Key Insights

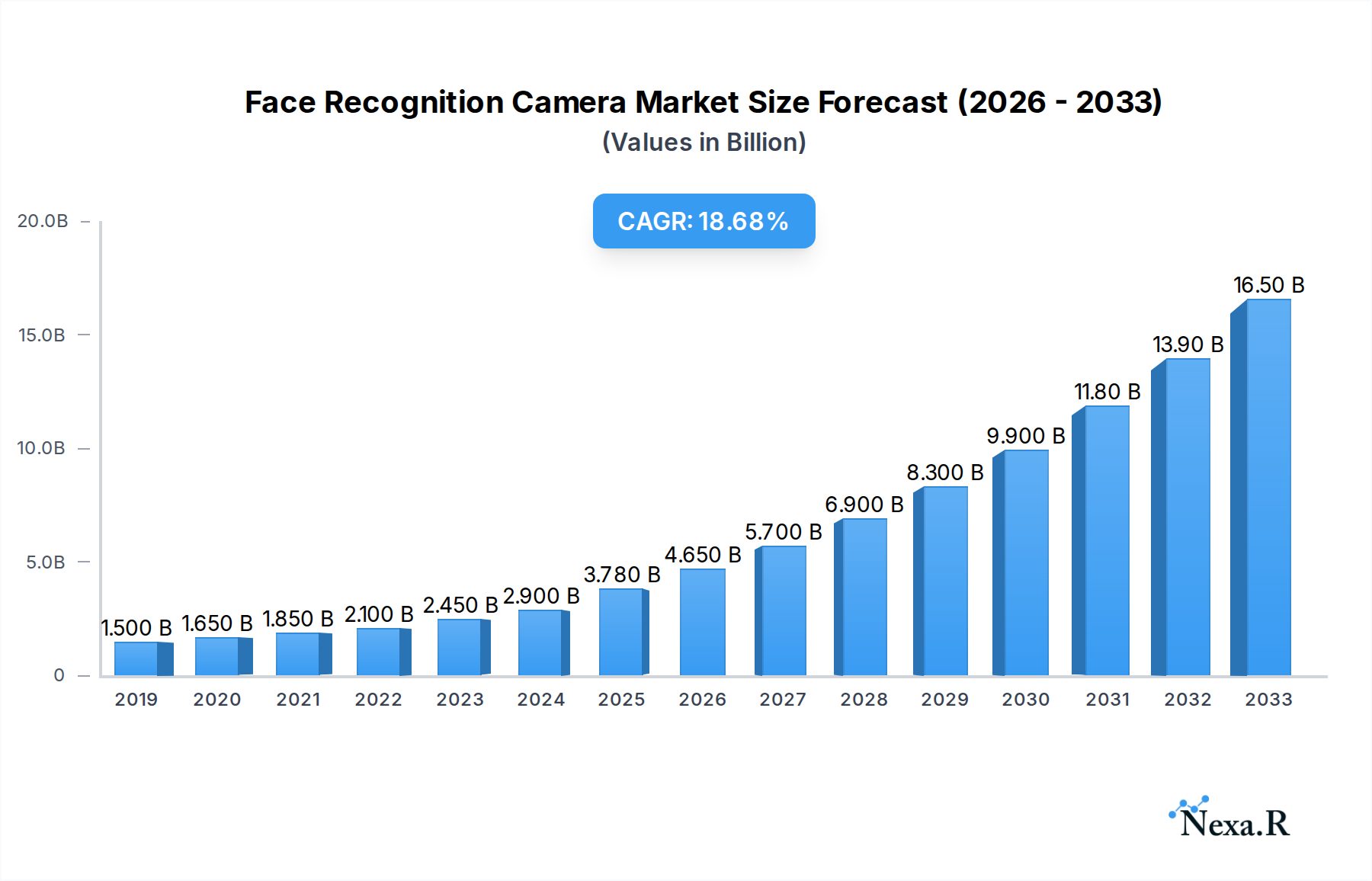

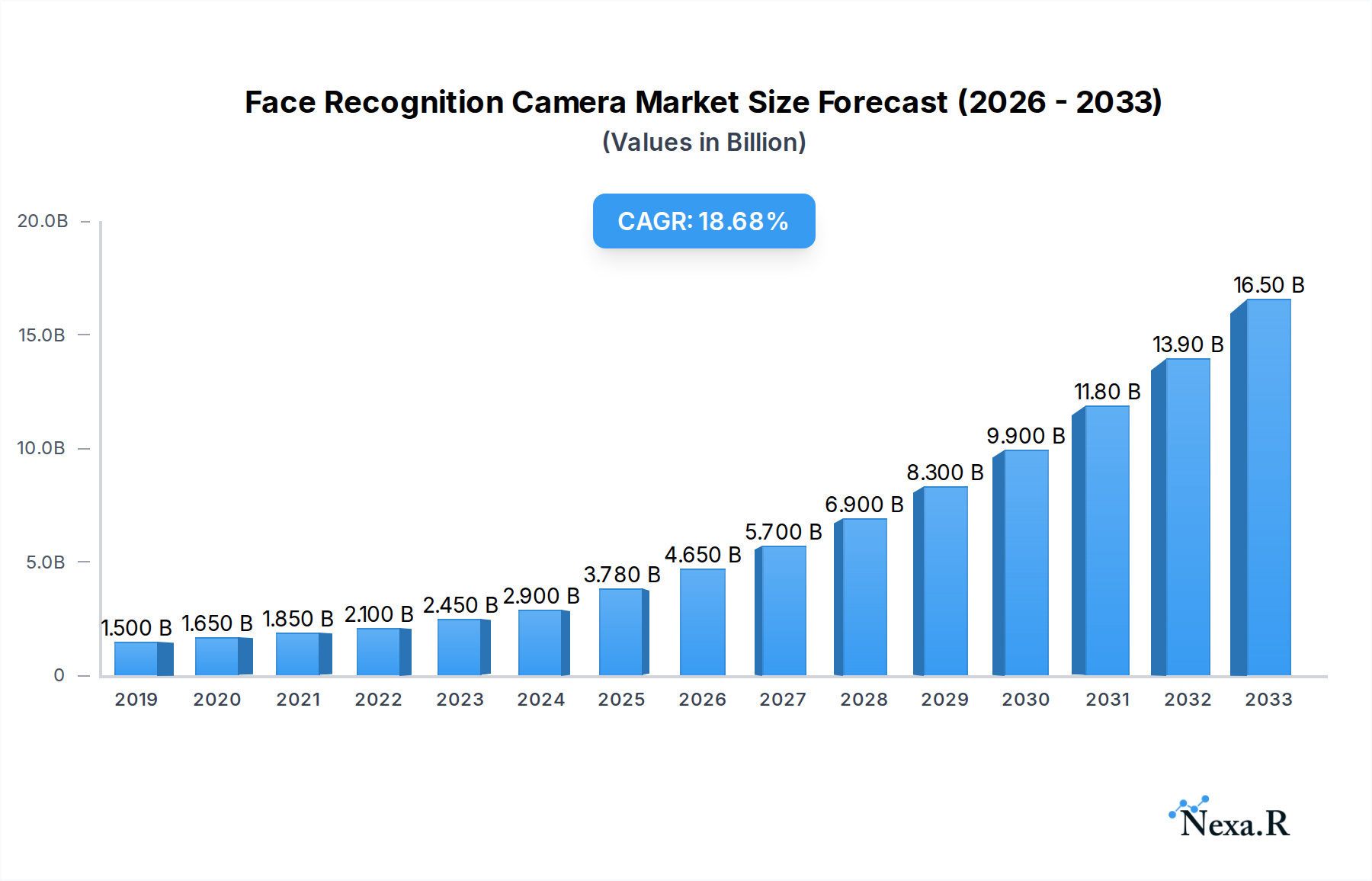

The global face recognition camera market is poised for remarkable expansion, projected to reach USD 3.78 billion in 2025 and grow at an impressive Compound Annual Growth Rate (CAGR) of 22.6% through 2033. This robust growth is fueled by an increasing demand for enhanced security solutions across various sectors, including BFSI, government, retail, and healthcare. The inherent capabilities of facial recognition technology to provide accurate and swift identity verification are driving its adoption for access control, surveillance, and customer analytics. Advancements in AI and deep learning algorithms are continually improving the accuracy and efficiency of these systems, making them more sophisticated and reliable. The integration of AI-powered features, such as emotion detection and demographic analysis, further broadens the application spectrum. Furthermore, the growing need for contactless identification methods, amplified by recent global health concerns, has significantly accelerated the market's trajectory, making face recognition cameras an indispensable tool for modern security infrastructure.

Face Recognition Camera Market Size (In Billion)

The market's dynamism is further shaped by a series of key trends and drivers. The increasing deployment of smart city initiatives and the persistent need for robust public safety measures are creating substantial opportunities for market players. Innovations in camera hardware, leading to more accurate 2D and 3D facial recognition, as well as the integration of thermal imaging and RGB-IR capabilities, are enhancing the technology's effectiveness in diverse environmental conditions. The burgeoning e-commerce sector is also leveraging facial recognition for secure payment authentication and personalized customer experiences. While the market presents immense growth potential, challenges such as data privacy concerns and regulatory hurdles need careful navigation. However, the continuous technological evolution and the persistent drive for automated, secure, and efficient identification solutions are expected to propel the face recognition camera market to new heights, making it a highly attractive investment and development area.

Face Recognition Camera Company Market Share

Here's a compelling, SEO-optimized report description for the Face Recognition Camera market, incorporating high-traffic keywords, parent/child markets, and all specified details.

Unlock unparalleled insights into the rapidly expanding face recognition camera market, a critical component of modern security systems, surveillance technology, and identity verification solutions. This in-depth report, covering the study period 2019–2033 with a focus on the base year 2025 and a forecast period of 2025–2033, provides a strategic roadmap for stakeholders navigating this dynamic industry. Explore the intricate market structure, key growth drivers, dominant regions, and the competitive landscape shaped by leading innovators.

Face Recognition Camera Market Dynamics & Structure

The global face recognition camera market is characterized by a moderate to high concentration, with a few key players dominating market share. Technological innovation is a primary driver, fueled by advancements in artificial intelligence (AI), deep learning algorithms, and computer vision. The increasing demand for enhanced biometric security, access control systems, and customer analytics is propelling adoption across various sectors. Regulatory frameworks are evolving, with a growing focus on data privacy and ethical AI deployment, influencing product development and market access. Competitive product substitutes, such as fingerprint scanners and iris recognition, exist but are increasingly being integrated with or surpassed by sophisticated facial recognition capabilities. End-user demographics range from government agencies and enterprise clients to retail businesses and educational institutions, each with unique security and operational needs. Mergers and acquisitions (M&A) are prevalent as companies seek to consolidate market positions, acquire cutting-edge technologies, and expand their product portfolios. For instance, the M&A deal volume has seen a steady increase, with an estimated $X.X billion in disclosed transactions within the last three years, reflecting strategic consolidation. Innovation barriers include the high cost of R&D, the need for substantial computational power, and public concerns regarding facial recognition privacy.

Face Recognition Camera Growth Trends & Insights

The face recognition camera market is poised for exceptional growth, projected to reach an estimated market size of $XX.X billion by 2025, expanding to over $XXX.X billion by 2033, with a compelling CAGR of XX.X% during the forecast period 2025–2033. This robust expansion is driven by a confluence of factors, including the escalating need for enhanced security and surveillance in both public and private sectors. The adoption rates of face recognition technology are accelerating, moving beyond niche applications to become a mainstream security solution. Technological disruptions are at the forefront, with continuous improvements in accuracy, speed, and robustness of algorithms, enabling effective recognition under diverse conditions like low light and partial occlusion. The shift towards smarter cities and the integration of IoT devices are further augmenting the demand for intelligent surveillance solutions powered by face recognition. Consumer behavior is also evolving, with an increasing acceptance of facial recognition for convenience in applications like contactless payments and personalized retail experiences. Market penetration is rapidly increasing, particularly in urban areas and developed economies. The parent market for biometric systems is valued at approximately $XX.X billion in 2025, with face recognition cameras representing a significant and rapidly growing child market segment, estimated at $XX.X billion in 2025. This segment is projected to grow at a CAGR of XX.X% within the broader biometric landscape.

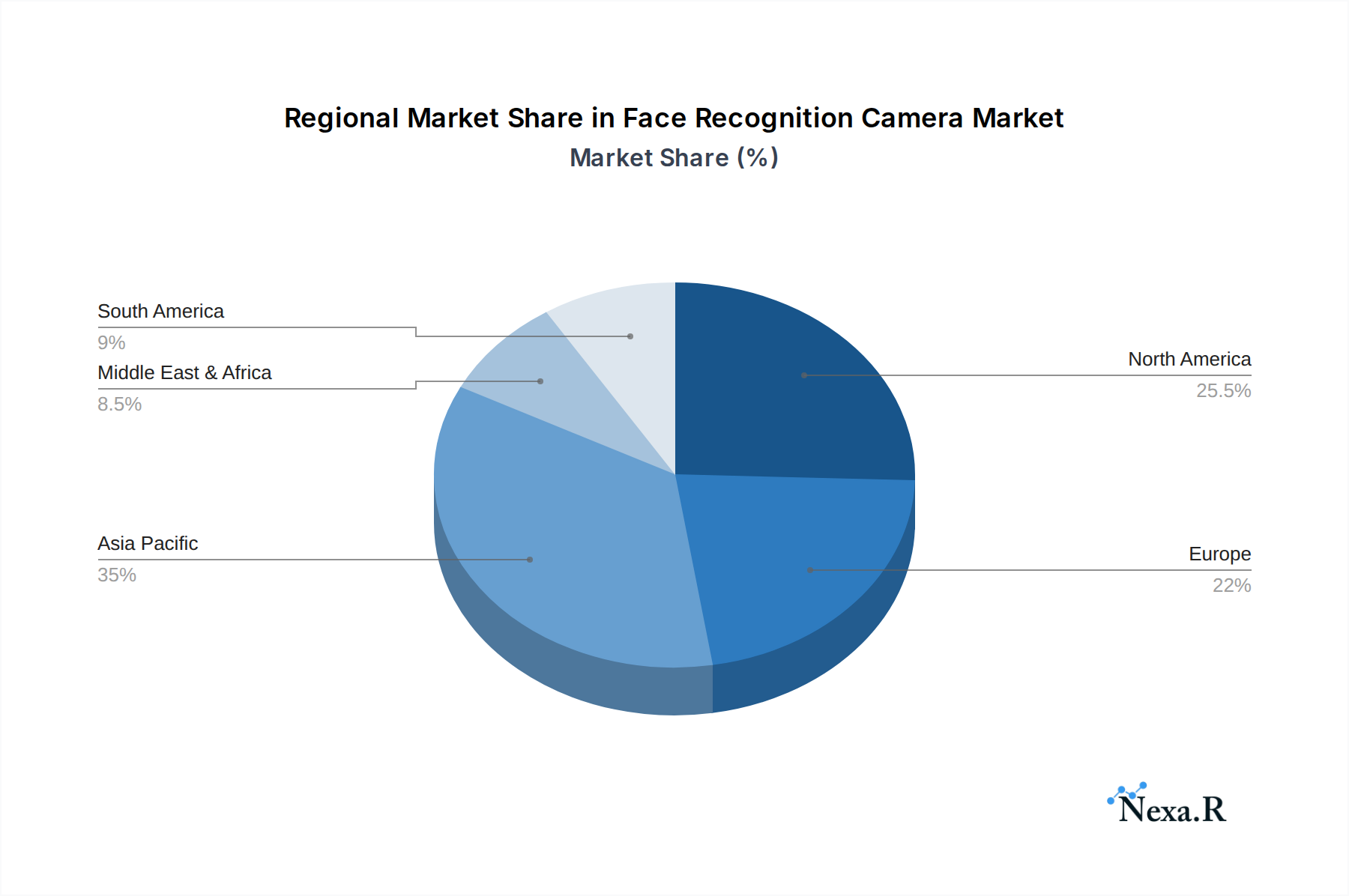

Dominant Regions, Countries, or Segments in Face Recognition Camera

The Government and Defence segment, with its substantial investment in national security, border control, and law enforcement, stands as a dominant force in the face recognition camera market. This sector's demand for advanced surveillance systems and identity management solutions fuels significant market share, estimated at XX.X% of the total market in 2025. Coupled with this, Asia Pacific, particularly countries like China and India, is the leading region, driven by large populations, rapid urbanization, and proactive government initiatives to enhance public safety and smart city infrastructure. The market in North America and Europe also demonstrates strong growth, propelled by stringent security regulations, high adoption of advanced technologies in the BFSI sector, and a mature retail market seeking personalized customer experiences.

- Application Dominance:

- Government and Defence: Critical for national security, law enforcement, border surveillance, and public safety initiatives. Estimated market share of XX.X% in 2025.

- BFSI: Used for fraud prevention, customer authentication, ATM security, and branch access control. This segment is projected to grow at XX.X% CAGR from 2025-2033.

- Retail and E-Commerce: Employed for customer analytics, personalized marketing, loss prevention, and improved in-store experiences.

- Type Dominance:

- 2D Facial Recognition Cameras: Continue to dominate due to their cost-effectiveness and wide availability, making up an estimated XX.X% of the market in 2025.

- Smart Cameras: Integration of AI capabilities within cameras is a key trend, enhancing processing power and enabling edge analytics, driving significant growth.

- Key Drivers for Dominance:

- Economic Policies: Government investments in security infrastructure and smart city projects.

- Technological Advancements: Continuous improvements in algorithm accuracy and hardware capabilities.

- Infrastructure Development: Expansion of surveillance networks and public safety systems.

- Growing Security Concerns: Rising threats necessitate advanced identification and tracking solutions.

- Market Size: The BFSI sector alone accounts for an estimated $XX.X billion in 2025, showcasing its significant contribution. The Government and Defence sector's market size is projected to reach $XX.X billion by 2033.

Face Recognition Camera Product Landscape

The face recognition camera product landscape is rapidly evolving, characterized by an increasing integration of artificial intelligence and advanced imaging technologies. Innovations focus on enhancing accuracy rates, reducing false positive/negative ratios, and enabling real-time processing. Products now feature enhanced capabilities for recognizing faces under challenging environmental conditions, including low light, varying angles, and partial occlusions. 2D facial recognition cameras remain prevalent due to their cost-effectiveness, while 3D facial recognition cameras are gaining traction for their superior accuracy and resistance to spoofing attempts. The emergence of smart cameras with embedded AI processors allows for on-device analytics, reducing latency and bandwidth requirements. Furthermore, RGB-IR cameras offer improved performance in both visible and infrared light spectrums, enhancing recognition accuracy in diverse lighting conditions. Multi-camera systems are being deployed for comprehensive surveillance and tracking across large areas.

Key Drivers, Barriers & Challenges in Face Recognition Camera

Key Drivers: The face recognition camera market is propelled by escalating global security concerns, demanding more sophisticated identification and surveillance solutions. The rapid adoption of smart city initiatives worldwide, aiming to improve public safety and urban management, is a significant growth catalyst. Advancements in AI and deep learning algorithms are continuously improving the accuracy and efficiency of facial recognition technology, making it more viable for diverse applications. The increasing integration of face recognition into existing security infrastructure, such as access control systems and CCTV networks, further fuels market expansion. The growing demand for contactless identity verification in sectors like healthcare and retail, amplified by recent public health concerns, also serves as a crucial driver.

Barriers & Challenges: Despite its growth potential, the market faces significant challenges. Privacy concerns and ethical debates surrounding the widespread use of facial recognition technology are leading to stricter regulations and public scrutiny in many regions, potentially hindering adoption. The high cost of implementation, particularly for advanced 3D systems and large-scale deployments, can be a barrier for smaller organizations. Data security vulnerabilities and the risk of unauthorized access to sensitive biometric data pose ongoing challenges. Furthermore, the accuracy of algorithms can be affected by factors such as aging, facial expressions, and the use of accessories like masks and sunglasses, requiring continuous technological refinement. Supply chain disruptions and the availability of skilled personnel for installation and maintenance can also impact market growth. The global market for biometrics is projected to be $XX.X billion in 2025, but the face recognition segment faces the challenge of navigating evolving ethical landscapes.

Emerging Opportunities in Face Recognition Camera

Emerging opportunities in the face recognition camera market lie in the expanding application across novel sectors and the development of more sophisticated, user-centric solutions. The automotive industry presents a burgeoning area, with face recognition being explored for in-car driver monitoring, personalization of vehicle settings, and enhanced security. The education sector is increasingly adopting these cameras for attendance tracking, campus security, and student identification. Furthermore, the development of emotion recognition capabilities within facial recognition technology opens avenues for enhanced customer service analytics in retail and improved mental health monitoring in healthcare. The growing demand for edge AI processing in cameras presents an opportunity for more decentralized and privacy-preserving facial recognition solutions. The child market segment for facial recognition within broader security solutions is projected to see significant growth, driven by its adaptability to various security needs.

Growth Accelerators in the Face Recognition Camera Industry

The face recognition camera industry's long-term growth is being accelerated by continuous technological breakthroughs, particularly in deep learning and neural network advancements, leading to unprecedented levels of accuracy and speed. Strategic partnerships between camera manufacturers, AI software developers, and system integrators are crucial for creating comprehensive and scalable solutions. Market expansion strategies targeting emerging economies with increasing security needs and government investments in infrastructure are also key growth accelerators. The development of more affordable and scalable solutions, including cloud-based platforms and AI-powered edge devices, is making face recognition technology accessible to a wider range of businesses and institutions. Furthermore, the ongoing evolution of biometric standards and interoperability protocols is fostering greater integration and adoption across diverse platforms.

Key Players Shaping the Face Recognition Camera Market

- Hikvision

- Dahua Technology

- Hanwha Techwin

- Axis Communications

- Panasonic

- Bosch Security Systems

- Honeywell Security Systems

- Avigilon Corporation

- NEC Corporation

- Sony Corporation

- Toshiba America

- FLIR Systems

- Arecont Vision

- Tyco Security Products

- ZKTeco

- IDIS

- Genetec Inc.

- CP Plus

- Suprema Inc.

- Anviz Global Inc.

- Vivotek

- Milesight Technology Co., Ltd.

Notable Milestones in Face Recognition Camera Sector

- 2019: Significant advancements in deep learning algorithms lead to a reported XX% increase in accuracy rates across leading platforms.

- 2020: The global pandemic accelerates the demand for contactless identification solutions, boosting interest in face recognition for access control and payment systems.

- 2021: Major technology companies announce significant investments in AI research, focusing on improving facial recognition robustness and addressing privacy concerns.

- 2022: Emergence of sophisticated 3D facial recognition cameras with enhanced spoofing detection capabilities, increasing their adoption in high-security environments.

- 2023: Growing regulatory frameworks in various countries begin to shape the ethical deployment and data handling practices for facial recognition technology.

- 2024: Increased integration of facial recognition with edge computing capabilities, enabling faster on-device processing and reduced reliance on cloud infrastructure.

In-Depth Face Recognition Camera Market Outlook

The future outlook for the face recognition camera market is exceptionally promising, driven by the continued integration of advanced AI, the expansion into new industry verticals, and the growing global emphasis on security and personalized experiences. Growth accelerators, including breakthroughs in algorithmic efficiency and the development of more cost-effective solutions, will further democratize access to this technology. Strategic partnerships and market expansion into underserved regions will unlock significant potential. The child market segments, such as smart retail analytics and enhanced automotive safety, are expected to experience exponential growth, contributing to the overall market's substantial expansion. Industry professionals can anticipate a landscape ripe with opportunities for innovation, strategic investment, and market leadership.

Face Recognition Camera Segmentation

-

1. Application

- 1.1. BFSI

- 1.2. Government and Defence

- 1.3. Retail and E-Commerce

- 1.4. Healthcare

- 1.5. Education

- 1.6. Automotive

- 1.7. Others

-

2. Type

- 2.1. 2D Facial Recognition Cameras

- 2.2. 3D Facial Recognition Cameras

- 2.3. Thermal Imaging Cameras

- 2.4. RGB-IR cameras

- 2.5. Multi-Camera Systems

- 2.6. Smart Cameras

Face Recognition Camera Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Face Recognition Camera Regional Market Share

Geographic Coverage of Face Recognition Camera

Face Recognition Camera REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Face Recognition Camera Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. BFSI

- 5.1.2. Government and Defence

- 5.1.3. Retail and E-Commerce

- 5.1.4. Healthcare

- 5.1.5. Education

- 5.1.6. Automotive

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 2D Facial Recognition Cameras

- 5.2.2. 3D Facial Recognition Cameras

- 5.2.3. Thermal Imaging Cameras

- 5.2.4. RGB-IR cameras

- 5.2.5. Multi-Camera Systems

- 5.2.6. Smart Cameras

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Face Recognition Camera Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. BFSI

- 6.1.2. Government and Defence

- 6.1.3. Retail and E-Commerce

- 6.1.4. Healthcare

- 6.1.5. Education

- 6.1.6. Automotive

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 2D Facial Recognition Cameras

- 6.2.2. 3D Facial Recognition Cameras

- 6.2.3. Thermal Imaging Cameras

- 6.2.4. RGB-IR cameras

- 6.2.5. Multi-Camera Systems

- 6.2.6. Smart Cameras

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Face Recognition Camera Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. BFSI

- 7.1.2. Government and Defence

- 7.1.3. Retail and E-Commerce

- 7.1.4. Healthcare

- 7.1.5. Education

- 7.1.6. Automotive

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 2D Facial Recognition Cameras

- 7.2.2. 3D Facial Recognition Cameras

- 7.2.3. Thermal Imaging Cameras

- 7.2.4. RGB-IR cameras

- 7.2.5. Multi-Camera Systems

- 7.2.6. Smart Cameras

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Face Recognition Camera Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. BFSI

- 8.1.2. Government and Defence

- 8.1.3. Retail and E-Commerce

- 8.1.4. Healthcare

- 8.1.5. Education

- 8.1.6. Automotive

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 2D Facial Recognition Cameras

- 8.2.2. 3D Facial Recognition Cameras

- 8.2.3. Thermal Imaging Cameras

- 8.2.4. RGB-IR cameras

- 8.2.5. Multi-Camera Systems

- 8.2.6. Smart Cameras

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Face Recognition Camera Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. BFSI

- 9.1.2. Government and Defence

- 9.1.3. Retail and E-Commerce

- 9.1.4. Healthcare

- 9.1.5. Education

- 9.1.6. Automotive

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 2D Facial Recognition Cameras

- 9.2.2. 3D Facial Recognition Cameras

- 9.2.3. Thermal Imaging Cameras

- 9.2.4. RGB-IR cameras

- 9.2.5. Multi-Camera Systems

- 9.2.6. Smart Cameras

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Face Recognition Camera Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. BFSI

- 10.1.2. Government and Defence

- 10.1.3. Retail and E-Commerce

- 10.1.4. Healthcare

- 10.1.5. Education

- 10.1.6. Automotive

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 2D Facial Recognition Cameras

- 10.2.2. 3D Facial Recognition Cameras

- 10.2.3. Thermal Imaging Cameras

- 10.2.4. RGB-IR cameras

- 10.2.5. Multi-Camera Systems

- 10.2.6. Smart Cameras

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hikvision

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dahua Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hanwha Techwin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Axis Communications

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Panasonic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bosch Security Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell Security Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avigilon Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NEC Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sony Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Toshiba America

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FLIR Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Arecont Vision

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tyco Security Products

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ZKTeco

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 IDIS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Genetec Inc.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 CP Plus

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Suprema Inc.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Anviz Global Inc.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Vivotek

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Milesight Technology Co. Ltd.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Hikvision

List of Figures

- Figure 1: Global Face Recognition Camera Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Face Recognition Camera Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Face Recognition Camera Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Face Recognition Camera Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Face Recognition Camera Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Face Recognition Camera Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Face Recognition Camera Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Face Recognition Camera Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Face Recognition Camera Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Face Recognition Camera Revenue (billion), by Type 2025 & 2033

- Figure 11: South America Face Recognition Camera Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Face Recognition Camera Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Face Recognition Camera Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Face Recognition Camera Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Face Recognition Camera Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Face Recognition Camera Revenue (billion), by Type 2025 & 2033

- Figure 17: Europe Face Recognition Camera Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Face Recognition Camera Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Face Recognition Camera Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Face Recognition Camera Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Face Recognition Camera Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Face Recognition Camera Revenue (billion), by Type 2025 & 2033

- Figure 23: Middle East & Africa Face Recognition Camera Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Face Recognition Camera Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Face Recognition Camera Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Face Recognition Camera Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Face Recognition Camera Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Face Recognition Camera Revenue (billion), by Type 2025 & 2033

- Figure 29: Asia Pacific Face Recognition Camera Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Face Recognition Camera Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Face Recognition Camera Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Face Recognition Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Face Recognition Camera Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Face Recognition Camera Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Face Recognition Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Face Recognition Camera Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Face Recognition Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Face Recognition Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Face Recognition Camera Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Face Recognition Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Face Recognition Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Face Recognition Camera Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Face Recognition Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Face Recognition Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Face Recognition Camera Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Face Recognition Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Face Recognition Camera Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Face Recognition Camera Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Face Recognition Camera Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Face Recognition Camera Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Face Recognition Camera?

The projected CAGR is approximately 22.6%.

2. Which companies are prominent players in the Face Recognition Camera?

Key companies in the market include Hikvision, Dahua Technology, Hanwha Techwin, Axis Communications, Panasonic, Bosch Security Systems, Honeywell Security Systems, Avigilon Corporation, NEC Corporation, Sony Corporation, Toshiba America, FLIR Systems, Arecont Vision, Tyco Security Products, ZKTeco, IDIS, Genetec Inc., CP Plus, Suprema Inc., Anviz Global Inc., Vivotek, Milesight Technology Co., Ltd..

3. What are the main segments of the Face Recognition Camera?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.78 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Face Recognition Camera," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Face Recognition Camera report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Face Recognition Camera?

To stay informed about further developments, trends, and reports in the Face Recognition Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence