Key Insights

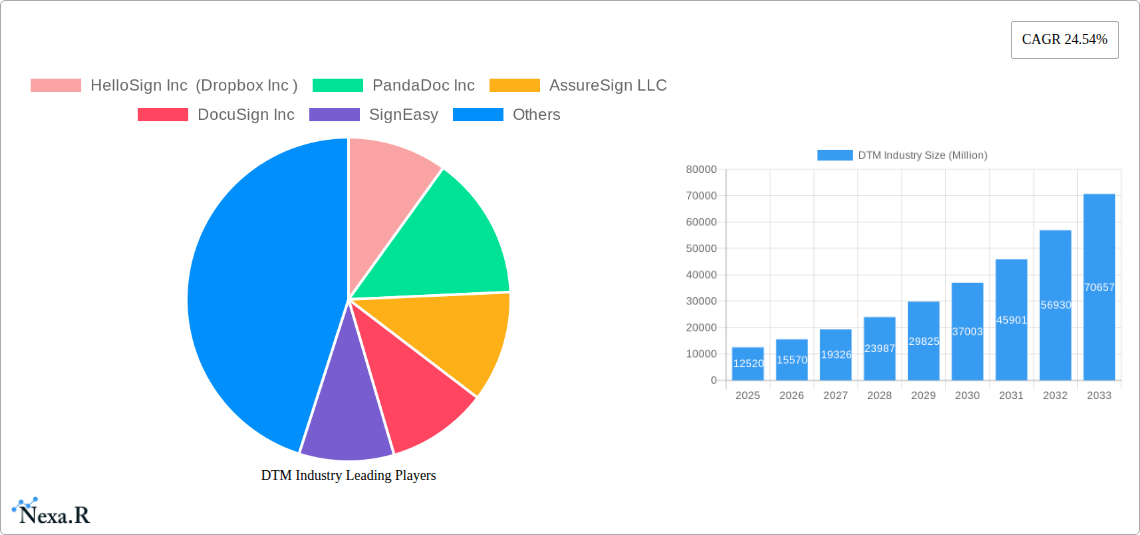

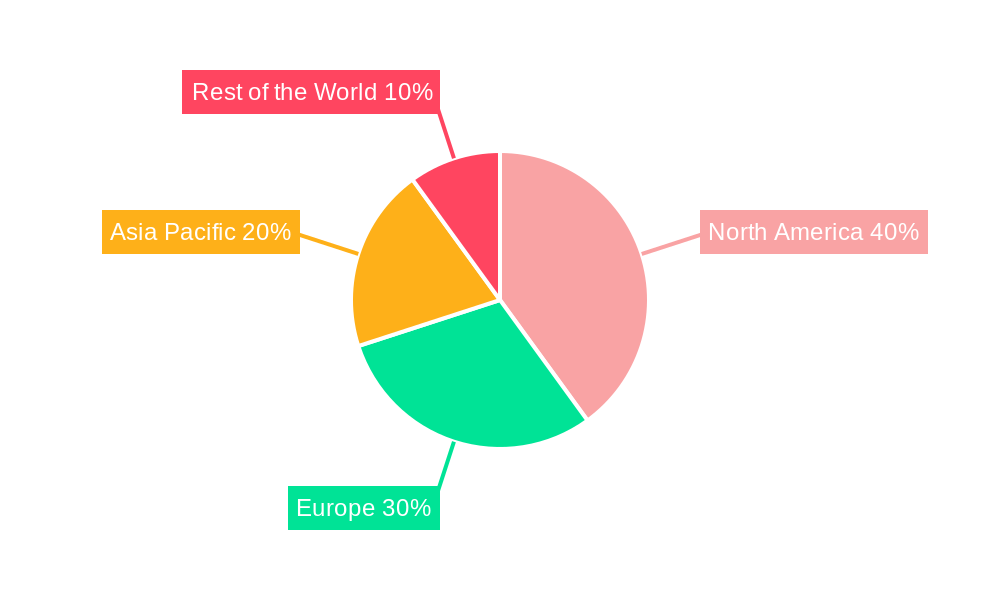

The Digital Transaction Management (DTM) market is experiencing robust growth, projected to reach $12.52 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 24.54% from 2025 to 2033. This expansion is driven by several key factors. The increasing need for secure and efficient document workflows across various industries, particularly BFSI (Banking, Financial Services, and Insurance), Healthcare, and Retail, is a primary catalyst. Businesses are increasingly adopting cloud-based solutions to streamline operations, enhance collaboration, and reduce operational costs associated with paper-based processes. Furthermore, the growing emphasis on regulatory compliance and the need to minimize fraud are significantly boosting the adoption of DTM solutions. The market is segmented by organization size (SMEs and large enterprises), end-user industry, and component (solutions and services). Large enterprises are currently driving significant market share due to their higher investment capacity and complex document management needs. However, the SME segment is expected to witness substantial growth in the coming years driven by increasing awareness of the benefits of digital transformation and the availability of affordable cloud-based DTM solutions. The market's geographic distribution is expected to be fairly diverse, with North America maintaining a significant share, followed by Europe and Asia Pacific. The ongoing digital transformation across various sectors, coupled with the increasing adoption of advanced technologies like AI and machine learning in DTM solutions, will continue to fuel market growth throughout the forecast period.

DTM Industry Market Size (In Billion)

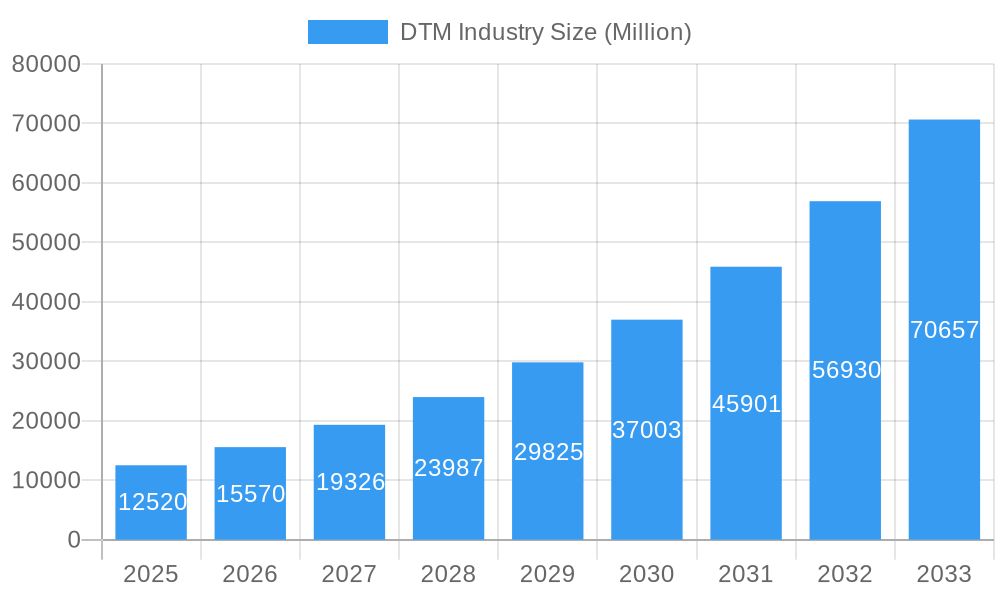

The competitive landscape is characterized by a mix of established players like DocuSign and Adobe, alongside several emerging companies offering specialized solutions. The success of these companies depends on their ability to innovate, offer competitive pricing, and provide robust customer support. The market is likely to witness further consolidation through mergers and acquisitions as companies strive to expand their market share and service offerings. The continuous development of features such as advanced automation, enhanced security protocols, and seamless integration with existing enterprise systems will be crucial for future growth. Challenges may include integrating legacy systems with new DTM solutions, ensuring data security and compliance with evolving regulations, and addressing concerns regarding digital signature validity and legal enforceability.

DTM Industry Company Market Share

This comprehensive report provides a detailed analysis of the Digital Transaction Management (DTM) industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, and is essential for industry professionals, investors, and strategists seeking to navigate this rapidly evolving market. The global DTM market is projected to reach xx Million units by 2033.

DTM Industry Market Dynamics & Structure

The DTM market is characterized by moderate concentration, with several key players holding significant market share, but a vibrant ecosystem of smaller players driving innovation. Technological advancements, particularly in AI and blockchain, are reshaping the landscape, while regulatory frameworks, like GDPR and CCPA, significantly impact data security and compliance. The market also faces competition from traditional document management systems and emerging digital signature solutions. Mergers and acquisitions (M&A) activity has been steadily increasing, reflecting consolidation and expansion strategies.

- Market Concentration: DocuSign and Adobe hold a combined market share of approximately xx%, with other players such as HelloSign and PandaDoc securing smaller, yet significant shares.

- Technological Innovation: AI-powered automation, blockchain for secure document management, and advanced analytics are key drivers.

- Regulatory Landscape: GDPR, CCPA, and other data privacy regulations are shaping security and compliance protocols.

- M&A Activity: An average of xx M&A deals per year were recorded between 2019 and 2024, with a predicted increase in the coming years.

- End-User Demographics: The adoption rate is higher in Large Enterprises compared to SMEs.

DTM Industry Growth Trends & Insights

The DTM market has experienced significant growth in recent years, driven by the increasing demand for efficient, secure, and cost-effective document management solutions. The adoption of digital technologies across various industries is a major catalyst, along with the increasing emphasis on remote work and digital transformation initiatives. Technological disruptions, particularly cloud-based solutions, have streamlined operations and improved accessibility. Consumer behavior shifts toward digital interactions further fuel market growth. The compound annual growth rate (CAGR) is estimated at xx% during the forecast period (2025-2033), indicating substantial market expansion. Market penetration is highest in the BFSI sector and is expected to continue growing across all industries.

Dominant Regions, Countries, or Segments in DTM Industry

North America currently dominates the DTM market, driven by early adoption of digital technologies and a strong presence of key players. However, the Asia-Pacific region shows significant growth potential, fueled by rising digitalization and increasing internet penetration. Within segments, the Large Enterprise segment contributes the highest revenue share, followed by the BFSI sector. The Solution component currently holds a larger share of the market than the Service segment.

- Leading Regions: North America (xx Million units), followed by Europe (xx Million units) and Asia-Pacific (xx Million units)

- Key Drivers: Strong digital infrastructure, favorable regulatory environments, and high adoption rates in specific industries.

- Dominant Segments: Large Enterprise (xx Million units), BFSI (xx Million units), and Solution (xx Million units).

DTM Industry Product Landscape

DTM solutions are evolving beyond simple e-signatures, incorporating features like workflow automation, document collaboration, and advanced analytics. Products now emphasize user-friendly interfaces, robust security measures, and seamless integration with existing enterprise systems. Key features include advanced audit trails, real-time document tracking, and customizable workflows. This increased functionality enhances efficiency and compliance, boosting product appeal across various industries.

Key Drivers, Barriers & Challenges in DTM Industry

Key Drivers:

- Increased demand for digital transformation and automation in document workflows.

- Growing adoption of cloud-based solutions for improved accessibility and scalability.

- Stringent regulatory compliance requirements driving the need for secure and auditable solutions.

Challenges & Restraints:

- High initial investment costs for implementing DTM solutions, particularly for SMEs.

- Concerns about data security and privacy in managing sensitive documents.

- Resistance to change from traditional document management processes. This translates into a market penetration that lags in some industries.

Emerging Opportunities in DTM Industry

- Expanding into untapped markets in developing economies.

- Development of specialized DTM solutions for niche industries (e.g., healthcare, legal).

- Integration of AI and machine learning for improved document processing and analytics.

Growth Accelerators in the DTM Industry Industry

Strategic partnerships between DTM providers and other technology companies are expanding reach and functionality. Technological advancements, such as AI-driven automation and blockchain security, are enhancing efficiency and security, further driving market growth. The expansion into new geographic markets and the development of innovative applications within existing sectors also provide strong growth catalysts.

Key Players Shaping the DTM Industry Market

- HelloSign Inc (Dropbox Inc)

- PandaDoc Inc

- AssureSign LLC

- DocuSign Inc

- SignEasy

- ZorroSign Inc

- Adobe Inc

- Nintex Group Pty Ltd

- InfoCert

- Mitratech Holdings Inc

- OneSpan Inc

- PactSafe Inc

- Topaz Systems Inc

- Namirial SpA

- eOriginal Inc

Notable Milestones in DTM Industry Sector

- December 2022: Skyslope partners with Weichert, Realtors, expanding its reach to thousands of agents in the USA and Canada.

- September 2022: DocuSign integrates with Zavvie's MoxiEngage CRM, enhancing its digital transaction management capabilities.

In-Depth DTM Industry Market Outlook

The DTM market is poised for continued robust growth, driven by technological innovations, increasing demand for digital solutions, and expanding market penetration across various sectors. Strategic partnerships, product diversification, and geographical expansion will be key factors for success. The long-term outlook is positive, with significant growth potential in emerging markets and new applications of DTM technology.

DTM Industry Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Service

-

2. Organization Size

- 2.1. Small and Medium Enterprise

- 2.2. Large Enterprise

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. IT and Telecommunication

- 3.5. Other End-user Industries

DTM Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

DTM Industry Regional Market Share

Geographic Coverage of DTM Industry

DTM Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-signatures and Adoption of Cloud Services; Focus on Business Automation; BFSI Industry is Expected to Hold a Significant Market Share

- 3.3. Market Restrains

- 3.3.1. Geopolitical Situation and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. BFSI Industry is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DTM Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprise

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. IT and Telecommunication

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America DTM Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium Enterprise

- 6.2.2. Large Enterprise

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. Retail

- 6.3.4. IT and Telecommunication

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe DTM Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium Enterprise

- 7.2.2. Large Enterprise

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. Retail

- 7.3.4. IT and Telecommunication

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific DTM Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium Enterprise

- 8.2.2. Large Enterprise

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. Retail

- 8.3.4. IT and Telecommunication

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World DTM Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium Enterprise

- 9.2.2. Large Enterprise

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. Retail

- 9.3.4. IT and Telecommunication

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 HelloSign Inc (Dropbox Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PandaDoc Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 AssureSign LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 DocuSign Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SignEasy

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ZorroSign Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Adobe Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nintex Group Pty Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 InfoCert

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mitratech Holdings Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 OneSpan Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 PactSafe Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Topaz Systems Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Namirial SpA

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 eOriginal Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 HelloSign Inc (Dropbox Inc )

List of Figures

- Figure 1: Global DTM Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 5: North America DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 6: North America DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America DTM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 13: Europe DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: Europe DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe DTM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Asia Pacific DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Asia Pacific DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Asia Pacific DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific DTM Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World DTM Industry Revenue (Million), by Component 2025 & 2033

- Figure 27: Rest of the World DTM Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Rest of the World DTM Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Rest of the World DTM Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Rest of the World DTM Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World DTM Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World DTM Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World DTM Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global DTM Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 7: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 11: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 15: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global DTM Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global DTM Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 19: Global DTM Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global DTM Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DTM Industry?

The projected CAGR is approximately 24.54%.

2. Which companies are prominent players in the DTM Industry?

Key companies in the market include HelloSign Inc (Dropbox Inc ), PandaDoc Inc, AssureSign LLC, DocuSign Inc, SignEasy, ZorroSign Inc, Adobe Inc, Nintex Group Pty Ltd, InfoCert, Mitratech Holdings Inc, OneSpan Inc, PactSafe Inc, Topaz Systems Inc, Namirial SpA, eOriginal Inc.

3. What are the main segments of the DTM Industry?

The market segments include Component, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-signatures and Adoption of Cloud Services; Focus on Business Automation; BFSI Industry is Expected to Hold a Significant Market Share.

6. What are the notable trends driving market growth?

BFSI Industry is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Geopolitical Situation and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

December 2022 - Skyslope announced a new partnership with Weichert, Realtors for its innovative digital transaction management to Weichert's over 7,000 corporate associates. This innovative partnership expands Skyslope's capability by adding several thousands of agents to the current members in the USA and Canada. In addition to the core transaction platform, Skyslope offers a prominent digital signature solution to send real estate documents out for e-signature.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DTM Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DTM Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DTM Industry?

To stay informed about further developments, trends, and reports in the DTM Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence