Key Insights

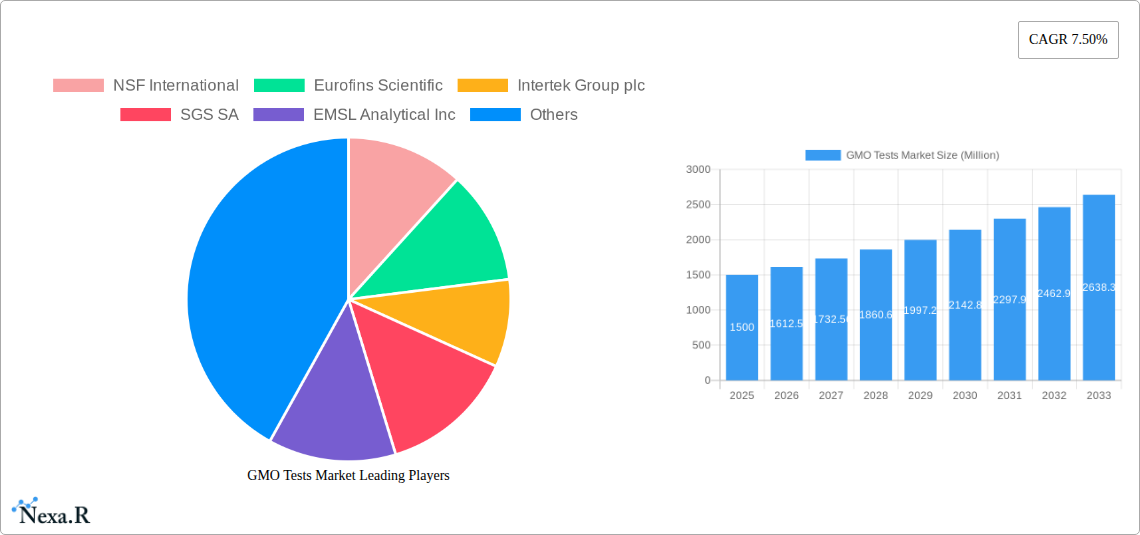

The global GMO testing market is projected for substantial expansion, expected to reach $2.77 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 10.9% between 2025 and 2033. This growth is propelled by increasing consumer demand for transparency in food labeling, stringent regulatory frameworks governing GMO presence, and technological advancements in testing methodologies like PCR and ELISA. The rising adoption of genetically modified crops worldwide further amplifies the need for accurate GMO detection. The PCR segment currently leads the market due to its superior accuracy and sensitivity.

GMO Tests Market Market Size (In Billion)

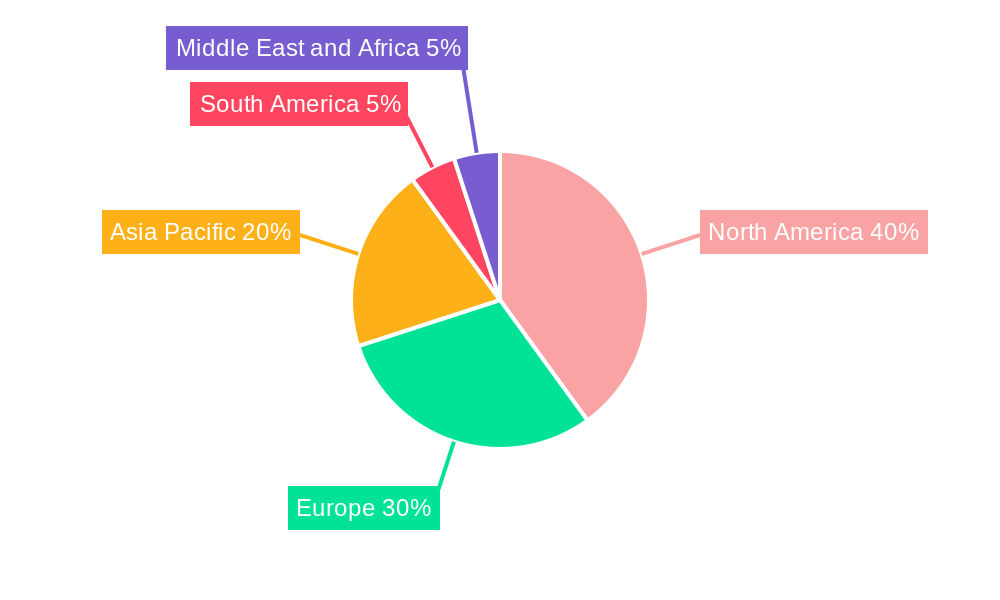

Geographically, North America, led by the US and Canada, is a dominant market owing to robust regulations and widespread GMO crop cultivation. Europe exhibits strong growth driven by heightened consumer awareness and strict labeling laws. The Asia-Pacific region presents significant growth potential, fueled by expanding agricultural sectors and increasing demand for processed foods. Challenges such as the cost of certain testing methods and the requirement for specialized expertise are present, but the overall market outlook remains positive, driven by the imperative for GMO detection and regulatory compliance.

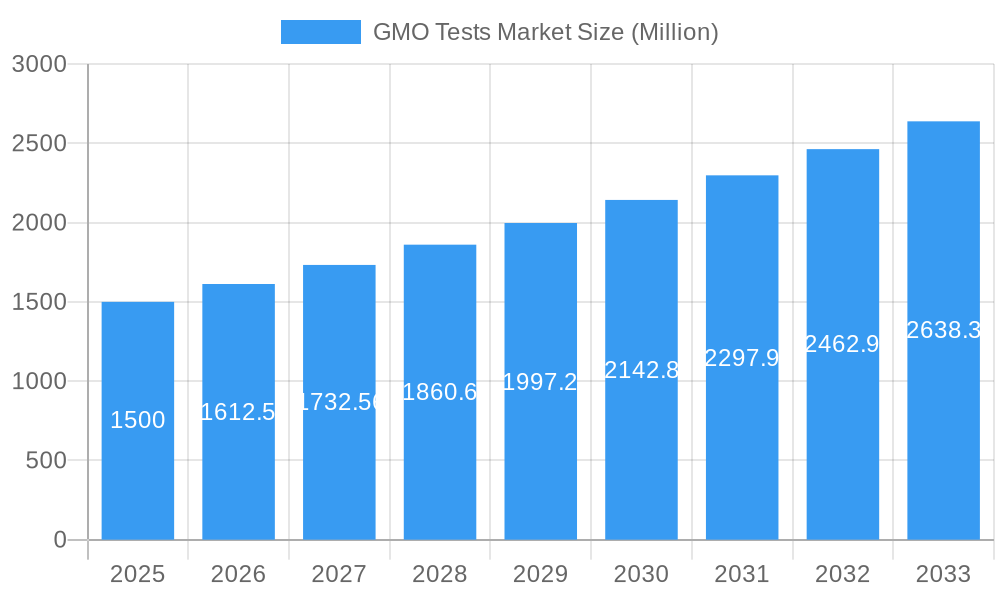

GMO Tests Market Company Market Share

This report offers a comprehensive analysis of the global GMO Tests Market, providing critical insights into market dynamics, growth trends, regional leadership, and the competitive environment. It forecasts market evolution from 2025 to 2033, examining key technologies including Polymerase Chain Reaction (PCR), ELISA Tests, and Strip Tests. The analysis covers the period from 2019 to 2033, with 2025 designated as the base and estimated year.

GMO Tests Market Dynamics & Structure

The GMO Tests market exhibits a moderately concentrated structure, with several large players holding significant market share. NSF International, Eurofins Scientific, Intertek Group plc, SGS SA, EMSL Analytical Inc, Merieux NutriSciences Corporation, ALS Limited, and Bureau Veritas are key players, though the market also includes numerous smaller specialized testing labs. The market is driven by stringent regulations concerning GMO labeling and food safety, coupled with rising consumer demand for transparency in food products. Technological advancements, particularly in PCR and ELISA testing, continue to improve accuracy and efficiency. However, high testing costs, especially for smaller producers, and the complexity of regulatory frameworks pose significant challenges. M&A activity has been moderate, with larger companies acquiring smaller labs to expand their geographical reach and service offerings.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025 (estimated).

- Technological Innovation: PCR remains the dominant technology, but ELISA and strip tests are gaining traction due to cost-effectiveness and rapid turnaround times.

- Regulatory Frameworks: Stringent regulations in developed nations are driving demand but also pose compliance challenges for smaller firms.

- Competitive Substitutes: Limited direct substitutes exist, but cost-effective alternatives are emerging, potentially impacting market growth.

- End-User Demographics: Primarily food producers, processors, retailers, and regulatory agencies.

- M&A Trends: Moderate activity, driven by expansion and diversification strategies of larger players. An estimated xx M&A deals were recorded between 2019 and 2024.

GMO Tests Market Growth Trends & Insights

The global GMO Tests market is experiencing a robust expansion, driven by a confluence of factors. Increasing consumer awareness regarding the presence and impact of Genetically Modified Organisms (GMOs) is a primary catalyst, fueling a significant demand for non-GMO certified products. This burgeoning consumer preference, coupled with the implementation of stringent GMO labeling regulations across various international markets, is propelling the market forward. Projections indicate the global GMO Tests market will reach substantial figures by 2033, demonstrating a healthy Compound Annual Growth Rate (CAGR) throughout the forecast period. The increasing adoption of advanced GMO testing methodologies, characterized by enhanced speed, accuracy, and sensitivity, is further contributing to this growth trajectory. While fluctuating agricultural commodity prices and global economic conditions can introduce some market volatility, the overarching trend points towards sustained expansion. The commitment to food safety, supply chain transparency, and the proactive response of businesses to evolving consumer demands will continue to be pivotal in shaping the future of the GMO Tests market.

Dominant Regions, Countries, or Segments in GMO Tests Market

North America currently holds the largest market share in the GMO tests market, driven by strict regulations, high consumer awareness, and a robust agricultural sector. Within this region, the United States dominates due to its large agricultural production and stringent GMO labeling laws. Europe also shows strong growth potential, driven by similar regulatory pressures and high consumer demand for GMO-free products. Among the technologies, Polymerase Chain Reaction (PCR) holds the largest segment share due to its high accuracy and reliability, but ELISA tests are experiencing rapid growth owing to their cost-effectiveness.

- North America: Strong regulatory environment, high consumer awareness, and established agricultural sector.

- Europe: Stringent regulations, high consumer demand for GMO-free products, and growing adoption of PCR and ELISA tests.

- Asia-Pacific: Rapidly expanding market driven by increasing agricultural production and rising consumer awareness.

- Polymerase Chain Reaction (PCR): High accuracy and reliability make it the dominant technology.

- ELISA Test: Cost-effective and faster testing method, gaining market share.

- Strip test (Lateral Flow Device or Dipstick): Simpler and portable, ideal for point-of-care testing.

GMO Tests Market Product Landscape

The GMO Tests market is characterized by a sophisticated and diverse product portfolio designed to cater to a wide array of analytical needs. Key offerings include highly sensitive Polymerase Chain Reaction (PCR)-based tests, enzyme-linked immunosorbent assays (ELISA) kits, and rapid and portable lateral flow devices. The industry is witnessing a relentless pursuit of innovation, with a sharp focus on developing solutions that offer superior speed, unparalleled accuracy, and improved cost-effectiveness. Leading market players are increasingly providing customized testing solutions, meticulously tailored to meet the unique requirements of their clientele. These solutions often emphasize high-throughput capabilities and accelerated turnaround times, crucial for businesses operating in fast-paced supply chains. User-friendly interfaces, easily interpretable results, and broad compatibility with various sample matrices are becoming standard features, enhancing accessibility and operational efficiency. Ongoing technological advancements are consistently pushing the boundaries of detection limits, improving sensitivity, and refining specificity for even the most trace levels of GMO components.

Key Drivers, Barriers & Challenges in GMO Tests Market

Key Drivers:

- Stringent government regulations and labeling requirements for GMOs.

- Increasing consumer demand for non-GMO products and transparency in food labeling.

- Technological advancements leading to more accurate, efficient, and cost-effective testing methods.

- Growth of the global food and agriculture industry.

Challenges and Restraints:

- High testing costs, especially for smaller agricultural producers.

- Complexity of regulatory frameworks and compliance requirements.

- Potential for cross-contamination during sampling and testing.

- Competition from alternative testing methods and the emergence of more affordable technologies.

Emerging Opportunities in GMO Tests Market

- Geographic Expansion: Significant opportunities exist in expanding into developing economies where agricultural sectors are growing and consumer awareness regarding GMOs is on the rise, creating a nascent but rapidly developing demand for testing services.

- Technological Advancements in Portability: The development of faster, more compact, and intuitively user-friendly testing devices is crucial for enabling point-of-care applications and field testing, broadening accessibility for smaller producers and on-site quality control.

- Integrated Testing Solutions: A growing demand for comprehensive GMO testing services that integrate multiple analytical techniques and provide holistic insights into product composition and compliance is emerging.

- Targeted Trait Identification: The development of specialized and innovative solutions focused on accurately identifying and quantifying specific GMO traits or gene stacking is becoming increasingly important for regulatory compliance and product differentiation.

- Blockchain Integration: Exploring the integration of blockchain technology with GMO testing data can enhance traceability and transparency throughout the food supply chain, offering a competitive edge.

Growth Accelerators in the GMO Tests Market Industry

Technological advancements, specifically in next-generation sequencing (NGS) and CRISPR-Cas technologies, are poised to revolutionize GMO testing, offering increased accuracy, speed, and cost-effectiveness. Strategic partnerships between testing labs and food producers are streamlining the testing process and ensuring timely compliance with regulations. Market expansion into emerging economies, driven by increased agricultural production and rising consumer demand for GMO-free products, presents substantial growth opportunities.

Key Players Shaping the GMO Tests Market Market

- NSF International

- Eurofins Scientific

- Intertek Group plc

- SGS SA

- EMSL Analytical Inc

- Merieux NutriSciences Corporation

- ALS Limited

- Bureau Veritas

- List Not Exhaustive

Notable Milestones in GMO Tests Market Sector

- 2020: Eurofins Scientific launched an advanced, rapid PCR-based GMO testing kit, setting a new benchmark for speed and efficiency in the market.

- 2022: A strategic merger between two specialized GMO testing laboratories resulted in enhanced market reach and a broadened service offering, demonstrating industry consolidation.

- 2023: A prominent industry player introduced a highly portable ELISA testing device, specifically designed to empower smaller-scale producers with accessible and reliable GMO detection capabilities.

- 2024: The implementation of significantly stricter GMO labeling regulations in several key global markets underscored the growing regulatory imperative for comprehensive GMO testing.

- 2024 (Continued): Significant investment in R&D by major companies towards developing next-generation sequencing (NGS) based GMO detection methods, promising greater accuracy and the ability to detect novel GMO events.

In-Depth GMO Tests Market Market Outlook

The GMO Tests market is firmly positioned for sustained and robust growth in the coming years. This optimistic outlook is underpinned by a powerful combination of relentless technological innovation, a rapidly escalating consumer demand for transparency and assurance in their food choices, and an increasingly complex and stringent global regulatory environment. Companies that actively pursue strategic partnerships, successfully expand their geographical footprint into untapped markets, and consistently develop cutting-edge, adaptable testing solutions are best positioned to capitalize on the emerging opportunities. The future success of market players will be critically dependent on their ability to deliver testing solutions that are not only fast and accurate but also cost-effective and responsive to the dynamic needs of both food producers and discerning consumers. A continued, unwavering focus on technological advancement, expanding market accessibility, and steadfastly meeting evolving regulatory requirements will be paramount for securing and maintaining market leadership in this vital sector.

GMO Tests Market Segmentation

-

1. Technology

- 1.1. Polymerase Chain Reaction

- 1.2. ELISA Test

- 1.3. Strip test (Lateral Flow Device or Dipstick)

GMO Tests Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

GMO Tests Market Regional Market Share

Geographic Coverage of GMO Tests Market

GMO Tests Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. PCR Technique Holds a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GMO Tests Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Polymerase Chain Reaction

- 5.1.2. ELISA Test

- 5.1.3. Strip test (Lateral Flow Device or Dipstick)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America GMO Tests Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Polymerase Chain Reaction

- 6.1.2. ELISA Test

- 6.1.3. Strip test (Lateral Flow Device or Dipstick)

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe GMO Tests Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Polymerase Chain Reaction

- 7.1.2. ELISA Test

- 7.1.3. Strip test (Lateral Flow Device or Dipstick)

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific GMO Tests Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Polymerase Chain Reaction

- 8.1.2. ELISA Test

- 8.1.3. Strip test (Lateral Flow Device or Dipstick)

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America GMO Tests Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Polymerase Chain Reaction

- 9.1.2. ELISA Test

- 9.1.3. Strip test (Lateral Flow Device or Dipstick)

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa GMO Tests Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Polymerase Chain Reaction

- 10.1.2. ELISA Test

- 10.1.3. Strip test (Lateral Flow Device or Dipstick)

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NSF International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EMSL Analytical Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merieux NutriSciences Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ALS Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bureau Veritas*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 NSF International

List of Figures

- Figure 1: Global GMO Tests Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America GMO Tests Market Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America GMO Tests Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America GMO Tests Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America GMO Tests Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe GMO Tests Market Revenue (billion), by Technology 2025 & 2033

- Figure 7: Europe GMO Tests Market Revenue Share (%), by Technology 2025 & 2033

- Figure 8: Europe GMO Tests Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe GMO Tests Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific GMO Tests Market Revenue (billion), by Technology 2025 & 2033

- Figure 11: Asia Pacific GMO Tests Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Asia Pacific GMO Tests Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific GMO Tests Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America GMO Tests Market Revenue (billion), by Technology 2025 & 2033

- Figure 15: South America GMO Tests Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: South America GMO Tests Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America GMO Tests Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa GMO Tests Market Revenue (billion), by Technology 2025 & 2033

- Figure 19: Middle East and Africa GMO Tests Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Middle East and Africa GMO Tests Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa GMO Tests Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GMO Tests Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global GMO Tests Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global GMO Tests Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global GMO Tests Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Rest of North America GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global GMO Tests Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Global GMO Tests Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Germany GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global GMO Tests Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Global GMO Tests Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: India GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: China GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Australia GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global GMO Tests Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Global GMO Tests Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Brazil GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global GMO Tests Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 31: Global GMO Tests Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South Africa GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: United Arab Emirates GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa GMO Tests Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GMO Tests Market?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the GMO Tests Market?

Key companies in the market include NSF International, Eurofins Scientific, Intertek Group plc, SGS SA, EMSL Analytical Inc, Merieux NutriSciences Corporation, ALS Limited, Bureau Veritas*List Not Exhaustive.

3. What are the main segments of the GMO Tests Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

PCR Technique Holds a Significant Market Share.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GMO Tests Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GMO Tests Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GMO Tests Market?

To stay informed about further developments, trends, and reports in the GMO Tests Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence