Key Insights

The North American smart factory market is experiencing robust growth, driven by the increasing adoption of automation technologies across various industries. The market's Compound Annual Growth Rate (CAGR) of 9.50% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. Key drivers include the need for enhanced efficiency, improved productivity, reduced operational costs, and the rising demand for higher-quality products in sectors like automotive, semiconductors, and pharmaceuticals. The integration of advanced technologies such as Industrial IoT (IIoT), machine learning (ML), and artificial intelligence (AI) is further accelerating this transformation. Specifically, the adoption of robotics (collaborative and industrial), advanced control systems (PLC, SCADA, DCS), and sophisticated data analytics solutions are prominent trends. While the initial investment costs for implementing smart factory technologies can be substantial, the long-term benefits significantly outweigh these upfront expenditures. Furthermore, data security concerns and the need for skilled labor to manage and maintain these complex systems present challenges that require careful consideration and strategic planning by businesses. The market segmentation reveals a strong demand across various product categories, including machine vision systems, industrial robotics, and advanced control devices. North America, particularly the United States and Canada, holds a substantial share of the global market, due to strong industrial bases and early adoption of technological advancements. The competitive landscape is populated by both established industry giants and innovative technology providers, constantly striving to improve existing solutions and introduce novel offerings.

The North American smart factory market's growth trajectory is poised for continued expansion, fueled by ongoing digital transformation initiatives across major industries. The ongoing push for increased supply chain resilience and flexibility, driven partly by recent geopolitical events, is further boosting demand for smart factory solutions. Specific segments within the market, such as advanced robotics and AI-powered predictive maintenance, are expected to show particularly strong growth in the coming years. Companies are increasingly adopting cloud-based solutions for improved data management and collaboration, driving the demand for related technologies and services. However, the talent gap in skilled labor required to implement and maintain these sophisticated systems remains a key challenge. Addressing this through robust training programs and partnerships with educational institutions is crucial for sustaining the market’s growth momentum. Looking ahead, the convergence of technologies such as 5G and edge computing will unlock new opportunities, further enhancing the capabilities and applications of smart factory solutions in North America.

North America Smart Factory Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America smart factory industry, covering market dynamics, growth trends, dominant segments, and key players. With a focus on the United States and Canada, the report offers valuable insights for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 as the base year and forecast period extending to 2033. The market size is presented in million units.

North America Smart Factory Industry Market Dynamics & Structure

The North American smart factory market is experiencing robust growth, driven by an accelerating wave of automation, pervasive digitalization, and the imperative for enhanced operational efficiency and peak productivity. The market landscape is characterized by moderate concentration, with a cadre of prominent key players commanding significant market share, complemented by a dynamic ecosystem of smaller, highly specialized firms. Technological innovation serves as a paramount catalyst, with continuous advancements in artificial intelligence (AI), the Internet of Things (IoT), and cloud computing fundamentally reshaping industry paradigms. Regulatory frameworks, particularly those meticulously addressing data security and stringent environmental compliance, exert considerable influence on market trajectories. While direct substitutes for smart factory solutions are limited, traditional manufacturing methodologies are increasingly facing competitive pressure due to escalating costs and comparatively lower efficiency. The end-user demographics are remarkably diverse, encompassing a broad spectrum of industrial sectors, and M&A activity remains frequent, a clear indicator of ongoing consolidation, strategic expansion, and the pursuit of synergistic opportunities within the market.

- Market Concentration: Moderate, with top 10 players projected to hold approximately XX% of the market share in 2025.

- Technological Innovation: AI, IoT, and cloud computing are the foundational pillars of innovation. Significant barriers include the inherent complexities of system integration and persistent cybersecurity vulnerabilities.

- Regulatory Frameworks: Strict adherence to data privacy regulations (e.g., GDPR, CCPA) and evolving environmental standards critically shapes market dynamics and strategic planning.

- M&A Activity: XX significant mergers and acquisitions were recorded between 2019 and 2024, with an estimated XX deals anticipated for the 2025-2033 period, signaling active market consolidation.

- End-user Demographics: Key end-user segments demonstrating substantial adoption include the Automotive, Semiconductor, and Pharmaceutical industries.

North America Smart Factory Industry Growth Trends & Insights

The North American smart factory market is experiencing significant growth, fueled by a rising demand for improved efficiency, reduced operational costs, and enhanced product quality. Market size expanded from $XX million in 2019 to an estimated $XXX million in 2025, exhibiting a CAGR of XX% during the historical period. This growth trajectory is projected to continue throughout the forecast period, with the market expected to reach $XXX million by 2033, driven by increasing adoption rates across various industries. Technological disruptions, particularly in areas like automation, robotics, and data analytics, are accelerating this transformation. Consumer behavior is shifting towards greater demand for customized products and faster delivery times, which further necessitates the adoption of smart factory technologies.

- Market Size (2019): $XX million

- Market Size (2025): $XXX million

- Market Size (2033): $XXX million

- CAGR (2019-2025): XX%

- CAGR (2025-2033): XX%

- Market Penetration (2025): XX%

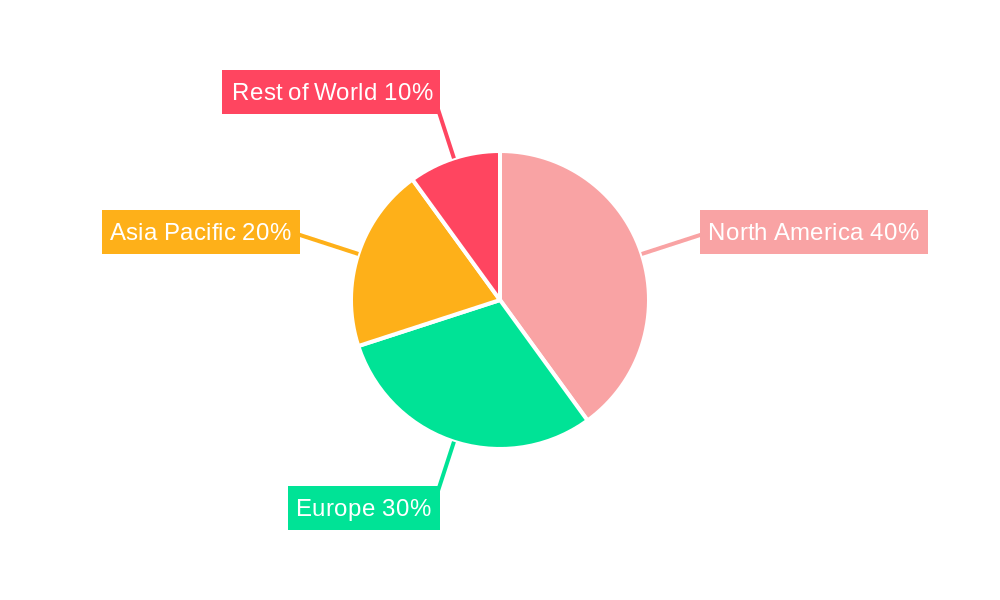

Dominant Regions, Countries, or Segments in North America Smart Factory Industry

The United States decisively leads the North American smart factory market, contributing an estimated XX% of the total market value in 2025. This commanding position is largely attributable to its sophisticated technological infrastructure, a deeply entrenched and advanced manufacturing sector, and supportive government policies that foster innovation and adoption. Canada also presents considerable growth potential, propelled by its robust automotive and aerospace industries, which are actively embracing smart factory technologies. Within specific segments, the Industrial Robotics and Collaborative Robots sector is demonstrating the highest growth trajectory, closely followed by advancements in Sensors and Communication Technologies. The Automotive and Semiconductor industries are recognized as having the strongest market demand for cutting-edge smart factory solutions.

- Dominant Region: United States, underscoring its leadership in technological adoption and manufacturing prowess.

- Leading Segment (By Product): Industrial Robotics and Collaborative Robots, revolutionizing automation and human-robot interaction on the factory floor.

- Leading Segment (By Technology): Programmable Logic Controllers (PLC) and Manufacturing Execution Systems (MES), forming the backbone of smart factory operations and control.

- Leading End-user Industry: Automotive and Semiconductors, driven by the need for precision, speed, and complex manufacturing processes.

- Key Growth Drivers: Government incentives actively promoting automation, a highly developed technological infrastructure, and an escalating emphasis on optimizing operational efficiency are critical growth accelerators.

North America Smart Factory Industry Product Landscape

The North American smart factory market features a diverse range of products, including advanced robotics, sophisticated sensors, data analytics platforms, and industrial IoT devices. Product innovations are characterized by increased connectivity, improved data processing capabilities, and greater levels of automation. Applications extend across various manufacturing processes, improving efficiency, quality, and safety. Key performance indicators (KPIs) such as production uptime, defect rates, and energy consumption are closely monitored to measure the impact of smart factory technologies. Unique selling propositions (USPs) often center around ease of integration, scalability, and advanced analytics capabilities.

Key Drivers, Barriers & Challenges in North America Smart Factory Industry

Key Drivers: The North American smart factory market is propelled by several potent forces. Paramount among these is the escalating demand for superior production efficiency and enhanced product quality. Government incentives and forward-thinking regulations that champion automation and digitalization provide a strong impetus. Furthermore, the imperative for greater supply chain resilience in an increasingly volatile global landscape is a significant driver. Advances in transformative technologies such as AI, machine learning, and IoT are fundamentally enabling these shifts.

Challenges & Restraints: Significant barriers to widespread adoption include the substantial initial implementation costs, a pervasive shortage of skilled labor capable of managing and operating advanced systems, and persistent cybersecurity concerns that necessitate robust protective measures. The intricate complexities of integrating disparate systems and the potential for disrupting established workflows also present considerable challenges. Moreover, recent supply chain disruptions, exacerbated by geopolitical instability, have impacted the availability and cost of crucial components, adding another layer of complexity.

Emerging Opportunities in North America Smart Factory Industry

Emerging opportunities lie in the increasing adoption of AI-powered solutions for predictive maintenance, the integration of blockchain technology for enhanced supply chain transparency, and the expansion of smart factory technologies into new industry verticals such as food processing and pharmaceuticals. Untapped markets exist within smaller and medium-sized enterprises (SMEs) that are increasingly seeking cost-effective ways to improve their operations. Further advancements in collaborative robotics and digital twins offer new avenues for innovation.

Growth Accelerators in the North America Smart Factory Industry

Long-term market expansion will be significantly propelled by groundbreaking technological advancements in areas such as edge computing, enabling real-time data processing, and the adoption of digital twins, creating virtual replicas for enhanced simulation and optimization. This will foster even greater automation and more sophisticated data-driven decision-making. Strategic alliances and partnerships forged between leading technology providers and forward-thinking manufacturing companies will serve to accelerate the deployment of innovative smart factory solutions. Government initiatives focused on comprehensive workforce development and targeted reskilling programs are indispensable for effectively addressing the existing talent deficit. The exploration and expansion into new geographic markets and novel applications will further fuel market growth and broaden its impact.

Key Players Shaping the North America Smart Factory Industry Market

- Honeywell International Inc

- ABB Ltd

- Cognex Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Fanuc Corporation

- Robert Bosch GmbH

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- FLIR Systems Inc

- Kuka AG

- Emerson Electric Company

Notable Milestones in North America Smart Factory Industry Sector

- 2020: A pronounced surge in investment in AI and machine learning applications, demonstrating a commitment to intelligent factory operations.

- 2021: The successful launch of several innovative cloud-based manufacturing platforms, enhancing accessibility and scalability of smart factory solutions.

- 2022: Witnessed substantial growth in the adoption rates of collaborative robots, transforming human-robot interaction and augmenting manufacturing flexibility.

- 2023: Marked by several key mergers and acquisitions, fundamentally reshaping the competitive landscape and driving market consolidation.

- 2024: A clear and significant shift in industry focus towards sustainability and the implementation of carbon reduction initiatives within smart factory environments.

In-Depth North America Smart Factory Industry Market Outlook

The North American smart factory market is poised for continued robust growth over the next decade. Technological advancements, strategic partnerships, and government support will continue to fuel market expansion. Opportunities abound in the integration of emerging technologies and the development of innovative solutions to address pressing industry challenges. Companies that successfully adapt to these changes and embrace sustainable practices will be best positioned to thrive in this dynamic market.

North America Smart Factory Industry Segmentation

-

1. Product

-

1.1. Machine Vision Systems

- 1.1.1. Cameras

- 1.1.2. Processors

- 1.1.3. Software

- 1.1.4. Enclosures

- 1.1.5. Frame Grabbers

- 1.1.6. Integration Services

- 1.1.7. Lighting

-

1.2. Industrial Robotics

- 1.2.1. Articulated Robots

- 1.2.2. Cartesian Robots

- 1.2.3. Cylindrical Robots

- 1.2.4. SCARA Robots

- 1.2.5. Parallel Robots

- 1.2.6. Collaborative Industry Robots

-

1.3. Control Devices

- 1.3.1. Relays and Switches

- 1.3.2. Servo Motors and Drives

- 1.4. Sensors

-

1.5. Communication Technologies

- 1.5.1. Wired

- 1.5.2. Wireless

- 1.6. Other Products

-

1.1. Machine Vision Systems

-

2. Technology

- 2.1. Product Lifecycle Management (PLM)

- 2.2. Human Machine Interface (HMI)

- 2.3. Enterprise Resource and Planning (ERP)

- 2.4. Manufacturing Execution System (MES)

- 2.5. Distributed Control System (DCS)

- 2.6. Supervisory Controller and Data Acquisition (SCADA

- 2.7. Programmable Logic Controller (PLC)

- 2.8. Other Technologies

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Semiconductors

- 3.3. Oil and Gas

- 3.4. Chemical and Petrochemical

- 3.5. Pharmaceutical

- 3.6. Aerospace and Defense

- 3.7. Food and Beverage

- 3.8. Mining

- 3.9. Other End-user Industries

North America Smart Factory Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Smart Factory Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Adoption of Internet of Things (IoT) Technologies Across the Value Chain; Rising Demand for Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. ; Huge Capital Investments for Transformations; Vulnerable to Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Semiconductor Industry is Observing a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Smart Factory Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Machine Vision Systems

- 5.1.1.1. Cameras

- 5.1.1.2. Processors

- 5.1.1.3. Software

- 5.1.1.4. Enclosures

- 5.1.1.5. Frame Grabbers

- 5.1.1.6. Integration Services

- 5.1.1.7. Lighting

- 5.1.2. Industrial Robotics

- 5.1.2.1. Articulated Robots

- 5.1.2.2. Cartesian Robots

- 5.1.2.3. Cylindrical Robots

- 5.1.2.4. SCARA Robots

- 5.1.2.5. Parallel Robots

- 5.1.2.6. Collaborative Industry Robots

- 5.1.3. Control Devices

- 5.1.3.1. Relays and Switches

- 5.1.3.2. Servo Motors and Drives

- 5.1.4. Sensors

- 5.1.5. Communication Technologies

- 5.1.5.1. Wired

- 5.1.5.2. Wireless

- 5.1.6. Other Products

- 5.1.1. Machine Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Product Lifecycle Management (PLM)

- 5.2.2. Human Machine Interface (HMI)

- 5.2.3. Enterprise Resource and Planning (ERP)

- 5.2.4. Manufacturing Execution System (MES)

- 5.2.5. Distributed Control System (DCS)

- 5.2.6. Supervisory Controller and Data Acquisition (SCADA

- 5.2.7. Programmable Logic Controller (PLC)

- 5.2.8. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Semiconductors

- 5.3.3. Oil and Gas

- 5.3.4. Chemical and Petrochemical

- 5.3.5. Pharmaceutical

- 5.3.6. Aerospace and Defense

- 5.3.7. Food and Beverage

- 5.3.8. Mining

- 5.3.9. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Smart Factory Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Smart Factory Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Smart Factory Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Smart Factory Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cognex Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mitsubishi Electric Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Schneider Electric SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fanuc Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Robert Bosch GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rockwell Automation Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yokogawa Electric Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 FLIR Systems Inc *List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kuka AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Emerson Electric Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Smart Factory Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Smart Factory Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Smart Factory Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Smart Factory Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Smart Factory Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Smart Factory Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Smart Factory Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Smart Factory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Smart Factory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Smart Factory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Smart Factory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Smart Factory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Smart Factory Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 12: North America Smart Factory Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 13: North America Smart Factory Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Smart Factory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Smart Factory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Smart Factory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Smart Factory Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Smart Factory Industry?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the North America Smart Factory Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Cognex Corporation, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Fanuc Corporation, Robert Bosch GmbH, Rockwell Automation Inc, Yokogawa Electric Corporation, FLIR Systems Inc *List Not Exhaustive, Kuka AG, Emerson Electric Company.

3. What are the main segments of the North America Smart Factory Industry?

The market segments include Product, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Adoption of Internet of Things (IoT) Technologies Across the Value Chain; Rising Demand for Energy Efficiency.

6. What are the notable trends driving market growth?

Semiconductor Industry is Observing a Significant Growth.

7. Are there any restraints impacting market growth?

; Huge Capital Investments for Transformations; Vulnerable to Cyber Attacks.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Smart Factory Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Smart Factory Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Smart Factory Industry?

To stay informed about further developments, trends, and reports in the North America Smart Factory Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence