Key Insights

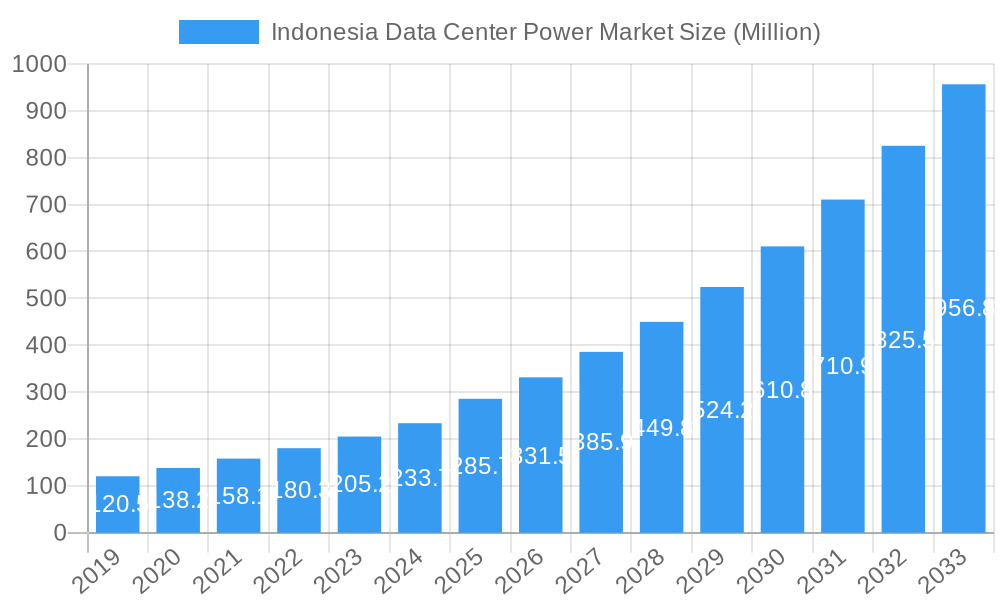

Indonesia's data center power market is poised for significant expansion, projected to reach an estimated USD 285.70 million by 2025, driven by a robust CAGR of 16.35%. This impressive growth trajectory is fueled by several key factors, most notably the escalating demand for digital services and cloud computing across various sectors. The burgeoning IT and Telecommunication industry, along with the critical needs of the BFSI and Government sectors, are significant contributors to this surge. Furthermore, the increasing adoption of advanced technologies, the proliferation of IoT devices, and the government's push for digital transformation initiatives are creating a fertile ground for data center development, consequently boosting the demand for reliable and efficient power solutions. The market is witnessing a substantial investment in robust power infrastructure, including uninterruptible power supply (UPS) systems, generators, and sophisticated power distribution solutions like switchgear and transfer switches. The forecast period (2025-2033) anticipates sustained high growth, reflecting a strong commitment to building out resilient and scalable data center facilities to support Indonesia's digital economy.

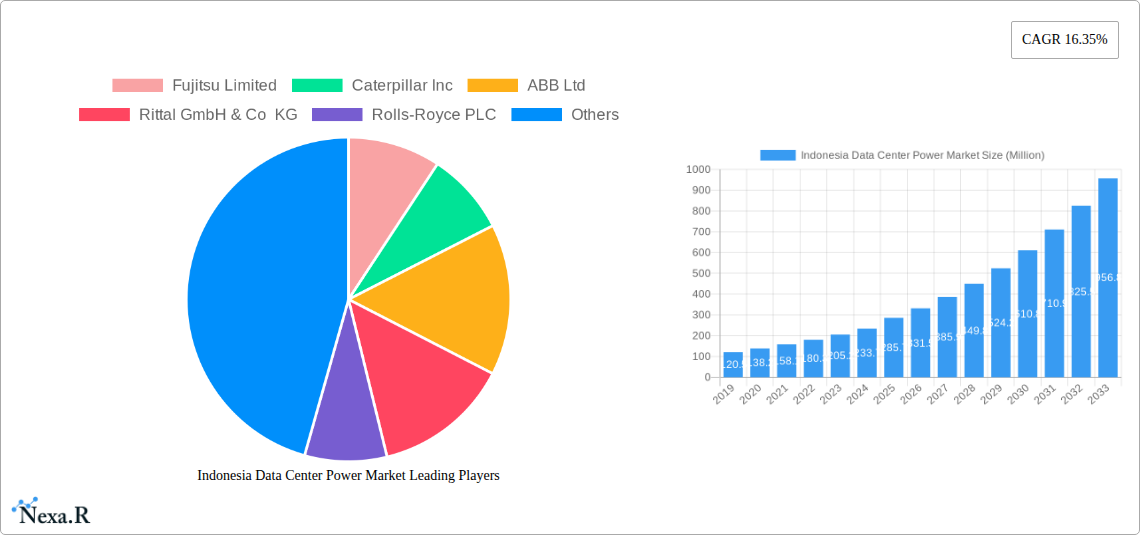

Indonesia Data Center Power Market Market Size (In Million)

The competitive landscape of the Indonesian data center power market is characterized by the presence of global industry leaders alongside capable local players, all vying to provide comprehensive power solutions. Key trends shaping the market include a strong emphasis on energy efficiency and sustainability, with a growing preference for greener power technologies and solutions that minimize operational costs and environmental impact. The integration of advanced monitoring and management systems for power infrastructure is also a significant trend, enabling real-time insights and proactive maintenance. While the market benefits from strong demand drivers, potential restraints could include the upfront capital investment required for advanced power solutions and the evolving regulatory landscape concerning energy consumption and data center operations. However, the overwhelming demand for data processing and storage, coupled with ongoing infrastructure development, is expected to outweigh these challenges, positioning Indonesia as a dynamic and rapidly growing market for data center power solutions over the coming years.

Indonesia Data Center Power Market Company Market Share

Indonesia Data Center Power Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Indonesia Data Center Power Market, a critical and rapidly expanding sector within the nation's digital infrastructure. Focused on the study period of 2019–2033, with a base year of 2025 and a forecast period spanning 2025–2033, this report offers unparalleled insights into market dynamics, growth trends, and future potential. We meticulously examine parent and child markets, detailing the intricate ecosystem of data center power solutions. With all values presented in Million units, this report is an indispensable resource for data center operators, power solution providers, investors, and policymakers seeking to navigate and capitalize on this lucrative market.

We delve into key segments including Power Infrastructure: Electrical Solution (encompassing UPS Systems, Generators, and Power Distribution Solutions like PDU, Switchgear, Critical Power Distribution, Transfer Switches, Remote Power Panels, and Other Power Distribution Solutions), Service, and End Users such as IT and Telecommunication, BFSI, Government, Media and Entertainment, and Other End Users. Our comprehensive coverage also highlights influential companies like Fujitsu Limited, Caterpillar Inc, ABB Ltd, Rittal GmbH & Co KG, Rolls-Royce PLC, Cisco Systems Inc (List Not Exhaustive), Cummins Inc, Vertiv Group Corp, Legrand Group, Schneider Electric SE, and Eaton Corporation.

Indonesia Data Center Power Market Market Dynamics & Structure

The Indonesia Data Center Power Market is characterized by a dynamic interplay of increasing digital transformation and evolving infrastructure demands. Market concentration is moderately fragmented, with key global players vying for dominance alongside emerging local entities. Technological innovation remains a primary driver, fueled by the constant need for higher efficiency, greater reliability, and reduced carbon footprints in data center operations. Regulatory frameworks are gradually maturing, aiming to standardize power quality and safety, though continuous adaptation to international best practices is crucial. Competitive product substitutes are abundant, ranging from traditional power backup systems to cutting-edge energy storage solutions, forcing providers to differentiate through performance, cost-effectiveness, and integrated services. End-user demographics are shifting towards hyperscale and colocation providers alongside traditional enterprise deployments, each with distinct power requirements. Merger and acquisition (M&A) trends are on the rise as established companies seek to expand their portfolios and geographical reach, and smaller innovators aim for scale. For instance, the recent acquisition of ZPE Systems Inc. by Legrand signifies a strategic move to bolster integrated data center solutions. Barriers to innovation often stem from the high capital expenditure required for advanced power technologies and the stringent reliability demands of the data center industry.

- Market Concentration: Moderately fragmented with a mix of global leaders and local players.

- Technological Innovation Drivers: Demand for higher efficiency, reliability, sustainability, and advanced cooling integration.

- Regulatory Frameworks: Evolving standards for power quality, safety, and environmental compliance.

- Competitive Product Substitutes: Wide array of solutions from UPS systems and generators to advanced energy storage and intelligent PDUs.

- End-User Demographics: Diversifying from enterprise to hyperscale, colocation, and edge computing needs.

- M&A Trends: Increasing activity driven by portfolio expansion and market consolidation.

- Innovation Barriers: High CAPEX, stringent reliability requirements, and long product lifecycles.

Indonesia Data Center Power Market Growth Trends & Insights

The Indonesia Data Center Power Market is poised for substantial expansion, driven by the nation's rapid digitalization and burgeoning demand for robust IT infrastructure. This market is experiencing significant growth in market size evolution, with projections indicating a compound annual growth rate (CAGR) of xx% during the forecast period. The adoption rates of advanced power solutions, such as high-efficiency UPS systems and intelligent power distribution units (PDUs), are escalating as data center operators prioritize operational resilience and energy cost reduction. Technological disruptions are playing a pivotal role, with innovations in modular power systems, advanced battery technologies, and smart grid integration offering new avenues for efficiency and sustainability. For example, the integration of renewable energy sources and sophisticated energy management systems is becoming a key trend. Consumer behavior shifts are also evident, with a growing emphasis on power redundancy, minimal downtime, and eco-friendly operations. Hyperscale cloud providers and large enterprises are increasingly investing in state-of-the-art power infrastructure to support their massive data processing needs and growing digital services. The increasing reliance on cloud computing, artificial intelligence, and the Internet of Things (IoT) is directly translating into a higher demand for reliable and scalable power solutions for data centers. Furthermore, the government's push towards digital transformation initiatives is creating a favorable environment for data center development, consequently boosting the power market. The expansion of 5G networks also necessitates more distributed data center infrastructure, further augmenting the need for localized and efficient power solutions. The market penetration of sophisticated power management software is also increasing, enabling data center managers to optimize power usage and predict potential issues proactively. This data-driven approach to power management is a significant trend shaping the market's future trajectory.

Dominant Regions, Countries, or Segments in Indonesia Data Center Power Market

Within the Indonesia Data Center Power Market, the Power Infrastructure: Electrical Solution segment stands out as a primary driver of growth, specifically the UPS Systems and Power Distribution Solutions. These components are fundamental to ensuring the continuous and stable operation of data centers, making them indispensable. The IT and Telecommunication end-user segment is the most dominant, given the exponential growth in data consumption, cloud services, and the ongoing rollout of advanced communication networks. This segment’s relentless demand for scalable and reliable data processing power directly translates into a substantial need for robust data center power infrastructure.

Key drivers for this dominance include:

- Economic Policies: Government initiatives promoting digital economy growth and investment in IT infrastructure create a fertile ground for data center expansion.

- Infrastructure Development: Significant investments in fiber optic networks and power grid upgrades are facilitating the establishment of new and expanded data center facilities.

- Surging Data Demand: The increasing adoption of e-commerce, digital payments, and streaming services by the Indonesian population fuels the need for more data storage and processing capacity.

- Colocation and Cloud Adoption: A growing number of businesses are migrating to colocation facilities and cloud services, necessitating the construction and expansion of data centers equipped with state-of-the-art power solutions.

- Technological Advancements: The adoption of technologies like AI, IoT, and big data analytics requires high-density computing environments, which in turn demand sophisticated and high-capacity power systems.

The Power Distribution Solutions, particularly PDUs and Switchgear, are crucial for efficiently managing and distributing power within the data center racks and across the facility. Their market share is substantial due to the increasing complexity of data center power architectures and the need for granular control and monitoring. The Service segment, encompassing installation, maintenance, and support, is also experiencing robust growth, driven by the need for specialized expertise to manage and optimize increasingly complex power systems. The BFSI sector also represents a significant end-user, with its stringent uptime requirements and data security needs driving substantial investments in reliable power infrastructure.

Indonesia Data Center Power Market Product Landscape

The Indonesia Data Center Power Market is witnessing a surge in innovative product offerings designed for enhanced efficiency, reliability, and sustainability. Leading players are focusing on developing high-density UPS Systems with improved power factors and reduced footprint, alongside intelligent PDUs offering advanced monitoring and control capabilities. Generators are evolving with more fuel-efficient engines and lower emission profiles, while Switchgear solutions are incorporating smart functionalities for enhanced safety and operational insights. The integration of these components into comprehensive Power Distribution Solutions is a key trend, providing data center operators with seamless and secure power management. Applications span from supporting hyperscale data centers with massive power demands to enabling the proliferation of edge computing facilities. Performance metrics are increasingly centered on energy efficiency ratios, uptime guarantees, and the ability to integrate with renewable energy sources.

Key Drivers, Barriers & Challenges in Indonesia Data Center Power Market

Key Drivers:

- Rapid Digital Transformation: The accelerating adoption of digital technologies across all sectors in Indonesia is a primary catalyst.

- Growing Demand for Cloud Services: Increasing reliance on cloud computing necessitates more data center capacity, thus driving demand for power solutions.

- Government Initiatives: Support for the digital economy and infrastructure development creates a favorable investment climate.

- Technological Advancements: Innovations in UPS, generators, and power distribution systems enhance efficiency and reliability.

- Increasing Data Consumption: The burgeoning use of AI, IoT, and big data analytics requires robust data processing capabilities.

Key Barriers & Challenges:

- High Initial Investment Costs: Advanced power infrastructure requires significant capital outlay, which can be a barrier for some operators.

- Grid Stability and Reliability: Inconsistent power supply in certain regions can pose challenges for data center operations.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and timely delivery of critical power components.

- Skilled Workforce Shortage: A lack of adequately trained personnel for installation, maintenance, and operation of sophisticated power systems.

- Regulatory Hurdles: Navigating complex permitting processes and evolving environmental regulations can be time-consuming.

- Competitive Pressures: Intense competition among power solution providers can lead to price pressures and thinner margins.

Emerging Opportunities in Indonesia Data Center Power Market

Emerging opportunities in the Indonesia Data Center Power Market lie in the burgeoning demand for edge data centers to support low-latency applications like autonomous vehicles and IoT devices. This creates a need for compact, highly efficient, and localized power solutions. Furthermore, the increasing focus on sustainability and green data centers presents a significant opportunity for providers of renewable energy integration solutions, advanced cooling technologies, and energy-efficient power equipment. The expansion of colocation services catering to SMEs and startups also opens up new market segments. The growing adoption of AI and machine learning in data center operations itself offers opportunities for intelligent power management software and predictive maintenance services, optimizing energy usage and minimizing downtime.

Growth Accelerators in the Indonesia Data Center Power Market Industry

Several key catalysts are accelerating growth in the Indonesia Data Center Power Market. The ongoing expansion of the digital economy, fueled by government policies promoting digital transformation and the increasing adoption of e-commerce and digital services, is a fundamental growth accelerator. The development of advanced connectivity infrastructure, including the expansion of 5G networks, directly stimulates the need for more data center capacity, thereby increasing the demand for reliable power. Strategic partnerships between data center developers, technology providers, and energy companies are also crucial, enabling integrated solutions and efficient project execution. Furthermore, market expansion strategies focused on developing hyperscale facilities and supporting specialized workloads like high-performance computing are significant growth drivers.

Key Players Shaping the Indonesia Data Center Power Market Market

- Fujitsu Limited

- Caterpillar Inc

- ABB Ltd

- Rittal GmbH & Co KG

- Rolls-Royce PLC

- Cisco Systems Inc

- Cummins Inc

- Vertiv Group Corp

- Legrand Group

- Schneider Electric SE

- Eaton Corporation

Notable Milestones in Indonesia Data Center Power Market Sector

- January 2024: Legrand acquired ZPE Systems Inc., a Fremont, California-based company that offers critical solutions and services to deliver resilience and security for customers’ business-critical infrastructure. The acquisition brings together ZPE’s secure and open management infrastructure and services delivery platform for data center, branch, and edge environments to Legrand’s comprehensive data center solutions of overhead busways, custom cabinets, intelligent PDUs, KVM switches, and advanced fiber solutions. ZPE Systems will become a business unit of Legrand’s Data, Power, and Control (DPC) division.

- December 2023: Cummins Inc. introduced three new generator models, C1760D5, C1875D5, and C2000D5B, with capacities ranging from 1700 kVA to 2000 kVA. These models are powered by the KTA50 engine series and are designed to meet diverse power needs.

In-Depth Indonesia Data Center Power Market Market Outlook

The future outlook for the Indonesia Data Center Power Market is exceptionally promising, driven by sustained economic growth, a rapidly expanding digital population, and increasing foreign investment in technology infrastructure. Key growth accelerators include the continued proliferation of cloud computing services, the development of advanced AI and IoT applications, and the government’s commitment to establishing Indonesia as a regional digital hub. Strategic opportunities lie in catering to the growing demand for hyperscale and colocation facilities, as well as the emerging need for power solutions supporting edge computing deployments. The market is expected to witness further innovation in energy-efficient power systems, renewable energy integration, and intelligent power management solutions, all contributing to a more sustainable and resilient data center ecosystem.

Indonesia Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Other Power Distribution Solutions

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT and Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media and Entertainment

- 2.5. Other End Users

Indonesia Data Center Power Market Segmentation By Geography

- 1. Indonesia

Indonesia Data Center Power Market Regional Market Share

Geographic Coverage of Indonesia Data Center Power Market

Indonesia Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Register Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Other Power Distribution Solutions

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media and Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fujitsu Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caterpillar Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rittal GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rolls-Royce PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cummins Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vertiv Group Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Legrand Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Schneider Electric SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eaton Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Fujitsu Limited

List of Figures

- Figure 1: Indonesia Data Center Power Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Data Center Power Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 2: Indonesia Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Indonesia Data Center Power Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 5: Indonesia Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Indonesia Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Data Center Power Market?

The projected CAGR is approximately 16.35%.

2. Which companies are prominent players in the Indonesia Data Center Power Market?

Key companies in the market include Fujitsu Limited, Caterpillar Inc, ABB Ltd, Rittal GmbH & Co KG, Rolls-Royce PLC, Cisco Systems Inc *List Not Exhaustive, Cummins Inc, Vertiv Group Corp, Legrand Group, Schneider Electric SE, Eaton Corporation.

3. What are the main segments of the Indonesia Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 285.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT and Telecom to Register Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

January 2024: Legrand acquired ZPE Systems Inc., a Fremont, California-based company that offers critical solutions and services to deliver resilience and security for customers’ business-critical infrastructure. The acquisition brings together ZPE’s secure and open management infrastructure and services delivery platform for data center, branch, and edge environments to Legrand’s comprehensive data center solutions of overhead busways, custom cabinets, intelligent PDUs, KVM switches, and advanced fiber solutions. ZPE Systems will become a business unit of Legrand’s Data, Power, and Control (DPC) division.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Data Center Power Market?

To stay informed about further developments, trends, and reports in the Indonesia Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence