Key Insights

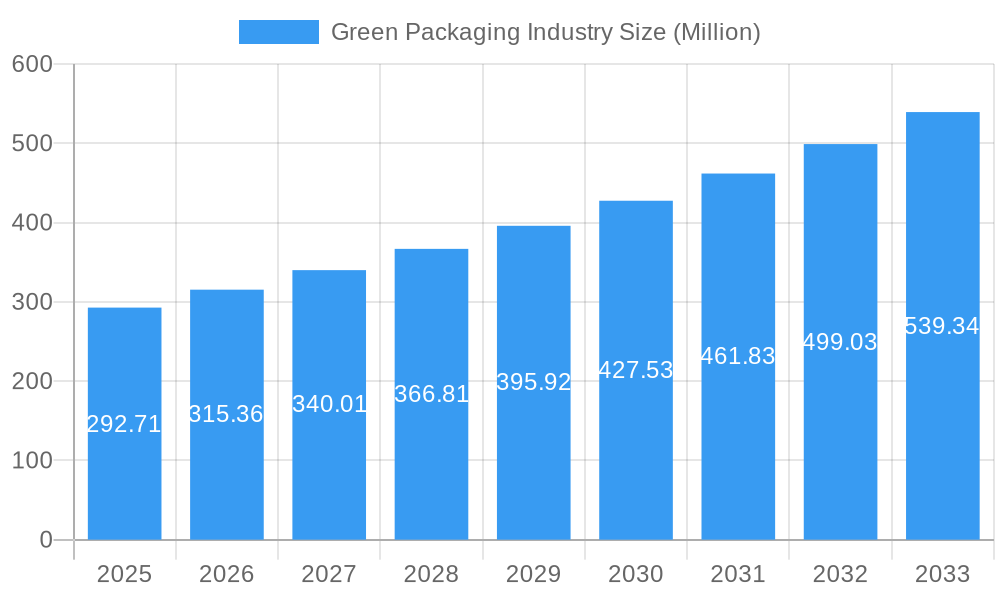

The global Green Packaging market is poised for significant expansion, projected to reach a substantial USD 292.71 million by the estimated year of 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 7.67% anticipated over the forecast period of 2025-2033. The increasing consumer demand for environmentally responsible products, coupled with stringent government regulations promoting sustainable practices, are the primary drivers behind this upward trajectory. Businesses are actively seeking alternatives to traditional packaging materials, leading to a surge in the adoption of reusable, degradable, and recycled packaging solutions across various industries. This shift not only addresses environmental concerns but also presents economic opportunities for companies investing in innovative green packaging technologies and materials.

Green Packaging Industry Market Size (In Million)

The market's dynamism is further underscored by its diverse segmentation. In terms of processes, reusable packaging is expected to witness substantial adoption due to its long-term cost-effectiveness and reduced waste generation. Degradable and recycled packaging segments are also crucial, catering to specific product needs and regulatory requirements. Material-wise, the market exhibits a strong preference for sustainable options like glass, metal, and paper, while also exploring advanced biodegradable plastics. The pharmaceutical and healthcare, cosmetics and personal care, and food and beverage industries are leading the charge in adopting green packaging, driven by consumer preferences and product safety considerations. Leading players like International Paper Company, Sonoco Products Company, and Ball Corporation are at the forefront, innovating and expanding their offerings to capture market share in this rapidly evolving landscape.

Green Packaging Industry Company Market Share

This comprehensive report offers an in-depth analysis of the burgeoning Green Packaging Industry, a critical sector driven by increasing environmental consciousness, stringent regulations, and evolving consumer demand for sustainable alternatives. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report provides actionable insights into market dynamics, growth trends, regional dominance, product innovation, and key player strategies. We meticulously examine the parent market and its intricate child markets, presenting all values in millions of units for clarity and direct application.

Green Packaging Industry Market Dynamics & Structure

The Green Packaging Industry is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and shifting consumer preferences. Market concentration varies across different segments, with leading players actively investing in R&D to develop advanced sustainable materials and processes. Technological innovation is a primary driver, pushing the boundaries of recyclability, biodegradability, and compostability. Regulatory bodies worldwide are increasingly implementing policies favoring eco-friendly packaging solutions, incentivizing businesses to adopt sustainable practices and penalizing the use of conventional, environmentally detrimental materials. Competitive product substitutes are abundant, ranging from traditional materials with improved eco-credentials to entirely novel bio-based alternatives. End-user demographics are a significant influencer, with younger, environmentally aware consumers actively seeking out brands that prioritize sustainability. Mergers and acquisitions (M&A) trends indicate a consolidation within the industry as larger entities acquire innovative startups to enhance their green product portfolios and market reach. Key players are investing heavily in advanced recycling technologies and circular economy models. The competitive landscape is intensifying with the introduction of novel bio-plastics and advanced paper-based solutions. Regulatory pressures are mounting, particularly concerning single-use plastics and extended producer responsibility (EPR) schemes.

- Market Concentration: Moderate to high in mature segments like recycled paper packaging, with increasing fragmentation in emerging bio-plastic markets.

- Technological Innovation: Focus on enhanced barrier properties, compostability, and integration of smart technologies for tracking and recycling.

- Regulatory Frameworks: Growing adoption of Extended Producer Responsibility (EPR) schemes and bans on certain single-use plastics.

- Competitive Product Substitutes: Advancements in biodegradable polymers, plant-based materials, and edible packaging solutions.

- End-User Demographics: Strong demand from the Food and Beverage, Cosmetics and Personal Care, and Pharmaceutical and Healthcare sectors.

- M&A Trends: Strategic acquisitions of innovative material producers and recycling technology providers by established packaging giants.

Green Packaging Industry Growth Trends & Insights

The Green Packaging Industry is poised for robust expansion, driven by an escalating global imperative for environmental responsibility. The market size is projected to witness significant evolution, propelled by increasing adoption rates of sustainable packaging solutions across diverse end-user industries. Technological disruptions, such as the development of advanced biodegradable polymers and novel recycling processes, are fundamentally reshaping the industry landscape. Consumer behavior shifts, with a heightened awareness of the environmental impact of packaging, are compelling brands to prioritize green alternatives. This shift is creating a virtuous cycle, where demand fuels innovation, which in turn, drives further adoption. The Food and Beverage segment, in particular, is a major contributor, driven by regulatory mandates and consumer preferences for recyclable and compostable packaging for food items. The Cosmetics and Personal Care industry is also experiencing a surge in demand for aesthetically pleasing yet eco-conscious packaging. The Pharmaceutical and Healthcare sector, while traditionally more risk-averse, is increasingly exploring sustainable options for certain applications, especially in light of environmental concerns and potential regulatory changes. The overall market penetration of green packaging solutions is expected to accelerate, moving beyond niche applications to become a mainstream offering. This growth trajectory is underpinned by a compound annual growth rate (CAGR) that reflects the industry's strong potential.

The Green Packaging Industry is experiencing a transformative growth phase, fueled by a confluence of factors including heightened environmental consciousness, stringent government regulations, and proactive corporate sustainability initiatives. The global market size is on an upward trajectory, projected to reach substantial figures as businesses worldwide pivot towards eco-friendly solutions. Adoption rates for various green packaging types, from reusable containers to compostable materials, are escalating across diverse sectors. Technological disruptions are playing a pivotal role, with ongoing innovations in material science leading to the development of advanced bio-based plastics, enhanced recyclability of composite materials, and more efficient waste-to-resource recovery systems. Consumer behavior has undergone a significant shift, with a growing segment of the population actively seeking out products with minimal environmental footprints, thus exerting considerable pressure on brands to align their packaging strategies accordingly. The Food and Beverage sector continues to be a dominant force, driven by the urgent need to reduce plastic waste and meet consumer demand for sustainable food packaging. Similarly, the Cosmetics and Personal Care industry is witnessing a pronounced trend towards minimalist, recyclable, and refillable packaging. Even the Pharmaceutical and Healthcare sector, historically bound by strict requirements, is exploring greener alternatives for non-critical applications, balancing safety with sustainability. The market penetration of these sustainable solutions is expanding rapidly, moving from specialized niches to mainstream acceptance. This growth is further bolstered by investments in advanced recycling infrastructure and the development of circular economy models. The Degradable Packaging and Reusable Packaging segments are anticipated to exhibit particularly strong growth as concerns surrounding plastic pollution intensify. The transition towards a circular economy, where materials are kept in use for as long as possible, is a key driver. The development of novel bio-degradable and compostable materials, coupled with enhanced recycling technologies, is enabling a broader application of green packaging across more sensitive product categories. The influence of non-governmental organizations (NGOs) and public awareness campaigns on corporate sustainability practices cannot be overstated, acting as a significant catalyst for change.

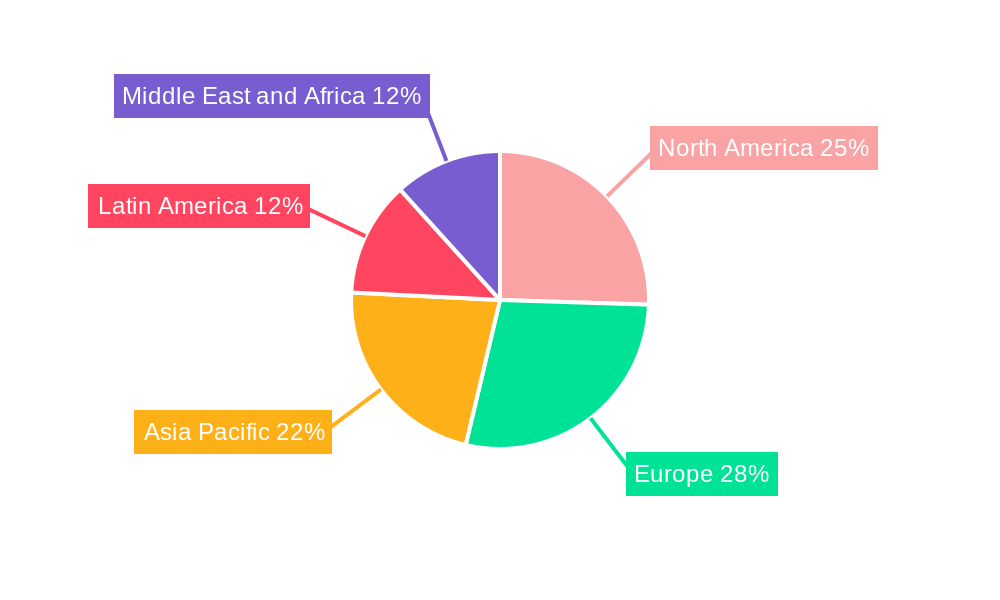

Dominant Regions, Countries, or Segments in Green Packaging Industry

The Green Packaging Industry exhibits varied dominance across different regions, countries, and market segments. Europe, with its stringent environmental regulations and high consumer awareness, consistently leads the adoption of green packaging solutions. The European Union's ambitious targets for waste reduction and circular economy initiatives have fostered a mature market for Reusable Packaging and Recycled Packaging. North America follows closely, driven by increasing consumer demand and corporate sustainability commitments. Asia-Pacific is emerging as a high-growth region, propelled by expanding economies, growing environmental consciousness, and government support for sustainable practices, particularly in countries like China and India.

Within the Process segment, Recycled Packaging currently holds a significant market share due to established infrastructure and cost-effectiveness. However, Reusable Packaging is witnessing rapid growth, driven by a strong push towards reducing single-use waste and the development of innovative closed-loop systems. Degradable Packaging, particularly compostable alternatives, is gaining traction, especially for food-related applications.

In terms of Material Type, Paper and Paperboard packaging dominate due to their high recyclability and biodegradability, making them favored choices for the Food and Beverage and Cosmetics and Personal Care sectors. Plastic packaging, while facing scrutiny, is evolving with the introduction of recycled and bio-based plastics. Metal packaging, particularly aluminum, benefits from its high recyclability rate and durability. Glass packaging is favored for its inert properties and premium appeal, especially in the Food and Beverage and Cosmetics and Personal Care segments.

The End User segments of Food and Beverage and Cosmetics and Personal Care represent the largest and fastest-growing markets for green packaging. The Pharmaceutical and Healthcare sector is gradually adopting green solutions, driven by regulations and a growing emphasis on sustainability in healthcare supply chains.

- Leading Region: Europe, driven by robust regulatory frameworks and high consumer awareness.

- Key Countries: Germany, the United Kingdom, France, the United States, and China are pivotal markets.

- Dominant Process Segment: Recycled Packaging, with significant growth potential for Reusable Packaging.

- Leading Material Type: Paper and Paperboard, followed by evolving Plastic alternatives.

- Primary End User: Food and Beverage, closely followed by Cosmetics and Personal Care.

- Growth Drivers: Stringent environmental policies, consumer demand for eco-friendly products, and corporate sustainability goals.

- Market Share: Europe holds a dominant share of approximately 35-40% of the global green packaging market.

- Growth Potential: Asia-Pacific is expected to exhibit the highest CAGR in the forecast period due to rapid industrialization and increasing environmental concerns.

Green Packaging Industry Product Landscape

The Green Packaging Industry is defined by a constant stream of innovative product developments and expanded applications. Companies are focusing on enhancing the performance metrics of their sustainable packaging solutions, ensuring they meet or exceed the functional requirements of traditional packaging. Key innovations include advanced barrier coatings for paper-based packaging, extending shelf life for perishable goods, and the development of bio-based and compostable films with improved tensile strength and heat resistance. The application of these green packaging solutions is broadening across all end-user segments. Unique selling propositions often revolve around a product's complete lifecycle: its raw material sourcing, manufacturing process, end-of-life recyclability or compostability, and overall carbon footprint reduction. Technological advancements are enabling the creation of lighter yet more durable packaging, reducing transportation emissions and material usage.

Key Drivers, Barriers & Challenges in Green Packaging Industry

The Green Packaging Industry is propelled by several key drivers.

- Drivers:

- Increasing Environmental Awareness: Growing consumer demand for sustainable products and ethical sourcing.

- Stringent Regulations: Government policies and mandates promoting eco-friendly packaging and waste reduction.

- Corporate Sustainability Goals: Companies integrating sustainability into their core business strategies and supply chains.

- Technological Advancements: Innovations in material science leading to cost-effective and high-performance green packaging.

- Circular Economy Initiatives: Focus on reducing waste and maximizing resource utilization.

Conversely, the industry faces significant barriers and challenges.

- Barriers & Challenges:

- Higher Initial Costs: Green packaging materials and manufacturing processes can sometimes be more expensive than conventional options.

- Inadequate Recycling Infrastructure: Limited availability and efficiency of recycling facilities for certain specialized green packaging materials.

- Performance Limitations: Some green packaging solutions may not yet match the performance characteristics (e.g., barrier properties, shelf life) of traditional materials for all applications.

- Consumer Education and Behavior: The need to educate consumers on proper disposal methods for different types of green packaging to ensure effective recycling or composting.

- Supply Chain Complexity: Establishing robust and sustainable supply chains for novel green materials can be challenging.

- Regulatory Uncertainty: Evolving and sometimes inconsistent regulations across different regions can create complexity for global businesses.

Emerging Opportunities in Green Packaging Industry

Emerging opportunities in the Green Packaging Industry are vast and diverse. The development of truly biodegradable and compostable packaging that can break down in home composting environments presents a significant opportunity for food service and single-use applications. The expansion of reusable packaging systems for e-commerce and food delivery services, facilitated by smart tracking technologies, offers a promising avenue for waste reduction. Furthermore, the integration of bio-based materials derived from agricultural waste or algae presents innovative feedstock solutions with a lower environmental impact. Untapped markets in developing economies, with a growing middle class and increasing environmental consciousness, represent significant growth potential. The demand for customizable and aesthetically pleasing green packaging is also on the rise, creating opportunities for innovative design and branding.

Growth Accelerators in the Green Packaging Industry Industry

Several catalysts are accelerating the long-term growth of the Green Packaging Industry. Technological breakthroughs in material science, particularly in the development of high-performance bio-plastics and advanced paper composites, are expanding the applicability of green packaging. Strategic partnerships between packaging manufacturers, material suppliers, and end-users are fostering innovation and creating integrated sustainable solutions. Market expansion strategies, including the penetration of emerging economies and the development of localized recycling infrastructure, are crucial for sustained growth. The increasing adoption of digital technologies for supply chain transparency and traceability further enhances the appeal and credibility of green packaging. Investment in research and development for novel sustainable materials and closed-loop recycling systems will continue to be a significant growth accelerator.

Key Players Shaping the Green Packaging Industry Market

- International Paper Company

- Sonoco Products Company

- Ball Corporation

- Westrock Company

- Ardagh Group SA

- TetraPak International SA

- Crown Holdings Inc

- BASF SE

- DS Smith PLC

- Mondi PLC

- Smurfit Kappa Group PLC

- Huhtamaki OYJ

- Amcor Limited

- Sealed Air Corporation

- Genpak LLC

Notable Milestones in Green Packaging Industry Sector

- July 2022: Mondi and converter Fiorini International collaborated to develop a new paper packaging option for Italian premium pasta product manufacturer Antico Pastificio Umbro. When applied to all pasta products, the new packaging, which is 100% recyclable, could reduce the amount of plastic used by up to 20 tonnes annually.

- April 2022: DS Smith introduced a corrugated cardboard box for the e-commerce shipment of medical devices. The corrugated cardboard box features a single-material solution instead of glued packaging with a single-use plastic insert.

In-Depth Green Packaging Industry Market Outlook

The Green Packaging Industry is set for a period of accelerated growth, driven by a confluence of environmental imperatives and market opportunities. Future market potential is immense, fueled by continued innovation in sustainable materials, such as advanced biodegradable polymers and highly recyclable paper-based composites. Strategic opportunities lie in expanding the adoption of reusable packaging systems, particularly for the burgeoning e-commerce sector, and in developing circular economy models that maximize material lifespan. The increasing consumer demand for transparent and ethically sourced products will further bolster the market. Investments in advanced recycling technologies and the expansion of infrastructure to support these initiatives will be critical growth accelerators. The industry's outlook is positive, characterized by strong demand, ongoing innovation, and a growing commitment from businesses to embrace sustainability as a core business principle.

Green Packaging Industry Segmentation

-

1. Process

- 1.1. Reusable Packaging

- 1.2. Degradable Packaging

- 1.3. Recycled Packaging

-

2. Material Type

- 2.1. Glass

- 2.2. Plastic

- 2.3. Metal

- 2.4. Paper

-

3. End User

- 3.1. Pharmaceutical and Healthcare

- 3.2. Cosmetics and Personal Care

- 3.3. Food and Beverage

- 3.4. Other End Users

Green Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Green Packaging Industry Regional Market Share

Geographic Coverage of Green Packaging Industry

Green Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives toward Sustainable Packaging; Downsizing of Packaging; Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials

- 3.3. Market Restrains

- 3.3.1. Capacity Constraint of Manufacturing Plants; High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Sustainable Plastic Packaging Solutions to Hold Major Share in Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Reusable Packaging

- 5.1.2. Degradable Packaging

- 5.1.3. Recycled Packaging

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Glass

- 5.2.2. Plastic

- 5.2.3. Metal

- 5.2.4. Paper

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical and Healthcare

- 5.3.2. Cosmetics and Personal Care

- 5.3.3. Food and Beverage

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. North America Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Reusable Packaging

- 6.1.2. Degradable Packaging

- 6.1.3. Recycled Packaging

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Glass

- 6.2.2. Plastic

- 6.2.3. Metal

- 6.2.4. Paper

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical and Healthcare

- 6.3.2. Cosmetics and Personal Care

- 6.3.3. Food and Beverage

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Europe Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Reusable Packaging

- 7.1.2. Degradable Packaging

- 7.1.3. Recycled Packaging

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Glass

- 7.2.2. Plastic

- 7.2.3. Metal

- 7.2.4. Paper

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical and Healthcare

- 7.3.2. Cosmetics and Personal Care

- 7.3.3. Food and Beverage

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. Asia Pacific Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Reusable Packaging

- 8.1.2. Degradable Packaging

- 8.1.3. Recycled Packaging

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Glass

- 8.2.2. Plastic

- 8.2.3. Metal

- 8.2.4. Paper

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical and Healthcare

- 8.3.2. Cosmetics and Personal Care

- 8.3.3. Food and Beverage

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Latin America Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Reusable Packaging

- 9.1.2. Degradable Packaging

- 9.1.3. Recycled Packaging

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Glass

- 9.2.2. Plastic

- 9.2.3. Metal

- 9.2.4. Paper

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical and Healthcare

- 9.3.2. Cosmetics and Personal Care

- 9.3.3. Food and Beverage

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Middle East and Africa Green Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process

- 10.1.1. Reusable Packaging

- 10.1.2. Degradable Packaging

- 10.1.3. Recycled Packaging

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Glass

- 10.2.2. Plastic

- 10.2.3. Metal

- 10.2.4. Paper

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical and Healthcare

- 10.3.2. Cosmetics and Personal Care

- 10.3.3. Food and Beverage

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 International Paper Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ball Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Westrock Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ardagh Group SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TetraPak International SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crown Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DS Smith PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mondi PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Smurfit Kappa Group PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Huhtamaki OYJ

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Amcor Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sealed Air Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Genpak LLC

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 International Paper Company*List Not Exhaustive

List of Figures

- Figure 1: Global Green Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 3: North America Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 4: North America Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 5: North America Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 11: Europe Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 12: Europe Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 13: Europe Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 14: Europe Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 19: Asia Pacific Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 20: Asia Pacific Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Asia Pacific Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Asia Pacific Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 27: Latin America Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 28: Latin America Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 29: Latin America Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 30: Latin America Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Latin America Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Green Packaging Industry Revenue (Million), by Process 2025 & 2033

- Figure 35: Middle East and Africa Green Packaging Industry Revenue Share (%), by Process 2025 & 2033

- Figure 36: Middle East and Africa Green Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 37: Middle East and Africa Green Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Middle East and Africa Green Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East and Africa Green Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Green Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Green Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 3: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Green Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 6: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 7: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 10: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 14: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 15: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 18: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 19: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 20: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Green Packaging Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 22: Global Green Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 23: Global Green Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global Green Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Packaging Industry?

The projected CAGR is approximately 7.67%.

2. Which companies are prominent players in the Green Packaging Industry?

Key companies in the market include International Paper Company*List Not Exhaustive, Sonoco Products Company, Ball Corporation, Westrock Company, Ardagh Group SA, TetraPak International SA, Crown Holdings Inc, BASF SE, DS Smith PLC, Mondi PLC, Smurfit Kappa Group PLC, Huhtamaki OYJ, Amcor Limited, Sealed Air Corporation, Genpak LLC.

3. What are the main segments of the Green Packaging Industry?

The market segments include Process, Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 292.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives toward Sustainable Packaging; Downsizing of Packaging; Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials.

6. What are the notable trends driving market growth?

Sustainable Plastic Packaging Solutions to Hold Major Share in Market.

7. Are there any restraints impacting market growth?

Capacity Constraint of Manufacturing Plants; High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

July 2022: Mondi and converter FioriniInternational collaborated to develop a new paper packaging option for Italian premium pasta product manufacturer Antico PastificioUmbro. When applied to all pasta products, the new packaging, which is 100% recyclable, could reduce the amount of plastic used by up to 20 tonnes annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Green Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Green Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Green Packaging Industry?

To stay informed about further developments, trends, and reports in the Green Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence