Key Insights

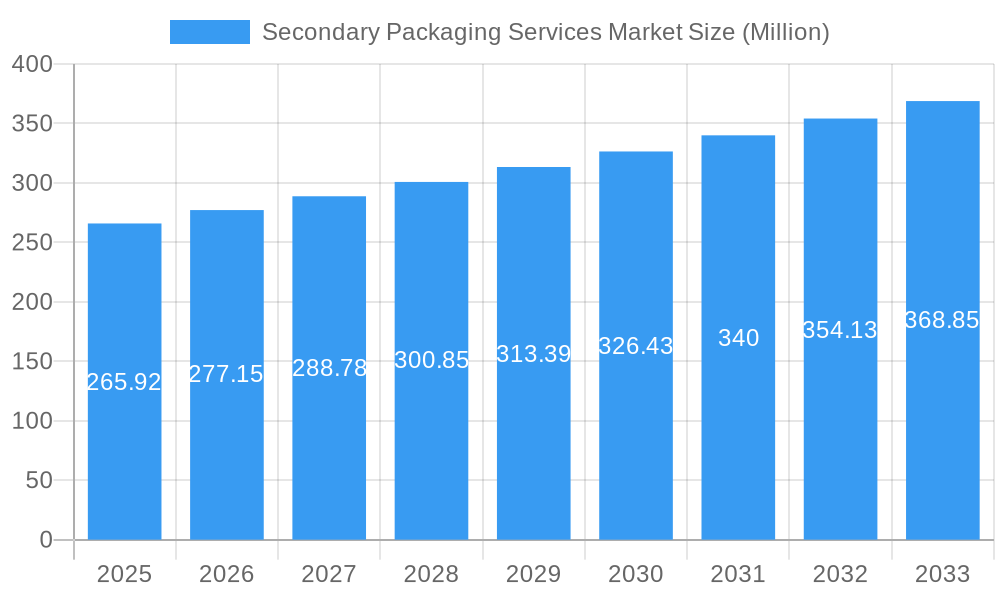

The global Secondary Packaging Services market is poised for significant growth, projected to reach an estimated USD 265.92 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.14% anticipated through the forecast period of 2025-2033. This expansion is largely fueled by the escalating demand for diverse packaging solutions across a multitude of end-user industries. The food and beverage sector, in particular, continues to be a dominant force, driven by increasing global consumption and the need for protective and shelf-ready packaging. Similarly, the healthcare industry's consistent growth, propelled by an aging global population and the expanding pharmaceutical market, is a key contributor. The burgeoning e-commerce landscape further amplifies the need for efficient and reliable secondary packaging to ensure product integrity during transit. Innovations in sustainable packaging materials, such as biodegradable films and recyclable corrugated boxes, are also shaping market dynamics, aligning with growing environmental consciousness among consumers and regulatory pressures.

Secondary Packaging Services Market Market Size (In Million)

The market's growth trajectory is supported by a dynamic interplay of drivers, including the increasing complexity of supply chains, the rising emphasis on brand differentiation through packaging, and the continuous technological advancements in packaging machinery and automation. However, certain restraints are also at play, such as the volatility of raw material prices, particularly for plastics and paper, which can impact profit margins for packaging service providers. Stringent environmental regulations in certain regions, while encouraging sustainable practices, can also present compliance challenges and increase operational costs. The competitive landscape features prominent players like WestRock Company, Stora Enso Oyj, Amcor PLC, and International Paper Company, among others, actively engaged in strategic collaborations, mergers, and acquisitions to expand their market reach and enhance their service portfolios. The focus remains on providing customized, cost-effective, and sustainable secondary packaging solutions to meet the evolving needs of a globalized marketplace.

Secondary Packaging Services Market Company Market Share

This in-depth report provides a definitive outlook on the global Secondary Packaging Services market, a vital segment within the broader packaging industry. We deliver a granular analysis of market dynamics, growth trends, dominant regions, product landscapes, and key players, offering critical insights for stakeholders seeking to navigate this evolving sector. Our comprehensive forecast extends from 2019 to 2033, with a base year of 2025, providing a robust understanding of current market conditions and future trajectories. We focus on secondary packaging solutions, retail packaging services, product bundling packaging, multi-pack packaging solutions, e-commerce secondary packaging, sustainable secondary packaging, custom secondary packaging, and contract packaging services to capture high-volume search interest. This report also delves into the interplay between parent market (overall packaging industry) and child market (specific secondary packaging services) dynamics.

Secondary Packaging Services Market Market Dynamics & Structure

The Secondary Packaging Services market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, alongside a robust ecosystem of smaller, specialized providers. Technological innovation is a key driver, particularly in areas like automation, advanced printing techniques, and the development of sustainable materials. Regulatory frameworks, emphasizing environmental responsibility and product safety, are increasingly shaping market strategies, pushing for the adoption of recyclable and biodegradable packaging options. Competitive product substitutes, such as direct-to-consumer shipping without secondary packaging or alternative display methods in retail, pose a constant challenge, necessitating value-added services. End-user demographics are shifting, with a growing demand for convenience, premiumization, and personalized packaging experiences across all sectors. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to achieve economies of scale, expand geographic reach, and enhance technological capabilities. For instance, the parent market saw a significant consolidation with the acquisition of DS Smith by International Paper Company for USD 7.2 billion in April 2024, signaling a drive for market leadership and innovation. The child market for specialized services like custom secondary packaging is witnessing increased M&A activity as companies seek to bolster their offerings in niche areas. The overall market share percentage for leading companies in secondary packaging services is estimated to be between 15-20% for the top three, while the M&A deal volumes are projected to see a consistent increase of 5-7% annually in the forecast period. Innovation barriers include the high cost of implementing advanced technologies and the complexity of navigating diverse international regulations.

Secondary Packaging Services Market Growth Trends & Insights

The global Secondary Packaging Services market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% to 7.5% from 2025 to 2033. This growth is intrinsically linked to the overall expansion of the parent market, the packaging industry, and the specific demands within the child market of secondary packaging. The market size, estimated at approximately USD 120,000 million units in 2025, is expected to reach over USD 200,000 million units by 2033. Adoption rates for advanced secondary packaging solutions, including smart packaging and customized designs, are steadily increasing due to the demand for enhanced consumer experience and improved supply chain efficiency. Technological disruptions, such as the integration of AI in packaging design and robotics in automated packaging lines, are significantly impacting operational efficiencies and cost-effectiveness. Consumer behavior shifts, driven by the rise of e-commerce and an increasing focus on sustainability, are profoundly influencing the demand for specialized secondary packaging. For instance, the demand for e-commerce secondary packaging is skyrocketing, requiring robust and protective solutions to withstand shipping stresses. Furthermore, the growing consumer preference for visually appealing and functional packaging for product display at the point of sale is a key driver for retail packaging services and product bundling packaging. The market penetration of sustainable secondary packaging options is also on an upward trajectory, with consumers actively choosing brands that demonstrate environmental responsibility. The shift towards multipack solutions, particularly in the food and beverage sectors, is a significant trend boosting the demand for multi-pack packaging solutions.

Dominant Regions, Countries, or Segments in Secondary Packaging Services Market

The Food and Beverage end-user industry segment is unequivocally the dominant force driving growth within the Secondary Packaging Services market. This segment consistently accounts for an estimated 40-45% of the total market share, owing to the sheer volume of consumer goods produced and distributed globally. Within this, corrugated boxes and folding cartons are the most prevalent product types, representing over 60% of the secondary packaging used. For example, the ubiquitous presence of beverages in multipacks, often secured with wraps and films or placed in corrugated trays, underscores their dominance.

Key drivers for the Food and Beverage segment's leadership include:

- High Consumption Rates: Perishable and non-perishable food and beverage items are consumed daily, necessitating continuous packaging and replenishment cycles.

- Shelf-Life Extension and Protection: Secondary packaging plays a crucial role in protecting products from damage during transit and on retail shelves, ensuring product integrity and freshness.

- Brand Visibility and Marketing: Innovative secondary packaging designs in the food and beverage sector are leveraged as powerful marketing tools, enhancing brand recognition and consumer appeal.

- Regulatory Compliance: Stringent regulations regarding food safety and handling necessitate robust and compliant secondary packaging solutions.

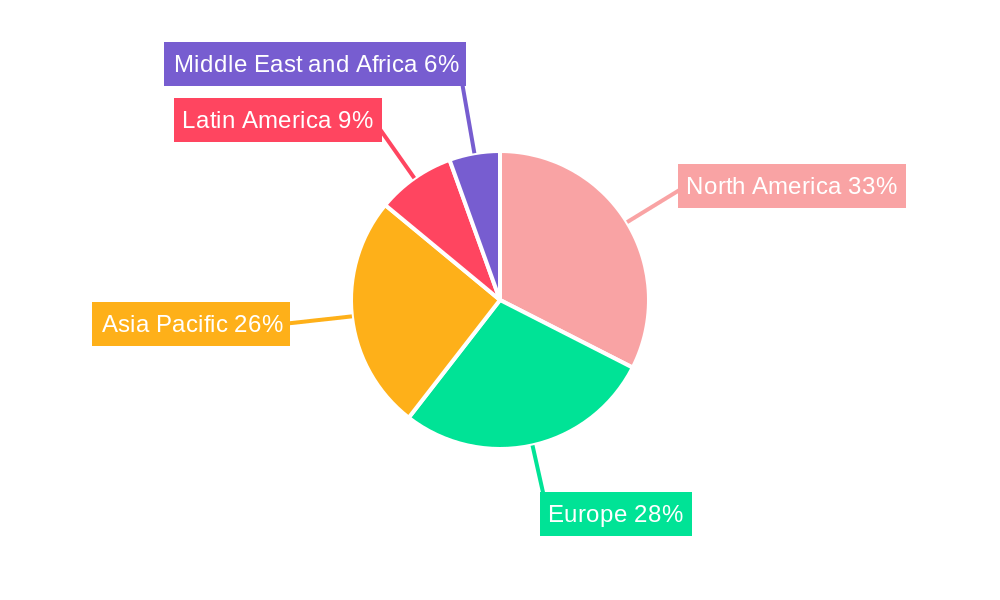

Geographically, North America and Europe currently lead the market in terms of value and volume, driven by established distribution networks, high consumer spending power, and a strong emphasis on product innovation and sustainability. However, the Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization, a burgeoning middle class, and the expanding e-commerce landscape. Countries like China and India are witnessing a surge in demand for all types of secondary packaging as their manufacturing and consumption capacities grow. The economic policies supporting manufacturing and trade, coupled with improving infrastructure, are key facilitators of this regional growth. The market share for secondary packaging in the Food and Beverage segment in North America is estimated at 25-30%, while the Asia-Pacific region is expected to see a CAGR of 8-10% in this segment over the forecast period.

Secondary Packaging Services Market Product Landscape

The secondary packaging landscape is characterized by continuous product innovation aimed at enhancing protection, sustainability, and consumer engagement. Folding cartons are evolving with advanced printing capabilities and intricate structural designs for premium consumer goods. Corrugated boxes are seeing advancements in material science, offering lighter yet stronger options with improved cushioning properties for e-commerce shipments. Plastic crates, while facing sustainability scrutiny, are being re-engineered for greater reusability and recyclability, particularly in logistics and industrial applications. Wraps and films are becoming more sophisticated, with barrier properties tailored to specific product needs and the introduction of compostable and biodegradable alternatives. The unique selling propositions across this landscape revolve around customization, eco-friendliness, and cost-effectiveness, driven by technological advancements in material science and manufacturing processes.

Key Drivers, Barriers & Challenges in Secondary Packaging Services Market

Key Drivers:

- E-commerce Boom: The exponential growth of online retail necessitates robust and protective secondary packaging for shipping and handling.

- Sustainability Mandates: Increasing consumer and regulatory pressure for eco-friendly packaging solutions drives demand for recyclable, biodegradable, and reusable materials.

- Product Differentiation & Branding: Innovative secondary packaging enhances product appeal, brand visibility, and consumer experience at the point of sale and beyond.

- Supply Chain Efficiency: Optimized secondary packaging reduces transit damage, minimizes shipping volumes, and improves logistical efficiency.

Barriers & Challenges:

- Rising Raw Material Costs: Fluctuations in the prices of paper, plastic, and other raw materials can impact profit margins.

- Complex Regulatory Environment: Navigating diverse and evolving packaging regulations across different regions poses a significant challenge.

- Supply Chain Disruptions: Global supply chain volatility can lead to material shortages and increased lead times.

- Competition from Substitutes: Direct-to-consumer shipping models and alternative retail display methods can reduce the need for traditional secondary packaging. The total value of supply chain disruptions impacting the market is estimated at 5-8% of annual revenues.

Emerging Opportunities in Secondary Packaging Services Market

Emerging opportunities in the Secondary Packaging Services market are largely driven by the growing demand for smart packaging solutions, which integrate technology to provide enhanced functionality like tracking, authentication, and condition monitoring. The untapped potential in developing economies for specialized food and beverage secondary packaging due to rising disposable incomes presents a significant growth avenue. Furthermore, the evolution of personal care and household care product packaging towards more sustainable and aesthetically pleasing designs opens new frontiers for innovative solutions. The development of circular economy models for packaging, focusing on reuse and closed-loop systems, is also a rapidly growing opportunity, appealing to environmentally conscious brands and consumers.

Growth Accelerators in the Secondary Packaging Services Market Industry

Growth accelerators for the Secondary Packaging Services industry are multi-faceted. Technological breakthroughs in material science, leading to lighter, stronger, and more sustainable packaging options, are paramount. Strategic partnerships between packaging providers and manufacturers are crucial for co-developing bespoke solutions and gaining market access. Furthermore, market expansion strategies, particularly targeting emerging economies with growing consumer bases and increasing demand for packaged goods, will significantly fuel long-term growth. The increasing adoption of automation and AI in packaging operations is also a key accelerator, enhancing efficiency and reducing operational costs, thereby making services more competitive.

Key Players Shaping the Secondary Packaging Services Market Market

- WestRock Company

- Stora Enso Oyj

- Reynolds Group Holdings

- Ball Corporation

- Multi-Pack Solutions LLC

- Mondi Group

- Amcor PLC

- International Paper Company

- Packaging Corporation of America

- Berry Global Inc

- Sealed Air Corporation

Notable Milestones in Secondary Packaging Services Market Sector

- April 2024: International Paper Company (IP) announced the acquisition of DS Smith for USD 7.2 billion, aiming to strengthen its European presence and drive innovation in sustainability.

- September 2023: Coca-Cola HBC AG launched plastic-free secondary packaging using LitePac Top cardboard for its 1.5-liter drinks in Austria, targeting an annual plastic saving of 200 tonnes.

In-Depth Secondary Packaging Services Market Market Outlook

The future outlook for the Secondary Packaging Services market is exceptionally bright, driven by persistent global trends. The continued surge in e-commerce will sustain the demand for resilient and protective e-commerce secondary packaging. The relentless pursuit of sustainability by consumers and regulators will accelerate the adoption of sustainable secondary packaging and innovative material solutions. Strategic initiatives by key players, focused on expanding their service portfolios and investing in cutting-edge technologies, will further solidify market growth. The child market for specialized services like contract packaging services is expected to see robust expansion as more companies outsource their packaging needs to focus on core competencies. Overall, the market is projected for continued expansion, offering substantial opportunities for innovation and strategic investment.

Secondary Packaging Services Market Segmentation

-

1. Product Type

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Plastic Crates

- 1.4. Wraps and Films

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare

- 2.4. Consumer Electronics

- 2.5. Personal Care and Household Care

Secondary Packaging Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Secondary Packaging Services Market Regional Market Share

Geographic Coverage of Secondary Packaging Services Market

Secondary Packaging Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Industrial and Consumer Activities across the World; Increased Need for Safe Transportation

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Needs and Awareness Towards a Sustainable Environment

- 3.4. Market Trends

- 3.4.1. The Folding Cartons Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Plastic Crates

- 5.1.4. Wraps and Films

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare

- 5.2.4. Consumer Electronics

- 5.2.5. Personal Care and Household Care

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Folding Cartons

- 6.1.2. Corrugated Boxes

- 6.1.3. Plastic Crates

- 6.1.4. Wraps and Films

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Healthcare

- 6.2.4. Consumer Electronics

- 6.2.5. Personal Care and Household Care

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Folding Cartons

- 7.1.2. Corrugated Boxes

- 7.1.3. Plastic Crates

- 7.1.4. Wraps and Films

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Healthcare

- 7.2.4. Consumer Electronics

- 7.2.5. Personal Care and Household Care

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Folding Cartons

- 8.1.2. Corrugated Boxes

- 8.1.3. Plastic Crates

- 8.1.4. Wraps and Films

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Healthcare

- 8.2.4. Consumer Electronics

- 8.2.5. Personal Care and Household Care

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Folding Cartons

- 9.1.2. Corrugated Boxes

- 9.1.3. Plastic Crates

- 9.1.4. Wraps and Films

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Healthcare

- 9.2.4. Consumer Electronics

- 9.2.5. Personal Care and Household Care

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Secondary Packaging Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Folding Cartons

- 10.1.2. Corrugated Boxes

- 10.1.3. Plastic Crates

- 10.1.4. Wraps and Films

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Healthcare

- 10.2.4. Consumer Electronics

- 10.2.5. Personal Care and Household Care

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stora Enso Oyj

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Reynolds Group Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ball Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Multi-Pack Solutions LLC*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Paper Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Packaging Corporation of America

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Berry Global Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sealed Air Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 WestRock Company

List of Figures

- Figure 1: Global Secondary Packaging Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Latin America Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Latin America Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Secondary Packaging Services Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Secondary Packaging Services Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Secondary Packaging Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Secondary Packaging Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Secondary Packaging Services Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Secondary Packaging Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Secondary Packaging Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Secondary Packaging Services Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Secondary Packaging Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Secondary Packaging Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Secondary Packaging Services Market?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Secondary Packaging Services Market?

Key companies in the market include WestRock Company, Stora Enso Oyj, Reynolds Group Holdings, Ball Corporation, Multi-Pack Solutions LLC*List Not Exhaustive, Mondi Group, Amcor PLC, International Paper Company, Packaging Corporation of America, Berry Global Inc, Sealed Air Corporation.

3. What are the main segments of the Secondary Packaging Services Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 265.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Industrial and Consumer Activities across the World; Increased Need for Safe Transportation.

6. What are the notable trends driving market growth?

The Folding Cartons Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Changing Consumer Needs and Awareness Towards a Sustainable Environment.

8. Can you provide examples of recent developments in the market?

April 2024: International Paper Company (IP), a US company, announced the acquisition of DS Smith, a London-based packaging company, for USD 7.2 billion. This strategic acquisition was intended to strengthen IP's operations in Europe through innovation and sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Secondary Packaging Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Secondary Packaging Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Secondary Packaging Services Market?

To stay informed about further developments, trends, and reports in the Secondary Packaging Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence