Key Insights

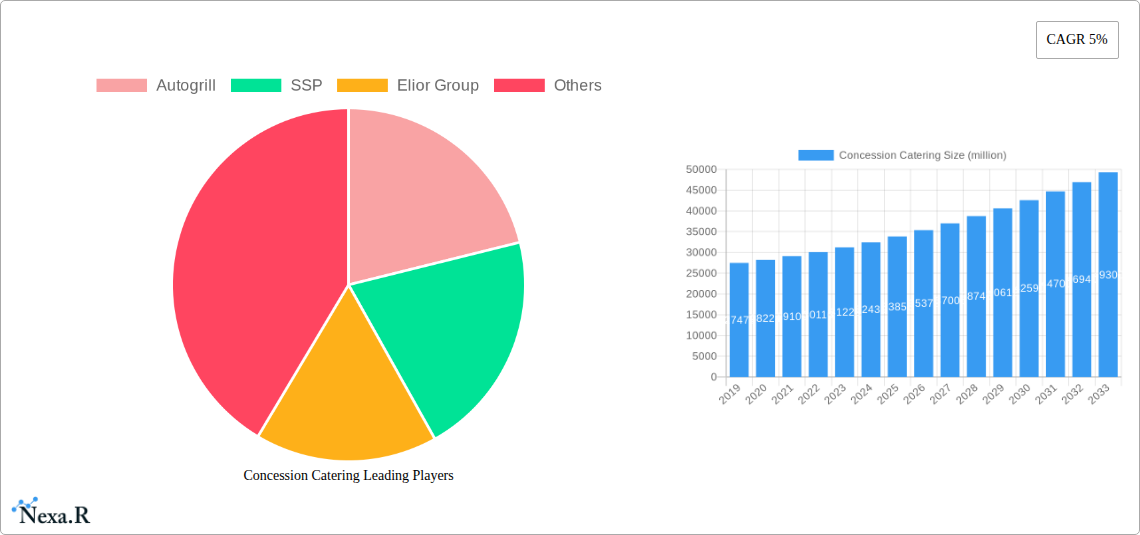

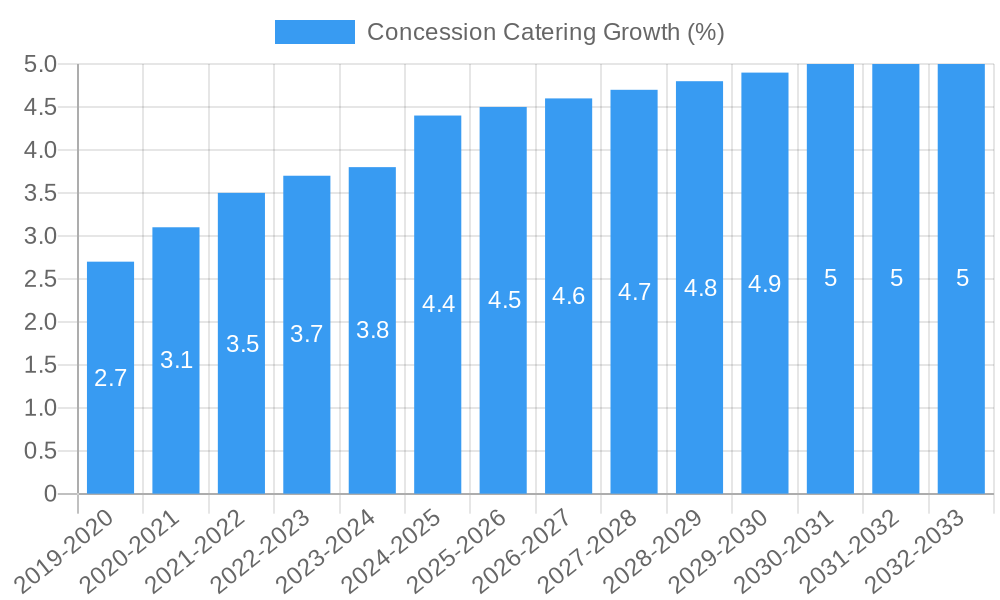

The global Concession Catering market is poised for robust growth, projected to reach an estimated USD 33,850 million by 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 5% over the study period of 2019-2033. This sustained momentum indicates a healthy and expanding sector, driven by increasing passenger traffic and evolving consumer preferences in travel and leisure hubs. The market's strength lies in its diverse applications, spanning high-volume environments like Airports and Motorways, as well as critical infrastructure such as Railways, and popular destinations like City Sites & Leisure. These segments collectively represent significant revenue streams and offer substantial opportunities for catering providers to innovate and cater to a wide array of tastes, from essential Food and Beverages to more specialized offerings. The presence of established players like Autogrill, SSP, and Elior Group underscores the competitive landscape and the strategic importance of these markets, driving investments in operational efficiency and customer experience.

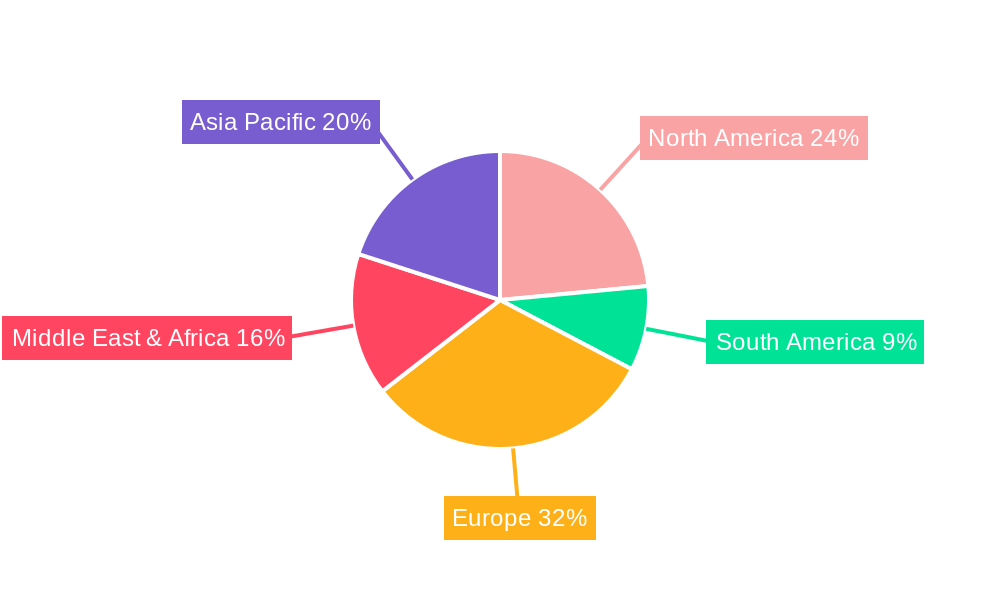

The anticipated growth in the Concession Catering market is further supported by key trends in the food and beverage industry, including a growing demand for healthier and more sustainable food options, the integration of digital technologies for ordering and payment, and the increasing emphasis on localized and artisanal offerings. While the market exhibits strong growth drivers, potential restraints such as fluctuating raw material costs and stringent food safety regulations will require strategic management by market participants. Geographically, the market is segmented across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, with each region presenting unique opportunities and challenges. The Asia Pacific region, in particular, is expected to witness significant expansion due to rapid urbanization, a growing middle class, and increased domestic and international travel. The strategic focus of major companies on enhancing their portfolio and expanding their geographical reach will be crucial in navigating this dynamic market.

This comprehensive report delves into the dynamic Concession Catering Market, providing an in-depth analysis of its structure, growth trajectory, and future outlook. Spanning the Study Period of 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033, this research offers critical insights for industry stakeholders. It meticulously examines the parent market and its extensive child markets, utilizing a vast array of high-traffic keywords to ensure maximum search engine visibility and engagement with industry professionals. All values are presented in million units, offering clear quantitative analysis.

Concession Catering Market Dynamics & Structure

The global concession catering market exhibits a moderately concentrated structure, with key players like Autogrill, SSP, and Elior Group holding significant market shares. Technological innovation, particularly in digital ordering platforms and sustainable food sourcing, is a primary driver of market evolution. Regulatory frameworks surrounding food safety, hygiene, and labor practices significantly influence operational standards across the sector. Competitive product substitutes include in-house food preparation by venue operators and the rise of independent food trucks and pop-up eateries. End-user demographics are diverse, encompassing travelers, commuters, event attendees, and local residents, each with distinct preferences and spending habits. Mergers and acquisitions (M&A) are a notable trend, aimed at expanding geographic reach, diversifying portfolios, and achieving economies of scale.

- Market Concentration: Dominated by a few large players, but with increasing fragmentation in niche segments.

- Technological Innovation Drivers: AI-powered analytics for demand forecasting, contactless payment solutions, and IoT for inventory management.

- Regulatory Frameworks: Strict adherence to global food safety standards (e.g., HACCP), local licensing, and sustainability mandates.

- Competitive Product Substitutes: Ghost kitchens, direct-to-consumer food delivery services, and smaller, independent catering providers.

- End-User Demographics: Young urban professionals, families, and business travelers with varying price sensitivities and demand for convenience.

- M&A Trends: Strategic acquisitions to enter new geographies or expand service offerings; divestitures of non-core assets.

Concession Catering Growth Trends & Insights

The Concession Catering Market is poised for robust expansion, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2025 and 2033. This growth is fueled by an increasing volume of travel, coupled with evolving consumer expectations for diverse and high-quality food and beverage options in transit and leisure hubs. The market size evolution is directly correlated with the recovery and subsequent growth of the parent market – global travel and leisure activities. Adoption rates of innovative service models, such as smart kiosks and personalized meal solutions, are rapidly increasing. Technological disruptions, including the integration of mobile ordering and payment systems, are enhancing customer experience and operational efficiency. Consumer behavior shifts, emphasizing a demand for healthier, locally sourced, and ethically produced food, are significantly shaping product offerings and brand partnerships. The penetration of specialized dietary options, such as vegan, gluten-free, and allergy-friendly menus, is also on an upward trajectory, reflecting a more health-conscious consumer base. This sustained growth is further supported by investments in upgrading facilities and improving the overall passenger and visitor experience, making concession catering an integral part of the service ecosystem in airports, motorways, railways, and city sites & leisure venues.

Dominant Regions, Countries, or Segments in Concession Catering

The Airports segment is a dominant force within the Concession Catering Market, driven by consistently high footfall and the captive nature of its customer base. In 2025, this segment is estimated to represent a market share of approximately 35% of the total global concession catering market. North America and Europe currently lead in terms of market value due to their mature aviation infrastructure and high passenger volumes. However, the Asia-Pacific region is emerging as a significant growth engine, propelled by expanding airline fleets, increasing disposable incomes, and the development of new international airports. The dominance of the airport segment is further amplified by the demand for a wide variety of food and beverages, catering to diverse palates and dietary needs, from quick-service options to sit-down dining experiences.

- Airports: Account for a substantial portion of the market due to passenger volume and dwell time.

- Key Drivers: Growing air travel, airport modernization projects, and demand for premium F&B experiences.

- Market Share: Estimated at 35% in 2025, with projected growth fueled by new route development.

- Growth Potential: High, especially in emerging economies and major international hubs.

- Motorways: Represent a consistent revenue stream driven by commuter traffic and long-haul travelers.

- Key Drivers: Infrastructure development, increased road travel, and demand for convenient F&B stops.

- Market Share: Estimated at 25% in 2025.

- Growth Potential: Stable, with opportunities in enhanced service offerings and technology integration.

- Railways: Benefits from increasing passenger rail usage and government investments in high-speed rail networks.

- Key Drivers: Growth in public transportation, urban mobility initiatives, and the need for onboard and station F&B.

- Market Share: Estimated at 20% in 2025.

- Growth Potential: Moderate, with significant expansion anticipated in developing nations.

- City Sites & Leisure: Encompasses stadiums, theme parks, and event venues, offering significant seasonal and event-driven opportunities.

- Key Drivers: Increased tourism, major sporting events, concerts, and cultural festivals.

- Market Share: Estimated at 20% in 2025.

- Growth Potential: High, but subject to event schedules and local consumer spending.

The Food segment within concession catering remains the primary revenue generator, with beverages playing a complementary but crucial role. The demand for diverse culinary options, including international cuisines and healthy eating choices, is a key differentiator.

Concession Catering Product Landscape

The concession catering product landscape is characterized by a constant stream of innovations aimed at enhancing customer convenience, taste, and health consciousness. Products range from readily available grab-and-go snacks and beverages to full-service dining experiences, with a growing emphasis on locally sourced ingredients and sustainable packaging. Unique selling propositions often lie in specialized dietary offerings, such as plant-based alternatives, gluten-free options, and allergen-conscious meals. Technological advancements are driving the development of smart vending machines offering a wider variety of fresh food and personalized ordering via mobile apps, further streamlining the purchase process and expanding product accessibility.

Key Drivers, Barriers & Challenges in Concession Catering

Key Drivers: The concession catering market is propelled by several powerful forces. Technological advancements, including digital ordering platforms and data analytics, are enhancing operational efficiency and customer personalization. The sustained recovery and growth in global travel and leisure activities directly translate into increased demand for concession services. Growing consumer preference for convenient, diverse, and high-quality food and beverage options, coupled with increasing disposable incomes in many regions, are significant drivers. Furthermore, government investments in infrastructure development, particularly in transportation hubs and tourist destinations, create expanded opportunities.

Barriers & Challenges: Despite the growth, the sector faces considerable challenges. Strict regulatory compliance regarding food safety and hygiene adds complexity and cost. Supply chain disruptions, exacerbated by geopolitical events and climate change, can impact ingredient availability and pricing. Intense competition from both established players and emerging food service models puts pressure on margins. Furthermore, managing labor shortages and retaining skilled staff in a demanding industry remains a persistent hurdle. The fluctuating nature of travel patterns and event attendance also poses a risk to consistent revenue streams.

Emerging Opportunities in Concession Catering

Emerging opportunities in the concession catering sector lie in the expansion of healthy and sustainable food options, catering to the growing demand for plant-based, organic, and locally sourced products. The integration of advanced technologies, such as AI-driven personalized recommendations and ghost kitchen models within larger venues, presents new avenues for revenue generation and improved operational efficiency. Furthermore, untapped markets in emerging economies with developing transportation infrastructure and a rising middle class offer significant growth potential. The focus on experiential dining, even in quick-service environments, also presents an opportunity to create unique and memorable food offerings that differentiate brands.

Growth Accelerators in the Concession Catering Industry

Growth accelerators in the concession catering industry are primarily driven by technological breakthroughs that enhance customer experience and operational efficiency, such as advanced mobile ordering and payment systems, and data analytics for personalized offerings. Strategic partnerships between concession operators and popular food brands, as well as with venue owners, are crucial for expanding reach and leveraging brand recognition. Market expansion strategies, including entering new geographical territories and diversifying service offerings to cater to evolving consumer preferences, are also significant growth catalysts. Investments in sustainable practices and the adoption of eco-friendly packaging are increasingly becoming a differentiator and a driver of consumer loyalty.

Key Players Shaping the Concession Catering Market

- Autogrill

- SSP

- Elior Group

- Hudson Group

- HMSHost Corporation

- Lagardère Travel Retail

- Compass Group

- Sodexo

- Areas

Notable Milestones in Concession Catering Sector

- 2019/03: Autogrill acquires HMSHost International, significantly expanding its global airport presence.

- 2020/01: SSP Group launches its "Eat Well" initiative focusing on healthier food options across its diverse portfolio.

- 2021/06: Elior Group strengthens its presence in the leisure segment with the acquisition of a major theme park caterer.

- 2022/09: Lagardère Travel Retail expands its food service offerings in key European railway stations.

- 2023/04: Hudson Group introduces advanced contactless payment solutions across its travel retail and food service locations.

- 2024/02: Compass Group reports strong recovery in its travel and leisure division post-pandemic, driven by increased passenger volumes.

In-Depth Concession Catering Market Outlook

The Concession Catering Market is set for substantial growth, driven by a convergence of factors including resilient travel demand, technological innovation, and evolving consumer preferences. Strategic investments in infrastructure, coupled with an emphasis on healthy, sustainable, and personalized F&B experiences, will further fuel this expansion. The integration of digital technologies for seamless ordering and payment, alongside data-driven insights to optimize offerings, will be critical for success. Companies that can effectively adapt to these trends, embrace innovative business models, and focus on customer satisfaction are poised to capitalize on the significant future market potential and strategic opportunities within this dynamic sector.

Concession Catering Segmentation

-

1. Application

- 1.1. Airports

- 1.2. Motorways

- 1.3. Railways, City Sites & Leisure

-

2. Types

- 2.1. Food

- 2.2. Beverages

Concession Catering Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Concession Catering REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Concession Catering Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Airports

- 5.1.2. Motorways

- 5.1.3. Railways, City Sites & Leisure

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Food

- 5.2.2. Beverages

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Concession Catering Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Airports

- 6.1.2. Motorways

- 6.1.3. Railways, City Sites & Leisure

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Food

- 6.2.2. Beverages

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Concession Catering Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Airports

- 7.1.2. Motorways

- 7.1.3. Railways, City Sites & Leisure

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Food

- 7.2.2. Beverages

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Concession Catering Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Airports

- 8.1.2. Motorways

- 8.1.3. Railways, City Sites & Leisure

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Food

- 8.2.2. Beverages

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Concession Catering Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Airports

- 9.1.2. Motorways

- 9.1.3. Railways, City Sites & Leisure

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Food

- 9.2.2. Beverages

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Concession Catering Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Airports

- 10.1.2. Motorways

- 10.1.3. Railways, City Sites & Leisure

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Food

- 10.2.2. Beverages

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Autogrill

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SSP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elior Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Autogrill

List of Figures

- Figure 1: Global Concession Catering Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Concession Catering Revenue (million), by Application 2024 & 2032

- Figure 3: North America Concession Catering Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Concession Catering Revenue (million), by Types 2024 & 2032

- Figure 5: North America Concession Catering Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Concession Catering Revenue (million), by Country 2024 & 2032

- Figure 7: North America Concession Catering Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Concession Catering Revenue (million), by Application 2024 & 2032

- Figure 9: South America Concession Catering Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Concession Catering Revenue (million), by Types 2024 & 2032

- Figure 11: South America Concession Catering Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Concession Catering Revenue (million), by Country 2024 & 2032

- Figure 13: South America Concession Catering Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Concession Catering Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Concession Catering Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Concession Catering Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Concession Catering Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Concession Catering Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Concession Catering Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Concession Catering Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Concession Catering Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Concession Catering Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Concession Catering Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Concession Catering Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Concession Catering Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Concession Catering Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Concession Catering Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Concession Catering Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Concession Catering Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Concession Catering Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Concession Catering Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Concession Catering Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Concession Catering Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Concession Catering Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Concession Catering Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Concession Catering Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Concession Catering Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Concession Catering Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Concession Catering Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Concession Catering Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Concession Catering Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Concession Catering Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Concession Catering Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Concession Catering Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Concession Catering Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Concession Catering Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Concession Catering Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Concession Catering Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Concession Catering Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Concession Catering Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Concession Catering Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Concession Catering?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Concession Catering?

Key companies in the market include Autogrill, SSP, Elior Group.

3. What are the main segments of the Concession Catering?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 33850 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Concession Catering," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Concession Catering report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Concession Catering?

To stay informed about further developments, trends, and reports in the Concession Catering, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence