Key Insights

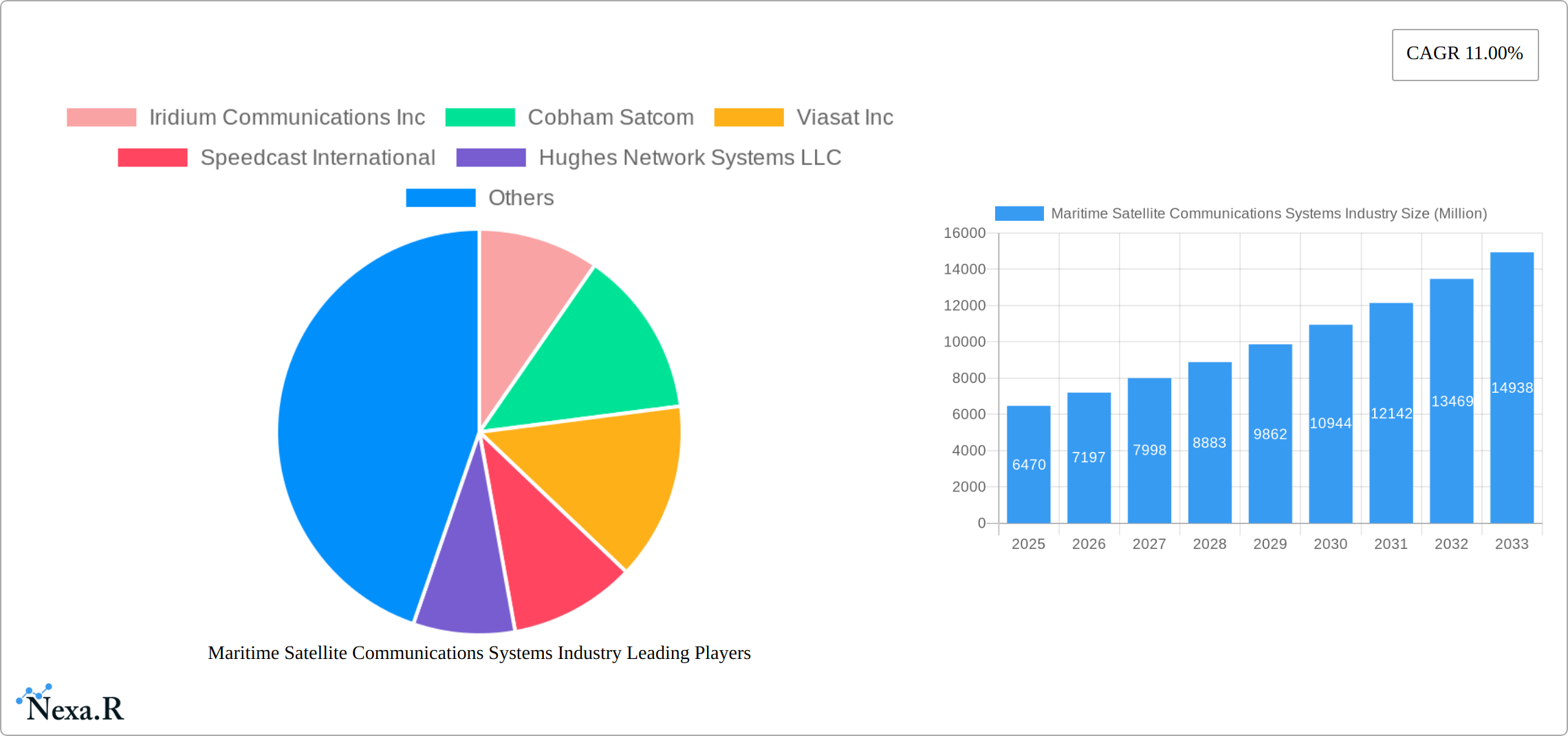

The maritime satellite communications systems market, valued at $6.47 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for reliable and high-speed internet connectivity at sea, particularly for enhanced vessel operations, safety, and crew welfare, is a primary driver. Growing adoption of Internet of Things (IoT) devices in maritime applications for real-time monitoring of cargo and vessel performance is further fueling market growth. Stringent regulations regarding maritime safety and security, necessitating robust communication systems, also contribute significantly. Furthermore, the expansion of global trade and the increasing size of the maritime fleet are driving demand for advanced satellite communication solutions. The market is segmented by type (MSS, VSAT), offering (solutions, services), and end-user verticals (merchant vessels, offshore rigs, passenger fleets, leisure crafts). The VSAT segment holds a significant share due to its ability to provide high-throughput data capabilities. Service offerings dominate the market due to the ongoing need for maintenance, support, and upgrades. The merchant vessel segment is the largest end-user vertical, owing to the sheer volume of cargo ships requiring communication solutions. Competition is fierce amongst established players like Iridium, Cobham, Viasat, and Inmarsat, prompting ongoing innovation and competitive pricing.

The geographical distribution of the market shows a balanced presence across regions. While North America and Europe currently hold significant market shares due to established infrastructure and a large maritime fleet, the Asia-Pacific region is projected to witness the highest growth rate over the forecast period, driven by expanding trade routes and investments in maritime infrastructure. The Rest of the World segment also presents significant growth opportunities, particularly in emerging economies with developing maritime industries. The market is expected to witness continuous technological advancements in areas such as improved bandwidth, reduced latency, and increased security features in the coming years. This will likely lead to the adoption of newer technologies, such as Low Earth Orbit (LEO) satellite constellations, which offer potential benefits in terms of coverage and speed, further shaping the market landscape.

Maritime Satellite Communications Systems Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Maritime Satellite Communications Systems industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period and a base year of 2025. The report segments the market by type (Mobile Satellite Services (MSS), Very Small Aperture Terminal (VSAT)), offering (Solution, Service), and end-user vertical (Merchant, Offshore Rigs, Passenger Fleet, Leisure, Fishing Vessels), offering a granular understanding of this dynamic sector. Key players analyzed include Iridium Communications Inc, Cobham Satcom, Viasat Inc, Speedcast International, Hughes Network Systems LLC, KVH Industries Inc, NSSL Global Limited, Thuraya Telecommunications Company, Marlink SAS (Providence Equity Partners), and Inmarsat Group Limited. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Maritime Satellite Communications Systems Industry Market Dynamics & Structure

The maritime satellite communications market is characterized by a dynamic interplay of moderate concentration and intense technological advancement. While a few prominent players command significant market share, the landscape is continuously shaped by innovation, particularly in the realm of Very Small Aperture Terminal (VSAT) technology and sophisticated hybrid network solutions that seamlessly blend satellite with terrestrial and cellular capabilities. Evolving international maritime regulations and spectrum allocation policies act as crucial guiding frameworks, influencing market operations and investment strategies. The persistent competition from terrestrial communication technologies, especially in well-served coastal regions, necessitates a constant focus on enhancing satellite service value. Furthermore, the end-user demographic is undergoing a significant transformation, with an escalating demand for higher bandwidth, ultra-reliable connectivity, and a richer digital experience across an increasingly diverse array of vessel types, from commercial shipping to offshore energy platforms and luxury yachts. Strategic mergers and acquisitions remain a moderate but impactful trend, driven by companies seeking to broaden their service portfolios, expand their geographical footprints, and secure competitive advantages.

- Market Concentration: Moderately concentrated, with the top 5 players projected to hold approximately 65-70% of the global market share in 2025, underscoring the importance of established providers.

- Technological Innovation: A primary growth catalyst, driven by advancements in VSAT technology, including the deployment of High Throughput Satellites (HTS), multi-orbit solutions, and sophisticated antenna technologies that deliver higher throughput, improved spectral efficiency, and enhanced operational resilience. Hybrid network solutions, integrating satellite, 5G, and Wi-Fi, are rapidly gaining traction.

- Regulatory Framework: International maritime regulations (e.g., IMO 2020, SOLAS), national spectrum allocation policies, and data privacy mandates significantly influence market growth, service deployment, and the adoption of new technologies.

- Competitive Substitutes: Terrestrial communication technologies, including advanced 5G networks and robust fiber optic infrastructure, continue to present a competitive challenge, particularly in port environments and along major shipping lanes, pushing satellite providers to offer superior performance and value propositions offshore.

- End-User Demographics: A clear trend towards increased data consumption for crew welfare, operational efficiency (IoT, real-time monitoring), and passenger services. This translates to a growing demand for higher bandwidth, lower latency, and more consistent, reliable connectivity across all vessel segments, including cargo ships, tankers, offshore support vessels, cruise liners, and yachts.

- M&A Trends: Moderate M&A activity is observed, characterized by strategic acquisitions aimed at consolidating market share, acquiring specialized technologies, expanding service offerings (e.g., cybersecurity, cloud solutions), and enhancing geographical reach. Approximately 10-15 significant deals are anticipated between 2019-2024.

Maritime Satellite Communications Systems Industry Growth Trends & Insights

The maritime satellite communications market has demonstrated consistent and robust growth throughout the historical period (2019-2024), propelled by the indispensable need for reliable and high-performance connectivity across a spectrum of maritime operations. Looking ahead, the market is poised for accelerated expansion, with projections indicating a Compound Annual Growth Rate (CAGR) of approximately 10-12% during the forecast period (2025-2033). This sustained growth is expected to culminate in an estimated market valuation exceeding $15-20 Billion by 2033. Key drivers fueling this upward trajectory include the continuous evolution of satellite technology, marked by the widespread deployment of higher-throughput VSAT systems, advanced Ka-band and Ku-band services, and the increasing integration of multi-orbit satellite constellations. Furthermore, the widespread adoption of these advanced satellite communication solutions is expanding across diverse maritime segments, including critical offshore energy operations, large-scale passenger fleets, and the growing leisure boating sector. A significant behavioral shift among end-users, characterized by a greater reliance on data-intensive applications for crew welfare, operational management, and enhanced passenger experiences, is a pivotal factor propelling market expansion. Despite significant progress, market penetration remains relatively nascent in certain niche segments and geographic regions, indicating substantial untapped potential for future growth and service innovation.

Dominant Regions, Countries, or Segments in Maritime Satellite Communications Systems Industry

The Asia-Pacific region is expected to dominate the maritime satellite communications market during the forecast period. Factors driving growth include significant investments in maritime infrastructure, rising shipping activity, and the increasing adoption of advanced communication technologies. Europe and North America are also key markets, albeit with slower growth rates than the Asia-Pacific region.

By Type: VSAT systems are the dominant type, accounting for approximately xx% of the market, driven by their cost-effectiveness and wide availability.

By Offering: Services account for the larger share (approximately xx%) compared to solutions, as vessel operators increasingly prefer managed services for seamless connectivity.

By End-User Vertical: The merchant shipping segment (cargo, tanker, container, bulk carrier) represents the largest end-user vertical, due to its large vessel count and growing need for efficient communication.

- Asia-Pacific: High shipping activity, investments in infrastructure, and increasing adoption of advanced technologies are key drivers.

- Europe & North America: Mature markets with steady growth, driven by technological advancements and regulatory changes.

- VSAT Dominance: Cost-effectiveness and wide availability are key reasons for VSAT’s market share.

- Service-Oriented Market: Growing preference for managed services ensures reliable connectivity.

- Merchant Shipping: Largest end-user segment due to high vessel count and need for efficient communication.

Maritime Satellite Communications Systems Industry Product Landscape

The maritime satellite communications industry offers a sophisticated and ever-evolving product ecosystem designed to meet the stringent demands of global maritime operations. Core offerings include Mobile Satellite Services (MSS) and Very Small Aperture Terminal (VSAT) systems, which are continuously enhanced with groundbreaking technological advancements. These innovations translate into significantly increased bandwidth capacities, superior spectral efficiency, and a host of advanced features. Users can now expect higher data speeds, reduced latency for real-time applications, improved network resilience against interference and outages, and enhanced onboard network management capabilities. The market is also witnessing the significant proliferation of intelligent hybrid systems, meticulously engineered to seamlessly integrate multiple connectivity sources. These systems typically combine the unwavering coverage of satellite networks with the high-speed accessibility of cellular (4G/5G) and local Wi-Fi networks, ensuring uninterrupted and optimized communication regardless of the vessel's location or the availability of terrestrial infrastructure.

Key Drivers, Barriers & Challenges in Maritime Satellite Communications Systems Industry

Key Drivers:

- Technological advancements, such as higher-throughput satellites and improved VSAT technology.

- Increasing demand for reliable connectivity from various vessel types.

- Growth in global shipping and offshore activities.

Challenges and Restraints:

- High initial investment costs for satellite communication systems can be a barrier to entry for smaller operators.

- Regulatory hurdles and spectrum allocation issues can hinder market growth.

- Competition from terrestrial communication technologies, especially in coastal areas. This results in approximately xx% reduction in market growth annually.

Emerging Opportunities in Maritime Satellite Communications Systems Industry

- Untapped markets: Expanding service offerings to fishing vessels and smaller leisure boats.

- Innovative applications: Integration of IoT sensors and data analytics for improved vessel management.

- Evolving consumer preferences: Growing demand for higher bandwidth and data-intensive applications.

Growth Accelerators in the Maritime Satellite Communications Systems Industry Industry

Technological breakthroughs, particularly in satellite technology and network optimization, are expected to drive long-term growth. Strategic partnerships between satellite operators and maritime technology providers will facilitate broader adoption. Expansion into untapped markets, particularly in developing economies with growing maritime activities, will further accelerate market growth.

Key Players Shaping the Maritime Satellite Communications Systems Industry Market

- Iridium Communications Inc

- Cobham Satcom

- Viasat Inc

- Speedcast International

- Hughes Network Systems LLC

- KVH Industries Inc

- NSSL Global Limited

- Thuraya Telecommunications Company

- Marlink SAS (Providence Equity Partners)

- Inmarsat Group Limited

Notable Milestones in Maritime Satellite Communications Systems Industry Sector

- September 2022: NSSLGlobal unveiled its latest VSAT IP@SEA on-demand customized connectivity packages. This innovative offering provides flexible bandwidth options up to a remarkable 150 Mbps, empowering customers with enhanced control and agility in managing their communication needs, thereby raising the bar for service customization in the market.

- July 2022: KVH introduced the groundbreaking KVH ONE Hybrid Network and TracNet Terminals. This integrated solution masterfully blends satellite, cellular, and Wi-Fi technologies, delivering a superior and seamless connectivity experience both at sea and in port. This launch significantly intensified competition by introducing a more robust and user-friendly hybrid connectivity option.

In-Depth Maritime Satellite Communications Systems Industry Market Outlook

The maritime satellite communications market exhibits significant long-term growth potential, driven by continuous technological advancements, increasing demand for reliable connectivity, and expansion into new markets. Strategic partnerships and investments in next-generation satellite technologies will further shape the market landscape, offering substantial opportunities for players to enhance their market positions and capture significant market share. The focus on innovative solutions, such as hybrid networks and IoT integration, will be key to success in this competitive market.

Maritime Satellite Communications Systems Industry Segmentation

-

1. Type

- 1.1. Mobile S

- 1.2. Very Small Aperture Terminal (VSAT)

-

2. Offering

- 2.1. Solution

- 2.2. Service

-

3. End-User Vertical

- 3.1. Merchant

- 3.2. Offshore Rigs and Support Vessels

- 3.3. Passenger Fleet (Cruise and Ferry)

- 3.4. Leisure (Yachts)

- 3.5. Finishing Vessels

Maritime Satellite Communications Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Maritime Satellite Communications Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Connectivity for Crew Welfare and Operations; Launch of High-Throughput Satellite (HTS) satellites

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About the Advanced Satellite Service Market; Reliance on High-cost Satellite Equipment

- 3.4. Market Trends

- 3.4.1. Maritime Satellite Communication Service Offering to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile S

- 5.1.2. Very Small Aperture Terminal (VSAT)

- 5.2. Market Analysis, Insights and Forecast - by Offering

- 5.2.1. Solution

- 5.2.2. Service

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Merchant

- 5.3.2. Offshore Rigs and Support Vessels

- 5.3.3. Passenger Fleet (Cruise and Ferry)

- 5.3.4. Leisure (Yachts)

- 5.3.5. Finishing Vessels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mobile S

- 6.1.2. Very Small Aperture Terminal (VSAT)

- 6.2. Market Analysis, Insights and Forecast - by Offering

- 6.2.1. Solution

- 6.2.2. Service

- 6.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.3.1. Merchant

- 6.3.2. Offshore Rigs and Support Vessels

- 6.3.3. Passenger Fleet (Cruise and Ferry)

- 6.3.4. Leisure (Yachts)

- 6.3.5. Finishing Vessels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mobile S

- 7.1.2. Very Small Aperture Terminal (VSAT)

- 7.2. Market Analysis, Insights and Forecast - by Offering

- 7.2.1. Solution

- 7.2.2. Service

- 7.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.3.1. Merchant

- 7.3.2. Offshore Rigs and Support Vessels

- 7.3.3. Passenger Fleet (Cruise and Ferry)

- 7.3.4. Leisure (Yachts)

- 7.3.5. Finishing Vessels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mobile S

- 8.1.2. Very Small Aperture Terminal (VSAT)

- 8.2. Market Analysis, Insights and Forecast - by Offering

- 8.2.1. Solution

- 8.2.2. Service

- 8.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.3.1. Merchant

- 8.3.2. Offshore Rigs and Support Vessels

- 8.3.3. Passenger Fleet (Cruise and Ferry)

- 8.3.4. Leisure (Yachts)

- 8.3.5. Finishing Vessels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mobile S

- 9.1.2. Very Small Aperture Terminal (VSAT)

- 9.2. Market Analysis, Insights and Forecast - by Offering

- 9.2.1. Solution

- 9.2.2. Service

- 9.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.3.1. Merchant

- 9.3.2. Offshore Rigs and Support Vessels

- 9.3.3. Passenger Fleet (Cruise and Ferry)

- 9.3.4. Leisure (Yachts)

- 9.3.5. Finishing Vessels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Maritime Satellite Communications Systems Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Iridium Communications Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Cobham Satcom

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Viasat Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Speedcast International

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Hughes Network Systems LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 KVH Industries Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NSSL Global Limited

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Thuraya Telecommunications Company

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Marlink SAS (Providence Equity Partners)

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Inmarsat Group Limited

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Iridium Communications Inc

List of Figures

- Figure 1: Global Maritime Satellite Communications Systems Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 13: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 14: North America Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 15: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 16: North America Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 21: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 22: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 23: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 24: Europe Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 29: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 30: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 31: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 32: Asia Pacific Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 37: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 38: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by End-User Vertical 2024 & 2032

- Figure 39: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by End-User Vertical 2024 & 2032

- Figure 40: Rest of the World Maritime Satellite Communications Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Maritime Satellite Communications Systems Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 5: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Maritime Satellite Communications Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Maritime Satellite Communications Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Maritime Satellite Communications Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Maritime Satellite Communications Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 16: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 17: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 20: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 21: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 24: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 25: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 28: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 29: Global Maritime Satellite Communications Systems Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Satellite Communications Systems Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Maritime Satellite Communications Systems Industry?

Key companies in the market include Iridium Communications Inc, Cobham Satcom, Viasat Inc, Speedcast International, Hughes Network Systems LLC, KVH Industries Inc, NSSL Global Limited, Thuraya Telecommunications Company, Marlink SAS (Providence Equity Partners), Inmarsat Group Limited.

3. What are the main segments of the Maritime Satellite Communications Systems Industry?

The market segments include Type, Offering, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Connectivity for Crew Welfare and Operations; Launch of High-Throughput Satellite (HTS) satellites.

6. What are the notable trends driving market growth?

Maritime Satellite Communication Service Offering to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness About the Advanced Satellite Service Market; Reliance on High-cost Satellite Equipment.

8. Can you provide examples of recent developments in the market?

September 2022 - NSSLGlobal launched its latest VSAT IP@SEA on-demand customized connectivity packages. Customers can use its brand-new customized connectivity packages, which offer two excellent options to fulfill users' data needs. Operators can reserve committed bandwidth by the hour using the On-Demand Bandwidth Streaming service. With its range of customizable containers that can reach speeds of up to 150 Mbps, these services may give customers further control and independence over their service and bandwidth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Satellite Communications Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Satellite Communications Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Satellite Communications Systems Industry?

To stay informed about further developments, trends, and reports in the Maritime Satellite Communications Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence