Key Insights

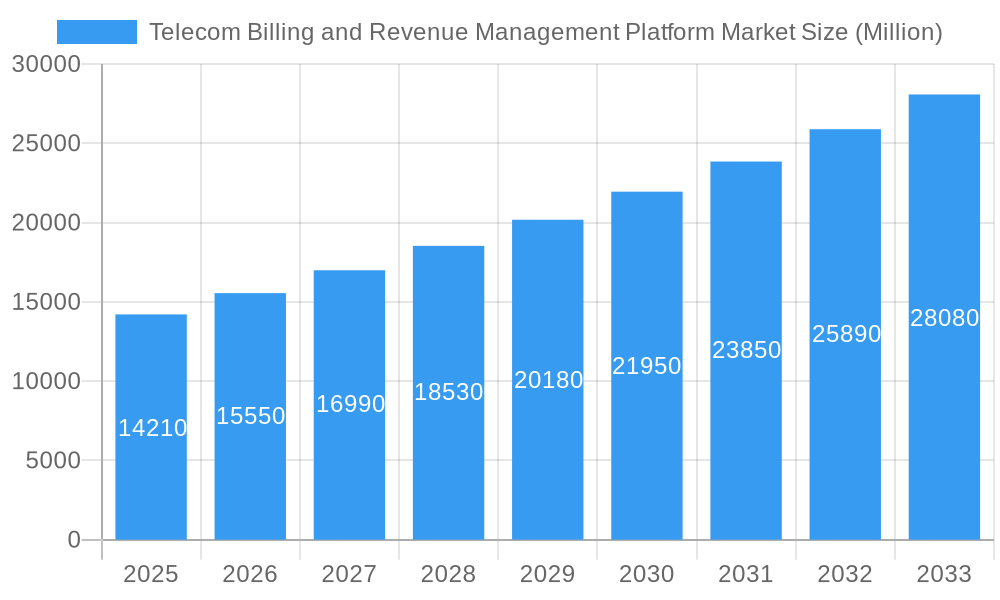

The Telecom Billing and Revenue Management Platform Market is poised for significant expansion, projected to reach a substantial $14.21 billion by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 9.43% throughout the forecast period of 2025-2033. The dynamic evolution of the telecommunications sector, characterized by the proliferation of diverse service offerings and increasing customer expectations for seamless billing and revenue assurance, serves as a primary driver. Key market enablers include the imperative for telcos to optimize revenue streams, enhance operational efficiency, and adapt to complex pricing models driven by 5G deployment, IoT expansion, and the growing demand for digital services. Furthermore, the increasing need for advanced analytics and personalized customer experiences within billing processes is also contributing to market momentum.

Telecom Billing and Revenue Management Platform Market Market Size (In Billion)

The market's expansion is further propelled by strategic shifts towards cloud-based solutions, offering scalability, flexibility, and reduced operational costs for telecom operators. While on-premise solutions remain relevant, the trend clearly favors cloud deployments for their agility in adapting to evolving market demands. The segmentation highlights the significant role of both software and service components, with operators increasingly seeking comprehensive solutions. Mobile operators and Internet Service Providers (ISPs) are the primary beneficiaries and adopters of these platforms, driven by the need to manage intricate billing cycles, prevent revenue leakage, and offer competitive convergent billing for bundled services. Despite the positive outlook, challenges such as the complexity of integrating legacy systems and the high initial investment for advanced platforms may pose some restraints. However, the sustained demand for efficient revenue assurance and sophisticated billing capabilities across all telecommunications segments ensures a promising trajectory for this market.

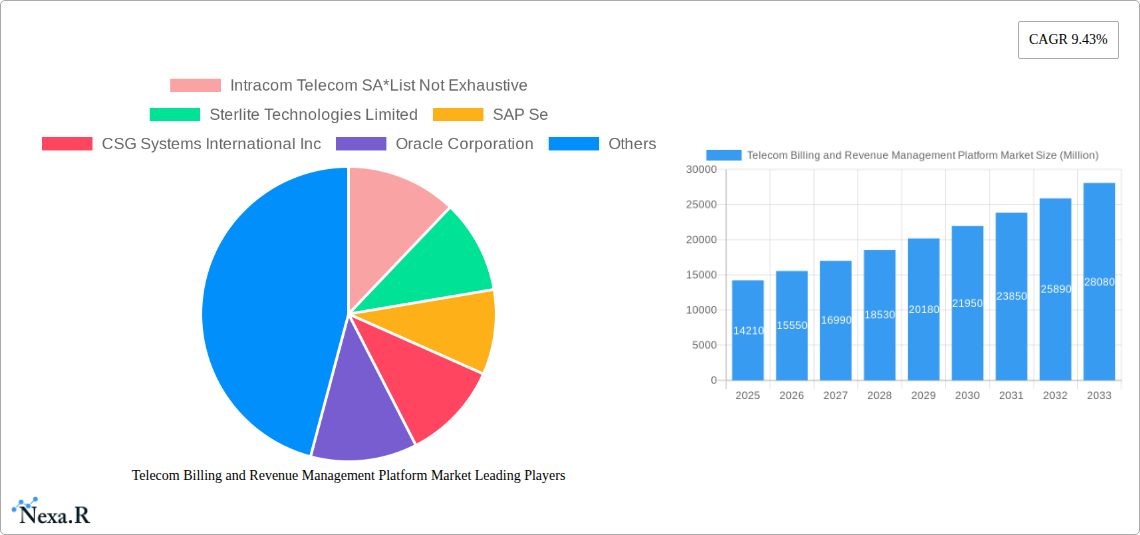

Telecom Billing and Revenue Management Platform Market Company Market Share

Telecom Billing and Revenue Management Platform Market: Comprehensive Report Description

Explore the dynamic Telecom Billing and Revenue Management Platform Market with our in-depth report, providing critical insights from 2019–2033. This essential resource for telecom operators, internet service providers (ISPs), and software vendors delves into the intricate landscape of telecom billing solutions, revenue assurance, and customer care platforms. Discover the latest telecom market trends, digital transformation strategies, and 5G monetization opportunities. With a focus on both cloud-based billing systems and on-premise deployments, and an analysis of mobile operator and ISP segments, this report is your definitive guide to navigating the evolving telecom revenue management ecosystem.

Telecom Billing and Revenue Management Platform Market Market Dynamics & Structure

The Telecom Billing and Revenue Management Platform Market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing market concentration. Key drivers include the relentless pursuit of operational efficiency and enhanced customer experience by telecom service providers. The market exhibits a moderate level of concentration, with major players like Oracle Corporation, SAP SE, Ericsson, and Nokia holding significant market share. However, niche players and new entrants are continually disrupting the landscape with specialized solutions. Technological innovation is primarily fueled by the demand for real-time billing, personalized customer offers, and advanced revenue assurance capabilities, especially with the rollout of 5G and IoT services. Regulatory frameworks, such as data privacy laws and inter-operator settlement regulations, also shape market dynamics. Competitive product substitutes, including in-house developed systems and less comprehensive billing tools, pose a challenge, but the specialized nature of dedicated platforms often provides a competitive edge. End-user demographics are shifting towards younger, digitally native consumers who expect seamless, self-service billing experiences. Mergers and acquisitions (M&A) are prevalent, driven by the need for scale, technological integration, and market expansion.

- Market Concentration: Moderate, with leading vendors and emerging specialists.

- Technological Innovation Drivers: Real-time billing, 5G monetization, IoT billing, AI-powered analytics, customer self-service.

- Regulatory Frameworks: Data privacy (e.g., GDPR), inter-operator settlement, consumer protection laws.

- Competitive Product Substitutes: In-house developed systems, simpler accounting software.

- End-User Demographics: Increasing demand for digital engagement and personalized services.

- M&A Trends: Driven by consolidation, acquisition of new technologies, and market access.

Telecom Billing and Revenue Management Platform Market Growth Trends & Insights

The Telecom Billing and Revenue Management Platform Market is poised for substantial growth, driven by the accelerating digital transformation within the telecommunications sector. Leveraging advancements in cloud computing and artificial intelligence, the market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% projected for the forecast period of 2025–2033. This growth is underpinned by the increasing adoption of sophisticated billing platforms that offer not just transactional capabilities but also deep insights into customer behavior and revenue streams. The surge in data consumption, the proliferation of connected devices, and the complex service offerings from mobile operators and Internet Service Providers necessitate robust and agile billing systems.

Technological disruptions are at the forefront of this evolution. The widespread deployment of 5G networks is creating new revenue streams from enhanced mobile broadband, massive machine-type communications, and ultra-reliable low-latency communication services, all of which demand intricate and flexible billing models. Similarly, the growth of the Internet of Things (IoT) ecosystem requires platforms capable of managing a massive volume of diverse transactions and charging mechanisms. Cloud-based billing solutions are gaining significant traction due to their scalability, cost-effectiveness, and faster deployment times, enabling telecom companies to adapt quickly to market changes and customer demands. This shift towards cloud infrastructure also facilitates easier integration with other enterprise systems, enhancing overall operational efficiency.

Consumer behavior is also a critical factor. Today's customers expect personalized offers, transparent billing, and convenient self-service options. Telecom billing platforms that can deliver these personalized experiences, coupled with effective customer relationship management (CRM) functionalities, are crucial for customer retention and acquisition. The ability of these platforms to provide real-time usage data, proactive alerts on potential overspending, and tailored service bundles directly influences customer satisfaction. Furthermore, the increasing focus on revenue assurance and fraud detection by telecom providers is driving the adoption of advanced analytics and AI capabilities within billing systems. These technologies help identify revenue leakage, prevent fraudulent activities, and optimize pricing strategies, thereby protecting and enhancing profitability. The overall market penetration of advanced billing and revenue management platforms is expected to rise as telecom operators prioritize modernization to remain competitive in a rapidly evolving industry landscape.

Dominant Regions, Countries, or Segments in Telecom Billing and Revenue Management Platform Market

The Cloud deployment segment is emerging as the dominant force within the Telecom Billing and Revenue Management Platform Market, significantly outpacing traditional On-premise solutions. This shift is propelled by the inherent advantages of cloud-based systems, including enhanced scalability, flexibility, and cost-efficiency, which are critical for telecom operators and Internet Service Providers navigating the complexities of modern network infrastructure. The ability to rapidly deploy, update, and scale services in the cloud allows providers to respond swiftly to market demands and technological advancements.

Among the types, the Software segment, encompassing both standalone billing solutions and integrated revenue management suites, is experiencing robust growth. This is further amplified by the increasing demand for Service-based offerings, such as managed billing services and cloud hosting for billing platforms, which reduce the operational burden on telecom providers.

The Mobile Operator segment remains a primary driver of market growth. The ever-increasing demand for mobile data, the ongoing 5G network deployments, and the introduction of diverse mobile service packages necessitate sophisticated billing and revenue management capabilities. These operators are at the forefront of adopting advanced technologies to monetize their services effectively and manage complex charging scenarios.

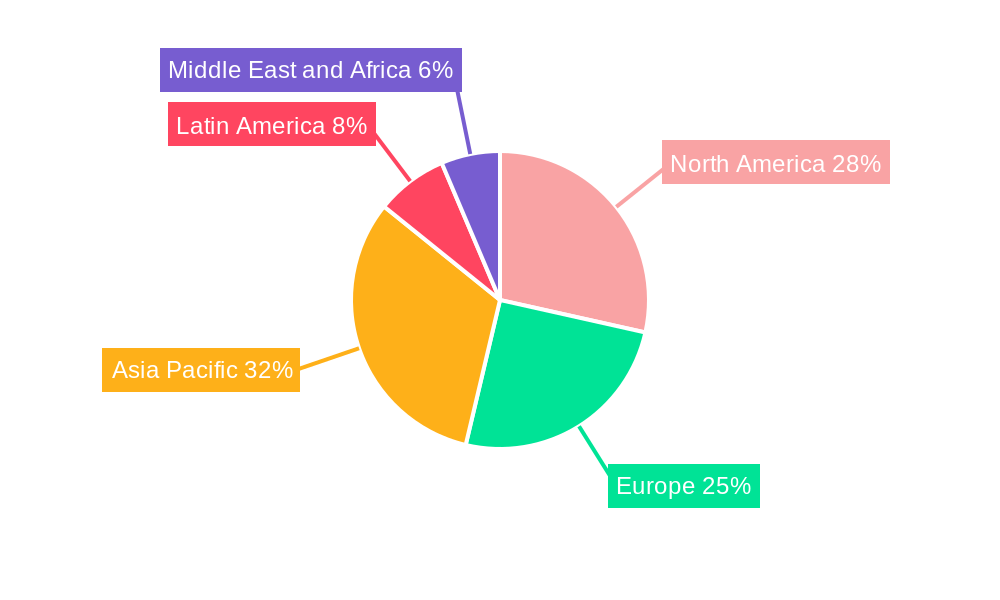

Geographically, North America and Europe currently represent the leading regions, driven by mature telecommunications markets, high smartphone penetration, and early adoption of advanced technologies like 5G. However, the Asia Pacific region is exhibiting the fastest growth rate. This surge is attributed to the rapid expansion of telecommunication infrastructure, a burgeoning subscriber base, significant investments in 5G technology, and government initiatives promoting digital inclusion. Countries like China, India, and Southeast Asian nations are increasingly adopting advanced telecom billing systems to manage their expanding networks and diverse customer needs.

Key drivers for this regional dominance include strong economic policies supporting digital infrastructure development, substantial foreign direct investment in the telecom sector, and a growing middle class with increasing disposable income for telecommunications services. The competitive landscape within these regions often spurs innovation, leading to the adoption of cutting-edge billing and revenue management platforms. The continuous evolution of service offerings, from bundled data plans to value-added services, further necessitates advanced platforms capable of handling intricate rating, charging, and billing processes.

Telecom Billing and Revenue Management Platform Market Product Landscape

The Telecom Billing and Revenue Management Platform Market showcases a landscape rich with innovative product offerings designed to streamline complex operations and unlock new revenue streams. Vendors are focusing on developing agile, cloud-native platforms that support real-time rating, charging, and billing for diverse services, including 5G, IoT, and converged offerings. Key product advancements include AI-powered analytics for revenue assurance, predictive customer churn analysis, and personalized product bundling. Unique selling propositions often revolve around the platform's ability to manage intricate charging rules for dynamic services, facilitate seamless integration with other enterprise systems, and provide a unified customer view across all touchpoints. Technological advancements are also centered on enhancing fraud detection capabilities, optimizing billing accuracy, and enabling self-service customer portals for greater convenience.

Key Drivers, Barriers & Challenges in Telecom Billing and Revenue Management Platform Market

Key Drivers:

The Telecom Billing and Revenue Management Platform Market is propelled by several key drivers. The accelerating adoption of 5G technology and the proliferation of IoT devices necessitate sophisticated billing solutions to manage complex data services and new revenue models. The increasing demand for personalized customer experiences and bundled service offerings requires agile platforms capable of flexible product configuration and real-time rating. Furthermore, the ongoing digital transformation initiatives by telecom operators and ISPs to improve operational efficiency and reduce costs are significant catalysts. The imperative to enhance revenue assurance and combat revenue leakage through advanced analytics and fraud detection also plays a crucial role.

Barriers & Challenges:

Despite the growth, the market faces significant barriers and challenges. The high cost of implementing and integrating new billing systems can be a deterrent, especially for smaller operators. Legacy systems within established telecom companies often present integration challenges and resistance to change. Evolving regulatory landscapes, particularly concerning data privacy and inter-operator settlements, can add complexity and compliance burdens. Intense competition from established vendors and the emergence of specialized niche players create pricing pressures and necessitate continuous innovation. Furthermore, the need for highly skilled personnel to manage and optimize these complex platforms poses a challenge for some organizations. Supply chain disruptions, while less direct for software, can impact the deployment timelines of hardware that integrates with billing systems.

Emerging Opportunities in Telecom Billing and Revenue Management Platform Market

Emerging opportunities within the Telecom Billing and Revenue Management Platform Market are abundant, driven by the rapid evolution of technology and consumer demands. The growing adoption of IoT devices presents a substantial opportunity for platforms capable of handling massive volumes of micro-transactions and diverse charging models for various connected devices, from smart homes to industrial applications. The expansion of the metaverse and Web3 technologies is likely to introduce new monetization avenues for telecom providers, requiring billing systems that can support complex digital asset transactions and virtual service subscriptions. Furthermore, the increasing demand for bundled digital services, encompassing streaming, gaming, and cloud storage, opens doors for integrated billing solutions that offer a seamless customer experience. The focus on sustainability and green ICT is also creating opportunities for platforms that can track and report energy consumption associated with network usage, potentially leading to new billing schemes.

Growth Accelerators in the Telecom Billing and Revenue Management Platform Market Industry

Several key growth accelerators are fueling the expansion of the Telecom Billing and Revenue Management Platform Market. The widespread rollout and adoption of 5G networks globally are creating a significant demand for advanced billing capabilities that can support new service types, dynamic pricing, and edge computing monetization strategies. Strategic partnerships and collaborations between telecom equipment manufacturers, software vendors, and cloud service providers are accelerating the development and deployment of integrated, end-to-end solutions. For instance, the collaboration between Netcracker Technology and Spectrum Enterprise exemplifies how expanded partnerships are leading to unified billing platforms serving a broader customer base. Market expansion strategies, particularly targeting developing economies with rapidly growing telecommunications infrastructure and subscriber bases, represent another crucial accelerator. The increasing emphasis on customer-centricity is driving the adoption of platforms that offer enhanced self-service portals, personalized offers, and loyalty programs, thereby improving customer retention and lifetime value.

Key Players Shaping the Telecom Billing and Revenue Management Platform Market Market

- Intracom Telecom SA

- Sterlite Technologies Limited

- SAP SE

- CSG Systems International Inc

- Oracle Corporation

- Comarch SA

- Enghouse Networks

- NetCracker Technology Corporation

- Nokia

- Huawei Technologies

- Optiva Inc

- Ericsson

Notable Milestones in Telecom Billing and Revenue Management Platform Market Sector

- March 2023: Spectrum Enterprise, a division of Charter Communications, and Netcracker Technology revealed an expanded partnership. Spectrum Enterprise selected Netcracker Revenue Management as its solution and will serve customers from a single billing platform. This development highlights the trend towards consolidated and integrated billing solutions for large-scale providers.

- October 2022: Ericsson partnered with Jio to build India's first 5G stand-alone network to achieve India's digital leadership. Jio's stand-alone 5G network deployment represents a major technological leap since it modernizes the network infrastructure to deliver a truly transformative 5G experience to consumers and enterprises. This milestone underscores the critical role of robust billing and revenue management platforms in supporting advanced network deployments and monetizing new services.

In-Depth Telecom Billing and Revenue Management Platform Market Market Outlook

The future outlook for the Telecom Billing and Revenue Management Platform Market is exceptionally bright, driven by continuous technological innovation and evolving market demands. Growth accelerators, such as the ongoing 5G expansion, the burgeoning IoT ecosystem, and the increasing demand for personalized digital services, are creating fertile ground for advanced billing and revenue assurance solutions. Strategic partnerships and market expansion into high-growth regions will further bolster industry development. The market's trajectory is firmly set towards cloud-native, AI-driven platforms that offer unparalleled flexibility, scalability, and customer insight. As telecom operators continue to prioritize digital transformation and seek to unlock new revenue streams, the demand for comprehensive and sophisticated billing and revenue management platforms will undoubtedly surge, solidifying its position as a critical component of the telecommunications value chain.

Telecom Billing and Revenue Management Platform Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. Type

- 2.1. Software

- 2.2. Service

-

3. Operator

- 3.1. Mobile Operator

- 3.2. Internet Service Provider

Telecom Billing and Revenue Management Platform Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Telecom Billing and Revenue Management Platform Market Regional Market Share

Geographic Coverage of Telecom Billing and Revenue Management Platform Market

Telecom Billing and Revenue Management Platform Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of Cellular or Mobile Subscribers; Growing Complexities in Revenue Sharing Across the Telecom Ecosystem

- 3.3. Market Restrains

- 3.3.1. Presence of Stringent Telecom Regulations

- 3.4. Market Trends

- 3.4.1. Mobile Operators to Account Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Billing and Revenue Management Platform Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Software

- 5.2.2. Service

- 5.3. Market Analysis, Insights and Forecast - by Operator

- 5.3.1. Mobile Operator

- 5.3.2. Internet Service Provider

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Telecom Billing and Revenue Management Platform Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Software

- 6.2.2. Service

- 6.3. Market Analysis, Insights and Forecast - by Operator

- 6.3.1. Mobile Operator

- 6.3.2. Internet Service Provider

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Telecom Billing and Revenue Management Platform Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Software

- 7.2.2. Service

- 7.3. Market Analysis, Insights and Forecast - by Operator

- 7.3.1. Mobile Operator

- 7.3.2. Internet Service Provider

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Telecom Billing and Revenue Management Platform Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Software

- 8.2.2. Service

- 8.3. Market Analysis, Insights and Forecast - by Operator

- 8.3.1. Mobile Operator

- 8.3.2. Internet Service Provider

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Telecom Billing and Revenue Management Platform Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Software

- 9.2.2. Service

- 9.3. Market Analysis, Insights and Forecast - by Operator

- 9.3.1. Mobile Operator

- 9.3.2. Internet Service Provider

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Telecom Billing and Revenue Management Platform Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Software

- 10.2.2. Service

- 10.3. Market Analysis, Insights and Forecast - by Operator

- 10.3.1. Mobile Operator

- 10.3.2. Internet Service Provider

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intracom Telecom SA*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sterlite Technologies Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SAP Se

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CSG Systems International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oracle Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Comarch SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Enghouse Networks

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NetCracker Technology Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nokia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huawei Technologies

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Optiva Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ericsson

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Intracom Telecom SA*List Not Exhaustive

List of Figures

- Figure 1: Global Telecom Billing and Revenue Management Platform Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Operator 2025 & 2033

- Figure 7: North America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Operator 2025 & 2033

- Figure 8: North America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Telecom Billing and Revenue Management Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Telecom Billing and Revenue Management Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Telecom Billing and Revenue Management Platform Market Revenue (Million), by Operator 2025 & 2033

- Figure 15: Europe Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Operator 2025 & 2033

- Figure 16: Europe Telecom Billing and Revenue Management Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue (Million), by Operator 2025 & 2033

- Figure 23: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Operator 2025 & 2033

- Figure 24: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Latin America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Operator 2025 & 2033

- Figure 31: Latin America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Operator 2025 & 2033

- Figure 32: Latin America Telecom Billing and Revenue Management Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue (Million), by Operator 2025 & 2033

- Figure 39: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Operator 2025 & 2033

- Figure 40: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Telecom Billing and Revenue Management Platform Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Operator 2020 & 2033

- Table 4: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Operator 2020 & 2033

- Table 8: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: US Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Operator 2020 & 2033

- Table 14: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: UK Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Operator 2020 & 2033

- Table 22: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: India Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: China Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Telecom Billing and Revenue Management Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Operator 2020 & 2033

- Table 30: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 32: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Operator 2020 & 2033

- Table 34: Global Telecom Billing and Revenue Management Platform Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Billing and Revenue Management Platform Market?

The projected CAGR is approximately 9.43%.

2. Which companies are prominent players in the Telecom Billing and Revenue Management Platform Market?

Key companies in the market include Intracom Telecom SA*List Not Exhaustive, Sterlite Technologies Limited, SAP Se, CSG Systems International Inc, Oracle Corporation, Comarch SA, Enghouse Networks, NetCracker Technology Corporation, Nokia, Huawei Technologies, Optiva Inc, Ericsson.

3. What are the main segments of the Telecom Billing and Revenue Management Platform Market?

The market segments include Deployment, Type, Operator.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Cellular or Mobile Subscribers; Growing Complexities in Revenue Sharing Across the Telecom Ecosystem.

6. What are the notable trends driving market growth?

Mobile Operators to Account Major Market Share.

7. Are there any restraints impacting market growth?

Presence of Stringent Telecom Regulations.

8. Can you provide examples of recent developments in the market?

March 2023 - A national supplier of scalable fiber technology solutions, Spectrum Enterprise, a division of Charter Communications, and Netcracker Technology revealed an expanded partnership. Spectrum Enterprise selected Netcracker Revenue Management as its solution and will serve customers from a single billing platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Billing and Revenue Management Platform Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Billing and Revenue Management Platform Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Billing and Revenue Management Platform Market?

To stay informed about further developments, trends, and reports in the Telecom Billing and Revenue Management Platform Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence