Key Insights

The North American retail bags market, including grocery, food service, and other sectors across the United States and Canada, is poised for robust expansion. Projected to grow from a base year of 2025 with a market size of $19.3 billion at a Compound Annual Growth Rate (CAGR) of 7%, the market is anticipated to reach approximately $34.1 billion by 2033. This growth is fueled by the escalating adoption of e-commerce and online grocery delivery, increasing the demand for reliable and practical retail packaging. Concurrently, heightened consumer and regulatory emphasis on sustainability is driving the adoption of biodegradable and recyclable bag solutions, spurring innovation in eco-friendly alternatives. Furthermore, sustained growth within the food and beverage industry, especially in quick-service restaurants, is a significant contributor to the demand for retail bags.

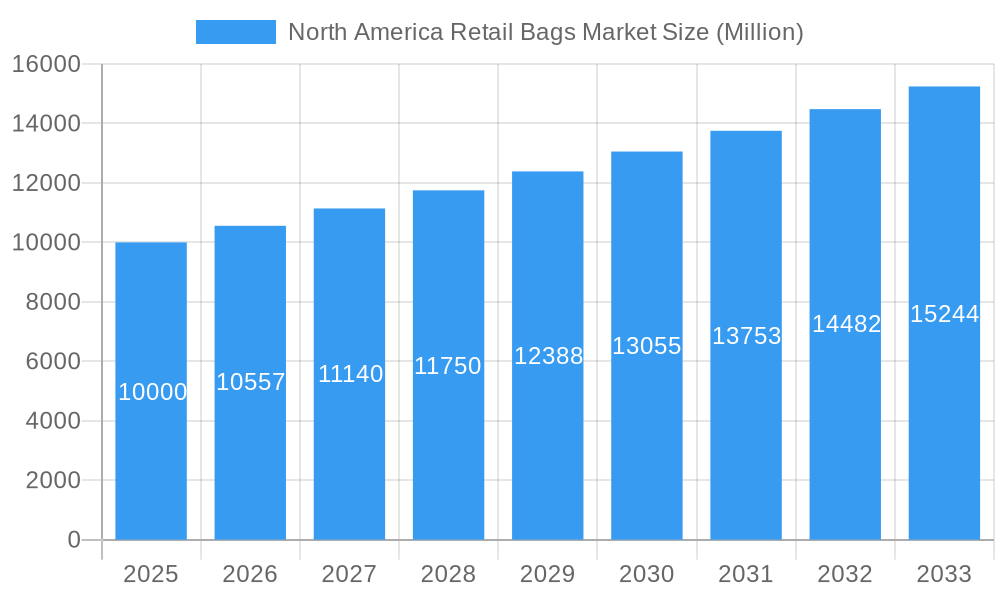

North America Retail Bags Market Market Size (In Billion)

Despite this positive outlook, the market contends with several obstacles. Volatility in raw material costs, notably for paper and plastic, directly influences manufacturing expenses and profit margins. Increasingly stringent environmental mandates concerning plastic bag usage necessitate transitions to sustainable alternatives, often requiring substantial initial capital outlays. Intense competition from established global entities and emerging regional suppliers necessitates ongoing innovation and cost-efficiency measures. Strategic market segmentation by end-user and geography presents opportunities for tailored approaches to meet diverse consumer needs and regional market demands. A thorough understanding of these market dynamics is crucial for achieving competitive advantage.

North America Retail Bags Market Company Market Share

North America Retail Bags Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America retail bags market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. The market size is projected to reach xx million units by 2033.

North America Retail Bags Market Market Dynamics & Structure

The North American retail bag market is a dynamic and evolving landscape shaped by a confluence of economic, environmental, and regulatory forces. While moderately concentrated with a presence of both established global manufacturers and numerous regional players, the market is increasingly characterized by a fierce drive towards sustainability. Technological innovation is no longer a niche pursuit but a core necessity, spurred by growing consumer consciousness regarding environmental impact and a burgeoning demand for eco-friendly alternatives. Stringent regulatory frameworks, including bans and taxes on single-use plastic bags implemented across various states and provinces, are significantly influencing market dynamics. This regulatory push, coupled with evolving consumer preferences, is creating substantial competitive pressure on traditional plastic bag manufacturers, paving the way for the wider adoption of compostable, recyclable, and reusable bag solutions.

- Market Concentration: The market exhibits moderate concentration. Leading players are expected to collectively hold an estimated xx% market share by 2025, with significant competition from a robust base of regional and specialized manufacturers.

- Technological Innovation: The focus is heavily on developing and implementing sustainable materials, including advanced biodegradable plastics, high-recycled content paper, and innovative bio-based composites. Enhancements in barrier properties for extended product shelf-life and lightweight, durable designs for improved user experience are also key areas of innovation.

- Regulatory Framework: An increasing number of jurisdictions are enacting bans and restrictions on single-use plastic bags, coupled with the introduction of fees or taxes. This trend is a primary catalyst for the adoption of sustainable and reusable alternatives across the retail sector.

- Competitive Product Substitutes: The market faces significant competition from a growing array of alternatives, including advanced biodegradable plastics, a wide range of reusable bag options (cotton, non-woven polypropylene, recycled PET), and innovative packaging solutions that minimize or eliminate the need for traditional bags.

- End-User Demographics: Consumer preferences are increasingly skewed towards environmentally responsible products. Demand for convenience remains high, but this is now often intertwined with the desire for sustainable choices, influencing purchasing decisions at the point of sale.

- M&A Trends: The trend of consolidation is anticipated to persist. Larger entities are actively acquiring smaller companies to broaden their sustainable product offerings, gain access to new technologies, and expand their geographical footprint. The volume of M&A deals observed between 2019 and 2024 is estimated to be approximately xx, indicating a strategic realignment of market players.

North America Retail Bags Market Growth Trends & Insights

The North America retail bags market experienced robust growth during the historical period (2019-2024), driven by the rising popularity of e-commerce and increased consumer spending. The market is expected to maintain a steady growth trajectory throughout the forecast period (2025-2033), fueled by ongoing technological advancements in sustainable packaging materials and increasing environmental awareness. The CAGR for the forecast period is estimated at xx%. Growing adoption of online grocery shopping and delivery services is significantly impacting demand for retail bags. Technological disruptions, particularly in the area of sustainable packaging solutions, are reshaping the market landscape. Consumer behavior is shifting toward eco-conscious choices, impacting material preferences and driving demand for sustainable alternatives.

Dominant Regions, Countries, or Segments in North America Retail Bags Market

The United States dominates the North America retail bags market, driven by its large population, robust retail sector, and higher per capita consumption compared to Canada. The Grocery Stores segment represents the largest end-user segment due to high volume sales.

- United States: Largest market share due to high population, robust retail sector, and significant e-commerce growth. Stringent environmental regulations are accelerating adoption of sustainable packaging.

- Canada: Smaller market size compared to the US, but experiencing gradual growth fueled by increasing consumer demand for sustainable products and evolving environmental policies.

- Grocery Stores: Largest end-user segment due to the high volume of grocery purchases requiring packaging.

- Food Service: Growing demand from restaurants and food delivery services, particularly for sustainable takeaway packaging.

- Other End-Users: Includes various retail and industrial applications, showing moderate growth.

North America Retail Bags Market Product Landscape

The North American retail bag market is distinguished by its comprehensive product diversity, encompassing traditional paper bags, a spectrum of plastic bag options (including conventional polyethylene and increasingly, bio-based and biodegradable variants), and a rapidly expanding segment of reusable bags. Innovation is a constant, with a primary focus on enhancing the environmental credentials of products through improved recyclability, compostability, and the utilization of recycled or renewable materials. Performance characteristics such as enhanced strength, tear resistance, and moisture protection are also being refined, particularly for paper and specialized plastic alternatives. Advancements in barrier technologies are crucial for extending the shelf life and preserving the quality of packaged goods. Ultimately, the unique selling propositions that resonate most strongly with consumers and retailers alike revolve around demonstrable eco-friendliness, robust recyclability, and certified compostability.

Key Drivers, Barriers & Challenges in North America Retail Bags Market

Key Drivers:

- The sustained and accelerated growth of e-commerce and online grocery shopping, which necessitates efficient and reliable packaging solutions.

- A pronounced and growing consumer demand for sustainable, eco-friendly, and ethically sourced packaging materials, driven by environmental awareness.

- Stringent and evolving government regulations globally and within North America, which are increasingly penalizing or banning the use of conventional single-use plastic bags.

- Significant advancements and innovations in biodegradable, compostable, and bio-based material science, leading to more viable and effective alternatives.

Key Challenges:

- Volatility in the pricing of raw materials, such as virgin resins for plastics and pulp for paper, which can significantly impact production costs and profit margins.

- Persistent and sometimes acute supply chain disruptions, stemming from geopolitical events, natural disasters, or logistical bottlenecks, which can hinder production schedules and product availability.

- Intense competition, not only from established, large-scale players but also from agile new entrants and specialized manufacturers, leading to price pressures and market saturation in certain segments.

- Regulatory uncertainty and evolving standards surrounding new materials and advanced recycling technologies. This uncertainty impacts approximately xx% of businesses, as it complicates long-term investment decisions and product development strategies.

Emerging Opportunities in North America Retail Bags Market

- Growing demand for customized and branded retail bags.

- Expansion into untapped markets, including smaller retail chains and specialized stores.

- Opportunities in developing innovative bag designs for specific product types.

- Increased adoption of smart packaging solutions incorporating RFID or other tracking technologies.

Growth Accelerators in the North America Retail Bags Market Industry

The growth trajectory of the North American retail bags market is being significantly propelled by strategic collaborations between innovative packaging manufacturers and forward-thinking retailers. These partnerships are instrumental in accelerating the development and widespread adoption of sustainable alternatives, ensuring products meet both consumer expectations and regulatory requirements. Concurrent advancements in material science are yielding more durable, functional, and environmentally responsible bag options. Furthermore, targeted market expansion strategies, focusing on underserved geographic regions and the rapidly growing emerging retail segments (such as direct-to-consumer brands and subscription box services), are poised to fuel substantial market growth.

Key Players Shaping the North America Retail Bags Market Market

- International Paper company

- El Dorado Packaging Inc

- Novolex Holdings Inc

- Mondi Group PLC

- Smurfit Kappa Group PLC

- Jet Paper Bags

- List Not Exhaustive

Notable Milestones in North America Retail Bags Market Sector

- May 2022: Smurfit Kappa launched AquaStop, a pioneering sustainable water-resistant paper technology. This innovation significantly enhances the recyclability and durability of paper bags, offering a compelling alternative for moisture-sensitive applications.

- May 2022: Eco-Products, a Novolex brand, introduced a new compostable sandwich wrap designed for the food service industry. This launch caters directly to the escalating demand for convenient, single-use, yet environmentally responsible food packaging solutions.

In-Depth North America Retail Bags Market Market Outlook

The North America retail bags market is poised for continued growth, driven by the ongoing shift toward sustainable packaging solutions and the expansion of e-commerce. Strategic investments in research and development, coupled with innovative product launches, will play a critical role in shaping future market dynamics. Companies that effectively adapt to evolving consumer preferences and regulatory landscapes will capture significant market share in the coming years.

North America Retail Bags Market Segmentation

-

1. End-User

- 1.1. Grocery Stores

- 1.2. Food Service

- 1.3. Other Emd-users

North America Retail Bags Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Retail Bags Market Regional Market Share

Geographic Coverage of North America Retail Bags Market

North America Retail Bags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector; Stringent Government Regulations Against the Use of Single Use Plastic bags

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices and Supply Chain Disruptions

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Retail Bags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Grocery Stores

- 5.1.2. Food Service

- 5.1.3. Other Emd-users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 International Paper company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 El Dorado Packaging Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novolex Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi Group PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Smurfit Kappa Group PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jet Paper Bags*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 International Paper company

List of Figures

- Figure 1: North America Retail Bags Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Retail Bags Market Share (%) by Company 2025

List of Tables

- Table 1: North America Retail Bags Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: North America Retail Bags Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Retail Bags Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: North America Retail Bags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Retail Bags Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Retail Bags Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Retail Bags Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Retail Bags Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the North America Retail Bags Market?

Key companies in the market include International Paper company, El Dorado Packaging Inc, Novolex Holdings Inc, Mondi Group PLC, Smurfit Kappa Group PLC, Jet Paper Bags*List Not Exhaustive.

3. What are the main segments of the North America Retail Bags Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector; Stringent Government Regulations Against the Use of Single Use Plastic bags.

6. What are the notable trends driving market growth?

Increasing Demand for Sustainable Packaging Alternatives in the Retail Sector.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices and Supply Chain Disruptions.

8. Can you provide examples of recent developments in the market?

May 2022 - Smurfit Kappa developed AquaStop sustainable water-resistant paper as part of Smurfit Kappa's new TechniPaper portfolio because of a special coating added to it during the manufacturing process without compromising the recyclability of the product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Retail Bags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Retail Bags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Retail Bags Market?

To stay informed about further developments, trends, and reports in the North America Retail Bags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence