Key Insights

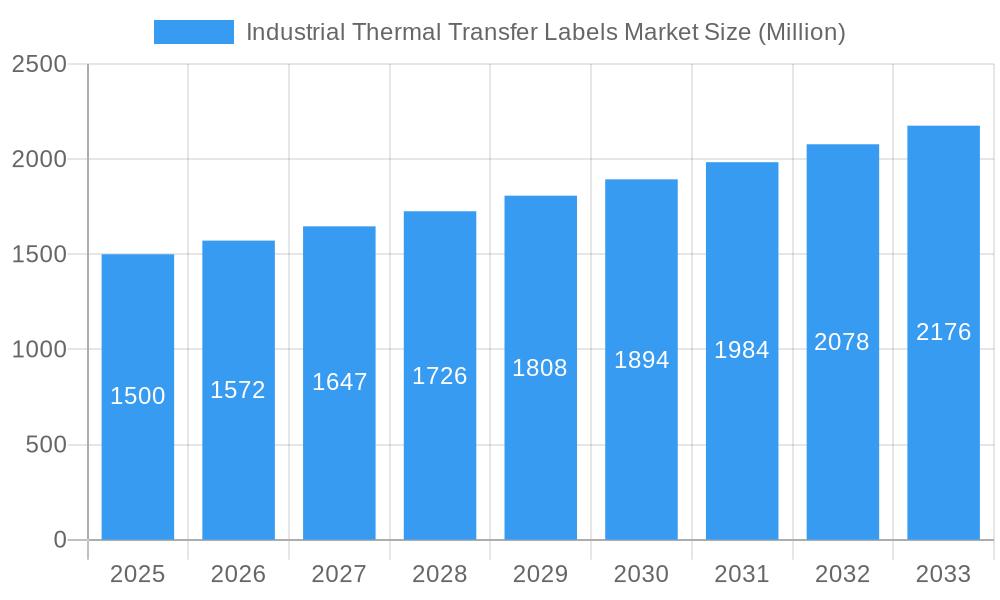

The Industrial Thermal Transfer Labels market is projected for substantial expansion, estimated at $15 billion by 2025. The market is expected to grow at a robust compound annual growth rate (CAGR) of 12.7% from 2025 to 2033. This growth is primarily attributed to the increasing integration of automation and digitalization across key sectors, including logistics, healthcare, and manufacturing, which demand high-performance labeling solutions. Thermal transfer labels provide superior print clarity, environmental resilience, and enhanced traceability, making them indispensable for demanding industrial environments. The escalating need for product traceability and adherence to regulatory mandates further fuels demand for these labels, optimizing supply chain management and inventory control. The availability of diverse material options, such as paper, polyester, and polypropylene, accommodates a wide array of application requirements, thereby broadening market penetration. While North America and Europe represent established markets, the Asia-Pacific region is poised for significant growth, driven by rapid industrialization and expanding manufacturing capabilities. Key challenges include the volatility of raw material prices and environmental considerations associated with certain label materials, necessitating a focus on sustainable solutions and efficient supply chain strategies.

Industrial Thermal Transfer Labels Market Market Size (In Billion)

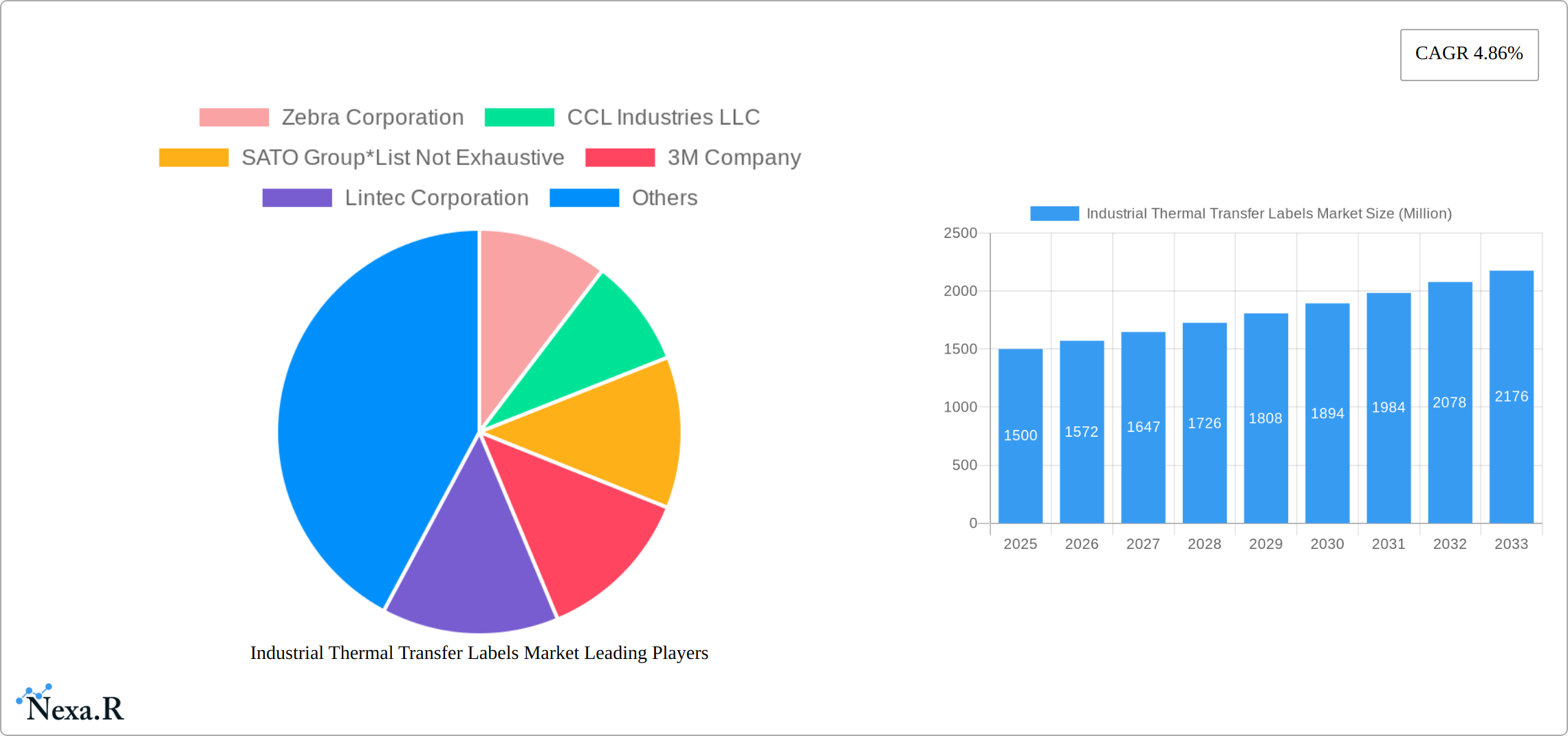

Market segmentation highlights significant opportunities across various industries. The food and beverage sector is a leading consumer, driven by stringent quality control and traceability mandates. The healthcare industry relies on these labels for precise medication and patient identification. The logistics and transportation sector, a primary growth catalyst, requires durable labels capable of withstanding rigorous shipping conditions. Furthermore, the semiconductor and electronics industries utilize these labels for their high precision, exceptional durability, and resistance to extreme temperatures. Continuous advancements in label materials, printing technologies, and adhesive formulations are anticipated to drive further market expansion and diversification. Prominent industry players, including Zebra Corporation, CCL Industries LLC, and 3M Company, are at the forefront of innovation, consistently enhancing their product offerings to meet the evolving demands of diverse industrial applications.

Industrial Thermal Transfer Labels Market Company Market Share

Industrial Thermal Transfer Labels Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Industrial Thermal Transfer Labels Market, encompassing market dynamics, growth trends, regional dominance, product landscape, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers crucial insights for industry professionals, investors, and strategic decision-makers. The report covers the parent market of labeling solutions and the child market of industrial thermal transfer labels. The market size is valued in Million units.

Industrial Thermal Transfer Labels Market Market Dynamics & Structure

This section provides a comprehensive analysis of the competitive landscape and underlying forces shaping the Industrial Thermal Transfer Labels Market. We examine market concentration, technological advancements, regulatory influences, substitute products, end-user demographics, and merger & acquisition (M&A) activity, offering both quantitative market share data for key players and qualitative insights into market growth drivers and challenges.

- Market Concentration and Competitive Intensity: The market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share ([Insert Specific Percentage]%). However, a dynamic group of smaller players actively participates, fostering competition and innovation. The Herfindahl-Hirschman Index (HHI) or similar metric could be used to quantify concentration levels further.

- Technological Innovation and Disruption: Continuous advancements in printing technologies (e.g., liner-free printing, high-resolution printing, improved printhead durability) and label materials (e.g., sustainable and recyclable options, specialized materials for extreme environments) are pivotal drivers. Innovation barriers include significant R&D investments, intellectual property protection, and the need for stringent regulatory compliance. The emergence of digital printing technologies presents both competition and opportunities for synergy.

- Regulatory Landscape and Compliance: Government regulations regarding labeling standards (e.g., GHS, FDA), material safety (e.g., REACH, RoHS), and environmental concerns (e.g., waste reduction) significantly influence market growth and product development. Compliance costs, particularly for smaller businesses, can be substantial and impact competitiveness.

- Competitive Dynamics and Substitute Products: While thermal transfer labels retain a dominant position in many industrial applications due to their cost-effectiveness and ease of use, competitive pressures exist from alternative labeling technologies such as digital printing, inkjet, and laser printing. The choice of technology often depends on the specific application, volume, and required level of customization.

- End-User Segmentation and Demand Drivers: The industrial sector comprises a diverse end-user base, with strong demand from food and beverage, healthcare, logistics, manufacturing (including automotive, aerospace, and electronics), and chemical industries. Growth is anticipated across all segments, with particularly robust prospects in rapidly expanding sectors such as semiconductors, renewable energy, and e-commerce fulfillment.

- Mergers, Acquisitions, and Strategic Alliances: The past five years have witnessed [Insert Specific Number] M&A deals in the broader labeling industry, reflecting a trend toward consolidation and strategic expansion. These transactions encompass both horizontal (merging with competitors) and vertical (integrating upstream or downstream) integration strategies, impacting market dynamics and competitive positioning.

Industrial Thermal Transfer Labels Market Growth Trends & Insights

This section details the historical and projected growth trajectory of the Industrial Thermal Transfer Labels Market, providing a comprehensive overview informed by robust market research data. The analysis encompasses market size evolution, adoption rates across various industry segments, technological disruptions, and evolving consumer preferences (e.g., increased demand for sustainable and eco-friendly labels).

The market experienced a Compound Annual Growth Rate (CAGR) of [Insert Specific Percentage]% during the historical period (2019-2024). Market penetration stood at [Insert Specific Percentage]% in the base year (2025). Projected growth is fueled by several key factors: the increasing adoption of automation and robotics in industrial settings, the expansion of e-commerce and its associated logistical demands, and stringent regulatory requirements driving the adoption of robust and compliant labeling solutions. Technological advancements, such as improved print quality, the introduction of liner-free labels, and the development of smart labels with embedded RFID or other tracking capabilities, are further accelerating market growth. The forecast period (2025-2033) anticipates a CAGR of [Insert Specific Percentage]%, driven by the escalating demand across diverse industries and geographic regions.

Dominant Regions, Countries, or Segments in Industrial Thermal Transfer Labels Market

This section pinpoints the leading geographical regions, countries, and product segments driving market expansion. The analysis considers both the current market dominance and future growth potential of key segments, providing a nuanced understanding of regional and product-specific dynamics.

- Dominant Regions: North America currently holds the largest market share ([Insert Specific Percentage]%), followed by Europe ([Insert Specific Percentage]%) and Asia-Pacific ([Insert Specific Percentage]%). This dominance stems from the high concentration of manufacturing industries, well-established logistics networks, and relatively stringent regulatory frameworks in these regions. However, emerging economies in Asia-Pacific and Latin America present significant growth opportunities.

- Dominant Segment (By Material): Polyester labels maintain a dominant market share due to their superior durability, resistance to harsh environmental conditions, and suitability for diverse industrial applications. However, the growing demand for sustainable alternatives is driving increased adoption of paper and other eco-friendly materials.

- Dominant Segment (By End-user Industry): The Food and Beverages sector currently demonstrates the highest demand, driven by stringent labeling regulations and the need for clear product identification throughout the supply chain. However, significant growth is expected in healthcare, logistics, and the expanding electronics and semiconductor industries, reflecting increasing automation and traceability requirements.

Key drivers within each region and segment include favorable economic policies, investments in industrial infrastructure, the increasing adoption of automation technologies, and evolving consumer preferences for sustainable and traceable products. Asia-Pacific, in particular, exhibits considerable growth potential due to rapid industrialization, rising e-commerce activity, and a growing middle class.

Industrial Thermal Transfer Labels Market Product Landscape

The Industrial Thermal Transfer Labels Market offers a range of products with varying material compositions, adhesive types, and printing capabilities. Technological advancements have led to the development of high-performance labels with enhanced durability, resistance to extreme temperatures and chemicals, and improved print clarity. The focus is increasingly shifting towards environmentally friendly materials and liner-free solutions to minimize waste and enhance sustainability.

Key Drivers, Barriers & Challenges in Industrial Thermal Transfer Labels Market

Key Drivers: Growing demand from diverse industrial sectors, increasing automation in manufacturing and logistics, stringent regulatory compliance, and technological advancements in printing technologies and label materials drive market growth.

Key Challenges: Fluctuations in raw material prices, intense competition, and complexities in supply chain management pose significant challenges to market growth. Regulatory changes and stringent environmental regulations also add to the pressure. The impact of these challenges is estimated to reduce annual growth by xx% during peak periods.

Emerging Opportunities in Industrial Thermal Transfer Labels Market

Emerging opportunities lie in the development of specialized labels for niche applications (e.g., cryogenic labels for healthcare), the adoption of sustainable and eco-friendly materials, and penetration into untapped markets within developing economies. Furthermore, the integration of smart label technologies (e.g., RFID) presents a significant opportunity for market expansion.

Growth Accelerators in the Industrial Thermal Transfer Labels Market Industry

Several key factors are driving accelerated growth within the Industrial Thermal Transfer Labels Market. These include strategic collaborations and partnerships, technological breakthroughs in printing technologies (e.g., higher resolution printing, increased speed and efficiency), expansion into new geographic markets and emerging industrial sectors, and a growing focus on sustainable manufacturing practices and improved supply chain efficiency. Furthermore, the increasing demand for traceability and anti-counterfeiting measures is contributing to market expansion.

Key Players Shaping the Industrial Thermal Transfer Labels Market Market

- Zebra Corporation

- CCL Industries LLC

- SATO Group

- 3M Company

- Lintec Corporation

- Honeywell International

- Ricoh Holdings

- Constantia Flexibles

- [Add other relevant key players]

Notable Milestones in Industrial Thermal Transfer Labels Market Sector

- January 2020: Epson America Inc. launched the TM-L90II LFC thermal label printer, enhancing printing flexibility and supporting liner-free options.

- August 2020: Sato America introduced the SG112-ex series wide format label printer, improving printing speed and efficiency.

In-Depth Industrial Thermal Transfer Labels Market Market Outlook

The Industrial Thermal Transfer Labels Market is poised for sustained growth, driven by ongoing technological advancements, increasing adoption across various industries, and the expansion into new geographic markets. Strategic partnerships, investments in R&D, and a focus on sustainability will further shape the market landscape, creating significant opportunities for market participants. The market is predicted to reach xx Million units by 2033, showing a robust future.

Industrial Thermal Transfer Labels Market Segmentation

-

1. Material

- 1.1. Paper

- 1.2. Polyester

- 1.3. PP

- 1.4. Other Materials

-

2. End-user Industry

- 2.1. Food and Beverages

- 2.2. Healthcare

- 2.3. Logistics and Transportation

- 2.4. Industrial Goods

- 2.5. Semiconductor and Electronics

- 2.6. Other End-user Verticals

Industrial Thermal Transfer Labels Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Thermal Transfer Labels Market Regional Market Share

Geographic Coverage of Industrial Thermal Transfer Labels Market

Industrial Thermal Transfer Labels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in the Demand for Thermal Transfer Labels in the Healthcare Industry Aided by Growth in Volume Sales; Material Advancements

- 3.2.2 Specifically in the Case of Polyester-based Labels Expected to Drive the Demand in the Electronics and Food and Beverages Sector; Growing Online Sales

- 3.3. Market Restrains

- 3.3.1. Increased Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Healthcare is Expected to Register Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Thermal Transfer Labels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper

- 5.1.2. Polyester

- 5.1.3. PP

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverages

- 5.2.2. Healthcare

- 5.2.3. Logistics and Transportation

- 5.2.4. Industrial Goods

- 5.2.5. Semiconductor and Electronics

- 5.2.6. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Industrial Thermal Transfer Labels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Paper

- 6.1.2. Polyester

- 6.1.3. PP

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverages

- 6.2.2. Healthcare

- 6.2.3. Logistics and Transportation

- 6.2.4. Industrial Goods

- 6.2.5. Semiconductor and Electronics

- 6.2.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Industrial Thermal Transfer Labels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Paper

- 7.1.2. Polyester

- 7.1.3. PP

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverages

- 7.2.2. Healthcare

- 7.2.3. Logistics and Transportation

- 7.2.4. Industrial Goods

- 7.2.5. Semiconductor and Electronics

- 7.2.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Industrial Thermal Transfer Labels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Paper

- 8.1.2. Polyester

- 8.1.3. PP

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverages

- 8.2.2. Healthcare

- 8.2.3. Logistics and Transportation

- 8.2.4. Industrial Goods

- 8.2.5. Semiconductor and Electronics

- 8.2.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Rest of the World Industrial Thermal Transfer Labels Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Paper

- 9.1.2. Polyester

- 9.1.3. PP

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverages

- 9.2.2. Healthcare

- 9.2.3. Logistics and Transportation

- 9.2.4. Industrial Goods

- 9.2.5. Semiconductor and Electronics

- 9.2.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Zebra Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CCL Industries LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SATO Group*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 3M Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lintec Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Honeywell International

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ricoh Holdings

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Constantia Flexibles

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Zebra Corporation

List of Figures

- Figure 1: Global Industrial Thermal Transfer Labels Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial Thermal Transfer Labels Market Revenue (billion), by Material 2025 & 2033

- Figure 3: North America Industrial Thermal Transfer Labels Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Industrial Thermal Transfer Labels Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Industrial Thermal Transfer Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Industrial Thermal Transfer Labels Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Industrial Thermal Transfer Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Industrial Thermal Transfer Labels Market Revenue (billion), by Material 2025 & 2033

- Figure 9: Europe Industrial Thermal Transfer Labels Market Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe Industrial Thermal Transfer Labels Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Industrial Thermal Transfer Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Industrial Thermal Transfer Labels Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Industrial Thermal Transfer Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Thermal Transfer Labels Market Revenue (billion), by Material 2025 & 2033

- Figure 15: Asia Pacific Industrial Thermal Transfer Labels Market Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific Industrial Thermal Transfer Labels Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Industrial Thermal Transfer Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Industrial Thermal Transfer Labels Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Industrial Thermal Transfer Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Industrial Thermal Transfer Labels Market Revenue (billion), by Material 2025 & 2033

- Figure 21: Rest of the World Industrial Thermal Transfer Labels Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Rest of the World Industrial Thermal Transfer Labels Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Industrial Thermal Transfer Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Industrial Thermal Transfer Labels Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Industrial Thermal Transfer Labels Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Material 2020 & 2033

- Table 5: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Material 2020 & 2033

- Table 8: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Material 2020 & 2033

- Table 11: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Material 2020 & 2033

- Table 14: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Industrial Thermal Transfer Labels Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Thermal Transfer Labels Market?

The projected CAGR is approximately 12.7%.

2. Which companies are prominent players in the Industrial Thermal Transfer Labels Market?

Key companies in the market include Zebra Corporation, CCL Industries LLC, SATO Group*List Not Exhaustive, 3M Company, Lintec Corporation, Honeywell International, Ricoh Holdings, Constantia Flexibles.

3. What are the main segments of the Industrial Thermal Transfer Labels Market?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 15 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Demand for Thermal Transfer Labels in the Healthcare Industry Aided by Growth in Volume Sales; Material Advancements. Specifically in the Case of Polyester-based Labels Expected to Drive the Demand in the Electronics and Food and Beverages Sector; Growing Online Sales.

6. What are the notable trends driving market growth?

Healthcare is Expected to Register Significant Growth Rate.

7. Are there any restraints impacting market growth?

Increased Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

In January 2020, Epson America Inc. announced the new TM-L90II LFC thermal label printer at the NRF 2020 Retail's Big Show. The new label printer is a flexible label printer that supports 40-, 58-, and 80mm full media for flexible printing options. Replacing the TM-L90 Plus LFC models, this flexible and adaptable thermal label printer supports liner-free printing and receipt printing and features a back-feed functionality and label-taken sensor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Thermal Transfer Labels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Thermal Transfer Labels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Thermal Transfer Labels Market?

To stay informed about further developments, trends, and reports in the Industrial Thermal Transfer Labels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence