Key Insights

The European frozen food packaging market is projected for substantial growth, reaching an estimated market size of $11.95 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.34% through 2033. This expansion is driven by shifting consumer lifestyles, escalating demand for convenient food options, and a growing consumer preference for frozen foods attributed to their perceived health benefits and sustainability. The market features a diverse array of packaging materials, with glass, paper, and plastic holding significant roles. Glass provides superior barrier properties and a premium aesthetic, while paper-based options are increasingly favored for their environmental advantages. Plastic remains a dominant material due to its adaptability, cost-efficiency, and durability, particularly for trays and tubs. A key trend is the demand for advanced packaging solutions that enhance shelf life, preserve food quality, and improve consumer appeal, encompassing innovations in material science, active and intelligent packaging, and eco-friendly alternatives to conventional plastics.

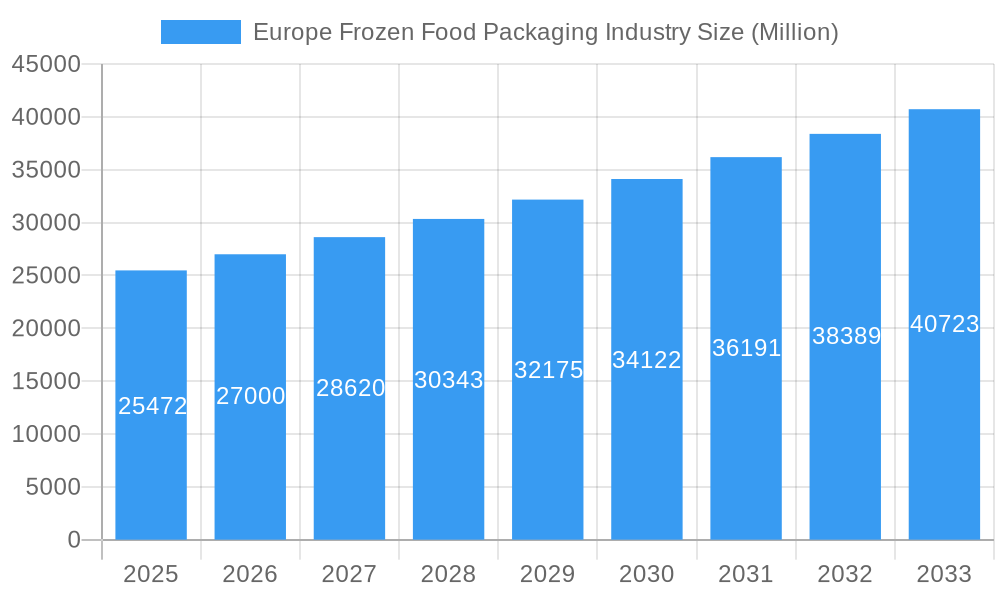

Europe Frozen Food Packaging Industry Market Size (In Billion)

Key growth catalysts include the expanding retail presence for frozen foods, especially in developing European economies, and ongoing innovation in frozen food product categories, such as ready-to-eat meals, baked goods, and premium seafood and meat items. The inherent convenience of frozen foods, enabling consumers to store and prepare meals on demand, further supports market expansion. Conversely, the market faces challenges such as stringent environmental regulations on plastic waste and increasing raw material costs. Nevertheless, the persistent focus on sustainable packaging solutions, alongside technological advancements in printing and barrier technologies, will define the future trajectory of the European frozen food packaging sector, ensuring sustained growth and evolution. The market's segmentation by packaging product types, including bags, boxes, tubs, cups, and trays, highlights the varied requirements of the frozen food industry.

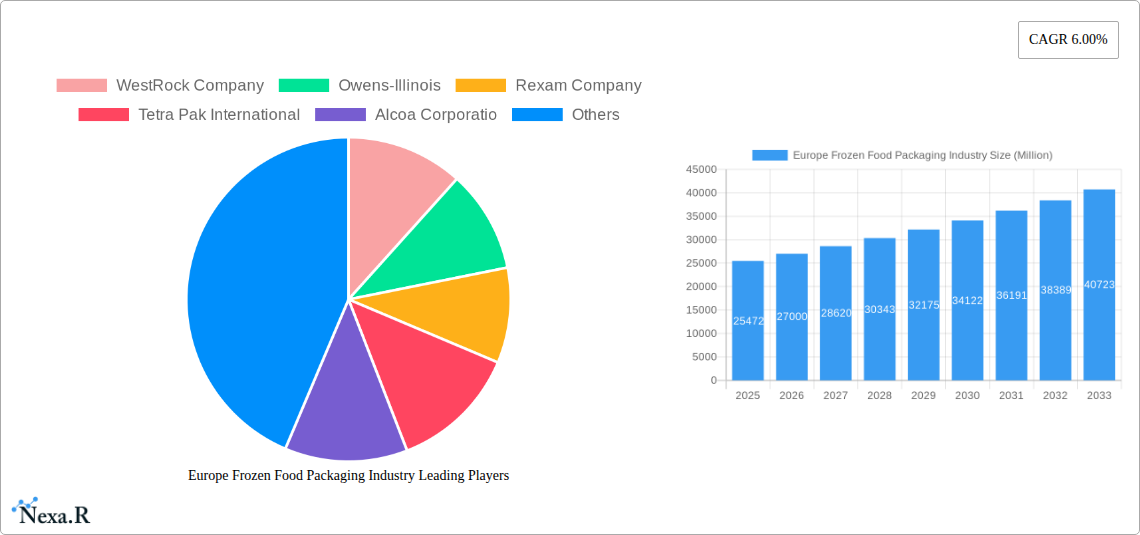

Europe Frozen Food Packaging Industry Company Market Share

Europe Frozen Food Packaging Market: Industry Analysis, Growth Trajectories, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Europe frozen food packaging market, offering an in-depth analysis of its structure, growth trends, dominant segments, and future potential. With a detailed examination from 2019 to 2033, including a base year of 2025 and a forecast period from 2025–2033, this report equips industry professionals with crucial insights for strategic decision-making. We meticulously analyze key segments such as primary materials (Glass, Paper, Metal, Plastic, Others), packaging product types (Bags, Boxes, Tubs and Cups, Trays, Wrappers, Pouches, Other Types of Packaging), and food product types (Readymade Meals, Fruits and Vegetables, Meat, Sea Food, Baked Goods, Others). Explore critical industry developments and understand the strategic landscape shaped by leading players like WestRock Company, Owens-Illinois, Rexam Company, Tetra Pak International, Alcoa Corporation, Nuconic Packaging, The Scoular Company, Toyo Seikan Group Holdings Ltd, Graham Packaging Company Inc, Ball Corporation Inc, Crown Holdings, Placon Corporation, Genpak LLC, Pactiv, and Amcor Ltd. This report is your definitive guide to the European frozen food packaging industry, providing a granular view of market dynamics, competitive strategies, and emerging opportunities.

Europe Frozen Food Packaging Industry Market Dynamics & Structure

The Europe frozen food packaging market is characterized by a moderate to high degree of market concentration, with key players like Amcor Ltd and Tetra Pak International holding significant shares. Technological innovation is a primary driver, particularly in developing sustainable and advanced barrier properties for extended shelf life and food safety. Regulatory frameworks, such as the EU's Packaging and Packaging Waste Regulation, significantly influence material choices and design, pushing for recyclability and reduced environmental impact. Competitive product substitutes are emerging, especially in the plant-based and ready-to-eat meal sectors, demanding innovative packaging solutions. End-user demographics are shifting towards convenience-seeking millennials and an aging population, both driving demand for easy-to-prepare frozen meals. Mergers and acquisitions (M&A) trends are evident, with larger companies acquiring smaller, innovative firms to expand their product portfolios and geographical reach. For instance, there have been approximately 15-20 M&A deals in the past five years, focusing on sustainable packaging solutions and advanced material technologies.

- Market Concentration: Moderate to high, with key players dominating specific segments.

- Technological Innovation: Driven by sustainability, barrier properties, and smart packaging.

- Regulatory Frameworks: EU regulations on packaging waste and food safety are key influencers.

- Competitive Substitutes: Increasing demand for premium and convenient frozen food options.

- End-User Demographics: Convenience-driven younger generations and an aging population.

- M&A Trends: Focus on sustainable solutions and market expansion.

Europe Frozen Food Packaging Industry Growth Trends & Insights

The Europe frozen food packaging market is projected to witness robust growth, driven by evolving consumer lifestyles and increasing demand for convenience foods. The market size is estimated to grow from approximately 7,500 million units in 2025 to over 9,800 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 3.2%. Adoption rates for advanced and sustainable packaging solutions are rapidly increasing, influenced by growing environmental consciousness and stringent regulations. Technological disruptions, such as the development of biodegradable plastics and improved barrier coatings, are reshaping the market. Consumer behavior shifts towards a preference for portion-controlled, healthy, and ready-to-cook frozen meals are also significantly impacting packaging requirements. The market penetration of specialized frozen food packaging, designed to maintain product integrity and appeal, is expected to expand significantly. For instance, the adoption of recyclable and compostable packaging materials has seen a year-on-year increase of 7% in the last two years. The growth is further fueled by the expansion of e-commerce for frozen food delivery, necessitating robust and temperature-controlled packaging solutions. Innovations in active and intelligent packaging, aimed at extending shelf life and providing real-time product monitoring, are also gaining traction, although their market penetration is still in its nascent stages. The shift towards plant-based diets is also creating new opportunities for frozen food packaging, requiring specific solutions to maintain texture and taste.

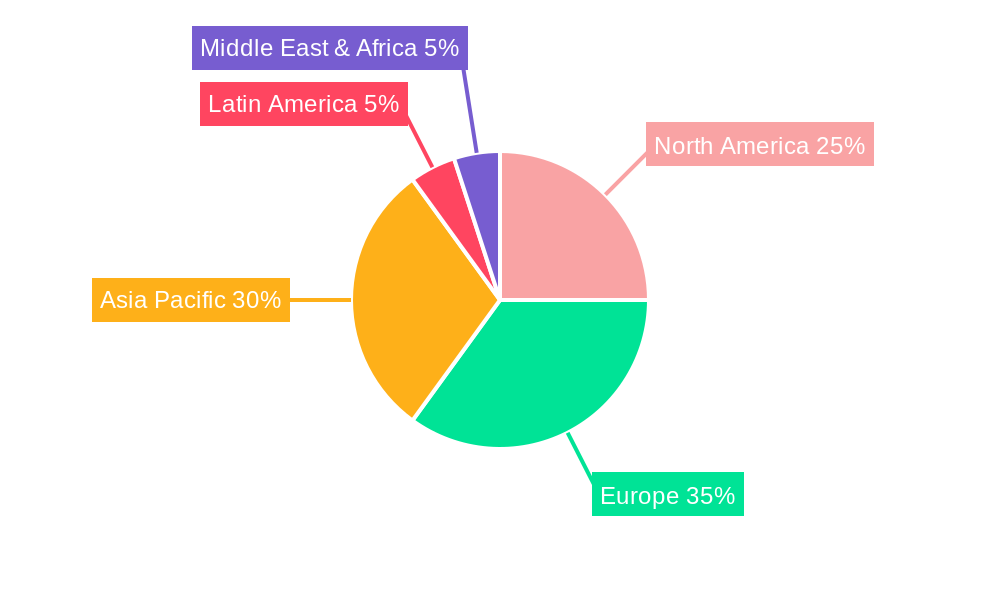

Dominant Regions, Countries, or Segments in Europe Frozen Food Packaging Industry

The Plastic segment, particularly in the form of Tubs and Cups, and Bags and Pouches, is expected to be a dominant force in the Europe frozen food packaging market. This dominance is attributed to the material's versatility, cost-effectiveness, and excellent barrier properties, crucial for preserving the quality of frozen foods like Readymade Meals, Fruits and Vegetables, and Meat. Geographically, Germany, France, and the United Kingdom are anticipated to lead the market due to their large consumer bases, high disposable incomes, and advanced retail infrastructure. The Readymade Meals food product segment is experiencing substantial growth, driven by busy lifestyles and a demand for convenient, quick-to-prepare options, which directly translates to a higher need for specialized frozen food packaging solutions.

- Primary Material Dominance: Plastic is expected to lead due to its versatility and cost-effectiveness.

- Excellent barrier properties for frozen food preservation.

- Wide range of applications across various food types.

- Packaging Product Dominance: Tubs and Cups, Bags, and Pouches are key.

- Tubs and cups are ideal for ready meals and ice cream.

- Bags and pouches offer flexibility for fruits, vegetables, and meats.

- Food Product Dominance: Readymade Meals are a primary growth driver.

- Increasing consumer demand for convenience and variety.

- Development of diverse frozen meal options, from ethnic cuisines to healthy alternatives.

- Dominant Regions: Germany, France, and the UK are expected to lead.

- Large and affluent consumer populations.

- Well-developed cold chain logistics and retail networks.

- High adoption rates for frozen food products.

- Key Drivers for Dominance:

- Economic Policies: Supportive policies for food processing and retail sectors.

- Infrastructure: Robust cold chain logistics and distribution networks.

- Consumer Preferences: Growing acceptance and demand for frozen convenience foods.

- Technological Advancements: Innovations in plastic packaging for improved shelf life and sustainability.

Europe Frozen Food Packaging Industry Product Landscape

Innovations in Europe frozen food packaging are focused on enhancing sustainability, functionality, and consumer appeal. Advancements in recyclable and compostable plastics, such as high-barrier bio-polymers, are gaining traction, addressing environmental concerns. The development of multi-layer films with improved oxygen and moisture barrier properties extends the shelf life of frozen foods, preserving freshness and flavor. Smart packaging solutions, incorporating QR codes for traceability and temperature indicators, are emerging to enhance consumer trust and product safety. Applications range from retort pouches for ready meals that can be heated directly in the packaging to resealable trays for portioned vegetables, optimizing convenience and minimizing waste. Performance metrics like puncture resistance, seal integrity, and freeze-thaw stability are critical. Unique selling propositions often lie in the packaging's ability to offer a premium unboxing experience while maintaining eco-friendly credentials.

Key Drivers, Barriers & Challenges in Europe Frozen Food Packaging Industry

Key Drivers:

- Growing Demand for Convenience: Busy lifestyles and an increasing need for quick meal solutions.

- Technological Advancements: Innovations in materials science for improved barrier properties and sustainability.

- Sustainability Initiatives: Rising consumer and regulatory pressure for eco-friendly packaging.

- Expansion of E-commerce: Growth in online grocery shopping for frozen goods.

- Product Innovation in Frozen Foods: New product development in ready meals, plant-based alternatives, and premium offerings.

Barriers & Challenges:

- Cost of Sustainable Materials: Higher initial costs associated with eco-friendly packaging alternatives.

- Regulatory Complexity: Navigating diverse and evolving environmental regulations across EU member states.

- Supply Chain Disruptions: Potential for raw material shortages and logistics challenges affecting production.

- Consumer Education on Recycling: Need for clearer consumer guidance on proper disposal of specialized packaging.

- Competition from Fresh Produce: Ongoing competition from fresh food alternatives, impacting market share.

Emerging Opportunities in Europe Frozen Food Packaging Industry

Emerging opportunities in the Europe frozen food packaging market are centered around circular economy principles and enhanced consumer engagement. The development of advanced recycling technologies for multi-material packaging presents a significant opportunity for material recovery and reuse. Untapped markets include personalized frozen meal portions catering to specific dietary needs and preferences, requiring flexible and innovative packaging designs. Evolving consumer preferences for transparency and traceability are driving demand for smart packaging solutions that offer real-time information about the product's journey and quality. Furthermore, the growth of the plant-based food sector is creating demand for specialized frozen food packaging that can maintain the texture and integrity of these products during freezing and thawing. The integration of minimalist and aesthetically pleasing designs is also a growing trend, enhancing the premium appeal of frozen food products.

Growth Accelerators in the Europe Frozen Food Packaging Industry Industry

Long-term growth in the Europe frozen food packaging industry will be significantly accelerated by breakthroughs in bio-based and biodegradable materials, offering a viable alternative to conventional plastics. Strategic partnerships between packaging manufacturers, food producers, and waste management companies are crucial for establishing effective closed-loop recycling systems. The ongoing expansion of the cold chain infrastructure across emerging European markets will unlock new distribution channels for frozen food products, thereby boosting packaging demand. Furthermore, governmental support for innovation in sustainable packaging through grants and favorable policies will act as a significant catalyst. The increasing consumer willingness to pay a premium for sustainable and high-quality packaging further incentivizes investment and development in these areas.

Key Players Shaping the Europe Frozen Food Packaging Industry Market

- WestRock Company

- Owens-Illinois

- Rexam Company

- Tetra Pak International

- Alcoa Corporation

- Nuconic Packaging

- The Scoular Company

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company Inc

- Ball Corporation Inc

- Crown Holdings

- Placon Corporation

- Genpak LLC

- Pactiv

- Amcor Ltd

Notable Milestones in Europe Frozen Food Packaging Industry Sector

- 2019: Amcor Ltd's acquisition of Bemis Company, significantly expanding its global flexible packaging footprint.

- 2020: Increased focus on recyclable packaging solutions driven by new EU waste directives.

- 2021: Introduction of novel compostable films for frozen fruit and vegetable packaging by several manufacturers.

- 2022: Tetra Pak International launched initiatives for increased recycled content in its carton packaging.

- 2023: Growing investment in advanced barrier coatings for plastic films to enhance shelf life.

- 2024 (Estimated): Rise in the adoption of mono-material plastic packaging to improve recyclability.

In-Depth Europe Frozen Food Packaging Industry Market Outlook

The Europe frozen food packaging market is poised for sustained growth, driven by a confluence of consumer demand for convenience, environmental consciousness, and technological innovation. The transition towards a circular economy will be a defining characteristic, with a strong emphasis on recyclable, reusable, and biodegradable packaging solutions. Strategic alliances and investments in advanced material science will be critical for companies to maintain a competitive edge. Future growth will be significantly influenced by the expansion of the plant-based food sector and the continued evolution of e-commerce for frozen goods. The market outlook is overwhelmingly positive, with substantial opportunities for companies that can effectively integrate sustainability, functionality, and consumer appeal into their packaging offerings.

Europe Frozen Food Packaging Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Metal

- 1.4. Plastic

- 1.5. Others

-

2. Type of Packaging Product

- 2.1. Bags

- 2.2. Boxes

- 2.3. Tubs and Cups

- 2.4. Trays

- 2.5. Wrappers

- 2.6. Pouches

- 2.7. Other Types of Packaging

-

3. Type of Food Product

- 3.1. Readymade Meals

- 3.2. Fruits and Vegetables

- 3.3. Meat

- 3.4. Sea Food

- 3.5. Baked Goods

- 3.6. Others

Europe Frozen Food Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Frozen Food Packaging Industry Regional Market Share

Geographic Coverage of Europe Frozen Food Packaging Industry

Europe Frozen Food Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing demand for convenience by consumers; Increase in disposable income and changing consumer behavior

- 3.3. Market Restrains

- 3.3.1. ; Government Regulations and Interventions

- 3.4. Market Trends

- 3.4.1. Increasing demand for convenience by consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Frozen Food Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Plastic

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type of Packaging Product

- 5.2.1. Bags

- 5.2.2. Boxes

- 5.2.3. Tubs and Cups

- 5.2.4. Trays

- 5.2.5. Wrappers

- 5.2.6. Pouches

- 5.2.7. Other Types of Packaging

- 5.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 5.3.1. Readymade Meals

- 5.3.2. Fruits and Vegetables

- 5.3.3. Meat

- 5.3.4. Sea Food

- 5.3.5. Baked Goods

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WestRock Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Owens-Illinois

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rexam Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tetra Pak International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alcoa Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nuconic Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Scoular Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyo Seikan Group Holdings Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Graham Packaging Company Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ball Corporation Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Crown Holdings

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Placon Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Genpak LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pactiv

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Amcor Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 WestRock Company

List of Figures

- Figure 1: Europe Frozen Food Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Frozen Food Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Type of Packaging Product 2020 & 2033

- Table 3: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Type of Food Product 2020 & 2033

- Table 4: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Type of Packaging Product 2020 & 2033

- Table 7: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Type of Food Product 2020 & 2033

- Table 8: Europe Frozen Food Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Frozen Food Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Frozen Food Packaging Industry?

The projected CAGR is approximately 5.34%.

2. Which companies are prominent players in the Europe Frozen Food Packaging Industry?

Key companies in the market include WestRock Company, Owens-Illinois, Rexam Company, Tetra Pak International, Alcoa Corporatio, Nuconic Packaging, The Scoular Company, Toyo Seikan Group Holdings Ltd, Graham Packaging Company Inc, Ball Corporation Inc, Crown Holdings, Placon Corporation, Genpak LLC, Pactiv, Amcor Ltd.

3. What are the main segments of the Europe Frozen Food Packaging Industry?

The market segments include Primary Material, Type of Packaging Product , Type of Food Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.95 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing demand for convenience by consumers; Increase in disposable income and changing consumer behavior.

6. What are the notable trends driving market growth?

Increasing demand for convenience by consumers.

7. Are there any restraints impacting market growth?

; Government Regulations and Interventions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Frozen Food Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Frozen Food Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Frozen Food Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Frozen Food Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence