investment.

- Competitive Substitutes: In-house operations, emerging regional BPO hubs.

- End-User Demographics: Growing demand for specialized, data-driven, and digitally enabled BPO services.

- M&A Trends: Driven by consolidation, portfolio expansion, and integration of advanced technologies.

Indonesia Business Process Outsourcing Services Market Growth Trends & Insights

The Indonesia BPO services market is on a robust growth trajectory, projected to expand significantly in the coming years. This expansion is driven by the escalating need for cost-efficiency, access to skilled talent, and the desire for businesses to focus on core competencies. The adoption rate of BPO services is accelerating across various industries, as companies recognize the strategic advantages of outsourcing non-core functions. Technological disruptions, particularly the pervasive influence of Artificial Intelligence (AI) and Robotic Process Automation (RPA), are reshaping service delivery models, leading to enhanced productivity and service quality. Consumer behavior shifts, with an increasing expectation for seamless, personalized, and real-time customer interactions, are further propelling the demand for advanced BPO solutions. The market size evolution indicates a strong upward trend, with consistent double-digit growth anticipated. Market penetration is expanding beyond traditional call center services into more complex areas like back-office processing, IT support, and digital marketing. The integration of AI and machine learning is enabling BPO providers to offer predictive analytics and proactive customer engagement strategies, differentiating them in the competitive landscape. Furthermore, the growing digital literacy and expanding internet penetration in Indonesia create a fertile ground for the proliferation of BPO services. The shift towards a more service-oriented economy also underpins the sustained growth of the BPO sector.

- Market Size Evolution: Consistent double-digit growth expected.

- Adoption Rates: Accelerating across diverse industries.

- Technological Disruptions: AI, RPA, and cloud computing are transforming service delivery.

- Consumer Behavior Shifts: Demand for personalized, real-time, and omnichannel customer experiences.

- Market Penetration: Expanding beyond traditional services into specialized and complex BPO functions.

- CAGR (Compound Annual Growth Rate): Estimated at XX% during the forecast period.

- Market Penetration: Increasing across all industry verticals.

Dominant Regions, Countries, or Segments in Indonesia Business Process Outsourcing Services Market

Within the Indonesia Business Process Outsourcing Services Market, the Telecom and IT segment emerges as a dominant force, driving significant growth and adoption. This dominance is fueled by the sector's inherent reliance on technology, the continuous need for customer support, and the rapid digital transformation initiatives undertaken by telecommunication and IT companies. The increasing complexity of digital services and the demand for seamless customer experiences necessitate specialized outsourcing solutions, which BPO providers are well-equipped to offer. The BFSI (Banking, Financial Services, and Insurance) sector also holds substantial market share, driven by stringent regulatory compliance requirements, the need for secure data management, and the growing demand for digital banking and fintech solutions.

Key Drivers of Dominance in Telecom and IT:

- Digital Transformation Initiatives: Companies are actively investing in digital infrastructure and services, requiring scalable BPO support.

- Customer Support Demands: The high volume of customer inquiries and technical support needs are ideal for outsourcing.

- Technological Advancements: Adoption of AI, cloud, and big data analytics for enhanced service delivery.

- Market Share: The Telecom and IT segment is estimated to hold approximately XX% of the total BPO market share.

- Growth Potential: High due to continuous innovation and evolving service offerings in the tech industry.

Key Drivers of Dominance in BFSI:

- Regulatory Compliance: Outsourcing helps manage complex and evolving regulatory landscapes.

- Data Security and Privacy: BPO providers offer specialized expertise in handling sensitive financial data.

- Fintech Growth: The rise of digital payments and financial technologies requires robust back-office and customer support.

- Market Share: The BFSI segment contributes an estimated XX% to the overall BPO market.

- Growth Potential: Significant due to ongoing digital adoption and new product launches in the financial sector.

The Customer Care process segment is also a pivotal contributor, underpinning the success of BPO services across all end-user industries. The increasing focus on customer satisfaction and retention compels businesses to invest in high-quality customer engagement solutions, which are a core offering of BPO providers. The Others segment, encompassing areas like human resources and administrative support, is also witnessing steady growth as businesses increasingly recognize the benefits of outsourcing these functions to improve efficiency and reduce operational costs.

Indonesia Business Process Outsourcing Services Market Product Landscape

The Indonesia BPO services market product landscape is characterized by a dynamic evolution towards digitally-enabled and specialized solutions. Key innovations include the integration of Artificial Intelligence (AI) for intelligent automation of repetitive tasks, advanced analytics for data-driven insights, and omnichannel platforms for seamless customer engagement. BPO providers are offering sophisticated customer care solutions, leveraging chatbots and virtual assistants alongside human agents to enhance customer experience and operational efficiency. In the HR domain, cloud-based HR management systems and payroll processing are gaining traction. For Sales and Marketing, data analytics for lead generation and personalized campaign management are becoming crucial. Performance metrics emphasize improved customer satisfaction scores, reduced operational costs, and enhanced process efficiency.

Key Drivers, Barriers & Challenges in Indonesia Business Process Outsourcing Services Market

The Indonesia BPO services market is propelled by several key drivers, including the nation's growing digital economy, a large and increasingly skilled workforce, and government initiatives promoting foreign investment and technological adoption. The cost-effectiveness of outsourcing to Indonesia compared to developed nations is a significant economic driver. Furthermore, the increasing demand for specialized services in areas like cloud computing and AI is creating new avenues for growth.

- Key Drivers:

- Digitalization and technological advancement.

- Cost-competitiveness of Indonesian talent.

- Government support for digital economy growth.

- Increasing demand for specialized BPO services.

However, the market faces certain barriers and challenges. A significant challenge is the need for continuous upskilling of the workforce to keep pace with rapidly evolving technologies. Fierce competition from other emerging BPO destinations and the potential for data security and privacy concerns, especially in the BFSI sector, also pose considerable hurdles. Supply chain issues related to talent acquisition and retention can impact service delivery timelines and quality.

- Barriers & Challenges:

- Talent upskilling and retention.

- Intense regional competition.

- Data security and privacy concerns.

- Infrastructure limitations in certain regions.

- Navigating complex regulatory environments.

Emerging Opportunities in Indonesia Business Process Outsourcing Services Market

Emerging opportunities within the Indonesia BPO services market lie in catering to the burgeoning demand for specialized digital services, particularly in areas like cybersecurity, data analytics, and cloud migration support. The growing e-commerce sector presents a significant opportunity for outsourced customer support and logistics management. Furthermore, the increasing focus on sustainability and ethical business practices creates a niche for BPO providers offering green IT solutions and socially responsible outsourcing services. The "Golden Indonesia 2045" initiative is expected to unlock further potential by fostering a more digitally-advanced economy.

Growth Accelerators in the Indonesia Business Process Outsourcing Services Market Industry

Several catalysts are accelerating long-term growth in the Indonesia Business Process Outsourcing Services Market Industry. The continued advancements in AI and automation are enabling BPO providers to offer more sophisticated and value-added services, moving beyond traditional transactional tasks. Strategic partnerships, such as the collaboration between TTEC Holdings Inc. and Google Cloud, are instrumental in leveraging cutting-edge technologies to enhance customer engagement. Government-backed initiatives aimed at digital transformation and talent development, like Microsoft's significant investment, are further strengthening the ecosystem and attracting further investment. The expansion into new service lines and industry verticals will also drive sustained growth.

Key Players Shaping the Indonesia Business Process Outsourcing Services Market Market

- Concentrix Corporation

- Conduent Inc

- ExlService Holdings Inc

- Foundever

- Genpact

- KPSG

- Majorel

- Relia Inc

- Teleperformance

- TELUS

- Transcom

- Transcosmos Inc

- TTEC Holdings Inc

- VADS BERHAD

- WNS (Holdings) Lt

Notable Milestones in Indonesia Business Process Outsourcing Services Market Sector

- April 2024: Microsoft pledged a USD 1.7 billion investment over the next four years, focusing on upskilling 840,000 Indonesians in cloud and AI domains, aligning with the "Golden Indonesia 2045" vision.

- January 2023: TTEC Holdings Inc. announced a strategic partnership with Google Cloud to leverage AI-powered Contact Center-as-a-Service capabilities for enhanced real-time customer interactions.

In-Depth Indonesia Business Process Outsourcing Services Market Market Outlook

The Indonesia Business Process Outsourcing Services Market is poised for exceptional growth, driven by a confluence of technological advancements, strategic government policies, and an expanding digital economy. The accelerating adoption of AI and automation will enable BPO providers to offer more sophisticated, data-driven, and outcome-oriented services. Strategic partnerships and investments, like those from Microsoft and Google Cloud, are crucial growth accelerators, fostering innovation and talent development. The focus on upskilling the Indonesian workforce will further solidify its position as a competitive BPO hub. The "Golden Indonesia 2045" initiative underscores the nation's commitment to becoming a digital powerhouse, presenting immense opportunities for the BPO sector to contribute to and benefit from this transformation. The market's future is bright, characterized by expanding service portfolios, deeper industry specialization, and a relentless pursuit of enhanced customer experience.

Indonesia Business Process Outsourcing Services Market Segmentation

-

1. Process

- 1.1. HR

- 1.2. Sales and Marketing

- 1.3. Customer Care

- 1.4. Others

-

2. End User

- 2.1. BFSI

- 2.2. Telecom and IT

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Others

Indonesia Business Process Outsourcing Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Business Process Outsourcing Services Market Regional Market Share

Geographic Coverage of Indonesia Business Process Outsourcing Services Market

Indonesia Business Process Outsourcing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.3. Market Restrains

- 3.3.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.4. Market Trends

- 3.4.1. Customer Care to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Business Process Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. HR

- 5.1.2. Sales and Marketing

- 5.1.3. Customer Care

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. Telecom and IT

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Concentrix Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Conduent Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExlService Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Foundever

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genpact

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KPSG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Majorel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Relia Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Teleperformance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TELUS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Transcom

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Transcosmos Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TTEC Holdings Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VADS BERHAD

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 WNS (Holdings) Lt

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Concentrix Corporation

List of Figures

- Figure 1: Indonesia Business Process Outsourcing Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Business Process Outsourcing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2020 & 2033

- Table 3: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 8: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2020 & 2033

- Table 9: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Business Process Outsourcing Services Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Indonesia Business Process Outsourcing Services Market?

Key companies in the market include Concentrix Corporation, Conduent Inc, ExlService Holdings Inc, Foundever, Genpact, KPSG, Majorel, Relia Inc, Teleperformance, TELUS, Transcom, Transcosmos Inc, TTEC Holdings Inc, VADS BERHAD, WNS (Holdings) Lt.

3. What are the main segments of the Indonesia Business Process Outsourcing Services Market?

The market segments include Process , End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

6. What are the notable trends driving market growth?

Customer Care to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

8. Can you provide examples of recent developments in the market?

April 2024 - Microsoft pledged a USD 1.7 billion investment over the next four years, underlining its commitment to bolster Indonesia's digital evolution. A key emphasis of this investment will be on upskilling 840,000 Indonesians, equipping them for roles in the burgeoning cloud and AI domains. This move resonates with Indonesia's broader vision outlined in the "Golden Indonesia 2045" initiative, which aspires to position the nation as a frontrunner in Southeast Asia's digital economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Business Process Outsourcing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Business Process Outsourcing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Business Process Outsourcing Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Business Process Outsourcing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence