Key Insights

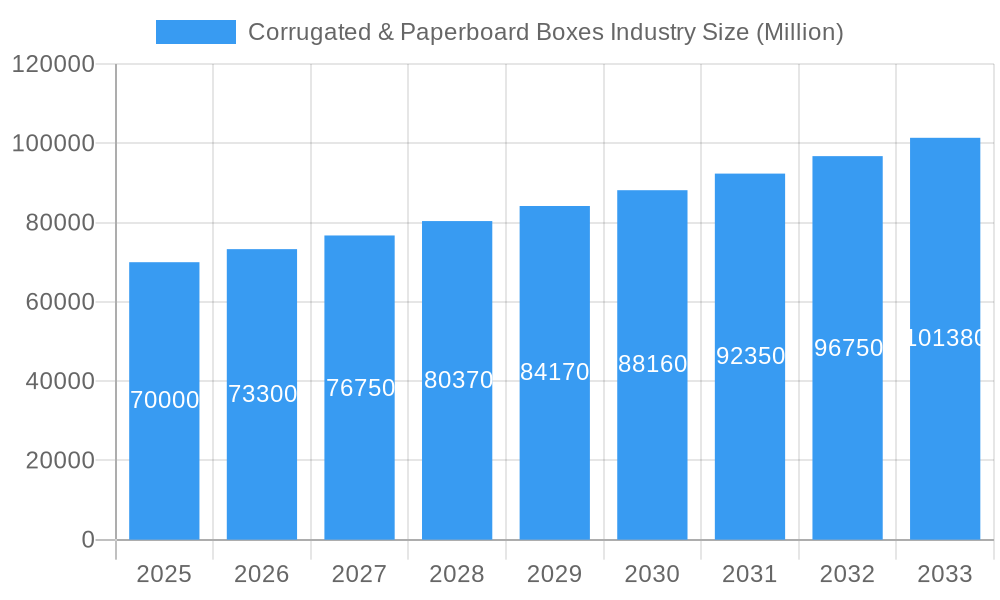

The global Corrugated & Paperboard Boxes market is projected to reach $124.92 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 4.1% from its 2025 base year. This robust growth is primarily driven by the escalating demand from the Food and Beverage sector, fueled by increasing consumption of packaged goods. The sustained e-commerce boom continues to be a significant catalyst, necessitating secure and sustainable packaging solutions for online retail. The inherent durability and recyclability of corrugated and paperboard materials align with global sustainability initiatives, positioning them as preferred alternatives to plastic. The Paper & Publishing industry contributes to market expansion, while the Chemicals sector presents steady demand for reliable packaging to ensure product integrity during transit and storage. Innovation in structural design and printing technologies enhances both functionality and aesthetic appeal across the market.

Corrugated & Paperboard Boxes Industry Market Size (In Billion)

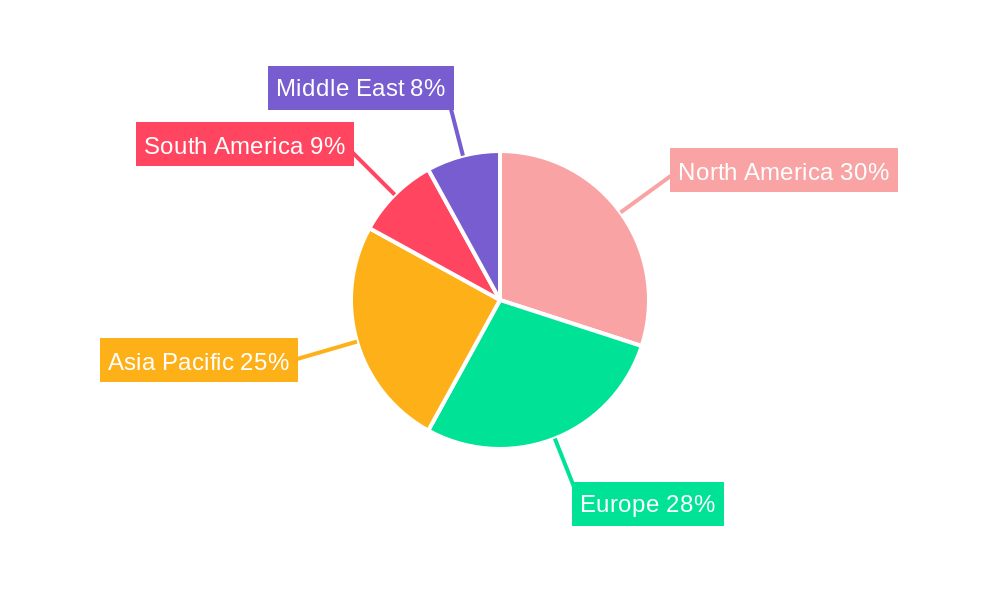

Key market restraints include fluctuating raw material costs, such as pulp and recycled paper, impacting profit margins. Intense competition among established players and emerging entrants also exerts pricing pressures. However, advancements in manufacturing efficiency and strategic partnerships are mitigating these challenges. The market segmentation highlights the dominance of Corrugated and Solid Fiber Boxes, attributed to their versatility and cost-effectiveness. Folding Paperboard Boxes are significant for consumer goods packaging. Geographically, North America and Europe currently lead in revenue, driven by developed economies and a strong focus on sustainable packaging. The Asia Pacific region is anticipated to experience the fastest growth, propelled by rapid industrialization, a burgeoning middle class, and increasing e-commerce adoption. Emerging economies in South America and the Middle East are also expected to contribute to sustained market expansion.

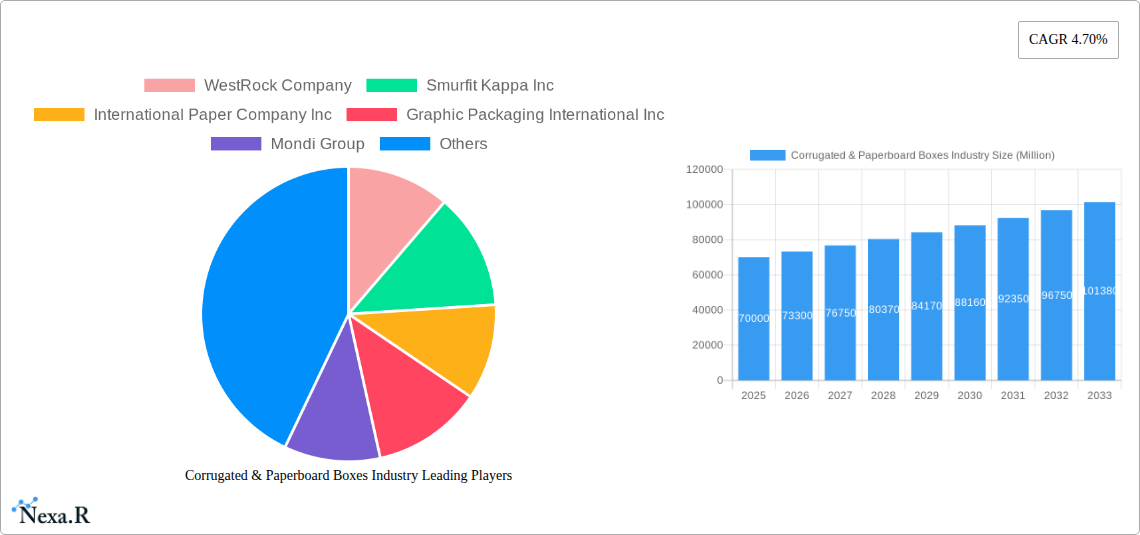

Corrugated & Paperboard Boxes Industry Company Market Share

Corrugated & Paperboard Boxes Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global corrugated and paperboard boxes industry. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study provides critical insights into market dynamics, growth trends, key players, and emerging opportunities. Leverage our meticulously researched data to understand market concentration, technological innovations, regulatory frameworks, competitive landscapes, and end-user demographics. With detailed segment analysis, including product types like Corrugated and Solid Fiber Boxes, Folding Paperboard Boxes, and Set-up Paperboard Boxes, and end-user industries such as Food and Beverage, Durable Goods, and Chemicals, this report is an indispensable resource for industry professionals seeking to navigate and capitalize on market opportunities. All values are presented in Million Units.

Corrugated & Paperboard Boxes Industry Market Dynamics & Structure

The corrugated and paperboard boxes industry exhibits a moderately consolidated market structure, with a few large players holding significant market share, alongside a substantial number of regional and specialized manufacturers. Technological innovation is primarily driven by the demand for enhanced packaging sustainability, increased durability, and improved printing capabilities. Key drivers include the development of eco-friendly materials, smart packaging solutions, and advanced manufacturing processes that optimize efficiency and reduce waste. Regulatory frameworks, particularly concerning environmental impact, recycling, and food safety, play a crucial role in shaping product development and operational standards. Competitive product substitutes, such as plastic containers and flexible packaging, continuously challenge the market, necessitating ongoing innovation in paper-based solutions. End-user demographics are shifting towards e-commerce, which demands robust, lightweight, and easily transportable packaging. Mergers and acquisitions (M&A) trends are evident as companies seek to expand their geographical reach, diversify their product portfolios, and achieve economies of scale. For instance, a significant number of M&A deals were recorded between 2019-2024, driven by consolidation strategies and the acquisition of innovative technologies. Barriers to innovation include high capital investment for advanced machinery and the need to meet diverse regulatory requirements across different regions.

- Market Concentration: Dominated by a few key global players with substantial market presence.

- Technological Innovation: Focus on sustainability (recycled content, biodegradability), enhanced printability, and structural integrity for e-commerce.

- Regulatory Frameworks: Stringent environmental regulations, recycling mandates, and food contact safety standards influence production and material choices.

- Competitive Substitutes: Plastics and flexible packaging present ongoing competitive pressures.

- End-User Demographics: Growing e-commerce sector drives demand for specialized, protective, and aesthetically pleasing packaging.

- M&A Trends: Strategic acquisitions aimed at market expansion, capacity enhancement, and technology integration.

Corrugated & Paperboard Boxes Industry Growth Trends & Insights

The global corrugated and paperboard boxes market is poised for steady expansion, driven by a confluence of economic, environmental, and technological factors. The CAGR for the forecast period is projected at 4.2%. Market size is anticipated to reach $180,500 Million Units by 2033, a significant increase from $130,000 Million Units in 2023. This growth trajectory is underpinned by the burgeoning e-commerce sector, which has dramatically increased the demand for robust and cost-effective shipping solutions. The shift towards sustainable packaging materials further bolsters the industry, as consumers and businesses increasingly favor recyclable and biodegradable options over traditional plastics. Technological advancements in papermaking, printing, and structural design are enabling the creation of lighter, stronger, and more customized boxes, catering to a wider array of product needs. Adoption rates for advanced printing techniques, such as digital printing for short runs and personalized packaging, are steadily rising. Consumer behavior is evolving, with a greater emphasis on brand presentation and the unboxing experience, pushing manufacturers to innovate in design and aesthetics. The increasing preference for online shopping, particularly in emerging economies, acts as a potent market penetration accelerator. The development of specialized corrugated solutions for perishable goods, electronics, and sensitive items is also contributing to market diversification. Furthermore, the growing awareness and implementation of circular economy principles are driving demand for recycled content in paperboard production. The industry is witnessing a significant adoption of advanced manufacturing technologies, including automation and AI-powered quality control, leading to improved efficiency and reduced production costs. The increasing emphasis on supply chain resilience also favors the localized production capabilities offered by paperboard packaging.

Dominant Regions, Countries, or Segments in Corrugated & Paperboard Boxes Industry

The Food and Beverage segment is a dominant force within the corrugated and paperboard boxes industry, consistently driving market growth across global regions. This dominance stems from the high volume and continuous demand for packaged food and beverages, ranging from perishable items requiring specialized insulation and protection to shelf-stable products needing robust secondary packaging for retail display and transit. Within this segment, the sub-segment of Corrugated and Solid Fiber Boxes accounts for the largest market share due to its versatility, strength, and cost-effectiveness in handling diverse food and beverage products.

Key Drivers of Dominance in Food and Beverage Segment:

- Constant Consumer Demand: The essential nature of food and beverages ensures a perpetual need for packaging, regardless of economic fluctuations.

- E-commerce Growth in Food Delivery: The rapid expansion of online grocery shopping and food delivery services has significantly amplified the demand for secure and hygienic shipping solutions.

- Regulatory Compliance: Stringent food safety regulations necessitate packaging that offers protection against contamination and spoilage, a role well-fulfilled by high-quality paperboard.

- Brand Visibility and Marketing: Paperboard packaging offers excellent surfaces for vibrant printing, enabling attractive branding and product differentiation on retail shelves and during the unboxing experience.

- Sustainability Mandates: The food and beverage industry is increasingly under pressure to adopt sustainable practices, making recyclable and biodegradable paperboard a preferred choice.

Regional Dominance:

While the Food and Beverage segment leads overall, Asia Pacific emerges as a dominant region, propelled by its massive population, expanding middle class, and rapid industrialization, particularly in countries like China and India. This region's burgeoning e-commerce market, coupled with a growing demand for processed and packaged foods, significantly contributes to the consumption of corrugated and paperboard boxes. Government initiatives promoting domestic manufacturing and trade further bolster the industry's growth in this area.

- Asia Pacific Market Share: Projected to hold over 35% of the global market by 2033.

- Key Countries: China, India, Japan, and South Korea are major contributors.

- Growth Potential: Driven by increasing disposable incomes and urbanization.

Corrugated & Paperboard Boxes Industry Product Landscape

The product landscape is characterized by continuous innovation in material science and structural design. Corrugated and solid fiber boxes are increasingly engineered for enhanced strength-to-weight ratios, crucial for e-commerce logistics and reducing shipping costs. Folding paperboard boxes are witnessing advancements in printability and folding-gluing technologies, enabling intricate designs and seamless assembly for premium consumer goods. Set-up paperboard boxes are evolving to offer a more luxurious and durable packaging experience, often incorporating unique finishes and structural elements for high-value products. Performance metrics such as stacking strength, puncture resistance, and moisture resistance are key areas of focus, alongside improved sustainability through the use of higher recycled content and novel bio-based coatings.

Key Drivers, Barriers & Challenges in Corrugated & Paperboard Boxes Industry

Key Drivers:

The primary forces propelling the corrugated and paperboard boxes industry include the relentless growth of e-commerce, demanding robust and cost-effective shipping solutions. The increasing consumer and regulatory demand for sustainable packaging is a significant driver, pushing innovation towards recycled content and biodegradable materials. Technological advancements in printing and structural design enable customization and enhanced product appeal. The Food and Beverage sector, with its consistent demand, also acts as a major growth accelerator.

Barriers & Challenges:

A significant challenge is the fluctuating cost of raw materials, particularly pulp and energy, which can impact profitability. Supply chain disruptions, as witnessed in recent years, can lead to material shortages and increased lead times. Intense competition from alternative packaging materials like plastics and flexible films poses a constant threat. Moreover, stringent and diverse regulatory requirements across different geographical markets can add complexity and cost to operations. The capital-intensive nature of advanced manufacturing technologies can also be a barrier for smaller players.

Emerging Opportunities in Corrugated & Paperboard Boxes Industry

Emerging opportunities lie in the development of specialized packaging for the booming plant-based food and alternative protein markets, requiring enhanced barrier properties and temperature control. The growing demand for personalized and custom-branded packaging, driven by e-commerce and direct-to-consumer models, presents significant potential for digital printing solutions. Furthermore, the exploration of advanced coatings and barrier technologies to improve the shelf-life of packaged goods, particularly perishables, is a key area for innovation. The integration of smart packaging features, such as QR codes for traceability and anti-counterfeiting measures, also offers new avenues for value creation.

Growth Accelerators in the Corrugated & Paperboard Boxes Industry Industry

Catalysts for long-term growth include continued advancements in sustainable papermaking processes, such as the development of closed-loop systems and the increased utilization of agricultural waste for pulp production. Strategic partnerships between paperboard manufacturers, logistics providers, and e-commerce platforms can streamline supply chains and foster collaborative innovation. Market expansion into developing economies, where the adoption of modern packaging solutions is still nascent, represents a significant growth frontier. Furthermore, the development of high-performance, lightweight corrugated materials that can substitute for heavier packaging alternatives will drive efficiency and cost savings across various industries.

Key Players Shaping the Corrugated & Paperboard Boxes Industry Market

- WestRock Company

- Smurfit Kappa Inc

- International Paper Company Inc

- Graphic Packaging International Inc

- Mondi Group

- Georgia-Pacific LLC

- Oji Holding Corporation

- Packaging Corporation Of America

- Orora Packaging Australia Pty Ltd

- DS Smith Plc

- Nippon Paper Industries Co Ltd

- Cascades Inc

- Rengo Co Ltd

- Nine Dragons Paper (Holding) Limited

- Klabin S A

Notable Milestones in Corrugated & Paperboard Boxes Industry Sector

- 2020: Increased adoption of e-commerce packaging solutions due to global pandemic, leading to capacity expansion for many manufacturers.

- 2021: Growing emphasis on circular economy principles and increased investment in recycled fiber infrastructure.

- 2022: Significant advancements in digital printing technologies for corrugated packaging, enabling mass customization.

- 2023: Introduction of novel bio-based barrier coatings to enhance sustainability and product protection.

- 2024: Strategic mergers and acquisitions aimed at consolidating market share and expanding global reach.

In-Depth Corrugated & Paperboard Boxes Industry Market Outlook

The future outlook for the corrugated and paperboard boxes industry is robust, driven by sustained demand from the e-commerce sector and the imperative for sustainable packaging solutions. Growth accelerators like technological breakthroughs in material science, strategic partnerships across the value chain, and market expansion into emerging economies will continue to fuel expansion. The industry is well-positioned to capitalize on evolving consumer preferences for eco-friendly products and the increasing adoption of advanced packaging functionalities, offering significant strategic opportunities for market leaders and agile innovators.

Corrugated & Paperboard Boxes Industry Segmentation

-

1. Product

- 1.1. Corrugated and Solid Fiber Boxes

- 1.2. Folding Paperboard Boxes

- 1.3. Set-up Paperboard Boxes

- 1.4. Other Products

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Durable Goods

- 2.3. Paper & Publishing

- 2.4. Chemicals

- 2.5. Other End-user Industries

Corrugated & Paperboard Boxes Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Corrugated & Paperboard Boxes Industry Regional Market Share

Geographic Coverage of Corrugated & Paperboard Boxes Industry

Corrugated & Paperboard Boxes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in E - commerce Sales; Growing Consumer Awareness on Paper Packaging

- 3.3. Market Restrains

- 3.3.1. ; Availability of High-performance Substitutes; Rising Operational Costs

- 3.4. Market Trends

- 3.4.1. Food and Beverage Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Corrugated & Paperboard Boxes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Corrugated and Solid Fiber Boxes

- 5.1.2. Folding Paperboard Boxes

- 5.1.3. Set-up Paperboard Boxes

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Durable Goods

- 5.2.3. Paper & Publishing

- 5.2.4. Chemicals

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Corrugated & Paperboard Boxes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Corrugated and Solid Fiber Boxes

- 6.1.2. Folding Paperboard Boxes

- 6.1.3. Set-up Paperboard Boxes

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverage

- 6.2.2. Durable Goods

- 6.2.3. Paper & Publishing

- 6.2.4. Chemicals

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Corrugated & Paperboard Boxes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Corrugated and Solid Fiber Boxes

- 7.1.2. Folding Paperboard Boxes

- 7.1.3. Set-up Paperboard Boxes

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverage

- 7.2.2. Durable Goods

- 7.2.3. Paper & Publishing

- 7.2.4. Chemicals

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Corrugated & Paperboard Boxes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Corrugated and Solid Fiber Boxes

- 8.1.2. Folding Paperboard Boxes

- 8.1.3. Set-up Paperboard Boxes

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverage

- 8.2.2. Durable Goods

- 8.2.3. Paper & Publishing

- 8.2.4. Chemicals

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Corrugated & Paperboard Boxes Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Corrugated and Solid Fiber Boxes

- 9.1.2. Folding Paperboard Boxes

- 9.1.3. Set-up Paperboard Boxes

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverage

- 9.2.2. Durable Goods

- 9.2.3. Paper & Publishing

- 9.2.4. Chemicals

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East Corrugated & Paperboard Boxes Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Corrugated and Solid Fiber Boxes

- 10.1.2. Folding Paperboard Boxes

- 10.1.3. Set-up Paperboard Boxes

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food and Beverage

- 10.2.2. Durable Goods

- 10.2.3. Paper & Publishing

- 10.2.4. Chemicals

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WestRock Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smurfit Kappa Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 International Paper Company Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Graphic Packaging International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mondi Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Georgia-Pacific LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oji Holding Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Packaging Corporation Of America

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Orora Packaging Australia Pty Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DS Smith Plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nippon Paper Industries Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cascades Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rengo Co Ltd*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nine Dragons Paper (Holding) Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Klabin S A

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 WestRock Company

List of Figures

- Figure 1: Global Corrugated & Paperboard Boxes Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Corrugated & Paperboard Boxes Industry Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Corrugated & Paperboard Boxes Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Corrugated & Paperboard Boxes Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Corrugated & Paperboard Boxes Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Corrugated & Paperboard Boxes Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Corrugated & Paperboard Boxes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Corrugated & Paperboard Boxes Industry Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Corrugated & Paperboard Boxes Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Corrugated & Paperboard Boxes Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Corrugated & Paperboard Boxes Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Corrugated & Paperboard Boxes Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Corrugated & Paperboard Boxes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Corrugated & Paperboard Boxes Industry Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Corrugated & Paperboard Boxes Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Corrugated & Paperboard Boxes Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Corrugated & Paperboard Boxes Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Corrugated & Paperboard Boxes Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Corrugated & Paperboard Boxes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Corrugated & Paperboard Boxes Industry Revenue (billion), by Product 2025 & 2033

- Figure 21: South America Corrugated & Paperboard Boxes Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Corrugated & Paperboard Boxes Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Corrugated & Paperboard Boxes Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Corrugated & Paperboard Boxes Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Corrugated & Paperboard Boxes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Corrugated & Paperboard Boxes Industry Revenue (billion), by Product 2025 & 2033

- Figure 27: Middle East Corrugated & Paperboard Boxes Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East Corrugated & Paperboard Boxes Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East Corrugated & Paperboard Boxes Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Corrugated & Paperboard Boxes Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Corrugated & Paperboard Boxes Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Corrugated & Paperboard Boxes Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Corrugated & Paperboard Boxes Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Corrugated & Paperboard Boxes Industry?

Key companies in the market include WestRock Company, Smurfit Kappa Inc, International Paper Company Inc, Graphic Packaging International Inc, Mondi Group, Georgia-Pacific LLC, Oji Holding Corporation, Packaging Corporation Of America, Orora Packaging Australia Pty Ltd, DS Smith Plc, Nippon Paper Industries Co Ltd, Cascades Inc, Rengo Co Ltd*List Not Exhaustive, Nine Dragons Paper (Holding) Limited, Klabin S A.

3. What are the main segments of the Corrugated & Paperboard Boxes Industry?

The market segments include Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 124.92 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growth in E - commerce Sales; Growing Consumer Awareness on Paper Packaging.

6. What are the notable trends driving market growth?

Food and Beverage Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Availability of High-performance Substitutes; Rising Operational Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Corrugated & Paperboard Boxes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Corrugated & Paperboard Boxes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Corrugated & Paperboard Boxes Industry?

To stay informed about further developments, trends, and reports in the Corrugated & Paperboard Boxes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence