Key Insights

The China Plastic Caps & Closures market is projected for significant expansion, fueled by a growing consumer base and increasing demand across vital end-use industries. With a market size estimated at $6.34 billion in the base year of 2024 and a Compound Annual Growth Rate (CAGR) of 5.7%, this sector is a key contributor to the global packaging landscape. Growth is primarily driven by the sustained demand for packaged food and beverages, the rigorous quality standards of the pharmaceutical industry, and the rising sophistication in cosmetic and household product packaging. Innovations in material science, including the broader adoption of PET, PP, HDPE, and LDPE, are elevating the performance, longevity, and visual appeal of plastic caps and closures. Furthermore, design advancements, such as tamper-evident and child-resistant features, are aligning with evolving consumer expectations for safety and convenience.

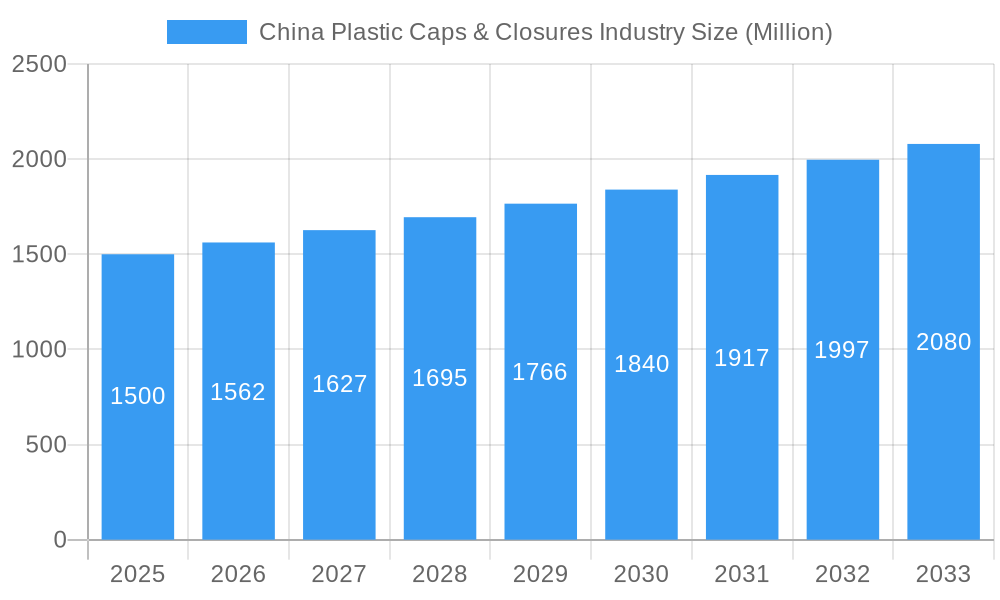

China Plastic Caps & Closures Industry Market Size (In Billion)

Emerging trends are actively shaping the Chinese market, with a pronounced emphasis on sustainability and the circular economy. Manufacturers are increasingly adopting recycled and bio-based materials in response to regulatory mandates and heightened consumer environmental awareness. Automation and advanced manufacturing processes are being implemented to enhance production efficiency and product quality, while simultaneously reducing operational expenses. However, market challenges include volatile raw material prices, particularly for petroleum-based plastics, which can affect profitability. Stringent environmental regulations and a push for plastic reduction and alternative packaging solutions in specific segments also present obstacles. Despite these challenges, sustained demand from diverse sectors such as food, beverages, pharmaceuticals, and cosmetics, combined with a robust manufacturing infrastructure, guarantees ongoing growth and innovation opportunities within China's plastic caps and closures industry.

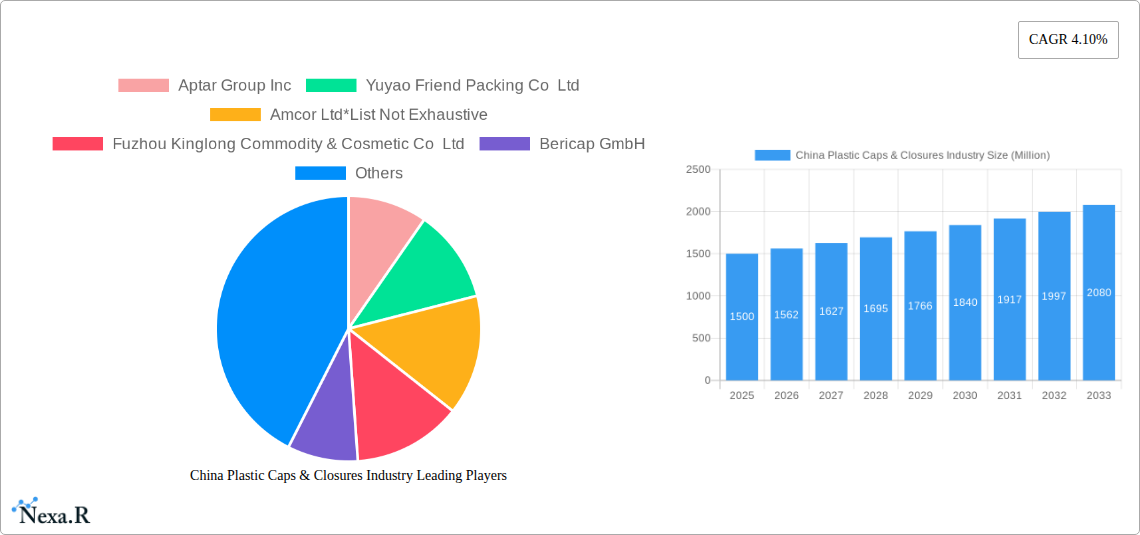

China Plastic Caps & Closures Industry Company Market Share

China Plastic Caps & Closures Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the China plastic caps and closures market, offering critical insights into its intricate dynamics, robust growth trajectory, and future potential. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on opportunities within this rapidly evolving sector. We deliver granular data on market size, segmentation, regional dominance, and competitive landscapes, all presented in million units for clarity and actionable intelligence.

China Plastic Caps & Closures Industry Market Dynamics & Structure

The China plastic caps and closures market exhibits a moderate market concentration, with several key players vying for significant market share. Technological innovation remains a primary driver, fueled by advancements in materials science, manufacturing processes, and intelligent closure solutions. For instance, the integration of QR codes for product authentication and consumer engagement, as seen with Nestle's initiatives, highlights this trend. The regulatory framework, while evolving, emphasizes safety, environmental sustainability, and product integrity, influencing material choices and design standards. Competitive product substitutes, primarily from metal and glass closures, exert pressure, but the cost-effectiveness, versatility, and lightweight properties of plastics continue to secure their dominance. End-user demographics are increasingly sophisticated, demanding convenience, enhanced shelf-life, tamper-evidence, and sustainable packaging solutions. Mergers and acquisitions (M&A) trends indicate a strategic push for market consolidation, vertical integration, and the acquisition of innovative technologies to enhance R&D capabilities and expand product portfolios.

- Market Concentration: Moderate, with a blend of large multinational corporations and numerous domestic manufacturers.

- Technological Innovation: Driven by smart closures, advanced materials, and sustainable manufacturing techniques.

- Regulatory Framework: Focus on food safety, environmental compliance, and consumer protection.

- Competitive Substitutes: Metal, glass, and alternative sealing mechanisms.

- End-User Demographics: Demand for convenience, safety, sustainability, and added functionality.

- M&A Activity: Strategic acquisitions to gain market share, technology, and R&D prowess.

China Plastic Caps & Closures Industry Growth Trends & Insights

The China plastic caps and closures market is poised for substantial growth, underpinned by increasing domestic consumption, a burgeoning export market, and continuous product innovation. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reaching an estimated XXX million units by the end of the forecast period. Adoption rates for specialized closures, such as those with child-resistant features or tamper-evident seals, are accelerating across various industry verticals, driven by stringent safety regulations and heightened consumer awareness. Technological disruptions, including advancements in injection molding techniques, bioplastics, and smart packaging solutions, are reshaping product offerings and manufacturing efficiencies. Consumer behavior shifts are significantly influencing demand; there is a growing preference for convenient, lightweight, and sustainable packaging. This is particularly evident in the food and beverage, pharmaceutical, and cosmetic sectors, where brand differentiation and product integrity are paramount. The rising middle class and urbanization trends further contribute to the increased demand for packaged goods, directly impacting the consumption of plastic caps and closures. The market penetration of advanced closure technologies is expected to rise as manufacturers invest in R&D and adapt to evolving market demands for functionality and eco-friendliness.

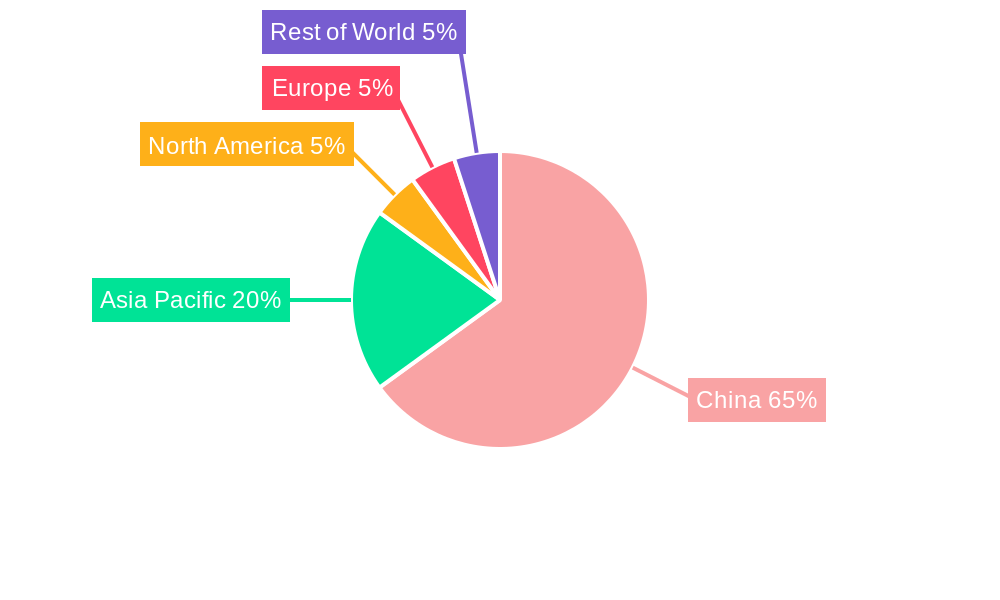

Dominant Regions, Countries, or Segments in China Plastic Caps & Closures Industry

The China plastic caps and closures industry is experiencing significant growth, with several regions and segments demonstrating robust performance. The Eastern China region, encompassing provinces like Guangdong, Jiangsu, and Zhejiang, stands as the dominant force. This dominance is attributed to a confluence of factors, including a highly developed manufacturing base, extensive logistical networks, and a concentration of key end-user industries. The presence of major ports facilitates both domestic distribution and international exports, further bolstering the region's market leadership. Economically, these provinces are among China's most prosperous, leading to higher consumer spending on packaged goods, which directly fuels the demand for caps and closures.

Within the Raw Material segment, Polypropylene (PP) and High-Density Polyethylene (HDPE) are the leading materials, collectively accounting for an estimated 65% of the market share. PP's excellent chemical resistance, heat stability, and stiffness make it ideal for a wide range of applications, particularly in food and beverage packaging. HDPE's durability, flexibility, and cost-effectiveness make it a preferred choice for household chemicals and certain beverage applications. The demand for Polyethylene Terephthalate (PET) closures is also significant, especially for beverage bottles, owing to its clarity and barrier properties.

In terms of Industry Vertical, the Food and Beverages sector emerges as the largest consumer of plastic caps and closures, representing approximately 40% of the total market. This segment's dominance is driven by the sheer volume of packaged food and drinks consumed daily. The Pharmaceutical and Cosmetics and Household segments also exhibit strong growth, driven by increasing healthcare awareness, a growing beauty market, and rising household disposable incomes. The pharmaceutical sector demands highly specialized, tamper-evident, and child-resistant closures to ensure product safety and compliance. The cosmetics industry relies on aesthetic appeal, functionality, and premium finishes for its closures.

- Dominant Region: Eastern China (Guangdong, Jiangsu, Zhejiang) – characterized by advanced manufacturing, robust logistics, and high consumer spending.

- Leading Raw Materials: Polypropylene (PP) and High-Density Polyethylene (HDPE) – driven by their versatility, cost-effectiveness, and suitability for diverse applications.

- Primary Industry Vertical: Food and Beverages – due to high consumption volumes and diverse packaging needs.

- Key Drivers: Economic policies, advanced infrastructure, concentration of end-user industries, and rising consumer demand for packaged goods.

- Growth Potential: Significant opportunities exist in the pharmaceutical and cosmetics sectors due to increasing demand for specialized and high-value closures.

China Plastic Caps & Closures Industry Product Landscape

The China plastic caps and closures industry is characterized by a dynamic product landscape focused on enhancing functionality, safety, and sustainability. Innovations include the development of tamper-evident seals for pharmaceutical and food products, ensuring consumer confidence and product integrity. Child-resistant closures (CRCs) are increasingly mandated and adopted, particularly for household chemicals and pharmaceuticals, prioritizing child safety. The integration of smart features, such as QR codes and NFC tags, is on the rise, enabling track-and-trace capabilities, brand authentication, and consumer engagement platforms. Furthermore, there is a growing emphasis on lightweighting designs to reduce material consumption and logistics costs, alongside the adoption of recycled and bio-based plastics to meet sustainability demands. Performance metrics such as seal integrity, ease of opening, durability, and compatibility with various filling processes are critical considerations for manufacturers.

Key Drivers, Barriers & Challenges in China Plastic Caps & Closures Industry

Key Drivers:

- Robust Growth in End-User Industries: Expanding food & beverage, pharmaceutical, and cosmetic sectors are directly increasing demand.

- Rising Disposable Incomes & Urbanization: Driving higher consumption of packaged goods.

- Technological Advancements: Innovations in materials, manufacturing, and smart closures enhance product value and functionality.

- Government Support for Manufacturing: Policies promoting domestic production and export competitiveness.

- Focus on Product Safety & Tamper-Evidence: Stringent regulations and consumer expectations driving demand for specialized closures.

Barriers & Challenges:

- Intense Price Competition: A fragmented market leads to pressure on profit margins.

- Raw Material Price Volatility: Fluctuations in petrochemical prices directly impact production costs.

- Environmental Regulations & Sustainability Pressures: Increasing demand for eco-friendly solutions requires significant R&D and investment.

- Supply Chain Disruptions: Global events and logistics challenges can impact raw material availability and delivery times.

- Counterfeiting Concerns: The need for robust anti-counterfeiting measures in packaging.

Emerging Opportunities in China Plastic Caps & Closures Industry

Emerging opportunities in the China plastic caps and closures industry lie in the growing demand for sustainable packaging solutions. This includes the development and adoption of closures made from recycled content (PCR) and biodegradable or compostable materials. The e-commerce and direct-to-consumer (DTC) channels present an opportunity for innovative packaging designs that ensure product protection during transit and enhance unboxing experiences. Furthermore, the increasing sophistication of the personal care and premium cosmetic markets is driving demand for high-end, aesthetically pleasing, and functionally advanced closures. The pharmaceutical sector's continuous growth and stringent safety requirements will continue to fuel demand for specialized closures, including those with advanced tamper-evident and child-resistant features.

Growth Accelerators in the China Plastic Caps & Closures Industry Industry

Several catalysts are accelerating the growth of the China plastic caps and closures industry. Technological breakthroughs in injection molding, such as multi-component molding and thin-wall technology, are enhancing manufacturing efficiency and enabling the production of complex designs at lower costs. Strategic partnerships between material suppliers, closure manufacturers, and brand owners are fostering collaborative innovation, leading to the development of tailored solutions that meet specific market needs. Market expansion strategies, including increasing export activities to emerging economies and focusing on high-growth domestic segments, are also contributing significantly. Investments in automation and digitalization within manufacturing facilities are further boosting productivity and quality control.

Key Players Shaping the China Plastic Caps & Closures Industry Market

- Aptar Group Inc

- Yuyao Friend Packing Co Ltd

- Amcor Ltd

- Fuzhou Kinglong Commodity & Cosmetic Co Ltd

- Bericap GmbH

- Albea Group

- Silgan White Cap (Shanghai) Co

- Shandong Haishengyu Plastics Industry Co Ltd

- Crown Asia Pacific Holdings Limited

- Berry Global Inc

Notable Milestones in China Plastic Caps & Closures Industry Sector

- May 2022: Carlyle plans to acquire China-based cosmetic packaging company HCP. HCP works with more than 250 leading cosmetics, skincare, and fragrance brands, including Estée Lauder, L'Oréal, and Shiseido. Carlyle will work with HCP through strategic acquisitions to strengthen the company's research and development (R&D) capabilities.

- August 2021: After successfully launching its QR code closure solution in China, Nestle launched the products in Vietnam. These closures include QR codes that can be easily scanned and serve as a reward point to be redeemed online via the Vietnamese messaging app Zalo.

In-Depth China Plastic Caps & Closures Industry Market Outlook

The outlook for the China plastic caps and closures industry remains exceptionally bright, driven by sustained demand from its vast consumer base and continuous innovation. Growth accelerators such as the increasing adoption of sustainable materials and smart packaging technologies are poised to redefine market offerings. Strategic investments in advanced manufacturing and a keen focus on meeting evolving consumer preferences for convenience and safety will further propel market expansion. The industry is on track to witness significant value creation, presenting lucrative opportunities for both domestic and international players to capitalize on this dynamic and expanding market.

China Plastic Caps & Closures Industry Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate

- 1.2. Polypropylene

- 1.3. HDPE and LDPE

- 1.4. Other Ra

-

2. Industry Vertical

- 2.1. Food

- 2.2. Beverages

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Household

- 2.5. Other In

China Plastic Caps & Closures Industry Segmentation By Geography

- 1. China

China Plastic Caps & Closures Industry Regional Market Share

Geographic Coverage of China Plastic Caps & Closures Industry

China Plastic Caps & Closures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Single Serve Beverages; Growing Demand from Cosmetic Industry

- 3.3. Market Restrains

- 3.3.1. Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Caps & Closures Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate

- 5.1.2. Polypropylene

- 5.1.3. HDPE and LDPE

- 5.1.4. Other Ra

- 5.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Household

- 5.2.5. Other In

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aptar Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yuyao Friend Packing Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuzhou Kinglong Commodity & Cosmetic Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bericap GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Albea Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan White Cap (Shanghai) Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shandong Haishengyu Plastics Industry Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Crown Asia Pacific Holdings Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berry Global Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aptar Group Inc

List of Figures

- Figure 1: China Plastic Caps & Closures Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Plastic Caps & Closures Industry Share (%) by Company 2025

List of Tables

- Table 1: China Plastic Caps & Closures Industry Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 2: China Plastic Caps & Closures Industry Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 3: China Plastic Caps & Closures Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Plastic Caps & Closures Industry Revenue billion Forecast, by Raw Material 2020 & 2033

- Table 5: China Plastic Caps & Closures Industry Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 6: China Plastic Caps & Closures Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Caps & Closures Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the China Plastic Caps & Closures Industry?

Key companies in the market include Aptar Group Inc, Yuyao Friend Packing Co Ltd, Amcor Ltd*List Not Exhaustive, Fuzhou Kinglong Commodity & Cosmetic Co Ltd, Bericap GmbH, Albea Group, Silgan White Cap (Shanghai) Co, Shandong Haishengyu Plastics Industry Co Ltd, Crown Asia Pacific Holdings Limited, Berry Global Inc.

3. What are the main segments of the China Plastic Caps & Closures Industry?

The market segments include Raw Material, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Single Serve Beverages; Growing Demand from Cosmetic Industry.

6. What are the notable trends driving market growth?

Food and Beverage Industry to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives.

8. Can you provide examples of recent developments in the market?

May 2022: Carlyle plans to acquire China-based cosmetic packaging company HCP. HCP works with more than 250 leading cosmetics, skincare, and fragrance brands, including Estée Lauder, L'Oréal, and Shiseido. Carlyle will work with HCP through strategic acquisitions to strengthen the company's research and development (R&D) capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Caps & Closures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Caps & Closures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Caps & Closures Industry?

To stay informed about further developments, trends, and reports in the China Plastic Caps & Closures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence