Key Insights

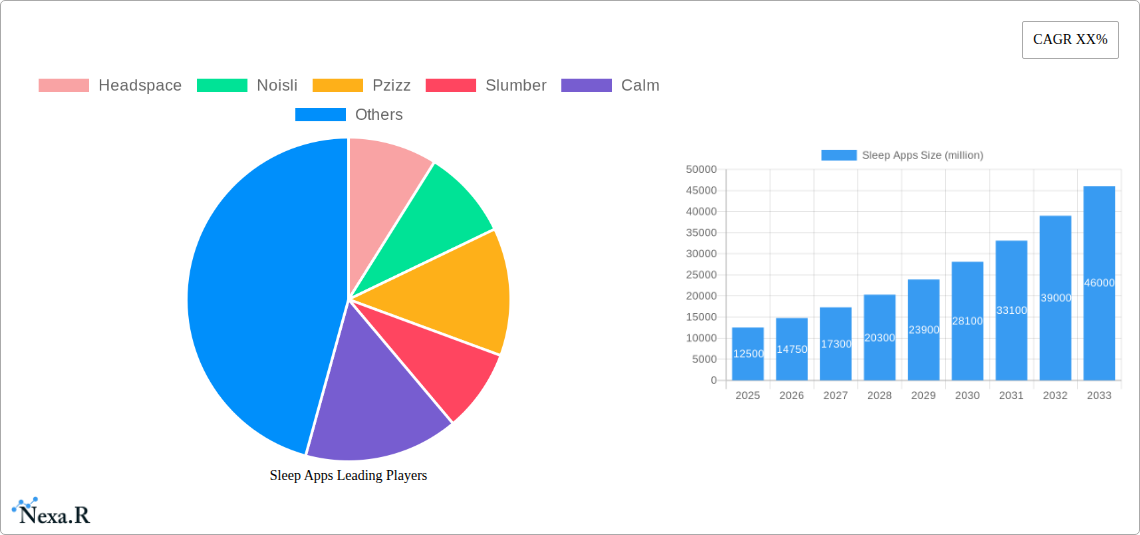

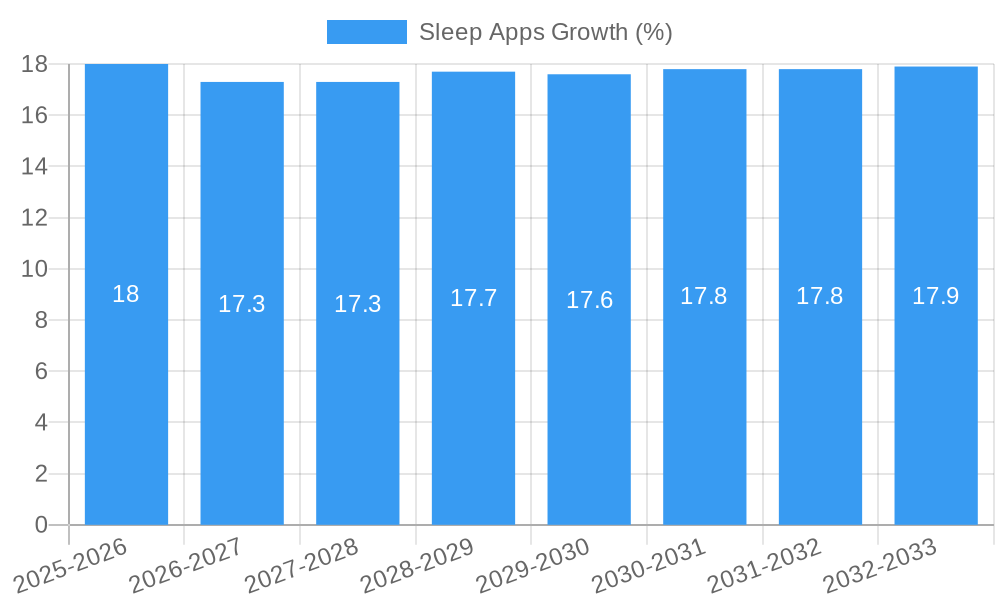

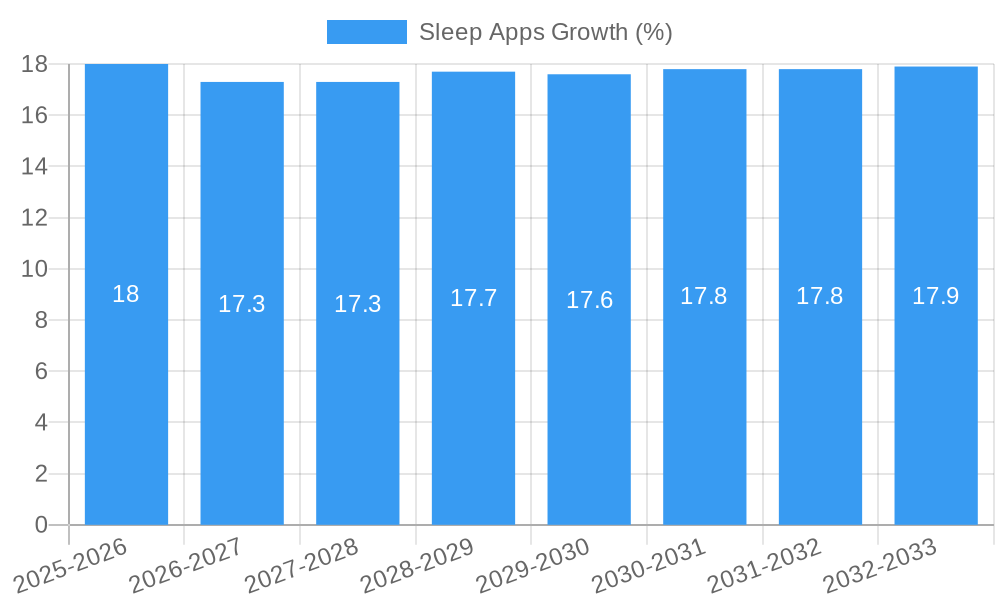

The global Sleep Apps market is poised for substantial growth, projected to reach an estimated $12,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 18% during the forecast period of 2025-2033. This impressive expansion is fueled by a confluence of escalating awareness regarding the critical importance of quality sleep for overall health and well-being, coupled with the widespread adoption of smartphones and wearable technology. The persistent rise in stress, anxiety, and the prevalence of sleep disorders among diverse age groups are significant drivers, creating a robust demand for accessible, digital solutions. Sleep Aid and Relax applications are expected to dominate the market segments, reflecting a collective societal shift towards prioritizing mental and physical rejuvenation through technology. The market's trajectory is further bolstered by continuous innovation in app features, including advanced sleep tracking, personalized meditation programs, soothing soundscapes, and AI-driven sleep coaching.

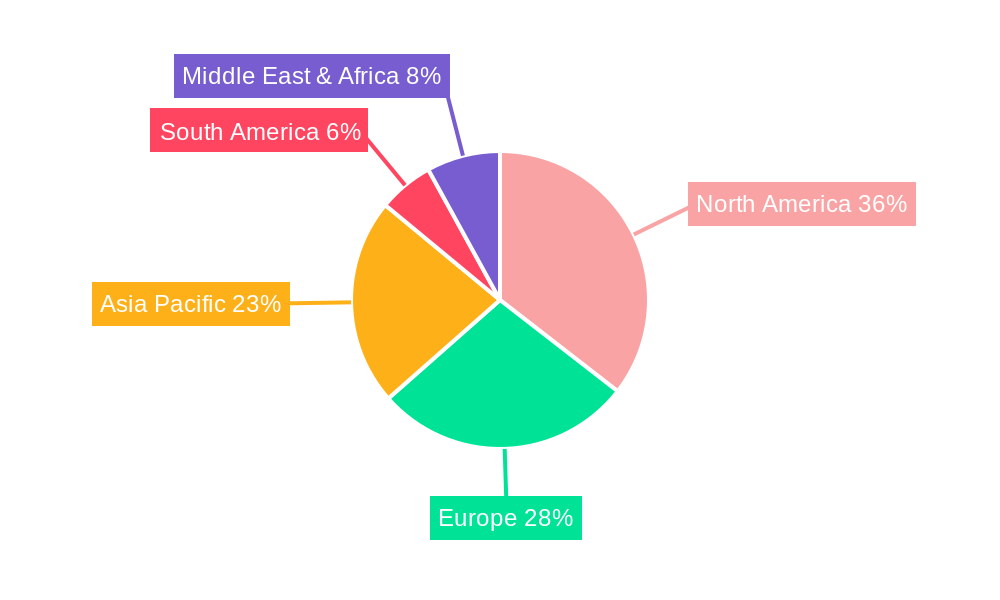

Despite the optimistic outlook, certain restraints may temper the growth momentum. Data privacy concerns, the potential for app fatigue, and the challenge of demonstrating long-term efficacy to a skeptical user base are notable hurdles. Furthermore, the increasing competition within the market necessitates a strong focus on differentiation and user retention strategies for companies. The market is segmented into Sound, Image, and Video types, with sound-based applications currently leading in adoption due to their simplicity and effectiveness. Geographically, North America is anticipated to hold a significant market share, driven by high disposable incomes, advanced technological infrastructure, and a proactive approach to health and wellness. Asia Pacific, with its rapidly growing economies and increasing digital penetration, presents a substantial growth opportunity. Key players like Headspace, Calm, and Sleep Cycle are actively shaping the market landscape through strategic product development and marketing initiatives.

Comprehensive Report: Sleep Apps Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This in-depth market research report provides a panoramic view of the global sleep apps market, encompassing its historical trajectory, current state, and projected future. Analyzing key segments, dominant players, and evolving industry landscapes, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning sleep technology sector. The report leverages extensive data spanning the Study Period (2019–2033), with a Base Year (2025) and an Estimated Year (2025), providing a robust Forecast Period (2025–2033) grounded in Historical Period (2019–2024) data. The report is structured to offer both broad market insights and granular details, with a particular focus on understanding parent and child market dynamics to reveal comprehensive growth potential.

Sleep Apps Market Dynamics & Structure

The global sleep apps market exhibits a dynamic and evolving structure, characterized by moderate market concentration with key players like Calm, Headspace, and Sleep Cycle holding significant market shares. Technological innovation is the primary driver, with advancements in AI-powered personalized sleep coaching, biofeedback integration, and smart alarm systems continually reshaping the competitive landscape. Regulatory frameworks are relatively nascent, primarily focusing on data privacy and security, with no significant overarching governmental regulations dictating app functionality. Competitive product substitutes include traditional sleep aids, mindfulness practices, and wearable sleep trackers, though the convenience and accessibility of apps provide a distinct advantage. End-user demographics are broad, encompassing individuals of all ages experiencing sleep difficulties, stress, or seeking general well-being enhancement. Mergers and acquisitions (M&A) trends are gradually increasing as larger wellness companies seek to integrate specialized sleep solutions into their broader health ecosystems.

- Market Concentration: Moderate, with a few dominant players and a growing number of niche providers.

- Technological Innovation Drivers: AI personalization, biofeedback integration, smart alarm technology, guided meditation advancements.

- Regulatory Frameworks: Primarily focused on data privacy (e.g., GDPR, CCPA) and app store guidelines.

- Competitive Product Substitutes: Over-the-counter sleep aids, professional therapy, wearable sleep trackers, mindfulness techniques.

- End-User Demographics: Broad, including students, working professionals, elderly individuals, and those with chronic sleep issues.

- M&A Trends: Increasing as wellness and healthcare companies look to expand their digital offerings. For instance, a projected xx M&A deals in the forecast period.

Sleep Apps Growth Trends & Insights

The sleep apps market is poised for robust expansion, driven by escalating global health awareness and the persistent rise in sleep-related disorders. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated $xx billion by the end of the forecast period, up from an estimated $xx billion in 2025. Adoption rates are rapidly increasing, with market penetration expected to reach xx% globally by 2033, a significant jump from xx% in 2024. Technological disruptions, including the integration of machine learning for personalized sleep recommendations and the advent of advanced haptic feedback for gentle awakenings, are transforming user experience and driving demand. Consumer behavior shifts are equally pivotal, with a growing preference for digital-first wellness solutions and a proactive approach to managing mental and physical health. The increasing adoption of smartphones and the widespread availability of high-speed internet further facilitate market growth. The trend towards subscription-based models for premium features and content is also a significant factor in sustained revenue generation. Furthermore, the growing acceptance of digital therapeutics for various health conditions is indirectly fueling the growth of sleep aid applications as a complementary wellness tool. The rising prevalence of anxiety and stress disorders globally directly correlates with the demand for relaxation and sleep-inducing applications, further solidifying the market's upward trajectory. The evolution of augmented reality (AR) and virtual reality (VR) technologies also presents future opportunities for immersive sleep experiences, albeit in the later stages of the forecast period. The underlying demand for improved sleep quality, driven by its crucial role in overall health and productivity, remains the fundamental growth engine.

Dominant Regions, Countries, or Segments in Sleep Apps

North America currently dominates the global sleep apps market, driven by high disposable incomes, advanced technological infrastructure, and a proactive approach to mental and physical well-being. The United States, in particular, stands out as a leading country due to its large consumer base and the significant presence of major sleep app developers. The Application: Sleep Aid segment is the primary growth engine within this region, accounting for an estimated xx% of the total market share. This dominance is fueled by the high prevalence of sleep disorders, including insomnia and sleep apnea, and a strong consumer demand for readily accessible solutions. Within the Application: Sleep Aid segment, the Types: Sound sub-segment, encompassing features like white noise, nature sounds, and guided sleep stories, holds the largest market share, estimated at xx% of the sleep aid application market. This is attributed to the universal appeal and effectiveness of auditory interventions in promoting relaxation and sleep.

- Leading Region: North America, specifically the United States.

- Dominant Segment: Application: Sleep Aid, capturing an estimated xx% of the regional market.

- Key Drivers in North America:

- High per capita income and consumer spending on health and wellness.

- Widespread smartphone adoption and robust internet connectivity.

- Increased awareness and diagnosis of sleep disorders.

- Supportive digital health ecosystem and venture capital investment.

- Active engagement with mindfulness and meditation practices.

- Key Drivers in North America:

- Dominant Sub-Segment: Types: Sound within the Sleep Aid application, with an estimated xx% market share.

- Drivers for Sound Type Dominance:

- Proven efficacy in masking disruptive noises and promoting relaxation.

- Wide variety of soundscapes catering to diverse user preferences.

- Low technological barrier to implementation and user accessibility.

- Integration with smart home devices for enhanced ambient sound control.

- Affordable development and distribution costs compared to video-based content.

- Drivers for Sound Type Dominance:

Sleep Apps Product Landscape

The sleep apps product landscape is characterized by a constant influx of innovative features and functionalities. Apps are increasingly integrating personalized sleep analytics, offering users detailed insights into their sleep patterns, duration, and quality. Advanced algorithms are being employed to provide tailored recommendations for improving sleep hygiene, ranging from bedtime routines to environmental adjustments. Unique selling propositions often lie in the breadth of content offered, such as extensive libraries of guided meditations, sleep stories narrated by celebrity voices, and diverse soundscapes. Technological advancements are also focusing on seamless integration with wearable devices to collect more accurate biometric data, enhancing the precision of sleep tracking and personalized advice.

Key Drivers, Barriers & Challenges in Sleep Apps

Key Drivers:

- Growing Health Consciousness: Increased public awareness of sleep's critical role in overall physical and mental health.

- Rising Stress & Anxiety Levels: The escalating prevalence of mental health issues drives demand for relaxation and sleep aids.

- Technological Advancements: AI, machine learning, and sophisticated audio/visual technologies enhance app capabilities.

- Smartphone Penetration & Affordability: Widespread access to mobile devices and affordable data plans.

- Convenience & Accessibility: Offering on-demand sleep solutions anytime, anywhere.

Barriers & Challenges:

- Data Privacy Concerns: User apprehension regarding the collection and usage of sensitive sleep data.

- Subscription Fatigue: User reluctance to commit to recurring subscription fees for multiple wellness apps.

- Effectiveness Perception: Skepticism regarding the actual efficacy of app-based sleep solutions compared to traditional methods.

- Intense Competition: A crowded market with numerous free and paid offerings.

- Monetization Models: Balancing free access with premium features to ensure sustainable revenue.

- Regulatory Uncertainty: Evolving landscape of digital health regulations.

- User Engagement & Retention: Challenges in keeping users consistently engaged with app features.

Emerging Opportunities in Sleep Apps

Emerging opportunities in the sleep apps industry are largely centered on hyper-personalization and integration. The development of AI-driven sleep coaches that adapt in real-time based on user feedback and biometric data presents a significant avenue for growth. Furthermore, the expansion of sleep apps into corporate wellness programs, offering solutions to improve employee productivity and reduce stress-related absenteeism, is a burgeoning area. The integration of sleep tracking and improvement tools with broader mental health platforms and telehealth services also offers synergistic growth potential. Untapped markets in developing economies, where smartphone penetration is rising, represent a significant expansion opportunity.

Growth Accelerators in the Sleep Apps Industry

Several catalysts are accelerating the growth of the sleep apps industry. Technological breakthroughs, such as advancements in natural language processing for more engaging sleep story narratives and the development of biofeedback mechanisms within apps, are key. Strategic partnerships between sleep app developers and wearable device manufacturers are crucial for enhancing data accuracy and user experience. Market expansion strategies, including localization of content for diverse cultural preferences and the development of specialized apps for specific demographics (e.g., new parents, shift workers), are vital for broader reach. The increasing investment from venture capitalists and established tech companies signals strong confidence in the sector's long-term growth potential.

Key Players Shaping the Sleep Apps Market

- Headspace

- Noisli

- Pzizz

- Slumber

- Calm

- Sleep Cycle

- 10% Happier

- Reflectly

- Sleepiest

- Moshi

- Tide

Notable Milestones in Sleep Apps Sector

- 2019: Launch of enhanced AI-driven personalization features in several leading sleep apps.

- 2020: Increased focus on guided meditation and mindfulness content to address pandemic-related stress.

- 2021: Expansion of sleep stories with celebrity narrators driving user engagement and subscription growth.

- 2022: Integration of advanced biofeedback features with select wearable devices.

- 2023: Emergence of specialized sleep apps targeting niche markets like chronic pain sufferers.

- 2024: Growing emphasis on data privacy and security compliance within app development.

- 2025 (Estimated): Further advancements in AI for predictive sleep analysis and personalized interventions.

- 2026-2033 (Forecast): Significant growth in B2B offerings for corporate wellness and healthcare integration.

In-Depth Sleep Apps Market Outlook

The future of the sleep apps market is exceptionally promising, driven by the undeniable link between quality sleep and overall well-being. Growth accelerators such as continuous technological innovation, particularly in AI and biofeedback, coupled with strategic partnerships with wearable tech companies, will fuel market expansion. The increasing recognition of sleep health as a critical component of comprehensive wellness strategies by both consumers and healthcare providers will solidify demand. Emerging opportunities in personalized sleep coaching, corporate wellness solutions, and integration with broader digital health ecosystems present substantial untapped potential. The market is projected to not only grow in user numbers but also in the sophistication and efficacy of its offerings, making it a vital segment of the digital health landscape for years to come.

Sleep Apps Segmentation

-

1. Application

- 1.1. Sleep Aid

- 1.2. Relax

- 1.3. Other

-

2. Types

- 2.1. Sound

- 2.2. Image

- 2.3. Video

Sleep Apps Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sleep Apps REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sleep Apps Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sleep Aid

- 5.1.2. Relax

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Sound

- 5.2.2. Image

- 5.2.3. Video

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sleep Apps Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sleep Aid

- 6.1.2. Relax

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Sound

- 6.2.2. Image

- 6.2.3. Video

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sleep Apps Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sleep Aid

- 7.1.2. Relax

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Sound

- 7.2.2. Image

- 7.2.3. Video

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sleep Apps Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sleep Aid

- 8.1.2. Relax

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Sound

- 8.2.2. Image

- 8.2.3. Video

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sleep Apps Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sleep Aid

- 9.1.2. Relax

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Sound

- 9.2.2. Image

- 9.2.3. Video

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sleep Apps Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sleep Aid

- 10.1.2. Relax

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Sound

- 10.2.2. Image

- 10.2.3. Video

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Headspace

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Noisli

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pzizz

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Slumber

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Calm

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sleep Cycle

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 10% Happier

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Reflectly

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sleepiest

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moshi

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tide

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Headspace

List of Figures

- Figure 1: Global Sleep Apps Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Sleep Apps Revenue (million), by Application 2024 & 2032

- Figure 3: North America Sleep Apps Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Sleep Apps Revenue (million), by Types 2024 & 2032

- Figure 5: North America Sleep Apps Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Sleep Apps Revenue (million), by Country 2024 & 2032

- Figure 7: North America Sleep Apps Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Sleep Apps Revenue (million), by Application 2024 & 2032

- Figure 9: South America Sleep Apps Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Sleep Apps Revenue (million), by Types 2024 & 2032

- Figure 11: South America Sleep Apps Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Sleep Apps Revenue (million), by Country 2024 & 2032

- Figure 13: South America Sleep Apps Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sleep Apps Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Sleep Apps Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Sleep Apps Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Sleep Apps Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Sleep Apps Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Sleep Apps Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Sleep Apps Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Sleep Apps Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Sleep Apps Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Sleep Apps Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Sleep Apps Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Sleep Apps Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Sleep Apps Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sleep Apps Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sleep Apps Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Sleep Apps Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Sleep Apps Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Sleep Apps Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sleep Apps Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sleep Apps Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Sleep Apps Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Sleep Apps Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Sleep Apps Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Sleep Apps Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Sleep Apps Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Sleep Apps Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Sleep Apps Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Sleep Apps Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Sleep Apps Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Sleep Apps Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Sleep Apps Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Sleep Apps Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Sleep Apps Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Sleep Apps Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Sleep Apps Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Sleep Apps Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Sleep Apps Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Sleep Apps Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sleep Apps?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Sleep Apps?

Key companies in the market include Headspace, Noisli, Pzizz, Slumber, Calm, Sleep Cycle, 10% Happier, Reflectly, Sleepiest, Moshi, Tide.

3. What are the main segments of the Sleep Apps?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sleep Apps," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sleep Apps report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sleep Apps?

To stay informed about further developments, trends, and reports in the Sleep Apps, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence