Key Insights

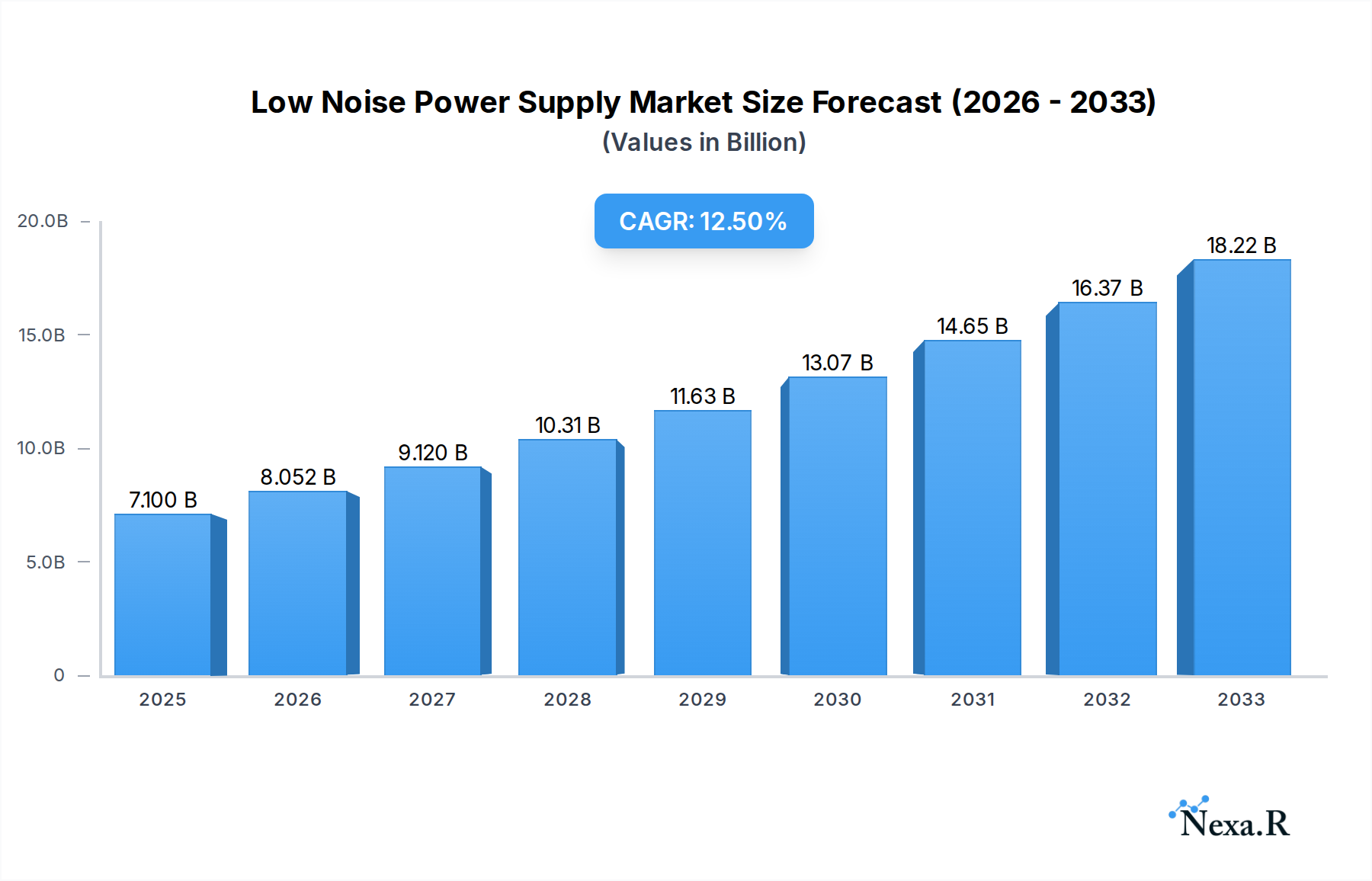

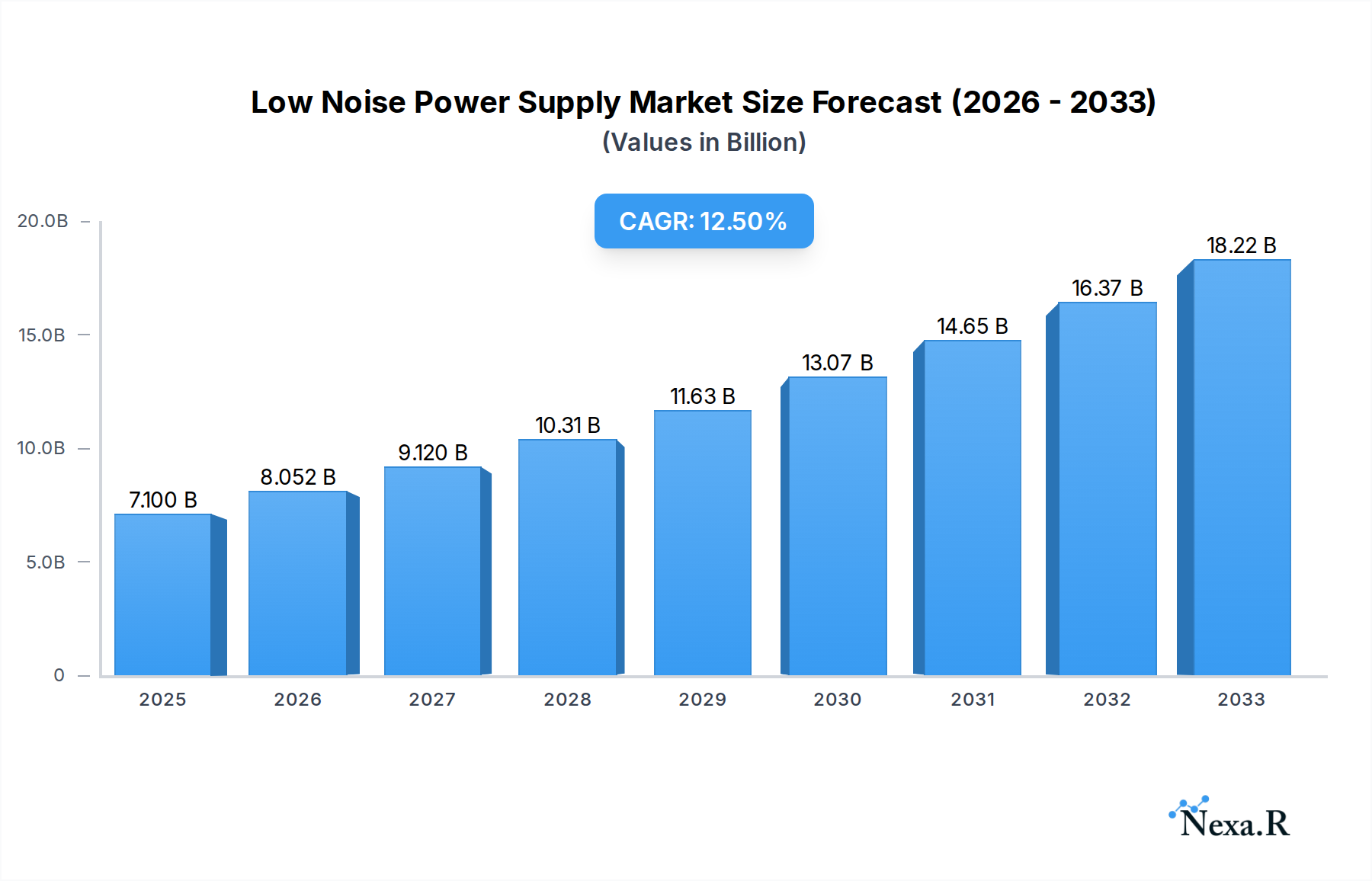

The global Low Noise Power Supply market is poised for significant expansion, projected to reach $7.1 billion in 2025. This robust growth is underpinned by an impressive Compound Annual Growth Rate (CAGR) of 13.21%, indicating a dynamic and rapidly evolving sector. The demand for ultra-stable and precise power sources is a primary driver, stemming from the increasing sophistication and sensitivity of applications in areas like advanced electronics and scientific research. The "Energy" and "Electronic Engineering" segments are expected to be the dominant forces, reflecting the widespread need for high-performance power solutions across diverse industries. This escalating demand for cleaner, more reliable power is fueling innovation and market penetration.

Low Noise Power Supply Market Size (In Billion)

Several key trends are shaping the Low Noise Power Supply market. The miniaturization of electronic devices and the development of high-frequency components necessitate power supplies with exceptionally low noise profiles to maintain signal integrity and operational efficiency. Furthermore, the proliferation of sensitive scientific instruments and precision measurement equipment in R&D labs and manufacturing settings significantly contributes to market growth. While the market enjoys strong growth, certain restraints, such as the high cost of specialized components and the complexity of designing ultra-low noise circuitry, could temper rapid adoption in some price-sensitive applications. However, the overwhelming benefits of reduced noise interference and enhanced system performance are expected to outweigh these challenges, driving continued investment and innovation.

Low Noise Power Supply Company Market Share

Low Noise Power Supply Market: Comprehensive Industry Analysis and Future Outlook (2019-2033)

This comprehensive report delivers an in-depth analysis of the global Low Noise Power Supply market, a critical component in advanced electronic systems across numerous industries. Our research forecasts significant growth, driven by increasing demand for precision and reliability in sensitive applications such as scientific instrumentation, medical devices, and high-frequency communications. The report meticulously examines market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the competitive ecosystem, providing actionable insights for stakeholders from 2019 to 2033. We quantify market evolution, adoption rates, and technological disruptions, with a base year of 2025 and an extensive forecast period from 2025 to 2033.

Low Noise Power Supply Market Dynamics & Structure

The global Low Noise Power Supply market exhibits a moderately concentrated structure, characterized by the presence of both established multinational corporations and specialized niche players. Technological innovation serves as a primary market concentration driver, with continuous advancements in noise reduction techniques, efficiency, and miniaturization pushing the boundaries of performance. Regulatory frameworks, particularly those related to electromagnetic compatibility (EMC) and safety standards, also shape market entry and product development. Competitive product substitutes, while limited in achieving the same level of ultra-low noise performance, exist in the form of standard power supplies for less demanding applications. End-user demographics are increasingly sophisticated, demanding higher precision and reliability, particularly within the parent market of advanced electronics and the child market of specialized instrumentation. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to expand their product portfolios, gain access to new technologies, and consolidate market share.

- Market Concentration: Moderately concentrated with key players holding significant market share.

- Technological Innovation Drivers: Advancements in noise filtering, voltage regulation, and component miniaturization.

- Regulatory Frameworks: EMC directives, safety certifications (e.g., UL, CE), and industry-specific standards.

- Competitive Product Substitutes: Standard power supplies for non-critical applications.

- End-User Demographics: High demand from scientific research, medical, telecommunications, and aerospace sectors.

- M&A Trends: Strategic acquisitions to enhance technological capabilities and market reach. Estimated M&A deal volume: ~15-20 deals annually in the last 3 years, valued in billions of US dollars.

Low Noise Power Supply Growth Trends & Insights

The Low Noise Power Supply market is poised for robust expansion, projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This sustained growth trajectory is underpinned by a confluence of factors, including the burgeoning demand for high-precision instrumentation in scientific research, advancements in medical diagnostic equipment requiring minimal interference, and the ever-increasing complexity of telecommunications infrastructure necessitating ultra-clean power. The parent market for electronic components is experiencing a secular growth trend, with the child market of specialized power solutions for sensitive applications demonstrating even more accelerated adoption rates.

The market size evolution showcases a significant upward trend. From an estimated $XX billion in 2025, the market is projected to reach $XX billion by 2033. This surge is attributed to the increasing penetration of low noise power supplies in emerging technologies like quantum computing, advanced semiconductor testing, and high-resolution imaging systems. Technological disruptions, such as the development of novel filtering techniques and more efficient power management ICs, are continuously enhancing product performance and driving adoption.

Consumer behavior shifts are also playing a crucial role. Engineers and system designers are increasingly prioritizing power supply quality over cost for critical applications, recognizing the long-term benefits of reduced noise, improved signal integrity, and enhanced equipment lifespan. This behavioral change is directly influencing purchasing decisions, leading to a greater demand for premium low noise power supply solutions. Market penetration is deepening, moving beyond traditional high-end applications into mid-range systems where noise sensitivity is becoming a more significant consideration.

Key Market Size Evolution Metrics:

- Market Size (2025): $XX billion

- Market Size (2033): $XX billion

- CAGR (2025-2033): XX%

Adoption and Penetration Insights:

- Increased adoption in sectors like renewable energy monitoring and advanced automotive electronics.

- Market penetration is deepening, with enhanced adoption in laboratory test and measurement equipment.

Technological Adoption Drivers:

- Miniaturization and higher power density in low noise power supply designs.

- Integration of advanced digital control for superior noise suppression.

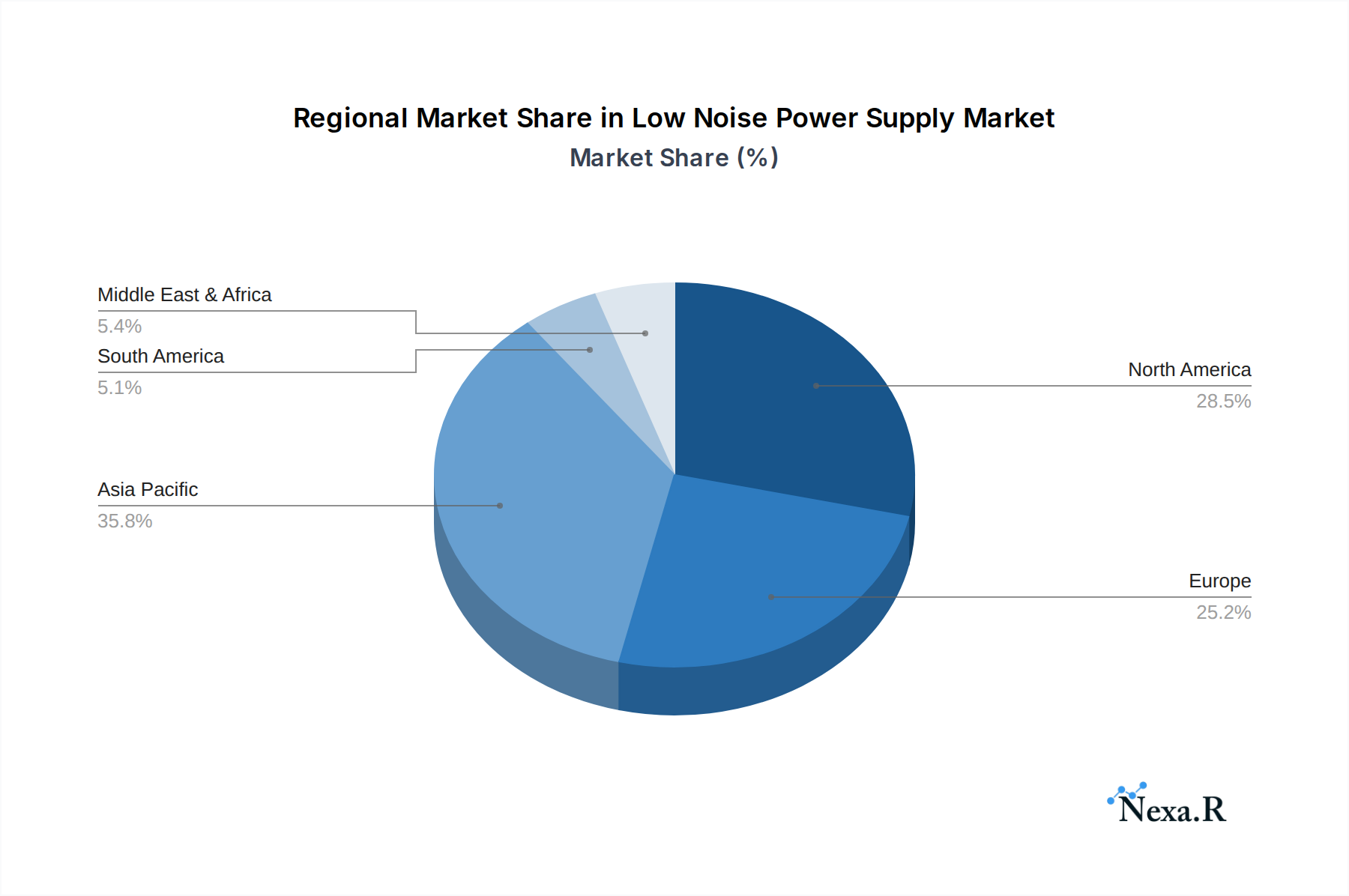

Dominant Regions, Countries, or Segments in Low Noise Power Supply

The Energy application segment is identified as a dominant driver of growth within the global Low Noise Power Supply market. This dominance stems from the critical need for stable and interference-free power in the operation of sensitive energy infrastructure, including advanced grid monitoring systems, renewable energy inverters (solar, wind), and precision energy storage solutions. The parent market of energy infrastructure development, particularly the push towards smart grids and decentralized energy systems, necessitates the use of high-quality power supplies to ensure operational integrity and data accuracy. The child market of specialized energy monitoring and control equipment directly benefits from and drives the demand for these sophisticated power solutions.

North America, particularly the United States, stands out as a leading country due to its substantial investments in research and development, advanced manufacturing capabilities, and a strong presence of key end-user industries such as aerospace, defense, and medical technology. Government initiatives promoting technological innovation and stringent quality standards further bolster demand for low noise power supplies.

Dominant Application Segment: Energy

- Key Drivers: Smart grid development, renewable energy integration, advanced energy storage systems, critical infrastructure monitoring.

- Market Share Contribution (Estimated): XX% of the total market in 2025.

- Growth Potential: High, driven by global energy transition initiatives.

Leading Region: North America

- Key Drivers: Strong R&D ecosystem, advanced manufacturing, significant presence of key end-user industries (aerospace, medical, telecommunications), favorable government policies for technology adoption.

- Market Share (Estimated): XX% of the global market in 2025.

- Growth Potential: Sustained, fueled by continuous technological advancement and industry expansion.

Dominant Type: DC Low Noise Power Supplies

- Key Drivers: Ubiquitous use in sensitive electronic circuits, battery-powered devices, and data acquisition systems.

- Market Share (Estimated): XX% of the total market in 2025.

- Growth Potential: Steady, driven by proliferation of portable electronics and IoT devices.

Low Noise Power Supply Product Landscape

The Low Noise Power Supply product landscape is characterized by continuous innovation focused on enhancing noise suppression capabilities, improving power efficiency, and achieving greater miniaturization. Products range from linear and switching power supplies specifically engineered for ultra-low noise output, to modular solutions offering flexibility for diverse applications. Key applications span scientific instrumentation, medical devices, telecommunications infrastructure, and high-performance computing. Performance metrics of paramount importance include extremely low ripple and noise voltage (in microvolts or nanovolts), high power supply rejection ratio (PSRR), and excellent transient response. Unique selling propositions often revolve around proprietary filtering technologies and highly stable output voltage regulation, ensuring signal integrity in the most demanding electronic environments.

Key Drivers, Barriers & Challenges in Low Noise Power Supply

Key Drivers:

- Technological Advancement: Continuous innovation in noise reduction techniques, component miniaturization, and higher efficiency designs.

- Increasing Demand for Precision: Growing need for ultra-low noise power in advanced scientific instruments, medical devices, and high-frequency communications.

- Industry 4.0 and IoT: Proliferation of connected devices and automated systems requiring stable, reliable power.

- Government Support for R&D: Investments in research and development, particularly in sectors like defense and aerospace, fuel demand.

Barriers & Challenges:

- High Development Costs: The specialized engineering and rigorous testing required for low noise power supplies lead to higher manufacturing costs.

- Supply Chain Volatility: Reliance on specialized components can make supply chains vulnerable to disruptions, impacting production timelines and costs.

- Stringent Performance Requirements: Meeting extremely low noise specifications can be challenging, requiring sophisticated design and manufacturing processes.

- Price Sensitivity in Certain Segments: While critical applications tolerate higher costs, broader adoption can be hindered by price sensitivity in less demanding segments. Estimated impact of supply chain disruptions on lead times: increased by 15-20% in the last year.

Emerging Opportunities in Low Noise Power Supply

Emerging opportunities in the Low Noise Power Supply market are abundant, particularly in areas where signal integrity and precision are paramount. The rapid growth of the quantum computing sector presents a significant untapped market, requiring extremely stable and noise-free power for sensitive qubits. Similarly, advancements in bio-sensing technology and high-resolution imaging for medical diagnostics will drive demand for specialized low noise power solutions. The increasing adoption of artificial intelligence (AI) in edge computing also necessitates compact and efficient low noise power supplies for embedded systems. Evolving consumer preferences for highly reliable and long-lasting electronic devices are also creating a pull for higher quality power components.

Growth Accelerators in the Low Noise Power Supply Industry

Several key growth accelerators are poised to propel the Low Noise Power Supply industry forward. Technological breakthroughs in wide-bandgap semiconductor materials (like GaN and SiC) are enabling more efficient and compact power supply designs with improved noise characteristics. Strategic partnerships between power supply manufacturers and semiconductor designers are crucial for co-developing next-generation solutions. Furthermore, market expansion strategies targeting emerging economies and their rapidly developing high-tech manufacturing sectors will unlock new avenues for growth. The increasing demand for custom power solutions tailored to specific application requirements will also act as a significant accelerator, fostering innovation and market diversification.

Key Players Shaping the Low Noise Power Supply Market

- B&K Precision

- Bruel And Kjaer

- IFM Electronic

- Keithley Instruments

- FSP Technology

- Kikusui Electronics

- Tektronix

- BST Caltek Industrial

- Gigahertz Optik GmbH

- Bicker Elektronik

- Microset

- iDRC

- IEI Integration

- PORTWELL

Notable Milestones in Low Noise Power Supply Sector

- 2021: Launch of advanced GaN-based switching power supplies with significantly reduced EMI emissions.

- 2020: Introduction of highly compact, modular low noise power solutions for portable medical devices.

- 2022: Major advancements in digital control algorithms for adaptive noise cancellation in power supplies.

- 2023: Increased M&A activity as larger companies acquire specialized low noise power supply manufacturers to expand their portfolios.

- 2019: Development of new filtering techniques to achieve sub-microvolt noise levels for critical scientific research equipment.

In-Depth Low Noise Power Supply Market Outlook

The future outlook for the Low Noise Power Supply market is exceptionally bright, driven by sustained technological innovation and the ever-growing demand for precision in critical applications. Growth accelerators, including the adoption of advanced semiconductor materials, strategic collaborations, and market expansion into high-growth regions, will continue to fuel this upward trajectory. The increasing emphasis on miniaturization, higher power density, and superior noise performance will shape product development. Strategic opportunities lie in catering to nascent markets like quantum computing and advanced bio-technologies, as well as enhancing offerings for established sectors such as telecommunications and medical devices. The market is well-positioned for continued expansion, offering substantial potential for stakeholders who can effectively navigate technological advancements and evolving industry needs.

Low Noise Power Supply Segmentation

-

1. Application

- 1.1. Energy

- 1.2. Electronic Engineering

- 1.3. Others

-

2. Types

- 2.1. AC

- 2.2. DC

Low Noise Power Supply Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Low Noise Power Supply Regional Market Share

Geographic Coverage of Low Noise Power Supply

Low Noise Power Supply REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Noise Power Supply Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Energy

- 5.1.2. Electronic Engineering

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. AC

- 5.2.2. DC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Low Noise Power Supply Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Energy

- 6.1.2. Electronic Engineering

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. AC

- 6.2.2. DC

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Low Noise Power Supply Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Energy

- 7.1.2. Electronic Engineering

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. AC

- 7.2.2. DC

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Low Noise Power Supply Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Energy

- 8.1.2. Electronic Engineering

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. AC

- 8.2.2. DC

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Low Noise Power Supply Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Energy

- 9.1.2. Electronic Engineering

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. AC

- 9.2.2. DC

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Low Noise Power Supply Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Energy

- 10.1.2. Electronic Engineering

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. AC

- 10.2.2. DC

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 B&K Precision

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bruel And Kjaer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IFM Electronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Keithley Instruments

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FSP Technology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kikusui Electronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tektronix

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BST Caltek Industrial

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gigahertz Optik GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bicker Elektronik

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Microset

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 iDRC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 IEI Integration

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 PORTWELL

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 B&K Precision

List of Figures

- Figure 1: Global Low Noise Power Supply Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Low Noise Power Supply Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Low Noise Power Supply Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Low Noise Power Supply Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Low Noise Power Supply Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Low Noise Power Supply Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Low Noise Power Supply Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Low Noise Power Supply Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Low Noise Power Supply Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Low Noise Power Supply Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Low Noise Power Supply Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Low Noise Power Supply Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Low Noise Power Supply Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Low Noise Power Supply Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Low Noise Power Supply Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Low Noise Power Supply Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Low Noise Power Supply Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Low Noise Power Supply Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Low Noise Power Supply Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Low Noise Power Supply Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Low Noise Power Supply Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Low Noise Power Supply Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Low Noise Power Supply Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Low Noise Power Supply Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Low Noise Power Supply Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Low Noise Power Supply Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Low Noise Power Supply Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Low Noise Power Supply Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Low Noise Power Supply Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Low Noise Power Supply Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Low Noise Power Supply Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Low Noise Power Supply Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Low Noise Power Supply Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Low Noise Power Supply Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Low Noise Power Supply Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Low Noise Power Supply Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Low Noise Power Supply Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Low Noise Power Supply Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Low Noise Power Supply Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Low Noise Power Supply Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Low Noise Power Supply Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Low Noise Power Supply Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Low Noise Power Supply Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Low Noise Power Supply Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Low Noise Power Supply Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Low Noise Power Supply Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Low Noise Power Supply Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Low Noise Power Supply Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Low Noise Power Supply Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Low Noise Power Supply Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Noise Power Supply?

The projected CAGR is approximately 13.21%.

2. Which companies are prominent players in the Low Noise Power Supply?

Key companies in the market include B&K Precision, Bruel And Kjaer, IFM Electronic, Keithley Instruments, FSP Technology, Kikusui Electronics, Tektronix, BST Caltek Industrial, Gigahertz Optik GmbH, Bicker Elektronik, Microset, iDRC, IEI Integration, PORTWELL.

3. What are the main segments of the Low Noise Power Supply?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Noise Power Supply," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Noise Power Supply report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Noise Power Supply?

To stay informed about further developments, trends, and reports in the Low Noise Power Supply, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence