Key Insights

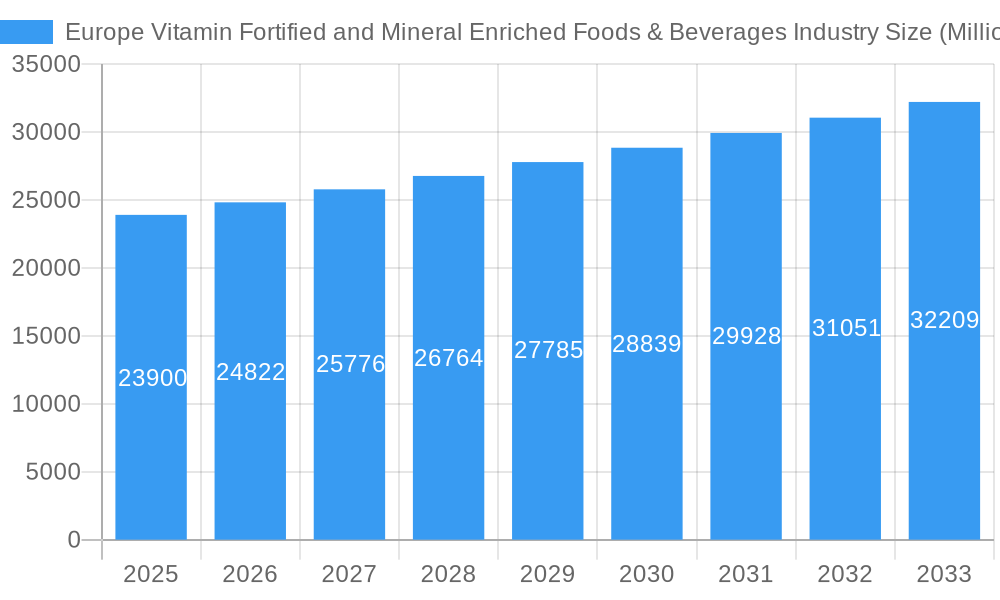

The European market for vitamin-fortified and mineral-enriched foods and beverages is a substantial and growing sector, projected to reach €23.90 billion in 2025. A compound annual growth rate (CAGR) of 3.89% from 2025 to 2033 indicates continued expansion, driven by several key factors. Increasing consumer awareness of the importance of nutrition and health, particularly among health-conscious demographics, fuels demand for functional foods and beverages. The rising prevalence of nutrient deficiencies and the growing adoption of convenient, on-the-go consumption patterns further contribute to market growth. Product innovation, including the development of new fortified foods and beverages with appealing flavors and textures, plays a crucial role in driving market expansion. The market is segmented by product type (cereal-based products, dairy products, beverages, infant formulas, and others), and distribution channels (supermarkets/hypermarkets, convenience stores, pharmacies/drug stores, online retailers, and others). Major players like Nestle SA, PepsiCo Inc., Danone SA, and Kellogg Company dominate the market, leveraging their established brand recognition and extensive distribution networks. Significant regional variations exist within Europe, with Germany, France, the UK, and Italy representing key markets.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Size (In Billion)

The projected growth, however, faces certain restraints. Fluctuating raw material prices, stringent regulatory frameworks concerning food fortification, and potential consumer concerns regarding the long-term effects of consuming heavily fortified products could influence market growth. Despite these challenges, the ongoing trend towards proactive health management and the increasing demand for convenient, nutritious options suggest a positive outlook for the European vitamin-fortified and mineral-enriched foods and beverages market. The expanding online retail channel presents significant opportunities for market players to reach wider consumer bases and enhance market penetration. Companies are likely to focus on strategic partnerships, product diversification, and targeted marketing campaigns to maintain their competitive edge in this dynamic market.

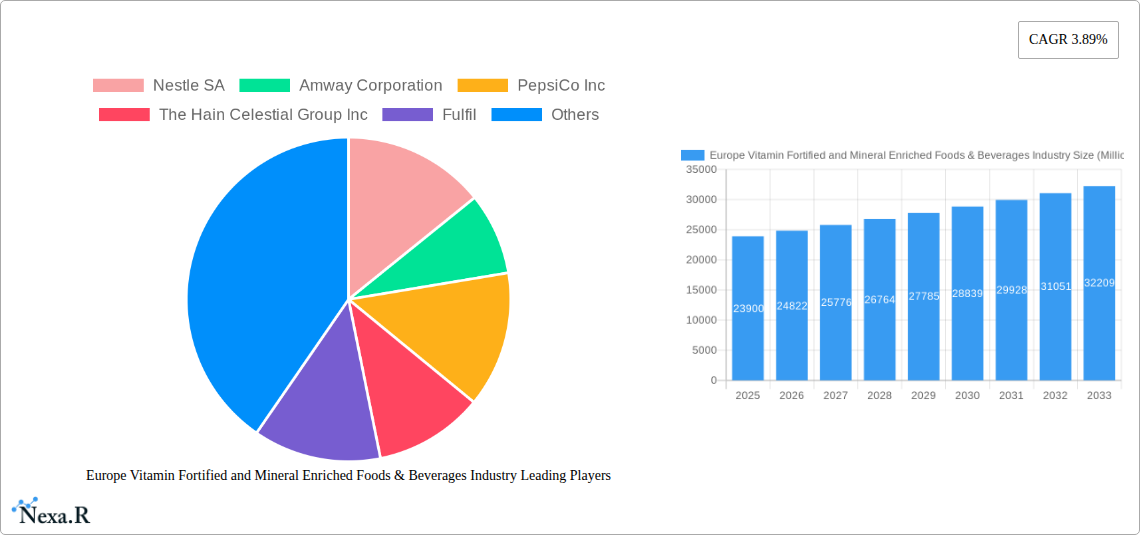

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Company Market Share

This comprehensive report provides a detailed analysis of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages industry, offering invaluable insights for industry professionals, investors, and stakeholders. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report examines key market segments, including product types (Cereal-based Products, Dairy Products, Beverages, Infant Formulas, Other Product Types) and distribution channels (Supermarket/Hypermarket, Convenience Stores, Pharmacy/Drug Store, Online Retail Store, Other Distribution Channels), featuring analysis of major players such as Nestlé SA, Amway Corporation, PepsiCo Inc., and more. The report’s value is expressed in Million units.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and market trends within the European vitamin-fortified and mineral-enriched food and beverage industry. The report delves into the impact of mergers and acquisitions (M&A) activities and their influence on market consolidation.

- Market Concentration: The European market is characterized by a mix of large multinational corporations and smaller niche players. The top 10 companies hold an estimated xx% market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: Ongoing innovation focuses on enhancing fortification methods, developing functional foods and beverages with enhanced nutritional profiles, and improving product shelf life and palatability. Barriers to innovation include high R&D costs and stringent regulatory approvals.

- Regulatory Framework: EU regulations concerning food fortification and labeling significantly influence market dynamics. Compliance with these regulations is crucial for market entry and ongoing operation.

- Competitive Product Substitutes: The market faces competition from naturally nutrient-rich foods and alternative health supplements. These substitutes may pose a challenge to growth, depending on consumer preferences and health trends.

- End-User Demographics: The increasing health consciousness among consumers, particularly within age groups concerned about nutritional deficiencies, drives market growth. Growing awareness of the benefits of vitamin and mineral supplementation is also a major factor.

- M&A Trends: The industry has witnessed xx M&A deals between 2019 and 2024, primarily driven by strategies to expand product portfolios and market reach.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Growth Trends & Insights

This section offers a comprehensive evaluation of the market's growth trajectory, encompassing historical data (2019-2024) and future projections (2025-2033). The analysis incorporates various market indicators to provide a holistic perspective.

The European vitamin-fortified and mineral-enriched food and beverage market exhibited a CAGR of xx% during 2019-2024. Driven by increasing health awareness, changing consumer preferences towards functional foods, and supportive government regulations, this trend is expected to continue, with a projected CAGR of xx% from 2025-2033. Market penetration for vitamin-fortified products has increased from xx% in 2019 to xx% in 2024, reflecting the growing consumer adoption of these products. Technological disruptions, particularly in food processing and fortification techniques, are expected to further accelerate growth. Changing consumer behaviors, including a greater focus on convenience and on-the-go consumption, are also influencing product development and market segmentation. The market size is projected to reach xx Million units by 2033.

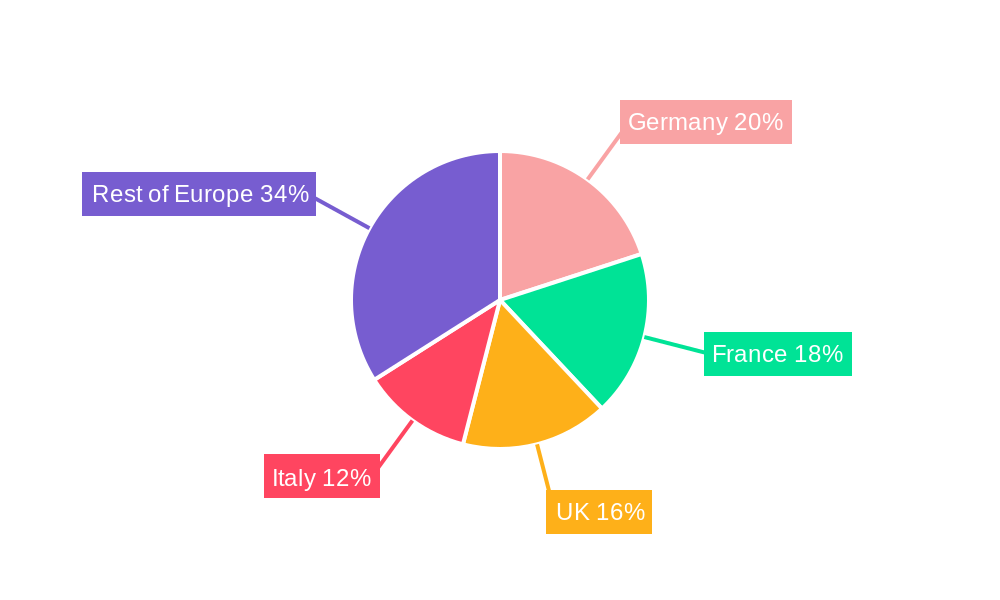

Dominant Regions, Countries, or Segments in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

This section identifies leading regions, countries, and segments within the European market, providing insights into the drivers behind their dominance.

Leading Regions: Western European countries, notably Germany, France, and the UK, currently hold significant market share, driven by higher disposable incomes and higher consumer awareness of health and wellness. The Eastern European markets are expected to show increased growth potential, as health consciousness and disposable incomes rise.

Leading Countries: Germany is expected to maintain its position as the leading market due to its high consumer spending power and the prevalence of health-conscious consumers. France and the UK show steady growth, driven by similar factors.

Leading Product Types: Beverages, including sports drinks and functional beverages, are currently leading the market due to their convenience and growing popularity. Dairy products show consistent growth, fueled by innovations in fortified milk and yogurt products. Infant formula remains a significant segment, due to its crucial role in child nutrition.

Leading Distribution Channels: Supermarket/Hypermarkets remain the dominant distribution channel due to their widespread availability and established consumer preference. However, online retail channels are demonstrating rapid growth, reflecting the shift toward online grocery shopping.

Key Drivers:

- Strong consumer demand for health and wellness products.

- Growing awareness of nutritional deficiencies among the population.

- Increasing prevalence of lifestyle diseases.

- Government initiatives promoting healthy diets and nutritional well-being.

- Innovation in food fortification technologies.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Product Landscape

The European market showcases a diverse range of vitamin-fortified and mineral-enriched products, including cereals, dairy products, beverages, and infant formulas. These products are formulated to cater to specific dietary needs and health goals. Recent innovations focus on improving product taste and texture while maintaining their nutritional value. Technological advancements, such as improved fortification methods and micronutrient stabilization techniques, enable the production of high-quality, long-lasting products. Unique selling propositions frequently include enhanced bioavailability of nutrients and tailored formulations for specific age groups or health conditions.

Key Drivers, Barriers & Challenges in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

Key Drivers:

The increasing prevalence of lifestyle diseases, rising consumer awareness of the importance of nutrition, and the introduction of new product innovations are propelling market expansion. Government initiatives to promote healthy eating habits further stimulate demand. The development of more sustainable and ethically sourced ingredients also positively impacts market growth.

Challenges and Restraints:

Stringent regulatory requirements and fluctuating raw material costs pose significant challenges. Competition from existing and emerging players adds complexity to the market. Maintaining consistency in product quality and ensuring the bioavailability of fortified nutrients are crucial issues. Supply chain disruptions caused by external factors can lead to production delays and increased costs. The potential for negative consumer perceptions surrounding artificial fortification may limit growth, emphasizing the need for transparent labeling and natural fortification methods.

Emerging Opportunities in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

The growing demand for personalized nutrition, plant-based products, and products tailored to specific health conditions creates significant opportunities. Expanding into underserved markets in Eastern Europe, increasing online distribution channels, and focusing on sustainable and ethical sourcing offer growth potential. Innovation in product formats and flavors will continue to be a driving force, catering to evolving consumer preferences. The development of functional foods and beverages with targeted health benefits will also generate new growth avenues.

Growth Accelerators in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Industry

Long-term growth will be fueled by technological advancements in food fortification and processing, strategic alliances between food manufacturers and health organizations, and expansion into new geographic markets. The focus on personalized nutrition will lead to the development of specialized products catering to individual needs. Increased investment in research and development of new fortification methods will improve nutrient bioavailability and product stability. Strategic partnerships with healthcare professionals and nutritionists can enhance product credibility and market penetration.

Key Players Shaping the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market

- Nestle SA

- Amway Corporation

- PepsiCo Inc

- The Hain Celestial Group Inc

- Fulfil

- Abbott Laboratories

- Danone SA

- The Coca-Cola Company

- Kellogg Company

- Marks and Spencer

Notable Milestones in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Sector

- April 2023: Kellogg's launched vitamin D-infused Rice Krispies cereals, initially available online in Europe.

- August 2022: Operate Drinks launched Operate Recovery, a vitamin and mineral-infused sports drink in two flavors.

- March 2022: Moulins Dumée and Moulins Bourgeois launched hemp-fortified bread and flour mixes, providing protein, fiber, and omega-3s.

In-Depth Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Outlook

The future of the European vitamin-fortified and mineral-enriched food and beverage market is promising, driven by long-term growth trends in health consciousness, increasing disposable incomes, and the continued development of innovative product offerings. Strategic partnerships, focusing on sustainable and ethical sourcing, and targeted marketing strategies will play a critical role in shaping market dynamics. The market's potential for growth is considerable, particularly in emerging markets and through the expansion of online retail channels. A focus on personalized nutrition and customized product development will further enhance market penetration and overall growth.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Segmentation

-

1. Product Type

- 1.1. Cereal-based Products

- 1.2. Dairy Products

- 1.3. Beverages

- 1.4. Infant Formulas

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Pharmacy/Drug Store

- 2.4. Online Retail Store

- 2.5. Other Distribution Channels

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Regional Market Share

Geographic Coverage of Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products

- 3.3. Market Restrains

- 3.3.1. Expensive pricing of vitamin-infused food products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal-based Products

- 5.1.2. Dairy Products

- 5.1.3. Beverages

- 5.1.4. Infant Formulas

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacy/Drug Store

- 5.2.4. Online Retail Store

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cereal-based Products

- 6.1.2. Dairy Products

- 6.1.3. Beverages

- 6.1.4. Infant Formulas

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacy/Drug Store

- 6.2.4. Online Retail Store

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cereal-based Products

- 7.1.2. Dairy Products

- 7.1.3. Beverages

- 7.1.4. Infant Formulas

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacy/Drug Store

- 7.2.4. Online Retail Store

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cereal-based Products

- 8.1.2. Dairy Products

- 8.1.3. Beverages

- 8.1.4. Infant Formulas

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacy/Drug Store

- 8.2.4. Online Retail Store

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cereal-based Products

- 9.1.2. Dairy Products

- 9.1.3. Beverages

- 9.1.4. Infant Formulas

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacy/Drug Store

- 9.2.4. Online Retail Store

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cereal-based Products

- 10.1.2. Dairy Products

- 10.1.3. Beverages

- 10.1.4. Infant Formulas

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacy/Drug Store

- 10.2.4. Online Retail Store

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Italy Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Cereal-based Products

- 11.1.2. Dairy Products

- 11.1.3. Beverages

- 11.1.4. Infant Formulas

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarket/Hypermarket

- 11.2.2. Convenience Stores

- 11.2.3. Pharmacy/Drug Store

- 11.2.4. Online Retail Store

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Cereal-based Products

- 12.1.2. Dairy Products

- 12.1.3. Beverages

- 12.1.4. Infant Formulas

- 12.1.5. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarket/Hypermarket

- 12.2.2. Convenience Stores

- 12.2.3. Pharmacy/Drug Store

- 12.2.4. Online Retail Store

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Amway Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hain Celestial Group Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fulfil

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Abbott Laboratories

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Coca-Cola Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kellogg Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Marks and Spencer

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

Key companies in the market include Nestle SA, Amway Corporation, PepsiCo Inc, The Hain Celestial Group Inc, Fulfil, Abbott Laboratories, Danone SA, The Coca-Cola Company, Kellogg Company, Marks and Spencer.

3. What are the main segments of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food.

7. Are there any restraints impacting market growth?

Expensive pricing of vitamin-infused food products.

8. Can you provide examples of recent developments in the market?

April 2023: Kellogg's launched its new breakfast: Rice Krispies cereals infused with vitamin D in fruity flavors. The company claims that consuming one bowl of these cereals provides 20% of the daily vitamin D requirement. These products are initially available in Europe through online distribution channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

To stay informed about further developments, trends, and reports in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence