Key Insights

The Russia Glass Packaging Market is projected to reach USD 61.5 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 4%. This expansion is propelled by the rising demand for premium and sustainable packaging across key sectors. The beverage industry, especially for liquor, beer, and soft drinks, remains a primary driver, influenced by consumer preference for attractive and eco-friendly options. The food sector also sees increased adoption of glass for its preservation qualities and aesthetic appeal. Pharmaceuticals rely on glass for its inertness and safety in packaging medicines. Advancements in glass manufacturing, including lighter, durable containers and enhanced recyclability, further support market growth.

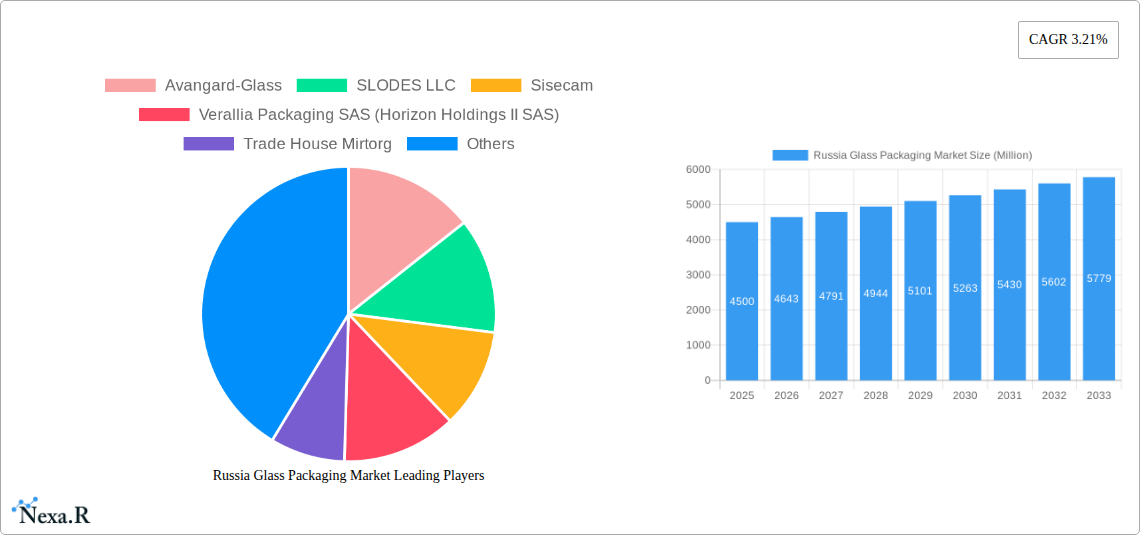

Russia Glass Packaging Market Market Size (In Billion)

Key market trends include the growing demand for customized and uniquely shaped glass containers, particularly in the cosmetics and luxury beverage segments, to enhance brand differentiation. A significant shift towards sustainable packaging, driven by consumer and regulatory emphasis on recycled content and recyclability, is also evident. While the market shows strong growth prospects, potential restraints include raw material price volatility (soda ash, sand) affecting production costs, and logistical challenges with higher transportation expenses compared to lighter materials. Nevertheless, the inherent advantages of glass, such as inertness, impermeability, and perceived premium quality, are expected to sustain demand.

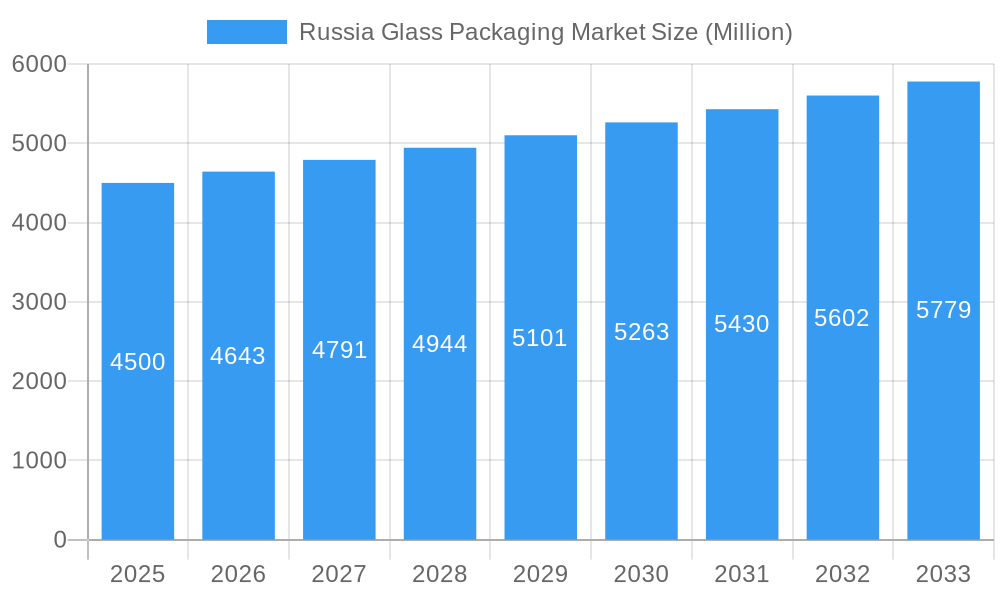

Russia Glass Packaging Market Company Market Share

Russia Glass Packaging Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a granular analysis of the Russia glass packaging market, encompassing bottles and containers, jars, ampoules, vials, and syringes. Delving into beverage packaging (liquor, beer, soft drinks) and food packaging, as well as pharmaceutical and cosmetic applications, this study offers crucial insights for stakeholders. Explore market dynamics, growth trends, regional dominance, product innovations, key players, and future opportunities from 2019 to 2033, with a base and estimated year of 2025. Discover the impact of industry developments such as the 2022 Ukraine invasion and European gas shortage concerns on the Russian glass packaging sector.

Russia Glass Packaging Market Market Dynamics & Structure

The Russia glass packaging market exhibits a moderately concentrated structure, with a few key players dominating a significant portion of the market share. Technological innovation remains a crucial driver, particularly in areas like lightweighting of glass bottles and containers and enhanced barrier properties for glass jars used in food preservation. However, adoption rates for cutting-edge technologies can be influenced by the economic climate and investment capacity of smaller manufacturers. Regulatory frameworks concerning food safety, pharmaceutical packaging standards, and environmental impact are continuously evolving, posing both compliance challenges and opportunities for innovation.

- Market Concentration: Leading companies collectively hold an estimated XX% of the market share, with regional players focusing on specific product niches.

- Technological Innovation: Focus on sustainable manufacturing processes, including energy-efficient furnace designs and increased recycled glass content in glass packaging production.

- Regulatory Frameworks: Strict adherence to GOST standards for food and beverage contact materials, and evolving regulations for pharmaceutical and cosmetic packaging.

- Competitive Product Substitutes: While glass packaging offers superior barrier properties and aesthetic appeal, competition from PET bottles, cartons, and flexible packaging for certain applications remains a consideration.

- End-User Demographics: Growing middle class and an increasing demand for premium and artisanal products in the beverage and food sectors are influencing the types of glass packaging sought.

- M&A Trends: Limited significant M&A activity reported in recent years, with a focus on organic growth and capacity expansion by existing players.

Russia Glass Packaging Market Growth Trends & Insights

The Russia glass packaging market is poised for steady growth, driven by evolving consumer preferences and the inherent advantages of glass as a packaging material. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This growth is underpinned by an increasing demand for sustainable and premium packaging solutions, particularly within the beverage sector (liquor, beer, soft drinks) and the food industry. Adoption rates for advanced glass packaging technologies, such as hot-filling capabilities for glass jars and high-precision ampoules and vials for pharmaceuticals, are on an upward trajectory.

Consumer behavior shifts towards healthier lifestyles are indirectly benefiting the glass packaging market, as consumers increasingly opt for natural and preservative-free food and beverage products, where glass offers a perceived superior quality and safety. Technological disruptions in manufacturing processes, focusing on energy efficiency and reduced carbon footprint, are also influencing market dynamics. The pharmaceutical segment, with its stringent requirements for product integrity and safety, continues to be a robust driver for high-quality glass vials and syringes. The overall market penetration of glass packaging in Russia is expected to strengthen as its benefits in terms of inertness, recyclability, and brand perception become more widely recognized. The Russia glass containers market is a significant sub-segment of this broader industry.

Dominant Regions, Countries, or Segments in Russia Glass Packaging Market

The Russia glass packaging market is largely dominated by the Bottles and Containers product segment, which accounts for an estimated XX% of the total market value. This dominance is primarily fueled by the expansive Beverage end-user industry, encompassing liquor, beer, and soft drinks, where glass remains the preferred choice for its ability to preserve taste, aroma, and carbonation. Within the beverage sector, the liquor segment particularly drives demand for premium and specialty glass bottles. The Food segment, with its broad range of applications from jams and preserves to sauces and baby food, also contributes significantly to the demand for glass jars and containers.

The Pharmaceutical sector, while a smaller segment by volume, represents a high-value market for glass vials and ampoules due to the critical need for sterile and inert packaging for drugs and vaccines. Economic policies supporting domestic production and consumption, coupled with robust distribution networks, are key drivers in the leading regions. Infrastructure development, particularly in manufacturing hubs, facilitates efficient production and supply chains for glass packaging manufacturers.

- Bottles and Containers: Holds the largest market share due to extensive use in beverages and food products.

- Liquor Bottles: Demand driven by premiumization and gifting culture.

- Beer Bottles: Resurgence in popularity due to environmental concerns and perceived quality.

- Soft Drink Bottles: Continued demand for carbonated beverages.

- Beverage End-User Industry: The largest end-user sector, encompassing a wide range of alcoholic and non-alcoholic drinks.

- Market Share: Estimated XX% of the overall glass packaging market.

- Growth Potential: Driven by evolving consumer tastes and preference for traditional packaging.

- Food End-User Industry: Significant contributor with applications in various food categories.

- Key Drivers: Demand for safe, long-shelf-life food products.

- Product Focus: Jars for preserves, condiments, and ready-to-eat meals.

- Russia's Central Federal District: Often considered a dominant region due to its high population density, concentration of major beverage and food producers, and developed logistics infrastructure, thereby driving substantial demand for glass packaging.

Russia Glass Packaging Market Product Landscape

The Russia glass packaging market is characterized by a diverse product landscape catering to a wide array of consumer and industrial needs. Innovation in glass bottles and containers is focused on achieving lighter weights without compromising strength, enhancing design aesthetics for premium brands, and improving barrier properties to extend shelf life. The pharmaceutical segment is witnessing advancements in vials and ampoules with specialized coatings and tamper-evident features to ensure drug integrity and patient safety. Innovations in glass jars are geared towards ease of opening and improved sealing mechanisms for food products. The market also includes specialized product types like syringes, where precision manufacturing and material purity are paramount.

Key Drivers, Barriers & Challenges in Russia Glass Packaging Market

The Russia glass packaging market is propelled by several key drivers, including the growing consumer preference for sustainable and premium packaging, the inherent inertness and recyclability of glass, and the expanding demand from the beverage and food industries. Technological advancements in manufacturing, such as energy-efficient furnaces and lightweighting techniques, also contribute to market growth.

However, the market faces significant barriers and challenges. The Russia's invasion of Ukraine and subsequent geopolitical tensions have led to increased raw material costs, particularly for energy and soda ash, impacting production expenses. Supply chain disruptions and the potential for reduced export opportunities pose considerable hurdles. Furthermore, competition from alternative packaging materials like PET and cartons, especially in price-sensitive segments, remains a persistent challenge. Regulatory complexities and the need for continuous investment in modernizing production facilities also present challenges for market participants.

Emerging Opportunities in Russia Glass Packaging Market

Emerging opportunities in the Russia glass packaging market lie in the increasing demand for sustainable and eco-friendly packaging solutions, aligning with global environmental trends. The premiumization trend within the beverage (especially liquor and craft beer) and food sectors presents a significant opportunity for customized and aesthetically appealing glass bottles and jars. The growing pharmaceutical industry's need for high-quality, sterile vials and ampoules offers another avenue for growth. Furthermore, advancements in recycling technologies and the development of closed-loop systems can create new business models and enhance the sustainability proposition of glass packaging.

Growth Accelerators in the Russia Glass Packaging Market Industry

The Russia glass packaging market industry is experiencing significant growth acceleration fueled by several factors. The inherent benefits of glass, such as its inertness, recyclability, and perceived premium quality, continue to drive consumer and industry preference. Technological breakthroughs in manufacturing, including energy-efficient furnace designs and the adoption of advanced automation, are leading to improved productivity and cost efficiencies. Strategic partnerships between glass packaging manufacturers and key end-users, particularly in the beverage and pharmaceutical sectors, are fostering innovation and ensuring a consistent demand pipeline. Market expansion strategies, including capacity enhancements and the development of specialized product lines for niche applications, are further accelerating growth.

Key Players Shaping the Russia Glass Packaging Market Market

- Avangard-Glass

- SLODES LLC

- Sisecam

- Verallia Packaging SAS (Horizon Holdings II SAS)

- Trade House Mirtorg

- Ardagh Group S A

- SIBSTEKLO LTD

- Saverglass

- Melnir

- GRODNO GLASSWORKS JSC

Notable Milestones in Russia Glass Packaging Market Sector

- November 2022: Russia's invasion of Ukraine in February 2022 unexpectedly impacted the global wine trade, driving up the price and availability of wine bottles and glassware, thus presenting turbulent times for glass packaging companies.

- August 2022: European companies, including glass manufacturers reliant on Russian gas, prepared for potential gas shortages into winter. Maximilian Riedel's family business, with furnaces running for 11 generations, noted reliance on Russian gas for two factories producing 60 million units of machine-made glasses annually, alongside an electric-powered plant for hand-made glasses.

In-Depth Russia Glass Packaging Market Market Outlook

The Russia glass packaging market is set for a robust future, driven by the unwavering demand for sustainable, safe, and premium packaging solutions. The ongoing trend towards premiumization in the beverage and food sectors, coupled with the critical requirements of the pharmaceutical industry for high-quality glass vials and ampoules, will continue to be major growth catalysts. Investment in advanced manufacturing technologies aimed at enhancing energy efficiency and reducing environmental impact will be crucial for long-term success. Strategic collaborations and a focus on circular economy principles, including increased use of recycled glass, will further bolster the market's growth trajectory and appeal. The inherent advantages of glass ensure its continued relevance and expansion in the coming years.

Russia Glass Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Containers

- 1.2. Ampoules

- 1.3. Vials

- 1.4. Syringes

- 1.5. Jars

- 1.6. Other Product Types

-

2. End-User Industry

-

2.1. Beverage

- 2.1.1. Liquor

- 2.1.2. Beer

- 2.1.3. Soft Drinks

- 2.1.4. Other Beverages

- 2.2. Food

- 2.3. Cosmetics

- 2.4. Pharmaceutical

- 2.5. Other End-user Industries

-

2.1. Beverage

Russia Glass Packaging Market Segmentation By Geography

- 1. Russia

Russia Glass Packaging Market Regional Market Share

Geographic Coverage of Russia Glass Packaging Market

Russia Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Shift Towards Sustainable Packaging Due to Stringent Regulations; Growing Adoption of Premium Glass packaging in End-user Industries such as Beverage and Cosmetics; Bottles are Expected to Hold Prominent Share

- 3.3. Market Restrains

- 3.3.1. Alternative Forms of Packaging is Challenging the Market Growth

- 3.4. Market Trends

- 3.4.1. Bottles are Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Glass Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Containers

- 5.1.2. Ampoules

- 5.1.3. Vials

- 5.1.4. Syringes

- 5.1.5. Jars

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Beverage

- 5.2.1.1. Liquor

- 5.2.1.2. Beer

- 5.2.1.3. Soft Drinks

- 5.2.1.4. Other Beverages

- 5.2.2. Food

- 5.2.3. Cosmetics

- 5.2.4. Pharmaceutical

- 5.2.5. Other End-user Industries

- 5.2.1. Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Avangard-Glass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SLODES LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sisecam

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Verallia Packaging SAS (Horizon Holdings II SAS)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trade House Mirtorg

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardagh Group S A *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIBSTEKLO LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saverglass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Melnir

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GRODNO GLASSWORKS JSC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Avangard-Glass

List of Figures

- Figure 1: Russia Glass Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Glass Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Glass Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Russia Glass Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Russia Glass Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Glass Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Russia Glass Packaging Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: Russia Glass Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Glass Packaging Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Russia Glass Packaging Market?

Key companies in the market include Avangard-Glass, SLODES LLC, Sisecam, Verallia Packaging SAS (Horizon Holdings II SAS), Trade House Mirtorg, Ardagh Group S A *List Not Exhaustive, SIBSTEKLO LTD, Saverglass, Melnir, GRODNO GLASSWORKS JSC.

3. What are the main segments of the Russia Glass Packaging Market?

The market segments include Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 61.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Shift Towards Sustainable Packaging Due to Stringent Regulations; Growing Adoption of Premium Glass packaging in End-user Industries such as Beverage and Cosmetics; Bottles are Expected to Hold Prominent Share.

6. What are the notable trends driving market growth?

Bottles are Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Alternative Forms of Packaging is Challenging the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022 - Russia's invasion of Ukraine in February 2022 unexpectedly impacted the global wine trade. It drove up the price and availability of wine bottles and glassware. Thus, glass packaging companies have faced turbulent times.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Russia Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence