Key Insights

The South American alcoholic beverage market, valued at approximately 38.04 billion in 2025, is projected to experience robust expansion, with a Compound Annual Growth Rate (CAGR) of 4.46% from 2025 to 2033. This growth is propelled by escalating disposable incomes, particularly within emerging middle classes in Brazil and Argentina, fostering increased demand for premium and imported alcoholic beverages. Evolving consumer preferences are increasingly favoring craft beers, premium spirits, and ready-to-drink (RTD) cocktails, creating dynamic market segments and fostering innovation. The thriving tourism sector across key regions further supports market expansion. While the off-trade channel (retail) is anticipated to maintain its dominance, the on-trade segment (hospitality) is poised for significant growth, driven by the recovery and expansion of the hospitality industry. Brazil and Argentina lead the South American market, attributed to their substantial populations and deeply ingrained alcoholic beverage cultures. Growth in the "Rest of South America" segment is also expected, fueled by rising urbanization and greater exposure to global brands.

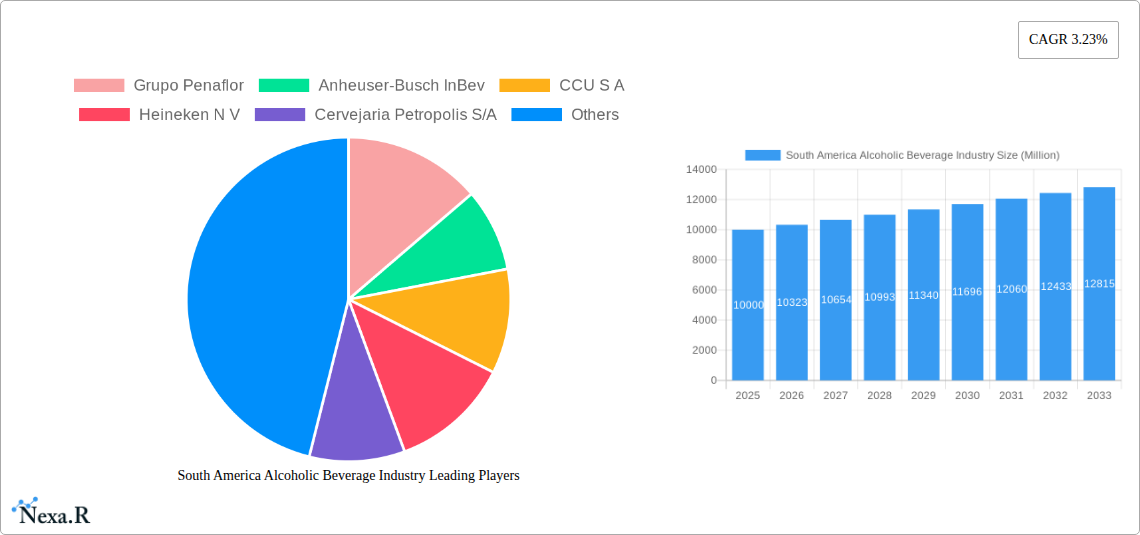

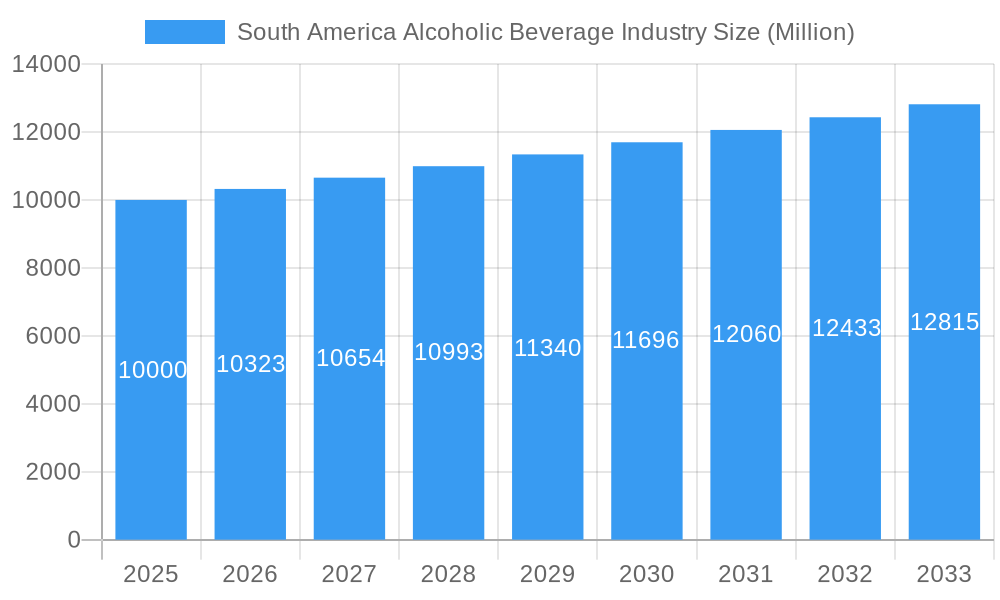

South America Alcoholic Beverage Industry Market Size (In Billion)

The competitive landscape of the South American alcoholic beverage market is characterized by intense rivalry between global leaders such as Anheuser-Busch InBev, Diageo, and Heineken, and prominent regional entities including Grupo Penaflor and CCU S.A. Challenges within the market include economic volatility in certain South American nations and navigating regulatory frameworks governing alcohol sales and marketing. Additionally, fluctuating currency exchange rates and rising input costs, such as for barley and grapes, present ongoing operational risks for businesses. Despite these challenges, the long-term outlook for the South American alcoholic beverage market remains optimistic, underpinned by rising consumption, a diverse product portfolio, and a dynamic industry ecosystem. Strategic collaborations, product innovation, and targeted marketing strategies will be instrumental for companies seeking to thrive in this vibrant yet demanding market.

South America Alcoholic Beverage Industry Company Market Share

South America Alcoholic Beverage Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the South America alcoholic beverage industry, covering the period 2019-2033. It offers invaluable insights into market dynamics, growth trends, key players, and future opportunities for industry professionals, investors, and researchers. The report leverages extensive data and analysis to provide a 360-degree view of this dynamic market, encompassing beer, wine, and spirits across on-trade and off-trade distribution channels.

South America Alcoholic Beverage Industry Market Dynamics & Structure

This section analyzes the South American alcoholic beverage market's competitive landscape, encompassing market concentration, technological advancements, regulatory influences, substitute products, consumer demographics, and mergers & acquisitions (M&A) activity. We delve into the market share of key players and examine the impact of various factors shaping the industry.

- Market Concentration: The South American alcoholic beverage market exhibits a moderately concentrated structure, with a few major players dominating certain segments. xx% of the market is controlled by the top 5 players, while smaller, regional breweries and distilleries account for the remaining share.

- Technological Innovation: Technological advancements in brewing, winemaking, and distilling are driving efficiency gains and product innovation. However, adoption rates vary across the region due to factors like infrastructure and investment capacity.

- Regulatory Frameworks: Varying regulations across South American countries influence pricing, distribution, and marketing strategies. Compliance and navigating diverse regulatory landscapes present significant challenges.

- Competitive Product Substitutes: The rise of non-alcoholic beverages and health-conscious consumer choices pose a competitive threat to traditional alcoholic beverages. This necessitates innovation and diversification of product portfolios.

- End-User Demographics: The South American market is characterized by a diverse population with varying consumption patterns based on age, income, and cultural preferences. Understanding these demographics is crucial for targeted marketing and product development.

- M&A Trends: Consolidation is a prominent trend in the industry. The number of M&A deals increased by xx% between 2021 and 2022, driven by the pursuit of economies of scale, market expansion, and brand diversification.

South America Alcoholic Beverage Industry Growth Trends & Insights

This section provides a detailed examination of market size evolution, adoption rates, technological disruptions, and shifting consumer behavior within the South American alcoholic beverage market from 2019-2033. We utilize robust data analysis to project future growth and identify key trends.

The market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by increasing disposable incomes, changing consumption habits, and the expansion of the middle class across several South American countries. Market penetration for premium alcoholic beverages, especially craft beers and imported spirits, shows consistent growth, fueled by rising consumer demand for high-quality products. Technological disruptions, such as e-commerce platforms for beverage sales and advanced production techniques, are revolutionizing the distribution and production processes. Further consumer behavior shifts towards healthier options and increased preference for locally sourced products are significant factors driving the overall market dynamics. The impact of these factors, coupled with economic policies and social trends, is meticulously analyzed in the report to present a comprehensive understanding of the market.

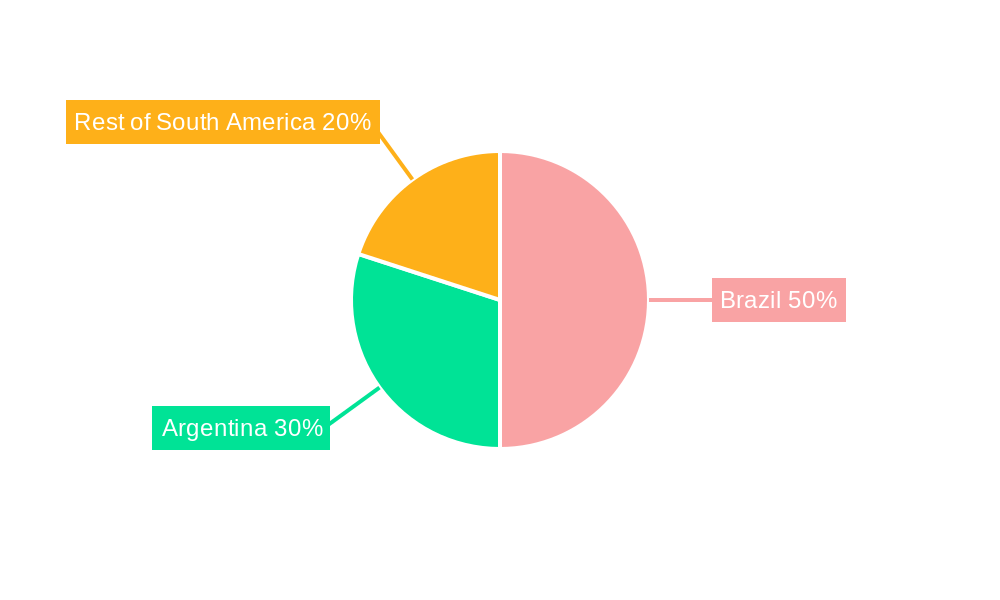

Dominant Regions, Countries, or Segments in South America Alcoholic Beverage Industry

This section pinpoints the leading regions, countries, and segments (beer, wine, spirits; on-trade, off-trade) driving market growth. We analyze market share, growth potential, and key factors influencing dominance.

- Dominant Region: Brazil consistently maintains its position as the dominant market due to its significant population size and high alcohol consumption rates.

- Dominant Country: Brazil's dominance extends to the country level as well, followed by xx and xx.

- Dominant Product Type: Beer remains the leading product type, comprising xx% of the market share. However, the spirits category is experiencing robust growth due to the increasing popularity of premium and craft products.

- Dominant Distribution Channel: The off-trade channel accounts for a significant share of the market due to the increasing availability of alcohol in supermarkets, convenience stores, and online platforms. However, the on-trade sector is expected to see a recovery post-pandemic.

Key factors driving growth in these dominant segments include rising disposable income, expanding middle class, increasing tourism, and favorable regulatory environments. However, challenges include fluctuating currency exchange rates, regional economic downturns, and varying degrees of governmental regulations.

South America Alcoholic Beverage Industry Product Landscape

The South American alcoholic beverage market displays innovation across beer, wine, and spirits. We see the introduction of new flavors, formats (e.g., canned wine, ready-to-drink cocktails), and premium offerings. Technological advancements in brewing and distilling enhance efficiency and product quality. The market has witnessed successful launches of hard seltzers and the growth of the craft beer segment, all highlighting the dynamism in the product landscape. Unique selling propositions such as organic ingredients, sustainable sourcing, and locally-focused branding are gaining traction amongst increasingly discerning consumers.

Key Drivers, Barriers & Challenges in South America Alcoholic Beverage Industry

Key Drivers:

- Increasing disposable incomes and a growing middle class fuel consumption growth.

- Changing consumer preferences towards premium and craft beverages drive innovation.

- Tourism contributes to growth in key regions.

Key Barriers & Challenges:

- Economic instability in some countries impacts consumer spending. (e.g., xx% decrease in sales observed in xx during the xx economic crisis).

- Stringent regulations and licensing requirements complicate market entry and expansion.

- Intense competition from both local and international players creates pressure on pricing and profit margins.

- Supply chain disruptions due to infrastructure limitations and logistics complexities can lead to delays and increased costs.

Emerging Opportunities in South America Alcoholic Beverage Industry

- The rising popularity of health-conscious options creates opportunities for low-calorie, low-sugar, and non-alcoholic alternatives.

- Growing demand for craft beverages opens avenues for artisanal producers and niche brands.

- E-commerce provides potential for wider distribution reach.

- Untapped markets in specific regions hold significant growth potential.

Growth Accelerators in the South America Alcoholic Beverage Industry

Long-term growth in South America's alcoholic beverage industry will be fueled by sustained economic expansion, increased disposable incomes, and ongoing product innovation. Strategic partnerships between local and international companies will drive market penetration and the adoption of innovative technologies. Expanding distribution networks, especially through e-commerce platforms, will enhance accessibility and convenience for consumers.

Key Players Shaping the South America Alcoholic Beverage Industry Market

- Grupo Penaflor

- Anheuser-Busch InBev

- CCU S A

- Heineken N V

- Cervejaria Petropolis S/A

- Diageo

- Brown-Forman

- Molson Coors Beverage Company

- Companhia Muller de Bebidas

- Pernod Ricard

Notable Milestones in South America Alcoholic Beverage Industry Sector

- November 2022: Diageo Plc's acquisition of Balcones Distilling expands its premium spirits portfolio.

- February 2022: Grupo Peñaflor's launch of Mingo Hard Seltzer signifies its entry into a rapidly growing segment.

- November 2021: Grupo Petrópolis's Itaipava 100% malt launch strengthens its premium beer offering.

In-Depth South America Alcoholic Beverage Industry Market Outlook

The South American alcoholic beverage market holds significant long-term potential, driven by several factors. Sustained economic growth, coupled with the increasing adoption of premium and craft beverages, will further boost market value. Strategic partnerships, technological advancements, and expansion into untapped markets will contribute to significant growth over the forecast period. Companies adopting innovative marketing strategies and focusing on specific consumer segments are well-positioned to capitalize on the numerous opportunities within this dynamic market.

South America Alcoholic Beverage Industry Segmentation

-

1. Product Type

- 1.1. Beer

- 1.2. Wine

- 1.3. Spirits

-

2. Distribution Channel

- 2.1. On-trade

- 2.2. Off-trade

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Alcoholic Beverage Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Alcoholic Beverage Industry Regional Market Share

Geographic Coverage of South America Alcoholic Beverage Industry

South America Alcoholic Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Brazil Dominates the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beer

- 5.1.2. Wine

- 5.1.3. Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beer

- 6.1.2. Wine

- 6.1.3. Spirits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beer

- 7.1.2. Wine

- 7.1.3. Spirits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beer

- 8.1.2. Wine

- 8.1.3. Spirits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Grupo Penaflor

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Anheuser-Busch InBev

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CCU S A

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Heineken N V

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cervejaria Petropolis S/A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Diageo

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Brown-Forman

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Molson Coors Beverage Company*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Companhia Muller de Bebidas

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Pernod Ricard

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Grupo Penaflor

List of Figures

- Figure 1: South America Alcoholic Beverage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Alcoholic Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 3: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 7: South America Alcoholic Beverage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America Alcoholic Beverage Industry Volume liter Forecast, by Region 2020 & 2033

- Table 9: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 11: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 15: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

- Table 17: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 19: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 23: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

- Table 25: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 27: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 31: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Alcoholic Beverage Industry?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the South America Alcoholic Beverage Industry?

Key companies in the market include Grupo Penaflor, Anheuser-Busch InBev, CCU S A, Heineken N V, Cervejaria Petropolis S/A, Diageo, Brown-Forman, Molson Coors Beverage Company*List Not Exhaustive, Companhia Muller de Bebidas, Pernod Ricard.

3. What are the main segments of the South America Alcoholic Beverage Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Brazil Dominates the Region.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

November 2022: Diageo Plc announced the acquisition of Balcones Distilling ('Balcones'), a Texas Craft Distiller. Balcones is one of the leading producers of American Single Malt Whisky.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Alcoholic Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Alcoholic Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Alcoholic Beverage Industry?

To stay informed about further developments, trends, and reports in the South America Alcoholic Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence