Key Insights

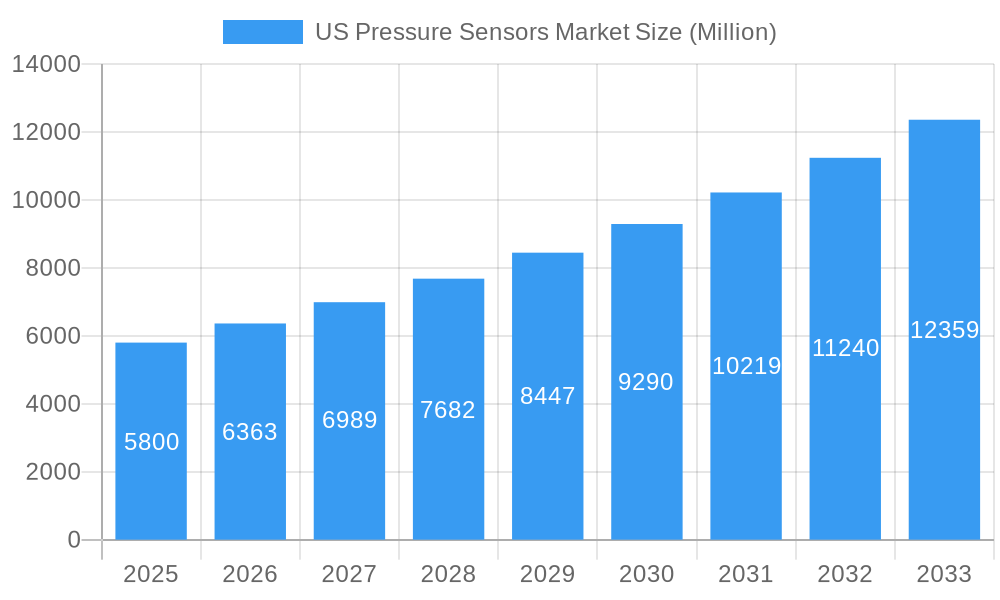

The US Pressure Sensors Market is projected for substantial growth, estimated at 9703 million in 2025, with a Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This expansion is driven by increasing demand for advanced sensing solutions across key industries. The automotive sector is a primary contributor, boosted by the adoption of Advanced Driver-Assistance Systems (ADAS), stringent emission standards, and the burgeoning electric vehicle (EV) market, all requiring precise pressure monitoring for optimal performance, safety, and efficiency. The medical industry's ongoing innovation in diagnostic equipment, patient monitoring, and minimally invasive surgical tools fuels consistent demand for high-accuracy pressure sensors. Miniaturization and smart functionality integration in consumer electronics also significantly contribute to market growth.

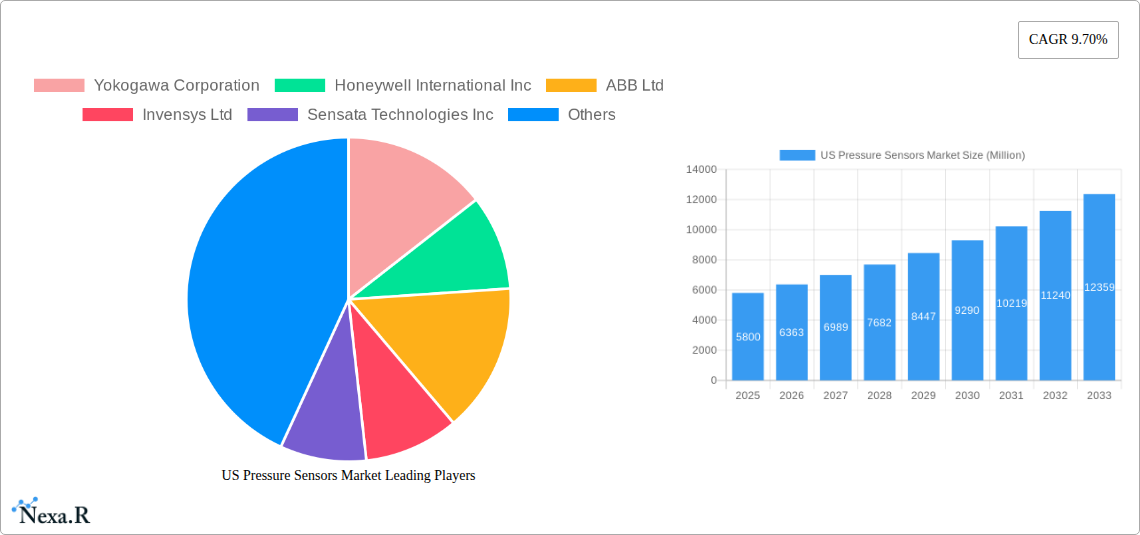

US Pressure Sensors Market Market Size (In Billion)

Further propelling this market are trends like the integration of IoT and AI in industrial automation, creating a need for smart pressure sensors for real-time data analysis and predictive maintenance. The aerospace and defense sector's focus on improved aircraft performance, safety, and advanced defense system development presents significant opportunities. While these drivers are strong, market growth may face challenges from the high cost of research and development for novel sensor technologies and the complexity of ensuring system interoperability. Stringent regulatory compliance in sectors such as healthcare and aerospace can also impact development timelines and costs. Despite these factors, the US pressure sensors market is on a positive trajectory, driven by continuous innovation and expanding applications.

US Pressure Sensors Market Company Market Share

This comprehensive report offers a definitive analysis of the US Pressure Sensors Market, providing critical insights into its current state, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this report utilizes high-traffic keywords for maximum search engine visibility. We analyze parent and child market dynamics, presenting all values in million units for clear understanding.

US Pressure Sensors Market Dynamics & Structure

The US Pressure Sensors Market is characterized by a moderately concentrated structure, with leading players continually innovating to capture market share. Technological innovation is a primary driver, fueled by advancements in miniaturization, increased accuracy, and enhanced connectivity, particularly for IoT applications. Regulatory frameworks, especially those pertaining to safety and environmental standards in automotive and industrial sectors, also shape market dynamics. Competitive product substitutes, such as alternative sensing technologies, pose a challenge but are often outpaced by the specialized performance of pressure sensors. End-user demographics are increasingly diverse, spanning from demanding aerospace and defense applications to mass-market consumer electronics. Mergers and Acquisitions (M&A) are an ongoing trend, as larger entities seek to consolidate their product portfolios and expand their technological capabilities.

- Market Concentration: Dominated by a blend of established global players and specialized niche manufacturers.

- Technological Innovation Drivers: Miniaturization, IoT integration, improved accuracy, and energy efficiency.

- Regulatory Frameworks: Stringent standards in automotive, medical, and industrial sectors drive demand for certified and reliable sensors.

- Competitive Product Substitutes: While alternatives exist, specialized pressure sensing capabilities remain crucial.

- End-User Demographics: Diversified across industrial, automotive, medical, and consumer electronics sectors.

- M&A Trends: Strategic acquisitions to enhance product offerings and market reach. For instance, Sensata Technologies' acquisition of Xirgo Technologies in February 2021 for USD 400 million underscores this trend.

US Pressure Sensors Market Growth Trends & Insights

The US Pressure Sensors Market is poised for robust expansion, driven by an escalating demand across various pivotal sectors. The market size is projected to witness substantial growth throughout the forecast period (2025–2033), underpinned by increasing adoption rates in sophisticated applications and persistent technological advancements. We anticipate a significant CAGR of XX% from the base year 2025, reflecting a dynamic and evolving market landscape. The integration of pressure sensors into the Internet of Things (IoT) ecosystem is a key disruptive force, enabling real-time monitoring and predictive maintenance in industrial settings, enhancing efficiency and safety in automotive systems, and facilitating advanced functionalities in medical devices and consumer electronics. Shifts in consumer behavior, such as the growing preference for smart devices and wearables, are directly translating into increased demand for compact, highly accurate, and power-efficient pressure sensors. The historical period (2019–2024) has laid a strong foundation, with steady growth driven by industrial automation and automotive advancements. The estimated year 2025 is expected to see a continued upward trend, setting the stage for accelerated growth in the subsequent years. The market penetration of advanced pressure sensing technologies is steadily increasing, as industries recognize their critical role in operational optimization and product innovation. The ongoing development of MEMS (Micro-Electro-Mechanical Systems) pressure sensors, offering superior performance and cost-effectiveness, will further democratize access to these vital components, thereby fueling market expansion.

Dominant Regions, Countries, or Segments in US Pressure Sensors Market

The Industrial application segment stands as the most dominant force within the US Pressure Sensors Market, driving significant growth and innovation throughout the study period (2019–2033). This dominance is attributed to the pervasive need for precise pressure measurement in a wide array of industrial processes, ensuring operational efficiency, safety, and product quality. The industrial sector encompasses critical sub-segments such as manufacturing, oil and gas, chemical processing, and power generation, all of which rely heavily on pressure sensors for continuous monitoring and control.

- Industrial Segment Drivers:

- Automation and Process Control: Essential for optimizing manufacturing processes, reducing waste, and enhancing productivity.

- Safety and Compliance: Crucial for preventing equipment failure, hazardous leaks, and ensuring adherence to stringent safety regulations.

- Predictive Maintenance: Enabling early detection of anomalies, thereby minimizing downtime and maintenance costs.

- Energy Efficiency: Optimizing operations to reduce energy consumption and operational expenses.

- Infrastructure Development: Ongoing investments in industrial infrastructure necessitate reliable sensing solutions.

The Automotive segment is a close second, with a substantial and growing market share. The increasing sophistication of vehicles, including the proliferation of advanced driver-assistance systems (ADAS), autonomous driving technologies, and powertrain management systems, directly translates into a higher demand for various types of pressure sensors. These sensors are vital for monitoring tire pressure, fuel pressure, exhaust pressure, and engine manifold pressure, all contributing to enhanced safety, fuel efficiency, and performance.

- Automotive Segment Drivers:

- ADAS and Autonomous Driving: Requires precise pressure data for accurate system functioning.

- Emission Control: Monitoring exhaust gas pressure is critical for meeting environmental regulations.

- Fuel Efficiency: Optimizing engine performance through precise fuel and manifold pressure readings.

- Electric Vehicles (EVs): Pressure sensors play a role in battery management systems and thermal control.

The Aerospace & Defence segment, while smaller in volume, represents a high-value market due to the stringent performance and reliability requirements. Pressure sensors are indispensable for critical functions such as altitude measurement, cabin pressurization, engine performance monitoring, and flight control systems.

The Medical segment is experiencing significant growth, driven by the increasing demand for advanced medical devices, patient monitoring systems, and diagnostic equipment. Pressure sensors are integral to ventilators, infusion pumps, blood pressure monitors, and surgical instruments, where accuracy and reliability are paramount.

Consumer Electronics and HVAC segments also contribute to market growth, with applications ranging from barometric pressure sensing in smartphones and wearables for altitude tracking to pressure monitoring in HVAC systems for efficient climate control. The Food & Beverage sector utilizes pressure sensors for process control, packaging, and quality assurance.

Overall, the Industrial sector's pervasive application and continuous need for optimization and safety make it the leading segment, closely followed by the rapidly evolving Automotive sector.

US Pressure Sensors Market Product Landscape

The US Pressure Sensors Market product landscape is characterized by a constant stream of innovations focused on enhanced performance, miniaturization, and integration capabilities. MEMS (Micro-Electro-Mechanical Systems) technology dominates, enabling the production of small, cost-effective, and highly accurate pressure sensors. Key product innovations include barometric pressure sensors with exceptional altitude measurement accuracy, as demonstrated by Bosch Sensortec's BMP390, capable of detecting height changes below 10 centimeters, ideal for smartphones and wearables. Absolute, gauge, and differential pressure sensors are available across various pressure ranges and operating conditions, catering to diverse applications. Advanced materials and packaging techniques are improving sensor resilience to harsh environments and increasing their lifespan. The focus is on developing intelligent sensors with integrated signal conditioning, digital interfaces (like I2C and SPI), and self-diagnostic capabilities, facilitating seamless integration into complex systems and IoT platforms. Unique selling propositions often lie in specialized features such as high-temperature resistance, chemical inertness, and low power consumption.

Key Drivers, Barriers & Challenges in US Pressure Sensors Market

Key Drivers:

- Industrial Automation and IoT: The widespread adoption of automation in manufacturing and the burgeoning Internet of Things (IoT) ecosystem are paramount drivers, necessitating real-time pressure monitoring for efficiency and control.

- Automotive Advancements: The increasing complexity of vehicles, including ADAS and the electrification trend, fuels demand for a wide array of pressure sensing applications.

- Medical Device Innovation: The continuous development of advanced medical equipment and diagnostic tools requires highly accurate and reliable pressure sensors.

- Miniaturization and Cost Reduction: Advancements in MEMS technology allow for smaller, more affordable pressure sensors, expanding their application scope.

Key Barriers & Challenges:

- Supply Chain Volatility: Geopolitical factors and global demand fluctuations can lead to disruptions and price volatility in raw material sourcing and component availability.

- Technological Obsolescence: Rapid technological advancements can render older sensor technologies obsolete, requiring continuous investment in R&D and product upgrades.

- Stringent Calibration and Certification Requirements: Particularly in sectors like aerospace, medical, and automotive, rigorous calibration and certification processes add to development time and cost.

- Intense Competition: The market features numerous players, leading to price pressures and the need for strong differentiation.

Emerging Opportunities in US Pressure Sensors Market

Emerging opportunities in the US Pressure Sensors Market lie significantly in the expanding domain of the Internet of Things (IoT) and Smart Cities. The demand for connected devices in smart homes, smart grids, and intelligent infrastructure monitoring will propel the need for highly integrated and low-power pressure sensors. Furthermore, the renewable energy sector, particularly in monitoring pressure in wind turbines and solar power systems, presents a growing avenue. Advancements in wearable technology beyond fitness trackers, such as medical-grade wearables for continuous health monitoring, will also unlock new demand for highly accurate and miniature pressure sensors. The increasing focus on environmental monitoring and industrial hygiene will drive the need for specialized sensors to detect pressure variations indicative of leaks or atmospheric changes.

Growth Accelerators in the US Pressure Sensors Market Industry

Several catalysts are accelerating the growth trajectory of the US Pressure Sensors Market. Technological breakthroughs in materials science and microfabrication are leading to the development of sensors with unprecedented accuracy, sensitivity, and durability. Strategic partnerships and collaborations between sensor manufacturers and end-users are fostering innovation tailored to specific application needs. The increasing adoption of Industry 4.0 principles across manufacturing sectors mandates the deployment of advanced sensing technologies for enhanced data collection and analysis. Furthermore, government initiatives promoting technological adoption and industrial modernization are creating a supportive environment for market expansion. The growing emphasis on predictive maintenance across industries is a significant growth accelerator, as pressure sensors are fundamental to identifying potential equipment failures before they occur.

Key Players Shaping the US Pressure Sensors Market Market

- Yokogawa Corporation

- Honeywell International Inc

- ABB Ltd

- Invensys Ltd

- Sensata Technologies Inc

- Endress+Hauser AG

- Rockwell Automation Inc

- Kistler Group

- All Sensors Corporation

- GMS Instruments BV

- Bosch Sensortec GmbH

- Rosemount Inc (Emerson Electric Company)

- Siemens AG

Notable Milestones in US Pressure Sensors Market Sector

- April 2020: Bosch Sensortec announced the BMP390, a barometric pressure sensor for altitude tracking in smartphones and wearable and hearable devices. According to Bosch, the new sensor can measure height changes below 10 centimeters and is 50 percent more accurate than its predecessor. The new BMP390 supports GPS applications for outdoor navigation and calorie expenditure estimation tasks and is available for high-volume smartphones, wearable, and hearable manufacturers.

- February 2021: Sensata Technologies, an industrial technology company and provider of sensor-rich solutions, announced the acquisition of telematics and data insight provider Xirgo Technologies Intermediate Holdings, LLC ('Xirgo') for USD 400 million.

In-Depth US Pressure Sensors Market Market Outlook

The future outlook for the US Pressure Sensors Market is exceptionally promising, characterized by sustained innovation and expanding application horizons. Growth accelerators such as the relentless pursuit of IoT integration, the continued evolution of automotive technologies, and the increasing sophistication of medical devices will fuel demand. Strategic market expansion, particularly into emerging areas like smart infrastructure and advanced healthcare solutions, will further solidify the market's growth trajectory. The ongoing development of AI-powered analytics for sensor data will unlock new levels of operational efficiency and predictive capabilities, creating significant value for end-users. The market is set to witness a paradigm shift towards more intelligent, interconnected, and application-specific pressure sensing solutions.

US Pressure Sensors Market Segmentation

-

1. Application

- 1.1. Automoti

- 1.2. Medical

- 1.3. Consumer Electronics

- 1.4. Industrial

- 1.5. Aerospace & Defence

- 1.6. Food & Beverage

- 1.7. HVAC

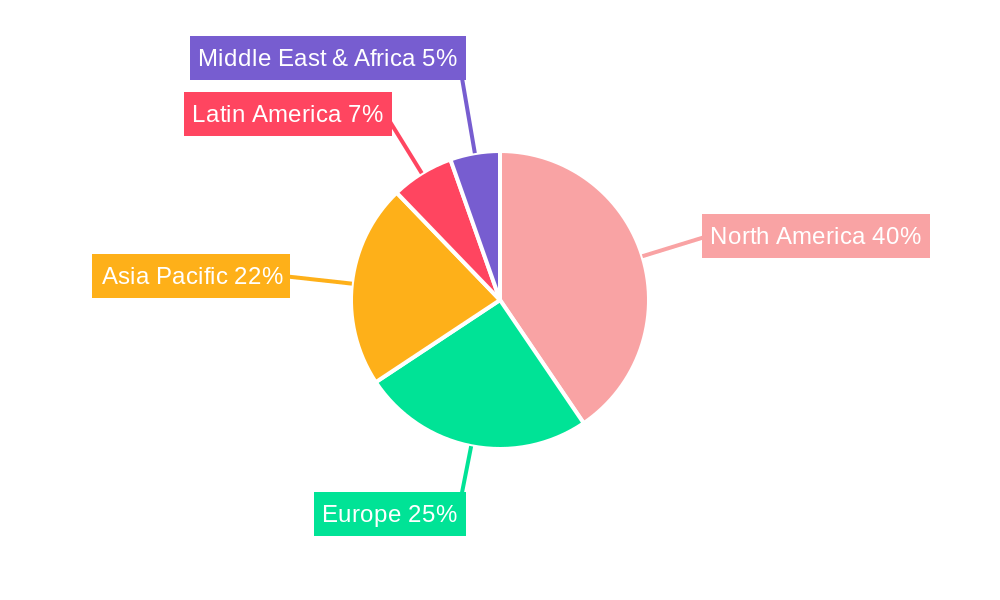

US Pressure Sensors Market Segmentation By Geography

- 1. United States

US Pressure Sensors Market Regional Market Share

Geographic Coverage of US Pressure Sensors Market

US Pressure Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth Of End-user Verticals

- 3.2.2 such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Sensing Products

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Pressure Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automoti

- 5.1.2. Medical

- 5.1.3. Consumer Electronics

- 5.1.4. Industrial

- 5.1.5. Aerospace & Defence

- 5.1.6. Food & Beverage

- 5.1.7. HVAC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Yokogawa Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Invensys Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sensata Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Endress+Hauser AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rockwell Automation Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kistler Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 All Sensors Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GMS Instruments BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bosch Sensortec GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rosemount Inc (Emerson Electric Company)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Siemens AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Yokogawa Corporation

List of Figures

- Figure 1: Global US Pressure Sensors Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: United States US Pressure Sensors Market Revenue (million), by Application 2025 & 2033

- Figure 3: United States US Pressure Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: United States US Pressure Sensors Market Revenue (million), by Country 2025 & 2033

- Figure 5: United States US Pressure Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Pressure Sensors Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global US Pressure Sensors Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global US Pressure Sensors Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global US Pressure Sensors Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Pressure Sensors Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the US Pressure Sensors Market?

Key companies in the market include Yokogawa Corporation, Honeywell International Inc, ABB Ltd, Invensys Ltd, Sensata Technologies Inc, Endress+Hauser AG, Rockwell Automation Inc, Kistler Group, All Sensors Corporation, GMS Instruments BV, Bosch Sensortec GmbH, Rosemount Inc (Emerson Electric Company), Siemens AG.

3. What are the main segments of the US Pressure Sensors Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9703 million as of 2022.

5. What are some drivers contributing to market growth?

Growth Of End-user Verticals. such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry.

6. What are the notable trends driving market growth?

Automotive Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

High Costs Associated with Sensing Products.

8. Can you provide examples of recent developments in the market?

April 2020 - Bosch Sensortec announced the BMP390, a barometric pressure sensor for altitude tracking in smartphones and wearable and hearable devices. According to Bosch, the new sensor can measure height changes below 10 centimeters and is 50 percent more accurate than its predecessor. The new BMP390 supports GPS applications for outdoor navigation and calorie expenditure estimation tasks and is available for high-volume smartphones, wearable, and hearable manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Pressure Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Pressure Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Pressure Sensors Market?

To stay informed about further developments, trends, and reports in the US Pressure Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence