Key Insights

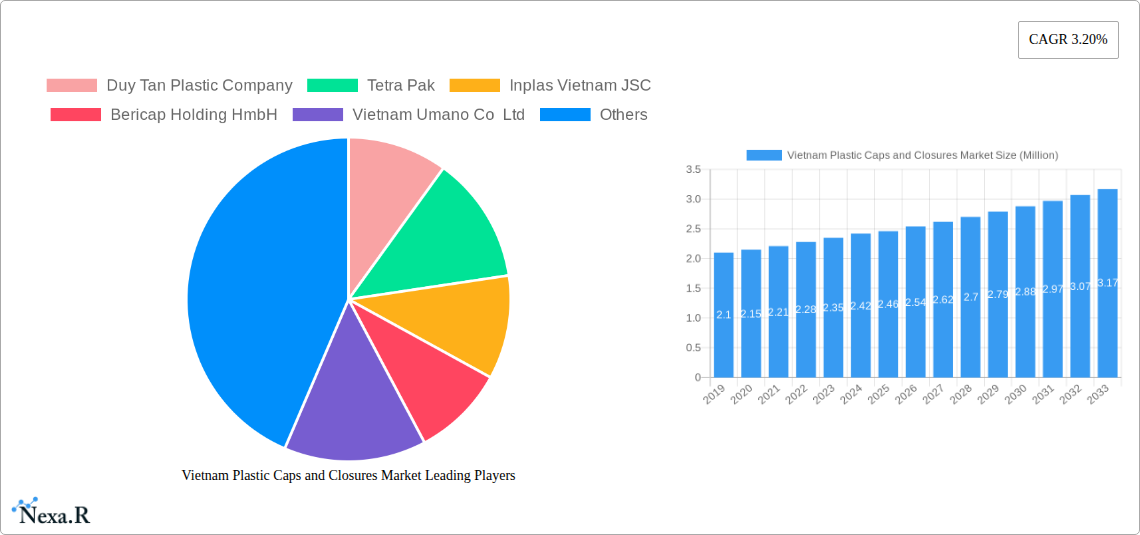

The Vietnam Plastic Caps and Closures Market is poised for significant growth, projected to reach an estimated USD 2.46 million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 3.20% through 2033. This expansion is primarily fueled by the burgeoning demand from key end-use industries such as Food & Beverage, Personal Care & Cosmetics, and Household Chemicals. The increasing consumption of packaged goods, coupled with a rising middle class and evolving consumer lifestyles, is driving the adoption of plastic caps and closures for enhanced product safety, preservation, and convenience. Furthermore, the growth of specific beverage segments, including bottled water and juices, directly correlates with the demand for specialized closures like dispensing and child-resistant caps.

Vietnam Plastic Caps and Closures Market Market Size (In Million)

The market's dynamism is further shaped by the diverse resin types utilized, with Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP) dominating the material landscape. Innovations in product types, particularly the emphasis on child-resistant and dispensing closures, are catering to stringent safety regulations and consumer preferences for ease of use. While the market benefits from strong domestic manufacturing capabilities and strategic investments from leading companies like Indorama Ventures Vietnam and Bericap Holding HmbH, potential restraints may include fluctuations in raw material prices and increasing environmental concerns regarding plastic waste. However, the overarching trend towards sustainable and recyclable packaging solutions presents an opportunity for market players to innovate and capture a larger share.

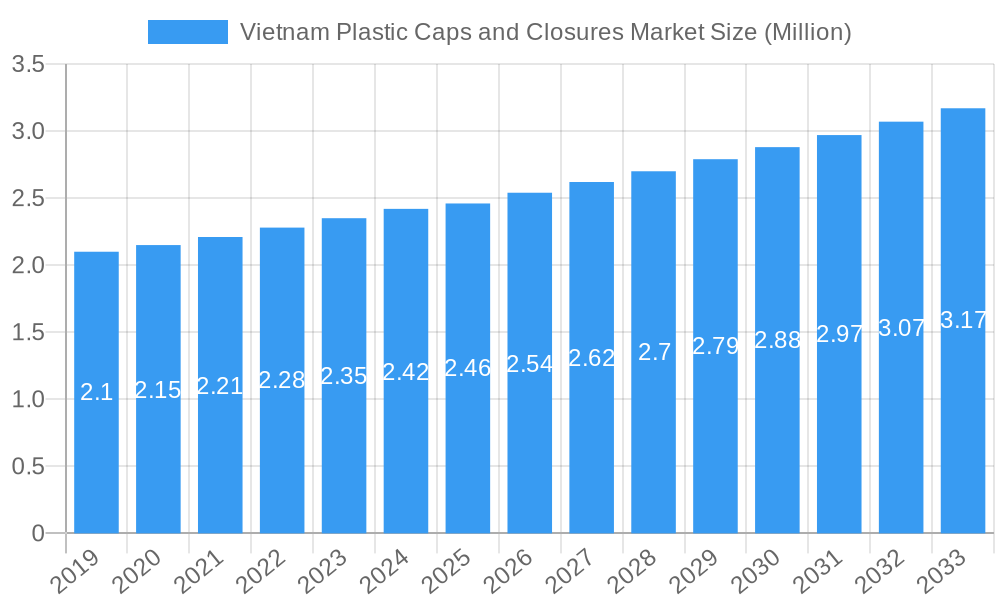

Vietnam Plastic Caps and Closures Market Company Market Share

Vietnam Plastic Caps and Closures Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a granular analysis of the Vietnam Plastic Caps and Closures Market, offering critical insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report dissects market dynamics, growth trends, key segments, and competitive landscape. We deliver quantitative data on market size and growth rates, alongside qualitative analysis of influencing factors, enabling strategic decision-making in the dynamic Vietnamese packaging sector. Our research encompasses a detailed examination of resin types (PE, PET, PP), product categories (threaded, dispensing, child-resistant), and end-use industries (food, beverage, personal care, household chemicals). Valued in million units, this report is an indispensable resource for manufacturers, suppliers, investors, and industry analysts seeking to capitalize on the burgeoning Vietnamese plastic caps and closures market.

Vietnam Plastic Caps and Closures Market Market Dynamics & Structure

The Vietnam plastic caps and closures market exhibits a moderately concentrated structure, with key players continuously vying for market share through product innovation and strategic expansion. Technological innovation is primarily driven by the demand for sustainable materials, enhanced safety features like child-resistant closures, and improved dispensing functionalities. Regulatory frameworks, while evolving, focus on food-grade certifications and environmental compliance, influencing material choices and manufacturing processes. Competitive product substitutes, such as metal closures and alternative packaging formats, pose a moderate threat, but the cost-effectiveness and versatility of plastic closures maintain their dominance. End-user demographics are shifting towards a growing middle class with increasing disposable income, driving demand for packaged goods across all sectors. Mergers and acquisitions (M&A) are a growing trend, as larger entities seek to consolidate their market position and expand their product portfolios. For instance, recent investments in advanced manufacturing capabilities by key players are aimed at enhancing efficiency and product quality. The market is characterized by a healthy growth rate, projected at 8.5% CAGR for the forecast period. However, barriers to entry include high capital investment for sophisticated molding machinery and the need to comply with stringent international quality standards.

Vietnam Plastic Caps and Closures Market Growth Trends & Insights

The Vietnam plastic caps and closures market is poised for significant expansion, projected to grow from an estimated 3,500 million units in 2025 to over 6,000 million units by 2033. This robust growth is underpinned by several converging trends. The ever-increasing consumption of packaged foods and beverages in Vietnam, driven by urbanization and evolving consumer lifestyles, directly fuels the demand for plastic caps and closures. The beverage sector, particularly bottled water and soft drinks, represents the largest end-use segment, consuming an estimated 1,800 million units in 2025. The personal care and cosmetics industry also demonstrates strong growth, with an anticipated CAGR of 9.2% over the forecast period, fueled by rising disposable incomes and a growing focus on personal grooming.

Technological disruptions are playing a crucial role. Manufacturers are increasingly adopting advanced injection molding techniques and hot runner systems to improve production efficiency, reduce material waste, and enhance the precision of closure designs. The adoption of polyethylene (PE) and polypropylene (PP) as primary resins continues to dominate due to their cost-effectiveness and versatile properties, accounting for an estimated 75% of the total resin consumption in the market. However, there is a notable shift towards recycled and bio-based plastics, driven by growing environmental consciousness and stricter regulations concerning plastic waste.

Consumer behavior is also a significant driver. Consumers are increasingly seeking convenient, tamper-evident, and easy-to-use packaging solutions. This is driving the demand for specialized closures such as dispensing caps and child-resistant closures, especially in the pharmaceutical and household chemical sectors. The market penetration of premium and innovative closure designs is expected to rise as consumers become more discerning. For example, the demand for flip-top caps and trigger spray closures is expected to see a year-on-year growth of 7%. The expansion of the e-commerce sector in Vietnam further bolsters the market, as more products are sold online and require secure, reliable packaging to withstand transit. The Vietnamese government's focus on export-oriented manufacturing also contributes to market growth, with Vietnamese manufacturers increasingly supplying caps and closures to regional and international markets. The overall market size is expected to reach USD 850 million by 2033, a significant increase from the estimated USD 400 million in 2025. This trajectory highlights the inherent strength and promising future of the Vietnam plastic caps and closures industry.

Dominant Regions, Countries, or Segments in Vietnam Plastic Caps and Closures Market

The Vietnam plastic caps and closures market is characterized by distinct regional and sectoral dominance, driven by a confluence of economic, demographic, and industrial factors. In terms of resin types, Polyethylene (PE) is the leading segment, projected to consume approximately 1,600 million units in 2025. This dominance is attributed to PE's cost-effectiveness, durability, and suitability for a wide range of closure applications, particularly in food and beverage packaging. Polypropylene (PP) follows closely, anticipated to account for around 1,200 million units in the same year, valued for its excellent chemical resistance and stiffness, making it ideal for household chemicals and certain beverage closures. Polyethylene Terephthalate (PET), while essential for specific applications like carbonated beverage bottles, holds a smaller but significant share, estimated at 500 million units.

Analyzing product types, Threaded closures are the most dominant, expected to account for an overwhelming 2,200 million units in 2025. This is driven by their universal application across beverage, food, and personal care products requiring secure sealing. Dispensing closures are a rapidly growing segment, with an estimated market of 700 million units, fueled by increasing demand for convenience in personal care and household chemical products. Unthreaded closures, used in specific packaging like certain pharmaceutical vials and smaller cosmetic containers, represent a smaller but stable segment. Child-resistant closures are a niche but critically important segment, particularly in the pharmaceutical and household chemical sectors, with an estimated 150 million units consumed, driven by stringent safety regulations.

The Food and Beverage sector is the undisputed leader in terms of end-use industry, projected to consume an immense 1,800 million units in 2025. Within this sector, Bottled Water and Carbonated Soft Drinks are the primary volume drivers, consuming an estimated 700 million units and 550 million units respectively. The Juices & Energy Drinks segment also contributes significantly, with projected consumption of 300 million units. The Personal Care & Cosmetics sector, expected to consume 600 million units, is a key growth driver, with increasing demand for sophisticated dispensing closures and aesthetically pleasing designs. The Household Chemicals sector, though smaller with an estimated 350 million units, is crucial for child-resistant closure demand.

Geographically, the Southern region of Vietnam, particularly around Ho Chi Minh City, remains the most dominant economic hub, housing a significant concentration of manufacturing facilities and end-user industries, thus driving the highest demand for plastic caps and closures. This dominance is supported by robust infrastructure, access to ports for raw material import and finished goods export, and a skilled labor force. The proactive investment policies of the Vietnamese government in manufacturing and its strategic location within ASEAN further contribute to the dominance of this region.

Vietnam Plastic Caps and Closures Market Product Landscape

The product landscape of the Vietnam plastic caps and closures market is characterized by continuous innovation aimed at enhancing functionality, safety, and sustainability. Manufacturers are increasingly focusing on lightweighting solutions without compromising on sealing integrity, leading to the development of thinner yet robust closures. Tamper-evident features are now standard across most product categories, providing consumers with assurance of product safety and integrity. The market is witnessing a rise in customization options, allowing brands to align closures with their product aesthetics and branding. Dispensing caps are evolving with improved valve technologies for precise dosage control and controlled flow. Furthermore, there is a growing emphasis on mono-material solutions to facilitate easier recycling at the end of the product lifecycle. Performance metrics like seal strength, torque retention, and ease of opening are key differentiators, with companies investing in advanced testing and quality control to meet stringent industry standards.

Key Drivers, Barriers & Challenges in Vietnam Plastic Caps and Closures Market

Key Drivers:

- Growing Packaged Food & Beverage Consumption: The increasing demand for convenience and processed foods and beverages in Vietnam is the primary catalyst.

- Rising Disposable Incomes: As the middle class expands, consumers are willing to spend more on packaged goods, directly impacting closure demand.

- E-commerce Growth: The surge in online retail necessitates robust and reliable packaging, including secure closures.

- Demand for Specialty Closures: Innovations in dispensing caps, child-resistant closures, and tamper-evident features are driving market growth.

- Government Support for Manufacturing: Policies aimed at boosting industrial production and exports create a favorable environment.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the global prices of PET and PE resins can impact manufacturing costs and profitability.

- Intensifying Competition: The market is becoming increasingly competitive, with both domestic and international players vying for market share.

- Environmental Regulations: Evolving regulations on plastic waste and single-use plastics may necessitate costly changes in materials and production processes.

- Supply Chain Disruptions: Global and local logistical challenges can impact the timely availability of raw materials and finished goods.

- Technological Upgradation Costs: Investing in advanced manufacturing technology and automation requires significant capital outlay.

Emerging Opportunities in Vietnam Plastic Caps and Closures Market

Emerging opportunities in the Vietnam plastic caps and closures market are largely centered around sustainability, innovation, and niche market penetration. There is a significant untapped market for biodegradable and compostable closures, driven by increasing consumer and regulatory pressure. The pharmaceutical sector presents a substantial opportunity for highly specialized and compliant closures, particularly those with advanced tamper-evident and child-resistant features. Furthermore, the growth of the convenience store and food service sectors creates demand for single-serve and portion-controlled packaging solutions, requiring unique closure designs. Companies can also leverage digitalization and Industry 4.0 technologies to optimize production, improve traceability, and offer customized solutions to clients, thereby creating a competitive edge. The growing demand for premium and aesthetically pleasing packaging in the cosmetics and personal care sectors also presents a lucrative avenue for manufacturers capable of delivering innovative and visually appealing closures.

Growth Accelerators in the Vietnam Plastic Caps and Closures Market Industry

Several key catalysts are accelerating the growth of the Vietnam plastic caps and closures industry. Technological breakthroughs in polymer science, enabling the development of lighter, stronger, and more sustainable plastic materials, are a major growth accelerator. Strategic partnerships between raw material suppliers and closure manufacturers are fostering innovation and ensuring a steady supply of advanced materials. Furthermore, market expansion strategies by leading companies, including capacity additions and diversification into related packaging solutions, are significantly boosting market volume. The increasing adoption of automation and advanced manufacturing techniques enhances production efficiency and reduces costs, making Vietnamese products more competitive globally. Finally, the growing demand for custom-designed closures that align with specific brand identities and product functionalities is a significant driver, encouraging R&D investment and product differentiation.

Key Players Shaping the Vietnam Plastic Caps and Closures Market Market

- Duy Tan Plastic Company

- Tetra Pak

- Inplas Vietnam JSC

- Bericap Holding GmbH

- Vietnam Umano Co Ltd

- VPP Co Ltd

- Pavico Vietnam Joint Stock Company

- Indorama Ventures Vietnam

Notable Milestones in Vietnam Plastic Caps and Closures Market Sector

- April 2024: Bericap Holding GmbH, a German company operating in Vietnam, recently bolstered its Asian manufacturing footprint by inaugurating a new plant in Kunshan, China. This strategic location, in proximity to Shanghai, positions the company to better serve an expanded clientele with its plastic caps and closures.

- March 2024: Duy Tan Plastic Company, a Vietnam-based company, opened its flagship store in Hanoi. The store showcases plastic products, including household, rigid, and flexible packaging. The opening of a new store is the company's expansion strategy in Vietnam, which is likely to expand the company's customer base.

In-Depth Vietnam Plastic Caps and Closures Market Market Outlook

The outlook for the Vietnam plastic caps and closures market remains exceptionally positive, driven by sustained economic growth and evolving consumer preferences. Key growth accelerators include the continuous innovation in sustainable materials, the increasing demand for specialized closures like child-resistant and dispensing variants, and the expansion of e-commerce. Strategic opportunities lie in tapping into the growing demand from niche sectors such as pharmaceuticals and premium personal care, alongside a potential surge in demand for biodegradable and compostable alternatives. Manufacturers that invest in advanced technologies, build strategic partnerships, and prioritize product quality and innovation will be well-positioned to capitalize on the market's robust upward trajectory, ensuring sustained growth and profitability in the coming years.

Vietnam Plastic Caps and Closures Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Pl

-

2. Product Type

- 2.1. Threaded

- 2.2. Dispensing

- 2.3. Unthreaded

- 2.4. Child-Resistant

-

3. End-Use Industries

- 3.1. Food

-

3.2. Beverage

- 3.2.1. Bottled Water

- 3.2.2. Carbonated Soft Drinks

- 3.2.3. Alcoholic Beverages

- 3.2.4. Juices & Energy Drinks

- 3.2.5. Other Beverages

- 3.3. Personal Care & Cosmetics

- 3.4. Household Chemicals

- 3.5. Other End-Use Industries

Vietnam Plastic Caps and Closures Market Segmentation By Geography

- 1. Vietnam

Vietnam Plastic Caps and Closures Market Regional Market Share

Geographic Coverage of Vietnam Plastic Caps and Closures Market

Vietnam Plastic Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism in the Country to Boost Food Industry; Rising Popularity of Customized Caps and Closures

- 3.3. Market Restrains

- 3.3.1. Growing Tourism in the Country to Boost Food Industry; Rising Popularity of Customized Caps and Closures

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) is Estimated to Have the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Plastic Caps and Closures Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Pl

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Threaded

- 5.2.2. Dispensing

- 5.2.3. Unthreaded

- 5.2.4. Child-Resistant

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.2.1. Bottled Water

- 5.3.2.2. Carbonated Soft Drinks

- 5.3.2.3. Alcoholic Beverages

- 5.3.2.4. Juices & Energy Drinks

- 5.3.2.5. Other Beverages

- 5.3.3. Personal Care & Cosmetics

- 5.3.4. Household Chemicals

- 5.3.5. Other End-Use Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Duy Tan Plastic Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tetra Pak

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Inplas Vietnam JSC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bericap Holding HmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vietnam Umano Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VPP Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pavico Vietnam Joint Stock Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Indorama Ventures Vietnam*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Duy Tan Plastic Company

List of Figures

- Figure 1: Vietnam Plastic Caps and Closures Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Plastic Caps and Closures Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 3: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 6: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 7: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 10: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 11: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 14: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 15: Vietnam Plastic Caps and Closures Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Vietnam Plastic Caps and Closures Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Plastic Caps and Closures Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Vietnam Plastic Caps and Closures Market?

Key companies in the market include Duy Tan Plastic Company, Tetra Pak, Inplas Vietnam JSC, Bericap Holding HmbH, Vietnam Umano Co Ltd, VPP Co Ltd, Pavico Vietnam Joint Stock Company, Indorama Ventures Vietnam*List Not Exhaustive.

3. What are the main segments of the Vietnam Plastic Caps and Closures Market?

The market segments include Resin, Product Type, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism in the Country to Boost Food Industry; Rising Popularity of Customized Caps and Closures.

6. What are the notable trends driving market growth?

Polyethylene (PE) is Estimated to Have the Largest Market Share.

7. Are there any restraints impacting market growth?

Growing Tourism in the Country to Boost Food Industry; Rising Popularity of Customized Caps and Closures.

8. Can you provide examples of recent developments in the market?

April 2024: Bericap Holding GmbH, a German company operating in Vietnam, recently bolstered its Asian manufacturing footprint by inaugurating a new plant in Kunshan, China. This strategic location, in proximity to Shanghai, positions the company to better serve an expanded clientele with its plastic caps and closures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Plastic Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Plastic Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Plastic Caps and Closures Market?

To stay informed about further developments, trends, and reports in the Vietnam Plastic Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence