Key Insights

The Italian plastic packaging films market is projected to reach 155.8 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 5.5% from 2025 to 2033. Growth is primarily driven by strong demand from the food and beverage sector, particularly for confectionery, frozen foods, fresh produce, and dairy. The increasing adoption of advanced packaging solutions in healthcare and personal care, ensuring product safety and integrity, also fuels market expansion. Polyethylene (PE), Polypropylene (PP), and Polystyrene (PS) remain dominant due to their versatility and cost-effectiveness, while bio-based films are gaining traction amidst growing environmental awareness.

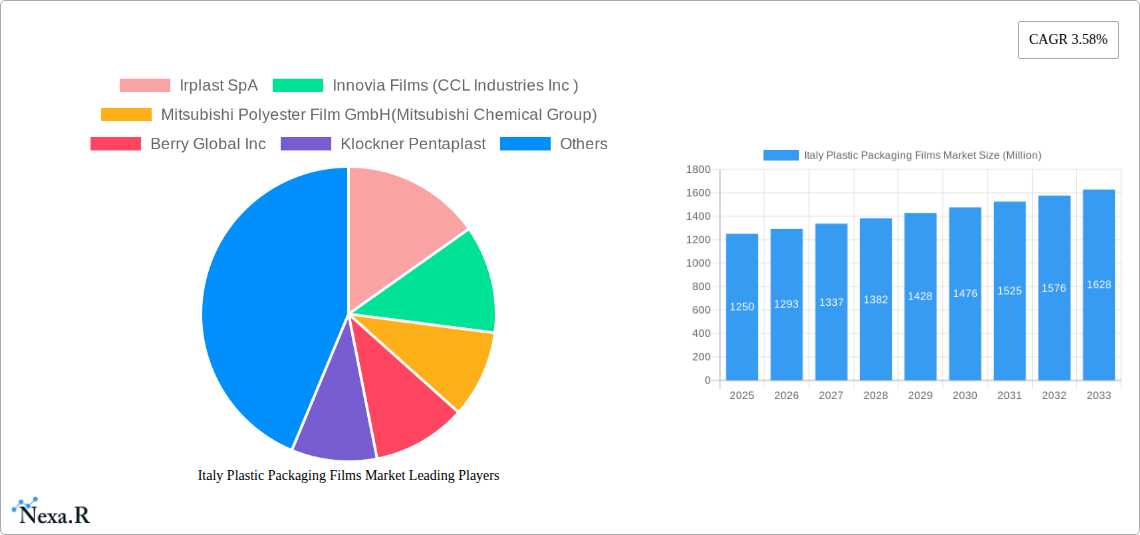

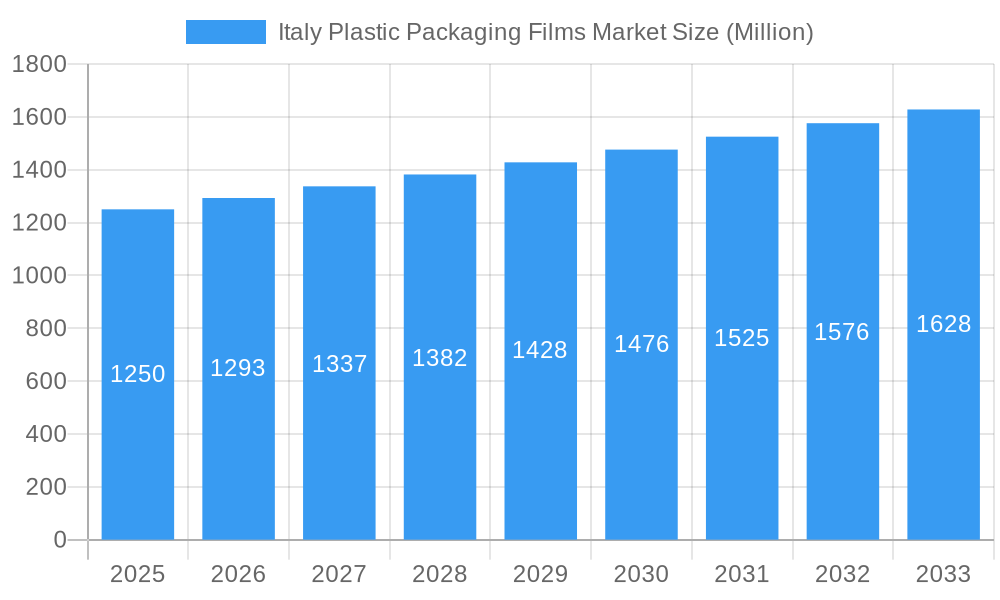

Italy Plastic Packaging Films Market Market Size (In Billion)

Key market restraints include fluctuating raw material prices and increasing regulatory scrutiny on plastic waste and sustainability. European Union directives on circular economy and single-use plastics are compelling manufacturers to innovate with sustainable and recyclable film solutions, driving the adoption of advanced materials like EVOH and PETG for enhanced barrier properties and recyclability. Industrial packaging presents a substantial opportunity, supported by Italy's robust manufacturing base. Leading players are actively investing in research and development, strategic collaborations, and capacity expansions to maintain a competitive edge and adapt to evolving market dynamics through innovation and sustainable practices.

Italy Plastic Packaging Films Market Company Market Share

Italy Plastic Packaging Films Market: In-depth Analysis & Growth Forecast (2025-2033)

This comprehensive report offers strategic insights into the dynamic Italian plastic packaging films market. It provides an in-depth analysis of market size, segmentation, key players, and future projections. Explore the evolution of plastic films in Italy, from commodity polyolefins to advanced bio-based and high-barrier materials, driven by stringent regulations and consumer demand for sustainable, high-performance packaging. Understand the pivotal role of the food industry, including confectionery, frozen foods, and fresh produce, alongside critical sectors like healthcare and personal care. Gain a competitive edge with detailed market dynamics, growth trends, regional dominance, product innovations, and key strategic initiatives shaping the future of this significant industry.

Italy Plastic Packaging Films Market Market Dynamics & Structure

The Italian plastic packaging films market is characterized by a moderately consolidated structure, with key players like Irplast SpA, Innovia Films (CCL Industries Inc.), and Mitsubishi Polyester Film GmbH (Mitsubishi Chemical Group) holding significant market shares. Technological innovation is a primary driver, with ongoing advancements in film properties such as barrier performance, recyclability, and compostability directly influencing product development and market adoption. Regulatory frameworks, including EU directives on plastic waste and packaging, are profoundly shaping the market by incentivizing the use of recycled content and sustainable materials. Competitive product substitutes, primarily from alternative packaging materials and innovative bioplastics, present both a challenge and an opportunity for market participants to differentiate their offerings. End-user demographics, particularly the growing demand for convenience, food safety, and aesthetically pleasing packaging, are influencing product design and material selection. Mergers and acquisitions (M&A) trends indicate a strategic consolidation of capabilities, aimed at expanding product portfolios and market reach. For instance, the acquisition of smaller specialized film manufacturers by larger entities has been observed, enhancing their competitive positioning. The market is witnessing a push towards circular economy principles, with a growing emphasis on designing films for recyclability and increasing the incorporation of post-consumer recycled (PCR) content, reflecting a shift in industry focus from virgin material reliance to sustainable sourcing.

Italy Plastic Packaging Films Market Growth Trends & Insights

The Italy plastic packaging films market is poised for robust expansion, driven by a confluence of factors that underscore evolving consumer preferences, stringent environmental regulations, and relentless technological innovation. The market size, estimated at approximately XX million units in 2025, is projected to witness a healthy Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This growth trajectory is intrinsically linked to the increasing adoption of advanced packaging solutions across diverse end-user industries. Technological disruptions, such as the development of high-barrier films offering enhanced shelf-life extension and the rise of innovative biodegradable and compostable film alternatives, are fundamentally reshaping consumption patterns. Consumer behavior shifts are also playing a crucial role; a growing awareness of environmental sustainability is compelling manufacturers and consumers alike to favor packaging that minimizes ecological impact. This has led to increased demand for films with higher recycled content, enhanced recyclability, and those derived from renewable resources, a trend expected to accelerate as legislative pressures and consumer consciousness intensify. The market penetration of specialized films, particularly those designed for specific applications in food preservation and medical packaging, is also on an upward trend, reflecting a sophisticated demand for tailored solutions. The emphasis on lightweighting in packaging to reduce material usage and transportation costs further contributes to the market's dynamic evolution. The integration of smart packaging features, such as indicators for freshness or tamper-evident seals, is also gaining traction, adding value beyond basic containment and protection. Furthermore, the ongoing development of advanced recycling technologies promises to unlock new avenues for material recovery and reuse, thereby strengthening the circularity of plastic packaging films within the Italian economy.

Dominant Regions, Countries, or Segments in Italy Plastic Packaging Films Market

Within the Italian plastic packaging films market, polyethylene (PE) films, particularly polyethylene terephthalate (PETG) and polyethylene (PE) film types, are expected to dominate owing to their versatility, cost-effectiveness, and extensive applications across numerous end-user industries. The Food sector, encompassing sub-segments like Candy and Confectionery, Frozen Foods, Fresh Produce, and Dairy Products, is the primary growth engine. This dominance is fueled by the Italian penchant for high-quality, fresh, and convenience food products, necessitating advanced packaging solutions for preservation, extended shelf-life, and consumer appeal. Italy's robust agricultural sector and its status as a major food exporter further amplify the demand for specialized food packaging films. The Healthcare sector also presents significant growth potential, driven by the increasing demand for sterile and protective packaging for pharmaceuticals and medical devices, adhering to stringent quality and safety standards.

Key drivers for the dominance of polyethylene films and the food sector include:

- Economic Policies: Supportive policies encouraging food production, export, and innovation in packaging contribute to sustained demand.

- Infrastructure: A well-established logistics and retail infrastructure ensures efficient distribution and accessibility of packaged food products across the nation.

- Consumer Preferences: A strong consumer preference for convenience, hygiene, and visually appealing packaging directly translates into demand for high-performance plastic films in the food industry.

- Technological Advancements: Continuous innovation in PE film technology, focusing on improved barrier properties, recyclability, and printability, aligns perfectly with industry requirements.

- Regulatory Landscape: While regulations aim for sustainability, they also drive innovation in recyclable and safe food-contact materials, often favoring advanced PE formulations.

The Industrial Packaging segment is also a significant contributor, driven by the need for robust and protective packaging for manufactured goods, machinery, and construction materials. The increasing focus on e-commerce and global trade further bolsters this segment. Regions with a strong concentration of food processing industries and manufacturing hubs, such as Northern Italy, are expected to exhibit the highest market penetration and growth rates. The evolving landscape of bio-based and recycled films also signifies a growing trend, responding to environmental concerns and aiming to capture market share within specific niche applications. The interplay between these dominant segments and emerging trends will define the future growth trajectory of the Italian plastic packaging films market, with continuous adaptation to sustainability goals and technological advancements being paramount.

Italy Plastic Packaging Films Market Product Landscape

The product landscape of the Italy plastic packaging films market is characterized by a relentless pursuit of enhanced performance and sustainability. Innovations are focused on developing films with superior barrier properties to extend product shelf-life, reduce food waste, and maintain product integrity. This includes the development of multi-layer films incorporating specialized materials like EVOH for exceptional oxygen barrier or PETG for clarity and toughness. A significant trend is the integration of recycled content, with advancements in mechanical and chemical recycling enabling higher percentages of post-consumer recycled (PCR) materials in film production without compromising quality. Furthermore, the emergence of bio-based and compostable films, derived from renewable resources, is gaining traction, offering eco-friendly alternatives for specific applications. These innovations address growing consumer and regulatory demands for sustainable packaging solutions. The focus is on creating films that are not only functional and cost-effective but also environmentally responsible throughout their lifecycle.

Key Drivers, Barriers & Challenges in Italy Plastic Packaging Films Market

Key Drivers:

- Growing Demand in the Food & Beverage Sector: The vast and dynamic Italian food industry's need for high-barrier, shelf-life extending, and visually appealing packaging remains a primary growth engine.

- Sustainability Initiatives & Regulations: Increasing environmental consciousness and stringent EU directives promoting recyclability, recycled content, and reduced plastic waste are driving innovation and adoption of greener film solutions.

- Technological Advancements: Continuous R&D in film properties, including enhanced barrier performance, lightweighting, and improved recyclability, fuels market expansion and product differentiation.

- Evolving Consumer Preferences: A rising consumer demand for convenience, hygiene, extended shelf-life, and eco-friendly packaging solutions directly influences product development and market trends.

Barriers & Challenges:

- Regulatory Complexity & Compliance Costs: Navigating evolving environmental regulations and the costs associated with compliance, such as investment in new recycling technologies or material sourcing, can be a significant hurdle.

- Supply Chain Volatility & Raw Material Costs: Fluctuations in the prices and availability of petrochemical feedstocks and recycled plastics can impact production costs and profitability.

- Competition from Alternative Materials: While plastic films offer unique advantages, competition from glass, paper, and novel biodegradable materials for certain applications necessitates continuous innovation.

- Consumer Perception & Misinformation: Negative consumer perceptions surrounding plastic packaging, often fueled by misinformation, can create market resistance, requiring effective communication and education strategies.

- Infrastructure for Recycling: The development and widespread availability of advanced recycling infrastructure across the country are crucial for achieving true circularity in plastic packaging films.

Emerging Opportunities in Italy Plastic Packaging Films Market

Emerging opportunities in the Italy plastic packaging films market lie in the burgeoning demand for sustainable and circular packaging solutions. The growing adoption of bio-based and compostable films presents a significant avenue for growth, catering to consumers and brands seeking to minimize their environmental footprint. Furthermore, the development of advanced recycling technologies, such as chemical recycling, opens up possibilities for recycling previously unrecyclable mixed plastic waste, creating a more robust supply of high-quality recycled content. The healthcare sector continues to offer untapped potential, with the need for specialized, high-performance films for sterile packaging and drug delivery systems. Innovations in smart packaging, incorporating features like traceability, tamper-evidence, and freshness indicators, also represent a valuable growth area, adding functional and informational value to packaged goods. The push towards lightweighting in all packaging applications, to reduce material usage and transportation emissions, also presents an ongoing opportunity for film manufacturers to develop thinner yet stronger film solutions.

Growth Accelerators in the Italy Plastic Packaging Films Market Industry

Several key catalysts are propelling the long-term growth of the Italy plastic packaging films market. Technological breakthroughs in material science, particularly in the development of high-barrier films, biodegradable alternatives, and films with enhanced recyclability, are fundamental. Strategic partnerships between film manufacturers, raw material suppliers, and converters are crucial for driving innovation and ensuring efficient supply chains. Collaborations focused on developing and implementing circular economy models, including investments in advanced recycling infrastructure, are also significant growth accelerators. Furthermore, market expansion strategies that target niche applications within sectors like pharmaceuticals, medical devices, and specialized food packaging will unlock new revenue streams. The increasing emphasis on corporate sustainability goals by major brands is a powerful market expansion driver, creating demand for innovative and environmentally friendly packaging solutions. Government incentives and supportive policies aimed at promoting the circular economy and sustainable materials will also play a vital role in accelerating market growth.

Key Players Shaping the Italy Plastic Packaging Films Market Market

- Irplast SpA

- Innovia Films (CCL Industries Inc.)

- Mitsubishi Polyester Film GmbH (Mitsubishi Chemical Group)

- Berry Global Inc

- Klockner Pentaplast

- SUDPACK Holding GmbH

- Taghleef Industries

- Jindal Films Europe

- SRF LIMITED

- VALTEC ITALIA SRL

- Cartonal Italia SpA

- Luigi Bandera SpA

- IDEALPLAST SRL

- COMPLEJOS DE VINILO SA

- POLIFILM Gmb

Notable Milestones in Italy Plastic Packaging Films Market Sector

- June 2024: Crocco (SpA SB) partnered with Versalis (Eni’s chemical arm) to introduce a new food packaging film. This film is crafted from raw materials, with a significant portion sourced from post-consumer plastic recycling, aiming to scale production for the expansive retail market.

- May 2024: BlueAlp and Recupero Etico Sostenibile (RES) inked a deal to pioneer Italy's inaugural industrial-scale advanced recycling plant. The facility will handle and transform 20 kilotons of mixed plastic waste annually. RES will own and operate the plant, which is positioned adjacent to RES's current mechanical recycling setup in Pettoranello del Molise, with an expected launch around mid-2026.

In-Depth Italy Plastic Packaging Films Market Market Outlook

The future outlook for the Italy plastic packaging films market is exceptionally promising, driven by a confluence of accelerating factors. The sustained demand from the food sector, coupled with increasing regulatory pressures and consumer preference for sustainable packaging, will continue to fuel innovation in recyclable, bio-based, and compostable films. Investments in advanced recycling infrastructure are expected to mature, creating a more robust circular economy for plastics. Furthermore, technological advancements in high-barrier films and specialized packaging for healthcare and industrial applications will create new avenues for growth. Strategic partnerships and mergers are likely to continue, consolidating market strengths and fostering greater innovation. The market is on a trajectory to embrace a more sustainable and circular model, presenting significant opportunities for forward-thinking players to capture market share and drive industry evolution.

Italy Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End-user Industry

-

2.1. Food

- 2.1.1. Candy and Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care and Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

Italy Plastic Packaging Films Market Segmentation By Geography

- 1. Italy

Italy Plastic Packaging Films Market Regional Market Share

Geographic Coverage of Italy Plastic Packaging Films Market

Italy Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Lightweight Packaging Solution; Rising Demand Across Industries Signals Growth Potential for Plastic Films

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Lightweight Packaging Solution; Rising Demand Across Industries Signals Growth Potential for Plastic Films

- 3.4. Market Trends

- 3.4.1. Food Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Plastic Packaging Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.1.1. Candy and Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Irplast SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Innovia Films (CCL Industries Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Polyester Film GmbH(Mitsubishi Chemical Group)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berry Global Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Klockner Pentaplast

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUDPACK Holding GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taghleef Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jindal Films Europe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SRF LIMITED

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VALTEC ITALIA SRL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cartonal Italia SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Luigi Bandera SpA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 IDEALPLAST SRL

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 COMPLEJOS DE VINILO SA

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 POLIFILM Gmb

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Irplast SpA

List of Figures

- Figure 1: Italy Plastic Packaging Films Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Plastic Packaging Films Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Italy Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Italy Plastic Packaging Films Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Plastic Packaging Films Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Italy Plastic Packaging Films Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Italy Plastic Packaging Films Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Plastic Packaging Films Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Italy Plastic Packaging Films Market?

Key companies in the market include Irplast SpA, Innovia Films (CCL Industries Inc ), Mitsubishi Polyester Film GmbH(Mitsubishi Chemical Group), Berry Global Inc, Klockner Pentaplast, SUDPACK Holding GmbH, Taghleef Industries, Jindal Films Europe, SRF LIMITED, VALTEC ITALIA SRL, Cartonal Italia SpA, Luigi Bandera SpA, IDEALPLAST SRL, COMPLEJOS DE VINILO SA, POLIFILM Gmb.

3. What are the main segments of the Italy Plastic Packaging Films Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 155.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Lightweight Packaging Solution; Rising Demand Across Industries Signals Growth Potential for Plastic Films.

6. What are the notable trends driving market growth?

Food Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Demand for Lightweight Packaging Solution; Rising Demand Across Industries Signals Growth Potential for Plastic Films.

8. Can you provide examples of recent developments in the market?

June 2024: Crocco (SpA SB), a flexible packaging company, partnered with Versalis, Eni’s chemical arm, to introduce a new food packaging film. This film is crafted from raw materials, with a significant portion sourced from post-consumer plastic recycling. The aim is to scale production, explicitly targeting the expansive retail market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the Italy Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence