Key Insights

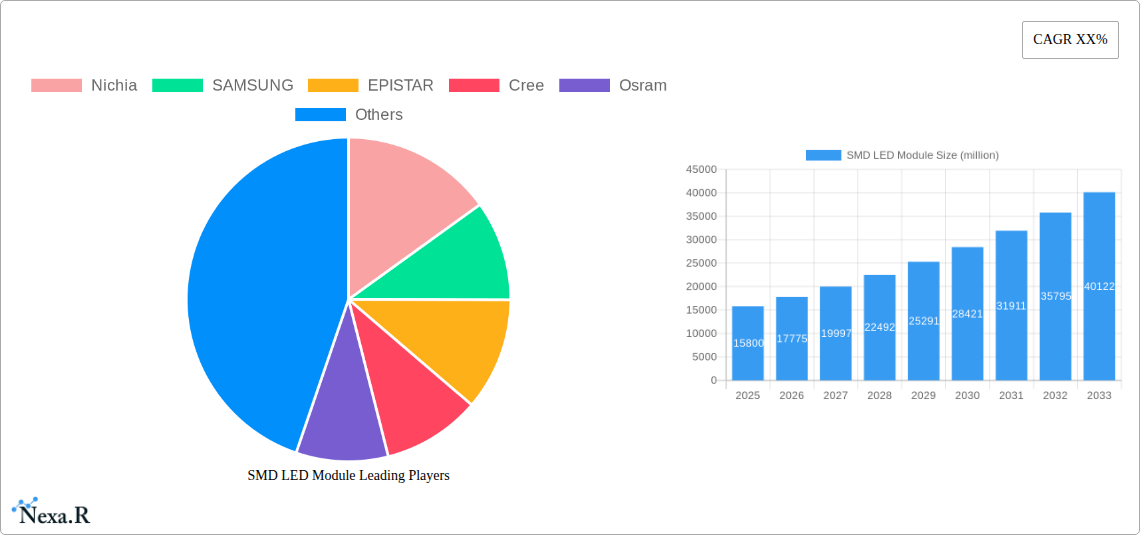

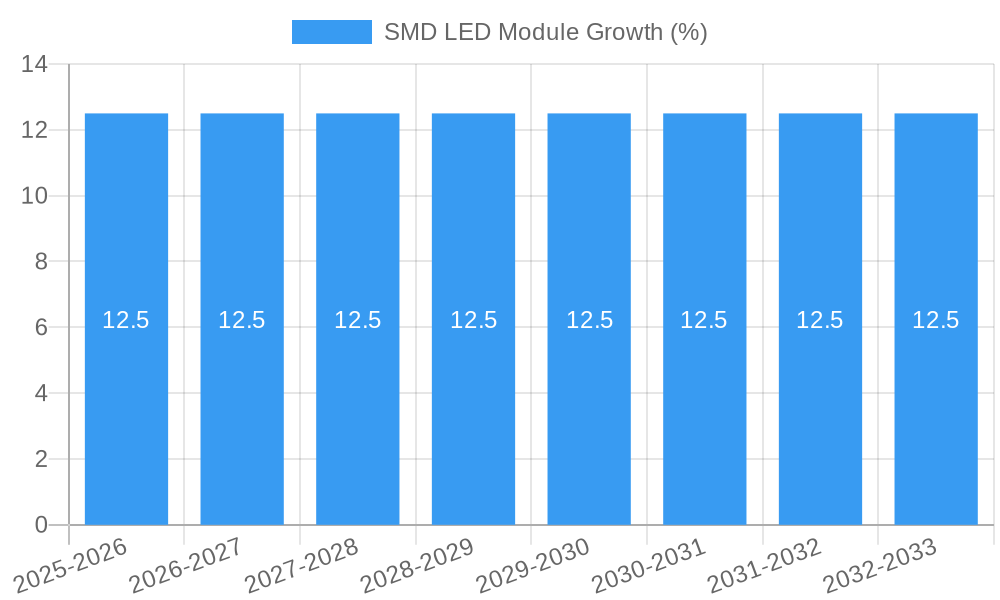

The global SMD LED Module market is poised for robust growth, projected to reach an estimated $15,800 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This significant expansion is primarily driven by the escalating demand for energy-efficient and long-lasting lighting solutions across diverse applications, from residential illumination and commercial shop-window displays to intricate advertising campaigns and sophisticated automotive interior lighting. The inherent advantages of SMD LED modules, including their compact size, high brightness, low power consumption, and versatility, make them an indispensable component in modern product design and infrastructure development. The increasing adoption of LED technology in smart homes, dynamic retail environments, and the automotive sector, which prioritizes advanced interior lighting for enhanced aesthetics and user experience, are key accelerators for this market. Furthermore, ongoing technological advancements leading to improved efficacy, color rendering, and cost-effectiveness of SMD LED modules will continue to fuel their widespread adoption.

The market dynamics are further shaped by several emerging trends and a few restraining factors. Key trends include the growing popularity of high-power SMD LED modules for demanding applications, the integration of smart technologies for IoT-enabled lighting control, and the increasing focus on sustainable and eco-friendly lighting solutions. The burgeoning e-commerce sector and the rise of digital signage are also contributing to the demand for innovative SMD LED module applications. However, the market faces certain restraints, such as the initial high upfront cost of certain advanced SMD LED modules and intense price competition among manufacturers, particularly for standard product lines. Despite these challenges, the inherent benefits and continuous innovation within the SMD LED Module industry, coupled with supportive government regulations promoting energy efficiency, are expected to propel sustained market growth throughout the forecast period. Major players like Nichia, SAMSUNG, EPISTAR, Cree, Osram, PHILIPS Lumileds, SSC, LG Innotek, Toyoda Gosei, and Semileds are actively investing in research and development to cater to evolving market needs.

This in-depth report provides a definitive analysis of the global SMD LED Module market, offering critical insights into its structure, growth trajectory, key players, and future outlook. Covering the historical period from 2019–2024, the base year 2025, and a forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving dynamics of this rapidly expanding sector. The report delves into market concentration, technological innovation, regulatory landscapes, competitive substitutes, end-user demographics, and M&A trends, alongside detailed analyses of market size, adoption rates, technological disruptions, and consumer behavior shifts.

SMD LED Module Market Dynamics & Structure

The SMD LED Module market, a pivotal segment within the broader LED lighting industry, exhibits a moderately fragmented structure. Innovation remains a key driver, fueled by relentless pursuit of higher efficacy, improved color rendering indexes (CRIs), and enhanced lifespan. Governments worldwide are increasingly implementing stringent energy efficiency regulations, mandating the adoption of energy-saving lighting solutions, thereby providing a significant tailwind for the SMD LED Module market. Competitive product substitutes, while present in the form of traditional lighting technologies, are steadily losing ground due to the superior performance and cost-effectiveness of SMD LEDs. End-user demographics are diverse, ranging from residential consumers seeking aesthetic and energy-efficient home illumination to commercial entities demanding reliable and impactful solutions for shop windows and advertising. Mergers and acquisitions (M&A) activity, while not at a fever pitch, continues to play a role in consolidating market share and fostering technological synergy.

- Market Concentration: Moderately fragmented with a blend of large, established players and numerous smaller, specialized manufacturers.

- Technological Innovation Drivers: Demand for higher lumen output, improved energy efficiency (lumens per watt), better thermal management, miniaturization, and smart lighting integration.

- Regulatory Frameworks: Increasingly favorable, with energy efficiency standards and government incentives promoting LED adoption.

- Competitive Product Substitutes: Incandescent, halogen, and fluorescent lamps are diminishing in relevance, while OLEDs present a nascent, high-end alternative.

- End-User Demographics: Broad spectrum including homeowners, retail businesses, automotive manufacturers, and signage companies.

- M&A Trends: Strategic acquisitions aimed at acquiring new technologies, expanding product portfolios, and gaining market access.

SMD LED Module Growth Trends & Insights

The global SMD LED Module market is poised for robust growth throughout the forecast period (2025–2033), driven by escalating demand for energy-efficient lighting solutions across diverse applications. The market size is projected to witness a significant expansion, with estimates suggesting a compound annual growth rate (CAGR) of approximately 12.8% from the base year 2025. This upward trajectory is underpinned by several critical factors. Technological advancements are continuously improving the performance and reducing the cost of SMD LED modules, making them increasingly accessible and attractive for a wider range of applications. For instance, innovations in packaging technologies and material science are leading to modules with higher luminous efficacy and longer operational lifespans, translating into substantial energy savings and reduced maintenance costs for end-users. The adoption rates of SMD LED modules are accelerating as awareness of their benefits grows and as governments worldwide continue to phase out less energy-efficient lighting technologies. This shift is particularly evident in the residential and commercial lighting sectors. Consumer behavior is also playing a pivotal role, with an increasing preference for smart, connected lighting solutions that offer convenience, customization, and energy management capabilities. The integration of IoT technology into LED lighting systems allows for remote control, scheduling, and dimming, appealing to a growing segment of environmentally conscious and tech-savvy consumers. Furthermore, the expanding automotive sector, with its increasing adoption of LED lighting for both interior and exterior applications, presents a substantial growth opportunity. Automobile interior lighting, in particular, is experiencing a surge in demand for sophisticated and energy-efficient SMD LED modules to enhance cabin ambiance and functionality. The advertising and shop-window illumination segments are also crucial growth drivers, as businesses recognize the power of bright, eye-catching, and energy-efficient lighting to attract customers and enhance brand visibility. The ongoing urbanization and infrastructure development initiatives in emerging economies are further contributing to the demand for advanced lighting solutions, including SMD LED modules. The evolution of LED technology, moving towards higher brightness, better color consistency, and specialized spectrum outputs, is also opening up new application niches and pushing the boundaries of what is possible with solid-state lighting.

- Market Size Evolution: Expected to grow from approximately $18.5 billion in 2025 to over $48.2 billion by 2033.

- Adoption Rates: Increasing significantly across residential, commercial, and automotive sectors due to cost-effectiveness and performance benefits.

- Technological Disruptions: Continuous improvements in efficacy, CRI, thermal management, and integration with smart home technologies.

- Consumer Behavior Shifts: Growing demand for energy efficiency, smart lighting, aesthetic customization, and long-term cost savings.

- CAGR: Projected at approximately 12.8% for the forecast period 2025–2033.

- Market Penetration: Expected to surpass 75% in general lighting applications by 2033.

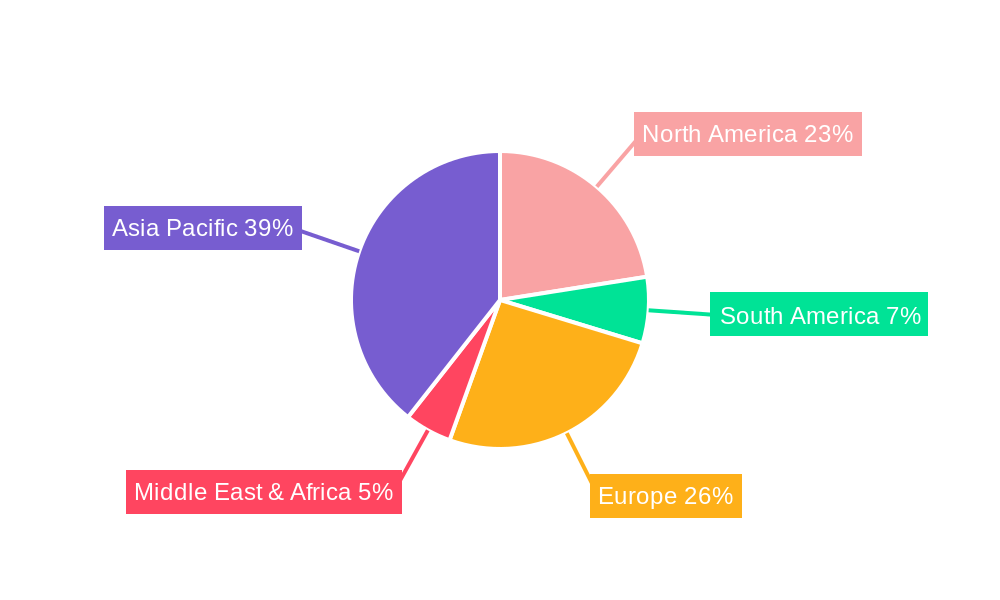

Dominant Regions, Countries, or Segments in SMD LED Module

The global SMD LED Module market exhibits distinct regional and segmental dominance, driven by a confluence of economic, technological, and policy-related factors. Asia Pacific, spearheaded by China, stands as the undisputed leader in terms of both production and consumption of SMD LED modules. This dominance is attributable to several key factors. Firstly, China's robust manufacturing infrastructure, coupled with a vast and increasingly affluent domestic market, has fostered an environment conducive to large-scale production and rapid adoption. Government initiatives supporting the LED industry, including subsidies and preferential policies, have further propelled the region's growth. The sheer volume of production of these modules, estimated at over 3.5 billion units in 2025, positions Asia Pacific as the primary supply hub. Within the Applications segment, Home Illumination emerges as the most significant growth driver. The rising disposable incomes, increasing urbanization, and a growing consumer preference for energy-efficient and aesthetically pleasing home environments are fueling a substantial demand for SMD LED modules in this segment. Global sales for home illumination are expected to reach an impressive $7.9 billion in 2025. Furthermore, the widespread replacement of traditional lighting in existing homes and the construction of new residential properties further amplify this demand.

In terms of Types, the 5630 SMD LED Module segment is expected to exhibit exceptional growth. Its superior brightness, efficiency, and versatility make it a preferred choice for a wide array of applications, including general lighting, signage, and architectural lighting. Sales for this specific type are projected to be around $3.2 billion in 2025. The continuous advancements in the performance of 5630 modules, offering higher lumen output and better thermal dissipation, solidify its position as a market leader. The economic policies in the Asia Pacific region, which often favor manufacturing and export, coupled with substantial investments in smart city projects and infrastructure development, further bolster the dominance of this region. The presence of major manufacturers like SAMSUNG, Nichia, and EPISTAR in this region also contributes to its leadership through continuous innovation and competitive pricing. The increasing adoption of LED lighting in the automotive sector within this region, particularly for interior lighting applications, also adds to the overall market dynamism. The growth potential in emerging economies within Asia Pacific, such as India and Southeast Asian nations, remains immense, offering significant opportunities for market expansion. The country-specific adoption rates are also noteworthy, with China leading in sheer volume, followed by the United States and then European nations like Germany. The application of SMD LED modules in advertising and shop-window displays, while smaller in overall market size, is characterized by high growth rates driven by the need for visually impactful and energy-efficient retail environments.

- Dominant Region: Asia Pacific (led by China) – estimated production of 3.5 billion units in 2025.

- Dominant Application Segment: Home Illumination – projected to reach $7.9 billion in 2025.

- Dominant Type Segment: 5630 SMD LED Module – expected sales of $3.2 billion in 2025.

- Key Drivers in Asia Pacific: Robust manufacturing base, supportive government policies, large domestic market, and rapid urbanization.

- Growth Potential in Home Illumination: Driven by rising disposable incomes, energy efficiency consciousness, and renovation trends.

- Factors for 5630 SMD LED Module Dominance: High brightness, superior efficiency, thermal performance, and versatility.

SMD LED Module Product Landscape

The SMD LED Module product landscape is characterized by continuous innovation focused on enhancing performance, efficiency, and functionality. Manufacturers are developing modules with higher lumen outputs, improved color rendering indices (CRIs) exceeding 90, and extended lifespans of up to 50,000 hours. Advanced thermal management techniques, such as improved substrate materials and heat dissipation designs, are crucial for maintaining optimal performance and longevity. Miniaturization of SMD LED modules is also a key trend, enabling their integration into increasingly compact and diverse applications. Furthermore, the integration of smart features, including dimming capabilities, color tuning, and connectivity to IoT platforms, is expanding the utility and value proposition of these modules, particularly in applications like Automobile Interior Lighting and Home Illumination where user experience and ambiance are paramount.

Key Drivers, Barriers & Challenges in SMD LED Module

Key Drivers: The primary forces propelling the SMD LED Module market are the persistent global drive for energy efficiency and cost reduction, spurred by escalating energy prices and environmental concerns. Government regulations mandating the phase-out of less efficient lighting technologies and promoting LED adoption serve as significant catalysts. Technological advancements leading to higher efficacy, improved light quality, and lower manufacturing costs are continuously expanding the market's appeal. The burgeoning demand for smart and connected lighting solutions, offering enhanced user experience and control, is another crucial growth accelerator. The automotive industry's increasing reliance on LED technology for both functional and aesthetic purposes, particularly for Automobile Interior Lighting, presents a substantial opportunity.

Barriers & Challenges: Despite the positive outlook, the SMD LED Module market faces certain challenges. Fluctuations in the cost of raw materials, such as rare earth elements and phosphors, can impact manufacturing costs and profit margins. Intense competition among numerous manufacturers, particularly in the commoditized segments, can lead to price wars and erode profitability. The initial upfront cost of LED lighting systems, although decreasing, can still be a barrier for some price-sensitive consumers and businesses. Supply chain disruptions, as witnessed in recent global events, can affect the availability and timely delivery of components. Furthermore, the disposal and recycling of LED modules pose an emerging environmental challenge that requires industry-wide attention and sustainable solutions. The presence of counterfeit or low-quality products in the market can also damage consumer trust and hinder wider adoption.

Emerging Opportunities in SMD LED Module

Emerging opportunities in the SMD LED Module sector are abundant, driven by evolving consumer preferences and technological frontiers. The rapid expansion of the Internet of Things (IoT) ecosystem presents a significant avenue for smart and connected LED lighting solutions, enabling advanced control, automation, and data analytics capabilities in applications ranging from Home Illumination to smart cities. The increasing demand for specialized lighting in horticulture, healthcare (e.g., germicidal UV LEDs), and aquaculture opens up niche, high-value markets. The automotive sector's transition towards electric vehicles (EVs) is creating new opportunities for integrated LED lighting solutions that optimize energy consumption and enhance vehicle aesthetics. The growing trend of retrofitting older buildings with energy-efficient lighting offers substantial market potential. Furthermore, the development of human-centric lighting solutions that mimic natural daylight cycles to improve well-being and productivity is an area ripe for innovation and market penetration. The integration of LED modules with advanced display technologies for dynamic signage and advertising also represents a promising growth area.

Growth Accelerators in the SMD LED Module Industry

Several key catalysts are accelerating long-term growth in the SMD LED Module industry. Continuous technological breakthroughs in material science and manufacturing processes are leading to higher efficiency LEDs with improved spectral control and longer lifespans. Strategic partnerships and collaborations between LED manufacturers, luminaire designers, and smart technology providers are fostering innovation and creating integrated lighting solutions that cater to emerging market needs. Market expansion strategies targeting developing economies, where energy efficiency is becoming a critical concern, are unlocking new growth avenues. The increasing global focus on sustainability and the circular economy is driving the development of more eco-friendly manufacturing processes and recyclable LED modules. The ongoing development of advanced driver ICs and control systems that optimize LED performance and enable seamless integration with building management systems further contributes to market expansion. The growing demand for customizable and modular LED lighting solutions allows for greater design flexibility and application-specific solutions.

Key Players Shaping the SMD LED Module Market

- Nichia

- SAMSUNG

- EPISTAR

- Cree

- Osram

- PHILIPS Lumileds

- SSC

- LG Innotek

- Toyoda Gosei

- Semileds

Notable Milestones in SMD LED Module Sector

- 2019: Introduction of high-efficacy 300-lumen-per-watt SMD LED modules, significantly improving energy efficiency.

- 2020: Major manufacturers begin focusing on recyclable and sustainable LED module designs.

- 2021: Increased integration of AI and machine learning for intelligent lighting control systems.

- 2022: Significant advancements in color-tunable white SMD LED modules for human-centric lighting applications.

- 2023: Widespread adoption of advanced thermal management solutions in high-power SMD LED modules.

- 2024: Emergence of ultra-miniature SMD LED modules enabling unprecedented design flexibility in consumer electronics.

In-Depth SMD LED Module Market Outlook

- 2019: Introduction of high-efficacy 300-lumen-per-watt SMD LED modules, significantly improving energy efficiency.

- 2020: Major manufacturers begin focusing on recyclable and sustainable LED module designs.

- 2021: Increased integration of AI and machine learning for intelligent lighting control systems.

- 2022: Significant advancements in color-tunable white SMD LED modules for human-centric lighting applications.

- 2023: Widespread adoption of advanced thermal management solutions in high-power SMD LED modules.

- 2024: Emergence of ultra-miniature SMD LED modules enabling unprecedented design flexibility in consumer electronics.

In-Depth SMD LED Module Market Outlook

The SMD LED Module market is characterized by a highly optimistic outlook, driven by a confluence of robust growth accelerators. The persistent global imperative for energy efficiency, coupled with increasingly stringent environmental regulations, will continue to propel demand. Technological innovation remains a cornerstone, with ongoing advancements in efficacy, color quality, and intelligent control systems unlocking new application frontiers. The expansion of the IoT ecosystem provides a fertile ground for smart lighting solutions, enhancing user convenience and enabling data-driven energy management. Emerging markets, with their burgeoning economies and increasing urbanization, represent significant untapped potential for widespread adoption. Strategic partnerships and mergers are expected to further consolidate the industry, fostering greater efficiency and innovation. The market's ability to adapt to evolving consumer preferences, such as the demand for personalized lighting experiences and sustainable products, will be crucial for sustained growth. The forecast period 2025–2033 promises a dynamic and expanding market, offering substantial opportunities for stakeholders who can leverage technological advancements and cater to diverse application needs.

SMD LED Module Segmentation

-

1. Application

- 1.1. Home Illumination

- 1.2. Shop-Windows

- 1.3. Advertising

- 1.4. Automobile Interior Lighting

- 1.5. Other

-

2. Types

- 2.1. 5050 SMD LED Module

- 2.2. 3528 SMD LED Module

- 2.3. 3020 SMD LED Module

- 2.4. 5630 SMD LED Module

- 2.5. Other

SMD LED Module Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

SMD LED Module REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global SMD LED Module Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Illumination

- 5.1.2. Shop-Windows

- 5.1.3. Advertising

- 5.1.4. Automobile Interior Lighting

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 5050 SMD LED Module

- 5.2.2. 3528 SMD LED Module

- 5.2.3. 3020 SMD LED Module

- 5.2.4. 5630 SMD LED Module

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America SMD LED Module Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home Illumination

- 6.1.2. Shop-Windows

- 6.1.3. Advertising

- 6.1.4. Automobile Interior Lighting

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 5050 SMD LED Module

- 6.2.2. 3528 SMD LED Module

- 6.2.3. 3020 SMD LED Module

- 6.2.4. 5630 SMD LED Module

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America SMD LED Module Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home Illumination

- 7.1.2. Shop-Windows

- 7.1.3. Advertising

- 7.1.4. Automobile Interior Lighting

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 5050 SMD LED Module

- 7.2.2. 3528 SMD LED Module

- 7.2.3. 3020 SMD LED Module

- 7.2.4. 5630 SMD LED Module

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe SMD LED Module Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home Illumination

- 8.1.2. Shop-Windows

- 8.1.3. Advertising

- 8.1.4. Automobile Interior Lighting

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 5050 SMD LED Module

- 8.2.2. 3528 SMD LED Module

- 8.2.3. 3020 SMD LED Module

- 8.2.4. 5630 SMD LED Module

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa SMD LED Module Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home Illumination

- 9.1.2. Shop-Windows

- 9.1.3. Advertising

- 9.1.4. Automobile Interior Lighting

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 5050 SMD LED Module

- 9.2.2. 3528 SMD LED Module

- 9.2.3. 3020 SMD LED Module

- 9.2.4. 5630 SMD LED Module

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific SMD LED Module Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home Illumination

- 10.1.2. Shop-Windows

- 10.1.3. Advertising

- 10.1.4. Automobile Interior Lighting

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 5050 SMD LED Module

- 10.2.2. 3528 SMD LED Module

- 10.2.3. 3020 SMD LED Module

- 10.2.4. 5630 SMD LED Module

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nichia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SAMSUNG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EPISTAR

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cree

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Osram

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PHILIPS Lumileds

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SSC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LG Innotek

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Toyoda Gosei

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Semileds

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nichia

List of Figures

- Figure 1: Global SMD LED Module Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global SMD LED Module Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America SMD LED Module Revenue (million), by Application 2024 & 2032

- Figure 4: North America SMD LED Module Volume (K), by Application 2024 & 2032

- Figure 5: North America SMD LED Module Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America SMD LED Module Volume Share (%), by Application 2024 & 2032

- Figure 7: North America SMD LED Module Revenue (million), by Types 2024 & 2032

- Figure 8: North America SMD LED Module Volume (K), by Types 2024 & 2032

- Figure 9: North America SMD LED Module Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America SMD LED Module Volume Share (%), by Types 2024 & 2032

- Figure 11: North America SMD LED Module Revenue (million), by Country 2024 & 2032

- Figure 12: North America SMD LED Module Volume (K), by Country 2024 & 2032

- Figure 13: North America SMD LED Module Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America SMD LED Module Volume Share (%), by Country 2024 & 2032

- Figure 15: South America SMD LED Module Revenue (million), by Application 2024 & 2032

- Figure 16: South America SMD LED Module Volume (K), by Application 2024 & 2032

- Figure 17: South America SMD LED Module Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America SMD LED Module Volume Share (%), by Application 2024 & 2032

- Figure 19: South America SMD LED Module Revenue (million), by Types 2024 & 2032

- Figure 20: South America SMD LED Module Volume (K), by Types 2024 & 2032

- Figure 21: South America SMD LED Module Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America SMD LED Module Volume Share (%), by Types 2024 & 2032

- Figure 23: South America SMD LED Module Revenue (million), by Country 2024 & 2032

- Figure 24: South America SMD LED Module Volume (K), by Country 2024 & 2032

- Figure 25: South America SMD LED Module Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America SMD LED Module Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe SMD LED Module Revenue (million), by Application 2024 & 2032

- Figure 28: Europe SMD LED Module Volume (K), by Application 2024 & 2032

- Figure 29: Europe SMD LED Module Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe SMD LED Module Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe SMD LED Module Revenue (million), by Types 2024 & 2032

- Figure 32: Europe SMD LED Module Volume (K), by Types 2024 & 2032

- Figure 33: Europe SMD LED Module Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe SMD LED Module Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe SMD LED Module Revenue (million), by Country 2024 & 2032

- Figure 36: Europe SMD LED Module Volume (K), by Country 2024 & 2032

- Figure 37: Europe SMD LED Module Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe SMD LED Module Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa SMD LED Module Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa SMD LED Module Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa SMD LED Module Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa SMD LED Module Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa SMD LED Module Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa SMD LED Module Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa SMD LED Module Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa SMD LED Module Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa SMD LED Module Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa SMD LED Module Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa SMD LED Module Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa SMD LED Module Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific SMD LED Module Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific SMD LED Module Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific SMD LED Module Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific SMD LED Module Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific SMD LED Module Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific SMD LED Module Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific SMD LED Module Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific SMD LED Module Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific SMD LED Module Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific SMD LED Module Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific SMD LED Module Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific SMD LED Module Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global SMD LED Module Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global SMD LED Module Volume K Forecast, by Region 2019 & 2032

- Table 3: Global SMD LED Module Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global SMD LED Module Volume K Forecast, by Application 2019 & 2032

- Table 5: Global SMD LED Module Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global SMD LED Module Volume K Forecast, by Types 2019 & 2032

- Table 7: Global SMD LED Module Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global SMD LED Module Volume K Forecast, by Region 2019 & 2032

- Table 9: Global SMD LED Module Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global SMD LED Module Volume K Forecast, by Application 2019 & 2032

- Table 11: Global SMD LED Module Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global SMD LED Module Volume K Forecast, by Types 2019 & 2032

- Table 13: Global SMD LED Module Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global SMD LED Module Volume K Forecast, by Country 2019 & 2032

- Table 15: United States SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global SMD LED Module Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global SMD LED Module Volume K Forecast, by Application 2019 & 2032

- Table 23: Global SMD LED Module Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global SMD LED Module Volume K Forecast, by Types 2019 & 2032

- Table 25: Global SMD LED Module Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global SMD LED Module Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global SMD LED Module Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global SMD LED Module Volume K Forecast, by Application 2019 & 2032

- Table 35: Global SMD LED Module Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global SMD LED Module Volume K Forecast, by Types 2019 & 2032

- Table 37: Global SMD LED Module Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global SMD LED Module Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global SMD LED Module Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global SMD LED Module Volume K Forecast, by Application 2019 & 2032

- Table 59: Global SMD LED Module Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global SMD LED Module Volume K Forecast, by Types 2019 & 2032

- Table 61: Global SMD LED Module Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global SMD LED Module Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global SMD LED Module Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global SMD LED Module Volume K Forecast, by Application 2019 & 2032

- Table 77: Global SMD LED Module Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global SMD LED Module Volume K Forecast, by Types 2019 & 2032

- Table 79: Global SMD LED Module Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global SMD LED Module Volume K Forecast, by Country 2019 & 2032

- Table 81: China SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific SMD LED Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific SMD LED Module Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the SMD LED Module?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the SMD LED Module?

Key companies in the market include Nichia, SAMSUNG, EPISTAR, Cree, Osram, PHILIPS Lumileds, SSC, LG Innotek, Toyoda Gosei, Semileds.

3. What are the main segments of the SMD LED Module?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "SMD LED Module," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the SMD LED Module report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the SMD LED Module?

To stay informed about further developments, trends, and reports in the SMD LED Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence