Key Insights

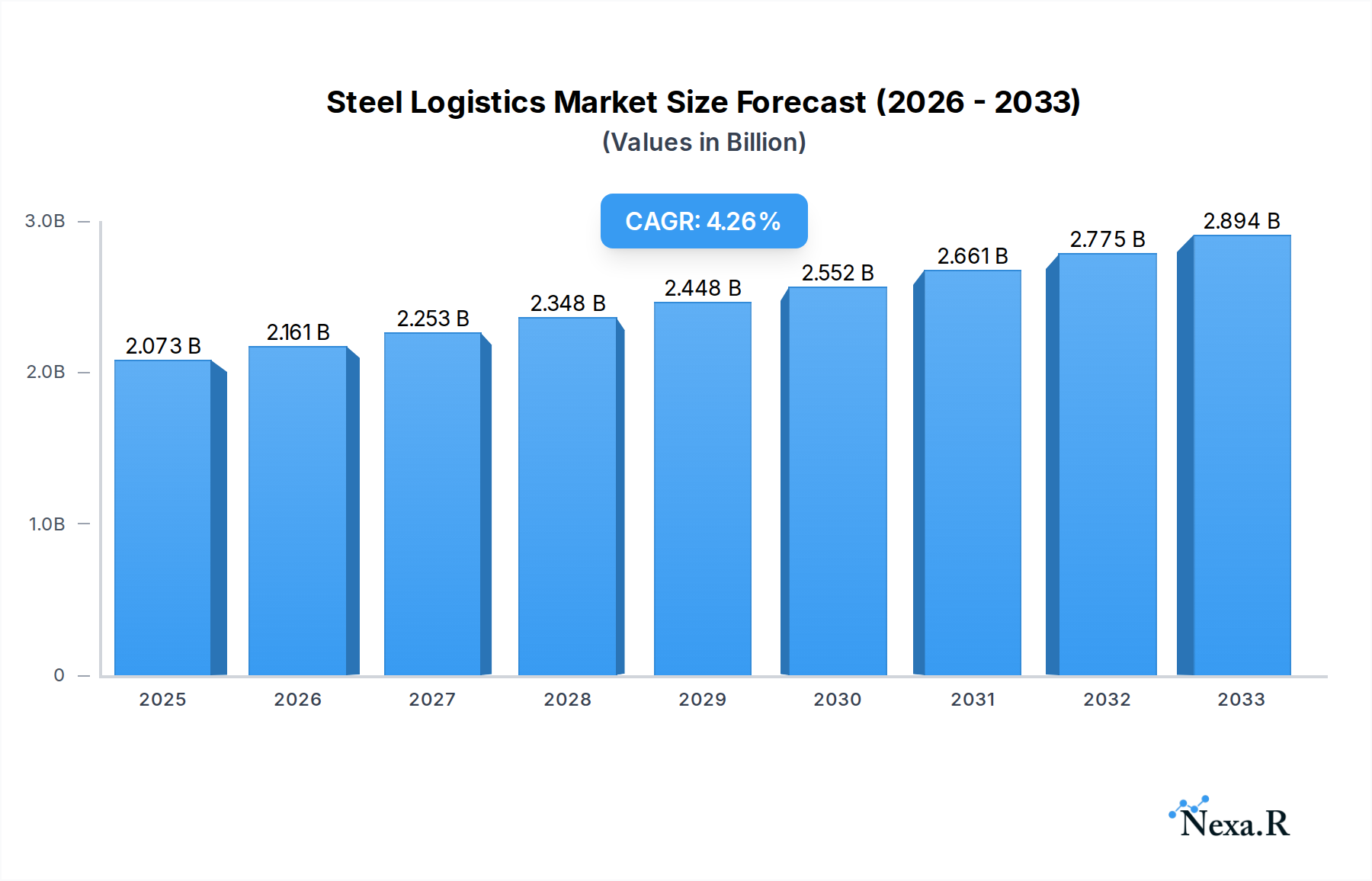

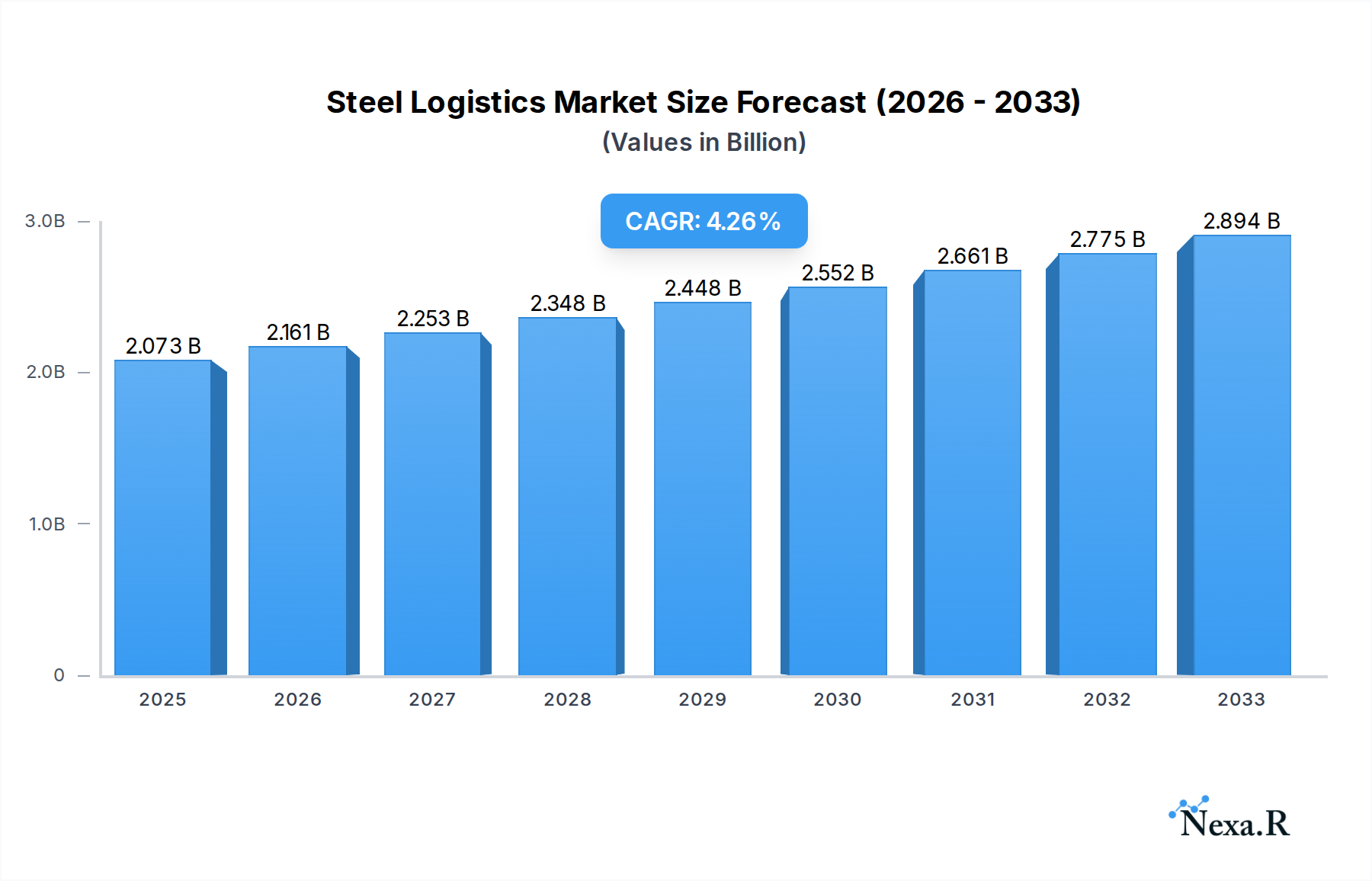

The global Steel Logistics market is poised for significant expansion, projected to reach an estimated USD 2,073.3 million in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.5% over the forecast period of 2025-2033. The primary drivers fueling this upward trajectory include the increasing global demand for steel across various industries such as construction, automotive, and infrastructure development. As nations continue to invest in urban development and modernization, the need for efficient and reliable logistics solutions for raw material procurement, production, and finished steel product distribution becomes paramount. Furthermore, technological advancements in logistics management, including the adoption of digital platforms, real-time tracking, and optimized route planning, are enhancing operational efficiencies and cost-effectiveness for stakeholders. The market is witnessing a growing emphasis on integrated logistics services that offer end-to-end solutions, from raw material sourcing to final delivery, thereby streamlining the complex steel supply chain.

Steel Logistics Market Size (In Billion)

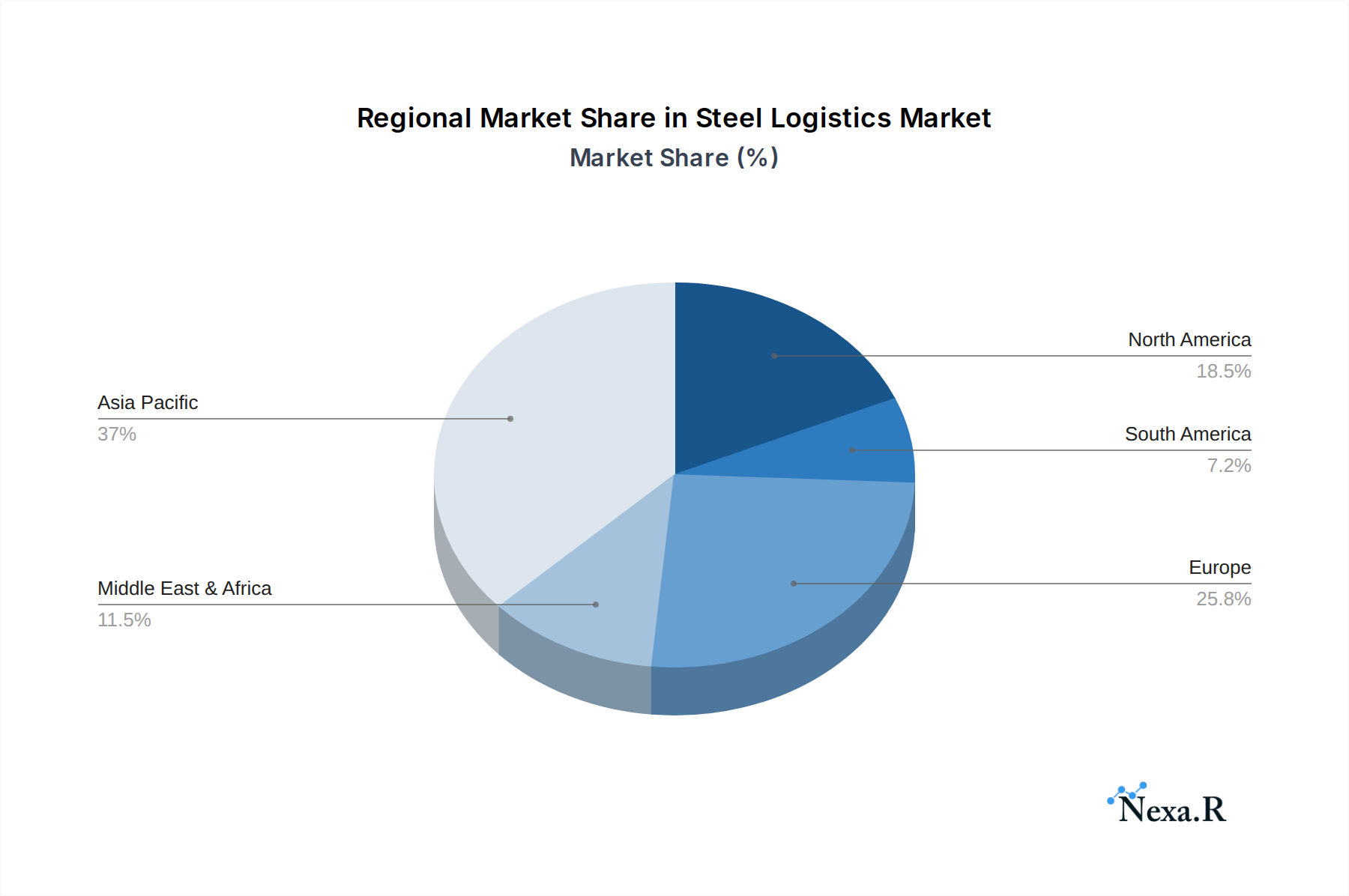

The Steel Logistics market segmentation by application highlights key areas of focus, with Raw Material Producers, Steel Producers, and Steel Downstream Users representing the core customer base. Each segment demands specialized logistics strategies to manage the unique challenges of handling bulk materials, finished goods, and the intricate interdependencies within the steel value chain. The market also comprises distinct types of logistics services: Raw Material Procurement Logistics, Production Logistics, and Sales Logistics, each playing a critical role in ensuring the smooth flow of steel products. Geographically, the market is geographically diverse, with Asia Pacific, particularly China and India, expected to be a significant growth engine due to rapid industrialization. Europe and North America also represent mature yet substantial markets, driven by ongoing infrastructure projects and advancements in manufacturing. Emerging trends such as the adoption of sustainable logistics practices and the increasing use of specialized transportation for different steel grades are also shaping the market's future. While the market exhibits strong growth potential, factors such as fluctuating raw material prices, geopolitical uncertainties, and the need for significant capital investment in specialized logistics infrastructure may present challenges.

Steel Logistics Company Market Share

Steel Logistics Market: Comprehensive Growth Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Steel Logistics market, offering critical insights into its dynamics, growth trajectories, and future potential. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this research is indispensable for stakeholders seeking to navigate the evolving landscape of steel transportation and supply chain management. The report meticulously details market size, segmentation by application and type, regional dominance, key players, and emerging opportunities, all presented with robust quantitative data and expert qualitative analysis.

Steel Logistics Market Dynamics & Structure

The Steel Logistics market, while experiencing periods of consolidation, is characterized by a fragmented yet strategically evolving structure. Technological innovation, particularly in digitalization and automation, acts as a significant driver, enhancing efficiency and visibility across the supply chain. Regulatory frameworks, while sometimes posing barriers, also shape market standards and promote sustainability. Competitive product substitutes are limited given the specialized nature of steel, but alternative transportation modes and optimized routing present continuous competition. End-user demographics are shifting, with an increasing demand for just-in-time delivery and customized solutions from sectors like automotive and construction. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expanding service portfolios.

- Market Concentration: Moderate fragmentation with key global players and numerous regional specialists.

- Technological Innovation Drivers: Real-time tracking, IoT, AI-powered route optimization, blockchain for transparency.

- Regulatory Frameworks: Focus on safety standards, emissions reduction, and cross-border trade facilitation.

- Competitive Product Substitutes: Limited for raw steel, but efficiency gains through intermodal transport and optimized warehousing.

- End-User Demographics: Growing demand from construction, automotive, manufacturing, and infrastructure development.

- M&A Trends: Strategic acquisitions for network expansion, service diversification, and technological integration. M&A deal volumes are projected to increase by 15% year-on-year.

Steel Logistics Growth Trends & Insights

The global Steel Logistics market is poised for substantial growth, driven by the insatiable demand for steel across various industries and advancements in supply chain technology. The market size is projected to reach USD 850 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.2% from the base year of 2025. Adoption rates of digital logistics solutions are accelerating, with an estimated increase of 20% in the utilization of advanced tracking and management systems. Technological disruptions, such as autonomous vehicles and advanced analytics for predictive maintenance, are set to revolutionize operational efficiencies. Consumer behavior shifts are evident, with a growing preference for sustainable logistics options and end-to-end supply chain visibility.

- Market Size Evolution: From an estimated USD 600 billion in 2025, projected to reach USD 850 billion by 2033.

- Adoption Rates: Rising adoption of digital platforms and automated systems by 25% within the forecast period.

- Technological Disruptions: Integration of AI for route optimization and predictive analytics, impact on operational costs reduction by 10%.

- Consumer Behavior Shifts: Increased demand for green logistics and real-time supply chain transparency.

Dominant Regions, Countries, or Segments in Steel Logistics

The Asia-Pacific region, particularly China and India, is currently the dominant force driving growth in the Steel Logistics market. This dominance is fueled by massive infrastructure projects, burgeoning manufacturing sectors, and significant steel production capacities. The "Steel Producers" segment within the Application category is a primary growth driver, with its logistics needs encompassing raw material procurement, in-plant movement, and finished product distribution. Among the types of logistics, "Raw Material Procurement Logistics" and "Production Logistics" are critical, ensuring the seamless flow of iron ore, coking coal, and scrap steel to steel mills, and then managing the internal movement of steel products for further processing.

- Dominant Region: Asia-Pacific, driven by China's vast steel production and consumption, alongside India's rapid industrialization.

- Key Countries: China, India, United States, Germany, Japan.

- Dominant Application Segment: Steel Producers, representing a market share of approximately 45% in 2025.

- Dominant Type Segment: Raw Material Procurement Logistics and Production Logistics, collectively accounting for over 60% of the logistics spend within the steel value chain.

- Key Drivers in Asia-Pacific:

- Massive government investments in infrastructure projects.

- High domestic steel demand from construction and automotive sectors.

- Presence of leading global steel manufacturers.

- Development of advanced port and rail networks.

- Market Share & Growth Potential: Asia-Pacific expected to maintain a growth rate of 6.5% annually, significantly higher than other regions.

Steel Logistics Product Landscape

The Steel Logistics product landscape is characterized by a focus on specialized equipment and integrated technology solutions designed for the safe, efficient, and timely transportation of steel products. This includes heavy-duty trucks, specialized railcars, barges, and container solutions engineered to handle various steel forms like coils, pipes, and sheets. Innovations are centered around enhancing load security, optimizing weight distribution, and minimizing transit times. Performance metrics are measured by delivery accuracy, damage reduction rates, and overall cost per ton-mile. Unique selling propositions often lie in the ability to provide end-to-end solutions, from plant to customer, incorporating value-added services like warehousing and inventory management.

Key Drivers, Barriers & Challenges in Steel Logistics

Key Drivers: The Steel Logistics market is propelled by escalating global demand for steel, driven by infrastructure development and manufacturing growth, particularly in emerging economies. Technological advancements in tracking, automation, and route optimization are crucial for enhancing efficiency and reducing costs. Supportive government policies promoting trade and industrial growth also act as significant catalysts. Strategic partnerships between logistics providers and steel manufacturers are further accelerating market expansion.

Barriers & Challenges: Supply chain disruptions, including geopolitical instability, fluctuating fuel prices, and port congestion, pose significant challenges. Regulatory hurdles related to environmental standards and cross-border transportation can increase operational complexity and costs. Intense competition among logistics providers can lead to price pressures, impacting profit margins. The specialized nature of steel handling requires significant capital investment in dedicated infrastructure and trained personnel, acting as a barrier to entry for smaller players. The need for real-time visibility and the integration of disparate IT systems across the supply chain also present ongoing technological challenges.

Emerging Opportunities in Steel Logistics

Emerging opportunities in Steel Logistics lie in the growing demand for sustainable and green logistics solutions, pushing for the adoption of electric and hybrid vehicles, and optimized intermodal transportation to reduce carbon footprints. The increasing complexity of global supply chains presents opportunities for specialized third-party logistics (3PL) providers offering end-to-end management and value-added services. The digital transformation of the steel industry itself, including smart manufacturing, creates a demand for sophisticated, data-driven logistics solutions that can integrate seamlessly with production processes. Furthermore, the expansion of steel applications into renewable energy sectors like wind turbines and solar farms opens new niche logistics requirements.

Growth Accelerators in the Steel Logistics Industry

Technological breakthroughs in AI and machine learning are pivotal growth accelerators, enabling predictive analytics for demand forecasting, proactive maintenance of fleets, and highly optimized route planning. Strategic partnerships and collaborations between steel producers, logistics companies, and technology providers are fostering innovation and creating integrated supply chain ecosystems. Market expansion into underdeveloped regions with significant infrastructure development plans offers substantial growth potential. The increasing focus on supply chain resilience and risk management is also driving investment in advanced logistics solutions that can mitigate disruptions and ensure business continuity.

Key Players Shaping the Steel Logistics Market

- PLS

- Seagate Corporation

- Broekman Logistics

- OSL Europe Shipping & Logistics

- Pastrello Autotrasporti S.r.l.

- Central Oceans

- COLI Group

- IRC Group

- Mackleys

- Steel Solutions BV

- AsstrA

- GP Steel Logistics

- Alliance Steel

- Bemidji Steel Company

Notable Milestones in Steel Logistics Sector

- 2023: Increased adoption of AI-powered route optimization software, leading to an estimated 8% reduction in transit times for major logistics providers.

- 2022: Significant investment in intermodal transport solutions in Europe to address road congestion and environmental concerns.

- 2021: Introduction of blockchain technology for enhanced supply chain transparency and traceability in steel shipments.

- 2020: Global pandemic highlights vulnerabilities in traditional supply chains, spurring investment in resilient logistics networks and diversified sourcing strategies.

- 2019: Growing trend of digitalization and automation in warehouse operations for steel handling.

In-Depth Steel Logistics Market Outlook

The future of the Steel Logistics market is characterized by robust growth, driven by sustained demand from core industries and the transformative power of technology. Growth accelerators such as advanced analytics, automation, and strategic partnerships will continue to shape the industry, leading to more efficient, resilient, and sustainable supply chains. Opportunities abound in emerging markets and in catering to the specialized logistics needs of new steel applications. Stakeholders can expect a market that increasingly prioritizes end-to-end visibility, real-time data integration, and a commitment to environmental responsibility. The strategic imperative for companies will be to embrace innovation and adapt to the evolving demands of the global steel industry.

Steel Logistics Segmentation

-

1. Application

- 1.1. Raw Material Producers

- 1.2. Steel Producers

- 1.3. Steel Downstream Users

- 1.4. Others

-

2. Types

- 2.1. Raw Material Procurement Logistics

- 2.2. Production Logistics

- 2.3. Sales Logistics

Steel Logistics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Steel Logistics Regional Market Share

Geographic Coverage of Steel Logistics

Steel Logistics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Steel Logistics Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Raw Material Producers

- 5.1.2. Steel Producers

- 5.1.3. Steel Downstream Users

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Raw Material Procurement Logistics

- 5.2.2. Production Logistics

- 5.2.3. Sales Logistics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Steel Logistics Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Raw Material Producers

- 6.1.2. Steel Producers

- 6.1.3. Steel Downstream Users

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Raw Material Procurement Logistics

- 6.2.2. Production Logistics

- 6.2.3. Sales Logistics

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Steel Logistics Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Raw Material Producers

- 7.1.2. Steel Producers

- 7.1.3. Steel Downstream Users

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Raw Material Procurement Logistics

- 7.2.2. Production Logistics

- 7.2.3. Sales Logistics

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Steel Logistics Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Raw Material Producers

- 8.1.2. Steel Producers

- 8.1.3. Steel Downstream Users

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Raw Material Procurement Logistics

- 8.2.2. Production Logistics

- 8.2.3. Sales Logistics

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Steel Logistics Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Raw Material Producers

- 9.1.2. Steel Producers

- 9.1.3. Steel Downstream Users

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Raw Material Procurement Logistics

- 9.2.2. Production Logistics

- 9.2.3. Sales Logistics

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Steel Logistics Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Raw Material Producers

- 10.1.2. Steel Producers

- 10.1.3. Steel Downstream Users

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Raw Material Procurement Logistics

- 10.2.2. Production Logistics

- 10.2.3. Sales Logistics

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PLS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Seagate Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Broekman Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OSL Europe Shipping & Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pastrello Autotrasporti S.r.l.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Central Oceans

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 COLI Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IRC Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mackleys

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Steel Solutions BV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AsstrA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GP Steel Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Alliance Steel

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bemidji Steel Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 PLS

List of Figures

- Figure 1: Global Steel Logistics Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Steel Logistics Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Steel Logistics Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Steel Logistics Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Steel Logistics Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Steel Logistics Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Steel Logistics Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Steel Logistics Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Steel Logistics Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Steel Logistics Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Steel Logistics Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Steel Logistics Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Steel Logistics Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Steel Logistics Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Steel Logistics Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Steel Logistics Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Steel Logistics Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Steel Logistics Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Steel Logistics Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Steel Logistics Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Steel Logistics Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Steel Logistics Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Steel Logistics Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Steel Logistics Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Steel Logistics Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Steel Logistics Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Steel Logistics Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Steel Logistics Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Steel Logistics Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Steel Logistics Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Steel Logistics Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Steel Logistics Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Steel Logistics Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Steel Logistics Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Steel Logistics Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Steel Logistics Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Steel Logistics Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Steel Logistics Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Steel Logistics Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Steel Logistics Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Steel Logistics Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Steel Logistics Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Steel Logistics Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Steel Logistics Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Steel Logistics Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Steel Logistics Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Steel Logistics Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Steel Logistics Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Steel Logistics Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Steel Logistics Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Steel Logistics?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Steel Logistics?

Key companies in the market include PLS, Seagate Corporation, Broekman Logistics, OSL Europe Shipping & Logistics, Pastrello Autotrasporti S.r.l., Central Oceans, COLI Group, IRC Group, Mackleys, Steel Solutions BV, AsstrA, GP Steel Logistics, Alliance Steel, Bemidji Steel Company.

3. What are the main segments of the Steel Logistics?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Steel Logistics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Steel Logistics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Steel Logistics?

To stay informed about further developments, trends, and reports in the Steel Logistics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence