Key Insights

The Post-Consumer Recycled (PCR) packaging market is poised for significant expansion, propelled by escalating environmental concerns and stringent regulations designed to curb plastic waste. With a projected Compound Annual Growth Rate (CAGR) of 6.3%, the market is estimated to reach $47.55 billion by 2025. Key growth drivers are evident across market segments. The PET (polyethylene terephthalate) material segment is anticipated to command the largest market share, owing to its widespread application in beverage containers and its inherent recyclability. Among product types, bottles are expected to lead, followed by trays and pouches, reflecting dominant packaging needs across diverse industries. The food and beverage sectors are primary end-users, with healthcare and cosmetics also contributing substantially to market demand. Geographically, the Asia Pacific region is projected to experience robust growth, driven by its substantial population and expanding manufacturing capabilities, while North America and Europe will maintain considerable market shares due to established recycling infrastructure and heightened consumer awareness. Nonetheless, challenges persist, including variability in recycled material quality and the premium cost of PCR packaging over virgin plastics. Industry players are actively investing in advanced recycling technologies and forging collaborations with brands to enhance PCR content in packaging, thereby fostering market growth. This expansion is further amplified by increasing consumer preference for sustainable products and brands prioritizing eco-conscious packaging solutions.

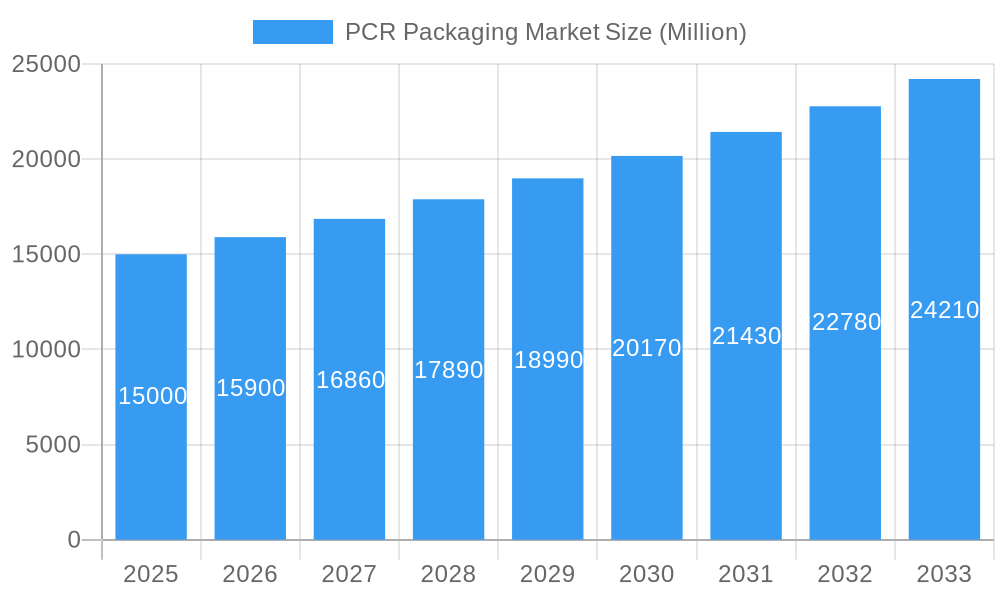

PCR Packaging Market Market Size (In Billion)

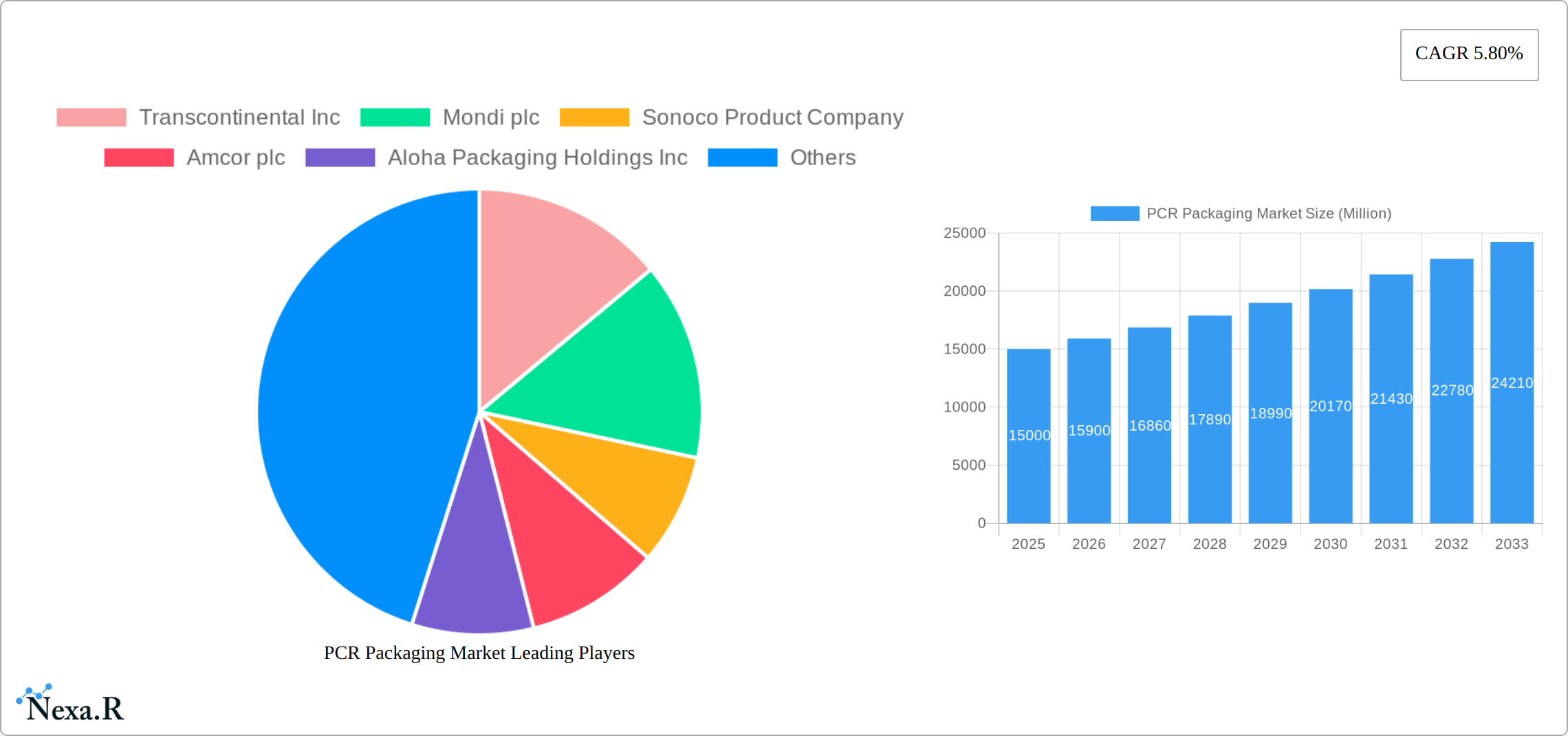

The competitive landscape features a dynamic interplay between large multinational corporations and agile, specialized firms. Leading entities such as Amcor plc, Berry Global, and Sonoco Product Company are capitalizing on their extensive manufacturing capacities and distribution networks to meet the escalating demand for PCR packaging. Smaller companies are driving innovation through novel PCR material formulations and sustainable packaging designs, effectively challenging established market participants. The burgeoning e-commerce sector, with its consequent surge in packaging requirements, presents both opportunities and hurdles for PCR packaging manufacturers. The strategic focus will remain on augmenting the efficiency and scale of recycling operations, elevating the quality of recycled materials, and narrowing the cost differential between PCR and virgin plastic packaging to facilitate broader adoption and accelerate market growth. Future market trajectory will be significantly influenced by governmental policies promoting sustainable packaging, technological advancements in recycling processes, and a continued rise in consumer preference for environmentally friendly products.

PCR Packaging Market Company Market Share

PCR Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the PCR (Post-Consumer Recycled) Packaging Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The market is segmented by material (PET, PE, PVC, PP, PS, Others), product type (Bottles, Trays, Pouches, Other Product Types), and end-user verticals (Food, Beverage, Healthcare, Cosmetics, Industrial, Other End-user Verticals). This report is invaluable for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. The market size is projected to reach xx Million units by 2033.

PCR Packaging Market Market Dynamics & Structure

The PCR (Post-Consumer Recycled) packaging market is characterized by a moderately concentrated landscape, featuring several key industry leaders who command significant market share. This dynamic sector is experiencing robust expansion, propelled by a growing global consciousness regarding environmental preservation, increasingly stringent governmental mandates advocating for sustainable packaging solutions, and a surging consumer demand for eco-friendly products. Advances in recycling technologies, coupled with the development of enhanced PCR-compatible materials, are further accelerating market growth and innovation.

Market Concentration: In 2025, the top 5 players collectively held approximately [Insert Percentage]% of the global PCR packaging market share. This concentration is projected to see a slight dilution by 2033, attributed to the emergence of new market entrants and intensified competitive pressures.

Technological Innovation: Substantial investments are being channeled into pioneering advanced recycling methodologies and the creation of novel PCR materials boasting superior performance attributes. Nevertheless, achieving consistent quality and ensuring the scalability of PCR material production remain persistent challenges for the industry.

Regulatory Frameworks: Governments worldwide are actively implementing more rigorous regulations targeting plastic waste reduction and actively promoting the incorporation of recycled content in packaging. These legislative measures serve as a powerful catalyst for the sustained growth of the PCR packaging market.

Competitive Product Substitutes: While bio-based and biodegradable packaging materials are emerging as viable alternatives, their current cost-effectiveness and performance benchmarks often fall short when directly compared to established PCR packaging solutions.

M&A Trends: Over the past five years, the PCR packaging market has witnessed a moderate volume of mergers and acquisitions (M&A). These strategic consolidations have primarily aimed at broadening product portfolios and extending geographical reach. An estimated [Insert Number] M&A deals were recorded between 2019 and 2024.

End-User Demographics: Heightened environmental awareness, particularly among younger demographics like millennials and Gen Z, is a significant driver fueling the adoption of PCR packaging across a diverse range of end-user industries.

PCR Packaging Market Growth Trends & Insights

The PCR packaging market has demonstrated consistent and impressive growth over recent years, a trend attributable to a multifaceted interplay of influential factors. The market size escalated from [Insert Value] Million units in 2019 to [Insert Value] Million units in 2024, charting a Compound Annual Growth Rate (CAGR) of [Insert Percentage]%. This upward trajectory is anticipated to persist, with a projected CAGR of [Insert Percentage]% anticipated for the forecast period spanning 2025-2033. This substantial growth is predominantly fueled by an increasing consumer preference for sustainable products, stringent governmental regulations, and significant technological advancements that are continuously enhancing the quality and accessibility of PCR materials. The penetration of PCR packaging is steadily increasing across various end-user segments, with the food and beverage sectors currently exhibiting the highest adoption rates. Emerging technological breakthroughs, such as the development of sophisticated chemical recycling technologies, are further augmenting the market's growth potential. Consumer behavior is undergoing a pronounced shift towards a greater emphasis on eco-friendly and ethically sourced products, thereby stimulating the demand for innovative PCR packaging solutions.

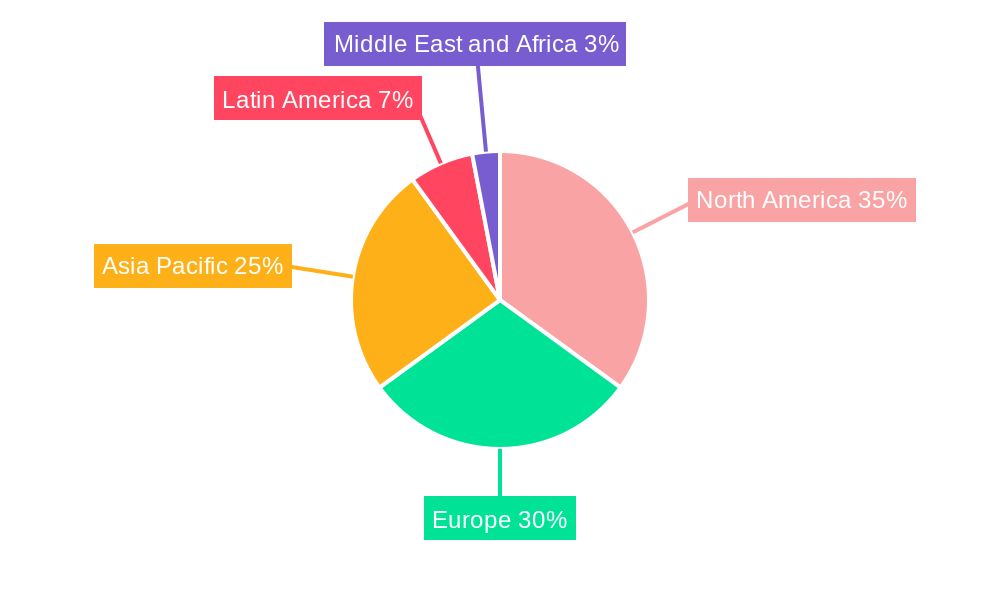

Dominant Regions, Countries, or Segments in PCR Packaging Market

The PCR packaging market exhibits considerable regional disparities in its growth patterns. Currently, North America and Europe command the largest market share, a position bolstered by stringent environmental regulations, elevated levels of consumer environmental awareness, and well-established recycling infrastructure. Conversely, the Asia-Pacific region is projected to experience the most rapid growth rate during the forecast period. This accelerated expansion is driven by burgeoning economies, rising consumer disposable incomes, and proactive government initiatives aimed at promoting sustainable packaging practices.

By Material: Polyethylene Terephthalate (PET) continues to dominate the PCR packaging material segment, owing to its broad applicability and excellent recyclability. However, Polyethylene (PE) and Polypropylene (PP) are steadily gaining market traction due to their cost-effectiveness and suitability for a wide array of packaging applications.

By Product: Bottles and trays currently hold the largest market share within the PCR packaging product segment, primarily due to their extensive usage in the food and beverage industries. Nonetheless, pouches are experiencing particularly rapid growth, attributed to their inherent lightweight properties and space-saving advantages.

By End-user Verticals: The food and beverage industry remains the dominant end-user segment for PCR packaging, followed closely by the healthcare and cosmetics industries. The escalating demand for sustainable packaging solutions across these sectors is a key driver of market growth.

- Key Drivers (North America & Europe): Stringent environmental regulations, high consumer awareness regarding sustainability, and a well-developed recycling infrastructure.

- Key Drivers (Asia-Pacific): Rapid economic expansion, increasing consumer disposable incomes, government initiatives promoting sustainable packaging, and escalating industrialization.

PCR Packaging Market Product Landscape

The PCR packaging product landscape is characterized by continuous innovation, focusing on improving material properties, enhancing recyclability, and expanding application areas. Recent advancements include the development of PCR materials with improved barrier properties, extended shelf life, and enhanced aesthetics. These improvements have broadened the applicability of PCR packaging to various end-user industries, driving market expansion.

Key Drivers, Barriers & Challenges in PCR Packaging Market

Key Drivers:

- A pronounced and growing consumer preference for sustainable and environmentally responsible products.

- The implementation of stringent government regulations that actively encourage and mandate the use of recycled content in packaging.

- Significant technological advancements in both recycling methodologies and the production processes for PCR materials, leading to improved quality and availability.

- An increasing global awareness and understanding of critical environmental issues, driving demand for sustainable solutions.

Key Challenges:

- Inherent fluctuations in the quality and consistent availability of PCR materials, which can impact production reliability.

- The often higher cost associated with PCR materials compared to virgin (newly manufactured) plastics, presenting a price barrier for some applications.

- Limited scalability of certain advanced recycling technologies, hindering widespread adoption and capacity.

- Complexities within the supply chain and logistics involved in sourcing and processing PCR materials effectively.

Emerging Opportunities in PCR Packaging Market

- Growing demand for sustainable packaging in developing economies

- Expansion into new applications, such as flexible packaging and specialized industrial packaging

- Development of innovative recycling solutions for complex packaging materials

- Increased focus on circular economy models and closed-loop recycling systems

Growth Accelerators in the PCR Packaging Market Industry

The PCR packaging market’s long-term growth is primarily fueled by technological breakthroughs in recycling and material science, strategic collaborations among industry players to improve supply chains and develop innovative solutions, and market expansion into untapped regions and sectors. Government initiatives supporting the adoption of sustainable packaging further contribute to market growth.

Key Players Shaping the PCR Packaging Market Market

- Transcontinental Inc

- Mondi plc

- Sonoco Product Company

- Amcor plc

- Aloha Packaging Holdings Inc

- IDEALPAK

- Spectra Packaging Solutions Ltd

- Berry Global

- Genpak LLC

- ePac Holdings LLC

- ALPLA Group

- INDEVCO

Notable Milestones in PCR Packaging Market Sector

- August 2022: Mondi, in collaboration with Essity and Dow, successfully developed innovative, recyclable secondary packaging for Essity's feminine care products. This initiative prominently featured the utilization of renewable materials and post-consumer recycled content.

- July 2022: Berry M&H announced a series of strategic initiatives designed to support its customers' sustainability objectives and comply with the UK Plastic Packaging Tax requirements. A key aspect of these initiatives involves incorporating at least 30% PCR plastic into the majority of its standard product offerings.

In-Depth PCR Packaging Market Market Outlook

The PCR packaging market is poised for substantial growth in the coming years. Continued advancements in recycling technologies, coupled with increasing consumer demand for sustainable solutions and stricter environmental regulations, will drive market expansion. Strategic partnerships, product diversification, and geographical expansion will be key factors shaping the competitive landscape and unlocking significant growth opportunities. The market is expected to see increased innovation in materials and product design, leading to improved performance and greater recyclability.

PCR Packaging Market Segmentation

-

1. Material

- 1.1. PET

- 1.2. PVC

- 1.3. PP

- 1.4. PS

- 1.5. Others

-

2. Product

- 2.1. Bottles

- 2.2. Trays

- 2.3. Pouches

- 2.4. Other Product Types

-

3. End-user Verticals

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Cosmetics

- 3.5. Industrial

- 3.6. Other End user verticals

PCR Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

PCR Packaging Market Regional Market Share

Geographic Coverage of PCR Packaging Market

PCR Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption from Beverage Industry; Rising Government Initiatives Toward PCR plastic packaging

- 3.3. Market Restrains

- 3.3.1. Unforeseen Consequences of Reusing Plastic Packaging and Health Related Concerns

- 3.4. Market Trends

- 3.4.1. Beverage Industry Driving the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PCR Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. PET

- 5.1.2. PVC

- 5.1.3. PP

- 5.1.4. PS

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Bottles

- 5.2.2. Trays

- 5.2.3. Pouches

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Cosmetics

- 5.3.5. Industrial

- 5.3.6. Other End user verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America PCR Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. PET

- 6.1.2. PVC

- 6.1.3. PP

- 6.1.4. PS

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Bottles

- 6.2.2. Trays

- 6.2.3. Pouches

- 6.2.4. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare

- 6.3.4. Cosmetics

- 6.3.5. Industrial

- 6.3.6. Other End user verticals

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe PCR Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. PET

- 7.1.2. PVC

- 7.1.3. PP

- 7.1.4. PS

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Bottles

- 7.2.2. Trays

- 7.2.3. Pouches

- 7.2.4. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare

- 7.3.4. Cosmetics

- 7.3.5. Industrial

- 7.3.6. Other End user verticals

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific PCR Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. PET

- 8.1.2. PVC

- 8.1.3. PP

- 8.1.4. PS

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Bottles

- 8.2.2. Trays

- 8.2.3. Pouches

- 8.2.4. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare

- 8.3.4. Cosmetics

- 8.3.5. Industrial

- 8.3.6. Other End user verticals

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America PCR Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. PET

- 9.1.2. PVC

- 9.1.3. PP

- 9.1.4. PS

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Bottles

- 9.2.2. Trays

- 9.2.3. Pouches

- 9.2.4. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare

- 9.3.4. Cosmetics

- 9.3.5. Industrial

- 9.3.6. Other End user verticals

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa PCR Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. PET

- 10.1.2. PVC

- 10.1.3. PP

- 10.1.4. PS

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Bottles

- 10.2.2. Trays

- 10.2.3. Pouches

- 10.2.4. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare

- 10.3.4. Cosmetics

- 10.3.5. Industrial

- 10.3.6. Other End user verticals

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Transcontinental Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mondi plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonoco Product Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amcor plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aloha Packaging Holdings Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IDEALPAK

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Spectra Packaging Solutions Ltd *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berry Global

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Genpak LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ePac Holdings LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ALPLA Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 INDEVCO

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Transcontinental Inc

List of Figures

- Figure 1: Global PCR Packaging Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America PCR Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 3: North America PCR Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America PCR Packaging Market Revenue (billion), by Product 2025 & 2033

- Figure 5: North America PCR Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America PCR Packaging Market Revenue (billion), by End-user Verticals 2025 & 2033

- Figure 7: North America PCR Packaging Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 8: North America PCR Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America PCR Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe PCR Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 11: Europe PCR Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe PCR Packaging Market Revenue (billion), by Product 2025 & 2033

- Figure 13: Europe PCR Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe PCR Packaging Market Revenue (billion), by End-user Verticals 2025 & 2033

- Figure 15: Europe PCR Packaging Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 16: Europe PCR Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe PCR Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific PCR Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 19: Asia Pacific PCR Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific PCR Packaging Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Asia Pacific PCR Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Asia Pacific PCR Packaging Market Revenue (billion), by End-user Verticals 2025 & 2033

- Figure 23: Asia Pacific PCR Packaging Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 24: Asia Pacific PCR Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific PCR Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America PCR Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 27: Latin America PCR Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Latin America PCR Packaging Market Revenue (billion), by Product 2025 & 2033

- Figure 29: Latin America PCR Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Latin America PCR Packaging Market Revenue (billion), by End-user Verticals 2025 & 2033

- Figure 31: Latin America PCR Packaging Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 32: Latin America PCR Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America PCR Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa PCR Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 35: Middle East and Africa PCR Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa PCR Packaging Market Revenue (billion), by Product 2025 & 2033

- Figure 37: Middle East and Africa PCR Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 38: Middle East and Africa PCR Packaging Market Revenue (billion), by End-user Verticals 2025 & 2033

- Figure 39: Middle East and Africa PCR Packaging Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 40: Middle East and Africa PCR Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa PCR Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global PCR Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global PCR Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Global PCR Packaging Market Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 4: Global PCR Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global PCR Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Global PCR Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Global PCR Packaging Market Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 8: Global PCR Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global PCR Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 10: Global PCR Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global PCR Packaging Market Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 12: Global PCR Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global PCR Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 14: Global PCR Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 15: Global PCR Packaging Market Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 16: Global PCR Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global PCR Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 18: Global PCR Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 19: Global PCR Packaging Market Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 20: Global PCR Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global PCR Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 22: Global PCR Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 23: Global PCR Packaging Market Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 24: Global PCR Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PCR Packaging Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the PCR Packaging Market?

Key companies in the market include Transcontinental Inc, Mondi plc, Sonoco Product Company, Amcor plc, Aloha Packaging Holdings Inc, IDEALPAK, Spectra Packaging Solutions Ltd *List Not Exhaustive, Berry Global, Genpak LLC, ePac Holdings LLC, ALPLA Group, INDEVCO.

3. What are the main segments of the PCR Packaging Market?

The market segments include Material, Product, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.55 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption from Beverage Industry; Rising Government Initiatives Toward PCR plastic packaging.

6. What are the notable trends driving market growth?

Beverage Industry Driving the Growth.

7. Are there any restraints impacting market growth?

Unforeseen Consequences of Reusing Plastic Packaging and Health Related Concerns.

8. Can you provide examples of recent developments in the market?

August 2022 - Mondi collaborated with Essity and Dow to create new, recyclable secondary packaging for Essity's feminine care products, using renewable materials and post-consumer recycled content that reduce fossil-based materials. Extensive research and testing by Mondi resulted in the recommendation of a new solution that aligns with Essity's packaging goals to work towards 100% recyclability and to use up to 85% biomass, renewable or recycled material in all bags where up to 25% are recycled plastics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PCR Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PCR Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PCR Packaging Market?

To stay informed about further developments, trends, and reports in the PCR Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence