Key Insights

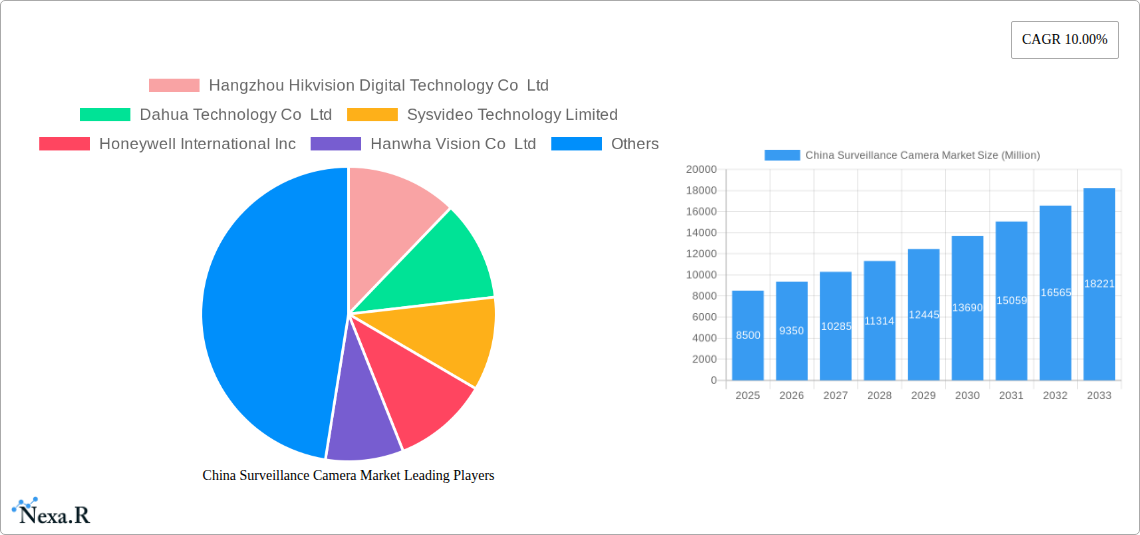

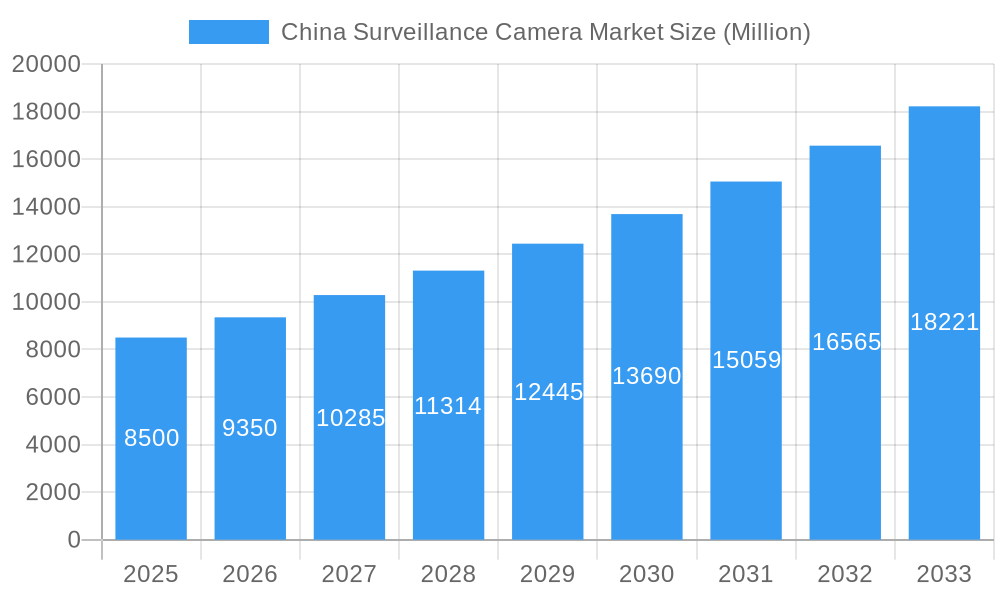

The China Surveillance Camera Market is poised for robust expansion, currently valued at an estimated USD 8.5 billion in 2025. This substantial market is projected to experience a Compound Annual Growth Rate (CAGR) of 10.00% from 2025 to 2033, indicating a strong upward trajectory. This growth is primarily fueled by escalating demand for enhanced security and public safety across various sectors. The increasing adoption of advanced surveillance technologies, such as IP-based cameras offering higher resolution, remote accessibility, and intelligent analytics, is a significant driver. Furthermore, the "smart city" initiatives being vigorously pursued by the Chinese government, encompassing intelligent transportation systems, public safety management, and urban infrastructure monitoring, are creating a massive and consistent demand for sophisticated surveillance solutions. The integration of artificial intelligence (AI) and machine learning into surveillance systems, enabling features like facial recognition, behavior analysis, and anomaly detection, further propels market adoption as end-users seek more proactive and efficient security measures.

China Surveillance Camera Market Market Size (In Billion)

The market's dynamism is further shaped by a confluence of trends and strategic investments by key players. The shift towards AI-powered analytics and integrated security platforms is a prominent trend, allowing for a more holistic approach to security management. Increased government spending on public security and smart city development projects continues to be a foundational driver. While the market is largely driven by public sector applications in government and transportation, the banking and industrial sectors are also showing increased investment in surveillance for loss prevention, operational efficiency, and compliance. The competitive landscape is characterized by the presence of both established global players and strong domestic manufacturers, leading to continuous innovation and price competition. Challenges, though present, are being effectively navigated; while data privacy concerns and the need for robust cybersecurity infrastructure are considerations, the overwhelming benefits of enhanced security and operational efficiency are driving market penetration. Emerging technologies like edge computing in surveillance devices are also gaining traction, promising faster processing and reduced reliance on centralized networks, further cementing the market's growth potential.

China Surveillance Camera Market Company Market Share

This comprehensive report provides an in-depth analysis of the China surveillance camera market, offering critical insights into its evolution, growth drivers, competitive landscape, and future trajectory. With a focus on both parent and child markets, this study delivers actionable intelligence for industry stakeholders navigating this dynamic sector. All market values are presented in Million units.

China Surveillance Camera Market Market Dynamics & Structure

The China surveillance camera market is characterized by a moderate to high level of concentration, with key players dominating market share. Technological innovation is a primary driver, fueled by continuous advancements in AI, video analytics, and network infrastructure, enhancing capabilities like facial recognition and object detection. Government initiatives and policies promoting public safety and smart city development significantly shape the market, alongside evolving regulatory frameworks addressing data privacy and security. Competitive product substitutes, primarily from integrated security solutions and alternative monitoring technologies, present a challenge. End-user demographics are diversifying, with increased demand from sectors beyond government and law enforcement, including retail, transportation, and residential. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger companies acquiring smaller innovative firms to expand their product portfolios and market reach. For instance, the past few years have seen a steady volume of M&A deals, with an estimated xx deals recorded between 2021 and 2024, impacting market shares and technological capabilities.

- Market Concentration: Dominated by a few key players, with top 5 companies holding approximately xx% market share.

- Technological Innovation Drivers: AI-powered analytics (facial recognition, behavior analysis), IoT integration, cloud-based solutions, higher resolution imaging.

- Regulatory Frameworks: Growing emphasis on data privacy regulations (e.g., Personal Information Protection Law), cybersecurity standards, and national security guidelines.

- Competitive Product Substitutes: Drone surveillance, advanced alarm systems, cybersecurity solutions for data protection.

- End-User Demographics: Expanding beyond government and law enforcement to include retail, hospitality, education, healthcare, and smart homes.

- M&A Trends: Strategic acquisitions to gain technology, market share, and expand product offerings.

China Surveillance Camera Market Growth Trends & Insights

The China surveillance camera market has witnessed significant expansion and is projected for robust growth throughout the forecast period. The market size has evolved from an estimated $xx,xxx Million units in 2019 to $xx,xxx Million units in 2025, demonstrating a healthy Compound Annual Growth Rate (CAGR) of approximately xx.x% during the historical period. This growth is underpinned by increasing government investments in public security infrastructure, smart city initiatives, and the burgeoning demand for advanced video surveillance solutions across diverse end-user industries. Adoption rates for IP-based cameras are rapidly increasing, outpacing analog systems due to their superior image quality, scalability, and advanced features. Technological disruptions, including the integration of Artificial Intelligence (AI) for intelligent video analytics, edge computing for real-time processing, and the adoption of 5G technology for enhanced connectivity and data transmission, are reshaping the market landscape. Consumer behavior is shifting towards proactive security measures, with individuals and businesses alike recognizing the importance of surveillance for crime prevention, operational efficiency, and remote monitoring. Market penetration for advanced surveillance systems is estimated to reach xx% by 2025, with further potential for growth as smart home adoption accelerates. The ongoing development of smart city projects across major Chinese metropolises further fuels the demand for integrated and intelligent surveillance solutions.

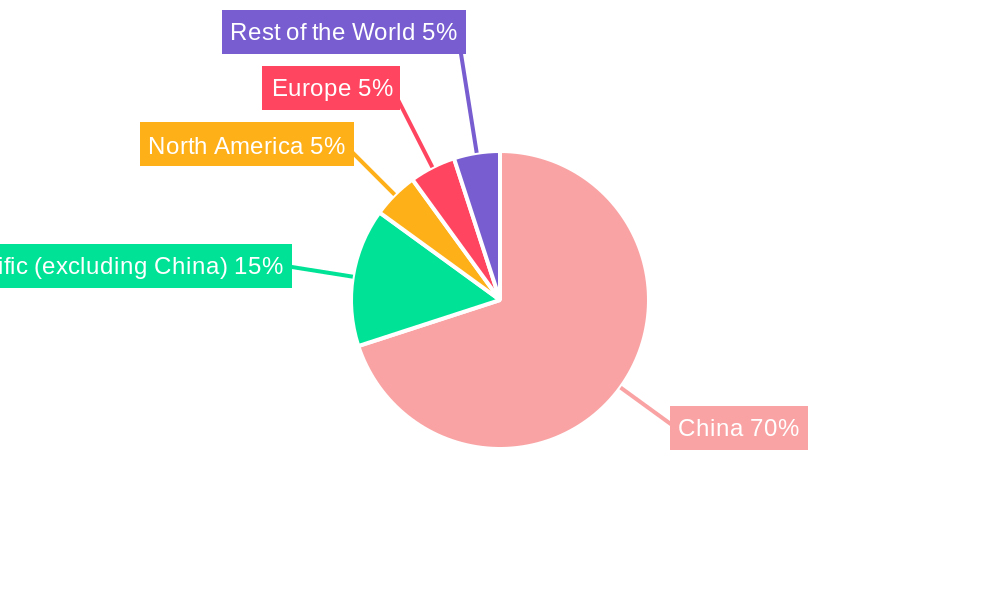

Dominant Regions, Countries, or Segments in China Surveillance Camera Market

The IP Based segment is unequivocally the dominant force driving growth within the China surveillance camera market. This segment has experienced a meteoric rise, eclipsing traditional Analog Based systems due to its inherent advantages in image clarity, flexibility, and advanced feature integration. By 2025, the IP Based segment is estimated to command a market share of over xx%, with projected revenues reaching $xx,xxx Million units. The Government end-user industry segment also stands out as a significant growth catalyst, heavily influenced by national security mandates and ongoing smart city development projects. Government expenditure on surveillance infrastructure for public safety, traffic management, and critical infrastructure protection is substantial, estimated to contribute xx% to the overall market revenue by 2025. Regions such as Eastern China, particularly cities like Shanghai and Hangzhou, lead in adoption rates, driven by higher disposable incomes, advanced technological infrastructure, and proactive government investment in smart city solutions. The sheer scale of urban development and population density in these areas necessitates sophisticated surveillance systems, further propelling the demand for IP-based solutions within the government and commercial sectors.

- Dominant Segment (Type): IP Based Cameras

- Key Drivers: Superior image quality, enhanced scalability, AI and video analytics capabilities, remote accessibility, cost-effectiveness in the long run.

- Market Share (2025): Estimated xx% of the total market.

- Growth Potential: Continued innovation and decreasing costs will drive further adoption.

- Dominant Segment (End-user Industry): Government

- Key Drivers: Public safety initiatives, smart city development, national security concerns, traffic management, infrastructure protection.

- Market Share (2025): Estimated xx% of the total market.

- Growth Potential: Ongoing government investments and expansion of smart city projects.

- Dominant Region: Eastern China

- Key Drivers: High urbanization, advanced technological infrastructure, significant government investment, strong economic development.

- Market Share (2025): Estimated xx% of the regional market.

China Surveillance Camera Market Product Landscape

The product landscape is characterized by continuous innovation, with manufacturers focusing on enhanced resolution, wider dynamic range, and intelligent features. AI-powered analytics are becoming standard, enabling advanced functions like behavioral analysis, anomaly detection, and facial recognition. Applications span across public safety, traffic management, retail analytics, industrial monitoring, and smart home security. Performance metrics are steadily improving, with cameras offering higher frame rates, better low-light performance, and more robust environmental resistance. Unique selling propositions often revolve around the integration of edge computing for localized data processing, reducing reliance on network bandwidth and cloud infrastructure, and seamless integration with broader smart city platforms.

Key Drivers, Barriers & Challenges in China Surveillance Camera Market

Key Drivers:

- Government Initiatives: Strong push for smart cities and public safety, leading to increased infrastructure spending.

- Technological Advancements: AI, IoT, 5G integration enabling smarter and more efficient surveillance.

- Growing Security Concerns: Rising awareness of security needs across various sectors and households.

- Urbanization: Increasing population density in cities necessitates enhanced monitoring.

- Cost-Effectiveness: Declining prices of IP-based cameras making them more accessible.

Barriers & Challenges:

- Data Privacy Regulations: Evolving laws and public concern over data misuse can restrict deployment.

- Cybersecurity Threats: Vulnerability to hacking and data breaches requires robust security measures.

- Interoperability Issues: Lack of standardization across different vendors can hinder seamless integration.

- Supply Chain Disruptions: Geopolitical factors and global manufacturing complexities can impact component availability and pricing.

- High Initial Investment: While costs are decreasing, large-scale deployments can still require significant capital expenditure.

Emerging Opportunities in China Surveillance Camera Market

Emerging opportunities lie in the burgeoning smart home market, with demand for integrated home security and monitoring solutions on the rise. The expansion of specialized industrial surveillance needs, such as in manufacturing for quality control and in logistics for asset tracking, presents significant untapped potential. Furthermore, the development of AI-driven video analytics for applications beyond traditional security, like retail customer behavior analysis and healthcare patient monitoring, offers novel avenues for growth. The increasing adoption of cloud-based surveillance services also presents an opportunity for recurring revenue models and enhanced data management.

Growth Accelerators in the China Surveillance Camera Market Industry

The long-term growth of the China surveillance camera market is being significantly accelerated by continuous technological breakthroughs in AI and machine learning, enabling more sophisticated and predictive analytics. Strategic partnerships between surveillance manufacturers, AI solution providers, and telecommunications companies are fostering integrated ecosystems and expanding market reach. Market expansion strategies, including the development of specialized solutions for niche industries and the penetration of rural markets, are further catalyzing growth. The ongoing global demand for advanced video surveillance, coupled with China's position as a manufacturing hub, also provides a sustained growth impetus.

Key Players Shaping the China Surveillance Camera Market Market

- Hangzhou Hikvision Digital Technology Co Ltd

- Dahua Technology Co Ltd

- Sysvideo Technology Limited

- Honeywell International Inc

- Hanwha Vision Co Ltd

- Axis Communications AB

- Bosch Security and Safety Systems

- Shenzhen XONZ Technology Co Ltd

- ZANUO Technology Co Ltd

- Zhuhai RaySharp Technology Co Ltd

- LS Vision

- Unifore Security (Shenzhen Meidasi Technology Development Co Ltd )

Notable Milestones in China Surveillance Camera Market Sector

- December 2023: Hanwha Vision's Vietnam facility achieved a milestone of producing its ten millionth unit, highlighting robust growth and a focus on the US market.

- November 2023: Dahua Technology launched its Dahua Wireless Series, featuring compact, easy-to-install cameras (Turret, Picoo, Bullet, Hero) for SMB applications, with seamless integration with DMSS app and DSS video management system.

In-Depth China Surveillance Camera Market Market Outlook

The China surveillance camera market is poised for sustained and significant growth, driven by a confluence of factors including advanced technological integration, supportive government policies, and evolving security demands. The increasing adoption of AI-powered analytics and edge computing will unlock new applications and enhance the intelligence of surveillance systems. Strategic collaborations and the continuous drive for innovation will further fuel market expansion. The outlook points towards a future where surveillance cameras are not just security tools but integral components of smart cities, intelligent infrastructure, and enhanced user experiences, offering substantial opportunities for market participants.

China Surveillance Camera Market Segmentation

-

1. Type

- 1.1. Analog Based

- 1.2. IP Based

-

2. End-user Industry

- 2.1. Government

- 2.2. Banking

- 2.3. Healthcare

- 2.4. Transportation and Logistics

- 2.5. Industrial

- 2.6. Others (

China Surveillance Camera Market Segmentation By Geography

- 1. China

China Surveillance Camera Market Regional Market Share

Geographic Coverage of China Surveillance Camera Market

China Surveillance Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Presence of an Established Ecosystem for Surveillance Camera Manufacturing; Supportive Government Outlook Towards Security and Surveillance of Public and Private Spaces

- 3.3. Market Restrains

- 3.3.1. Presence of an Established Ecosystem for Surveillance Camera Manufacturing; Supportive Government Outlook Towards Security and Surveillance of Public and Private Spaces

- 3.4. Market Trends

- 3.4.1. IP based Surveillance Cameras Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Surveillance Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog Based

- 5.1.2. IP Based

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government

- 5.2.2. Banking

- 5.2.3. Healthcare

- 5.2.4. Transportation and Logistics

- 5.2.5. Industrial

- 5.2.6. Others (

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dahua Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sysvideo Technology Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanwha Vision Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Communications AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch Security and Safety Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shenzhen XONZ Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ZANUO Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zhuhai RaySharp Technology Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LS Vision

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Unifore Security (Shenzhen Meidasi Technology Development Co Ltd )*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: China Surveillance Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Surveillance Camera Market Share (%) by Company 2025

List of Tables

- Table 1: China Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: China Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: China Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: China Surveillance Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Surveillance Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China Surveillance Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: China Surveillance Camera Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: China Surveillance Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: China Surveillance Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: China Surveillance Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Surveillance Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Surveillance Camera Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the China Surveillance Camera Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology Co Ltd, Sysvideo Technology Limited, Honeywell International Inc, Hanwha Vision Co Ltd, Axis Communications AB, Bosch Security and Safety Systems, Shenzhen XONZ Technology Co Ltd, ZANUO Technology Co Ltd, Zhuhai RaySharp Technology Co Ltd, LS Vision, Unifore Security (Shenzhen Meidasi Technology Development Co Ltd )*List Not Exhaustive.

3. What are the main segments of the China Surveillance Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Presence of an Established Ecosystem for Surveillance Camera Manufacturing; Supportive Government Outlook Towards Security and Surveillance of Public and Private Spaces.

6. What are the notable trends driving market growth?

IP based Surveillance Cameras Driving the Demand.

7. Are there any restraints impacting market growth?

Presence of an Established Ecosystem for Surveillance Camera Manufacturing; Supportive Government Outlook Towards Security and Surveillance of Public and Private Spaces.

8. Can you provide examples of recent developments in the market?

December 2023: Within just five years of commencing operations, Hanwha Vision's Vietnam facility hit a significant milestone, producing its ten millionth unit. This milestone underscores Hanwha Vision's robust growth, particularly in the US market. With this achievement as a springboard, the company is poised to fortify its global standing, with a continued emphasis on the US market.November 2023: Dahua Technology unveiled its latest innovation: the Dahua Wireless Series. This series features a lineup of cameras—Turret, Picoo, Bullet, and Hero—specifically tailored for small and medium-sized applications. These cameras are compact and wireless and boast a design that emphasizes ease of installation and discreet monitoring. What sets these cameras apart is their seamless integration with the Dahua Mobile Security Surveillance (DMSS) app, allowing users to manage them over cell phone networks. Alternatively, users can opt for the Dahua Security System (DSS) video management system, accessible via WiFi, for a professional remote surveillance experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Surveillance Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Surveillance Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Surveillance Camera Market?

To stay informed about further developments, trends, and reports in the China Surveillance Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence