Key Insights

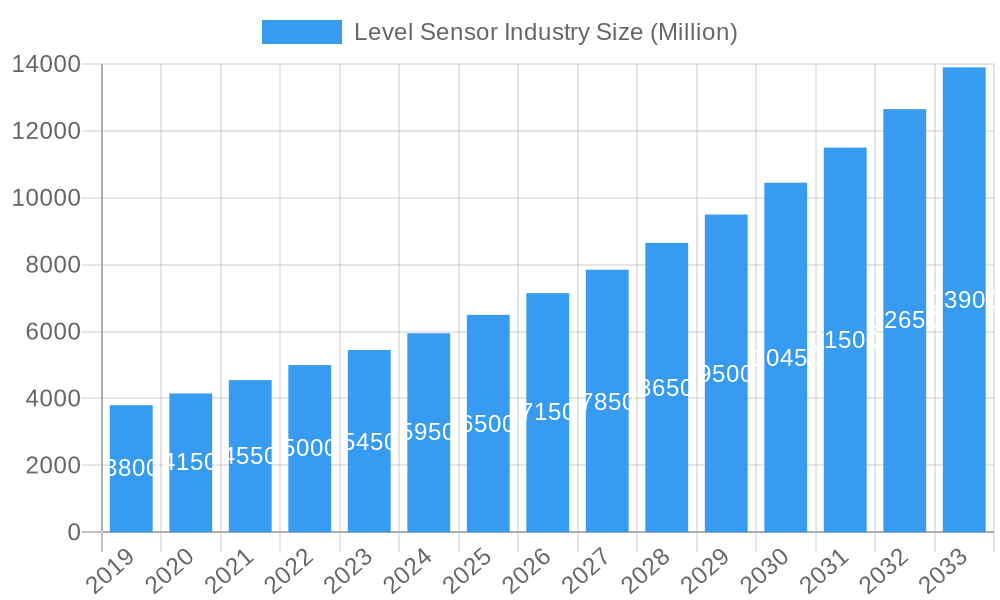

The global level sensor market is projected for significant expansion, with an estimated market size of $6.1 billion by 2025 and a robust Compound Annual Growth Rate (CAGR) of 7.26% throughout the forecast period of 2025-2033. This growth is driven by the increasing demand for automation and precise process control across industries, particularly in power generation, oil and gas, and chemical sectors. Key drivers include the need for enhanced operational efficiency, safety compliance, and material wastage reduction. Digital transformation and IoT integration are creating opportunities for smart level sensors, enabling real-time data acquisition, remote monitoring, and predictive maintenance. The market segmentation shows a strong focus on point and continuous level sensors, with radar, ultrasonic, and magnetostrictive technologies gaining traction for their accuracy and reliability.

Level Sensor Industry Market Size (In Billion)

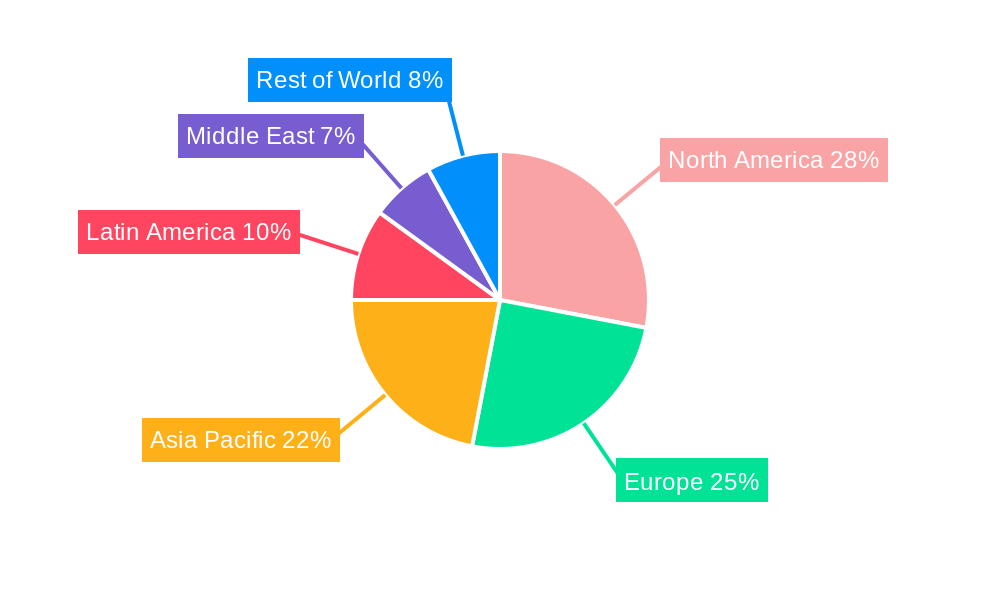

While initial costs of advanced technologies and the requirement for skilled personnel may present some restraints, continuous innovation in sensor design, miniaturization, and cost reduction strategies are mitigating these challenges. Expanding applications in water/wastewater management and the food and beverage industry further contribute to market growth. Geographically, North America and Europe are expected to lead, supported by established industrial infrastructure and stringent regulations. The Asia Pacific region is anticipated to experience the fastest growth due to rapid industrialization and increasing adoption of Industry 4.0 principles. Leading companies such as Honeywell International Inc., ABB Ltd., Emerson Electric Co., and Siemens AG are driving innovation and expanding product portfolios.

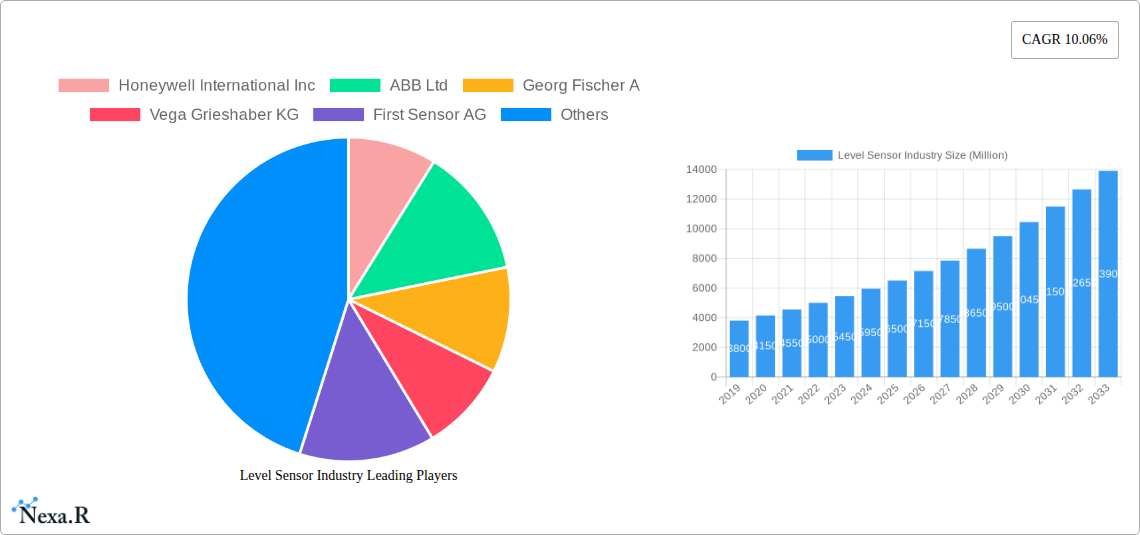

Level Sensor Industry Company Market Share

Global Level Sensor Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers critical insights into the global Level Sensor industry's current state and future trajectory from 2019 to 2033, with a base year of 2025. It is an essential resource for professionals, investors, and decision-makers seeking to understand market dynamics, growth drivers, technological advancements, and competitive landscapes. Our analysis utilizes high-traffic keywords and incorporates parent and child market segments for a holistic view, presenting all quantitative data in billions.

Level Sensor Industry Market Dynamics & Structure

The global Level Sensor industry is characterized by a moderately concentrated market structure, with key players like Honeywell International Inc, ABB Ltd, Georg Fischer AG, VEGA Grieshaber KG, and Emerson Electric Co holding significant market shares. Technological innovation serves as a primary driver, with continuous advancements in sensor technologies such as radar, ultrasonic, and magnetostrictive sensors enhancing precision, reliability, and application breadth. Regulatory frameworks, particularly those pertaining to safety, environmental compliance, and hazardous area certifications (e.g., ATEX, IECEx), significantly influence product development and market access. Competitive product substitutes, including simpler mechanical sensors and even manual gauging methods in less demanding applications, present a constant challenge, driving the need for higher performance and value propositions from advanced level sensing solutions. End-user demographics are diverse, with substantial demand stemming from the oil and gas, chemical, water and wastewater, and power generation sectors, each with unique operational requirements and environmental conditions. Mergers and Acquisitions (M&A) trends are observed, driven by the desire to expand product portfolios, gain market access, and consolidate technological expertise. For instance, recent M&A activity indicates a trend towards acquiring companies with specialized sensor technologies or strong regional presence. Barriers to innovation include the high cost of research and development for cutting-edge sensor technologies and the need for rigorous testing and certification to meet stringent industry standards.

- Market Concentration: Moderately concentrated, with top players dominating.

- Technological Innovation Drivers: Advancements in radar, ultrasonic, magnetostrictive, and laser technologies.

- Regulatory Frameworks: Emphasis on safety, environmental compliance, and hazardous area certifications.

- Competitive Product Substitutes: Mechanical sensors, manual gauging methods.

- End-User Demographics: Dominated by Oil & Gas, Chemical, Water & Wastewater, Power Generation.

- M&A Trends: Focus on portfolio expansion and technological consolidation.

- Innovation Barriers: High R&D costs, stringent certification requirements.

Level Sensor Industry Growth Trends & Insights

The global Level Sensor industry is projected to experience robust growth, driven by increasing industrial automation, stringent environmental regulations, and the growing demand for efficient resource management across various end-user industries. The market size is estimated to reach $7,500 Million by 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033. This growth trajectory is underpinned by several key trends. Firstly, the accelerating adoption of the Industrial Internet of Things (IIoT) and Industry 4.0 initiatives is a significant catalyst, demanding real-time data and sophisticated monitoring capabilities that advanced level sensors provide. This fuels the demand for continuous level sensors like radar and ultrasonic types, which offer non-contact measurement and high accuracy in challenging environments. Secondly, technological disruptions, including the miniaturization of sensor components, improved communication protocols (e.g., wireless), and enhanced data analytics capabilities integrated with level sensing solutions, are expanding application possibilities and improving operational efficiencies. For instance, the development of self-calibrating sensors and predictive maintenance algorithms is gaining traction. Consumer behavior shifts within industrial sectors are also playing a crucial role. End-users are increasingly prioritizing solutions that offer not only accurate measurement but also contribute to operational cost reduction, enhanced safety, and improved sustainability. This is evident in the growing preference for non-contact and hazardous-area-certified sensors, particularly in the oil and gas and chemical industries. Furthermore, the increasing complexity of industrial processes and the need for precise inventory management in sectors like food and beverage and pharmaceuticals are driving the demand for specialized and highly accurate level sensing technologies. The global market penetration of advanced level sensors is steadily increasing, moving beyond traditional applications to encompass a wider array of industrial processes. The forecast period is anticipated to witness significant market penetration for smart level sensors capable of transmitting data wirelessly and integrating seamlessly with SCADA and DCS systems. This evolving landscape presents substantial opportunities for manufacturers to innovate and cater to the specific needs of a dynamic industrial environment. The market's resilience is further bolstered by the essential nature of level measurement in critical industrial operations, ensuring consistent production and safety.

Dominant Regions, Countries, or Segments in Level Sensor Industry

The global Level Sensor industry’s growth is significantly influenced by regional dynamics and segment-specific demand. North America, particularly the United States and Canada, is a dominant region, driven by its mature industrial infrastructure, strong presence of oil and gas exploration and production, and advanced chemical manufacturing sectors. The U.S. market alone is projected to contribute over 30% of the global revenue by 2025. Key drivers in this region include stringent safety regulations in the oil and gas sector, requiring reliable level monitoring in upstream, midstream, and downstream operations, and substantial investments in water and wastewater infrastructure upgrades.

In terms of End-user Industry, the Oil and Gas sector continues to be the largest consumer of level sensors globally, estimated to account for approximately 25% of the total market revenue in 2025. This dominance is attributed to the vast number of storage tanks, processing facilities, and offshore platforms that require continuous and precise level monitoring for safety, inventory management, and operational efficiency. The Mining and Metal Processing sector also presents significant growth potential, driven by the need to monitor levels in ore bins, flotation cells, and tailings ponds, especially with the increasing global demand for raw materials.

Within Monitoring Type, Continuous Level Sensors are anticipated to experience a higher growth rate compared to Point Level Sensors. Among continuous sensors, Radar Level Sensors are emerging as a particularly strong segment, estimated to capture over 15% of the continuous sensor market by 2025, owing to their non-contact nature, high accuracy, and suitability for a wide range of media and challenging conditions like high temperatures and pressures. Ultrasonic level sensors also hold a substantial market share due to their cost-effectiveness and ease of installation.

Key Drivers in North America:

- Robust oil and gas industry with extensive infrastructure.

- Stringent safety and environmental regulations.

- Significant investments in water and wastewater management.

- High adoption rate of automation and IIoT technologies.

Dominance Factors in Oil and Gas:

- Critical need for safety and inventory control.

- Vast number of storage and processing facilities.

- Harsh operating environments requiring durable sensors.

Growth Potential in Continuous Level Sensors:

- Increasing demand for real-time data and automation.

- Superior accuracy and reliability in diverse applications.

- Advancements in IIoT integration and wireless communication.

Market Share of Radar Level Sensors:

- Projected to exceed 15% of the continuous sensor market by 2025.

- High suitability for challenging industrial media.

Level Sensor Industry Product Landscape

The product landscape of the Level Sensor industry is characterized by continuous innovation aimed at enhancing precision, reliability, and applicability across diverse industrial environments. Key advancements include the development of non-contact sensors like advanced radar and laser level sensors that offer superior performance in corrosive or abrasive media. Miniaturization and integration of smart features, such as wireless connectivity and self-diagnostic capabilities, are also prominent, enabling seamless integration into Industry 4.0 ecosystems. For applications requiring direct contact, improved materials and sealing technologies are enhancing the lifespan and accuracy of float and vibratory probe level sensors. The unique selling proposition for leading products often lies in their ability to operate reliably in extreme temperatures, high pressures, and hazardous environments, alongside their accuracy and ease of maintenance.

Key Drivers, Barriers & Challenges in Level Sensor Industry

Key Drivers: The Level Sensor industry is propelled by several critical factors. The relentless push towards industrial automation and Industry 4.0 initiatives is a primary driver, demanding precise and real-time data for efficient process control and optimization. Government regulations mandating improved safety and environmental monitoring, particularly in the oil and gas, chemical, and water treatment sectors, also significantly boost demand for advanced level sensing solutions. Furthermore, the growing need for accurate inventory management and loss prevention across various industries, including food and beverage and manufacturing, fuels the adoption of sophisticated level sensing technologies. Economic growth in developing regions also contributes by expanding industrial footprints and infrastructure development.

Barriers & Challenges: Despite strong growth drivers, the industry faces several hurdles. High upfront costs associated with sophisticated sensor technologies, such as advanced radar or guided wave radar systems, can be a barrier for small and medium-sized enterprises. The diverse and often harsh operating environments in industries like oil and gas and mining necessitate highly robust and specialized sensors, increasing development and manufacturing costs. Intense competition from established players and new entrants, leading to price pressures, is another significant challenge. Supply chain disruptions and the availability of raw materials for sensor manufacturing can also impact production timelines and costs. Moreover, the need for skilled personnel to install, calibrate, and maintain complex level sensing systems can limit adoption in certain regions.

Emerging Opportunities in Level Sensor Industry

Emerging opportunities in the Level Sensor industry are ripe for exploration. The increasing adoption of smart manufacturing and IIoT across a broader spectrum of industries presents a significant opportunity for sensors with integrated communication capabilities and data analytics. The growing focus on sustainability and resource efficiency in sectors like agriculture and food and beverage will drive demand for precise level monitoring in silos, tanks, and processing equipment. Furthermore, the expansion of renewable energy infrastructure, such as solar and wind farms that require monitoring of associated fluids and lubricants, and the development of advanced battery technologies with specific fluid level monitoring needs, offer new application avenues. The burgeoning market for specialized sensors in emerging economies, catering to nascent industrialization and infrastructure projects, also represents a substantial growth frontier.

Growth Accelerators in the Level Sensor Industry Industry

Several catalysts are accelerating long-term growth in the Level Sensor industry. Technological breakthroughs in materials science are enabling the development of sensors with enhanced durability and resistance to extreme conditions. Strategic partnerships between sensor manufacturers and IIoT platform providers are facilitating the creation of integrated solutions that offer greater value to end-users. Market expansion strategies, including targeted product development for niche applications and establishing strong distribution networks in emerging economies, are crucial for sustained growth. The increasing demand for predictive maintenance solutions, where level sensors play a vital role in monitoring equipment health and preventing unplanned downtime, is another significant accelerator.

Key Players Shaping the Level Sensor Industry Market

- Honeywell International Inc

- ABB Ltd

- Georg Fischer AG

- VEGA Grieshaber KG

- First Sensor AG

- BinMaster Inc

- Emerson Electric Co

- Siemens AG

- Sick AG

- TE Connectivity Ltd

- Endress + Hauser AG

- Baumer Group

Notable Milestones in Level Sensor Industry Sector

- 2020: Introduction of advanced contactless radar sensors with improved signal processing for highly viscous media.

- 2021: Launch of IIoT-enabled ultrasonic level sensors with integrated wireless connectivity for remote monitoring.

- 2022: Significant M&A activity focused on acquiring companies with expertise in magnetostrictive and guided wave radar technologies.

- 2023: Increased development of AI-powered analytics for level sensing data to enable predictive maintenance.

- 2024: Introduction of miniature and highly robust vibratory probe sensors for compact industrial applications.

In-Depth Level Sensor Industry Market Outlook

The outlook for the Level Sensor industry remains exceptionally positive, driven by ongoing technological advancements and the indispensable role of level measurement in modern industrial operations. Growth accelerators such as the pervasive adoption of Industry 4.0, a heightened emphasis on safety and environmental compliance, and the continuous demand for efficient resource management will fuel market expansion. Strategic opportunities lie in developing more intelligent, connected, and application-specific sensor solutions. The industry is poised for continued innovation, with future developments likely to focus on enhanced accuracy, remote diagnostics, and seamless integration into sophisticated control systems, ensuring sustained market growth and increased value creation for stakeholders.

Level Sensor Industry Segmentation

-

1. Monitoring Type

-

1.1. Point Level Sensors

- 1.1.1. Mechanical and Magnetic Float Level Sensors

- 1.1.2. Capacitance Level Sensors

- 1.1.3. Vibratory Probe Level Sensors

- 1.1.4. Conductivity Level Sensors

- 1.1.5. Other Point Level Sensors

-

1.2. Continuous Level Sensors

- 1.2.1. Laser Level Sensor

- 1.2.2. Ultrasonic Level Sensors

- 1.2.3. Magnetostrictive Level Sensors

- 1.2.4. Radar Level Sensors

- 1.2.5. Other Continuous Level Sensors

-

1.1. Point Level Sensors

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Oil and Gas

- 2.3. Mining and Metal Processing

- 2.4. Food and Beverage

- 2.5. Chemical

- 2.6. Water and Wastewater

- 2.7. Other En

Level Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East

Level Sensor Industry Regional Market Share

Geographic Coverage of Level Sensor Industry

Level Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Focus on Industrial Process Control; Growing Advancement of the IIoT and Industry 4.0

- 3.3. Market Restrains

- 3.3.1. Rising concerns related to data security

- 3.4. Market Trends

- 3.4.1. Oil and Gas Sector to be the Largest User of Level Sensors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Level Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 5.1.1. Point Level Sensors

- 5.1.1.1. Mechanical and Magnetic Float Level Sensors

- 5.1.1.2. Capacitance Level Sensors

- 5.1.1.3. Vibratory Probe Level Sensors

- 5.1.1.4. Conductivity Level Sensors

- 5.1.1.5. Other Point Level Sensors

- 5.1.2. Continuous Level Sensors

- 5.1.2.1. Laser Level Sensor

- 5.1.2.2. Ultrasonic Level Sensors

- 5.1.2.3. Magnetostrictive Level Sensors

- 5.1.2.4. Radar Level Sensors

- 5.1.2.5. Other Continuous Level Sensors

- 5.1.1. Point Level Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Oil and Gas

- 5.2.3. Mining and Metal Processing

- 5.2.4. Food and Beverage

- 5.2.5. Chemical

- 5.2.6. Water and Wastewater

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 6. North America Level Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 6.1.1. Point Level Sensors

- 6.1.1.1. Mechanical and Magnetic Float Level Sensors

- 6.1.1.2. Capacitance Level Sensors

- 6.1.1.3. Vibratory Probe Level Sensors

- 6.1.1.4. Conductivity Level Sensors

- 6.1.1.5. Other Point Level Sensors

- 6.1.2. Continuous Level Sensors

- 6.1.2.1. Laser Level Sensor

- 6.1.2.2. Ultrasonic Level Sensors

- 6.1.2.3. Magnetostrictive Level Sensors

- 6.1.2.4. Radar Level Sensors

- 6.1.2.5. Other Continuous Level Sensors

- 6.1.1. Point Level Sensors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power Generation

- 6.2.2. Oil and Gas

- 6.2.3. Mining and Metal Processing

- 6.2.4. Food and Beverage

- 6.2.5. Chemical

- 6.2.6. Water and Wastewater

- 6.2.7. Other En

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 7. Europe Level Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 7.1.1. Point Level Sensors

- 7.1.1.1. Mechanical and Magnetic Float Level Sensors

- 7.1.1.2. Capacitance Level Sensors

- 7.1.1.3. Vibratory Probe Level Sensors

- 7.1.1.4. Conductivity Level Sensors

- 7.1.1.5. Other Point Level Sensors

- 7.1.2. Continuous Level Sensors

- 7.1.2.1. Laser Level Sensor

- 7.1.2.2. Ultrasonic Level Sensors

- 7.1.2.3. Magnetostrictive Level Sensors

- 7.1.2.4. Radar Level Sensors

- 7.1.2.5. Other Continuous Level Sensors

- 7.1.1. Point Level Sensors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power Generation

- 7.2.2. Oil and Gas

- 7.2.3. Mining and Metal Processing

- 7.2.4. Food and Beverage

- 7.2.5. Chemical

- 7.2.6. Water and Wastewater

- 7.2.7. Other En

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 8. Asia Pacific Level Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 8.1.1. Point Level Sensors

- 8.1.1.1. Mechanical and Magnetic Float Level Sensors

- 8.1.1.2. Capacitance Level Sensors

- 8.1.1.3. Vibratory Probe Level Sensors

- 8.1.1.4. Conductivity Level Sensors

- 8.1.1.5. Other Point Level Sensors

- 8.1.2. Continuous Level Sensors

- 8.1.2.1. Laser Level Sensor

- 8.1.2.2. Ultrasonic Level Sensors

- 8.1.2.3. Magnetostrictive Level Sensors

- 8.1.2.4. Radar Level Sensors

- 8.1.2.5. Other Continuous Level Sensors

- 8.1.1. Point Level Sensors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power Generation

- 8.2.2. Oil and Gas

- 8.2.3. Mining and Metal Processing

- 8.2.4. Food and Beverage

- 8.2.5. Chemical

- 8.2.6. Water and Wastewater

- 8.2.7. Other En

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 9. Latin America Level Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 9.1.1. Point Level Sensors

- 9.1.1.1. Mechanical and Magnetic Float Level Sensors

- 9.1.1.2. Capacitance Level Sensors

- 9.1.1.3. Vibratory Probe Level Sensors

- 9.1.1.4. Conductivity Level Sensors

- 9.1.1.5. Other Point Level Sensors

- 9.1.2. Continuous Level Sensors

- 9.1.2.1. Laser Level Sensor

- 9.1.2.2. Ultrasonic Level Sensors

- 9.1.2.3. Magnetostrictive Level Sensors

- 9.1.2.4. Radar Level Sensors

- 9.1.2.5. Other Continuous Level Sensors

- 9.1.1. Point Level Sensors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Power Generation

- 9.2.2. Oil and Gas

- 9.2.3. Mining and Metal Processing

- 9.2.4. Food and Beverage

- 9.2.5. Chemical

- 9.2.6. Water and Wastewater

- 9.2.7. Other En

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 10. Middle East Level Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 10.1.1. Point Level Sensors

- 10.1.1.1. Mechanical and Magnetic Float Level Sensors

- 10.1.1.2. Capacitance Level Sensors

- 10.1.1.3. Vibratory Probe Level Sensors

- 10.1.1.4. Conductivity Level Sensors

- 10.1.1.5. Other Point Level Sensors

- 10.1.2. Continuous Level Sensors

- 10.1.2.1. Laser Level Sensor

- 10.1.2.2. Ultrasonic Level Sensors

- 10.1.2.3. Magnetostrictive Level Sensors

- 10.1.2.4. Radar Level Sensors

- 10.1.2.5. Other Continuous Level Sensors

- 10.1.1. Point Level Sensors

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Power Generation

- 10.2.2. Oil and Gas

- 10.2.3. Mining and Metal Processing

- 10.2.4. Food and Beverage

- 10.2.5. Chemical

- 10.2.6. Water and Wastewater

- 10.2.7. Other En

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Georg Fischer A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vega Grieshaber KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 First Sensor AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BinMaster Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emerson Electric Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sick AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TE Connectivity Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Endress + Hauser AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Baumer Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Level Sensor Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Level Sensor Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Level Sensor Industry Revenue (billion), by Monitoring Type 2025 & 2033

- Figure 4: North America Level Sensor Industry Volume (K Unit), by Monitoring Type 2025 & 2033

- Figure 5: North America Level Sensor Industry Revenue Share (%), by Monitoring Type 2025 & 2033

- Figure 6: North America Level Sensor Industry Volume Share (%), by Monitoring Type 2025 & 2033

- Figure 7: North America Level Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 8: North America Level Sensor Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Level Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Level Sensor Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Level Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Level Sensor Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Level Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Level Sensor Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Level Sensor Industry Revenue (billion), by Monitoring Type 2025 & 2033

- Figure 16: Europe Level Sensor Industry Volume (K Unit), by Monitoring Type 2025 & 2033

- Figure 17: Europe Level Sensor Industry Revenue Share (%), by Monitoring Type 2025 & 2033

- Figure 18: Europe Level Sensor Industry Volume Share (%), by Monitoring Type 2025 & 2033

- Figure 19: Europe Level Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 20: Europe Level Sensor Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Level Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Level Sensor Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Level Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Level Sensor Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Level Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Level Sensor Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Level Sensor Industry Revenue (billion), by Monitoring Type 2025 & 2033

- Figure 28: Asia Pacific Level Sensor Industry Volume (K Unit), by Monitoring Type 2025 & 2033

- Figure 29: Asia Pacific Level Sensor Industry Revenue Share (%), by Monitoring Type 2025 & 2033

- Figure 30: Asia Pacific Level Sensor Industry Volume Share (%), by Monitoring Type 2025 & 2033

- Figure 31: Asia Pacific Level Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 32: Asia Pacific Level Sensor Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Pacific Level Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Pacific Level Sensor Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Pacific Level Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Level Sensor Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Level Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Level Sensor Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Level Sensor Industry Revenue (billion), by Monitoring Type 2025 & 2033

- Figure 40: Latin America Level Sensor Industry Volume (K Unit), by Monitoring Type 2025 & 2033

- Figure 41: Latin America Level Sensor Industry Revenue Share (%), by Monitoring Type 2025 & 2033

- Figure 42: Latin America Level Sensor Industry Volume Share (%), by Monitoring Type 2025 & 2033

- Figure 43: Latin America Level Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Latin America Level Sensor Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Latin America Level Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Latin America Level Sensor Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Latin America Level Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Latin America Level Sensor Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Level Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Level Sensor Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Level Sensor Industry Revenue (billion), by Monitoring Type 2025 & 2033

- Figure 52: Middle East Level Sensor Industry Volume (K Unit), by Monitoring Type 2025 & 2033

- Figure 53: Middle East Level Sensor Industry Revenue Share (%), by Monitoring Type 2025 & 2033

- Figure 54: Middle East Level Sensor Industry Volume Share (%), by Monitoring Type 2025 & 2033

- Figure 55: Middle East Level Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 56: Middle East Level Sensor Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Middle East Level Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East Level Sensor Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East Level Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East Level Sensor Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East Level Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Level Sensor Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Level Sensor Industry Revenue billion Forecast, by Monitoring Type 2020 & 2033

- Table 2: Global Level Sensor Industry Volume K Unit Forecast, by Monitoring Type 2020 & 2033

- Table 3: Global Level Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Level Sensor Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Level Sensor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Level Sensor Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Level Sensor Industry Revenue billion Forecast, by Monitoring Type 2020 & 2033

- Table 8: Global Level Sensor Industry Volume K Unit Forecast, by Monitoring Type 2020 & 2033

- Table 9: Global Level Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Level Sensor Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Level Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Level Sensor Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Level Sensor Industry Revenue billion Forecast, by Monitoring Type 2020 & 2033

- Table 18: Global Level Sensor Industry Volume K Unit Forecast, by Monitoring Type 2020 & 2033

- Table 19: Global Level Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Level Sensor Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Level Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global Level Sensor Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: France Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Level Sensor Industry Revenue billion Forecast, by Monitoring Type 2020 & 2033

- Table 32: Global Level Sensor Industry Volume K Unit Forecast, by Monitoring Type 2020 & 2033

- Table 33: Global Level Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Level Sensor Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Level Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Level Sensor Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: China Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: China Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: India Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Japan Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Rest of Asia Pacific Level Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Rest of Asia Pacific Level Sensor Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Global Level Sensor Industry Revenue billion Forecast, by Monitoring Type 2020 & 2033

- Table 46: Global Level Sensor Industry Volume K Unit Forecast, by Monitoring Type 2020 & 2033

- Table 47: Global Level Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 48: Global Level Sensor Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 49: Global Level Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Level Sensor Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Global Level Sensor Industry Revenue billion Forecast, by Monitoring Type 2020 & 2033

- Table 52: Global Level Sensor Industry Volume K Unit Forecast, by Monitoring Type 2020 & 2033

- Table 53: Global Level Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Level Sensor Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Level Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Global Level Sensor Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Level Sensor Industry?

The projected CAGR is approximately 7.26%.

2. Which companies are prominent players in the Level Sensor Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Georg Fischer A, Vega Grieshaber KG, First Sensor AG, BinMaster Inc, Emerson Electric Co, Siemens AG, Sick AG, TE Connectivity Ltd, Endress + Hauser AG, Baumer Group.

3. What are the main segments of the Level Sensor Industry?

The market segments include Monitoring Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Focus on Industrial Process Control; Growing Advancement of the IIoT and Industry 4.0.

6. What are the notable trends driving market growth?

Oil and Gas Sector to be the Largest User of Level Sensors.

7. Are there any restraints impacting market growth?

Rising concerns related to data security.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Level Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Level Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Level Sensor Industry?

To stay informed about further developments, trends, and reports in the Level Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence