Key Insights

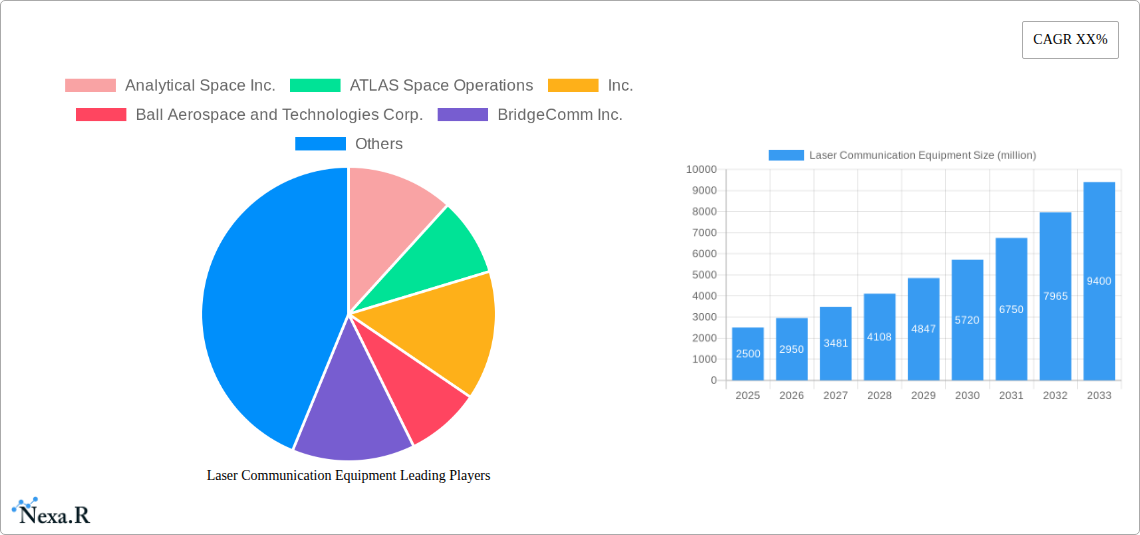

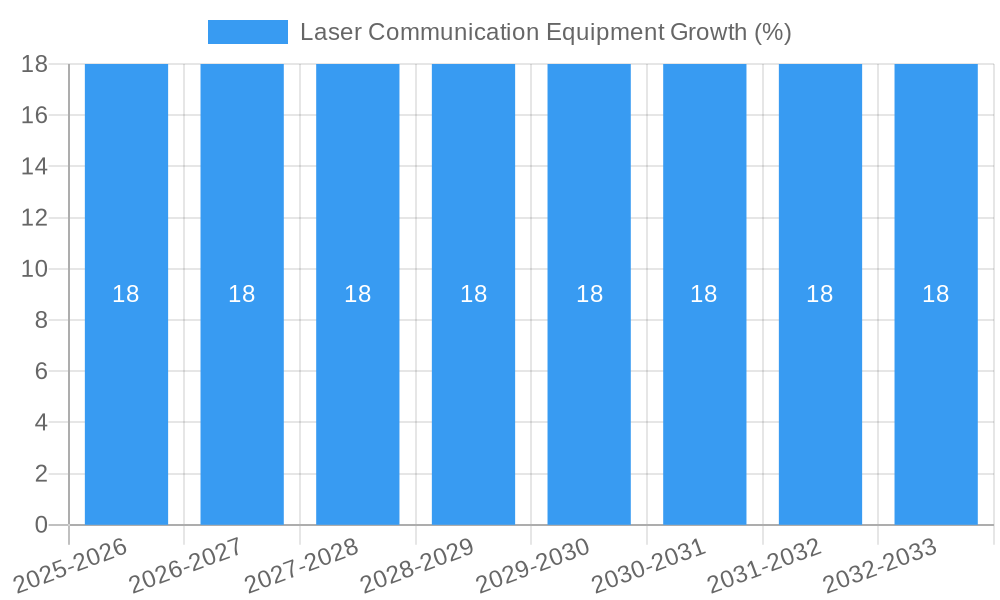

The global Laser Communication Equipment market is projected for substantial growth, with a current market size estimated at approximately \$2,500 million in 2025 and a robust Compound Annual Growth Rate (CAGR) of around 18%. This expansion is primarily fueled by the escalating demand for high-bandwidth, secure, and low-latency communication solutions across various sectors. Key drivers include the burgeoning satellite industry for Earth observation and backhaul services, the increasing adoption of enterprise connectivity solutions demanding superior data transfer capabilities, and the critical need for reliable last-mile access, especially in underserved areas. The inherent advantages of laser communication, such as increased data rates, reduced latency, and enhanced security due to focused beams, position it as a superior alternative to traditional radio frequency (RF) communication in many applications. Advancements in technology, including miniaturization of components and improved efficiency of transmitters and receivers, are further accelerating market penetration.

Despite the optimistic outlook, certain restraints could temper the growth trajectory. The high initial cost of deployment and the complexity of regulatory frameworks in some regions present significant hurdles. Furthermore, the susceptibility of laser communication to atmospheric conditions like fog and clouds, though being mitigated by technological advancements and redundancy strategies, remains a concern for specific terrestrial applications. However, the market is actively addressing these challenges through innovations in adaptive optics and the increasing reliance on space-based laser links. The competitive landscape is characterized by a mix of established aerospace and technology giants and emerging specialized players like Analytical Space Inc. and Mynaric AG, all vying to capture market share by offering advanced solutions for diverse applications ranging from backhaul and Earth observation to enterprise connectivity and last-mile access.

Laser Communication Equipment Market Report: Navigating the Future of High-Speed Data Transmission

This comprehensive report offers an in-depth analysis of the global Laser Communication Equipment market, meticulously examining market dynamics, growth trends, regional dominance, product innovations, and key strategic factors. Spanning from 2019 to 2033, with a base year of 2025, this report provides actionable insights for industry stakeholders, investors, and strategists seeking to capitalize on the rapidly evolving landscape of optical communication. We delve into the intricate interplay of technological advancements, competitive forces, and emerging applications that are shaping the future of high-bandwidth data transfer.

Laser Communication Equipment Market Dynamics & Structure

The Laser Communication Equipment market exhibits a dynamic and evolving structure, characterized by a moderate to high level of market concentration. Leading entities are investing heavily in research and development to push the boundaries of speed, reliability, and miniaturization. Technological innovation is primarily driven by the insatiable demand for higher data throughput, reduced latency, and increased security in communication networks. Regulatory frameworks, while still developing in some regions, are increasingly focusing on spectrum allocation and interoperability standards to facilitate wider adoption. Competitive product substitutes, mainly fiber optics, remain a significant factor, but laser communication's advantages in specific use cases, such as space-to-ground communication and secure point-to-point links, are creating distinct market niches. End-user demographics are expanding beyond traditional telecommunications to include satellite operators, defense agencies, enterprise networks, and even consumer applications requiring ultra-fast connectivity. Mergers and acquisitions (M&A) are becoming more prevalent as larger players seek to consolidate their market position and acquire specialized technologies. For instance, the market witnessed an estimated xx M&A deals in the historical period (2019-2024), signaling consolidation and strategic growth. Innovation barriers include the high cost of initial R&D and manufacturing, as well as the need for specialized infrastructure.

- Market Concentration: Dominated by a few key players with strong R&D capabilities, but with growing opportunities for niche specialists.

- Technological Innovation Drivers: Demand for higher bandwidth, lower latency, space-grade reliability, and enhanced security.

- Regulatory Frameworks: Evolving standards for spectrum usage, interoperability, and data transmission protocols.

- Competitive Product Substitutes: Fiber optics remain a strong competitor, but laser communication offers unique advantages in specific environments.

- End-User Demographics: Expanding from defense and aerospace to telecommunications, enterprise, and emerging IoT applications.

- M&A Trends: Increasing consolidation to acquire intellectual property and market share, with an estimated xx deals in the historical period.

Laser Communication Equipment Growth Trends & Insights

The Laser Communication Equipment market is poised for substantial growth, projected to expand at a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This upward trajectory is fueled by a confluence of factors, including the escalating global demand for high-speed data, the burgeoning satellite internet market, and the increasing need for secure and efficient communication solutions across various sectors. In the base year of 2025, the global market size is estimated at approximately $XX million units, with projections indicating a significant expansion by 2033. Adoption rates for laser communication technology are accelerating, particularly in the aerospace and defense sectors, where its inherent advantages in terms of bandwidth and security are paramount. The development of new satellite constellations and the increasing complexity of space-based missions are directly translating into higher demand for robust laser communication systems. Technological disruptions are continuously reshaping the market, with ongoing advancements in laser power efficiency, beam steering accuracy, and miniaturization of components. These innovations are making laser communication more accessible and applicable to a wider range of scenarios. Furthermore, evolving consumer behavior, with a growing expectation for seamless, high-bandwidth connectivity across all aspects of life, is indirectly pushing the demand for more advanced communication infrastructure that laser technology can help fulfill. The market penetration of laser communication in terrestrial applications is also on an upward trend, driven by the need for high-capacity backhaul solutions and secure enterprise connectivity. For instance, in the historical period (2019-2024), market penetration in key segments saw an estimated increase of XX%. The estimated market size in 2025 is projected to reach $XX million units, with strong growth forecasted across all application segments. The forecast period (2025-2033) is expected to witness a CAGR of XX%, highlighting the significant expansion potential.

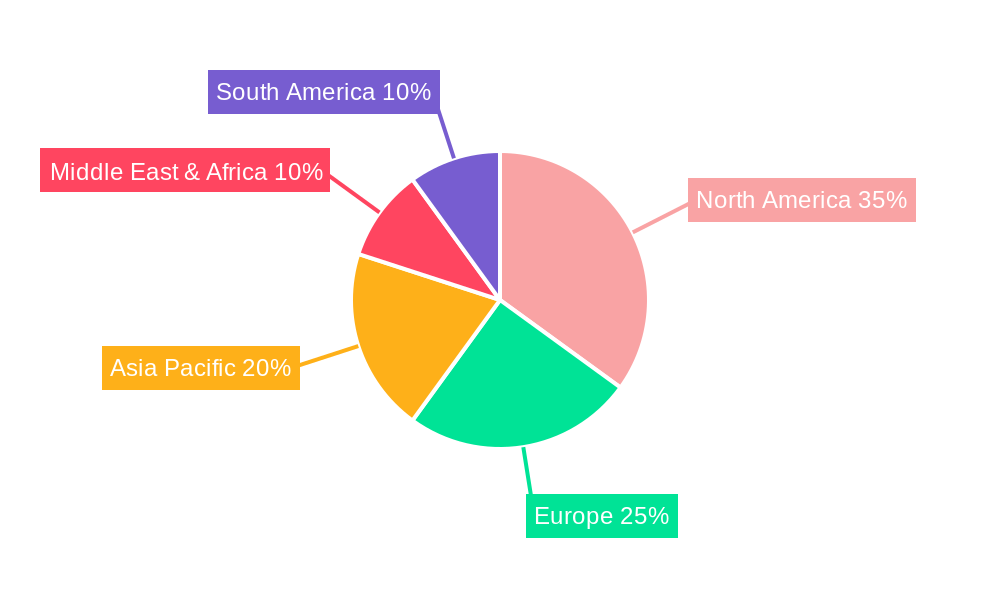

Dominant Regions, Countries, or Segments in Laser Communication Equipment

The global Laser Communication Equipment market's dominance is significantly influenced by advancements and strategic investments in specific regions and application segments. North America, particularly the United States, is a leading region driving market growth. This dominance is underpinned by strong government funding for defense and space exploration initiatives, coupled with a vibrant ecosystem of private companies and research institutions actively engaged in laser communication research and development. The presence of key players like Ball Aerospace and Technologies Corp., Maxar Technologies Ltd., and Analytical Space Inc. further solidifies North America's leading position. Economically, the region benefits from substantial investment in next-generation communication infrastructure, including satellite constellations and advanced terrestrial networks. The "Earth Observation" application segment is a primary driver of growth, fueled by increasing demand for high-resolution satellite imagery and data processing, which necessitates high-bandwidth communication links. Countries like the United States and its allies are investing heavily in Earth observation capabilities for scientific research, environmental monitoring, and national security. Furthermore, the "Backhaul" segment, crucial for augmenting existing terrestrial networks and connecting remote areas, is experiencing substantial growth, particularly in regions with developing infrastructure. Technological innovation in advanced satellite systems and ground stations is critical. For instance, the market share of Earth Observation applications is estimated to be around XX% in the base year 2025. The growth potential within this segment is further amplified by the increasing adoption of commercial Earth observation services. Additionally, the "Transmitter" and "Receiver" types of laser communication equipment are experiencing significant demand, as these are fundamental components for establishing optical links. Strategic partnerships between satellite manufacturers, ground station operators, and telecommunication providers are accelerating the deployment and adoption of these technologies, contributing to the overall market expansion. The market share of the Transmitter segment in the base year 2025 is estimated at XX million units, with similar figures for the Receiver segment.

- Leading Region: North America (primarily the United States) due to robust defense spending, space programs, and private sector innovation.

- Key Application Segment: Earth Observation, driven by demand for high-resolution satellite data and advanced imaging capabilities.

- Dominant Countries: United States, followed by Europe (especially Germany and France) and increasingly, China, due to their respective advancements in space technology and communication.

- Key Equipment Types: Transmitters and Receivers are fundamental components experiencing high demand.

- Growth Drivers: Government investments in defense and space, commercial satellite constellations, and the need for high-bandwidth terrestrial backhaul.

- Market Share (Earth Observation): Estimated XX% in 2025.

- Market Share (Transmitter Type): Estimated XX million units in 2025.

Laser Communication Equipment Product Landscape

The Laser Communication Equipment product landscape is characterized by continuous innovation focused on enhancing data rates, reducing size, weight, and power (SWaP) consumption, and improving the reliability of optical links. Leading companies are developing advanced laser communication terminals (LCTs) that offer multi-gigabit per second (Gbps) data transfer speeds, significantly outperforming traditional radio frequency (RF) communication for certain applications. Key product innovations include highly directional laser beams for secure point-to-point communication, adaptive optics for atmospheric compensation in terrestrial links, and miniaturized optical modules for integration into small satellites. Applications are diverse, ranging from high-speed backhaul for telecommunication networks and secure enterprise connectivity to critical data transfer for Earth observation satellites and inter-satellite links within constellations. The performance metrics being pushed include increased link distances, reduced bit error rates (BER), and wider operating temperature ranges. Unique selling propositions often revolve around the inherent security of laser communication, its resistance to jamming and interference, and its ability to handle vast amounts of data efficiently. For example, Mynaric AG is known for its advanced laser communication terminals designed for commercial and defense applications.

Key Drivers, Barriers & Challenges in Laser Communication Equipment

Key Drivers: The growth of the Laser Communication Equipment market is primarily propelled by the insatiable demand for higher bandwidth and faster data transmission speeds, driven by emerging technologies like 5G/6G networks, AI, and the Internet of Things (IoT). The increasing proliferation of satellite constellations for broadband internet, Earth observation, and defense applications is a significant catalyst. Furthermore, the inherent security advantages of laser communication, such as its narrow beam and resistance to interception, are crucial for government and defense applications. The growing need for efficient and reliable backhaul solutions in terrestrial networks, especially in areas with limited fiber optic infrastructure, also fuels market expansion.

Key Barriers & Challenges: Despite its potential, the market faces several barriers. The high cost of research, development, and manufacturing for advanced laser communication systems remains a significant impediment. Regulatory hurdles related to spectrum allocation and international standardization can slow down widespread adoption. Atmospheric conditions, such as clouds and fog, can disrupt terrestrial laser links, necessitating robust mitigation strategies or limiting their deployment in certain geographies, impacting an estimated XX% of potential terrestrial deployments. Supply chain issues for specialized optical components can also pose challenges. Competitive pressures from established fiber optic technologies, though offering different advantages, continue to influence market penetration.

Emerging Opportunities in Laser Communication Equipment

Emerging opportunities in the Laser Communication Equipment sector are primarily centered around the expansion of satellite-based services and the increasing demand for secure, high-capacity terrestrial links. The growth of small satellite constellations for Earth observation, telecommunications, and scientific research presents a substantial market for compact and efficient laser communication terminals. Furthermore, the development of free-space optical communication for providing last-mile connectivity in urban and rural areas, bypassing the need for extensive trenching and cabling, offers a significant untapped market. The integration of laser communication into next-generation aerial platforms, such as high-altitude pseudo-satellites (HAPS) and drones, for persistent surveillance and communication relays, is another promising avenue. The increasing adoption of quantum key distribution (QKD) over optical links further opens new markets for secure communication solutions.

Growth Accelerators in the Laser Communication Equipment Industry

Several catalysts are accelerating long-term growth in the Laser Communication Equipment industry. Technological breakthroughs in solid-state lasers, advanced optical modulators, and highly efficient detectors are continuously improving performance and reducing costs. Strategic partnerships between satellite manufacturers, telecommunication providers, and defense contractors are crucial for developing integrated solutions and expanding market reach. The ongoing miniaturization and commercialization of laser communication technology are making it more accessible for a wider range of applications, including commercial drones and aerial vehicles. Furthermore, increasing government initiatives and investments in space-based infrastructure and advanced communication technologies are providing a strong foundation for sustained growth. The development of standardized interfaces and interoperability protocols will also play a vital role in accelerating adoption.

Key Players Shaping the Laser Communication Equipment Market

- Analytical Space Inc.

- ATLAS Space Operations, Inc.

- Ball Aerospace and Technologies Corp.

- BridgeComm Inc.

- Hisdesat Servicios Estrategicos S.A.

- Laser Light Communications Inc.

- Maxar Technologies Ltd.

- Mitsubishi Electric Corporation

- Mynaric AG

- SITAEL S.p.A.

Notable Milestones in Laser Communication Equipment Sector

- 2020: Launch of the first commercial optical inter-satellite link by SpaceX for Starlink, demonstrating the viability of laser communication in large constellations.

- 2021: Mynaric AG successfully tests its CONDOR terminal for a record distance, showcasing advancements in long-range space-to-ground laser communication.

- 2022: BridgeComm Inc. announces successful demonstration of their free-space optical communication system for secure enterprise connectivity.

- 2023: Analytical Space Inc. secures significant funding to accelerate the development of their CubeSat laser communication capabilities.

- 2024: ATLAS Space Operations, Inc. expands its global ground station network, enhancing its capacity to support laser communication missions.

In-Depth Laser Communication Equipment Market Outlook

The future of the Laser Communication Equipment market is exceptionally promising, driven by persistent demand for higher bandwidth and increased connectivity across various sectors. Growth accelerators, including technological advancements in miniaturization and efficiency, coupled with strategic collaborations among key industry players, are poised to unlock significant market potential. The expansion of satellite constellations for Earth Observation and broadband internet services will continue to be a primary growth engine. Furthermore, emerging opportunities in last-mile access and secure enterprise connectivity, leveraging free-space optical technologies, represent substantial untapped markets. The increasing focus on space-based infrastructure and advanced communication by governments worldwide provides a strong foundation for sustained innovation and market expansion, solidifying laser communication's role as a critical enabler of future digital economies.

Laser Communication Equipment Segmentation

-

1. Application

- 1.1. Backhaul

- 1.2. Earth Observation

- 1.3. Enterprise Connectivity

- 1.4. Last Mile Access

- 1.5. Others

-

2. Types

- 2.1. Transmitter

- 2.2. Receiver

- 2.3. Modulator

- 2.4. Demodulator

Laser Communication Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Laser Communication Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laser Communication Equipment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Backhaul

- 5.1.2. Earth Observation

- 5.1.3. Enterprise Connectivity

- 5.1.4. Last Mile Access

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Transmitter

- 5.2.2. Receiver

- 5.2.3. Modulator

- 5.2.4. Demodulator

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Laser Communication Equipment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Backhaul

- 6.1.2. Earth Observation

- 6.1.3. Enterprise Connectivity

- 6.1.4. Last Mile Access

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Transmitter

- 6.2.2. Receiver

- 6.2.3. Modulator

- 6.2.4. Demodulator

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Laser Communication Equipment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Backhaul

- 7.1.2. Earth Observation

- 7.1.3. Enterprise Connectivity

- 7.1.4. Last Mile Access

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Transmitter

- 7.2.2. Receiver

- 7.2.3. Modulator

- 7.2.4. Demodulator

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Laser Communication Equipment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Backhaul

- 8.1.2. Earth Observation

- 8.1.3. Enterprise Connectivity

- 8.1.4. Last Mile Access

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Transmitter

- 8.2.2. Receiver

- 8.2.3. Modulator

- 8.2.4. Demodulator

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Laser Communication Equipment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Backhaul

- 9.1.2. Earth Observation

- 9.1.3. Enterprise Connectivity

- 9.1.4. Last Mile Access

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Transmitter

- 9.2.2. Receiver

- 9.2.3. Modulator

- 9.2.4. Demodulator

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Laser Communication Equipment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Backhaul

- 10.1.2. Earth Observation

- 10.1.3. Enterprise Connectivity

- 10.1.4. Last Mile Access

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Transmitter

- 10.2.2. Receiver

- 10.2.3. Modulator

- 10.2.4. Demodulator

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Analytical Space Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ATLAS Space Operations

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ball Aerospace and Technologies Corp.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BridgeComm Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hisdesat Servicios Estrategicos S.A.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Laser Light Communications Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maxar Technologies Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Electric Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mynaric AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SITAEL S.p.A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Analytical Space Inc.

List of Figures

- Figure 1: Global Laser Communication Equipment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Laser Communication Equipment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Laser Communication Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Laser Communication Equipment Revenue (million), by Types 2024 & 2032

- Figure 5: North America Laser Communication Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Laser Communication Equipment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Laser Communication Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Laser Communication Equipment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Laser Communication Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Laser Communication Equipment Revenue (million), by Types 2024 & 2032

- Figure 11: South America Laser Communication Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Laser Communication Equipment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Laser Communication Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Laser Communication Equipment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Laser Communication Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Laser Communication Equipment Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Laser Communication Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Laser Communication Equipment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Laser Communication Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Laser Communication Equipment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Laser Communication Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Laser Communication Equipment Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Laser Communication Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Laser Communication Equipment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Laser Communication Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Laser Communication Equipment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Laser Communication Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Laser Communication Equipment Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Laser Communication Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Laser Communication Equipment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Laser Communication Equipment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Laser Communication Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Laser Communication Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Laser Communication Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Laser Communication Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Laser Communication Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Laser Communication Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Laser Communication Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Laser Communication Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Laser Communication Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Laser Communication Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Laser Communication Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Laser Communication Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Laser Communication Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Laser Communication Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Laser Communication Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Laser Communication Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Laser Communication Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Laser Communication Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Laser Communication Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Laser Communication Equipment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Communication Equipment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Laser Communication Equipment?

Key companies in the market include Analytical Space Inc., ATLAS Space Operations, Inc., Ball Aerospace and Technologies Corp., BridgeComm Inc., Hisdesat Servicios Estrategicos S.A., Laser Light Communications Inc., Maxar Technologies Ltd., Mitsubishi Electric Corporation, Mynaric AG, SITAEL S.p.A.

3. What are the main segments of the Laser Communication Equipment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laser Communication Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laser Communication Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laser Communication Equipment?

To stay informed about further developments, trends, and reports in the Laser Communication Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence