Key Insights

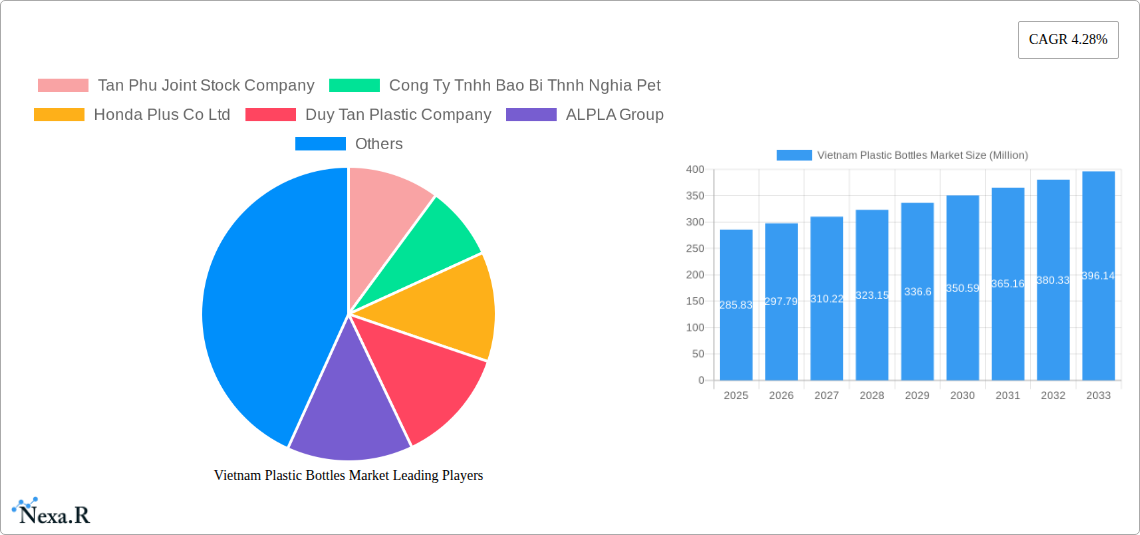

The Vietnam Plastic Bottles Market is poised for substantial growth, with a current market size estimated at $285.83 million and a projected Compound Annual Growth Rate (CAGR) of 4.28% during the forecast period of 2025-2033. This robust expansion is primarily fueled by escalating demand across key end-use industries, notably Food and Beverage, which constitutes a significant segment. Within the beverage sector, bottled water and carbonated soft drinks are leading the charge, driven by increasing consumer preference for convenience and the growing popularity of packaged drinks. The Pharmaceuticals and Personal Care & Toiletries sectors also contribute significantly to this market's dynamism, as plastic bottles offer an economical and versatile packaging solution for a wide array of products, from medications to cosmetics and hygiene items. The ongoing industrialization and urbanization in Vietnam further bolster demand for plastic bottles across various applications, including household chemicals and paints.

Vietnam Plastic Bottles Market Market Size (In Million)

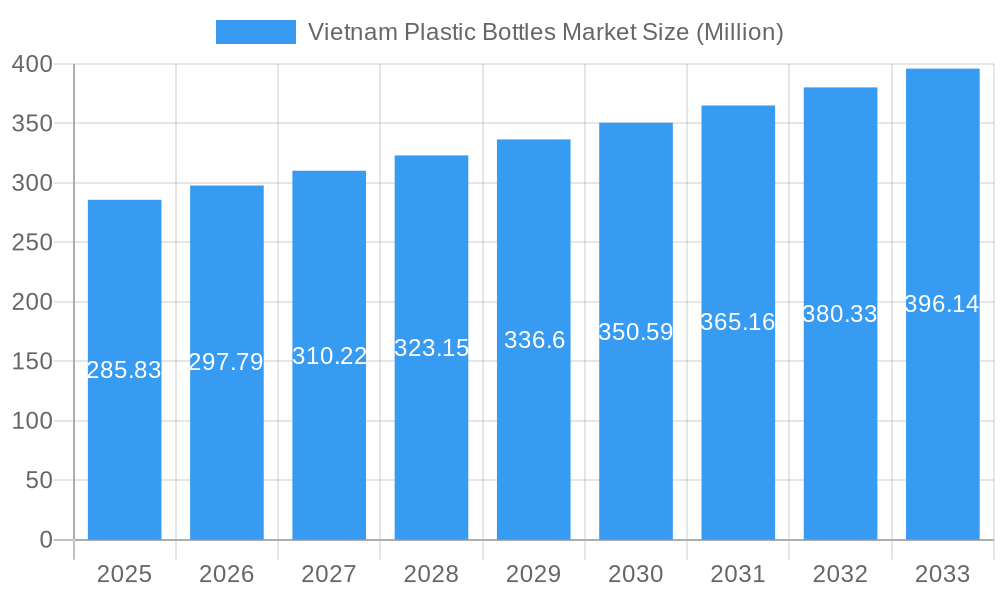

The market's growth trajectory is further supported by advancements in resin technology and increasing investment in sustainable packaging solutions. Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP) remain the dominant resin types, valued for their durability, cost-effectiveness, and recyclability. Emerging trends like the development of lightweight yet strong bottle designs, coupled with a growing consumer awareness regarding environmental impact, are prompting manufacturers to explore innovative materials and production processes. While the market benefits from a favorable demographic landscape and increasing disposable incomes, potential restraints such as fluctuating raw material prices and stringent environmental regulations regarding plastic waste management could pose challenges. However, the proactive engagement of leading companies like Tan Phu Joint Stock Company, Duy Tan Plastic Company, and ALPLA Group in research and development, alongside strategic collaborations, is expected to mitigate these risks and drive sustainable market expansion.

Vietnam Plastic Bottles Market Company Market Share

Vietnam Plastic Bottles Market: Comprehensive Outlook & Growth Analysis (2019-2033)

This in-depth report provides a definitive analysis of the Vietnam plastic bottles market, offering critical insights for stakeholders seeking to capitalize on its dynamic growth. Covering a study period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, and a detailed competitor analysis. The report leverages quantitative data and qualitative insights to present a holistic view of the market, with all values presented in Million units.

Vietnam Plastic Bottles Market Market Dynamics & Structure

The Vietnam plastic bottles market is characterized by a moderately concentrated structure, with key players investing in technological advancements to enhance production efficiency and sustainability. The demand for plastic bottles is significantly influenced by the burgeoning food and beverage sector, particularly bottled water and soft drinks, where convenience and shelf-life are paramount. Regulatory frameworks are evolving to encourage the adoption of recycled PET and promote sustainable packaging solutions. Competitive product substitutes, such as glass and aluminum, present a persistent challenge, but plastic bottles' cost-effectiveness and versatility maintain their dominance. End-user demographics are shifting, with a growing middle class and an increasing preference for packaged goods. Mergers and acquisitions are anticipated to play a role in market consolidation, driven by the pursuit of economies of scale and expanded market reach.

- Market Concentration: Moderately concentrated with a few dominant players and a fragmented landscape of smaller manufacturers.

- Technological Innovation Drivers: Focus on lightweighting, improved barrier properties, and the integration of recycled content.

- Regulatory Frameworks: Increasing emphasis on extended producer responsibility (EPR) schemes and the promotion of circular economy principles in plastic packaging.

- Competitive Product Substitutes: Glass bottles for premium beverages, aluminum cans for carbonated drinks, and emerging biodegradable alternatives.

- End-User Demographics: Growing demand from a young, urbanizing population with increasing disposable incomes.

- M&A Trends: Potential for consolidation to achieve operational efficiencies and enhance market share.

Vietnam Plastic Bottles Market Growth Trends & Insights

The Vietnam plastic bottles market is poised for robust expansion, driven by escalating consumer demand for packaged goods and a dynamic economic landscape. Projections indicate a significant Compound Annual Growth Rate (CAGR) between 2025 and 2033, reflecting the increasing adoption of plastic bottles across various end-use industries. Technological disruptions, such as advancements in PET resin technology and the development of more sophisticated recycling processes, are reshaping the market by improving product performance and sustainability credentials. Consumer behavior shifts, including a growing preference for convenience and single-serve formats, further fuel the demand for plastic bottles. Market penetration is expected to deepen, particularly in Tier 2 and Tier 3 cities, as urbanization continues to accelerate. The overall market size is projected to reach XX Million units by 2033.

Dominant Regions, Countries, or Segments in Vietnam Plastic Bottles Market

The Beverage segment, with a particular emphasis on Bottled Water and Carbonated Soft Drinks, stands as the dominant force in the Vietnam plastic bottles market. This dominance is underpinned by several key drivers, including Vietnam's young and growing population, increasing urbanization, and a rising disposable income that fuels demand for convenient, ready-to-drink products. The tropical climate also contributes significantly to the high consumption of bottled water and other beverages. Polyethylene Terephthalate (PET) is the leading resin in this segment, owing to its excellent clarity, strength, and recyclability, making it the preferred choice for beverage packaging. Economic policies that support the growth of the FMCG sector and infrastructure development that facilitates efficient distribution networks further bolster the beverage industry's demand for plastic bottles.

- Beverage Segment Dominance: Driven by high per capita consumption and a vibrant beverage industry.

- Bottled Water & Carbonated Soft Drinks: Leading sub-segments due to consumer preference for hydration and refreshment.

- Polyethylene Terephthalate (PET) Resin: Preferred due to its balance of cost, performance, and recyclability.

- Economic Policies: Government support for the food and beverage industry translates to increased packaging demand.

- Infrastructure Development: Improved logistics and supply chains enable wider market reach for bottled products.

- Growth Potential: Significant untapped potential in rural areas and emerging beverage categories.

Vietnam Plastic Bottles Market Product Landscape

The Vietnam plastic bottles market is characterized by a diverse product landscape tailored to meet specific application needs. Innovations focus on enhancing barrier properties to extend shelf life, reducing material usage through lightweighting techniques, and improving the aesthetics of bottles for enhanced consumer appeal. Applications range from single-serve beverage bottles to larger containers for household chemicals and industrial lubricants. Performance metrics such as drop resistance, compression strength, and chemical inertness are critical considerations. Unique selling propositions often revolve around advanced recycling compatibility, sustainable material sourcing, and customized branding options. Technological advancements in blow molding and injection molding processes enable manufacturers to produce complex bottle designs efficiently.

Key Drivers, Barriers & Challenges in Vietnam Plastic Bottles Market

Key Drivers: The Vietnam plastic bottles market is propelled by a rising middle class with increasing disposable incomes, a growing demand for convenient and hygienic packaged goods, particularly in the food and beverage sectors, and a significant young population driving consumption of beverages. Government initiatives promoting domestic manufacturing and foreign investment also act as catalysts.

Key Barriers & Challenges: Significant challenges include fluctuating raw material prices, particularly for virgin resins, and increasing environmental concerns leading to stricter regulations on single-use plastics and a push for higher recycling rates. Intense competition from both domestic and international players, coupled with the need for substantial investment in advanced recycling infrastructure, also presents hurdles. Supply chain disruptions can impact production timelines and costs.

Emerging Opportunities in Vietnam Plastic Bottles Market

Emerging opportunities in the Vietnam plastic bottles market lie in the growing demand for sustainable packaging solutions, including the increased use of recycled PET (rPET) and the development of bio-based plastics. The expansion of the e-commerce sector creates new avenues for specialized packaging designed for online retail. Furthermore, the increasing health consciousness among consumers is driving demand for specialized beverage bottles, such as those for functional drinks and fortified beverages. Innovations in smart packaging, incorporating features like temperature indicators, also present a nascent but promising area for growth.

Growth Accelerators in the Vietnam Plastic Bottles Market Industry

Growth accelerators in the Vietnam plastic bottles market include ongoing technological advancements in recycling processes, making post-consumer plastic more viable for new bottle production. Strategic partnerships between resin manufacturers, bottle producers, and major beverage brands are crucial for driving innovation and market penetration. The government's commitment to environmental sustainability and the circular economy, through favorable policies and investments in waste management infrastructure, will significantly boost the adoption of recycled materials. Furthermore, the expansion of modern retail formats and the increasing penetration of e-commerce will necessitate a greater volume of packaged goods.

Key Players Shaping the Vietnam Plastic Bottles Market Market

- Tan Phu Joint Stock Company

- Cong Ty Tnhh Bao Bi Thnh Nghia Pet

- Honda Plus Co Ltd

- Duy Tan Plastic Company

- ALPLA Group

- Phu Tuyen Plastic Co Ltd

- Ngoc Nghai Group

- Nhat Tien Manufacturing & Trading Co

- Taiwan Hon Chuan Co Ltd

Notable Milestones in Vietnam Plastic Bottles Market Sector

- February 2024: Previero N. SRL's Sorema Recycling Systems Division announced that Commercial Plastics Co. has met the quality and quantity benchmarks at its post-consumer PET bottle washing and recycling facility in Yangon, Myanmar. This achievement sets the stage for a forthcoming second plant in Vietnam with Sorema technology.

- June 2023: Coca-Cola Company unveiled its latest offering, 'Charged,' under the globally recognized Thums Up brand of caffeine supplements. Thums Up is set to roll out a series of engaging activities tailored to Vietnam's energetic and ambitious youth to celebrate this launch. Emblazoned with a logo echoing the thumbs-up gesture and embodying a 'go for it' spirit, Thums Up aims to inspire Gen Z to chase their passions and embrace life wholeheartedly.

In-Depth Vietnam Plastic Bottles Market Market Outlook

The future outlook for the Vietnam plastic bottles market is exceptionally promising, driven by sustained economic growth, evolving consumer preferences, and a global imperative for sustainable packaging. The increasing adoption of recycled PET (rPET) will be a significant growth accelerator, supported by technological advancements in recycling and favorable government policies promoting a circular economy. Strategic collaborations among industry players, from raw material suppliers to end-users, will foster innovation in lightweighting, improved barrier properties, and aesthetically superior designs. The expansion of modern retail and the burgeoning e-commerce sector will continue to fuel demand for efficient and versatile plastic bottle packaging solutions, solidifying the market's upward trajectory.

Vietnam Plastic Bottles Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Resins

-

2. End-use Industries

- 2.1. Food

-

2.2. Beverage**

- 2.2.1. Bottled Water

- 2.2.2. Carbonated Soft Drinks

- 2.2.3. Alcoholic Beverages

- 2.2.4. Juices & Energy Drinks

- 2.2.5. Other Beverages

- 2.3. Pharmaceuticals

- 2.4. Personal Care & Toiletries

- 2.5. Industrial

- 2.6. Household Chemicals

- 2.7. Paints & Coatings

- 2.8. Other End-use Industries

Vietnam Plastic Bottles Market Segmentation By Geography

- 1. Vietnam

Vietnam Plastic Bottles Market Regional Market Share

Geographic Coverage of Vietnam Plastic Bottles Market

Vietnam Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for RTD and Other Beverages; Plastic Recycling Trends to Push the Market

- 3.3. Market Restrains

- 3.3.1. Rise in Demand for RTD and Other Beverages; Plastic Recycling Trends to Push the Market

- 3.4. Market Trends

- 3.4.1. Market Growth Driven by Polyethylene Terephthalate (PET) Resin

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Plastic Bottles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by End-use Industries

- 5.2.1. Food

- 5.2.2. Beverage**

- 5.2.2.1. Bottled Water

- 5.2.2.2. Carbonated Soft Drinks

- 5.2.2.3. Alcoholic Beverages

- 5.2.2.4. Juices & Energy Drinks

- 5.2.2.5. Other Beverages

- 5.2.3. Pharmaceuticals

- 5.2.4. Personal Care & Toiletries

- 5.2.5. Industrial

- 5.2.6. Household Chemicals

- 5.2.7. Paints & Coatings

- 5.2.8. Other End-use Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tan Phu Joint Stock Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cong Ty Tnhh Bao Bi Thnh Nghia Pet

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honda Plus Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Duy Tan Plastic Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALPLA Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Phu Tuyen Plastic Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ngoc Nghai Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nhat Tien Manufacturing & Trading Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Taiwan Hon Chuan Co Ltd7 2 Competitor Analysis - Emerging vs Established Player

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Tan Phu Joint Stock Company

List of Figures

- Figure 1: Vietnam Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Plastic Bottles Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Vietnam Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 3: Vietnam Plastic Bottles Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 4: Vietnam Plastic Bottles Market Volume Million Forecast, by End-use Industries 2020 & 2033

- Table 5: Vietnam Plastic Bottles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Vietnam Plastic Bottles Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Vietnam Plastic Bottles Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 8: Vietnam Plastic Bottles Market Volume Million Forecast, by Resin 2020 & 2033

- Table 9: Vietnam Plastic Bottles Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 10: Vietnam Plastic Bottles Market Volume Million Forecast, by End-use Industries 2020 & 2033

- Table 11: Vietnam Plastic Bottles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Vietnam Plastic Bottles Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Plastic Bottles Market?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Vietnam Plastic Bottles Market?

Key companies in the market include Tan Phu Joint Stock Company, Cong Ty Tnhh Bao Bi Thnh Nghia Pet, Honda Plus Co Ltd, Duy Tan Plastic Company, ALPLA Group, Phu Tuyen Plastic Co Ltd, Ngoc Nghai Group, Nhat Tien Manufacturing & Trading Co, Taiwan Hon Chuan Co Ltd7 2 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Vietnam Plastic Bottles Market?

The market segments include Resin, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 285.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for RTD and Other Beverages; Plastic Recycling Trends to Push the Market.

6. What are the notable trends driving market growth?

Market Growth Driven by Polyethylene Terephthalate (PET) Resin.

7. Are there any restraints impacting market growth?

Rise in Demand for RTD and Other Beverages; Plastic Recycling Trends to Push the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Previero N. SRL's Sorema Recycling Systems Division announced that Commercial Plastics Co. has met the quality and quantity benchmarks at its post-consumer PET bottle washing and recycling facility in Yangon, Myanmar. This achievement sets the stage for a forthcoming second plant in Vietnam with Sorema technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Vietnam Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence